Professional Documents

Culture Documents

Chapter 2 in Managerial Economic

Uploaded by

myraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 in Managerial Economic

Uploaded by

myraCopyright:

Available Formats

Chapter 2 Economic Optimisation

2

analysis.

BASIC TRAINING - ECONOMIC OPTIMISATION

This chapter introduces a number of fundamental principles of economic

In chapter one, we defined managerial economics and discussed the various objectives that managers aim to achieve. The definition specifically states the application of decision science tools in analysing and evaluating decision alternatives.

As managers we encounter problems daily. Be it minor or major in nature, each problem requires serious attention. Of utmost importance is selecting the optimal course of action in light of available options and objectives. Effective managers must be able to collect, organise and process these information.

Economists build models to better understand and portray the essential link in terms of appropriate decision variables, costs and benefits. For very complex scenario, models are used to breakdown and subdivide aspects of the problem where necessary. It is easy to build models, but to build a good model requires in depth knowledge of economic concepts and methodology, which means that managers must have prior knowledge of basic economics and mathematics.

29

Chapter 2 Economic Optimisation

Even though solutions are easily arrived at via various means, economists place greater importance on number crunching and precision techniques which offer a realistic means in dealing with the complexities of goal-oriented managerial activities. Economists find calculus with specific reference to derivative or marginal analysis a vital tool.

This chapter places great emphasis on helping students understand marginal concepts and the rules of differentiation. To reinforce students understanding, chapter texts explicitly illustrate applications of marginal concept (be it unconstrained or constrained) in optimisation process.

Key terms for review:

Functions Total, average and marginal value Lagrangian multiplier

Aggregate Approach Marginal Approach Differentiation

30

Chapter 2 Economic Optimisation

CHAPTER OVERVIEW

31

Chapter 2 Economic Optimisation

Learning Objectives After reading this chapter, the students should be able to:

1. 2. 3.

Write functions to represent your economic problems. Build a model for the economic problem at hand. Relate the relationships that exist between total, average, and marginal concepts irrespective of whether it is revenue, cost or product.

4.

Perform optimisation analysis graphically via both aggregate and marginal approach.

5. 6. 7.

Conduct first- and second-order derivations. Apply marginal analysis in decision making Distinguish between maximum and minimum values in optimisation problems.

8. 9.

Perform optimisation analysis for multivariate functions. Solve constrained optimisation problems by the Lagrangian

technique. 10. Find an optimal solution to economic problems via the mathematical format.

32

Chapter 2 Economic Optimisation

INTRODUCTION

Mathematics scares a lot of people. But we need it in many things we do. This section intends to show you the practical applications of economic theory because in your capacity as managers, you will resort to and rely on many concepts, graphs and simple numerical examples to assist you in your decision making. Moreover, explanations of economic term, concepts and methods of analysis rely primarily on verbal definitions, numerical tables, and graphs. Appropriate discussions will centre on the same material using both algebra and calculus. In addition, exercises and problems will be slotted in to give students ample opportunity to reinforce their understanding.

Many students have already learnt the mathematics employed in this text, however, some would have studied this material some time ago and may benefit from a review.

This chapter introduces a number of fundamental principles of economic analysis, basic economic relations, the tools and techniques of optimisation. First, we will examine the ways of presenting relationships. Subsequently, we will be examining the relationships between total, average, and marginal concepts. Then, we will move on to examine optimisation analysis. To find an optimal solution to complex problems and to facilitate the above and forth coming discussions, calculus with specific emphasis on rules of differentiation will be discussed. Finally, we will apply the rules of differentiation to unconstrained and constrained optimisation problems.

2.1

FUNCTIONAL RELATIONSHIP & ECONOMIC MODELS

Mathematics is an important instructional vehicle in managerial economics. Economists study variables such as price, output, revenue, cost, and profit. Economists try to understand how and why the values of these variables change and what conditions will lead to optimal values.

33

Chapter 2 Economic Optimisation

NOTES

Optimal may refer to maximum value (as in the case of profit),or it may refer to minimum value (as in the case of cost.)

FUNCTION

Single variable In mathematics, the relationship of one variables value to the value of other variables is expressed in terms of function. For example;

y = f(x)

(Eqn.2.1a)

y is said to be a function of x, where y is the dependent variable, f is the function and x is the independent variable. The above function (Eqn.2.1a) has only one independent variable (i.e. x).

Multivariable But in most cases, functional relationship involves more than one independent variable (multivariate function) for example, equation 2.1.1 below:

y = f(x, z,...n)

( Eqn.2.1b)

NOTES

Multivariate function will be discussed further under the partial derivative topic.

34

Chapter 2 Economic Optimisation

FUNCTIONAL FORMS

Economic data are best presented in the forms of:

1) algebraic equations, 2.1a and 2.1b ; 2) tables ( table 1 next page ); or 3) graphs (diagram 1- next page)

Algebraic equation An equation is an expression of the functional relationships or connection among economic variables. Five key functions are used in this chapter; demand, total revenue, total cost, and profit. To illustrate the different ways of expressing a function, we will try to use as many functions as possible. In economics, the general functional relationship for total revenue is that it is dependent on the number of units sold, i.e. TR = f(Q).

RECALL

Total revenue is defined as the unit price of a product (P) multiplied by the units sold (Q),i.e. TR = PQ

This equation is read, Total revenue is a function of output. It merely states some relation exist between output and total revenue but does not indicate the specific relation between them. The value of the dependent variable (on the left hand side of the equal sign) depends on the size of the independent variable (on the right hand side of the equal sign). As such, a more precise expression would be:

TR = PQ or TR = 7Q - 0.1Q2 (Eqn.2.1c)

where P is the price at which each unit of Q is sold.

35

Chapter 2 Economic Optimisation

Similarly, the algebraic equations of price, cost and profit are respectively presented as such:

P = 7 - 0.1Q TC = 10 + 8Q - 0.3Q2+ 0.01Q3 = -10 - Q + 0.2Q - 0.01Q

2 3

(Eqn.2.1d) ...(Eqn.2.1e) (Eqn 2.1f)

Equation 2.1g below is an example of an algebraic equation for a multivariate function where there are more than 1 independent variable.

Q = 2K + 3L + LK

(Eqn.2.1g)

NOTES

For the purpose of discussion in this chapter, we will adhere consistently to equations 2.1c to 2.1g (wherever applicable).

Table Table is the simplest and most direct form of presenting data. The total revenue function (2.2) is depicted in table 1, which shows the relationship between total revenue and quantity over a selected range of output.

36

Chapter 2 Economic Optimisation

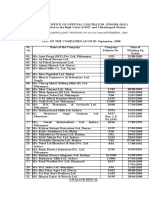

Table 1 Total revenue schedule of a firm Quantity(Q) Price(P) Total revenue(TR)=P.Q

0 10 20 30 40 50 60 70

7 6 5 4 3 2 1 0

0 60 100 120 120 100 60 0

Graphs The following diagrams show algebraic and graphical expressions for demand, total revenue, cost, and profit.

37

Chapter 2 Economic Optimisation

LINEAR, QUADRATIC, AND CUBIC FUNCTIONS

The demand function in equation 2.1d is in linear form. As a result we will derive a straight line to relate the relationship. The total revenue is expressed as a quadratic. This is a result of a second power in the independent variable. This is easily recognised by its parabolic shape. In addition, the independent variable can be raised to a third power, and the corresponding relationship is called a cubic function e.g. cost and profit functions (with 2 loops).

ECONOMIC MODELS - TYPE AND USES

In the above discussions, you have encounter jargon, graphs and algebraic equations and you will keep on seeing and using them later. They are used to model relationship that exists between and among variables and to facilitate your analysis and decisionmaking. Type- symbolic model Models are defined as simplified representation of a complex situation. For example, symbolic modes use jargons and symbols to represent reality. Managerial economics are liberal with jargon words (for example, cost, revenue, profit) which are only verbal models of things and phenomenon. Diagrams and mathematical expressions

similarly model a situation by means of lines or stating the relationship between and among variables. Where diagram (1.2) are economic models depicted graphically whilst equation (2.1c - 2.1g) are economic phenomenon. algebraic models that describe exactly the same

Uses All models serve three main purposes:

1) pedagogical purpose - as a device to teach about the operation of a complex

system ,

2) explanatory purpose - as a device to explain the relationship between and among

events in a logical fashion,

3) predictive purpose - to predict future behaviour.

