Professional Documents

Culture Documents

Kings Inc - Cost Acctg

Uploaded by

Shinji0 ratings0% found this document useful (0 votes)

32 views2 pagesNet sales (Note l) 870,000 Fac. Sal. Less: cost of goods manufactured and sold (Schedule l). 276,000 Depr.Gross profit 594,000 Other income (Note 2) 4,000 expenses Other expenses (note 5) 7,000 251,000 Advertising Net operating income 347,000 Appropriated for treasury stocks Total paid-in capital Retained Earnings: Free (140,000 + 235,960)

Original Description:

Original Title

Kings Inc- Cost Acctg

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNet sales (Note l) 870,000 Fac. Sal. Less: cost of goods manufactured and sold (Schedule l). 276,000 Depr.Gross profit 594,000 Other income (Note 2) 4,000 expenses Other expenses (note 5) 7,000 251,000 Advertising Net operating income 347,000 Appropriated for treasury stocks Total paid-in capital Retained Earnings: Free (140,000 + 235,960)

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views2 pagesKings Inc - Cost Acctg

Uploaded by

ShinjiNet sales (Note l) 870,000 Fac. Sal. Less: cost of goods manufactured and sold (Schedule l). 276,000 Depr.Gross profit 594,000 Other income (Note 2) 4,000 expenses Other expenses (note 5) 7,000 251,000 Advertising Net operating income 347,000 Appropriated for treasury stocks Total paid-in capital Retained Earnings: Free (140,000 + 235,960)

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Ex.

13, King Cost of goods manufactured and sold statement

Raw materials used (Note l) 102,000 Note l: Cost of raw materials used

Direct labor 60,000 Raw materials, beg.

Total prime costs 162,000 Add: Net cost of purchases

Purchase

Factory overhead (Note 2) 102,000 s

Total manufacturing costs 264,000 Freight in

Add: Work in Process, beg. 25,000 Cost of goods

Cost of goods placed in process 289,000 Less: Pur. Dis

Less: Work in process, end 16,000 Pur. Ret

Cost of goods manufactured 273,000 Cost of raw materials avail. F

Add: Finished goods, beg. 15,000 Less: Raw mat. End

Cost of goods available for sale 288,000 Cost of raw mat. Used

Less: Fin. Goods, end 12,000

Cost of goods manufactured and sold 276,000 Note 2: Factory overhead

Fac. Supp.

Income Statement Rep. And Mai

Net sales (Note l) 870,000 Fac. Sal.

Less: Cost of goods manuf. And sold (Schedule l) 276,000 Depr.-

Gross profit 594,000 Total

Add: Other income (Note 2) 4,000

Total 598,000 Note 2: Other income

Less: Operating exp. Interest incom

Selling expenses (Note 3) 202,000

Note 3: Selling

Admin. Expn. (Note 4) 42,000 expenses

Other expenses (Note 5) 7,000 251,000 Advertising

Net operating income 347,000 Sales Sal.

Less: Provision for income tax (32%) 111,040 Freight out

Net income after tax 235,960 Total

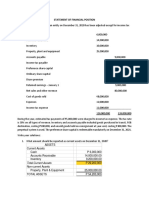

Balance

Sheet Note l: Net sa

Par Value: S

Capital Stock, issued, P10 par 140,000 L

Subscribed Capital Stock 100,000 di

Less: Subscriptions rec. 20,000 80,000 N

Stock Dividends to be Issued 40,000 260,000

N

Additional paid-in capital: ex

Donated Capital 10,000

Premium on Capital Stock 6,000

Paid-in capital from treasury stocks 4,000 20,000

Total paid-in capital 280,000

Retained Earnings:

Free (140,000 + 235,960) 375,960

Appropriated for treasury stocks 26,000 401,960

Appraisal Capital 296,000 N

Total 977,960

Treasury Stocks 26,000

Stockholders’ Equity 951,960

Total liabilities and Stockholders’ Eq. 1,631,000

You might also like

- Abm 3 Income StatementDocument6 pagesAbm 3 Income StatementYawzyGyuNo ratings yet

- Financial Management Master Budget ExerciseDocument10 pagesFinancial Management Master Budget ExerciseJerickho JNo ratings yet

- Pa12 Trần Khánh Vy Hw Ch5Document5 pagesPa12 Trần Khánh Vy Hw Ch5Vy Tran KhanhNo ratings yet

- DELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSDocument2 pagesDELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSLoren's Acads AccountNo ratings yet

- Cost Sheet: Solutions To Assignment ProblemsDocument3 pagesCost Sheet: Solutions To Assignment ProblemsNidaNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMelanie SamsonaNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Year 1Document15 pagesYear 1James De TorresNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Ratios QDocument1 pageRatios Qkashif.ali60001No ratings yet

- Budget CotchieDocument17 pagesBudget CotchieDuaaaaNo ratings yet

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- Ia Assignment 2Document2 pagesIa Assignment 2Shekinah SesbrenoNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Chapter 4 - Ia3Document10 pagesChapter 4 - Ia3Xynith Nicole RamosNo ratings yet

- The Deluxe Store Income Statement For The Year Ended November 30, 2020Document2 pagesThe Deluxe Store Income Statement For The Year Ended November 30, 2020Charisa BenjaminNo ratings yet

- Solution Chapter 6 Financial Statements Pre Adjustments 1Document8 pagesSolution Chapter 6 Financial Statements Pre Adjustments 1IsmahNo ratings yet

- Applied Overhads 60,000 Calculation of Actual OverheadDocument2 pagesApplied Overhads 60,000 Calculation of Actual OverheadRoshaanNo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Financial Accounting hw1Document5 pagesFinancial Accounting hw1Jermaine M. SantoyoNo ratings yet

- Line ItemDocument295 pagesLine ItemEve Rose Tacadao IINo ratings yet

- Chapter 2 Statement of Comprehensive IncomeDocument4 pagesChapter 2 Statement of Comprehensive IncomebwimeeeNo ratings yet

- Solutions:: I. In-Transit ItemDocument6 pagesSolutions:: I. In-Transit ItemMary EdsylleNo ratings yet

- Assignment 2 Solution Fall 2023 MBA 5241EDocument11 pagesAssignment 2 Solution Fall 2023 MBA 5241EDhyan HariaNo ratings yet

- E5-9 Multiple-Step Income StatementDocument2 pagesE5-9 Multiple-Step Income StatementNg. Minh ThảoNo ratings yet

- Accounting Chap 5Document6 pagesAccounting Chap 5Nguyễn Ngọc MaiNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisJoy ConsigeneNo ratings yet

- AssignmentDocument3 pagesAssignmentalmira garciaNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- 4) Nov 2006 Cost ManagementDocument30 pages4) Nov 2006 Cost Managementshyammy foruNo ratings yet

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Absorption and Marginal Costing TemplateDocument13 pagesAbsorption and Marginal Costing TemplateGeorge PNo ratings yet

- P4 MISE2014.Budgeting Exercices PDFDocument7 pagesP4 MISE2014.Budgeting Exercices PDFLeah Mae NolascoNo ratings yet

- Income Statement PreparationDocument11 pagesIncome Statement PreparationIbi Ifti100% (1)

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- I. Multiple Choice 1. D 2. A 3. A 4. D 5. BDocument3 pagesI. Multiple Choice 1. D 2. A 3. A 4. D 5. BBianca Nicole LiwanagNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocument12 pagesPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Marwa Year 1 Using Marginal Costing ApproachDocument6 pagesMarwa Year 1 Using Marginal Costing ApproachMak PussNo ratings yet

- Statement of Comprehensive Income - PROBLEMSDocument20 pagesStatement of Comprehensive Income - PROBLEMSSarah GNo ratings yet

- Thompson Corporation: InstructionsDocument7 pagesThompson Corporation: InstructionsrahmawNo ratings yet

- Financial Statment 12 JulyDocument13 pagesFinancial Statment 12 JulyMuhammad AshhadNo ratings yet

- Cash Flow Statement for 2017 ProjectDocument2 pagesCash Flow Statement for 2017 ProjectShakil ShekhNo ratings yet

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- 2- Income Statement & Closing Entries answeredDocument2 pages2- Income Statement & Closing Entries answeredbolaemil20No ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- Case Study 1Document2 pagesCase Study 1ruruNo ratings yet

- Bayer Lamp CompanyDocument5 pagesBayer Lamp CompanyTrisha Mae CorpuzNo ratings yet

- Advanced Costing and Auditing ProblemsDocument5 pagesAdvanced Costing and Auditing ProblemsOur Beatiful Waziristan OfficialNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Linear ProgrammingDocument2 pagesLinear ProgrammingShinjiNo ratings yet

