Professional Documents

Culture Documents

Case Solution - Vershire Company

Uploaded by

Jerelleen RodriguezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Solution - Vershire Company

Uploaded by

Jerelleen RodriguezCopyright:

Available Formats

Vershire

Company

In

1996

Vershire

Company

was

diversified

packaging

company

with

major

divisions,

including

the

Aluminum

Can

division-one

of

the

largest

several

ufacturers

of

aluminum

beverage

cans

in

the

United

States.

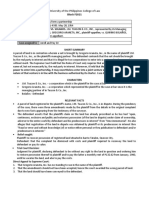

Exhibit

the

organization

chart

for

the

Aluminum

Can

division.

Reporting

to

the

shows

man-

sional general manager were two line managers, vice presidents in charge of manufacturing and marketing. These vice presidents headed all of the division's activities in their respective functional areas.

The Aluminum Can division's growth in salesslightly outpacedsalesgrowth

in the industry at large. The division had plants scattered throughout the United States. Each plant served customers in its own geographic region, often producing several different sizes of cans for a range of customers that included

both large and small breweries and soft drink bottlers. Most of these customers

had between two and four suppliers and spread purchases among them. If the division failed to meet the customer's cost and quality speciijcations or its stan-

dards for delivery and customer service,the customer would turn to another

supplier. All aluminum can producers employed essentially the same technology, and the division's product quality was equal to that of its competitors.

Industry

Traditionally, steel, glass, fiber-foil

Backgroundl

containers were made from one of several materials: (paper and metal composite), or plastic. The aluminum, metal con-

tainer industry consisted of the hundred-plus firms that produced aluminum

EXHIBIT 1

AluminumCan

Division

This case was adapted by Anil R.

Chitkar~ pared by Professor David Hawkins. case, prepared by Professor Hamerm~h

(T'94)

under

the

supervision

of

Professors

Govindarajan and RobertN. Anthony.The caseis based(with permission) on ~n earliercasepre1Theindustry backgroundis basedon a similardescriptionin the Crown Cork and SealCompany R".inA"

-:rh~1

Harvarn

Vijay

divi-

Vershire

Company

and tin-plated steel cans. Aluminum cans were used for packaging beverages (beer and soft drinks), while tin-plated steel cans were used primarily for food packaging, paints, and aerosols. In 1970, steel cans accounted for 88 percent of

the metal can production,

the industry. In 1996, aluminum

but by the 1990s aluminum

cans accounted for over

had come to dominate

75 percent of metal

can

production.

The

soft

drink

bottlers

who

purchased

the

containers

were

marily small independent franchisees of Coca-Cola and Pepsi Cola, which represented their independent bottlers in negotiating terms with the container companies. Five beverage container manufacturers accounted for 88 percent of the market. The minimum efficient scale for a container plant was five lines and it $20 million in equipment per line. Raw materials typically accounted for cost 64

percent of the production cost. Other costs included labor (15 percent), marketing and general administration (9 percent), transportation (8 percent), depreciation (2 percent), and research and development (2 percent). For beverage processors, the cost of the can usually exceeded the cost of the contents, with the container accounting for approximately 40 percent of the to-

tal manufacturing cost.Most beverageprocessors maintained two or more suppliers; and some processors integrated backward, manufacturing cans

themselves.On~ large beveragecompany produced one-third of its own container requirements and ranked ducers in the industry. as one of the top five beverage container pro-

Prior to the early 1970s, cans were produced by rolling a sheet of steel, soldering and cutting it to size, and attaching both the top and the bottom. In 1972 the industry was revolutionized when aluminum producers perfected a twopiece process in which a flat sheet of metal was pushed into a deep cup and top was attached. By 1996 the manufacturing process had become even more a

efficient,

producing

over 2,000 cans per minute. of flavoring;

lithograph; and

In addition to production efficiency,aluminum had other advantagesover

steel: It was easier to shape; it reduced the problems

more attractive packaging because it was easier to

it pernlitted

it reduced

transportation

costs

because

of

its

lighter

weight.

