Professional Documents

Culture Documents

Questions

Uploaded by

Rza RustamliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions

Uploaded by

Rza RustamliCopyright:

Available Formats

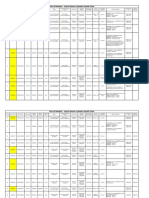

Cost of Capital at Ameritrade 1. 2. 3. 4. 5. 6.

What factors should Ameritrade management consider when evaluating the proposed advertising program and technology upgrades? Why? How can the Capital Asset Pricing Model be used to estimate the cost of capital for a real (not financial) investment decision? What is the estimate of the risk-free rate that should be employed in calculating the cost of capital for Ameritrade? What is the estimate of the market risk premium that should be employed in calculating the cost of capital for Ameritrade? In principle, what are the steps for computing the asset beta in the CAPM for purposes of calculating the cost of capital for a project? Ameritrade does not have a beta estimate as the firm has been publicly traded for only a short time period. Exhibit 4 provides various choices of comparable firms. What comparable firms do you recommend as the appropriate benchmarks for evaluating the risk of Ameritrades planned advertising and technology investments? Using the stock price and returns data in Exhibits 4 and 5, and the capital structure information in Exhibit 3, calculate the asset betas for the comparable firms. How should Joe Ricketts, the CEO of Ameritrade, view the cost of capital estimate you have calculated?

7. 8.

Colorscope, Inc. 1. 2. Why would any customer, let alone large advertising agencies and departmental stores, go to Colorscope rather than go to the large printers listed in Exhibit 3? Set up a two stage cost system to figure out the profitability of different jobs. You will have to choose resource drivers to allocate the cost of resources to cost pools. Then choose cost drivers to allocate the costs in various cost pools to jobs. Compute the cost driver rates. Calculate profitability of job 61001 by allocating costs to that job using the cost driver rates that you estimated. It might be useful to diagram this system before you start calculating the cost pools and cost driver rates. What is the profitability of customer number 16 for Colorscope? What you have done above is a "full-cost" analysis. This is in contrast to a "direct-cost" analysis that ignores overhead costs. Is full cost the right metric for job profitability and customer profitability? What assumptions are we making about the variability of overhead costs when we do a "full-cost" analysis. What is the financial consequence of rework? What should Colorscope do about rework? How? What do you recommend to solve the cost-quality tradeoff problem? Should Colorscope do anything about its incentive system?

3.

4. 5. 6.

Owens & Minor, Inc. 1. 2. 3. 4. What are the services rendered by the distributor to manufacturers and hospitals? How has the nature of distribution changed over time? What is the value-added by O&M? Evaluate the impact cost-plus pricing has on distributors, customers, and suppliers. What effect will ABP have on customer behavior? Explain Exhibit 5. How does the pricing matrix work? How do the costs in Exhibit 5 correspond to the costs shown in the customer profitability statement in Exhibit 4? Why doesnt the matrix comprise all the costs shown in Exhibit 4? What are the obstacles to successful implementation of ABP at Ideal? How would you address these obstacles? What type of customers will adopt ABP first? How difficult or easy is it for O&Ms rivals to adopt ABP? What are the risks associated with ABP for Owens and Minor? Why is Owens and Minor adopting a cost-based pricing strategy rather than value-based pricing strategy?

5. 6. 7. 8. 9.

Performance Pay at Safelite Auto Glass 1. 2. 3. 4. 5. Why was the productivity of the Safelite installers so low? Does the proposed PPP plan address the problems described in question 1? Does it introduce new problems? Explain. What are the pros and cons of switching from wage rates to piece rate pay? Are Safelite installers good candidates for piece-rate pay? Why or why not? Should there be a guaranteed wage? If so, how should it be set? What are the likely consequences of a switch from wage to piece rates for: Turnover Recruitment Productivity Product Quality

Dell's Working Capital 1. 2. 3. How was Dells working capital policy a competitive advantage? How did Dell fund its 52% growth in 1996? Assuming Dell sales will grow 50% in 1997, how might the company fund this growth internally? How much would working capital need to be reduced and/or profit margin increased? What steps do you recommend the company take? How would your answers to Question 3 change if Dell also repurchased $500 million of common stock in 1997 and repaid its long-term debt?

