Professional Documents

Culture Documents

BMMF5103 Assignment Ratios Users Benefits Costs

Uploaded by

Zol HasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BMMF5103 Assignment Ratios Users Benefits Costs

Uploaded by

Zol HasCopyright:

Available Formats

ASSIGNMENT BMMF5103

MAY SEMESTER 2013 MANAGERIAL FINANCE BMMF5103 ASSIGNMENT

INSTRUCTION: There are SIX questions. Answer ALL questions. Question 1 a) What does it mean to say that maximizing shareholder wealth is a moral imperative for financial managers? [4 marks] Briefly discuss principal - agent problems and agency costs as related to a corporation. [4 marks] What is the meaning of business ethics? By giving an example, explain why business ethics is important to corporations? [4 marks] Discuss the advantages and disadvantages of issuing common stock versus long-term debt. [4 marks] Name THREE main users of ratio analysis. For each group of user, discuss the type of ratios that would be meaningful to them. [4 marks] [TOTAL: 20 MARKS] Question 2 a) Briefly explain the different categories of financial ratios. Discuss some of the limitations of using the financial ratios to evaluate a company. [4 marks] Assuming that everything else remains the same, briefly discuss the effect of an increase in a companys debt ratio to its return on equity. [4 marks] A firm has notes payable of RM1,546,000, long-term debt of RM13,000,000, and total interest expense of RM1,300,000. If the firm pays 8 percent interest on its long-term debt, what rate of interest does it pay on its notes payable? [4 marks]

b)

c)

d)

e)

b)

c)

ASSIGNMENT BMMF5103

d)

Stockholders equity was RM537 million at the beginning of the year. During the year, the company generated RM128 million of net income and paid dividends of RM57 million. If the ending Stockholders Equity balance is RM485 million, what dollar amount of shares were repurchased throughout the year? [4 marks] A corporation has a current ratio of 5.65 when the industry average is 1.42. What could be the reason for this disparity? [4 marks] [TOTAL: 20 MARKS]

e)

Question 3 a) Why is the preferred stock also known as a hybrid security? [4 marks] b) MoonlightCorp has an outstanding preferred issue of stock with a par value of RM100 and an annual dividend of 10 percent (of par). Similar risk preferred stocks are yielding 11.5 percent annual rate of return. (i) What is the current value of the outstanding preferred stock? (ii) What will happen to the price of the preferred stock as the risk-free rate increases? Explain. [4 marks] c) The CenturyMotel Ltd. has been very successful in the past four years. Over these years, it has paid common stock dividend of RM4 in the first year, RM4.20 in the second year, RM4.41 in the third year, and its most recent dividend was RM4.63. The company is expected to continue this dividend growth indefinitely. What is the value of the companys stock if the required rate of return is 12 percent? [4 marks] You are given the following data: The risk-free rate is 5 percent. The required return on the market is 8 percent. The expected growth rate for the firm is 4 percent. The last dividend paid was RM0.80 per share. Beta is 1.3.

d)

Now assume the following changes occur: The inflation premium drops by 1 percent. An increased degree of risk aversion causes the required return on the market to go to 10 percent after adjusting for the changed inflation premium. The expected growth rate increases to 6 percent. Beta rises to 1.5. 2

ASSIGNMENT BMMF5103

What will be the change in price per share, assuming the stock was in equilibrium before the changes? [4 marks] e) Barney Garden Bhd currently (2013) does not pay any dividend. However, the company is expected to pay a RM1.00 dividend two years from today (2015). The dividend is then expected to grow at a rate of 20 percent a year for the following three years. After the dividend is paid in 2018, it is expected to grow forever at a constant rate of 7 percent. Currently, the risk-free rate is 6 percent, market risk premium (rM rRF) is 5 percent, and the stocks beta is 1.4. What should be the price of the stock today? [4 marks] [TOTAL: 20 MARKS] Question 4 a) In their meeting with their advisor, the Marians concluded that they would need RM40,000 per year during their retirement years in order to live comfortably. They will retire 10 years from now and expect a 20-year retirement period. How much should they deposit now in a bank account paying 9 percent to reach financial happiness during retirement? [4 marks] You are considering the purchase of new equipment for your company and you have narrowed down the possibilities to two models which perform equally well. However, the method of paying for the two models is different. Model A requires $5,000 per year payment for the next five years and Model B requires the payment following the schedule as shown below:

b)