Additionally;

aluminum

was

pri-

more attractive recycling material, with a ton of scrap aluminum having almost three times the value of a ton of scrap steel. Four global companies supplied alu-

minum to can producers:Alcoa,Alcan, Reynolds,and Kaiser.Two of thesecompanies, Alcoa and Reynolds, also manufactured aluminum containers.

Divisions

of Vershire

Company

were structured

to encompass

broad product

nesses with two exceptions: the raising of capital and labor relations,which

were both centralized at head office. The budget was used as the primary to direct each division's efforts towards common corporate objectives. tool

categories. Divisional general managers were given full control of their busi-

In May,eachdivisionalgeneralmanagersubmitteda preliminaryreport to

corporate management summarizing the outlook for sales, income. and caDital

Vershire

Company

requirements for the next budget year, and evaluating the trends anticipated

in each category over the subsequent two years. These reports were not and were usually fairly easy to pull together since each division was already detailed re-

quired to predict market conditions in the current year and to anticipate capital expenditures five years out as part of the strategic planning process.

Once the divisional general managers had submitted these preliminary re-

ports, the central market researchstaff at corporateheadquartersbeganto develop a more formal market assessment, exaInining the forthcoming year in detail and the following two years in more general terms. A sales budget forecast was then prepared for each division; and these forecasts were combined

create a forecast for the entire company. In developing division forecasts, the research staff considered several topics, including general econoInic conditions and their impact on customers, and market share for different products by geographic area. Fundamental assumptions were made as to price, new products, changes in particular accounts, new

plants, inventory carryovers, forward buying, packaging trends, industry growth trends, weather conditions, and alternative packaging.Each product line, regardlessof size,was reviewed in the samemanner.

These foreca~ts were prepared at the head office in order to ensure that basic assumptions were uniform and that overall corporate sales forecasts were

both reasonable and achievable.The completed forecasts were forwarded to

their from respective the bottom divisions up, asking for review, criticism, and fine-tuning. to estimate sales for the

The divisional general managers then compiled their own sales forecasts

each district sales manager

comingbudget year.The district managerscould requesthelp from the head office or the divisional staff but in the end assumed full responsibility for the forecasts they submitted. All district sales forecasts were consolidated at the division level for review by the vice president for marketing, but no changes were made in a district's forecast unless the district manager agreed. Likewise, once the budget had been approved, any changes had to be approved by all those responsible for that budget.

This processwas then repeated at the corporatelevel. When all the responsible parties were satisfied with the sales budget, the figures became fIXed ob-

jectives,with eachdistrict being held responsiblefor its own portion. The entire

review and approval process had four objectives:

1. To assess eachdivision's competitiveposition and formulate courses of action

to improve upon it.

2. To evaluate actions taken to increase market share or to respond to competitors' activities.

3. To considerundertaking capital expendituresor plant alterations to improve

existing products or introduce new products.

4. To developplans to improve cost efficiency,product quality, delivery methods, and service.

~~facturing~~~~~

Mer final approval at the divisional and corporate levels, the overall sales

budget was translated into a salesbudget for each plant, broken down accord-

to

Vershire

Company

ing

to

the

plants

from

which

the

finished

goods

would

be

shipped.

At

the

level,

the

sales

budget

was

then

categorized

according

to

price,

volume,

plant

end use. Onc~ the sales numbers

were estimated,

each plant

budgeted

gross profit,

fIXed expenses, and pretax income. Profit was calculated as the sales budget less budgetedvariable costs(including direct material, direct labor, and variable manufacturing overhead-each valued at a standard rate) and the fixed overhead budget. The plant manager was held responsiblefor this budgeted

profit number even if actual sales fell below the projected level. Cost standards and cost reduction targets were developed by the plant's industrial engineering department, which also determined budget performance standards for each department, operation, and cost center within the plantincluding such items as budgeted cost reductions, allowances for unfavorable

variancesfrom standards,and fixed costssuch as maintenancelabor.

Before plant budgets were submitted, controller staff from the head office visited each plant. These visits were extremely important because they provided an opportunity for plant managers to explain their situation and allowed controllers to familiarize themselves with the reasoning behind the managers' numbers so that they could better explain them when they were presented to corporate management. The controllers also used these visits to provide guidance as to whether the budgeted profits were in line with corporate goals, and

to reinforce the' notion that headquarters was in touch with the plant. Each visit usually lasted about half a day. Most of the time was devotedto

reviewing the budget with the plant manager and any supervisors the managers wished to include in the meetings; but time was also allocated for a walk-through so controllers could see for themselves how (and what) the plant em-

ployees

were

doing.

