Professional Documents

Culture Documents

Sport Scribd

Uploaded by

Megan ClarkeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sport Scribd

Uploaded by

Megan ClarkeCopyright:

Available Formats

4 The Guardian | Thursday 19 May 2011

Inside sport special report Premier League finances

In sickness and in wealth: a guide to the latest

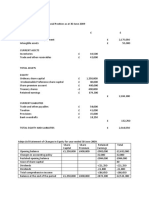

All details from most recently filed official information at Companies House. Debts are borrowings from banks, financial institutions, owners or other sources. All turnover category totals have been rounded to the nearest million.

Arsenal Aston Villa Birmingham City Blackburn Blackpool

Turnover £382m ▲ Turnover £91m ▲ Turnover £56m ▲ Turnover £58m ▲ Turnover £9m ▲

up from £316m in 2009 up from £84m in 2008 up from £27.5m in previous year up from £51m in previous year up from £7m in 2009

Gate and match-day income £94m Gate and match-day income £24m Gate and match-day income £7m Gate and match-day income £6m

TV and broadcasting £85m TV and broadcasting £52m TV and broadcasting £42m TV and broadcasting £43m

Retail £13m Commercial £14m Commercial £7m Commercial £9m

Commercial £31m

Property development £156m

Player trading £1m

Wage bill £110m ▲ Wage bill £80m ▲ Wage bill £38m ▲ Wage bill £47m ▲ Wage bill £13m ▲

up from £103m in previous year up from £50m in 2008 up from £27m in previous year up from £46m in 2009 up from £6m in 2009

Wages as proportion of turnover 29% Wages as proportion of turnover 88% Wages as proportion of turnover 68% Wages as proportion of turnover 81% Wages as proportion of turnover 144%

Profit before tax £56m Loss before tax £38m Profit before tax £0.1m Loss before tax £2m Loss before tax £7m

following £46m profit last year following £46m loss last year following £20m loss in 2009 following £4m profit in 2009 following £1m loss in 2009

Net debt £136m Net debt £110m Net debt £16m Net debt £21m Net debt £4.3m

Interest payable £19m Interest payable £5m Interest payable £1m Interest payable £0.7m Interest payable £0.06m

Highest paid director Highest paid director Highest paid director Highest paid director Highest paid director Not stated

Ivan Gazidis £1.7m Unnamed director £0.237m Karren Brady £0.725m John Williams £0.358m Accounts for the year to 31 May 2010

Accounts for the year to 31 May 2010 Accounts for the year to 31 May 2010 (£26K for one month plus £699,000 pay-off ) Accounts for the year to 30 June 2010

Accounts for the 10 months to 30 June 2010 Ownership

Ownership Ownership Ownership Owen Oyston 76.3%

Arsenal Holdings plc major shareholders are: Reform Acquisitions LLC Ownership Venkateshwara Hatcheries (Venky’s) of Pune, India Valery Belokon 20%

Kroenke Sports Enterprises UK (US company) 62%* (US company, owned ultimately by Randy Lerner) Birmingham International Holdings

Red and White Securities Ltd (Jersey company) 27% (incorporated in the Cayman Islands) Money put in by owners £104m Money put in by owners £2.7m owed to Oyston’s company,

*includes agreed purchase of Nina Bracewell-Smith’s 15.9% Money put in by owners £206m £100m in capital, £4m in interest-free loans Segesta, and £276,000 owed to Oyston personally; Belokon

£116m in cash for shares, £90m in loan notes Money put in by owners £15m was owed £603,000 (repaid in December). Karl Oyston owed

Money put in by owners Nil loan from Carson Yeung the club a £26,751 interest-free loan he had taken out

Turnover Turnover Turnover Turnover Turnover

£382m £91m £56m £58m £9m

Wage bill Wage bill Wage bill Wage bill Wage bill

£110m £80m £38m £47m £13m

Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total

5.3% 4.4% 0.6% 0.8% 0.2%

State they're in State they're in State they're in State they're in State they're in

Arsène Wenger’s team’s big-match These are sobering figures, from Despite turning around the These are the valedictory figures of the These figures from Blackpool’s promotion

collapses, major shareholders pocketing Martin O’Neill’s final season in charge, previous season’s £20m loss in the former chairman, John Williams, who season show how far the Seasiders

millions selling to Stan Kroenke and signalling why reality bit for Randy Championship, and Alex McLeish’s side wrestled 10 years in the Premier League, gambled on climbing up into the Premier

