Professional Documents

Culture Documents

Analyzing Capital Structure of Tesco and Sainsbury

Uploaded by

Sarath P BabuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analyzing Capital Structure of Tesco and Sainsbury

Uploaded by

Sarath P BabuCopyright:

Available Formats

ANALYZING CAPITAL STRUCTURE OF TESCO AND SAINSBURYS Tesco is one the worlds most successful retail operator of groceries

and general merchandise in United Kingdom they are considered as third 3rd worlds largest retailer they also have 14 wide variety stores in Asia, Europe and America founded by John Cohen in 1919. One of the key reasons of success of Tesco is wide range of products, brand preferences and popular product lines they also aggressively committed to expand internationally to gain global customers they also use the power of technology by selling their products online. Sainsburys is also considered as the 3rd largest retail stores in the United Kingdom founded by John James Sainsbury and family in 1869 in London, England. They have ups and down in business until Tesco has taken over their popularity but they still manage to survive the momentum of competition only in the United Kingdom while Tesco has been expanding in other regions. There are various determinant and significant reasons why they have become the customers preferred stores and they also has a good analysis of capital structure included in their program to support various original business plan for growth considering they are experts in cash management and financial system just like in a financing company. Tesco has also decided to put up a banking business. The financing department between the two companies has someone shown a very respectful management scheme in most of their business operation, their financial strategies includes equity, debt, financing and mixed capital investment. The following statement below may show their financial performance within the last 5 years of operation.

Upon analyzing the capital statement of giant companies the most basic analysis should include cost capital and key risk, corporate financial cash flows and the demand and purchase allocated within a year to be able to determine the Weighted Average Cost of Capital (WACC) In the records of Tesco from 2003 to 2007 capital gearing shows an average of 49.21% this means that the average capital that they have earned may have been use to leverage their business to essentially retained earnings, they have used their revenue to invest more diversification of funds to support their expansion and general operation to remain as the leading retail industry while their leverage their income gearing shows an average of 42.52 for interest paid on loan and operating profits paying obligatory debt and rate of interest to secure their balance. While Sainsbury only shows in 2003 to 2007 income gearing average of 43.61% and their income gearing shows only 3.84 which is not a very good mark of obligatory debt payment although it also show a strong investment determinants. In 2005 to 2006 Tesco maintain an average 39% income gearing while Sainsburys performed good enough in 2005 in the current year they have consolidated from other companies to regain a more stable capital structure. Tesco on the other hand, their income gearing still shows a good position in maintaining their obligations while Sainsburys continue tostruggle to meet their obligations up until 2007. The Weighted Average Cost of Capital (WACC) of Tesco is a very good determinant for stakeholders and investors they can expect good returns of their investment the measurement of WACC should be in their favor so more of them will invest in the company because it has shown a

reliable lower risk position. Here is the summary of Tesco WACC during 2007; Risk free rate is 4.61% while market returns average a total of 14.36% Pre tax cost of debt is 5.31% while tax rate is computed to rise as much as 30% the analysis shows a good conditions in the eyes of their investors only in this summary. The Weighted Average Cost of Capital (WACC) of Sainsburys shows the same rate it only differs in Pre tax cost debt which is 5.61% which still also shows a good conditions of investment confidence coming from their investors. TESCO Cost of Debt = 5.31% Cost of Equity 11.65% Market Value of equity 36222.8 m WACC of Tesco 10.7% while WACC of Sainsburys is 13.54% this again shows a good condition of both of the company for investors to put their money in any or both company. Generally the capital structure comparison may have shown that WACC of Sainsburys shows a bigger percentage in TESCO but it does not mean that investors in Sainsburys earn more in TESCO because they differ in stock preferences. The summary and analysis of these companies maychange in time depending in situation of Political, Economic, Social and Technological changes but most company usually maintain their positions for years if they have established long term engagement and customers confidence in their business just like in most businesses.