38

Chapter 2 Economic Optimisation

2.2

TOTAL, AVERAGE AND MARGINAL RELATIONSHIP

In the theory of demand, cost, production and market structures specific functional relationships called total, average and marginal functions are used. In optimisation analysis, the relationship between total, average and marginal is important I understanding the principle of managerial economics. Table 2 shows the relationship between total, average and marginal revenue of a firm with TR = 7Q - 0.1Q2. The first and second columns display the relationship between output and total revenue. Column 3 and 4 is the derived average revenue and marginal revenue respectively. Here, we assume the firm is in imperfect competition.

RECALL

An average relation is the dependent variable divided by the independent variable. A marginal relation is the change in the dependent variable caused by a one unit change in the independent variable.

Table 2 Total, average and marginal revenue of a firm Q PxQ 0 10 20 30 40 50 60 70 0 60 100 120 120 100 60 0 TR AR MR TRQ 6 4 2 0 -2 -4 -6 Remember TR = 7Q-0.1Q2 TRQ 6 5 4 3 2 1 0

39

Chapter 2 Economic Optimisation

AVERAGE REVENUE

Column 3 depicts average revenue. The average revenue of the tenth output is $6, which is simply a division of total revenue with output. Each subsequent row in the column is similarly derived.

MARGINAL REVENUE

In column 4, the marginal revenue earned from the tenth unit of output is $6. This is the change from $0 when there is no output, to $60 earned, when 10 units were sold, thus a one unit change is equivalent to $6. thus, the change in total revenue as a result of a change in output is called marginal revenue. Each marginal revenue derived in subsequent rows is calculated on the same basis.

Diagram revenue Demand and maximising

Total

function, function, Revenue price

and quantity

40

Chapter 2 Economic Optimisation

SUMMARISING

Let us summarise what we have discussed so far.

The key relationships between total, average and marginal are: 1) The value of the average function at any point is the slope of a ray drawn from that point to the total function. 2) The value of the marginal function at any point slope of a line drawn tangent to the total function at that point. 3) When total function increases, both average function and marginal function is positive 4) When total function is decreasing , average function is still positive but marginal function is negative 5) When total function is at its maximum, marginal function equals zero.

Example

A firms demand function is defined as Q =14 - 2P. Calculate total revenue when price is equal to 3 and when price is equal to 4. What is marginal revenue equal to between P=3 and P=4? Explain your answer.

SUGGESTED SOLUTIONS

When P=4, Q P=3, Q

= 14 - 2(3) = 6 = 14 - 2(4) = 8

TR TR

= PQ = $24 = PQ = $24

41

Chapter 2 Economic Optimisation

There is no change in TR from P=4 to P=3, thus MR is equal to 0. Thus this firm will maximise total revenue when output is between 6 units and 8 units.

IMPORTANCE OF CONCEPTS

The concepts of average, marginal and total relations should be thoroughly understood as they are widely used in short-run optimisation problems (as shown in 2.3, 2.6, 2.7 and 2.8).

NOTES

In diagram 2b, we relate price to quantity in a linear fashion. In a linear equation, the coefficient (-0.1) is the change in the dependent variable (P) over the change in the independent variable (Q), (i.e., P/Q). In other words, it represents the slope of the equation, which measures its steepness.

The slope of a function is critical to economic analysis because it is the essence of marginal analysis. Decisions made by managers involve some sort of change in one variable relative to a change in other variables. For example, whether or not to raise price would depend on the resulting change in revenue or profit. Many other economic decisions rely on marginal analysis, including purchasing additional equipment and hiring extra staff because of importance to you is the change in cost, productivity, or profit associated with a change in your resource allocation.

We can use concepts of calculus to clarify the relationship between average, marginal, and total. Therefore, elementary calculus will be discussed in 2.4.

42

Chapter 2 Economic Optimisation

2.3

OPTIMISATION ANALYSIS

In economic analysis, optimisation generally means finding either the maximum or minimum value of a variable of a function, thus a firm determines the output level at which it maximises total profit or minimises cost.

APPROACH FOR FINDING OPTIMAL VALUE

We can use either the aggregate approach or the marginal approach. Likewise, it can be illustrated graphically or calculated using calculus. Thus, we will begin by showing graphically how optimal output is obtained by the aggregate approach followed by the marginal approach. (In 2.6, we will use calculus to ascertain that the outcome is the same as shown graphically).

OPTIMISATION BY TOTAL REVENUE AND TOTAL COST APPROACH ( AGGREGATE APPROACH)

The aggregate approach looks at aggregate, for example, total profit is the difference between total revenue and total cost i.e.:

= TR - TC

If given TR = 7Q - 0.1Q2 and TC .

= 10 + 8Q - 0.3Q2 + 0.01Q 3 = 7Q - 0.1Q2 - 10 - 8Q + 0.3Q2 - 0.01Q 3 = - 10 - Q + 0.2Q2 - 0.01Q 3

43

Chapter 2 Economic Optimisation

Diagram 3 Total revenue, total cost, marginal revenue, marginal cost and profit maximisation.

We can show profit is maximised via graph, by plotting the total revenue and total cost functions for a range of output, Q. Diagram 3a shows the plotted total revenue and total cost whilst 3b shows profit function. The graphical representation shows that profit is maximised at Q2* =10 that is when the positive difference between TR and TC is the greatest (3a) or alternatively when the profit function is at its maximum (3b).

44

Chapter 2 Economic Optimisation

OPTIMISATION BY MARGINAL APPROACH (MR=MC)

RECALL

According to the marginal analysis, profit is maximised when MR=MC. As long as marginal benefit exceed marginal cost, it pays for the firm to increase output and the firm will continue doing so till marginal revenue equals marginal cost (at this point the firm would be maximising profit). It stems from the fact that the distance between revenue and cost function is maximised at the point where their slopes are the same. Because the slopes of total revenue and total cost measures marginal revenue and marginal cost, hence when these slopes are equal, MR = MC.

The maximum can also be located by finding the derivative or marginal of the function then determining the value of Q at which the derivative (Marginal M ) is equal to 0. For our hypothetical example, MR=MC occurs at Q2* = 10 as illustrated in 3a. The relevance of marginal revenue and marginal cost relations to profit maximisation can be demonstrated by considering the general expression

= TR TC

dTR

dTC -----dQ

Marginal profit is M = ------ = ------ dQ dQ

given that

dTR /dQ is MR and dTC/dQ is MC it follows that M = MR MC

45

Chapter 2 Economic Optimisation

Because maximization of any function requires that the first derivative equal zero, profit maximisation occurs where M or where MR

= MR MC = MC. at output Q

=0 = 10.

2.4

METHODS OF DIFFERENTIATION

CALCULUS - DEFINITION AND PURPOSE

Even though tables and graphs are useful for explaining concepts, equations are more suitable for problem solving. One reason being that the technique of differential calculus can be employed to locate maximum and minimum point more precisely.

Calculus is a mathematical technique that enables you to find instantaneous rate of change of a continuous function. Moreover, it is especially useful in constrained optimisation problems that often characterise managerial decision making.

CONCEPT OF A DERIVATIVE

A derivative is a precise specification of the marginal relation. As mentioned in earlier pages, the slope is a measure of the change in y relative to a infinitesimally small change in x. To find the magnitude of the slope, we need to employ derivatives. Differentiation is the process of determining the derivatives of a function. Consider the general function y = f(x).

NOTES Differentiation means finding the change in y (y) for a change in x ( x) as the change of x approaches 0.

46

Chapter 2 Economic Optimisation

Expressed formally: y

x0 x

dy

----- = lim ---dx

This notation is read: The derivative of y with respect to x equals the limit of the change in y relative to the change in x as the change in x approaches zero. Mathematicians use d to represent very small changes in a variable. The ratio y/x is a general

specification of the marginal concept.