6.5% increases to ticket prices have Lerner’s “good American” takeover lifting the Carling Cup, Birmingham are the Carling Cup in 2002 and four seasons League money pot. Valery Belokon,

cracked the Emirates Stadium halo. The at Villa Park. Lerner has problems to the Premier League’s headache club. in the Uefa Cup from a modicum of a Latvian industrialist, paid £4.5m in

figures look healthy – highest Premier address despite £206m invested. Their £24.65m has to be found for the club and financial backing by the trustees of the 2006 for 20% of Blackpool, which has

League club turnover, £56m profit, but turnover of £91m at the 42,582-capacity its Cayman Islands-registered holding late Jack Walker’s estate. The takeover long been owned and bankrolled by

the truer state of finances came in the Villa Park is the Premier League’s company to “operate within its agreed by Venky’s, the Indian chicken company, the publisher Owen Oyston, and run by

six month accounts to November 2010, seventh highest, but is so far behind banking facilities”. So far £7.15m of that is one of English football’s oddest; it his son, Karl. Although credited with

with income from selling the flats in the Chelsea, Manchester United and Arsenal money, underwritten by Polly Chu, who sacked Sam Allardyce and Williams doing so shrewdly, and avoiding paying

old Highbury (worth £156m to May 2010) they risk becoming a seller of players to runs casinos in Macau, has come in, but quickly left. Under Steve Kean, Rovers agents, the wage bill was 144% of the

no longer coming in. Arsenal lost £6m. the top clubs. the share issue for the other £17.15m has have plummeted into a relegation battle. total income, making a £7m loss.

Outlook Will fare well when Uefa’s Outlook Scaling back after O’Neill’s not completed. Outlook Were punching above their true Outlook A season in the Premier League

financial fair play rules come in, because sixth-place finishes were achieved with Outlook Carson Yeung-led regime size with a £3m annual subsidy from should have transformed finances,

their income is high. But the “Arsenal financial losses. Size and turnover should needs to find substantially more money. Walker’s estate. Will struggle if Venky’s whether they stay up or go down. This

way” no longer looks so pure. see them into Europa League places. Relegation could be catastrophic. does not show it is a sensible owner. season’s vast income has been banked.

Manchester City Manchester United Newcastle United Stoke City Sunderland

Turnover £125m ▲ Turnover £286m ▲ Turnover £52m ▼ Turnover £59m ▲ Turnover £65m #

up from £87m in 2009 up from £278m in 2009 down from £101m in 2009 up from £54m in 2009 same as 2009

Gate and match-day income £18m Gate and match-day income £100m Gate and match-day income £21m Gate and match-day income £13m

TV and broadcasting £54m TV and broadcasting £104m TV and broadcasting £16m TV and broadcasting £39m

Commercial £53m Commercial £81m Commercial £15m Sponsorship and royalties £8m

Commercial activities £5m

Wage bill £133m ▲ Wage bill £131m ▲ Wage bill £47m ▼ Wage bill £45m ▲ Wage bill £54m ▲

up from £82m in previous year up from £123m in 2009 down from £73m in previous year up from £30m in 2009 up from £50m in previous year

Wages as proportion of turnover 106% Wages as proportion of turnover 46% Wages as proportion of turnover 90% Wages as proportion of turnover 76% Wages as proportion of turnover 83%

Loss before tax £121m Loss before tax £79m Loss before tax £17m Loss before tax £5m Loss before tax £28m

following £93m loss in previous year following profit of £22m in 2009 following loss of £15m the previous year following profit of £0.5m in 2009 following £26m loss in previous year

Net debt £41m Net debt £590m Net debt £150m Net debts £8m Net debt £66m

Interest payable £4m Interest payable £107m Interest payable £2m Interest payable £6,000 Interest payable £2m

Highest paid director Highest paid director Highest paid director Highest paid director Highest paid director

Garry Cook £2m David Gill £2m Unnamed director £0.174m Unnamed director £0.119m Niall Quinn £0.326m

Accounts for the year to 31 May 2010 Accounts for the year to 30 June 2010 Accounts for the year to 30 June 2010 Accounts for the year to 31 May 2010 Accounts for the year to 31 July 2010

Ownership Ownership Ownership Ownership Ownership

Wholly owned by Sheikh Mansour bin Zayed al-Nahyan Malcolm Glazer and his family via Red Football Limited Mike Ashley via his company St James Holdings Limited Owned by online gambling company, bet365 Group Ellis Short via Drumaville, a company registered in Jersey

via the Abu Dhabi United Group, Partnership and Red Football General Partner Inc, both controlled by Denise Coates, the daughter of chairman, Peter,

registered in United Arab Emirates registered in the low-tax State of Nevada, US Money put in by owners £140m and family Money put in by owner £115m

in loans £47m in the year (£19m cash, £28m interest-free loans)