Year 1 2 3 4 5 [

Payment (RM) Model A Model B 5,000 5,000 5,000 5,000 5,000 7,000 6,000 5,000 4,000 3,000

Based on the above information, which model should you buy if your opportunity cost is 8 percent? [4 marks] 3

ASSIGNMENT BMMF5103

c)

To expand its operation, the Tyson Inc. (TI) has applied for a RM3,500,000 loan from the International Bank. According to TIs financial manager, the company can only afford a maximum yearly loan payment of RM1,000,000. The bank has offered TI, 1) a 3-year loan with a 10 percent interest rate, 2) a 4-year loan with a 11 percent interest rate, or 3) a 5-year loan with a 12 percent interest rate. Which option should the company choose? Justify your answer. [4 marks]

d) e)

How are present value and future value calculations related? [4 marks] In general, with an amortized loan, why does the principal portion of each payment grow over the life of the loan, while the interest portion of each payment decreases over the life of the loan? [4 marks] [TOTAL: 20 MARKS]

Question 5 a) b) Briefly explain the types of cash flows an investor will receive if he invests in bonds. [4 marks] What is the relationship between interest rates and bond prices? When is a bond sold at (i) a premium, and (ii) at a discount? [4 marks] Param has recently inherited RM10,000 and is considering purchasing 10 bonds of the Sunshine Corporation. The bond has a par value of RM1,000 with 10 percent coupon rate and will mature in 10 years. Does Param have enough money to buy 10 bonds if the required rate of return is 9 percent? [4 marks] Molleque Industries has issued a bond which has a RM1,000 par value and a 15 percent annual coupon interest rate. The bond will mature in ten years and currently sells for RM1,250. Using this information, what is the yield to maturity on Molleques bond? [4 marks] Differentiate between interest rate risk and reinvestment rate risk. To which type of risk are holders of long term bonds more exposed? [4 marks] [TOTAL: 20 MARKS] 4

c)

d)

e)

ASSIGNMENT BMMF5103

Question 6 a) Billie Jean bought 100 shares of Dresidon Corp at RM24.00 per share on 1 January, 2009. He received a dividend of RM2.00 per share at the end of 2009 and RM3.00 per share at the end of 2010. At the end of 2011, he collected a dividend of RM4.00 per share and sold his stock for RM18.00 per share. What was Billie Jeans realized rate of return during the three years holding period? [4 marks] Given that the market expected return is 12 percent and standard deviation of 20 percent. The risk-free rate is 8 percent. Information related to three stocks are as follows: Stock 1 2 3 i) ii) Beta 0.8 1.2 0.6 Ri(%) 12 13 11 [2 marks] Assume that an analyst, using fundamental analysis, develops the estimates labeled Ri for these stocks. Which stock would be recommended for purchase? Why? [2 marks]

b)

Calculate the required rate of return for each stock using the SML.

c)

Why is market risk sometimes said to be the relevant risk for a portfolio manager? What is the measure of market risk? [4 marks] Suppose the Security Market Line (SML) has a risk-free rate (kRF) of 5 percent and an expected market return ( kM ) of 15 percent. Now suppose that the SML shifts, changing slope, so that kRF is still 5 percent but kM is now 16 percent. What does this shift suggest about investors risk aversion? If the slope were to change downward, what would that suggest? [4 marks] You are an investor in common stock, and you currently hold a well-diversified portfolio which has an expected return of 12 percent, a beta of 1.2, and a total value of RM9,000. You plan to increase your portfolio by buying 100 shares of Techno Bhd at RM10 a share. Techno has an expected return of 20 percent with a beta of 2.0. What will be the expected return and the beta of your portfolio after you have purchased the new stock? [4 marks] [TOTAL: 20 MARKS]

d)

e)