2.5

RULES OF DIFFERENTIATION

Let us spend a few minutes reviewing basic differentiation. If you need additional material, refer to the MAT 153 (Business Calculus) module or any Calculus text

FIRST AND SECOND DERIVATIVES OF FUNCTIONS

Rule for finding derivative

Take for example a function expressed in the general form of y = bxn

The rule for finding derivative is

dy --- = nbxn-1 dx

47

Chapter 2 Economic Optimisation

NOTES

Derivative (or first derivative ) is denoted by dy/dx.

Let us try to use the rule.. Thus, suppose we have the equation y = 5x2

The derivative of equation (2.7) according to this rule is

dy --- = 2 . 5x 2-1 = 10x dx

meaning that if x=3, the instantaneous rate of change of y with respect to x is 10(3) or 30.

In economic analysis, there are several other rules for differentiating a function, such as differentiating a logarithmic function or function of a function. (For a detailed summary of rules of differentiation, which will be used extensively in this text, please refer to the table 3 that follows.)

48

Chapter 2 Economic Optimisation

Table 3 RULES FOR DIFFERENTIATING FUNCTIONS

Function

Derivative

1. Constant Function 2. Power function

y=a y = axb y=u+v y=u-v

dy/dx = 0 dy/dx = b.a.xb-1 dy/dx = du/dx + dv/dx dy/dx = du/dx - dv/dx dy/dx = u. dv/dx + v.du/dx v(du/dx) - u(dv/dx) dy/dx = ------------------------v2

3. Sums & differences function

4. Product of two functions 5. Quotient of two functions

y=u.v y = u/v

6. Function of a function

y = f(u) where u = g(x) dy/dx = (dy/du) . (du/dx)

Do not worry; do not let the mathematical symbols bother you. The process of differentiating is rather simple, actually

Examples:

1. y = 3 2. y = 3x3

dy/dx = 0 dy/dx = 3.3 x3-1 = 9x2

The following examples comprise of more than one function. Can you identify and write down the functions U and V in the box provided? 3. y = 3x3 + (x2 + 2) y = 3x3 - (x2 + 2) dy/dx = (3.3x3-1) +(2.x2-1) dy/dx = (3.3x3-1) - (2.x2-1) = 9x2 + 2x = 9x2- 2x

Examples 4,5 and 6 take into account the product of two functions

4. y = (3x3 ) ( x2 + 2)

dy/dx = (3x3)(2x) + (x2 + 2)(3.3x3-1)

49

Chapter 2 Economic Optimisation

= (6x4) +(x2 +2)9x2

= 6x4 +9x4 +18x2 =15x4 +18x2

5. y = (3x3 )/( x2 + 2) dy/dx =

(x2 + 2)(3.3x3-1) - (3x3)(2.x2-1) -------------------------------------( x2 + 2)2 (x2 + 2) 9x2 - (3x3 )( 2x) = ------------------------------(x2 + 2)2 (x2 + 2) 9x2 - 6x4 = -------------------(x2 + 2)2 3x4 + 18x2 = -------------(x2 + 2)2

6.

y = u2 + 5 and u = 3x2

dy/dx = (2u) ( 6x)

= 2.3x2(6x) = 36x3

But, almost all of the mathematical examples and problems involving calculus only require the rules for constant, powers, sum and differences.

Take this example that involves all the above. d/dQ = - 10 - Q + 0.2Q2 - 0.01Q3 = -1 + 0.4Q - 0.03Q2

50

Chapter 2 Economic Optimisation

Example

Determine the derivative of this function: y = 2000 - 200x2 + 3x3

SUGGESTED SOLUTIONS

dy/dx = - 400x + 9x2

FIRST DERIVATIVE

As mentioned earlier, the first derivative of a non-linear function is also called the marginal function.

Turning now to the total revenue function; TR = 7Q - 0.1Q2

When we take the first derivative of the above total function;

d(TR) ------ = 7 - 0.2Q = MR dQ

the outcome is also known as the marginal revenue (MR) function.

As opposed to the above power function, take the case of a linear function such as the demand equation P = 7 - 0.1Q.

51

Chapter 2 Economic Optimisation

The derivative is

dP ----- = - 0.1 dQ

NOTES

(dP/dQ is equal to a constant value - 0.1). Here, we see that the first derivative of a linear function is simply the value of the b coefficient, - 0.1 (i.e. the slope of the linear function itself).

SUMMARISING

First derivative of

1) a linear function is the slope and is a constant 2) a quadratic function is the marginal function

SECOND DERIVATIVE- DEFINITION

Sometimes, mathematical calculations require the use of second derivative. Generally, the second derivative is the derivative of its first derivative. Confusing? Not to worry. It simply means that the second derivative of a function is a measure of the rate of change of the first derivative.

PROCEDURE FOR FINDING SECOND DERIVATIVE

The procedure for finding the second derivative is quite simple. All the rules for finding the first derivative also apply to obtaining the second derivative.

For example, using the same TR function

52

Chapter 2 Economic Optimisation

TR = 7Q - 0.1Q2

d(TR) first derivative: --------- = 7 - 0.2Q dQ

When we derive it for the second time d2 (TR) ------- = - 0.2 dQ2

NOTES

Second derivative is denoted with a superscript 2.

Second order derivative is very important in optimisation problems. (We will deal with this in more detail in 2.6 .)

Example

Determine the first- and second- order derivatives of this function: C = 2000 - 200x2 + 3x 3 Solution = - 400x +9x2

First derivative:

dC/dx

Second derivative: d2C/dx

= - 400 + 18X

53

Chapter 2 Economic Optimisation

2.6

OPTIMISATION BY CALCULUS

MARGINAL ANALYSIS IN DECISION MAKING

Managerial decision making requires one to find minimum or maximum value of a function. When a function is at a minimum or maximum, its slope or marginal value is equal to zero, thus the derivative must be equated to zero. To illustrate we will discuss both aggregate and marginal approaches.

AGGREGATE APPROACH

A primary objective of managerial economics is finding optimal values of key variables. Beside being done graphically, the optimisation analysis is conducted much more expediently with the use of calculus - using marginal analysis and derivative concepts. For our hypothetical example, the profit function is obtained as follows: = TR - TC = 7Q - 0.1Q2 - 10 - 8Q + 0.3Q2 - 0.01Q 3 = -10 - Q + 0.2Q2 - 0.01Q 3

Let us now employ calculus to determine the point of profit maximisation. We begin by i) finding the first derivative of the profit function, ii) setting it equal to zero, and iii) solving for the value of Q that satisfies this condition. d /dQ = - 1 + 0.4Q - 0.03Q 2 (-10 +Q)(10 - 3Q) Q2* MARGINAL APPROACH As expected, Q2* coincides with the point shown in diagram 3a.

=0 = 0 = 10 or Q1* =10/3

Alternatively, you can use the marginal approach. First, i) find the derivative of total revenue and total cost, then ii) set them equal to each other and finally

54

Chapter 2 Economic Optimisation

iii) solve for Q* MC = dTC/dQ = 8 - 0.6Q + 0.03Q2

MR = dTR/dQ = 7 - 0.2Q and By equating MR = MC = M = 0 7 - 0.2Q -1 + 0.4Q - 0.03Q2 Q2*

= 8 - 0.6Q + 0.03Q2 =0 = 10 or Q1* =10/3 M = dTR/d M = dTR/dQ - dTC/dQ .

Marginal profit, the derivative of total profit is

Given that dTR/dQ by definition is marginal revenue, MR and dTC/dQ is marginal cost, MC, it follows that M = MR = MC. Since maximisation of any function requires that the first derivative = 0, profit maximisation occurs at M = MR = MC = 0 or where MR = MC = 0.

Example

A firms demand function is Q = 16-P and its total cost function is defined as TC = 3 + Q + 0.25Q2.

Form the firms profit function and then determine the level of output that yields the maximum profit. What is the level of profit at the optimum?

55

Chapter 2 Economic Optimisation

SUGGESTED SOLUTIONS

TR given Q P

= PxQ = 16 - P = 16 - Q = 16Q - Q2 and with TC = 3 + Q + 0.25Q2 = 16Q - Q2 - 3 - Q - 0.25Q2 = - 3 + 15Q - 1.25Q2

hence

TR

Using calculus: first derivative: d/dQ = 15 - 2.5Q implies Q =0 =6

and the second derivative d2/ dQ2 = - 2.5, which implies that Q = 6 is a maximum.(see page 15 for second-order condition)

Alternatively set hence

MR MR MC 16 - 2Q 2.5Q Q

= MC = 16 -2Q = 1 + 0.5Q = 1 + 0.5Q = 15 = 6.

