Professional Documents

Culture Documents

Deregulation of Essential Commodity

Uploaded by

brijeshbhaiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deregulation of Essential Commodity

Uploaded by

brijeshbhaiCopyright:

Available Formats

Situation of Sugar & some allied commodities have been sky rocketing in India and globally this fiscal.

This has been coupled by Dairy commodity prices shooting up more than 30% in past one month and sugar prices shooting up by more than 70% in 5 months in commodity exchanges worldwide. So its not suprising for industries dependent on these raw materials will have to pledge more money from their budgets this year towards commodity purchases. Though technically we claim sugar as a cyclic crop in India and wipe off the hands but the fact is, we have never been able to regulate/ deregulate the drastic market swings and provide consistancy to framers on sugar pricing as most of it is through cooperatives and its a more political crop in India. This year sugar prices not only kept pressure domestically but also in international markets where in, it has doubled within in a span of 4 months from 13th April to 1st August from 13 cents to 26 cents/ pound. Two major reasons have caused this effect this year, Growing demad in Brazil for diversification into Ethanol production, coupled with fall in production out put from India i.e we are short by 4.5 million Mt in inventories compared to previous years. Though our Mr. Perfect in Agriculture ministry denies it, but the ground reality reflects on price momentum. Thanks to the Indian met department in India for early predication of drought in many parts of India, where in the average rainfall in sugar growing regions will be roughly 63% which has created a cumulative speculation on domestic price rise and panic in international market, with two major sugar producers/ exporters in world are in vaccum for Sugar. Yes this year we will be short on sugar production and India has to import almost 1/4th of its volume from International market. Last two years there was a huge drop in sugar prices with drop of more than 35% which has left farmers look into alternate cropping, this has created a huge vaccum in total output coupled by drought this fiscal. Now sugar prices in International markets have come up to the same peak levels of 1981 with a 28 year high levels @ 25cents/ pound at LIFFE & ICE terminals. Suprisingly this year India has imported large volumes of Milk fat, Lactose & Dairy commodities from international markets to cope up the festive demand in Sep/ Oct & November. This is driving the Dairy commodity prices every week with volumes shrinking and demand building up in India, China & Far east. Today govt. is run by market manipulators, fixers, fly by operators, corporate gamblers. The first and prime reason the rising essential commodities because we created a commodity exchange like MCX and other like commodity exchanges. The market can manipulate within hours according to their own wish. It is nothing to do with our production, distribution, monsoon and other factors. Indians tears is the stock and commodity exchanges. Gamblers and fixers deciding the market now with the whole hearted support of the govt. It is a best lucrative and risk free business for mafias to engage such activities without any risk. Indias biggest mistake is that we opened door for the manipulators. At the time, a small and genuine investors, traders, businessman, and all other sections of society imposed with various taxes, duties and finding it difficult to survive due to licence, inspector and permit raj. The double standard is clearly visible. The inflation can be controlled to the large extent if the govt. give full freedom for farmers to sell their agricultural produce anywhere in India without any restriction and ensure free movement without taxing the same. All the agricultural produce is controlled by market forces especially the Baniyas, Marwaris and other rich and traditional traders. The price of goods are decided by these individuals. They create the artificial shortage and price rise. The farmers cannot sell their agriculture produce directly due to different reasons. The real farmers/ producers getting 1/3rdof the price. Rest of the profit swallowed by the middleman and traders only. We are witnessing farmers death across the country. Govt. have no concrete action plan to stop the suicides. At the end of the day, what the govt. need to do is to liberate the middleman and traders in manipulating the food grain and other agricultural produce prices. The farmers could sell their produce without the support of APMC market. The farmers have their right to sell, load, unload and transport the goods at any destination and the govt. will not restrict the movement from one dist. to other dist. one state to other state. Minimise and exemption of toll tax, octroi and other taxes when a small farmer move their product to other location. It will really help the actual producers to sell the produces directly to consumer and both consumer point of view and farmers get benefit each other without middleman support. The govt. should try to crate such a mechanism at the earliest to liberate the farmers from the clutches of middleman. The existing commodity exchange only benefits these traders and not the farmers which need to be noted.There is no proper check in FCI and other godowns to prevent black marketing. By stocking through these godowns, the manipulators creating artificial price rise and then it encouraged black marketing. The high inflation can be fully