- Transportation Problem Q&ADocument5 pagesTransportation Problem Q&AShinjiNo ratings yet

- Business Name Application Form Sole ProprietorshipDocument2 pagesBusiness Name Application Form Sole ProprietorshipShinji86% (14)

- OutsourcingDocument6 pagesOutsourcingShinjiNo ratings yet

- The Simulation Model and Methods of BudgetingDocument5 pagesThe Simulation Model and Methods of BudgetingShinjiNo ratings yet

- GlobalizationDocument29 pagesGlobalizationShinjiNo ratings yet

- GlobalizationDocument21 pagesGlobalizationShinjiNo ratings yet

- Define Operations ResearchDocument5 pagesDefine Operations ResearchShinjiNo ratings yet

- Origin & Nature of EntrepreneurshipDocument28 pagesOrigin & Nature of EntrepreneurshipShinji90% (31)

- The Political Economic and Legal Environments of International TradeDocument54 pagesThe Political Economic and Legal Environments of International TradeShinjiNo ratings yet

- GlobalizationDocument11 pagesGlobalizationShinjiNo ratings yet

- The Legal Mandates of LGUs On Records and Archives ManagementDocument3 pagesThe Legal Mandates of LGUs On Records and Archives ManagementShinji67% (3)

- Corruption Ranking by CountryDocument41 pagesCorruption Ranking by CountryShinjiNo ratings yet

- The Political and Legal Environments Facing BusinessDocument15 pagesThe Political and Legal Environments Facing BusinessShinjiNo ratings yet

- Theories, Definitions, Models, and Frameworks of Corporate GovernanceDocument22 pagesTheories, Definitions, Models, and Frameworks of Corporate GovernanceShinji100% (2)

- Self Leadership and The One Minute Manager: Increasing Effectiveness Through Situational Self Leadership Book ReportDocument6 pagesSelf Leadership and The One Minute Manager: Increasing Effectiveness Through Situational Self Leadership Book ReportShinji100% (1)

- Replacement TheoryDocument2 pagesReplacement TheoryShinji0% (1)

- How To Retain Employees - Case AnalysisDocument16 pagesHow To Retain Employees - Case AnalysisShinjiNo ratings yet

- MGT 8 HomeworkDocument4 pagesMGT 8 HomeworkShinjiNo ratings yet

- Define Operations Research: Applications of Management ScienceDocument5 pagesDefine Operations Research: Applications of Management ScienceShinjiNo ratings yet

- Sample Transportation ProblemsDocument4 pagesSample Transportation ProblemsShinjiNo ratings yet

- Speaker's Preparation ChecklistDocument1 pageSpeaker's Preparation ChecklistShinjiNo ratings yet

- Reviewer in Facility ManagementDocument2 pagesReviewer in Facility ManagementShinjiNo ratings yet

- MGT 8 - Organization of FilingDocument3 pagesMGT 8 - Organization of FilingShinjiNo ratings yet

- Local Government Supply and Property ManagementDocument1 pageLocal Government Supply and Property ManagementShinji50% (4)

- Methods of BudgetingDocument5 pagesMethods of BudgetingShinjiNo ratings yet

- Budgeting MethodsDocument2 pagesBudgeting MethodsShinjiNo ratings yet

- Transpo Model PresentationDocument47 pagesTranspo Model PresentationShinjiNo ratings yet

- Background of Dr. José Protacio Rizal Mercado y Alonzo de RealondaDocument1 pageBackground of Dr. José Protacio Rizal Mercado y Alonzo de RealondaShinji100% (2)

- Attributes of Entrepreneurs:: Report of Jesse Wilvic JacildoDocument19 pagesAttributes of Entrepreneurs:: Report of Jesse Wilvic JacildoShinjiNo ratings yet

- Courts Jamaica Accounting and Financing ResearchDocument11 pagesCourts Jamaica Accounting and Financing ResearchShae Conner100% (1)

- Narrative On Parents OrientationDocument2 pagesNarrative On Parents Orientationydieh donaNo ratings yet

- "AGROCRAFT (Farmer Buyer Portal) ": Ansh Chhadva (501816) Gladina Raymond (501821) Omkar Bhabal (501807)Document18 pages"AGROCRAFT (Farmer Buyer Portal) ": Ansh Chhadva (501816) Gladina Raymond (501821) Omkar Bhabal (501807)Omkar BhabalNo ratings yet