4.

Toy World, Inc. 1. 2. 3. What factors could Mr. McClintock consider in deciding whether or not to adopt the level production plan? What savings would be involved? Estimate the amount of added funds required and the timing of the needs under level production. Prepare pro forma income statements and balance sheets (rather than a cash budget) to make this estimate. Ignore interest expense in making these estimates. Compare the liabilities patterns feasible under the alternative production plans. What implications do their differences have for the risk assumed by the various parties?

4.

You might also like

- CompensateDocument5 pagesCompensateChaucer19No ratings yet

- TM ACC ABCandABM1Document7 pagesTM ACC ABCandABM1anamikarblNo ratings yet

- Lufthansa Finished EssayDocument27 pagesLufthansa Finished EssayKhaled Dakakni100% (1)

- Navigation Search: Brazil, Russia, India, and ChinaDocument16 pagesNavigation Search: Brazil, Russia, India, and ChinavickyNo ratings yet

- Chesbrough CasesDocument7 pagesChesbrough CasesRic Koba0% (1)

- Lincoln® Er80s-B2 PDFDocument2 pagesLincoln® Er80s-B2 PDFanupNo ratings yet

- Chapter 15 and Safelite B Fall 2004Document17 pagesChapter 15 and Safelite B Fall 2004yehtzuiNo ratings yet

- Case Map for Consumer Behavior TextbookDocument9 pagesCase Map for Consumer Behavior TextbookDCDR1No ratings yet

- Mount Everest 1996Document6 pagesMount Everest 1996Suraj GaikwadNo ratings yet

- Case Study EconomicsDocument1 pageCase Study EconomicsRinky Talwar73% (11)

- Case Study Lincoln HospitalDocument3 pagesCase Study Lincoln Hospitalba7r7737No ratings yet

- Discussion QuestionsDocument1 pageDiscussion QuestionsnancybadNo ratings yet

- Lincoln Electric Case StudyDocument34 pagesLincoln Electric Case Studyapi-595929580% (5)

- Bear Stearns Collapse Due to Risky CDO BetsDocument15 pagesBear Stearns Collapse Due to Risky CDO BetsJaja JANo ratings yet

- COMM 486 I - Pricing AnalysisDocument1 pageCOMM 486 I - Pricing AnalysisTiffany ZhongNo ratings yet

- Financial Management E BookDocument4 pagesFinancial Management E BookAnshul MishraNo ratings yet

- Ilrob Prelim 2Document11 pagesIlrob Prelim 2Luke Hong Gi BaekNo ratings yet

- Strengths and Weakness of Airborne FedexDocument2 pagesStrengths and Weakness of Airborne FedexSrilakshmi ShunmugarajNo ratings yet

- WACC: Understanding the Weighted Average Cost of CapitalDocument17 pagesWACC: Understanding the Weighted Average Cost of CapitalSiddharth JainNo ratings yet

- EmergingDocument10 pagesEmergingIsraelNo ratings yet

- Balakrishnan MGRL Solutions Ch12Document30 pagesBalakrishnan MGRL Solutions Ch12iluvumiNo ratings yet

- Starbucks Case Analysis 2Document3 pagesStarbucks Case Analysis 2Rajeev KumarNo ratings yet

- Case Study of Lincoln ElectricDocument2 pagesCase Study of Lincoln Electriczkshazly30490% (1)

- Case 13Document12 pagesCase 13Superb AdnanNo ratings yet

- Lecture # 4 PDFDocument41 pagesLecture # 4 PDFjunaid_256No ratings yet

- Investment Detective CaseDocument1 pageInvestment Detective CaseJonathan ZhaoNo ratings yet

- Comparing Depreciation at Delta Air Lines and Singapore AirlinesDocument110 pagesComparing Depreciation at Delta Air Lines and Singapore AirlinesSiratullah ShahNo ratings yet

