Professional Documents

Culture Documents

Jones Electrical Faces Cash Flow Issues Despite Profitability

Uploaded by

mwillar08Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jones Electrical Faces Cash Flow Issues Despite Profitability

Uploaded by

mwillar08Copyright:

Available Formats

Cases in Managerial Finance Jones Electrical Distribution

Working Capital Management and Short Time Finance Dr. Morris

Michael Willar Garrett Reeg

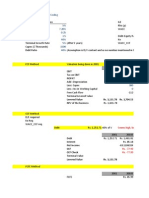

Ms. Montrose, A report and evaluation have been complied to assess the financial health of Jones Electrical Distribution and their request for an extended line of credit. For the fiscal years 2004 through 2007, Jones Electrical Distribution has grown considerably and remained profitable in a highly competitive industry. However, there are certain issues that require immediate managerial attention such as cash flow, increasing accounts receivable and accounts payable, and decreasing levels of inventory turnover. For the fiscal years of 2005 and 2006, net sales have increased by 18% and 17%, respectively. To finance this sales growth, Mr. Jones has internally leveraged his balance sheet through an increase in Accounts Payable. From 2005 to 2006, increases in accounts Payable rose from 6% to 78%, which subsequently decreased inventory turnover and raised levels of inventory and accounts receivables (Appendix E). The market for Jones Electric is seasonal and often fragmented. Mr. Jones increased the level of inventory in anticipation of expected sales growth. The inventory turnover ratio in 2005 was 5.52 and in 2006 it was 4.8 (Appendix A). Mr. Jones overbearing inventory prediction is a catalyst for the severe cash paucity. In 2005 and 2006, cash grew 18% and -57% respectively and ultimately deteriorated the financial strength of Jones Electric over that period (Appendix B). In 2005 and 2006, Jones Electrics days payable was in line with the 2/10 n/30 supplier payment discount. However, in 2006 Days Payable increased to 24 and Jones had to forgo the supplier payment discount (Appendix A). Forgoing the discount only further increases accounts payable, as seen in Q1 of 2007, with accounts payable of 208, and thus further suppresses an already decreasing cash flow. Despite Jones Electrics consistent profitability and sales growth, there is still a large credit reliance on suppliers, and thus a larger loan will be required to finance growth.

Moreover, the increase in accounts receivables (accounts receivable grew 24% and 14% in 2005 and 2006) and having more capital tied up, has added to the decreasing levels of cash, which will prove to be a challenge in the near future with sustaining profitability and sales growth (Appendix B). Through our analysis of Jones Electrical Distribution, we have come to the conclusion that an extended line of credit is certainly needed, if the company wants to finance its future growth and clean up their balance sheet and ratios. Despite the need for a loan, we do not agree with Mr. Jones loan requirements. In appendix E, we have calculated that if Mr. Jones wants to be in line with the supplier discount, the line of credit has to be $395,000, contingent with a $32,000 cash balance. The $350,000 line of credit will still mean that Mr. Jones will have to forgo the supplier discount and further increase accounts payable with his current loan requirements. A larger line of credit is needed to become less credit reliant with suppliers and be able to take advantage of the supplier discount. With the current loan Mr. Jones is asking for, we believe the company will not be able to take full advantage of growth in the future, save 2% with the supplier discount, nor lower his inventory and accounts payable anytime in the near future. He would need an additional $50,000 minimum to take advantage of the supplier discount and strengthen his financial statements. Unfortunately, we are only able to loan Jones Electrical $350,000. Mr. Jones current net worth to assets is an area of growing concern. From 2004 through to the first quarter of 2007, his net worth/assets have been decreasing (Appendix A). In 2005 the ratio was 32.03%, in 2006 it was 30.99%, and in Q1 of 2007 it dropped down to 28.67%. In appendix A, Mr. Jones ROA from 2005 to 2006 confirms the negative trend, falling from 4.36% to 3.83%. If Mr. Jones improved his inventory and collections policy, we believe his net worth to assets will become more favorable. In addition, Jones Electrical has very high operating

expenses and cost of goods sold. The company is increasing their cost of goods sold at the same rate as their net sales and gross profit on sales (Appendix C). We believe Mr. Jones needs to work on the efficiency of his operations, namely his inventory and collections policy, so he can make more money for the assets they have. We feel that high low levels of inventory turnover and high levels of accounts payable and receivable will still persist after the proposed loan. If we were to extend a loan offer to Jones Electrical, it would have to be secured. The loan that would be made to Jones would be a long-term loan. Long-term loans are typically secured, especially when the carry the amount of risk the loan to Jones Electrical would. There are several risks with the proposed loan. Will the $350,000 be enough money? Our analysis shows that Jones Electrical will most likely need more money in order to take advantage of the trade discount and support their growth. By extending the current proposed loan to Jones, we believe their financial situation will remain the same in the coming years. Jones is only making $30,000 of net income on over $2 million in sales. If Jones cannot lower their operating costs and increase their net income greatly, they will struggle to pay the annual interest on the loan, much less the principal. In the first year alone, $26,250 in interest will need will be accrued with an interest rate of 7.5%. Jones Electrical could also be hit hard by economic recessions. They also have a seasonal business usually thriving in the spring and summer months. This is another reason why the loan would have to be secured. Usually assets being secured are those being bought with money from the loan. It is probably not necessary to use Nelsons personal assets for collateral. He has enough property and equipment, accounts receivable, inventory, and cash to pay off a loan in the case of default. The only reason any personal assets would need to be secured is in the case of Nelsons death. We would have to take a closer look at management to determine how much the company would suffer in the case of his death and if it could succeed.