controlled if the govt. and the concerned authorities make proper check on the market and raid various godowns across the country. The governments recent decision to opening up retail sector to big multinational corporation going to create more problem because, these forces take full control of the market and whenever they want to make manipulate the market. On the other hand, it badly affect the govts. performance and public anger. The Present Prime Minister and Finance Minister, without making a second thought try to open up all sectors even the retail sector which will badly affect the retail traders as well as the consumers. On the farmers & direct consumers point of view, the govt. is doing nothing on this issue, just making a temporary noises, with no action. At the late hours, the govt. need to look into all aspects in its policies to address the pressing farmers issue, otherwise the present problem of price rise and farmers suicide going to increase many fold. It is an early wake up call. The Government of India has taken a bold decision to deregulate petrol and diesel (partially) prices in India and also come up with a price hike.As usual the vote bank politicians on the UPA alliance, opposition leaders and the left have voiced their protest. They claim that they are with the people of India and whole lot of other crap. Two of the most politically spoiled states in India The West Bengal and Kerala have readily jumped on to celebrate the situation with a Hartal (strike). But do they even know how pampered the people of India already are how much they are misusing one of the most limited natural resources such as petrol (LPG and diesel as well)? Decontrolling or deregulating the petrol prices mean that, the government will no longer be subsidizing petrol prices and the prices will be purely linked to theinternational crude prices. In the case of diesel, though, it will be only partially regulated the reason being an attempt to avoid sudden spike in inflation. As all of us know, petrol (or Gasoline) is produced out of crude oil which is a natural resource thats available in limited quantity. It is a matter of a few years before the crude gets totally exhausted. Although, there have been several crude discoveries in India, we are still dependent on the OPEC (Oil Producing and Exporting Countries) to import crude and refine it to produce petrol, LPG, diesel, aviation fuel, kerosene etc. As of today (26 June 2010), the crude oil costs $79 a barrel (159 Litres). Since this has to be transported to India via the marine root, there is a shipping cost. Lets say its something like 10%. Since the import duty on crude oil was waived sometime back, let us not count that part. Hence by the time the crude arrives in India, it is already costing something like $85 per 159L. So the petrol refining calculation goes as follows:

Cost of 1 barrel crude: $85 or Rs. 3910.00 (exchange rate of 46) Quantity of petrol produced from 1 barrel crude: 72L (45.4%) Since almost 100% of the crude is refined into some product or other, we can calculate the raw material cost of producing 72L or petrol as 45.4% of the price of crude barrel. Hence 72L petrols material cost alone is 3910 * 45.4 / 100 = Rs. 1775.00 Raw material cost of 1L of Petrol = 1775.00 / 72 = ~25 rupees Obviously, the raw materials alone do not contribute to a product. You need electric power, thousands of paid employees, machinery, maintenance etc to finally produce petrol. So finally when its of consumable form, it is costing around 30 rupees in the oil refining spot itself. The following are the other additional expense before you can consume the petrol at your favorite gas station:

Excise duty Education tax VAT Distribution and transportation cost Dealer commission

As I understand, all the above added up comes to around 27 rupees per litre of petrol the majority of the cost is towards excise duty, transportation cost and VAT (Isnt it a pity you have to spend more petrol or diesel to distribute petrol?) Essentially, one litre of petrol, by the time it reaches the petrol filling stations, is costing you already Rs. 57/without any profit added to the petroleum marketing companies. Obviously most of these companies are state run companies and hence cannot afford to reap 100% profit. Lets turn our back on them and tell them that you can make say 20% profit. And if you add that your 1L of petrol should actually cost you around Rs. 68/Now, arent you really lucky that its available below Rs.60/- even with the latest hike in petrol prices?