You might also like

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNo ratings yet

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesFrom EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNo ratings yet

- Tesco PLC and J Sainbury PLCDocument5 pagesTesco PLC and J Sainbury PLCUsman AhmedNo ratings yet

- Tesco Managing Operations and FinanceDocument22 pagesTesco Managing Operations and FinanceJames OmuseNo ratings yet

- TescoDocument4 pagesTescopoly2luckNo ratings yet

- Financial Analysis On Tesco 2012Document25 pagesFinancial Analysis On Tesco 2012AbigailLim SieEngNo ratings yet

- Graph 1. Tesco 3-PillarDocument4 pagesGraph 1. Tesco 3-PillarKathyNo ratings yet

- Ua Business StrategyDocument23 pagesUa Business Strategyrakshika somrajanNo ratings yet

- Apple Financial ReportDocument3 pagesApple Financial ReportBig ManNo ratings yet

- ALDI Financial PerspectiveDocument10 pagesALDI Financial PerspectiveJessica JessNo ratings yet

- Strategic Financial ManagemnetDocument26 pagesStrategic Financial ManagemnetIbilola IbisankaleNo ratings yet

- TESCODocument19 pagesTESCOEmmanuel OkemeNo ratings yet

- MN498 - Tesco Internationalisation - by - AndidasDocument18 pagesMN498 - Tesco Internationalisation - by - Andidasmoh1111111111No ratings yet

- Introduction To VC Business ModelDocument3 pagesIntroduction To VC Business ModelMuhammad Shahood JamalNo ratings yet

- Financial Analysis For Eastman KodakDocument4 pagesFinancial Analysis For Eastman KodakJacquelyn AlegriaNo ratings yet

- SrichandDocument22 pagesSrichandapi-36925052067% (3)

- Tesco AnalysisDocument12 pagesTesco Analysisdanny_wch7990No ratings yet

- Strategy Evaluation Toyota Motor CorportationDocument7 pagesStrategy Evaluation Toyota Motor CorportationGayathri KumarNo ratings yet

- Corporate Social Responsibility of TESCODocument22 pagesCorporate Social Responsibility of TESCOPanigrahi AbhaNo ratings yet

- Case DELL Overtake HP Final - EdDocument20 pagesCase DELL Overtake HP Final - Edas1klh0No ratings yet

- Sainsbury's Strategic Recovery Against TescoDocument15 pagesSainsbury's Strategic Recovery Against TescoamirlhrNo ratings yet

- Leeds Beckett University Leeds Business School: Word CountDocument43 pagesLeeds Beckett University Leeds Business School: Word CountperelapelNo ratings yet

- Porter's Diamond Model (Analysis of Competitiveness) ...Document2 pagesPorter's Diamond Model (Analysis of Competitiveness) ...BobbyNicholsNo ratings yet

- TESCO Individual AssignmentDocument16 pagesTESCO Individual AssignmentMihaela Maria NechiforNo ratings yet

- CVP Makes So Many Simplifications and Assumptions About Cost Behaviour To The Point That The Technique Cannot Work in Real SituationsDocument1 pageCVP Makes So Many Simplifications and Assumptions About Cost Behaviour To The Point That The Technique Cannot Work in Real SituationsMahmoud Al FalojeeNo ratings yet

- Assignment 3 - Financial Case StudyDocument1 pageAssignment 3 - Financial Case StudySenura SeneviratneNo ratings yet

- Theories of Ethics: Volkswagen's Diesel Emissions ScandalDocument5 pagesTheories of Ethics: Volkswagen's Diesel Emissions ScandalMoe EcchiNo ratings yet

- Tesco ReportDocument68 pagesTesco ReportSuhana IsmailNo ratings yet

- Tesco FinalDocument30 pagesTesco FinalKashika Kohli100% (5)

- Ratio Analysis of J Sainsbury PLCDocument21 pagesRatio Analysis of J Sainsbury PLCJitender SinghNo ratings yet

- A Comparison of Shell and BP's Corporate Social Responsibility EngagementsDocument11 pagesA Comparison of Shell and BP's Corporate Social Responsibility EngagementsOgweno OgwenoNo ratings yet

- 18 - Research On HRM and Lean Management A LiteratureDocument20 pages18 - Research On HRM and Lean Management A LiteratureHelen Bala DoctorrNo ratings yet