Money put in by owners £493m Money put in by owners Nil Money put in by owners £43m

in cash £28m in cash, £15m in interest-free loans

Turnover Turnover Turnover Turnover Turnover

£125m £286m £52m £59m £65m

Wage bill Wage bill Wage bill Wage bill Wage bill

£133m £131m £47m £45m £54m

Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total

1.6% 23.4% 6.0% 0.3% 2.6%

State they're in State they're in State they're in State they're in State they're in

Almost £500m cash from Sheikh More itemisation of the Glazer family’s Figures from Newcastle’s promotion Stoke’s achievement in establishing Difficult not to wonder whether this

Mansour has been poured into City in monstrous, debt-laden takeover. United season; with turnover halved, the themselves in the Premier League is is how US private equity investor Ellis

32 months. Hence the £133m wage bill are the Premier League’s most lucrative club kept a huge wage bill for the thanks financially to the backing of Short imagined owning a Premier

and £121m loss, the Premier League’s club, with the highest income, £286m, Championship and finished top. Mike Peter Coates and his family fortune from League club would be, when chairman

biggest. Uefa’s financial fair play rules once Arsenal’s one-off £156m boost from Ashley has been vilified for awful bet365 online gambling. After returning Niall Quinn met him at the US

seek to outlaw this kind of benefactor selling the Highbury flats is taken out. decisions and an absence of grace, yet he in 2005 to buy back the club he has Masters golf and sold him the idea of

bankrolling. The chairman, Khaldoon Still made a £79m loss. Refinancing with has put £140m in interest-free loans into always supported, Coates has put in Sunderland. The £47m Short paid last

al-Mubarak, and Garry Cook believe the £500m bond last year cost £65m. the club. With St James’ Park’s 52,000 £43m, much of it towards buying players year to bankroll a high wage bill and

they can increase income sufficiently, Owe £500m, even after paying out capacity and the fans having proved for Tony Pulis to keep Stoke up. The wage £28m losses followed £67.5m paid in and

boosted by the Champions League next around £350m to service the loans the their loyalty many times over, Newcastle bill is climbing steadily, as it tends to do converted into shares the previous year,

season, full houses at Eastlands and Glazers took on in 2005 to buy the club. should be a force. Also have the £35m once promoted clubs grow in ambition. when Sunderland needed to be bailed

increased commercial income. Outlook The costs of the Glazers’ from selling Andy Carroll and fans wait Having been the owner when Stoke went out of probable financial crisis.

Outlook Determined to satisfy takeover will still be draining, but Sir to see if Ashley will see it spent wisely. down to the third tier in 1998, Coates Outlook Even with Short’s financial

Mansour’s desire for success, while Alex Ferguson’s management, and the Outlook Should be financially strong and knows it can quickly change. support, losses do not look sustainable.

shuffling towards breaking even. An club’s increasing commercial income, are able to rebuild. But this is Newcastle, Outlook Healthy, with the Coates family Sunderland have to wrestle the wage bill

extreme challenge to do so in the time. keeping United formidable. and Ashley, so anything could happen. committed to backing the club. down, while remaining competitive.

The Guardian | Thursday 19 May 2011 5

accounts at England’s top clubs David

Conn

Bolton Wanderers Chelsea Everton Fulham Liverpool

Turnover £62m ▲ Turnover £213m ▲ Turnover £79m ▼ Turnover £77m ▲ Turnover £185m ▲

up from £59m in 2009 up from £209m in 2009 down from £80m in 2009 up from £67m in 2009 up from £177m in 2009

Gate and match-day income £9m Football activities £185m Gate and match-day income £19m Gate and match-day income £11m Gate and match-day income £43m

TV and broadcasting £38m Hotel/catering £10m TV and broadcasting £50m TV and broadcasting £42m TV and broadcasting £80m

Hotel £8m Corporate hospitality £2m Other commerical activities £10m Commercial £11m Commercial £62m

Corporate hospitality £2m Other commercial £5m Europa League £12m

Merchandising £1m Merchandising £11m

Sponsorship/advertising £3m

Wage bill £46m ▲ Wage bill £174m ▲ Wage bill £54m ▲ Wage bill £49m ▲ Wage bill £121m ▲

up from £41m in 2009 up from £167m in 2009 up from £49m in previous year up from £46m in 2009 up from £100m in previous year

Wages as proportion of turnover 74% Wages as proportion of turnover 82% Wages as proportion of turnover 69% Wages as proportion of turnover 63% Wages as proportion of turnover 65%

Loss before tax £35m Loss before tax £78m Loss before tax £3m Loss before tax £19m Loss before tax £20m

following £13m loss in 2009 following loss of £47m in 2009 following £7m loss in 2009 following £8.4m loss in 2009 following £16m loss in 2009