The story is not over yet. One needs to do similar calculations for other products such as diesel, aviation fuel, kerosene and LPG. Unfortunately diesel is the primary thing that fuel public transport and distribution system in India and kerosene LPG are house hold lifesavers when it comes to cooking purposes. In order to curb the inflation and protect the below poverty line people, the government has to subsidize it big time. A part of this subsidy cost is absorbed by the government while the oil marketing companies bear the other half. This puts some pressure on the government to increase taxes on luxury consumption sectors such as airlines by increasing aviation or jet fuel prices. They are also taxed heavily which is mainly borne by the rich or upper middle class people in India. The deregulation of petrol prices will definitely increase the rate of inflation in short term. Virtually there will be immediate price rise in commodities and other consumables. However, for long term I think it is a good move because at the end it will definitely reduce our long term debt and fiscal deficit. Our overall economy will get stabler in this case. Secondly, this measure will be a boost to the oil producing and marketing companies to recover their losses immediately. Remember, lakhs of people work in these huge companies and they need a life too. Moreover, the government run oil companies will be candidates for disinvestment which means that the government can lower their fiscal deficits further with additional income. The other advantage is that the inflation, at the moment, is a fake figure. Youwill get to know the actual inflation and variation of commodity prices only when the petrol prices move according to the international crude prices. This will also bring in big private players (e.g. Reliance) into the petrol marketing game. Remember that companies like Shell and Reliance used to provide excellent quality of petrol and service until Reliance pumps were forced to close down due to government regulations. This kind of competition will eventually bring in good service, good quality and in the future competitive pricing as well. The immediate woes will be compensated in the mid term thats my strong belief. The government, in the meantime, should try to reduce the excise duties and restructure the VAT to minimize the impact of immediate fuel price rise on inflation and the poor people. In the long term, there are several viable solutions that needs to be done from the sourcing point to distribution and consumption.

There are possibilities of under sea pipes (just like the one we were planning with Iran for gas sourcing) from the vendor nation to India to reduce shipping cost. This has a very good long term positive impact though initial cost of incorporation is high. The oil refining companies sourcing and storing mechanism needs to be optimized in a way that when the crude prices are low, we are able to store more. I am not sure, how much of optimization is done in this regard. Since we keep getting new and new governments every few years, they may not go for a long term plan for the same. Please remember that not too long back, the crude prices were at $35 or so per barrel. There is a scope for improving the internal distribution system as well. Though, India has a huge geographical region, we can still have oil distribution pipes from refineries directly to the regional distribution centers. This needs long term planning. I think our citizens (and even people from rest of the world) are misusing petroleum products and this kind of abuse needs to be first controlled via price hikes and then by introducing alternate energy options and technologies to optimize the usage. There is a lot of scope for India to take out those old, fuel inefficient vehicles from our roads. I think thetaxation needs to be restructured so that people and families who own more than one vehicle should be taxed more. There can be several other long term steps to improve the overall situation but please remember that at the end of it the petrol will anyhow get exhausted. And a request to our great politicians who always oppose what the government is trying to implement. If you are really with the people of India, please come up with real practical suggestions to improve the situation. It wouldnt be too long before you will be stone-pelt by the younger generation for preventing them an opportunity to live in a developed country by 2020. And my questions to my friends (not the poor) who are earning in thousands and lakhs. How dare you crib about a three rupees rise in petrol while you still prefer to drive to office alone in a 5, 10 or 15 lakh car?. More over I havent seen you cribbing while spending 1000 rupees for a dinner or while buying a shirt worth 1500 rupees.

The Reserve Bank of India (RBI) made a pitch for deregulation of savings bank deposit rates, saying that deregulation of interest rates on savings bank (SB) accounts would benefit savers, as it would enable lenders to come out with innovative products to attract more funds from low-income households. While the RBI had deregulated interest rates on fixed deposit schemes in 1997, it continues to fix the rate on savings bank deposits. The interest rate on savings bank deposits has remained unchanged at 3.5 per cent since March 1, 2003. As indicated in the second quarter review of Monetary Policy 2010-11 on November 2, 2010, the RBI released on its website a discussion paper on Deregulation of savings bank deposit interest rate'. Savings deposit interest rate can not be regulated for all times to come when all other interest rates have already been deregulated as it creates distortions in the system, the RBI noted. International experience suggests that in most countries, interest rates on savings bank accounts are set by commercial banks based on market interest rates. Most countries in Asia experimented with interest rate deregulation to support overall development and growth policies. These resulted in positive real interest rates, which in turn contributed to an increase in financial savings. Deregulation of savings bank deposit interest rate also led to product innovations. The RBI said that deregulation of interest rates in India since the early 1990s has improved the competitive environment in the