- Tesco PortfolioDocument21 pagesTesco PortfoliolegendmahenNo ratings yet

- Tesco SwotDocument4 pagesTesco SwotPhá Lấu100% (1)

- International Business 1116744Document9 pagesInternational Business 1116744Ravi KumawatNo ratings yet

- Good Corporate GovernanceDocument4 pagesGood Corporate GovernanceAstha Garg100% (1)

- Vertical IntegrationDocument36 pagesVertical IntegrationYvan Cham0% (1)

- Renault-Nissan Alliance Perspective: Thierry MOULONGUETDocument11 pagesRenault-Nissan Alliance Perspective: Thierry MOULONGUETSathish KumarNo ratings yet

- Literature Review 1 PDFDocument13 pagesLiterature Review 1 PDFsudarshan upretiNo ratings yet

- NissanDocument4 pagesNissanfara_munawarNo ratings yet

- 2018 UK Corporate Governance Code FINAL PDFDocument20 pages2018 UK Corporate Governance Code FINAL PDFMichał TomczykNo ratings yet

- Executive SummaryDocument20 pagesExecutive SummaryPreeti GillNo ratings yet

- Woolworth Analysis by Saurav GautamDocument15 pagesWoolworth Analysis by Saurav Gautamsaurav gautamNo ratings yet

- International Business - Case StudyDocument18 pagesInternational Business - Case StudyLinh LinhNo ratings yet

- McKinsey 7S Framework Assessment of Royal Mail ChangesDocument5 pagesMcKinsey 7S Framework Assessment of Royal Mail ChangesBishal KarkiNo ratings yet

- 15 Dividend DecisionDocument18 pages15 Dividend Decisionsiva19789No ratings yet

- Tesco Strategic PlanDocument12 pagesTesco Strategic PlanRameza RahmanNo ratings yet

- Strategy For Tesco Plc. The Report Will Use PESTLE and SWOT Analysis To Provide An InsightDocument6 pagesStrategy For Tesco Plc. The Report Will Use PESTLE and SWOT Analysis To Provide An InsightBogdan NegruNo ratings yet

- SAE Assignment International Centres-2012-13 FinalDocument4 pagesSAE Assignment International Centres-2012-13 FinalShivanthan BalendraNo ratings yet

- Letting Go Can Cut Both WaysDocument1 pageLetting Go Can Cut Both WaysGiang ĐinhNo ratings yet

- FSA Atlas Honda AnalysisDocument20 pagesFSA Atlas Honda AnalysisTaimoorNo ratings yet

- Investment Detective CaseDocument1 pageInvestment Detective CaseJonathan ZhaoNo ratings yet

- Porter's Five ForcesDocument4 pagesPorter's Five Forcesharini muthuNo ratings yet

- Assignment - 1 Mba - Iind (Operations Management)Document4 pagesAssignment - 1 Mba - Iind (Operations Management)Adnan A BhatNo ratings yet

- Impact of Global Environment On International Marketing StrategyDocument4 pagesImpact of Global Environment On International Marketing StrategyKrasimiraNo ratings yet

- 2008 Aviation Week Study - Optimizing A&D Supply ChainsDocument12 pages2008 Aviation Week Study - Optimizing A&D Supply ChainsVeera Lokesh AyireddyNo ratings yet

- Organisations and Leadership during Covid-19: Studies using Systems Leadership TheoryFrom EverandOrganisations and Leadership during Covid-19: Studies using Systems Leadership TheoryNo ratings yet

- Impact of Culture on the Transfer of Management Practices in Former British Colonies: A Comparative Case Study of Cadbury (Nigeria) Plc and Cadbury WorldwideFrom EverandImpact of Culture on the Transfer of Management Practices in Former British Colonies: A Comparative Case Study of Cadbury (Nigeria) Plc and Cadbury WorldwideNo ratings yet

- RedBus TicketDocument2 pagesRedBus TicketSarath P BabuNo ratings yet

- International Women EnpowermentDocument5 pagesInternational Women EnpowermentSarath P BabuNo ratings yet