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- MATRICS - Baseline Execution Index (BEI)Document4 pagesMATRICS - Baseline Execution Index (BEI)Zol HasNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- PMI-SVC I80 Roundtable Nov2008Document9 pagesPMI-SVC I80 Roundtable Nov2008Zol HasNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Top 30 Project Management Interview QuestionsDocument7 pagesTop 30 Project Management Interview QuestionsZol HasNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Investigation of Culvert Settlement in Hyrcanian Forest RoadsDocument12 pagesInvestigation of Culvert Settlement in Hyrcanian Forest RoadsZol HasNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Nota Poket Ramadhan 2020Document11 pagesNota Poket Ramadhan 2020Suhana AhmadNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Inflation Vs CompoundingDocument1 pageInflation Vs CompoundingZol HasNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hersey and Blanchard Situational Leadership ModelDocument6 pagesHersey and Blanchard Situational Leadership ModelZol HasNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Induction Course For M&E EngineerDocument9 pagesInduction Course For M&E EngineerZol HasNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hersey and Blanchard Situational Leadership ModelDocument6 pagesHersey and Blanchard Situational Leadership ModelZol HasNo ratings yet

- Why Plan EarlierDocument1 pageWhy Plan EarlierZol HasNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- BIA - Concrete STD Dev 19062012Document2 pagesBIA - Concrete STD Dev 19062012Zol HasNo ratings yet

- Business PlanningDocument102 pagesBusiness PlanningZol HasNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Summary - How To Win Friends & Influence PeopleDocument3 pagesSummary - How To Win Friends & Influence PeopleZol HasNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- BIA - Concrete STD Dev 19062012Document2 pagesBIA - Concrete STD Dev 19062012Zol HasNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- What Is Your No 1 PriorityDocument1 pageWhat Is Your No 1 PriorityZol HasNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Spend First or Save FirstDocument1 pageSpend First or Save FirstZol HasNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Brochure - Propolis ActiveDocument2 pagesBrochure - Propolis ActiveZol HasNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Investment Needs Time To GrowDocument1 pageInvestment Needs Time To GrowZol HasNo ratings yet

- Brochure - Olive Oil The Healing Power of OliveDocument2 pagesBrochure - Olive Oil The Healing Power of OliveZol HasNo ratings yet

- Brochures - MRT Sungai Buloh Kajang MRT LineDocument2 pagesBrochures - MRT Sungai Buloh Kajang MRT LineZol HasNo ratings yet

- Tracking TasksDocument1 pageTracking TasksZol HasNo ratings yet

- Weights and MeasuresDocument1 pageWeights and MeasuresZol HasNo ratings yet

- Brochures - R&D Activities On Selected HerbsDocument4 pagesBrochures - R&D Activities On Selected HerbsZol HasNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Brochures - JAS The Malaysian Marine Water Quality IndexDocument2 pagesBrochures - JAS The Malaysian Marine Water Quality IndexZol HasNo ratings yet

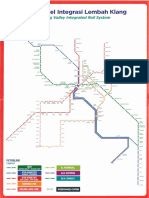

- Brochures - Sistem Rel Integrasi Lembah KlangDocument2 pagesBrochures - Sistem Rel Integrasi Lembah KlangZol HasNo ratings yet

- Brochure - HIMALAYA Herbal HealthcareDocument2 pagesBrochure - HIMALAYA Herbal HealthcareZol Has0% (1)

- Brochure - Jabbar HBS 2 Supplement Tonik HATIDocument2 pagesBrochure - Jabbar HBS 2 Supplement Tonik HATIZol HasNo ratings yet