- PORES analysis entrepreneurial evaluation process assessing business ideasDocument7 pagesPORES analysis entrepreneurial evaluation process assessing business ideassonagreNo ratings yet

- HONY, CIFA, AND ZOOMLION: Creating Value and Strategic Choices in A Dynamic MarketDocument5 pagesHONY, CIFA, AND ZOOMLION: Creating Value and Strategic Choices in A Dynamic MarketJitesh ThakurNo ratings yet

- SM - Airborne Express Example Submission Slides - NCDocument9 pagesSM - Airborne Express Example Submission Slides - NCDrNaveed Ul HaqNo ratings yet

- Quiz 1Document3 pagesQuiz 1Yong RenNo ratings yet

- TDC Case FinalDocument3 pagesTDC Case Finalbjefferson21No ratings yet

- Shobhit Saxena - CSTR - Assignment IDocument4 pagesShobhit Saxena - CSTR - Assignment IShobhit SaxenaNo ratings yet

- Acer America: Development of The AspireDocument10 pagesAcer America: Development of The Aspireagarhemant100% (1)

- QH1133Document8 pagesQH1133Whitney KellyNo ratings yet

- Vers Hire Company Study CaseDocument11 pagesVers Hire Company Study CaseAradhysta SvarnabhumiNo ratings yet

- Gallo WineryDocument43 pagesGallo WineryMuhammad Akmal HussainNo ratings yet

- Project Report Format 12345Document36 pagesProject Report Format 12345Rahul ShrivastavaNo ratings yet

- Decision Trees Guide Insurance or NotDocument3 pagesDecision Trees Guide Insurance or NotyrastogiNo ratings yet

- KhoslaDocument16 pagesKhoslaSaurav BharadwajNo ratings yet

- Is It Fair To Blame Fair Value Accounting For The Financial Crisis - PDFDocument13 pagesIs It Fair To Blame Fair Value Accounting For The Financial Crisis - PDFAndrea ChewNo ratings yet

- Dms - Group 4 - La Maison SimonsDocument8 pagesDms - Group 4 - La Maison SimonsGupta VishuNo ratings yet

- Accounting & Information Management Kanthal Case StudyDocument5 pagesAccounting & Information Management Kanthal Case StudyMuhammad Hafidz AkbarNo ratings yet

- Brazil, Russia, India, and China (BRIC)Document11 pagesBrazil, Russia, India, and China (BRIC)Muhammad AliNo ratings yet

- Innovation Simulation: Breaking News: HBP Product No. 8678Document9 pagesInnovation Simulation: Breaking News: HBP Product No. 8678Karan ShahNo ratings yet

- Case Study Air Canada and MaintenixDocument1 pageCase Study Air Canada and MaintenixcuribenNo ratings yet

- EMBA '23 Marketing Final ExamDocument8 pagesEMBA '23 Marketing Final ExamIgor SoaresNo ratings yet

- Group 10 - Southwest AirlinesDocument3 pagesGroup 10 - Southwest AirlinesnishankNo ratings yet

- Calculate profitability statements for two hospitals under activity-based pricingDocument2 pagesCalculate profitability statements for two hospitals under activity-based pricingVishal GoyalNo ratings yet

- GE PPT Ch22 Lecture 3 Transfer Pricing RevisedDocument46 pagesGE PPT Ch22 Lecture 3 Transfer Pricing RevisedZoe ChanNo ratings yet

- Q1. How Structurally Attractive Is The Russian Ice Cream Market? Discuss How Its Industry Structure Can Be Made More Attractive? (663 Words)Document5 pagesQ1. How Structurally Attractive Is The Russian Ice Cream Market? Discuss How Its Industry Structure Can Be Made More Attractive? (663 Words)Hongbo HaNo ratings yet

- EasyJet Vs Transworld AutoDocument3 pagesEasyJet Vs Transworld AutoTvarita Jain BJ22103No ratings yet

- PHT and KooistraDocument4 pagesPHT and KooistraNilesh PrajapatiNo ratings yet

- IB SummaryDocument7 pagesIB SummaryrronakrjainNo ratings yet

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocument7 pagesTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNo ratings yet