On or beforeSeptember1,plant budgetswere submitted to the division head

office, where they were consolidated and presented to the divisional general managers for review. If the budgets were not quite in line with management's

expectations, plant managers were asked to look for additional savings. When

the

divisional

general

manager

was

satisfied

with

the

budget,

the

budget

and

sent

to

the

Chief

Executive

Officer

(CEO),

who

either

approved

it

or

asked

was

certain

modifications.

The

final

consolidated

budget

was

submitted

for

proval

at

the

Board

of

Directors

meeting

in

Oncea budget had been approved,it was difficult to change.Any problems

that arose between sales and production at a given plant were expected to be solved by people in the field. If a customer called with a rush order that would disrupt production, for example, production could recommend various courses of

action but it was the salesmanager'sresponsibility to get the product to the customer. If the sales manager determined that it was essential to ship the product

right away,that would be done.The customerwas alwaysthe primary concern.

Performance -Measurement and Evaluation

On the second businessday after the closeof eachmonth, every plant faxed certain critical operating varianceswhich were combinedinto a "variance analysis sheet."A compilation of all variance sheetswas distributed the following morning to interested management. Plant managers were not supposed to wait until these monthly statements were prepared to identify unfavorable variances;

December.

ap-

for

Vershire Comoanv

rather, they were expectedto be aware of them (and to take correctiveaction)on

a daily basis.

Four business days after the close of every month, each plant submitted a report showing budgeted and actual results. Onee these reports were received, corporate management reviewed the variances for those items where figures exceededbudgetary amounts, thus requiring plant managers to explain only the

which budgetedtargets had not beenmet.The focuswason net sales,in-

areas

cluding price and mix changes, gross margin, and standard manufacturingcosts. The budgeted and actual information submitted is summarized in Exhibit 2. Supplemental information was provided by supporting documents (see Exhibit

3). Both reports were consolidatedfor eachdivision and for the entire company,

and distributed the next day.

The fIXedcostswere examinedto seeif the plants had carried out their various programs,if the programs had met budgetedcosts,and if the results were

in line with expectations.

in

Man~~~1!_t

The sales department

Incentives

had sole responsibility for the price, sales mix, and plant manager had responsibility for plant operations delivand

ery

schedules.

plant

profits:

Plant managers were motivated to meet their profit goals in a number of

ways. First, only capable managers were promoted, with profit performance being a main factor in determining capability. Second, plant managers' compensation packages were tied to achieving profit budgets. Third, each month a

chart was compiled showing manufacturing efficienct by plant and division.

These comparative efficiency charts were highly publicized by most plant managers despite the inherent unfairness in comparing plants that produced different products requiring different setup times, etc. Some plants ran internal competitions between production lines and departments to reduce certain cost items, rewarding department heads and foremen for their accomplishments.

Questions

1. Outline the strengths and weaknesses ofVershire Company's planning and

control system.

2. Trace the profit budgeting process at Vershire, starting in May and ending

with the Board of.Directors' meeting in December. Be prepared to describe the activities that took place at each step of the processand present the rationale for each. 3. Should the plant managersbe held responsiblefor profits? Why?Why not? 4. How do you assess the performanceevaluation systemcontainedin Exhibits

2 and 3?

5. On balance,would you redesign the managementcontrol structure at Vershire Company? If so, how and why?

The

Vershire Company

'Numbers

in this exhibit

have been'omitted,

--

~,'

You might also like

- CASE STUDY - Vershire CompanyDocument6 pagesCASE STUDY - Vershire Companysamir sandilia50% (4)

- Case 4-1. Vershire CompanyDocument3 pagesCase 4-1. Vershire CompanyMuhammad Kamil100% (1)

- Comparing Planning and Control Systems of Texas Instruments and Hewlett-PackardDocument20 pagesComparing Planning and Control Systems of Texas Instruments and Hewlett-PackardNaveen SinghNo ratings yet