- Img 909093710 PDFDocument1 pageImg 909093710 PDFAnonymous fE2l3DzlNo ratings yet

- Final Passage 1Document9 pagesFinal Passage 1Zol HasNo ratings yet

- Crippled by Debt After Treatments PDFDocument1 pageCrippled by Debt After Treatments PDFAnonymous fE2l3DzlNo ratings yet

- LIU Post student solves Black-Scholes equationDocument17 pagesLIU Post student solves Black-Scholes equationportaliteNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Binary Options Strategy PDFDocument21 pagesBinary Options Strategy PDFByron Rodriguez0% (1)

- A Project Report ON Portfolio Management & Investment: Company AnalysisDocument9 pagesA Project Report ON Portfolio Management & Investment: Company AnalysispurnitNo ratings yet

- Harshad Mehta: What All He DidDocument4 pagesHarshad Mehta: What All He DidPrakashramkumharNo ratings yet

- Inox ProspectusDocument537 pagesInox Prospectusgudachari4No ratings yet

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDocument19 pagesLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNo ratings yet

- Activity 3Document5 pagesActivity 3breymartjohnNo ratings yet

- 7.4 Options - Pricing Model - Black ScholesDocument36 pages7.4 Options - Pricing Model - Black ScholesSiva SankarNo ratings yet

- Financial DerivativesDocument3 pagesFinancial DerivativesRahul Thapa MagarNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )johanes ongoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- NCFM BeginnersDocument12 pagesNCFM BeginnersTrupti Mane100% (1)

- Learn to trade stocks, options and more with South India's largest trading masterclassDocument28 pagesLearn to trade stocks, options and more with South India's largest trading masterclassPrasadNo ratings yet

- A Comparative Study On Organised Security Market (Document12 pagesA Comparative Study On Organised Security Market (DeepakNo ratings yet

- A Study On InvestmentDocument4 pagesA Study On InvestmentSaloni GoyalNo ratings yet

- Tolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFDocument1 pageTolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFAnbu jaromiaNo ratings yet

- Sample Problems - DerivativesDocument4 pagesSample Problems - DerivativesMary Yvonne AresNo ratings yet

- Bond FundamentalsDocument19 pagesBond FundamentalsInstiRevenNo ratings yet

- Red Herring Prospectus & Initial Public OfferingDocument8 pagesRed Herring Prospectus & Initial Public OfferingMathan RajNo ratings yet

- Stock & Commodities 2010 - 01Document100 pagesStock & Commodities 2010 - 01John Green100% (1)

- Types of SharesDocument1 pageTypes of SharesMauti Nyakundi CollinsNo ratings yet

- Insider Trading PPT - CIADocument20 pagesInsider Trading PPT - CIACmaSumanKumarVermaNo ratings yet

- Chapter 18: Risk Management and DerivativesDocument14 pagesChapter 18: Risk Management and Derivativesarwa_mukadam03No ratings yet

- BseDocument6 pagesBseAnkit KediaNo ratings yet

- Long Term FinancingDocument47 pagesLong Term FinancingadekramlanNo ratings yet

- Online Trading Operating GuidelinesDocument5 pagesOnline Trading Operating GuidelinesKenneth BatchelorNo ratings yet

- Market Strategy: Trading Strategy: Short Term (2-3 Days) : Buy Chemplast Trading Ideas (Time Period: 1-14 Days)Document8 pagesMarket Strategy: Trading Strategy: Short Term (2-3 Days) : Buy Chemplast Trading Ideas (Time Period: 1-14 Days)pj.india1991No ratings yet

- 231 0405Document15 pages231 0405api-27548664100% (1)

- Class Exercises - Stock ValuationDocument15 pagesClass Exercises - Stock ValuationDua hussainNo ratings yet

- Life Cycle of SecurityDocument40 pagesLife Cycle of SecurityPuneet Sachdeva50% (2)

- Equity Securities MarketDocument6 pagesEquity Securities MarketAngelica DechosaNo ratings yet