Net debt £93m Net debt £734m Net debt £45m Net debt £190m Net debt £123m

Interest payable £5m Interest payable £0.8m Interest payable £4m Interest payable £2m Interest payable £18m

Highest paid director Highest paid director Highest paid director Highest paid director Highest paid director

Phil Gartside £0.532m Peter Kenyon £0.825m No directors were paid Alastair Mackintosh £0.55m Unnamed director £0.75m

Accounts for the year to 30 June 2010 Accounts for the year to 30 June 2010 Accounts for the year to 31 May 2010 Accounts for the year to 30 June 2010 Accounts for the year to 31 July 2010*

Ownership Ownership Ownership Ownership Ownership

95% owned by Fildraw, private trust owned by Wholly owned by Roman Abramovich Everton FC Limited major shareholders are: Mafco Holdings A Bermuda- (tax haven) based company Fenway Sports Group (US company owned by John Henry)

Edwin Davies, resident in Isle of Man, a tax haven registered as a Russian resident at Companies House Bill Kenwright 25% which is owned by Mohamed Al Fayed and his family *Accounts for a year when owned by Tom Hicks and George

Robert Earl (US resident) 23% Gillett, via US-registered Kop Investment LLC

Money put in by owners £85m Money put in by owners up to £739m Jon Woods 19% Money put in by owners £187m

loaned by Davies at 5% interest from his company, Moonshift Abramovich’s loans to the parent company, Fordstam Interest-free loans by Al Fayed’s companies Money put in by owners £144m

Money put in by owners Nil In interest-bearing loans, to the holding company

Turnover Turnover Turnover Turnover Turnover

£62m £213m £79m £77m £185m

Wage bill Wage bill Wage bill Wage bill Wage bill

£46m £174m £54m £49m £121m

Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total

4.1% 29.3% 1.8% 7.5% 4.8%

State they're in State they're in State they're in State they're in State they're in

Chairman and FA board member Phil This was the year the former chief Have wriggled with frustration for years The remarkable story of Mohamed Al Figures confirm that John Henry’s

Gartside spent two years advocating executive, Peter Kenyon, said Chelsea at grand old Goodison’s commercial Fayed’s long, deep subsidy of Fulham. Fenway Sports Group repaid £200m

a Premier League second division, to would be making enough money limitations. But on the income of £79m, The £187m he has loaned interest-free owed to Royal Bank of Scotland, which

cushion the financial blow for relegated commercially to break even. Won with a wage bill less than a third of to embed the club at Craven Cottage and Hicks and Gillett had borrowed to take

clubs. The increased parachute the title with the Premier League’s Chelsea’s, David Moyes’s team have finance its rise from the bottom division the club over. Liverpool made a £20m

payments, £48m over four seasons, highest wage bill and recorded a performed creditably. The chairman, to the Premier League has belied the loss and the £185m turnover included

were introduced partly to mollify that £78m loss. Abramovich’s relentless Bill Kenwright, has pushed the finances early expectation that he would cash Champions League income from 2009-

worry. Gartside has cause to be terrified ambition pushed his spending since as far as he can. Had Everton not sold in. Still complains about players’ wages 10, which the club must do without this

of relegation: a 14th-place finish, after 2003 to £739m, and £75m in January on Joleon Lescott to Manchester City for draining clubs, and argues that only season and next. FSG’s takeover has

10 consecutive seasons in the Premier Fernando Torres and David Luiz suggests £22m, they would have recorded a loss BSkyB actually makes money out of the not changed much financially so far,

League, achieved at a loss of £35m, with he will find it hard to restrain himself. of £22m. The chairman says his search Premier League, but with Harrods sold retaining the club’s own borrowings

debts up to £93m and £85m loans. Outlook Income is third highest behind for a benefactor goes on. to the Qatari ruling dynasty for £1.5bn from RBS, which are high at £86.6m.

Outlook Controversial recruitment of Manchester United and Arsenal but, Outlook If Everton could appreciate last year, Al Fayed shows no sign of Outlook Financial fair play should see

Owen Coyle from Burnley has proven given Abramovich’s obsession with their blessings – homely old ground, withdrawing. Liverpool climb back. But if they want to

successful. Challenge is to stay up winning, will be hard-pressed to break steely manager, strong team – they could Outlook Fortunes depend on indulgence challenge United again, FSG must decide

without huge losses and owner’s subsidy. even and comply with financial fair play. be happy, but the club wants success. of owner and his continued enthusiasm. how to expand stadium capacity.