If the company would be likely to fail without Nelson, we could discuss changing the beneficiary on his life insurance policy to the bank in the case of his death. As a bank taking over assets in bankruptcy, there could be issues with the quality and liquidity of those assets. For example, fixed assets like plant, property, and equipment could have poor quality and may not be very liquid depending on the market for them. We may not be able to sell these assets in a timely manner for what we feel they are worth. The main issue is what the fair market values of these assets are at the time of bankruptcy and how liquid they are. The fair market value is simply the price a buyer and seller are willing to meet at. If we are in a hurry to sell assets, we may not get the price we want. There would be several conditions, covenants, and restrictions we would include in the loan if we were to offer it to Nelson. First off, we would require Jones to terminate the relationship with his previous bank.. As with most loans, we would make sure the loan would only be applicable assuming financial statements were correct, Jones Electric is not subject to litigation, taxes have been filed and paid, Nelson owns the collateral that is secured, and other facts relevant to making our decision were factual and nothing was omitted. The covenants of the loan are perhaps most important. These are the minimum standards for performance of Jones Electric. Some covenants could be tied to financial projections by the borrower. This would be the case in for Jones Electric, as we see the credit risk as high. We would use these covenants as any financial analyst inside a company would use them. Their purpose is to provide warning for the company. If we were to offer the loan extension to Nelson, we would have certain inventory levels Nelson would have to meet. We believe he is holding way too much inventory, which has been a reason for the negative cash flow last year. In addition, we would take a closer look at operations and see if we could lower his cost of goods sold, as they are eating into his profit

margin greatly. This is having a big impact on his assets to net worth ratio. Lastly, we would have target ratios for his accounts receivable and accounts payable. Another key variable to remember is the seasonality of Jones Electrical Distributions business. Our covenants will reflect this fact. Affirmative covenants we would include are using loan proceeds for a specific purpose, compliance with laws, rights of inspection, and different financial and reporting requirements. A few measures that we feel are very weak are accounts payable, inventory, days inventory, cost of goods sold, and profit margin. A profit margin of 1% is very weak, and we would require that to be higher if we were to offer the loan. We would expect this to increase as a result of the trade discount, however. Also, accounts payable would have to return to normal levels and inventory management would have to be much stronger. Nelson is keeping all his cash in inventory that is sitting around for too long. Nelson Jones is the sole owner and founder of Jones Electrical Distribution. From the text, Jones seems like a fairly knowledgeable businessman. For example, Jones competed in such a tough industry by using a low price and strong sales force. He also managed his overhead and operating expenses very closely. His sales force was paid primarily by commission, which also lowered expenses. Nelson was successful is keeping inventory low by forecasting future demand. Lastly, Nelson was able to take advantage of a 2% discount at the beginning of his business by paying his suppliers within ten days. Unfortunately, Jones Electrical has been running low on cash and Jones has been internally financing his business through accounts payable. While this is not interest bearing debt, suppliers can become frustrated and Jones can lose credibility. Even worse, the company is losing out on 2% of everything they buy, which can make a huge difference on the bottom line. Jones also seems to have a good head on his shoulders. Nelsons friend, Jim Lyons, and area sales managers had nothing but compliments

when talking about Nelson. They described him as having the highest integrity, being handson, living a modest lifestyle, and being smart with expense management. Clearly, Mr. Jones seems to be a great person wanting the best for his business. We believe he would be a conscientious, yet very aggressive, borrower of the money. He seems to have a strong control on expenses from what his peers say, but we would have to do some more digging as to the cost of his operations are causing profit margins around 1%. Competitors in the industry surely have a higher margin. Regardless, Jones Electrical is growing at a decent pace and Nelson is sure to use the loan to continue the growth. In fact, he bought out his college roommate in 2003. His roommate thought he was growing the business too aggressively. All in all, we think Nelson Jones would be a good borrower of the money and do his best to grow Jones Electrical. In addition, due diligence reports were successful. The company is Nelsons baby that he has grown it from its infancy. Even though Nelson seems like a great owner who would be aggressive in the growth of his company, we have decided to not extend the loan offer to Jones Electrical. The final decision came down to the fact that we can only extend $350,000 to Jones, and we believe he needs at least $50,000 in order to take advantage of the 2% trade discount and to lower inventory and accounts payable levels. We do not see the growth we are looking for being possible with only $350,000. Instead, offering him only $350,000 will create a similar result as the first loan Jones was given. We would like to wish Mr. Jones his best in the future, but do not feel offering him the proposed loan would be in the best interest of Southern Bank & Trust.