financial system, imparted greater efficiency in resource allocation and strengthened the transmission mechanism of monetary policy. The only interest rate that continues to be regulated now is the savings deposit interest rate. Savings deposit interest rate has not been deregulated for the reason that a large portion of such deposits are held by low-income households in rural and semi-urban areas. Beneficial to savers The empirical evidence suggests that unlike metropolitan areas, savings deposits in rural, semi-urban and urban areas are responsive to interest rate changes in savings deposits. Therefore, the RBI argues that market-based interest rate may be beneficial to savers. Since savings deposit is a hybrid product, which combines the features of current account and term deposit, a market-based rate of interest on this product has the potential to attract large savings from low-income households. Deregulation will also allow banks to introduce product innovations which could also benefit the depositors. Deregulation will have another major advantage in that it will help improve the monetary transmission. Since savings deposits constitute a significant portion of aggregate deposits, regulation of interest rate on such deposits has impeded the transmission of monetary policy impulses, the RBI stated.

You might also like

- House Designs, QHC, 1950Document50 pagesHouse Designs, QHC, 1950House Histories100% (8)

- Research Paper of LawDocument21 pagesResearch Paper of LawbrijeshbhaiNo ratings yet

- Sugar IndustryDocument10 pagesSugar IndustryShoaib JanjirkarNo ratings yet

- Letter To FM From CAITDocument6 pagesLetter To FM From CAITMoneycontrol NewsNo ratings yet

- Lift food grain export ban and protect Indian farmersDocument6 pagesLift food grain export ban and protect Indian farmersMithun KonjathNo ratings yet

- General Knowledge TodayDocument5 pagesGeneral Knowledge Todayrebba89No ratings yet

- Farm LawDocument2 pagesFarm LawJazzy JSNo ratings yet

- Food Price Inflation IndiaDocument2 pagesFood Price Inflation IndiaZaman AliNo ratings yet

- Know Your Friends and FoesDocument7 pagesKnow Your Friends and FoesAnonymous 3pTM9WCYNo ratings yet

- Economics of rising fuel prices: Impacts and solutionsDocument6 pagesEconomics of rising fuel prices: Impacts and solutionsTwinkle MounamiNo ratings yet

- India approves $876m subsidy to boost sugar exports to 6m tonnesDocument26 pagesIndia approves $876m subsidy to boost sugar exports to 6m tonnes4I (02) Lee Shui HangNo ratings yet

- This House Regrets The Increase of Fuel PriceDocument8 pagesThis House Regrets The Increase of Fuel PriceNailah Rizqullah HafzahNo ratings yet

- FMCGDocument96 pagesFMCGAnkita Sadani0% (1)

- FMCG Project ReportDocument45 pagesFMCG Project Reportnavneetdevsingh100% (3)

- Should agricultural income be taxed? Pros, cons and alternatives discussedDocument4 pagesShould agricultural income be taxed? Pros, cons and alternatives discussedMadhura SridharNo ratings yet

- Wot Analysis of FMCG Industry - Document TranscriptDocument6 pagesWot Analysis of FMCG Industry - Document TranscriptKarandhina DhinaNo ratings yet

- EssayDocument6 pagesEssayManir HossainNo ratings yet

- A Study On Farming Bill 2020 1.2 History of Farming Bill 1.3 Advantage and Disadvantage 1.4 Challenges 1.5 SWOT AnalysisDocument48 pagesA Study On Farming Bill 2020 1.2 History of Farming Bill 1.3 Advantage and Disadvantage 1.4 Challenges 1.5 SWOT AnalysisAcchu RNo ratings yet

- FMCG Industry ReportDocument28 pagesFMCG Industry ReportSonu singhNo ratings yet

- Are We Ready For Another Petrol Price HikeDocument8 pagesAre We Ready For Another Petrol Price HikeMitali MahajanNo ratings yet

- MPDFDocument3 pagesMPDFMahamud Hossain ArnoNo ratings yet

- Export Assistance and IncentivesDocument8 pagesExport Assistance and IncentivesHarshit MasterNo ratings yet

- Indian Refinery IndustryDocument19 pagesIndian Refinery IndustryNiju K ANo ratings yet

- Shreyash Economics ProjectDocument17 pagesShreyash Economics ProjectShreyash DalalNo ratings yet

- India'S Petrol Problem: ($2.14 Billion)Document7 pagesIndia'S Petrol Problem: ($2.14 Billion)Rohan DasNo ratings yet