- MANAGEMENT CONTROL AT VERSHIREDocument13 pagesMANAGEMENT CONTROL AT VERSHIREMuhammad Zakky AlifNo ratings yet

- Westport Electric CorporationDocument3 pagesWestport Electric CorporationPraful PatilNo ratings yet

- Difference Between EVA and ROIDocument6 pagesDifference Between EVA and ROINik PatelNo ratings yet

- PPL CaseDocument22 pagesPPL Casepooja sharma43% (7)

- Abhilash Gs (03) Vershire Case StudyDocument8 pagesAbhilash Gs (03) Vershire Case StudyGs AbhilashNo ratings yet

- Westport Electric Corporation EditDocument6 pagesWestport Electric Corporation EditMichele GranadaNo ratings yet

- Ifm - Case 12Document2 pagesIfm - Case 12Patty Cherotschiltsch100% (4)

- Birch Paper Company Case Analysis MCSDocument3 pagesBirch Paper Company Case Analysis MCSMegaAppleNo ratings yet

- BUSI 354 - CHDocument4 pagesBUSI 354 - CHBarbara SlavovNo ratings yet

- SynopsisDocument7 pagesSynopsisAnchalNo ratings yet

- Codman & Shurtleff CaseDocument3 pagesCodman & Shurtleff CaseElom Katako33% (3)

- Puente Hills Toyota case analysisDocument7 pagesPuente Hills Toyota case analysisNur Annisa SafirraNo ratings yet

- Jalabhumi CaseDocument10 pagesJalabhumi CaseDhaval DevmurariNo ratings yet

- Chapter 17Document15 pagesChapter 17Monalisa SethiNo ratings yet

- Rendell CompanyDocument3 pagesRendell CompanyTung Nguyen KhacNo ratings yet

- Management Control Anthony TOCDocument5 pagesManagement Control Anthony TOCscribdlertoo33% (3)

- ABB Case StudyDocument4 pagesABB Case StudyAl Moazer Abdulaal AbdulateefNo ratings yet

- What Is The Significance of "Conflict Zones" in Emerging Economies, Especially From The Viewpoint of MNCS?Document4 pagesWhat Is The Significance of "Conflict Zones" in Emerging Economies, Especially From The Viewpoint of MNCS?Akshada VinchurkarNo ratings yet

- Case 2 - Vershire Company (Version 2.1)Document3 pagesCase 2 - Vershire Company (Version 2.1)shielamaeNo ratings yet

- CVP Analysis ProjectDocument63 pagesCVP Analysis ProjectMBA Sec ANo ratings yet

- Birch Paper Case Study Solution - Performance MeasurementDocument2 pagesBirch Paper Case Study Solution - Performance MeasurementPiotr Bartenbach100% (3)

- Cap Bud - HeroDocument13 pagesCap Bud - HeroMohmmedKhayyumNo ratings yet

- Case Study On Solartronics, IncDocument3 pagesCase Study On Solartronics, IncSrishti Wadhwa100% (2)

- Interpreting Financial StatementsDocument30 pagesInterpreting Financial StatementsAkshata Masurkar100% (2)

- MCS BudgetingDocument14 pagesMCS BudgetinghadapadNo ratings yet

- Case Study of Investment CriteriaDocument2 pagesCase Study of Investment CriteriammediboyinaNo ratings yet

- SHY Week 1 Assignment SolutionDocument2 pagesSHY Week 1 Assignment Solutionhy_saingheng_7602609No ratings yet

- A Synopsis Report ON A Study On Capital Budgeting AT L&TDocument19 pagesA Synopsis Report ON A Study On Capital Budgeting AT L&TMohmmedKhayyum100% (1)

- Framework For Business Analysis and Valuation Using Financial StatementsDocument9 pagesFramework For Business Analysis and Valuation Using Financial StatementsTubagus Donny SyafardanNo ratings yet

- Mems Case StudyDocument5 pagesMems Case StudyInggridChintyaSilalahiNo ratings yet

- Financial Performance Analysis of Force MotorsDocument89 pagesFinancial Performance Analysis of Force Motorsshaaiily100% (2)

- Anheuser Busch and Harbin Brewery Group of ChinaDocument17 pagesAnheuser Busch and Harbin Brewery Group of Chinapooja87No ratings yet