To find profit, substitute

Q profit

= 6 into the profit function, hence = - 3 + 15(6) - 1.25 (36) = 42

56

Chapter 2 Economic Optimisation

DISTINGUISHING MAXIMUM AND MINIMUM VALUES IN THE OPTIMISATION PROBLEMS

In economic analysis, finding optimum values generally means finding the maximum or minimum value of a variable, depending on the type of function discussed. For example, when a profit or total revenue function is analysed, the maximum value is the focus, whilst the minimum value would be the main concern if the total cost function is analysed

SECOND DERIVATIVE- REVISITED

However, there are instances when the function has both a maximum and a minimum value, (diagram1d - when a function is in cubic form). Since marginal value equals zero for both maximum and minimum values of a function, that means, the method described previously cannot tell us whether the optimum is a maximum or minimum. Hence further analysis is required. A formal mathematical procedure to distinguish between maximum or minimum value, requires the use of second derivative, which is, differentiation of the first derivative. As mentioned in our earlier discussions, rules for finding first derivative also apply to obtaining the second derivative.

The rule is that if the second derivative is positive, we have a minimum, and if the second derivative is negative, we have a maximum. RULES

Using mathematical notation, we can then state that the first-and second-order conditions for determining maximum and minimum values of a function are as follows.

First order condition

Second order condition d2 /dx 2 < 0 d2 /dx2 > 0

Maximum value Minimum value

dy/dx = 0 dy/dx = 0

57

Chapter 2 Economic Optimisation

USE OF MARGINALS TO MAXIMISE THE DIFFERENCE BETWEEN TWO FUNCTIONS

Now to illustrate,

Suppose the firm has the following revenue and cost function (note: we use a cubic function) TR = 7Q - 0.1Q2 TC = 10 + 8Q - 0.3Q2 + 0.01Q3

Based on these equations, the firms total profit function is = - 10 - Q + 0.2Q2 - 0.01Q3

Let us now employ calculus along with the first- and second- order conditions to determine the point at which the firm maximises its profit. d --dQ = (-10 + Q) (10-3Q) = 0 = -1 + 0.4Q - 0.03Q2 = marginal profit

Q1* = 10/3

Q*2 = 10

Although both Q1 * and Q2 * fulfil the first-order condition, only one satisfies the secondorder condition. To find out which one, let us find the second derivative of the function by taking the derivative of the marginal profit function or second derivative of the profit function: d2 ---dQ2

58

= 0.4 - 0.06Q

Chapter 2 Economic Optimisation

By substitution, we see that when Q= 10/3, the value of the second derivative is a positive number: d2/ dQ2 = 0.4 - 0.06(10/3) = 0.2

On the other hand, when Q=10, the value of the second derivative is a negative number: d2/ dQ2

= 0.4 - 0.06(10)

= - 0.2

Thus, we see that only Q2* enables us to adhere to the second-order condition of

d2 /dQ2 < 0.

As shown by graph (3a, 3b) and calculus above, only Q2* is THE optimal output. Our example also shows that MR=MC at profit maximising output level, the converse does not hold true. Profit is not necessarily maximised at any point where MR=MC (for example Q2*.=10/3)

NOTES

Optimal output is derived when total profit function reaches a maximum. This corresponds to the point when M = 0 at Q2*. To be the optimal output, it must satisfy both the F.O.C. and S.O.C that is

d/dQ = 0 and d2/ dQ2 < 0.

59

Chapter 2 Economic Optimisation

Example

Given the demand function Q = 1000 - 40P, where Q is quantity and P is price, determine the quantity that results in maximum total revenue.

SUGGESTED SOLUTIONS

Given

Q P

= 1000 - 40P = 25 - 0.025Q

and

TR

= PQ = 25Q - 0.025Q2

To determine the quantity that maximises TR, take the first derivative, set it equal to zero, and solve for Q.

d(TR) ------ = MR = 25 - 0.05Q = 0 dQ

Q = 500

That Q=500 is a maximum is clear because the second derivative is negative, that is, d2(TR) ------- = - 0.05 < 0 dQ2

60

Chapter 2 Economic Optimisation

CHECKLIST

Take a few minutes to check if you are now able to:

Write functions to represent your economic problems. Build a model for the economic problem at hand. Relate the relationships that exist between total, average, and marginal concepts irrespective of whether it is revenue, cost or product.

Perform optimisation analysis, graphically via both aggregate and marginal approach. Conduct first- and second-order derivations. Apply marginal analysis in decision making Distinguish between maximum and minimum values in

optimisation problems.

2.7

MULTIVARIATE OPTIMISATION

In this section, we determine maximum and minimum values of a function with more than one variable. First, we introduce the concept of partial derivative and then use it to examine the maximisation process of a multivariate function

PARTIAL DERIVATIVE

The functions discussed so far involve only one variable. Many functional relationships which you will encounter later involve more than one independent variable. For a multivariate function, for example y = f(x,z), the concept of partial derivative is employed.

61

Chapter 2 Economic Optimisation

SOME EXAMPLES OF MULTIVARIATE FUNCTIONS

Most economic relationship involves more than one variable, for example; demand of a product (Qdx) is influenced by the price of the product itself (Px ), price of a related product (Py, where y could be a substitute or complement), income (I), taste(T) and others, that is {Qdx = f(Px, Py, I,T,)}; total revenue (TR) depends on output (Q), advertisement (A), and taste factors (T), that is {TR= f(Q,A,T)} and output (Q)is a function of labour (L) and capital inputs(K). Hence, it is important to determine the marginal effect of each independent variable separately. To do so, we use partial derivative.

For example, given

y = f (x, z) y = 3x2 -xz + z2

When analysing multivariate function, we first take the partial of y with respect to x, i.e. y/x. This indicates the slope relationship between y and x when z is held constant. Similarly, the partial derivative of y with respect to z (y/z) is derived by assuming x Thus, y/x = 6x - z and y/z = 2z - x The partial derivative y/x means that a small change in x is associated with y changing at the rate of (6x - z) when z is held constant. If z =2, the slope associated with y and x is (6x - 2). Similarly, y/z means a small change in z is associated with y changing at the rate of (2z - x), when x is held constant. to be constant, and taking the first derivative of y with respect to z.

NOTES Partial derivative is denoted by y/x.

62

Chapter 2 Economic Optimisation

MAXIMISING A MULTIVARIATE FUNCTION

To maximise or minimise a multivariate function, we have to set each partial derivative equal to zero and solve simultaneously for the optimal value of the independent variable.

For example, to maximise total profit function = xz -3x2 - z2 + 11x

we find partial derivative, set it equal to 0 and solve for x and z. / x = z - 6x + 11 = 0 / z = x - 2z =0 ( i ) ( ii )

Multiplying ( i ) by 2 and add to ( ii ), we get

2z-12z + 22 x - 2z

=0 =0

------------------------------------------11x x z = 22 =2 =1

Substituting x = 2 into ( i ), we get z = 1 and substituting these values into the profit function , we get total profit:

= (2)(1)-3 (2)2 - (1)2 + 11(2) = 11

Thus when this firm maximises its profit amounting to $11 when it sells 2 units of x with 1 unit of y.

63

Chapter 2 Economic Optimisation

Example Given a firms total profit depends on the sale of product x and product z is = f(x,z) = 100x - x2 - xz - 2z2 + 190z, Find partial derivative of with respect to x and z. Find the combined output of x and z that maximises profit and profit, at that combination.

SUGGESTED SOLUTIONS

/x and /z

= 100 - 2x - z = -x - 4z + 190

( i ) ( ii )

To solve, (i)x4 ( iii) - (ii) 400 - 8x - 4z = 0 190 - x - 4z = 0 --------------------210 - 7x x z =0 = 30 = 40 ( iii )

Substituting x =30 and z = 40 into the profit function gives profit amounting to $5300

= 100(30) - (30)(30) - 30(40) - 2(40)(40) = $5300

64

Chapter 2 Economic Optimisation

2.8

CONSTRAINED OPTIMISATION

All the above discussions are illustrations of unconstrained optimisation, but that is not a realistic scenario.