- Email EtiquetteDocument27 pagesEmail EtiquetteVeeraNo ratings yet

- Asianet SelfCare ReceiptDocument2 pagesAsianet SelfCare ReceiptSarath P BabuNo ratings yet

- TCC Summer Os ReportDocument90 pagesTCC Summer Os ReportSarath P BabuNo ratings yet

- A Mandate For The UNHRCDocument2 pagesA Mandate For The UNHRCSarath P BabuNo ratings yet

- Hotel Receipt Template PDF DownloadDocument7 pagesHotel Receipt Template PDF DownloadSarath P BabuNo ratings yet

- To Whom So Ever It May ConcernDocument1 pageTo Whom So Ever It May ConcernSarath P BabuNo ratings yet

- Seawater DesalinationDocument26 pagesSeawater Desalinationchameera82No ratings yet

- Transitions of The Angry Middle ClassDocument5 pagesTransitions of The Angry Middle ClassSarath P BabuNo ratings yet

- 12 Little Known Laws of KarmaDocument4 pages12 Little Known Laws of KarmaSarath P Babu100% (1)

- Os 1st Pages: Mba 2012 Sngist TopperDocument6 pagesOs 1st Pages: Mba 2012 Sngist TopperSarath P BabuNo ratings yet

- Hotel Receipt Template PDF Download PDFDocument1 pageHotel Receipt Template PDF Download PDFSarath P BabuNo ratings yet

- Different Types and Kinds of Mutual FundsDocument3 pagesDifferent Types and Kinds of Mutual FundsSarath P BabuNo ratings yet

- 11 Major Rebranding Disasters and What You Can Learn From ThemDocument18 pages11 Major Rebranding Disasters and What You Can Learn From ThemSarath P BabuNo ratings yet

- Women Entrepreneurs To Be Promoted AsDocument3 pagesWomen Entrepreneurs To Be Promoted AsSarath P BabuNo ratings yet

- 10 Ways To Build Self ConfidenceDocument4 pages10 Ways To Build Self ConfidenceSarath P BabuNo ratings yet

- Organization Studys Ayur by LijinDocument71 pagesOrganization Studys Ayur by LijinSarath P BabuNo ratings yet

- SSC CGL 2014 Exam Age Limit Changes and Application Deadline ExtendedDocument1 pageSSC CGL 2014 Exam Age Limit Changes and Application Deadline ExtendedAshish MishraNo ratings yet

- First in India (General Knowledge)Document3 pagesFirst in India (General Knowledge)Sarath P BabuNo ratings yet

- Report Front PagesDocument5 pagesReport Front PagesSarath P BabuNo ratings yet

- MBA Syllabus 2012Document84 pagesMBA Syllabus 2012NathirshaRahimNo ratings yet

- Research Methodology, Aug 2012 Question PaperDocument2 pagesResearch Methodology, Aug 2012 Question PaperSarath P BabuNo ratings yet

- Research Methodology Question Paper MG UniversityDocument1 pageResearch Methodology Question Paper MG UniversitySarath P BabuNo ratings yet

- Mis Mba Full NoteDocument41 pagesMis Mba Full NoteShinu Joseph Kavalam83% (6)

- Mis Mba Full NoteDocument41 pagesMis Mba Full NoteShinu Joseph Kavalam83% (6)

- Organizational Study Report at Travancore Cochin ChemicalsDocument59 pagesOrganizational Study Report at Travancore Cochin ChemicalsSarath P Babu100% (4)

- May2 27Document57 pagesMay2 27Sarath P BabuNo ratings yet

- Lesson 01Document6 pagesLesson 01Anjum MushtaqueNo ratings yet

- JCOT InstrumentsDocument107 pagesJCOT InstrumentsvaymigadeNo ratings yet

- 19 Nov, Tuesday HRM 20 Nov, Wednesday SSM 21 Nov, Thursday FM 22 Nov, Friday Logistics 25 Nov, Monday Be & CSR 26 Nov, Tuesday SSFDocument36 pages19 Nov, Tuesday HRM 20 Nov, Wednesday SSM 21 Nov, Thursday FM 22 Nov, Friday Logistics 25 Nov, Monday Be & CSR 26 Nov, Tuesday SSFPayal AmbhoreNo ratings yet