- Transfer Pricing at Birch Paper CoDocument12 pagesTransfer Pricing at Birch Paper CoChristina AgustinNo ratings yet

- Automobile Industry Ratio AnalysisDocument71 pagesAutomobile Industry Ratio Analysisakshay50% (2)

- New Jersey InsuranceDocument2 pagesNew Jersey Insurancerksp9999950% (2)

- Understanding Strategy MCS 2Document30 pagesUnderstanding Strategy MCS 2abid746No ratings yet

- Case Analysis of Abrams CompanyDocument4 pagesCase Analysis of Abrams CompanyMilanPadariyaNo ratings yet

- Growth and Financing of a Major Indian Engineering CompanyDocument6 pagesGrowth and Financing of a Major Indian Engineering CompanySiddhanth MunjalNo ratings yet

- Desktop Solution IncDocument6 pagesDesktop Solution IncAmira Nur Afiqah Agus Salim0% (1)

- Lehigh Steel Case Analysis 1Document15 pagesLehigh Steel Case Analysis 1Arifin Suharto100% (1)

- Financial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTDocument69 pagesFinancial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTBabasab Patil (Karrisatte)100% (1)

- Barings CaseDocument3 pagesBarings CaseAnonymous LC5kFdtcNo ratings yet

- End Point Model CaseDocument8 pagesEnd Point Model CaseSAURAV KUMAR GUPTANo ratings yet

- Corporate Finance Project on Hero Moto CorpDocument10 pagesCorporate Finance Project on Hero Moto CorpSaikiran JanjanamNo ratings yet

- Quality Metal Service CenterDocument5 pagesQuality Metal Service CenterDatuk JujuNo ratings yet

- Sandip Voltas ReportDocument43 pagesSandip Voltas ReportsandipNo ratings yet

- FM Case 5 14ADocument43 pagesFM Case 5 14Asquishbug100% (2)

- Grand Jean CompanyDocument6 pagesGrand Jean CompanyAdi AdiadiNo ratings yet

- A ReportDocument53 pagesA ReportImnoneNo ratings yet

- Chapter 2 SolutionsDocument31 pagesChapter 2 Solutionsws100% (2)

- Vershire Company Aluminum Can Division Case StudyDocument7 pagesVershire Company Aluminum Can Division Case StudyAradhysta Svarnabhumi0% (1)

- Vershire CompanyDocument6 pagesVershire CompanyVrinda MalikNo ratings yet

- Empire Glass Case Study Analyzes Pricing StrategiesDocument23 pagesEmpire Glass Case Study Analyzes Pricing StrategiesHash100% (1)

- Demand and Supply TheoryDocument12 pagesDemand and Supply TheoryLuchoNo ratings yet

- Credit Analysis and Commercial Lending: November 8, 2011, DUFEDocument11 pagesCredit Analysis and Commercial Lending: November 8, 2011, DUFEHạnh LêNo ratings yet

- Strategic Issues in Product Recovery Management: Martijn Thierry Marc Salomon Jo Van Nunen Luk Van WassenhoveDocument23 pagesStrategic Issues in Product Recovery Management: Martijn Thierry Marc Salomon Jo Van Nunen Luk Van WassenhoveOnder TemelNo ratings yet

- Week 1: Introduction To Operations Strategy: QUESTION - "Many Organisations in Many Industries Claim To BeDocument5 pagesWeek 1: Introduction To Operations Strategy: QUESTION - "Many Organisations in Many Industries Claim To BeJakeNo ratings yet

- 66 Kukan International Corporation vs. ReyesDocument2 pages66 Kukan International Corporation vs. ReyesJerelleen RodriguezNo ratings yet

- Superior Commercial Enterprises, Inc. vs. Kunnan Enterprises LTDDocument2 pagesSuperior Commercial Enterprises, Inc. vs. Kunnan Enterprises LTDJerelleen Rodriguez100% (3)

- Price paid in kind allowed under Civil CodeDocument1 pagePrice paid in kind allowed under Civil CodeJerelleen RodriguezNo ratings yet