- Gamification in Consumer Research A Clear and Concise ReferenceFrom EverandGamification in Consumer Research A Clear and Concise ReferenceNo ratings yet

- Valuing Teuer Furniture Using DCF and Multiples MethodsDocument5 pagesValuing Teuer Furniture Using DCF and Multiples MethodsFaria CHNo ratings yet

- Question and Answer - 20Document31 pagesQuestion and Answer - 20acc-expertNo ratings yet

- DIN Flange Dimensions PDFDocument1 pageDIN Flange Dimensions PDFrasel.sheikh5000158No ratings yet

- Whisper Flo XF 3 PhaseDocument16 pagesWhisper Flo XF 3 Phasehargote_2No ratings yet

- Case Study Hotel The OrchidDocument5 pagesCase Study Hotel The Orchidkkarankapoor100% (4)

- Sharp Ar5731 BrochureDocument4 pagesSharp Ar5731 Brochureanakraja11No ratings yet

- Agricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsDocument84 pagesAgricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsRachel vNo ratings yet

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- Innovation Through Passion: Waterjet Cutting SystemsDocument7 pagesInnovation Through Passion: Waterjet Cutting SystemsRomly MechNo ratings yet

- Disaster Management Plan 2018Document255 pagesDisaster Management Plan 2018sifoisbspNo ratings yet

- UAPPDocument91 pagesUAPPMassimiliano de StellaNo ratings yet

- Lifespan Development Canadian 6th Edition Boyd Test BankDocument57 pagesLifespan Development Canadian 6th Edition Boyd Test Bankshamekascoles2528zNo ratings yet

- Obstetrical Hemorrhage: Reynold John D. ValenciaDocument82 pagesObstetrical Hemorrhage: Reynold John D. ValenciaReynold John ValenciaNo ratings yet

- Petty Cash Vouchers:: Accountability Accounted ForDocument3 pagesPetty Cash Vouchers:: Accountability Accounted ForCrizhae OconNo ratings yet

- Energy AnalysisDocument30 pagesEnergy Analysisca275000No ratings yet

- Lankeda 3d Printer Filament Catalogue 2019.02 WGDocument7 pagesLankeda 3d Printer Filament Catalogue 2019.02 WGSamuelNo ratings yet

- SEG Newsletter 65 2006 AprilDocument48 pagesSEG Newsletter 65 2006 AprilMilton Agustin GonzagaNo ratings yet

- FS2004 - The Aircraft - CFG FileDocument5 pagesFS2004 - The Aircraft - CFG FiletumbNo ratings yet

- Moor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsDocument4 pagesMoor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsIrene IturraldeNo ratings yet

- ServiceDocument47 pagesServiceMarko KoširNo ratings yet

- Report Emerging TechnologiesDocument97 pagesReport Emerging Technologiesa10b11No ratings yet

- 2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTDocument5 pages2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTIbrahim JaberNo ratings yet

- PandPofCC (8th Edition)Document629 pagesPandPofCC (8th Edition)Carlos Alberto CaicedoNo ratings yet

- Final Thesis Report YacobDocument114 pagesFinal Thesis Report YacobAddis GetahunNo ratings yet

- Unit 1 - Gear Manufacturing ProcessDocument54 pagesUnit 1 - Gear Manufacturing ProcessAkash DivateNo ratings yet

- 08 Sepam - Understand Sepam Control LogicDocument20 pages08 Sepam - Understand Sepam Control LogicThức Võ100% (1)

- QuickTransit SSLI Release Notes 1.1Document12 pagesQuickTransit SSLI Release Notes 1.1subhrajitm47No ratings yet

- Traffic LightDocument19 pagesTraffic LightDianne ParNo ratings yet

- Break Even AnalysisDocument4 pagesBreak Even Analysiscyper zoonNo ratings yet

- Quality Management in Digital ImagingDocument71 pagesQuality Management in Digital ImagingKampus Atro Bali0% (1)

- Postgraduate Notes in OrthodonticsDocument257 pagesPostgraduate Notes in OrthodonticsSabrina Nitulescu100% (4)