SOLVING BY SUBSTITUTION METHOD

In chapter 1, we mentioned that in attempting to achieve goals, managers face constrains. This would limit their options, hence the maximisation or minimisation of an objective function is subjected to constrain. One way to solve a constrained optimisation problem is the substitution method.

Suppose, a firm operates with this total cost function: TC = 3x2 + z2 - xz where x and z represent two products to be produced.

The manager is requested to determine the least-cost combination of x and z, subject to the constraint that total output of both products is 10 units. Therefore, the constrained optimisation problem is: = 3x2 + z2 - xz, = 10.

Minimise subject to

TC x+z

Solving the constraint for z and substituting this value into the objective function results in z and TC = 10 - x, = 3x2 + (10-x)2 - x(10-x) = 3x2 + 100 - 20x + x2 - 10x + x2 = 5x2 - 30x + 100

Now, it is possible to treat the above equation as an unconstrained minimisation problem. To solve, we find the first derivative, set it equal to zero. And solve for value of x:

65

Chapter 2 Economic Optimisation

dTC ------ = 10x -30 = 0 dx 10x x = 30 =3

A check of the sign of the second derivative at that point has to be made to ensure a minimum: d2TC ----- = 10 dx2

Since the second derivative is positive, x = 3 is indeed a minimum. When we substitute x = 3 into the constraint equation, we can determine the optimal output for z.

x + z = 10 z = 10 -3 =7

Thus a production of 3 units of x and 7 units of z is the least-cost combination for producing 10 units. The total cost of this combination is

TC

= 3(9) - (3)(7) + 49 = $55.

SOLVING BY LAGRANGIAN MULTIPLIER TECHNIQUE

Fallacy of the substitution technique

Unfortunately, the substitution technique discussed in the preceding section is not always feasible. Some decision problems involve numerous and complex constraint conditions. To overcome this, we have to resort to the Lagrangian multiplier technique.

66

Chapter 2 Economic Optimisation

LAGRANGIAN TECHNIQUE

This method optimises a function which incorporates the original objective function and the constraint function. This combined equation called the Lagragian function is created in such a way that when it is maximised or minimised, the original objective function is also maximised or minimised and all constraints are satisfied.

Lagrangian function

The first step in this method is to form a Lagrangian function. This is simply done by writing the objective function that the firm wishes to seek; (either maximises or minimises) plus (lambda - denoting the Lagragian multiplier ) times the constraint function and set equal to zero.

For our hypothetical example;

Min.x, (Objective function)

TC

subject to

total output (Constraint function)

Thus L TC = 3x2 + z2 - xz + ( x + z - 10)

TC

is defined as the Lagrangian function for the constrained optimisation under

consideration.

The partial derivative of the above functions with respect to the three unknown, x, z, and are as follows: LTC ----x = 6x - z + ,

67

Chapter 2 Economic Optimisation

LTC -----z LTC and ----- = x + z - 20 = 2z - x +

At a minimum point on a multivariate function, all partial derivatives are equal to zero. Setting these partial derivatives equal to zero, gives three equations and three unknown. 6x - z + = 0 2z - x + = 0 x + z - 10 = 0

(i) (ii) (Iii)

The above can be solved simultaneously. First we get rid of one unknown, ( ) by subtracting ( ii ) from ( i ) 6x - z + - 2z + x - gives 7x - 3z =0 ( iv )

Next, to get rid of z, multiply ( iii) by 3 and add to ( iv ) to give the solution for x:

3 x + 3z - 30 7x - 3z

=0 =0

--------------------------------------10x - 30 10x x = 0 = 30 =3

Substituting x = 3 into equation ( iii ) yields z = 7;

68

Chapter 2 Economic Optimisation

3+z z

= 10 = 7

and substituting x = 3 and z = 7 into equation ( i ), gives the value: 6(3) - 7 + =0 = -11

Here, = -11 is interpreted as the marginal cost of producing 10 units; meaning that if the firm reduces output from 10 to 9 units, total cost will fall by approximately $11.Thus, is the marginal effect on the objective function associated with per unit change (increase or decrease) in the constraint. The marginal relation described by the multiplier provides managers with economic data to evaluate the potential benefits or costs of relaxing constraints.

NOTES

The use of Lagrangian multiplier method is further examined in chapter 4 to find consumers maximum satisfaction from consumption. Again, in chapter 5, the Lagrangian technique for constrained optimisation is used to develop the optimal input proportion rule.

SUMMARISING

Steps to follow: 1. Form the Lagrangian function, (L ( ) ) 2. Find partial derivative (L ( ) ) with respect to the first variable, 3. Find partial derivative (L ( ) ) with respect to the second variable, 4. Find partial derivate (L ( ) ) with respect to , 5. Finally, solve simultaneously to get values of the first and second variable and .

69

Chapter 2 Economic Optimisation

The exercise below provides another perspective of the usefulness of the Lagrangian method.

Example

Given the utility function as follows u = 2x 0.75 - y 0.25 It would be great if you attempt the question before looking at the and the constraint function answer. Just follow the steps above

1000 = 2x + 4y

a) Formulate a Lagrangian function b) What are the values of x and y that will maximise utility? c) Find the value of and interpret it.

SUGGESTED SOLUTIONS

a) L( U*) = 2x0.75 y0.25 - (1000 - 2x - 4y) b) F.O.C.

U* ---- = 0.75(2x -0.25 y0.25 ) + 2 = 0 x U* ---- = 0.25(2x0.75 y -0..75) + 4 = 0 y

70

(1)

(2)

Chapter 2 Economic Optimisation

U* ------ = - 1000 + 2x + 4y =0 (3)

Divide equation (1) by (2) 1.5x -0.25 y0.25 0.5x0.75 y -0.75 - 2 - 4

---------------- = -----

3y ---x 2x x

2 = ---4 = 12y = 6y (4)

Substitute equation (4) into (3)

2 (6y) + 4y = 1000 y = 62.5 x = 6(62.5) = 375

A combination of x = 375 and y = 62.5 will maximises utility.

c) Substitute x = 375 and y = 62.5 into equation (1) 5(375)-0.25 (62.5)0.25 + 2

=0 = - 0.479

is the marginal effect of the objective function associated with the per unit change in the constraint function. A of - 0.479 means that total utility will fall by 0.479 when the income falls by one unit.

71

Chapter 2 Economic Optimisation

QUESTIONS

Q1.

Assume a firm produces its product in a market described with the following production function and price data.

Q = 2x + 3y + 6xy Px = $4, Py = $6

where x and y are two variable input factors in the production of output Q, and Px and Py are prices of x and y respectively.

a) What is the optimal input combination for x and y in this production if the firm

is operating with a $1000 budget constraint? (use the Lagrangian multiplier method)

b) What is the increase in output that could be obtained from an additional

expenditure of $1?

Q2.

A firms production function is given by Q = L2 + 5LK + 4K2

The price of a unit of labour service and a unit of capital is $5 and $10 respectively. The firm has a cost limitation of $1000 per time period.

a) Formulate the Lagrangian function. b) What should be the combination of K and L that will maximise output Q? c) How much is the maximum output?

72

Chapter 2 Economic Optimisation

d) Interpret the meaning of the Lagrangian multiplier.

Q3. A. Einstein invented a new alarm system for which he receives royalty of 20% of total revenue from the sales of the alarm system. If the total cost and demand function is given by

TC Q

= 200 000 + 30Q + 0.002Q = 12 500 - 50P

a) Calculate the total revenue maximising price and output. What is the amount

of royalty Einstein would receive?

b) Calculate the profit maximising output and price. What is the amount of

royalty Einstein would receive at this output?

Q4.

A company produces according to the following production function: Q = 500L - 0.5L2 + 1000K -0.25K2 + 100E - 0.1E2

where Q is output per month, L is number of workers employed per month, K is machines used per month and E is electricity used per month.

All output is sold at $10 per unit. L costs $2000 per month, machines cost $9000, electricity costs $0.10 per kilowatt/hour.

a) Formulate the profit function. b) What is the profit maximising level of labour, machine and electricity per

month?

c) What is the profit maximising level of output?

