Professional Documents

Culture Documents

ACCT212 WorkingPapers E3-22A

Uploaded by

lowluderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT212 WorkingPapers E3-22A

Uploaded by

lowluderCopyright:

Available Formats

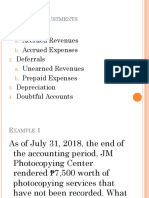

FINANCIAL ACCOUNTING - Eighth Edition E3-22A (15-20 min.

Solutions Manual

Learning Objectives 1, 3: Journalizing adjusting entries and analyzing their effects on net income; comparing accrual and cash basis An accountant made the following adjustments at December 31, the end of the accounting period: a. Prepaid insurance, beginning, $500. Payments for insurance during the period, $1,500. Prepaid insurance, ending, $1,000. Interest revenue accrued, $1,100. Unearned service revenue, beginning, $1,200. Unearned service revenue, ending, $400. Depreciation, $4,900. Employees salaries owed for three days of a five-day work week; weekly payroll, $14,000. Income before income tax, $22,000. Income tax rate is 25%.

b. c.

d. e.

f.

Requirements 1. 2. Journalize the adjusting entries. Suppose the adjustments were not made. Compute the overall overstatement or understatement of net income as a result of the omission of these adjustments.

Chapter 3: Accrual Accounting and Income

Page 1 of 2

FINANCIAL ACCOUNTING - Eighth Edition

Solutions Manual

Solution: Req. 1 Adjusting Entries ACCOUNT TITLES

DATE a.

DEBIT

CREDIT

b.

c.

d.

e.

f.

Req. 2

Chapter 3: Accrual Accounting and Income

Page 2 of 2

You might also like

- Chapter+3 the+Adjusting+ProcessDocument61 pagesChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- Cash Flow Statement ExampleDocument5 pagesCash Flow Statement ExampleAshish SinghNo ratings yet

- MODULE 7 and 8 ACCDocument3 pagesMODULE 7 and 8 ACCnorie jane pacisNo ratings yet

- Ac101 ch3Document21 pagesAc101 ch3Alex ChewNo ratings yet

- Chapter 3 Adjusting The AccountsDocument19 pagesChapter 3 Adjusting The AccountsKabeer Khan100% (1)

- 1 The Basics of Adjusting EntriesDocument9 pages1 The Basics of Adjusting Entriescyrize mae fajardoNo ratings yet

- Chapter 3 - The Adjusting ProcessDocument60 pagesChapter 3 - The Adjusting ProcessAzrielNo ratings yet

- Adjusting entries for accrualsDocument8 pagesAdjusting entries for accrualsRey ViloriaNo ratings yet

- Unit 8 Adjusting EntriesDocument8 pagesUnit 8 Adjusting EntriesRey ViloriaNo ratings yet

- Chapter 3_The Adjusting ProcessDocument60 pagesChapter 3_The Adjusting ProcessDafila 28No ratings yet

- Acc 410Document11 pagesAcc 410AnatoliiNo ratings yet

- Preparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...Document5 pagesPreparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...ehab_ghazallaNo ratings yet

- Current Liabilities Chapter Power NotesDocument28 pagesCurrent Liabilities Chapter Power NotesmorheenNo ratings yet

- Issues in AccountingDocument51 pagesIssues in AccountingKashif RaheemNo ratings yet

- Far Chap 8 SolDocument61 pagesFar Chap 8 SolCaterpillarNo ratings yet

- Business School: ACCT1501 Accounting and Financial Management 1A Session 1 2015Document14 pagesBusiness School: ACCT1501 Accounting and Financial Management 1A Session 1 2015Patricia ArgeseanuNo ratings yet

- Quiz Week 3 AnswersDocument5 pagesQuiz Week 3 AnswersDaniel WelschmeyerNo ratings yet

- POA WK 7 LECT 2 VER 1 28032021 115402am 17112022 110442am 06052023 101809amDocument65 pagesPOA WK 7 LECT 2 VER 1 28032021 115402am 17112022 110442am 06052023 101809ammuhammad atifNo ratings yet

- The Accounting EquationDocument49 pagesThe Accounting EquationsweetEmie031No ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- HOSP1860 4 AdjustingtheaccountsDocument6 pagesHOSP1860 4 AdjustingtheaccountsLule RamaNo ratings yet

- Ccounting Principles: Adjusting EntriesDocument18 pagesCcounting Principles: Adjusting EntriesRashid HussainNo ratings yet

- Adjustments (Part 2) : Subject-Descriptive Title Subject - CodeDocument11 pagesAdjustments (Part 2) : Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- ACT3100 Homework 12.12.2021Document4 pagesACT3100 Homework 12.12.2021DING ZHONG JUNNo ratings yet

- ADJUSTING ENTRIES FOR FINANCIAL STATEMENTSDocument32 pagesADJUSTING ENTRIES FOR FINANCIAL STATEMENTSAyniNuyda100% (1)

- M8-Correcting-Closing-Reversing-Entries-and-Financial-StatementsDocument10 pagesM8-Correcting-Closing-Reversing-Entries-and-Financial-StatementsMicha AlcainNo ratings yet

- Accounting LalaDocument2 pagesAccounting LalaPaw PaladanNo ratings yet

- Auditing Problems Lecture On Correction of ErrorsDocument6 pagesAuditing Problems Lecture On Correction of Errorskarlo100% (3)