- 02 Vda. de Gregorio, Et Al. vs. Go Chong BingDocument6 pages02 Vda. de Gregorio, Et Al. vs. Go Chong BingJerelleen RodriguezNo ratings yet

- 08 Superlines Transportation Company, Inc. vs. ICC Leasing & Financing CorporationDocument19 pages08 Superlines Transportation Company, Inc. vs. ICC Leasing & Financing CorporationJerelleen RodriguezNo ratings yet

- 38 Zulueta vs. Pan American World Airways, Inc.Document24 pages38 Zulueta vs. Pan American World Airways, Inc.Jerelleen RodriguezNo ratings yet

- Post Judgement Remedies; Remedies from a judgement of convictionDocument2 pagesPost Judgement Remedies; Remedies from a judgement of convictionJerelleen RodriguezNo ratings yet

- 1 People V BallesterosDocument2 pages1 People V BallesterosJerelleen Rodriguez100% (1)

- 18 Tuason Vs SolanosDocument2 pages18 Tuason Vs SolanosJerelleen RodriguezNo ratings yet

- 44 Triple V - Food Services Vs Filipino Mechants Insurance CorpDocument1 page44 Triple V - Food Services Vs Filipino Mechants Insurance CorpJerelleen RodriguezNo ratings yet

- Gochangco vs. DeanDocument5 pagesGochangco vs. DeanJerelleen RodriguezNo ratings yet

- 56 Soncuya Vs de LunaDocument1 page56 Soncuya Vs de LunaJerelleen RodriguezNo ratings yet

- Boothe vs. Director of PatentsDocument3 pagesBoothe vs. Director of PatentsJerelleen RodriguezNo ratings yet

- 150 Ilocos Norte Electric Co. v. Court of Appeals, 179 SCRA 5Document2 pages150 Ilocos Norte Electric Co. v. Court of Appeals, 179 SCRA 5Jerelleen RodriguezNo ratings yet

- Superior Commercial Enterprises, Inc. vs. Kunnan Enterprises LTDDocument2 pagesSuperior Commercial Enterprises, Inc. vs. Kunnan Enterprises LTDJerelleen RodriguezNo ratings yet

- Quality Metal Service Center - FinalDocument5 pagesQuality Metal Service Center - FinalJerelleen Rodriguez100% (1)

- Interest Computation and Nature of Transaction in Bank Loan CaseDocument2 pagesInterest Computation and Nature of Transaction in Bank Loan CaseJerelleen RodriguezNo ratings yet

- Patterns of Democracy - Arend LijphartDocument377 pagesPatterns of Democracy - Arend LijphartJerelleen Rodriguez100% (2)

- Double Sales - Case DigestsDocument3 pagesDouble Sales - Case DigestsJerelleen RodriguezNo ratings yet

- SMC AR2014 cd11Document78 pagesSMC AR2014 cd11Jerelleen RodriguezNo ratings yet

- LRTA AbstractDocument1 pageLRTA AbstractJerelleen RodriguezNo ratings yet

- Net XPaperDocument2 pagesNet XPaperJerelleen RodriguezNo ratings yet

- Income TaxationDocument92 pagesIncome TaxationJerelleen RodriguezNo ratings yet

- Boston Creamery Case StudyDocument6 pagesBoston Creamery Case StudyJerelleen RodriguezNo ratings yet

- Classification and Measurement of Financial AssetsDocument7 pagesClassification and Measurement of Financial AssetsJerelleen RodriguezNo ratings yet

- Conwi v. Cir, 213 Scra 83Document10 pagesConwi v. Cir, 213 Scra 83Ygh E SargeNo ratings yet

- Sales ReviewerDocument16 pagesSales ReviewerJerelleen RodriguezNo ratings yet

- Starbucks Corporation Ob Case StudyDocument5 pagesStarbucks Corporation Ob Case StudySyaie SyaiedaNo ratings yet

- Subway's Fresh Look: CEO Suzanne Greco Is Taking The Company To A Whole New Level With The Fresh Forward RebrandDocument9 pagesSubway's Fresh Look: CEO Suzanne Greco Is Taking The Company To A Whole New Level With The Fresh Forward RebrandTanvir KhanNo ratings yet