73

Chapter 2 Economic Optimisation

d) What is total profit per month?

Q5. The demand function faced by john associate is

P = 45 0.5Q

where Q represents output and p represents price

Its total cost is given by the equation TC = Q 3- 8Q 2 + 57Q + 2

a) derive the equation of the total profit function

b) determine the output level that maximises total profit

c) calculate the maximum total profit

Q6.

Given Q = 1500 50P

a) determine the TR function

b) determine the rate of output that maximise TR

c) calculate maximum TR

74

Chapter 2 Economic Optimisation

SUGGESTED SOLUTIONS

Q1

Steps to follow: 1 ) Form the Lagrangian function, (L ( ) ) 2 ) Partial derivate (L ( ) ) with respect to x, 3 ) Partial derivate (L ( ) ) with respect to y, 4 ) Partial derivate (L ( ) ) with respect to , 5 ) Finally, solve simultaneously to get values of x, y, and .

Objective function Q = 2x + 3y + 6xy Constraint function 4x + 6y = 1000 LQ = 2x + 3y + 6xy + (4x + 6y - 1000) LQ/ x = 2 + 6y + 4 LQ/ y = 3 + 6x + 6 LQ/ = 4x + 6y - 1000

a)

=0 =0 =0

(1) (2) (3)

(1) x 3 6 + 18y + 12 (2) x 2 6 + 12x + 12 (3) - (5)

18y -12x y

=0 =0 =0 = 2x /3

(4) (5)

Substitute into (3) 4x + 6 (2/3)x 4x + 4x x y = 1000 = 1000 = 125 = 125(2/3) = 83.33

75

Chapter 2 Economic Optimisation

Therefore optimal combination is x = 125 and y = 83.33 units

b) Substitute x = 125 and y =83.33 into (1)

2 + 6(83.33) = 4 = 502/4 = 125.5

When expenditures increase by $1, output will increase by 125.5 units.

Q2.

See Q1 for steps to follow. a) Objective function Q = L2 + 5LK + 4K2 Constraint function 5L + 10K = 1000

LQ = L2 + 5LK + 4K2 + (5L +10K -1000)

b) LQ / L = 2L + 5K + 5 LQ/ K LQ/ = 5L + 8K + 10 = 5L + 10K - 1000 =0 =0 =0 (1) (2) (3)

(1) x 2 4L + 10K + 10 (4)- (2) -L + 2K L From (5)

=0 =0 = 2K (6)

(4) (5)

Substitute (6) into (3) 5(2K) + 10K 20K K L

= 1000 = 1000 = 50 = 100

Output is maximised when K=50 and L =100 .

76

Chapter 2 Economic Optimisation

c) Substitute K=50 and L =100 into the output function. = L2 + 5LK + 4K2 = 100(100) + 5(100)(50) + 4(50)(50) = 45 000

d) Substitute K =50, L=100 into equation (1) 2(100) + 5(50) + 5 =0 = -90

When production budget falls by a unit, the output falls by 90 units.

Q3. Steps to follow: 1) Find TR

2) Conduct F.O.C on TR to get Q* and P* 3) Calculate 20% of TR 4) Conduct S.O.C. to reaffirm maximising.

a)

TR = PxQ given Q P and F.O.C. = 12500 - 50P = 250 - 0.02Q TR dTR/ dQ Q* = 250Q - 0.02Q2 = 250 - 0.04Q = 0 = 6250

Substitute Q*=6250 into P function: P*

= 250 - 0.02(6250) = $ 125

therefore

TR

= 125 x 6250 = $ 781 250

therefore the amount of royalty

= 20%( 781 250) = $ 156 250

77

Chapter 2 Economic Optimisation

b)

Steps to follow: 1) Find profit 2) Conduct F.O.C on function to get Q* and P*

3) Conduct S.O.C. to reaffirm maximising 4) Find TR by substitute Q* and P* into TR 5) Calculate 20% of royalty

= TR - TC = 250Q - 0.02Q2 - { 200 000 + 30Q + 0.0002Q2 } = - 200 000 + 230Q - 0.022Q2 /Q = 230 - 0.044Q Q* P* =0 = 5 000 = 250 - 0.02(5000) = $150 TR = PxQ = 150(5 000) = $ 750 000 Royalty = 20%(750 000) = $ 150 000

Q4.

Steps to follow:

1) Find profit by subtracting TC from TR

2) Partial derivate with respect to L, K, E 3) Solve for Q* for respective L, K,E 4) Conduct S.O.C. to reaffirm maximising 5) Find by substituting into answer a)

a)

= TR - TC

TR = PxQ given P = $10 and Q = 500L - 0.5L2 + 1000K -0.25K2 + 100E - 0.1E2

78

Chapter 2 Economic Optimisation

TR given PL TC

= 10(500L - 0.5L2 + 1000K -0.25K2 + 100E - 0.1E2) = 2000, PK = 9000, and PE = 0.1 = 2000L + 9000K + 0.1E = 10(500L - 0.5L2 + 1000K -0.25K2 + 100E - 0.1E2) - 2000L + 9000K + 0.1E

b)To maximise , input is employed to the point where the change associated with hiring one additional unit of input is equal to zero. Labour : /L = 10( 500 - L) - 2000

in

=0 L* = 300

Machines: /K = 10( 1000 - 0.5K) - 9000 = 0 K* = 200 Electricity: /E = 10( 100 - 0.2E) - 0.1 =0 E* = 499.95 = 500(300) - 0.5(300)2 + 1000(200) - 0.25(200)2 +100(499.95) 0.1(499.95)2 = 320 000 units = TR - TC TR 10( 320 000) TC Labour : 2000(300) = 600 000 3 200 000

c)

d)

Machines: 9000(200) Electricity: 0.1(499.95)

= 1 800 000 = 50 2 400 050 --------------Total profit $799 950 ---------------

Well, you have reached the end of the chapter. The math in this chapter has been carefully explained step by step. Please make sure you have understood the steps used in the calculation. It has also been a long chapter; if you find difficulties in understanding

79

Chapter 2 Economic Optimisation

the material, please go through the sections again carefully and note down questions that you need to discuss with your lecturer or classmates

SUMMARY

The functional relationship y = f(x) means there is a systematic relationship between the dependent variable y and the independent variable x.

Functional relationships can be expressed in algebraic equations, tables or graphs.

Functions can be linear, quadratic or cubic.

Economic models are used to illustrate an economic principle, explain an economic phenomenon, or to predict implications as a result of changes that affect the functional relationship.

The key relationships between total, average, and marginal are:

The value of the average function at any point is the slope of a ray drawn from that point to the total function. The value of the marginal function at any point is the slope of a line drawn tangent to the total function at that point. When total function increases, both average function and marginal function is positive. When total function decreases, average function is still positive but marginal function is negative. When total function is at its maximum, marginal function equals zero.

Optimisation means finding either the maximum or minimum value of a variable of a function.

80

Chapter 2 Economic Optimisation

The slope of a function y = f(x) is the change in y (y) divided by the corresponding change in x (x). The derivative of this function dy/dx or f (x) is the slope of a straight line drawn tangent to the function at that point.

The rules of differentiation contained in page will help you find derivatives of functions encountered in managerial economics.

Higher order derivatives are found by taking the first derivative of each resultant derivative, for example, second derivative is the derivative of the first derivative.

The maximum or minimum value of a function y = f(x) can be found by setting the first derivative equal to zero (dy/dx = 0 ) and solving for the value of x.

A function is at a maximum if dy/dx = 0 and d2y/dx2 < 0. Conversely, A function is at a minimum if dy/dx = 0 and d2y/dx2 > 0. Profit is maximised when MR=MC or M = 0 and dM /dQ< 0 (or alternatively d/dQ = 0 and d2/dQ2 < 0).

Revenue is maximised when MR = 0 Average cost is minimised when MC = AC and average cost is increasing as output expands.

For multivariate function (function with more than one independent variable y = f (x z) ), the concept of partial derivative ( y /x) has to be employed. When we partial derivate y with respect to x, we hold z constant meaning that we isolate the marginal effect on y from changes in x only.

To maximise or minimise a multivariate function, we set each partial derivative equal to zero and solve the resulting set of simultaneous equations for the optimal value of the independent variables.