- 13 Accounting Cycle of A Service Business 2Document28 pages13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- Unit V - Audit of Employee Benefits - Final - T31415 PDFDocument5 pagesUnit V - Audit of Employee Benefits - Final - T31415 PDFSed ReyesNo ratings yet

- CH 4 In-Class Exercise 2 (Solutions)Document3 pagesCH 4 In-Class Exercise 2 (Solutions)Zenni T XinNo ratings yet

- Entrepreneurship: Quarter 3 Week 4Document9 pagesEntrepreneurship: Quarter 3 Week 4michelleNo ratings yet

- NLKTDocument25 pagesNLKTBá Thiên Kim NguyễnNo ratings yet

- Financial Accounting Problem SetDocument3 pagesFinancial Accounting Problem SetLohraine DyNo ratings yet

- Fundamental of Corporate Finance, chpt2Document8 pagesFundamental of Corporate Finance, chpt2YIN SOKHENGNo ratings yet

- CB Module 1Document63 pagesCB Module 1Jen Faye Orpilla100% (5)

- Accounting Chapter 5Document24 pagesAccounting Chapter 5Will TrầnNo ratings yet

- BEACTG 03 REVISED MODULE 2 Business Transaction & Acctg EquationDocument25 pagesBEACTG 03 REVISED MODULE 2 Business Transaction & Acctg EquationChristiandale Delos ReyesNo ratings yet

- Chap 9 NotesDocument15 pagesChap 9 Notes乙คckคrψ YTNo ratings yet

- Payroll Fundamentals Practice TestDocument10 pagesPayroll Fundamentals Practice Testmohitkashap869No ratings yet

- Module 3 Class ExercisesDocument2 pagesModule 3 Class ExercisesKatie Van MeterNo ratings yet

- Answer Key Chapter 4Document2 pagesAnswer Key Chapter 4Emily TanNo ratings yet

- ACC101 Quiz Test 2 STDocument6 pagesACC101 Quiz Test 2 STNguyen Thi Kim ChuyenNo ratings yet

- Review Sessiokkbk 1 TEXTDocument6 pagesReview Sessiokkbk 1 TEXTMelissa WhiteNo ratings yet

- Module 4 Packet: AE 111 - Financial Accounting & ReportingDocument28 pagesModule 4 Packet: AE 111 - Financial Accounting & ReportingHelloNo ratings yet

- Chapter 3 Adjusting The Accounts-8EDocument28 pagesChapter 3 Adjusting The Accounts-8Emyechoes_1233% (3)

- Adjusting Entries ExplainedDocument27 pagesAdjusting Entries ExplainedEarl Hyannis ElauriaNo ratings yet

- Module 5 - Statement of Changes in Equity PDFDocument7 pagesModule 5 - Statement of Changes in Equity PDFSandyNo ratings yet

- 35-Principles of Accounting I WorksheetDocument6 pages35-Principles of Accounting I WorksheeteyoyoNo ratings yet

- Bab 3 (Inggris)Document21 pagesBab 3 (Inggris)Nadira Fadhila HudaNo ratings yet

- ACC101 - Accounting for ReceivablesDocument15 pagesACC101 - Accounting for Receivablesinfinite_dreamsNo ratings yet

- Chapter 7: Completing The Accounting Cycle For A Service ProviderDocument46 pagesChapter 7: Completing The Accounting Cycle For A Service ProviderLEONNA BEATRIZ LOPEZNo ratings yet

- Accounting Changes CH 22Document62 pagesAccounting Changes CH 22chloekim03No ratings yet

- The Accounting Cycle - Part6Document15 pagesThe Accounting Cycle - Part6RaaiinaNo ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Hhtfa8e ch01 StudDocument50 pagesHhtfa8e ch01 StudlowluderNo ratings yet

- ACCT212 WorkingPapers E2-16ADocument2 pagesACCT212 WorkingPapers E2-16AlowluderNo ratings yet

- ACCT212 WorkingPapers E12-20ADocument3 pagesACCT212 WorkingPapers E12-20AlowluderNo ratings yet

- ACCT212 WorkingPapers E12-17ADocument2 pagesACCT212 WorkingPapers E12-17AlowluderNo ratings yet

- ACCT212 WorkingPapers E1-23ADocument1 pageACCT212 WorkingPapers E1-23AlowluderNo ratings yet

- ACCT212 WorkingPapers E3-26ADocument2 pagesACCT212 WorkingPapers E3-26AlowluderNo ratings yet

- ACCT212 WorkingPapers E3-31ADocument2 pagesACCT212 WorkingPapers E3-31Alowluder0% (1)

- ACCT212 WorkingPapers E3-31ADocument2 pagesACCT212 WorkingPapers E3-31Alowluder0% (1)

- ACCT212 WorkingPapers E1-22ADocument1 pageACCT212 WorkingPapers E1-22AlowluderNo ratings yet

- ACCT212 WorkingPapers E1-17ADocument1 pageACCT212 WorkingPapers E1-17AlowluderNo ratings yet

- ACCT212 WorkingPapers E1-21ADocument1 pageACCT212 WorkingPapers E1-21AlowluderNo ratings yet

- ACCT212 - Financial Accounting - Mid Term AnswersDocument5 pagesACCT212 - Financial Accounting - Mid Term AnswerslowluderNo ratings yet