Tottenham Hotspur West Bromwich Albion West Ham United Wigan Athletic Wolverhampton W

Turnover £119m ▲ Turnover £28m ▼ Turnover £72m ▼ Turnover £43m ▼ Turnover £61m ▲

up from £113m in 2009 down from £47m in 2009 down from £76m in 2009 down from £46m in 2009 up from £18m in 2009

Gate and match-day income £27m Gate and match-day income £6m Gate and match-day income £17m Gate and match-day income £10m

TV and broadcasting £52m TV and broadcasting £17m TV and broadcasting £38m TV and broadcasting £39m

Sponsorship and corporate hospitality £26m Merchandising £2m Commercial activities £13m Sponsorship and advertising £5m

Merchandising £8m Other commercial income £3m Retail and merchandising £4m Commercial activities £6m

Commercial activities £8m

Wage bill £67m ▲ Wage bill £23m ▼ Wage bill £54m ▼ Wage bill £39m ▼ Wage bill £30m ▲

up from £60m in 2009 down from £31m in 2009 down from £67m in 2009 down from £42m in 2009 up from £17m in 2009

Wages as proportion of turnover 56% Wages as proportion of turnover 82% Wages as proportion of turnover 75% Wages as proportion of turnover 91% Wages as proportion of turnover 49%

Loss before tax £7m Profit before tax £0.5m Loss before tax £21m Loss before tax £4m Profit before tax £9m

following profit of £33m in 2009 following loss of £12m in 2009 following £16m loss in previous year following £6m loss in previous year following £5m loss in previous year

Net debt £65m Net debt £10m Net debt £34m Net debt £73m Net debt £0m

Interest payable £6m Interest payable £0.09m Interest payable £4m Interest payable £0.9m Wolves had £25m cash in the bank

Highest paid director Highest paid director Highest paid director Highest paid director Highest paid director

Daniel Levy £1.4m Jeremy Peace £0.712m Unnamed director £0.332m Brenda Spencer not declared Unnamed director £1.1m

Accounts for the year to 30 June 2010 Accounts for the year to 30 June 2010 Accounts for the year to 31 May 2010 Accounts for the year to 31 May 2010 Accounts for the year to 31 May 2010

Ownership

Ownership Ownership David Sullivan 30.6% Ownership Ownership

Enic International Limited registered in the Bahamas, owns Jeremy Peace chairman 60% David Gold 30.6% Dave Whelan and family Steve Morgan 25% personally and 75% via his company

85%. Joe Lewis, resident in the Bahamas, has the controlling, Geoff Hale 10.4% Straumur, the Icelandic investment bank which is in a form of via Whelco Holdings, registered in the UK Bridgemere Investments, based in Guernsey

70.6% ownership of Enic, with chairman Daniel Levy and administration, owns 35%

family owning the other 29.4%. Money put in by owners Nil Money put in by owners Money put in by owner £52m Money put in by owners £30m

Money put in by owners £15m £24m from Sullivan & Gold for extra 5.6% stake each. £20m to from Dave Whelan, interest free except for £7.5m on which In shares, in August 2007

by an issue of new shares buy 50% last year. Straumur wrote off £10m debt 5% a year is charged

Turnover Turnover Turnover Turnover Turnover

£119m £28m £72m £43m £61m

Wage bill Wage bill Wage bill Wage bill Wage bill

£67m £23m £54m £39m £30m

Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total Debt as % of Premier League total

2.6% 0.4% 1.4% 2.9% 0%

State they're in State they're in State they're in State they're in State they're in

Spurs pushed their finances, with a Considered to be a well-run club who Sullivan laments that West Ham are in Dave Whelan’s hometown project In their first season in the Premier

£15m investment from Enic and making have made their peace with yo-yoing, “a worse financial position than any continues at the stadium he named DW, League, Wolves’ turnover increased

a £7m loss, to just secure a Champions trying to stay in the Premier League club in the country”. Sullivan and Gold’s but, aged 74, he is worrying who will by £43m, boosted by their £39m share

League place via the 2009-10 last-match without overstretching. These figures investment brought net debt down to take it over after him. Wigan, a club of of the top flight’s TV and sponsorship

victory at Manchester City. Turnover are for last season’s promotion, in which £34m. West Ham made a £21m loss and humble football tradition which entered deals, compared to £2m the previous

will have been increased by their run in Albion cut the wage bill, keeping it at relegation will cause a crisis. Yet Sullivan the old Fourth Division for the first time season in the Championship. The wage

the competition this season, but Levy is £23m, huge for the Championship, with believes West Ham will soon be worth in 1978, were sprung into the Premier bill increased by £13m, as Morgan stayed

desperate to build a bigger stadium than the benefit of parachute payments and £500m. The foundations for that will League with an investment Whelan true to his promise not to be dazzled