- The Future of Cars: Special ReportDocument5 pagesThe Future of Cars: Special ReportWild Billy Barker GahanNo ratings yet

- QN 11 Market Structure (BTE and Competiton)Document38 pagesQN 11 Market Structure (BTE and Competiton)davidbohNo ratings yet

- FSSAI ActDocument7 pagesFSSAI ActEquinoxlab100% (1)

- Industrial Analysis: Personal Selling/ Direct SellingDocument2 pagesIndustrial Analysis: Personal Selling/ Direct Sellingshowhitee verangaNo ratings yet

- Aggregate Demand WorksheetDocument6 pagesAggregate Demand WorksheetDanaNo ratings yet

- Introduction To SCMDocument14 pagesIntroduction To SCMmridulchandraNo ratings yet

- Research QuestionnaireDocument6 pagesResearch Questionnairebharatnaryani100% (1)

- NRF-MRI-Blueprint v1.0.0 Full VersionDocument177 pagesNRF-MRI-Blueprint v1.0.0 Full VersionJonatan Evald BuusNo ratings yet

- Cadbury ProjectDocument89 pagesCadbury ProjectSachin NagargojeNo ratings yet

- Lazada Terms Conditions of Sale - Syndicate 2Document6 pagesLazada Terms Conditions of Sale - Syndicate 2Dyani Nabyla WidyaputriNo ratings yet

- Brief: Nike, Inc. Is An American Multinational Corporation That Is Engaged in The Design, DevelopmentDocument8 pagesBrief: Nike, Inc. Is An American Multinational Corporation That Is Engaged in The Design, DevelopmentAlexNo ratings yet

- Overview of RetailingDocument5 pagesOverview of RetailingBert AgrisNo ratings yet

- A Study On Logistics Management at Lintas FreightDocument39 pagesA Study On Logistics Management at Lintas FreightDatta SairamNo ratings yet

- Beauty Sector Snapshot September 2023Document15 pagesBeauty Sector Snapshot September 2023Acevagner_StonedAceFrehleyNo ratings yet

- Brand Management Assignment OnDocument16 pagesBrand Management Assignment OnEsheeta GhoshNo ratings yet

- Penn Foster 986032 Consumer Math, Part 1 Study GuideDocument4 pagesPenn Foster 986032 Consumer Math, Part 1 Study GuidesidrazeekhanNo ratings yet

- Strategic Analysis of Nintendo PDFDocument21 pagesStrategic Analysis of Nintendo PDFCaio Lima Toth100% (1)

- Creative Brief WorkshopDocument61 pagesCreative Brief Workshopeditmesh3No ratings yet

- CHAPTER 5 - The New Product Development ProcessDocument16 pagesCHAPTER 5 - The New Product Development ProcessSaud Alnooh100% (2)

- AN Assignment ON "SAM" "Define Advertising - Advertising Is A Social Evil Comment"Document4 pagesAN Assignment ON "SAM" "Define Advertising - Advertising Is A Social Evil Comment"Sumit NamdevNo ratings yet

- Social Media On Buying Behavior An Impact StudDocument15 pagesSocial Media On Buying Behavior An Impact StudJodie HapinNo ratings yet

- ISO 22000 & TQM at Bisleri: Processes, Departments, ProductionDocument27 pagesISO 22000 & TQM at Bisleri: Processes, Departments, ProductionDishank ShahNo ratings yet

- Download Slides, Ebook, Solutions and Test BankDocument51 pagesDownload Slides, Ebook, Solutions and Test BankNoor Mohammad100% (1)

- Starbucks Success Integrated Marketing CommunicationsDocument7 pagesStarbucks Success Integrated Marketing CommunicationsNiks Nikhil SharmaNo ratings yet

- Coca-Cola Media PlanDocument11 pagesCoca-Cola Media PlanPriscilla0% (1)

- Swot Analysis and Implication of WaltonDocument5 pagesSwot Analysis and Implication of Waltonanisul islamNo ratings yet

- E-Commerce Overview and BenefitsDocument8 pagesE-Commerce Overview and BenefitsShaik YusafNo ratings yet

- Kotler CPT1 14e RevisedDocument36 pagesKotler CPT1 14e RevisedAsif ZicoNo ratings yet