- Contribution of Omcs in The Economy of Pakistan: Summer Internship 2011Document5 pagesContribution of Omcs in The Economy of Pakistan: Summer Internship 2011JAwwad AkhtarNo ratings yet

- India's Petroleum Pricing Policies: An Analysis of Subsidies, Taxes, and ImpactDocument11 pagesIndia's Petroleum Pricing Policies: An Analysis of Subsidies, Taxes, and ImpactVinayak OletiNo ratings yet

- International Trade and AgricultureDocument6 pagesInternational Trade and AgriculturejashanNo ratings yet

- India's Problem of Rising PricesDocument4 pagesIndia's Problem of Rising PricesritikaNo ratings yet

- Advantages of Allowing FDI in RetailDocument6 pagesAdvantages of Allowing FDI in RetailAbaddon Bipul PurkaitNo ratings yet

- ED (1) AssignmentDocument21 pagesED (1) AssignmentSalman ZaiNo ratings yet

- Portfolio Final ReportDocument21 pagesPortfolio Final Reporttanvir5100% (1)

- Analysis of FMCG Industry NewDocument13 pagesAnalysis of FMCG Industry NewMohsin ElahiNo ratings yet

- Stevia ProjectDocument34 pagesStevia ProjectHitesh B. Bakutra50% (2)

- Dr. Bhamy Shenoy argues for eliminating costly diesel subsidy in IndiaDocument5 pagesDr. Bhamy Shenoy argues for eliminating costly diesel subsidy in Indiagloriousrh5333No ratings yet

- Budget Expectations 2011 - Commodity PerspectiveDocument4 pagesBudget Expectations 2011 - Commodity PerspectiveVidya RajagopalNo ratings yet

- Impact of WtoDocument79 pagesImpact of Wtoarun1974No ratings yet

- Economics Research PaperDocument17 pagesEconomics Research PaperDaksh ChawlaNo ratings yet

- GST and AgricultureDocument4 pagesGST and AgricultureRushikesh GadakhNo ratings yet

- India's Food Processing Industry Set for Strong GrowthDocument4 pagesIndia's Food Processing Industry Set for Strong GrowthDilwar HossainNo ratings yet

- Export Process of Sugar: Jagannath International Management School, KalkajiDocument11 pagesExport Process of Sugar: Jagannath International Management School, KalkajiAmit PrakashNo ratings yet

- Major Causes of Inflation in Bangladesh and Measure To Combat ItDocument3 pagesMajor Causes of Inflation in Bangladesh and Measure To Combat ItAlif KhanNo ratings yet

- Importance of Agriculture MarketingDocument3 pagesImportance of Agriculture MarketingShuvojeet MandalNo ratings yet

- Newspaperarticles 2NDMTDocument5 pagesNewspaperarticles 2NDMTaz2690No ratings yet

- Working at Sugar FactoryDocument64 pagesWorking at Sugar FactoryVinod KumarNo ratings yet

- Rising Food Prices in India: Causes and SolutionsDocument4 pagesRising Food Prices in India: Causes and SolutionsSudip DuttaNo ratings yet

- FDI in Retail: Misplaced Expectations and Half-Truths by Sukhpal SinghDocument7 pagesFDI in Retail: Misplaced Expectations and Half-Truths by Sukhpal SinghShihabudeenkunjuNo ratings yet

- Motilal Oswal - FDI in Retail - 28sep12Document8 pagesMotilal Oswal - FDI in Retail - 28sep12RomilKumarNo ratings yet

- Commodity June July Tur Dal Channa Dal Urad Dal SugarDocument4 pagesCommodity June July Tur Dal Channa Dal Urad Dal SugarSneha AgarwalNo ratings yet

- Fuel Subsidy Removal - in Our Best Interest, Exclusive Comments by SLSDocument3 pagesFuel Subsidy Removal - in Our Best Interest, Exclusive Comments by SLSProshareNo ratings yet

- Sl. No. Topic: Certificate Declaration Acknowledgement Chapter - IDocument49 pagesSl. No. Topic: Certificate Declaration Acknowledgement Chapter - IAashish Verma0% (1)

- FMCGDocument45 pagesFMCGapi-2736961867% (9)

- GST's Positive Impact on India's Agricultural SectorDocument6 pagesGST's Positive Impact on India's Agricultural SectorHaya FayazNo ratings yet