- FM Unit1.Document166 pagesFM Unit1.shaik masoodNo ratings yet

- Approaches To Detect Securities Fraud in Capital MarketsDocument20 pagesApproaches To Detect Securities Fraud in Capital MarketsIoanna ChNo ratings yet

- Financial Management Preliminary Exam ReviewDocument6 pagesFinancial Management Preliminary Exam ReviewJken OrtizNo ratings yet

- FMI7e ch19Document49 pagesFMI7e ch19lehoangthuchienNo ratings yet

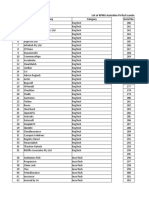

- List of KPMG Australian Fintech LandscapeDocument12 pagesList of KPMG Australian Fintech LandscapeFaysal Bank Strategy TeamNo ratings yet

- Unit 9 Financial ManagementDocument7 pagesUnit 9 Financial ManagementAaditi VNo ratings yet

- Sources of Working CapitalDocument7 pagesSources of Working CapitalSreelekshmi Kr100% (1)

- Ratio Analysis McqsDocument10 pagesRatio Analysis McqsNirmal PrasadNo ratings yet

- Post Merger Performance Analysis of Standard Chartered Bank PakistanDocument10 pagesPost Merger Performance Analysis of Standard Chartered Bank PakistanAdnan SiddiqueNo ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalShiv KothariNo ratings yet

- Boeing and Airbus: Financial Statements AnalysisDocument8 pagesBoeing and Airbus: Financial Statements AnalysisAlamgir AnsariNo ratings yet

- Sources of Financing A ProjectDocument8 pagesSources of Financing A ProjectAbhijith PaiNo ratings yet

- Finance Notes Business Studies HSCDocument24 pagesFinance Notes Business Studies HSCabonu16No ratings yet

- Questions Without Answers For CySec Exam 1Document147 pagesQuestions Without Answers For CySec Exam 1Murat HojabayevNo ratings yet

- Bab 7-EoqDocument32 pagesBab 7-EoqBrashella MadiliousNo ratings yet

- Master of Business Administration (Mba)Document56 pagesMaster of Business Administration (Mba)s.muthu100% (1)

- AssignmentDocument18 pagesAssignmentBidur KhanalNo ratings yet

- "Financial Analysis of HDFC Bank": Symbiosis Centre For Distance Learning, PuneDocument69 pages"Financial Analysis of HDFC Bank": Symbiosis Centre For Distance Learning, PuneBheeshm Singh100% (1)

- 1.. in Search of Islamic Economics NEWDocument64 pages1.. in Search of Islamic Economics NEWNoman EjazNo ratings yet

- Numericals On Capital Structure Theories - KDocument12 pagesNumericals On Capital Structure Theories - KnidhiNo ratings yet

- Sources Applications of FundsDocument234 pagesSources Applications of Fundsjananidhanasekaran26No ratings yet

- MindmapDocument6 pagesMindmapapi-302359373No ratings yet

- Mahindra & Mahindra vs. Tata Motors: Financial analysis and ratio comparisonDocument20 pagesMahindra & Mahindra vs. Tata Motors: Financial analysis and ratio comparisonPratik Kalekar100% (1)

- Chap. 7. Input Demand. The Capital Market and The Investment DecisionDocument43 pagesChap. 7. Input Demand. The Capital Market and The Investment DecisionPaul Jastine RodriguezNo ratings yet

- MCQ Sem 5 Fill UpDocument14 pagesMCQ Sem 5 Fill UpAnkita Kumbhar B-205No ratings yet

- Obinna FMTDocument33 pagesObinna FMTocmainNo ratings yet

- Project Report On Working Capital ManagementDocument76 pagesProject Report On Working Capital ManagementVikas Dalvi100% (1)

- FM Unit 3Document9 pagesFM Unit 3ashraf hussainNo ratings yet