Professional Documents

Culture Documents

ITNS 280: Challan No. Challan No. ITNS 281

Uploaded by

Saravana Kumar0 ratings0% found this document useful (0 votes)

6 views1 pageTDS CHalan

Original Title

Single Copy

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTDS CHalan

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageITNS 280: Challan No. Challan No. ITNS 281

Uploaded by

Saravana KumarTDS CHalan

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

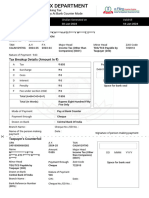

Single copy (to be sent to the ZAO)

CHALLAN CHALLAN NO. NO. ITNS 280 281 ITNS

Tax Applicable (Tick One)* TAX DEDUCTED / COLLECTED AT SOURCE FROM (0020) COMPANY DEDUCTEES (0021) NON COMPANY DEDUCTEES

Assessment Year

Tax Deduction Account Number (TAN) Full Name Complete Address with city & state

C H AL LA N N O.

PIN

Tel. No

IT Code Type of Payment NS TDS / TCS Payable by Taxpayer (200) 28 TDS / TCS Regular Assessment (Raised by I.T. Dept)(400) 0

Amount (in Rs.)

DETAILS OF PAYMENTS

Income Tax Surcharge Education Cess Interest Penalty Total Total (in words)

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

FOR USE IN RECEIVING BANK Debit to A/c / Cheque credited on

DD MM YY SPACE FOR BANK SEAL

Paid in

Cash/ Debit to A/c/Cheque No.

(Name of the Bank and Branch)

Dated

Drawn on

Date:

Signature of person making payment

Tear Off

Taxpayers counterfoil (To be filled up by tax payer) TAN

Received from (Name) Cash/ Debit to A/c/Cheque No. Rs. (in words) Drawn on

(Name of the Bank and Branch)

SPACE FOR BANK SEAL

For Rs.

Company

Non-Company

Deductees

On account of Tax Deducted at Source (TDS) / Tax Collected at source (TCS) from

For the Assessment Year

You might also like

- Challan No. ITNS 281 : Assessment YearDocument1 pageChallan No. ITNS 281 : Assessment YearTpm UmasankarNo ratings yet

- TDS TDSChallan280Document1 pageTDS TDSChallan280sikander1990No ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment Yearanaga1982No ratings yet

- CHALLAN 280 For 2013-14Document1 pageCHALLAN 280 For 2013-14mohanktvmNo ratings yet

- Challan 280Document1 pageChallan 280Mohit MehtaNo ratings yet

- VP Goyalt Tds ChallanDocument1 pageVP Goyalt Tds Challanverma619No ratings yet

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDocument2 pagesChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNo ratings yet

- TAX PAYMENT CHALLANDocument2 pagesTAX PAYMENT CHALLANravibhartia1978No ratings yet

- Zentds KDK SoftwareDocument1 pageZentds KDK Softwarear8ku9sh0aNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- RSD3Document1 pageRSD3Thaneshwar MishraNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- Challan NO./ ITNS 280Document2 pagesChallan NO./ ITNS 280amritaasraaNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- TDS TCS Tax ChallanDocument1 pageTDS TCS Tax Challanjagdish412301No ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Challan NO./ ITNS 280: A D G P M 4 8 2 8 BDocument1 pageChallan NO./ ITNS 280: A D G P M 4 8 2 8 BKarur KumarNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- Zero Zero Three Zero Two Zero: DD MM YyDocument1 pageZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonNo ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- TDS TCS Tax Challan PaymentDocument5 pagesTDS TCS Tax Challan PaymentSachin KumarNo ratings yet

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- Income Tax Proforma PakistanDocument16 pagesIncome Tax Proforma PakistanInayat UllahNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- For Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearDocument1 pageFor Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearJazzy BadshahNo ratings yet

- Challan F.Y 2012-13Document1 pageChallan F.Y 2012-13amit22505No ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- PrintTDSChallan (281) 2020-2021 PDFDocument1 pagePrintTDSChallan (281) 2020-2021 PDFAmeyNo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- Pay TDS and TCS via Challan FormDocument2 pagesPay TDS and TCS via Challan Formbrayan uyNo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- Ashima Kalra 194 CDocument1 pageAshima Kalra 194 CSudhanshu JaiswalNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- Pay Income Tax OnlineDocument1 pagePay Income Tax OnlineKamalNo ratings yet

- I.t.challan BlankDocument4 pagesI.t.challan Blankmaliktariq78100% (1)

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraNo ratings yet

- Challan 280Document6 pagesChallan 280Narendra PrajapatiNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9No ratings yet

- BSNL telephone bill detailsDocument3 pagesBSNL telephone bill detailsVarinder SinghNo ratings yet

- TDS Challan for Shree Raghuvanshi Lohana MahajanDocument2 pagesTDS Challan for Shree Raghuvanshi Lohana Mahajannilesh vithalaniNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- 27180Document1 page27180nupursingh604No ratings yet

- Itr 62 Form 17Document2 pagesItr 62 Form 17ManikdnathNo ratings yet

- File TDS return online for property saleDocument3 pagesFile TDS return online for property saleAnand JaiswalNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Challan No./ ITNS 282: Tax Applicable (Tick One)Document2 pagesChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- ChallanFormDocument1 pageChallanFormbghosh00112233No ratings yet

- Form 281 Candeur Constructions - 92bDocument1 pageForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariNo ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- Tds Challan 281 Excel FormatDocument459 pagesTds Challan 281 Excel FormatSaravana Kumar0% (1)

- Algorithms & Flow ChartsDocument4 pagesAlgorithms & Flow ChartsSaravana KumarNo ratings yet

- TDS On Provident Fund WithdrawalDocument2 pagesTDS On Provident Fund WithdrawalSaravana KumarNo ratings yet

- This Is My Document To Explain The Business PlanDocument1 pageThis Is My Document To Explain The Business PlanSaravana KumarNo ratings yet

- How To Change in Tally - ERP9 Last Year Closing Balance Current Year Opening BalanceDocument3 pagesHow To Change in Tally - ERP9 Last Year Closing Balance Current Year Opening BalanceSaravana KumarNo ratings yet

- A Low Cost STP That Treats Water Without Chemicals or Electricity Is Helping Communities Save LakhsDocument8 pagesA Low Cost STP That Treats Water Without Chemicals or Electricity Is Helping Communities Save LakhsSaravana KumarNo ratings yet

- How To Change in Tally - ERP9 Last Year Closing Balance Current Year Opening BalanceDocument3 pagesHow To Change in Tally - ERP9 Last Year Closing Balance Current Year Opening BalanceSaravana KumarNo ratings yet

- Tally and DEDocument1 pageTally and DESaravana KumarNo ratings yet

- The Online Grocery Opportunity 2012Document11 pagesThe Online Grocery Opportunity 2012Saravana Kumar100% (1)