36,534 capacity White Hart Lane. The went up comfortably. Have little debt, be laid if the club occupies the Olympic reckons to be £100m. Relegation will by promotion and ran Wolves like a

clearest comparison is with Spurs’ north and a good season staying up this year stadium after 2012, a huge commercial make Whelan’s task much more difficult. business. So a £9m profit was made

London rivals Arsenal: they made £156m will have improved their finances advantage for him and Gold, thanks to Outlook Whelan hopes to give his club and according to Morgan, Wolves have

from their property development, and Outlook Concentrate on doing as well £490m of public money, about which it away to a safe, wealthy new owner as invested substantially to try to stay up.

their football-based income of £226m as they can while remaining financially is surprising there is not more protest. Sir Jack Hayward did to Steve Morgan at Outlook Morgan has been careful with

was almost double that of Spurs. sound. Roy Hodgson’s success has Outlook Dire in the short term. Wolves. But Wigan lack Wolves’ support the Premier League bounty so Wolves

Outlook Will be a strong Premier League proved again how vital it is for any club’s Occupying the Olympic stadium would and tradition, and he will find it hard to are likely to be financially healthy even

club even at White Hart Lane. fortunes to appoint the right manager. represent a huge financial windfall. attract a willing backer. if they go down.

You might also like

- Southampton Investment BrochureDocument7 pagesSouthampton Investment BrochureMark I'AnsonNo ratings yet

- 2009 FY Master Slides FinalDocument35 pages2009 FY Master Slides Finaltipu001No ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- Northamptonshire NN18 Investment BrochureDocument7 pagesNorthamptonshire NN18 Investment BrochureMark I'AnsonNo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument14 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsRaza AliNo ratings yet

- Atxuk-2019-Marjun Sample-Q PDFDocument12 pagesAtxuk-2019-Marjun Sample-Q PDFONASHI DEVNANI BBANo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument13 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsRaza AliNo ratings yet

- ATX - UK Sample Questions SummaryDocument15 pagesATX - UK Sample Questions SummaryONASHI DEVNANI BBANo ratings yet

- CIPP Payroll FactcardDocument8 pagesCIPP Payroll FactcardRoxana GiurcaNo ratings yet

- Calculating Average Rate of Return (ARR) : Method and Worked ExampleDocument4 pagesCalculating Average Rate of Return (ARR) : Method and Worked ExamplehjycjycjycNo ratings yet

- TXUK 2018 SepDec QDocument9 pagesTXUK 2018 SepDec QmdNo ratings yet

- DocxDocument5 pagesDocxainun nisaNo ratings yet

- Year 10 Treasure HuntDocument2 pagesYear 10 Treasure HuntWeiwei LiangNo ratings yet

- Absorption and Marginal Costing TemplateDocument13 pagesAbsorption and Marginal Costing TemplateGeorge PNo ratings yet

- Tax Table December 2020Document3 pagesTax Table December 2020Mohamed ShaminNo ratings yet

- d18 Atxuk QPDocument15 pagesd18 Atxuk QPakankshaNo ratings yet

- ACCA ATX Paper Sep 2018Document16 pagesACCA ATX Paper Sep 2018Dilawar HayatNo ratings yet

- Investment Analysis1Document9 pagesInvestment Analysis1Kanchanit BangthamaiNo ratings yet

- Automotive Repair - Sales - Valet Business PlanDocument31 pagesAutomotive Repair - Sales - Valet Business PlanH E R ONo ratings yet

- Tugas 6 - Aulia KhairaniDocument3 pagesTugas 6 - Aulia KhairaniadvokesmahmmbNo ratings yet

- ACCA TX (F6) Tax Rates and Allowance Exam Formulae 2018Document3 pagesACCA TX (F6) Tax Rates and Allowance Exam Formulae 2018Katuta MwenyaNo ratings yet

- Examinable Documents, K and ATX-UK - FA 2019 Exam Docs June 20 To March 21 - Draft 2 (Clean) PDFDocument5 pagesExaminable Documents, K and ATX-UK - FA 2019 Exam Docs June 20 To March 21 - Draft 2 (Clean) PDFJudithNo ratings yet

- Go-Ahead AnalysisDocument25 pagesGo-Ahead AnalysisMirza Zain Ul AbideenNo ratings yet

- 2023 11 13 08 00 22 A021231048 William Mangumban A021231048 Tugas AkuntansiDocument1 page2023 11 13 08 00 22 A021231048 William Mangumban A021231048 Tugas AkuntansiWilliam MangumbanNo ratings yet

- Default Tariff Cap Level - LetterDocument3 pagesDefault Tariff Cap Level - LetterAlex ButcherNo ratings yet