- 2016-2018 Era of Economic Growth and Stability in PakistanDocument4 pages2016-2018 Era of Economic Growth and Stability in PakistanLuCiFeR GamingNo ratings yet

- Government and the Economy: Enriching Language and Literacy Through ContentFrom EverandGovernment and the Economy: Enriching Language and Literacy Through ContentNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- 2 ChapDocument6 pages2 ChapbrijeshbhaiNo ratings yet

- 16 ChapDocument3 pages16 ChapbrijeshbhaiNo ratings yet

- Charter On Indus Hazards & HRDocument14 pagesCharter On Indus Hazards & HRbrijeshbhaiNo ratings yet

- Case StudyDocument2 pagesCase StudybrijeshbhaiNo ratings yet

- Board of Directors Composition, Structure, Duties & PowersDocument29 pagesBoard of Directors Composition, Structure, Duties & PowersbrijeshbhaiNo ratings yet

- India's Income Tax Policy Changes Over TimeDocument32 pagesIndia's Income Tax Policy Changes Over TimebrijeshbhaiNo ratings yet

- Unit 8 Trade Mark Law in India: StructureDocument11 pagesUnit 8 Trade Mark Law in India: StructuremayurmachoNo ratings yet

- Law Exams - Question Paper - HCS (JB) (Pre) 2011 - Haryana Civil Service (Judicial Branch) (Preliminary) Examination 2011Document17 pagesLaw Exams - Question Paper - HCS (JB) (Pre) 2011 - Haryana Civil Service (Judicial Branch) (Preliminary) Examination 2011brijeshbhaiNo ratings yet

- The Role of The Non Executive Director An OverviewDocument4 pagesThe Role of The Non Executive Director An OverviewbrijeshbhaiNo ratings yet

- Amendments in India in IDRADocument3 pagesAmendments in India in IDRAbrijeshbhaiNo ratings yet

- Labor ReportDocument7 pagesLabor ReportbrijeshbhaiNo ratings yet

- VatDocument20 pagesVatbrijeshbhaiNo ratings yet

- Doctrinal and Non Doctrinal ResearchDocument4 pagesDoctrinal and Non Doctrinal ResearchRahul O Agrawal83% (6)

- 15-Investing in IndiaDocument41 pages15-Investing in IndiaChristine AnaninaNo ratings yet

- SSRN Id1636104Document26 pagesSSRN Id1636104brijeshbhaiNo ratings yet

- SSRN Id1644959Document11 pagesSSRN Id1644959brijeshbhaiNo ratings yet

- Research WorkDocument31 pagesResearch WorkbrijeshbhaiNo ratings yet

- University School of Chemical TechnologyDocument4 pagesUniversity School of Chemical TechnologybrijeshbhaiNo ratings yet

- Research PaperDocument19 pagesResearch PaperbrijeshbhaiNo ratings yet

- Legal ResearchDocument30 pagesLegal ResearchbrijeshbhaiNo ratings yet

- Format of Dissertation: Law College DehradunDocument36 pagesFormat of Dissertation: Law College Dehradunazizullakhan67% (3)

- SSRN Id1636104Document26 pagesSSRN Id1636104brijeshbhaiNo ratings yet

- 477 - LLM Seme-III 24-12-2012Document1 page477 - LLM Seme-III 24-12-2012brijeshbhaiNo ratings yet

- SSRN Id1644959Document11 pagesSSRN Id1644959brijeshbhaiNo ratings yet

- Legal Regulation FinalDocument30 pagesLegal Regulation FinalbrijeshbhaiNo ratings yet

- The Protection of Geographical Indication in India Case Study On Darjeeling TeaDocument8 pagesThe Protection of Geographical Indication in India Case Study On Darjeeling TeaGurpreet Singh PawarNo ratings yet

- SSRN Id1619523Document20 pagesSSRN Id1619523brijeshbhaiNo ratings yet

- Public Internationl LawfinalDocument8 pagesPublic Internationl LawfinalbrijeshbhaiNo ratings yet

- Hypophosphatemic Rickets: Etiology, Clinical Features and TreatmentDocument6 pagesHypophosphatemic Rickets: Etiology, Clinical Features and TreatmentDeysi Blanco CohuoNo ratings yet