81

Chapter 2 Economic Optimisation

For constrained optimisation problems, the Lagrangian technique has to be adopted. The Lagrangian function incorporates the objective function and the constraint conditions. The Lagrangian multiplier, , indicates the marginal effect on the objective function as a result of a unit increase or decrease in the constraint function.

STUDY NOTES

82

You might also like

- Maximizing Firm ValueDocument21 pagesMaximizing Firm Valueshahzaib_geniousNo ratings yet

- Managerial Economics IntroductionDocument180 pagesManagerial Economics Introductiondcold6100% (1)

- What Is Managerial Economics? Explain Its Nature, Scope and ItsDocument9 pagesWhat Is Managerial Economics? Explain Its Nature, Scope and Itsn13shukla85% (20)

- Circular Flow of Income in a Four-Sector EconomyDocument3 pagesCircular Flow of Income in a Four-Sector Economyvipul jain50% (2)

- Chapter One: 1. Introduction To OperationsDocument213 pagesChapter One: 1. Introduction To OperationsKidist Alemu100% (2)

- Test Bank Chapter1Document4 pagesTest Bank Chapter1shawktNo ratings yet

- Chapter#1 Introduction To Managerial Economics SolutionDocument3 pagesChapter#1 Introduction To Managerial Economics SolutionSadaf Faruqui78% (18)

- Methods and Types of CostingDocument2 pagesMethods and Types of CostingCristina Padrón PeraltaNo ratings yet

- Nature and Scope of Managerial EconomicsDocument2 pagesNature and Scope of Managerial EconomicsShakira Yasmin100% (1)

- Chapter 11 - Network Models - Operations ResearchDocument12 pagesChapter 11 - Network Models - Operations ResearchAnkit Saxena100% (5)

- Chap 004Document30 pagesChap 004Tariq Kanhar100% (1)

- Managerial EconomicsDocument31 pagesManagerial EconomicsRaj88% (8)

- Assignment On Managerial EconomicsDocument31 pagesAssignment On Managerial Economicsdiplococcous100% (7)

- Theory of Production 1 0Document22 pagesTheory of Production 1 0Suthan Dinho సుతాన్ దళినైడుNo ratings yet

- Managerial Economics Final ExamDocument1 pageManagerial Economics Final ExamHealthyYOU100% (5)

- Managerial EconomicsDocument89 pagesManagerial EconomicsPratibhaVijaykumarBale33% (9)

- Questio Bank Managerial EconomicsDocument12 pagesQuestio Bank Managerial EconomicsSarthak Bhargava67% (3)

- Demand Estimation and ForecastingDocument4 pagesDemand Estimation and Forecasting'mYk FavilaNo ratings yet

- Chapter 6-Distribution and Network Models: Multiple ChoiceDocument24 pagesChapter 6-Distribution and Network Models: Multiple ChoicePhie phieNo ratings yet

- Question Bank of Managerial Economics - 2 MarkDocument27 pagesQuestion Bank of Managerial Economics - 2 MarklakkuMS89% (18)

- Problems 1Document4 pagesProblems 1vishwajeetg50% (2)

- The Theory of CostDocument19 pagesThe Theory of CostFardus Mahmud50% (2)

- Business and Its Environment NotesDocument48 pagesBusiness and Its Environment NotesPrashant M Shah100% (4)

- BBS Macroeconomics 2nd YearDocument3 pagesBBS Macroeconomics 2nd YearIsmith Pokhrel0% (1)

- Social Cost Benefit Analysis Project AppraisalDocument47 pagesSocial Cost Benefit Analysis Project AppraisalRahul Jain100% (2)

- Allocation and ApportionmentDocument11 pagesAllocation and ApportionmentpRiNcE DuDhAtRa100% (2)

- Business Maths..Linear Programming 2Document114 pagesBusiness Maths..Linear Programming 2muhammadtaimoorkhan100% (4)

- Assignment On Strategic Evaluation & ControlDocument13 pagesAssignment On Strategic Evaluation & ControlShubhamNo ratings yet

- 9780199467068Document56 pages9780199467068Mayank Vyas100% (1)

- A Milk Producers Union Wishes To Test Whether The Preference Pattern of Consumers For Its Products Is Dependent On Income LevelsDocument2 pagesA Milk Producers Union Wishes To Test Whether The Preference Pattern of Consumers For Its Products Is Dependent On Income Levelsaruna270750% (2)

- Hull-OfOD8e-Homework Answers Chapter 05Document3 pagesHull-OfOD8e-Homework Answers Chapter 05hammernickyNo ratings yet

- Cost Accounting Short QuestionsDocument5 pagesCost Accounting Short QuestionsMalika HaiderNo ratings yet

- Job and Batch Costing NotesDocument5 pagesJob and Batch Costing NotesFarrukhsg100% (1)

- Managerial Economics (Chapter 3)Document72 pagesManagerial Economics (Chapter 3)api-370372471% (14)

- BBA II Sem Macroeconomics Concepts and DefinitionsDocument63 pagesBBA II Sem Macroeconomics Concepts and DefinitionsPrajwalNo ratings yet

- Managerial Accounting and CostDocument19 pagesManagerial Accounting and CostIqra MughalNo ratings yet

- Unit 17 Capital Structure: ObjectivesDocument11 pagesUnit 17 Capital Structure: ObjectivesMahadev SubramaniNo ratings yet

- International Portfolio Management Unit 2Document12 pagesInternational Portfolio Management Unit 2Omar Ansar Ali100% (1)

- Investment AvenuesDocument35 pagesInvestment AvenuesJoshua Stalin SelvarajNo ratings yet

- Management AccountingDocument38 pagesManagement AccountingHari Haran100% (1)

- Four Special Cases in SimplexDocument51 pagesFour Special Cases in SimplexQais87% (15)

- Operations Management Study GuideDocument8 pagesOperations Management Study GuidemariavcromeroNo ratings yet

- Long Term Sources of FinanceDocument26 pagesLong Term Sources of FinancemustafakarimNo ratings yet

- Revenue MaximizationDocument2 pagesRevenue Maximizationsambalikadzilla6052No ratings yet

- BBM 225 Intermediate Macroeconomics Instructional MaterialDocument120 pagesBBM 225 Intermediate Macroeconomics Instructional Materialmelvinrajeev50% (2)

- Managerial Economics CH 3Document32 pagesManagerial Economics CH 3karim kobeissi100% (1)

- Managerial Economics: Scope and Relation to Other DisciplinesDocument29 pagesManagerial Economics: Scope and Relation to Other DisciplinesYash GargNo ratings yet

- Cost Volume Profit Analysis As A Management Tool For Decision MakingDocument15 pagesCost Volume Profit Analysis As A Management Tool For Decision MakingGilbert G. Asuncion Jr.100% (3)

- CHP 2 SolDocument17 pagesCHP 2 SolZakiah Abu KasimNo ratings yet

- Elasticity of Demand Problems With SolutionsDocument3 pagesElasticity of Demand Problems With SolutionsFaraz SiddiquiNo ratings yet

- 5th Semester Finance True False FullDocument12 pages5th Semester Finance True False FullTorreus Adhikari75% (4)

- Individual AssignmentDocument4 pagesIndividual AssignmentFeyisa AyeleNo ratings yet

- M09 Rend6289 10 Im C09Document15 pagesM09 Rend6289 10 Im C09Nurliyana Syazwani80% (5)

- Module 1 Chapter 1 PDFDocument9 pagesModule 1 Chapter 1 PDFdoreethy manaloNo ratings yet

- Nature of Mathematical Economics: Contact Information: Kadjei-Mantey@ug - Edu.ghDocument19 pagesNature of Mathematical Economics: Contact Information: Kadjei-Mantey@ug - Edu.ghDarling Jonathan WallaceNo ratings yet

- Makalah Matematika EkonomiDocument11 pagesMakalah Matematika Ekonomimeidy adelinaNo ratings yet

- CGE Classroom ExcelDocument39 pagesCGE Classroom ExcelPaf Veterans-FamiliesNo ratings yet

- Linear ProgrammingDocument56 pagesLinear Programmingeunice IlakizaNo ratings yet