- Preparing Taxation Computations (UK Stream) : Tuesday 15 June 2010Document12 pagesPreparing Taxation Computations (UK Stream) : Tuesday 15 June 2010Erdene DexNo ratings yet

- Kingfisher Annual Report 2019.PDF - DownloadassetDocument196 pagesKingfisher Annual Report 2019.PDF - Downloadassetsurbhiaggarwal13No ratings yet

- Blue Prism FY 2019 ResultsDocument21 pagesBlue Prism FY 2019 ResultsRPA ToolsNo ratings yet

- Taxation - United Kingdom (TX - UK) : Applied SkillsDocument17 pagesTaxation - United Kingdom (TX - UK) : Applied Skillsbuls eyeNo ratings yet

- f6 Uk Specimen s16Document28 pagesf6 Uk Specimen s16Waleed QasimNo ratings yet

- Eun8e CH 005 PPTDocument47 pagesEun8e CH 005 PPTannNo ratings yet

- 14 - Tax TableDocument5 pages14 - Tax Tableayushagarwal23No ratings yet

- Eun8e CH 006 TomDocument41 pagesEun8e CH 006 TomCarter JayanNo ratings yet

- Soal 1Document1 pageSoal 1j8zpmzcnjxNo ratings yet

- Taxation (United Kingdom) : September/December 2017 - Sample QuestionsDocument9 pagesTaxation (United Kingdom) : September/December 2017 - Sample QuestionsAyushman BhardwajNo ratings yet

- Eun8e CH 006 PPTDocument41 pagesEun8e CH 006 PPTAhmed MajedNo ratings yet

- Jun 2014 Q PDFDocument14 pagesJun 2014 Q PDFAmbreen KureemunNo ratings yet

- Taxation (United Kingdom) : March/June 2016 - Sample QuestionsDocument15 pagesTaxation (United Kingdom) : March/June 2016 - Sample QuestionsAmbreen KureemunNo ratings yet

- BMV L9 1JQ LiverpoolDocument6 pagesBMV L9 1JQ LiverpoolOctav CobzareanuNo ratings yet

- The Deal Full Year 2016: UK Equity InvestmentDocument44 pagesThe Deal Full Year 2016: UK Equity InvestmentCrowdfundInsider100% (1)

- Total Comprehensive Income For The Year 139,400.00Document2 pagesTotal Comprehensive Income For The Year 139,400.00Siti rahmahNo ratings yet

- Jun 2015 Q PDFDocument14 pagesJun 2015 Q PDFAmbreen KureemunNo ratings yet

- Income Tax Rates and Allowances 2022-23 SummaryDocument5 pagesIncome Tax Rates and Allowances 2022-23 SummaryAmmaarah PatelNo ratings yet

- Unit 8 Lesson 4Document13 pagesUnit 8 Lesson 4shermatt0No ratings yet

- Standard Costing Problems and Variance AnalysisDocument4 pagesStandard Costing Problems and Variance AnalysisRoy Mitz Aggabao Bautista V100% (1)

- Items Amount (In RS) A. Fixed CostsDocument1 pageItems Amount (In RS) A. Fixed CostsShrey MaheshwariNo ratings yet

- ACCA F6 Mock Exam QuestionsDocument22 pagesACCA F6 Mock Exam QuestionsGeo Don100% (1)

- Abf Ar 2017Document178 pagesAbf Ar 2017ahmedNo ratings yet

- Tax Planning Advice for REP Limited and LamarDocument10 pagesTax Planning Advice for REP Limited and LamarJalees Ul HassanNo ratings yet

- 2 GIPM 02 Investment AppraisalDocument50 pages2 GIPM 02 Investment AppraisalSamantha Meril PandithaNo ratings yet

- Greystone Salary Guide 2019Document3 pagesGreystone Salary Guide 2019MekaNo1DNo ratings yet

- Acca-F6uk 2009 Dec q-090820101Document13 pagesAcca-F6uk 2009 Dec q-090820101annez3112No ratings yet

- December 2018Document8 pagesDecember 2018LelouchNo ratings yet

- Final Exam - FA PDFDocument7 pagesFinal Exam - FA PDFNga NguyễnNo ratings yet

- Financial Accounting - Accounting Is A Fundamental Aspect of Business OperationsDocument37 pagesFinancial Accounting - Accounting Is A Fundamental Aspect of Business OperationsZamzam AbdelazimNo ratings yet

- Angler Gaming PLC Q3 Report 2020 FINALDocument9 pagesAngler Gaming PLC Q3 Report 2020 FINALEmil Elias TalaniNo ratings yet

- F6uk 2010 Dec Q PDFDocument10 pagesF6uk 2010 Dec Q PDFInsia AhmedNo ratings yet