- Aleister Crowley and the SiriansDocument4 pagesAleister Crowley and the SiriansJCMNo ratings yet

- 1.2 - Sewing Machine and Special AttachmentsDocument3 pages1.2 - Sewing Machine and Special Attachmentsmaya_muth0% (1)

- Smart Grid Standards GuideDocument11 pagesSmart Grid Standards GuideKeyboardMan19600% (1)

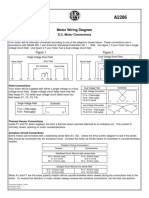

- Motor Wiring Diagram: D.C. Motor ConnectionsDocument1 pageMotor Wiring Diagram: D.C. Motor Connectionsczds6594No ratings yet

- The CongoDocument3 pagesThe CongoJoseph SuperableNo ratings yet

- Swatchh Bharat AbhiyanDocument13 pagesSwatchh Bharat AbhiyanHRISHI SHARMANo ratings yet

- 2 - Soil-Only Landfill CoversDocument13 pages2 - Soil-Only Landfill Covers齐左No ratings yet

- 12 Week Heavy Slow Resistance Progression For Patellar TendinopathyDocument4 pages12 Week Heavy Slow Resistance Progression For Patellar TendinopathyHenrique Luís de CarvalhoNo ratings yet

- Tutorial On The ITU GDocument7 pagesTutorial On The ITU GCh RambabuNo ratings yet

- Rectifiers and FiltersDocument68 pagesRectifiers and FiltersMeheli HalderNo ratings yet

- Lightwave Maya 3D TutorialsDocument8 pagesLightwave Maya 3D TutorialsrandfranNo ratings yet

- Stability Calculation of Embedded Bolts For Drop Arm Arrangement For ACC Location Inside TunnelDocument7 pagesStability Calculation of Embedded Bolts For Drop Arm Arrangement For ACC Location Inside TunnelSamwailNo ratings yet

- 1010 PDS WLBP 170601-EN PDFDocument4 pages1010 PDS WLBP 170601-EN PDFIan WoodsNo ratings yet

- DK Children Nature S Deadliest Creatures Visual Encyclopedia PDFDocument210 pagesDK Children Nature S Deadliest Creatures Visual Encyclopedia PDFThu Hà100% (6)

- Cs8791 Cloud Computing Unit2 NotesDocument37 pagesCs8791 Cloud Computing Unit2 NotesTeju MelapattuNo ratings yet

- Pioneer XC-L11Document52 pagesPioneer XC-L11adriangtamas1983No ratings yet

- Conjoint Analysis Basic PrincipleDocument16 pagesConjoint Analysis Basic PrinciplePAglu JohnNo ratings yet

- IS 4991 (1968) - Criteria For Blast Resistant Design of Structures For Explosions Above Ground-TableDocument1 pageIS 4991 (1968) - Criteria For Blast Resistant Design of Structures For Explosions Above Ground-TableRenieNo ratings yet

- 2 - Elements of Interior DesignDocument4 pages2 - Elements of Interior DesignYathaarth RastogiNo ratings yet

- Elements of ClimateDocument18 pagesElements of Climateእኔ እስጥፍNo ratings yet

- Railway Airport Docks and HarbourDocument21 pagesRailway Airport Docks and HarbourvalarmathibalanNo ratings yet

- Maintenance Handbook On Compressors (Of Under Slung AC Coaches) PDFDocument39 pagesMaintenance Handbook On Compressors (Of Under Slung AC Coaches) PDFSandeepNo ratings yet

- Idioms & Phrases Till CGL T1 2016Document25 pagesIdioms & Phrases Till CGL T1 2016mannar.mani.2000100% (1)

- Letter of MotivationDocument4 pagesLetter of Motivationjawad khalidNo ratings yet

- Air Wellness QRSDocument2 pagesAir Wellness QRSapi-3743459No ratings yet

- Project Binder 2Document23 pagesProject Binder 2Singh DhirendraNo ratings yet

- Usjr Temfacil Balance of Work Schedule Aug 25, 2022Document5 pagesUsjr Temfacil Balance of Work Schedule Aug 25, 2022Maribeth PalumarNo ratings yet

- An Online ECG QRS Detection TechniqueDocument6 pagesAn Online ECG QRS Detection TechniqueIDESNo ratings yet