- Data Mahasiswa Teknik Mesin 2020Document88 pagesData Mahasiswa Teknik Mesin 2020Husnatul AlifahNo ratings yet

- (Part B) APPLICATION LETTER, COVER LETTER, CV, RESUME & JOB INTERVIEW - Google Forms-1Document10 pages(Part B) APPLICATION LETTER, COVER LETTER, CV, RESUME & JOB INTERVIEW - Google Forms-1adNo ratings yet

- Hwa Tai AR2015 (Bursa)Document104 pagesHwa Tai AR2015 (Bursa)Muhammad AzmanNo ratings yet

- IB English L&L Paper 1 + 2 Tips and NotesDocument9 pagesIB English L&L Paper 1 + 2 Tips and NotesAndrei BoroianuNo ratings yet

- TARIFFS AND POLITICS - EVIDENCE FROM TRUMPS Trade War - Thiemo Fetze and Carlo Schwarz PDFDocument25 pagesTARIFFS AND POLITICS - EVIDENCE FROM TRUMPS Trade War - Thiemo Fetze and Carlo Schwarz PDFWilliam WulffNo ratings yet

- Penyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di MalaysiaDocument12 pagesPenyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di Malaysia2023225596No ratings yet

- In Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghDocument1 pageIn Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghRohith KumarNo ratings yet

- Maxwell McCombs BioDocument3 pagesMaxwell McCombs BioCameron KauderNo ratings yet

- Law, Rhetoric, and Irony in The Formation of Canadian Civil Culture (PDFDrive)Document374 pagesLaw, Rhetoric, and Irony in The Formation of Canadian Civil Culture (PDFDrive)Dávid KisNo ratings yet

- Addis Ababa University-1Document18 pagesAddis Ababa University-1ASMINO MULUGETA100% (1)

- Disaster Management Aims To ReduceDocument3 pagesDisaster Management Aims To ReduceFiyas BiNo ratings yet

- 24 Directions of Feng ShuiDocument9 pages24 Directions of Feng Shuitoml88No ratings yet

- Tech Refresh & Recycle Program: 2,100PB+ of Competitive GearDocument1 pageTech Refresh & Recycle Program: 2,100PB+ of Competitive GearRafi AdamNo ratings yet

- Vitiating Factors in ContractsDocument20 pagesVitiating Factors in ContractsDiana Wangamati100% (6)

- Informative Speech OutlineDocument5 pagesInformative Speech OutlineMd. Farhadul Ibne FahimNo ratings yet

- Construct Basic Sentence in TagalogDocument7 pagesConstruct Basic Sentence in TagalogXamm4275 SamNo ratings yet

- Exploratory EssayDocument9 pagesExploratory Essayapi-237899225No ratings yet

- CEI KAH OCT v1Document1 pageCEI KAH OCT v1Francis Ho HoNo ratings yet

- Housing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodDocument4 pagesHousing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodJoey AlbertNo ratings yet

- DJANGODocument4 pagesDJANGOprashanth ambalaNo ratings yet

- HRM Assessment (Final Copy) - Home Loan Experts Nepal - EMBA Fall 2020Document33 pagesHRM Assessment (Final Copy) - Home Loan Experts Nepal - EMBA Fall 2020Rajkishor YadavNo ratings yet

- How K P Pinpoint Events Prasna PDFDocument129 pagesHow K P Pinpoint Events Prasna PDFRavindra ChandelNo ratings yet

- List of Presidents of Pakistan Since 1947 (With Photos)Document4 pagesList of Presidents of Pakistan Since 1947 (With Photos)Humsafer ALiNo ratings yet

- Chap1 HRM581 Oct Feb 2023Document20 pagesChap1 HRM581 Oct Feb 2023liana bahaNo ratings yet

- Handout On Reed 1 Initium Fidei: An Introduction To Doing Catholic Theology Lesson 4 Naming GraceDocument8 pagesHandout On Reed 1 Initium Fidei: An Introduction To Doing Catholic Theology Lesson 4 Naming GraceLEILA GRACE MALACANo ratings yet

- Case Digest in Francisco vs. House of RepresentativesDocument2 pagesCase Digest in Francisco vs. House of RepresentativesJP DC100% (1)

- Cost of DebtDocument3 pagesCost of DebtGonzalo De CorralNo ratings yet