- Real Estate Business PlanDocument13 pagesReal Estate Business PlanAlex MichaelNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- CHAN 9363 BOOK - QXD 16/7/07 12:19 PM Page 2: John AdamsDocument9 pagesCHAN 9363 BOOK - QXD 16/7/07 12:19 PM Page 2: John AdamskapukapucarNo ratings yet

- Kitabee's 100 Geometry Questions FileDocument44 pagesKitabee's 100 Geometry Questions FileDeepam Garg100% (1)

- Ame3565 - Arcane AcademyDocument146 pagesAme3565 - Arcane AcademyNorischeNo ratings yet

- Rise of The RedsDocument2 pagesRise of The Redspierre van wykNo ratings yet

- Contemporary Philippine Arts from the Regions: Materials and TechniquesDocument11 pagesContemporary Philippine Arts from the Regions: Materials and Techniquesgroup 6No ratings yet

- Novomatic PercentageDocument3 pagesNovomatic PercentagePVL Mwanza0% (1)

- Mushoku Tensei - Volume 21 - Young Man Period - Cliff Chapter (Baka-Tsuki) (Autogenerated)Document764 pagesMushoku Tensei - Volume 21 - Young Man Period - Cliff Chapter (Baka-Tsuki) (Autogenerated)glen biazonNo ratings yet

- Ds2022 - Square L XLDocument10 pagesDs2022 - Square L XLAbed HajjoNo ratings yet

- Satire TechniquesDocument3 pagesSatire TechniquesSarahNo ratings yet

- Signs of Life (Penguin Cafe Orchestra Album) - WikipediaDocument2 pagesSigns of Life (Penguin Cafe Orchestra Album) - Wikipediajordanfakes.psdNo ratings yet

- 1e AD&DDocument10 pages1e AD&DAnthony BindleNo ratings yet

- The 50 Most Frequently Asked Questions On Movie Special EffectsDocument0 pagesThe 50 Most Frequently Asked Questions On Movie Special EffectsDaniel Hernández PérezNo ratings yet

- GSRTCDocument1 pageGSRTCSohum PatelNo ratings yet

- Elton JohnDocument51 pagesElton JohnGiorgio Paganelli100% (1)

- OSYSU Series: FeaturesDocument6 pagesOSYSU Series: FeaturesCh C AlexisNo ratings yet

- (HW F750 F751 Za) Ah68 02617a 06eng 0626Document26 pages(HW F750 F751 Za) Ah68 02617a 06eng 0626HarveyNo ratings yet

- Networked Production System: BZNS-2000 Series BZNS-700 SeriesDocument12 pagesNetworked Production System: BZNS-2000 Series BZNS-700 SeriesДраган МиљићNo ratings yet

- Smartstep 2 Servo Motors: @, R88M-Gp@Document6 pagesSmartstep 2 Servo Motors: @, R88M-Gp@HammadMehmoodNo ratings yet

- American Inside Out Evolution - Advanced Unit 2 Test: Name - Score - /50 VocabularyDocument5 pagesAmerican Inside Out Evolution - Advanced Unit 2 Test: Name - Score - /50 Vocabularypeda mapeNo ratings yet

- Kevin LynchDocument3 pagesKevin LynchKevinLynch17No ratings yet

- C Major Scale Positions and ChordsDocument1 pageC Major Scale Positions and ChordsjohnNo ratings yet

- Retirement Staking Plan: # Stake Odds Target Profit Divisor Won/Lost Losing BetsDocument3 pagesRetirement Staking Plan: # Stake Odds Target Profit Divisor Won/Lost Losing BetsFabio FerreiraNo ratings yet

- Theater of The AbsurdDocument34 pagesTheater of The Absurdrabin dasNo ratings yet

- Beethoven Lesson Plans K-2Document15 pagesBeethoven Lesson Plans K-2Gabriel FriedmanNo ratings yet

- SFC Songboard UpdatedDocument1,064 pagesSFC Songboard UpdatedKath MendozaNo ratings yet

- ORION Brochure PDFDocument31 pagesORION Brochure PDFparagbholeNo ratings yet

- Maschine 2.0 Mk2 Manual EnglishDocument695 pagesMaschine 2.0 Mk2 Manual EnglishJacob KreyenbühlNo ratings yet

- Wild WestDocument85 pagesWild WestAnonymous yAH8LaVDUCNo ratings yet

- Rapsodia BohemiaDocument19 pagesRapsodia BohemiaHilcA MusicNo ratings yet

- ENG FP30570 Zeppelin-Air ManualDocument130 pagesENG FP30570 Zeppelin-Air Manualmakabeus67No ratings yet