- M430 Unit-01 SampleDocument37 pagesM430 Unit-01 SamplepedroNo ratings yet

- Economic ModelsDocument6 pagesEconomic ModelsBellindah GNo ratings yet

- Statistics & SPSSDocument49 pagesStatistics & SPSSmyraNo ratings yet

- Features of Four Market StructuresDocument11 pagesFeatures of Four Market StructuresmyraNo ratings yet

- Brand Equity & Brand IdentityDocument29 pagesBrand Equity & Brand IdentitymyraNo ratings yet

- Internet Marketing MKT544 OCT 2008Document4 pagesInternet Marketing MKT544 OCT 2008myraNo ratings yet

- Product Management MKT 534 OCT2009Document3 pagesProduct Management MKT 534 OCT2009myraNo ratings yet

- Product Management MKT 534 OCT2010Document3 pagesProduct Management MKT 534 OCT2010myraNo ratings yet

- MKT534/531 October 2007Document3 pagesMKT534/531 October 2007myraNo ratings yet

- Product Management MKT 534 OCT2008Document3 pagesProduct Management MKT 534 OCT2008myraNo ratings yet

- MKT535/532/561/520 April 2008Document3 pagesMKT535/532/561/520 April 2008myraNo ratings yet

- Eco415 October 2007Document5 pagesEco415 October 2007myra0% (1)

- ECO415 November 2005Document6 pagesECO415 November 2005myra0% (1)

- ECO415 November 2005Document6 pagesECO415 November 2005myra0% (1)

- MKT534/531 October 2007Document3 pagesMKT534/531 October 2007myraNo ratings yet

- Marketing Research Mkt537 April 2009Document4 pagesMarketing Research Mkt537 April 2009myraNo ratings yet

- MKT537/536/562 October 2009Document5 pagesMKT537/536/562 October 2009myraNo ratings yet

- MKT535/532/561/520 October 2009Document3 pagesMKT535/532/561/520 October 2009myraNo ratings yet

- MKT 535/532/561 April 2007Document3 pagesMKT 535/532/561 April 2007myraNo ratings yet

- MKT 543/531 Apr2010Document3 pagesMKT 543/531 Apr2010myraNo ratings yet

- MKT535/532/561/520 April 2009Document3 pagesMKT535/532/561/520 April 2009myraNo ratings yet

- MKT537 536 562Document4 pagesMKT537 536 562xone1215No ratings yet

- MKT 534/531/530 Apr2008Document3 pagesMKT 534/531/530 Apr2008myraNo ratings yet

- MKT537/536/562 April 2008Document5 pagesMKT537/536/562 April 2008myraNo ratings yet

- MKT535/532/561/520 April 2008Document3 pagesMKT535/532/561/520 April 2008myraNo ratings yet

- Marketing Research Mkt537 April 2009Document4 pagesMarketing Research Mkt537 April 2009myraNo ratings yet

- MKT535/532/561/520 October 2008Document3 pagesMKT535/532/561/520 October 2008myra100% (1)

- MKT 537/536 April 2007Document7 pagesMKT 537/536 April 2007myraNo ratings yet

- MKT 543/541 Apr2009Document3 pagesMKT 543/541 Apr2009myraNo ratings yet

- 3R Leaflet BIoutlineDocument1 page3R Leaflet BIoutlinemyraNo ratings yet

- MKT 537/536 Oct 2007Document8 pagesMKT 537/536 Oct 2007myraNo ratings yet

- MKT 544 Apr - 2008 - MKTDocument4 pagesMKT 544 Apr - 2008 - MKTmyraNo ratings yet

- 2007 Bomet District Paper 2Document16 pages2007 Bomet District Paper 2Ednah WambuiNo ratings yet

- NetsimDocument18 pagesNetsimArpitha HsNo ratings yet

- MSDS FluorouracilDocument3 pagesMSDS FluorouracilRita NascimentoNo ratings yet

- Statement of Compulsory Winding Up As On 30 SEPTEMBER, 2008Document4 pagesStatement of Compulsory Winding Up As On 30 SEPTEMBER, 2008abchavhan20No ratings yet

- April 2017 Jacksonville ReviewDocument40 pagesApril 2017 Jacksonville ReviewThe Jacksonville ReviewNo ratings yet

- Tender Notice and Invitation To TenderDocument1 pageTender Notice and Invitation To TenderWina George MuyundaNo ratings yet

- Equipment, Preparation and TerminologyDocument4 pagesEquipment, Preparation and TerminologyHeidi SeversonNo ratings yet

- Ks3 Science 2008 Level 5 7 Paper 1Document28 pagesKs3 Science 2008 Level 5 7 Paper 1Saima Usman - 41700/TCHR/MGBNo ratings yet

- ROM Flashing Tutorial For MTK Chipset PhonesDocument5 pagesROM Flashing Tutorial For MTK Chipset PhonesAriel RodriguezNo ratings yet

- LON-Company-ENG 07 11 16Document28 pagesLON-Company-ENG 07 11 16Zarko DramicaninNo ratings yet

- Kahveci: OzkanDocument2 pagesKahveci: OzkanVictor SmithNo ratings yet

- Postnatal Assessment: Name Date: Age: D.O.A: Sex: Hospital: Marital Status: IP .NoDocument11 pagesPostnatal Assessment: Name Date: Age: D.O.A: Sex: Hospital: Marital Status: IP .NoRadha SriNo ratings yet

- Irctc Tour May 2023Document6 pagesIrctc Tour May 2023Mysa ChakrapaniNo ratings yet

- Job Description Support Worker Level 1Document4 pagesJob Description Support Worker Level 1Damilola IsahNo ratings yet

- Waves and Thermodynamics, PDFDocument464 pagesWaves and Thermodynamics, PDFamitNo ratings yet

- The Product Development and Commercialization ProcDocument2 pagesThe Product Development and Commercialization ProcAlexandra LicaNo ratings yet

- How To Check PC Full Specs Windows 10 in 5 Ways (Minitool News)Document19 pagesHow To Check PC Full Specs Windows 10 in 5 Ways (Minitool News)hiwot kebedeNo ratings yet

- Tygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingDocument4 pagesTygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingAluizioNo ratings yet

- Impolitic Art Sparks Debate Over Societal ValuesDocument10 pagesImpolitic Art Sparks Debate Over Societal ValuesCarine KmrNo ratings yet

- Ground Water Resources of Chennai DistrictDocument29 pagesGround Water Resources of Chennai Districtgireesh NivethanNo ratings yet

- Problems of Teaching English As A Foreign Language in YemenDocument13 pagesProblems of Teaching English As A Foreign Language in YemenSabriThabetNo ratings yet

- Instagram Dan Buli Siber Dalam Kalangan Remaja Di Malaysia: Jasmyn Tan YuxuanDocument13 pagesInstagram Dan Buli Siber Dalam Kalangan Remaja Di Malaysia: Jasmyn Tan YuxuanXiu Jiuan SimNo ratings yet

- Board 2Document1 pageBoard 2kristine_nilsen_2No ratings yet

- Modified Release Drug ProductsDocument58 pagesModified Release Drug Productsmailtorubal2573100% (2)

- Variable Speed Pump Efficiency Calculation For Fluid Flow Systems With and Without Static HeadDocument10 pagesVariable Speed Pump Efficiency Calculation For Fluid Flow Systems With and Without Static HeadVũ Tuệ MinhNo ratings yet

- Steps To Configure Linux For Oracle 9i Installation: 1. Change Kernel ParametersDocument5 pagesSteps To Configure Linux For Oracle 9i Installation: 1. Change Kernel ParametersruhelanikNo ratings yet

- Recycle Used Motor Oil With Tongrui PurifiersDocument12 pagesRecycle Used Motor Oil With Tongrui PurifiersRégis Ongollo100% (1)

- Extensive Reading Involves Learners Reading Texts For Enjoyment and To Develop General Reading SkillsDocument18 pagesExtensive Reading Involves Learners Reading Texts For Enjoyment and To Develop General Reading SkillsG Andrilyn AlcantaraNo ratings yet

- Tender34 MSSDSDocument76 pagesTender34 MSSDSAjay SinghNo ratings yet

- Course Tutorial ASP - Net TrainingDocument67 pagesCourse Tutorial ASP - Net Traininglanka.rkNo ratings yet