You might also like

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionMichelle Rodríguez100% (1)

- Jones Electrical Faces Cash Shortfall Despite ProfitsDocument5 pagesJones Electrical Faces Cash Shortfall Despite ProfitsAsif AliNo ratings yet

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionChris Mlincsek67% (3)

- Jones Electrical DistributionDocument2 pagesJones Electrical DistributionJeff FarleyNo ratings yet

- Jones Electrical DistributionDocument3 pagesJones Electrical DistributionAnirudh Kowtha0% (1)

- Case SolutionDocument9 pagesCase Solutiontiko100% (1)

- Jones Electrical DDocument2 pagesJones Electrical DAsif AliNo ratings yet

- Updated Stone Container PaperDocument6 pagesUpdated Stone Container Paperonetime699100% (1)

- Jones Electrical Line of Credit DecisionDocument6 pagesJones Electrical Line of Credit DecisionShak Uttam100% (2)

- Corp Fin CaseDocument5 pagesCorp Fin Caselogicat1989100% (4)

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionLoleeta H. Khaleel67% (9)

- Jones Electrical DistributionDocument7 pagesJones Electrical Distributionsd717No ratings yet

- Jones Electrical DistributionDocument12 pagesJones Electrical DistributionJohnNo ratings yet

- Jones Electrical SlidesDocument6 pagesJones Electrical SlidesRohit AwadeNo ratings yet

- Financial PerformanceDocument7 pagesFinancial PerformanceJustin Ho100% (1)

- (Holy Balance Sheet) Jones Electrical DistributionDocument29 pages(Holy Balance Sheet) Jones Electrical DistributionVera Lúcia Batista SantosNo ratings yet

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- Stone Container CorporationDocument5 pagesStone Container Corporationalice123h21No ratings yet

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- M&M Pizza Assignment - Group 6Document4 pagesM&M Pizza Assignment - Group 6Arnnava SharmaNo ratings yet

- Loewen Group CaseDocument2 pagesLoewen Group CaseSu_NeilNo ratings yet

- Yell U.K. Valuation Analysis for $1.8B AcquisitionDocument5 pagesYell U.K. Valuation Analysis for $1.8B AcquisitionAdithi RajuNo ratings yet

- Cooper Industries' bid for Nicholson File CompanyDocument5 pagesCooper Industries' bid for Nicholson File Companyprashaants5No ratings yet

- Ust SolutionDocument3 pagesUst SolutionAdeel_Akram_Ch_9271No ratings yet

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- Jones Electrical Distribution AnswersDocument29 pagesJones Electrical Distribution AnswersVera Lúcia Batista SantosNo ratings yet

- Case 26 Assignment AnalysisDocument1 pageCase 26 Assignment AnalysisNiyanthesh Reddy50% (2)

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- BKI's Capital Structure and Payout PoliciesDocument4 pagesBKI's Capital Structure and Payout Policieschintan MehtaNo ratings yet

- 25th June - Sampa VideoDocument6 pages25th June - Sampa VideoAmol MahajanNo ratings yet

- Hampton Machine Tool CompanyDocument5 pagesHampton Machine Tool Companydownloadsking100% (1)

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Bausch N LombDocument3 pagesBausch N LombRahul SharanNo ratings yet

- Dollarama Case DCFDocument22 pagesDollarama Case DCFDaniel Jinhong Park25% (4)

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezNo ratings yet

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Dividend Decision at Linear TechnologyDocument8 pagesDividend Decision at Linear TechnologyNikhilaNo ratings yet

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Deluxe Corporation's Debt Policy AssessmentDocument7 pagesDeluxe Corporation's Debt Policy Assessmentankur.mastNo ratings yet

- Case study solution: Water company financial projectionsDocument15 pagesCase study solution: Water company financial projectionsRahul Tiwari100% (2)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Deluxe CorpDocument7 pagesDeluxe CorpUdit UpretiNo ratings yet

- Wilson Lumber Company1Document5 pagesWilson Lumber Company1fica037No ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- Owens and Minor TemplateDocument22 pagesOwens and Minor TemplatePrashant Pratap Singh0% (1)

- M&M Pizza With 20% TaxDocument5 pagesM&M Pizza With 20% TaxAnkitNo ratings yet

- Jones Electrical Distribution Finance CaseDocument8 pagesJones Electrical Distribution Finance CaseKathGuNo ratings yet

- Jones Electrical Faces Growth DecisionDocument9 pagesJones Electrical Faces Growth DecisionRaju SharmaNo ratings yet

- Executive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonDocument9 pagesExecutive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonRakesh GyamlaniNo ratings yet

- Executive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonDocument3 pagesExecutive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonRakesh GyamlaniNo ratings yet

- Jones CaseDocument1 pageJones CaseAlejandra GutierrezNo ratings yet

- 2011 Jan Wells Fargo CMBS OutlookDocument81 pages2011 Jan Wells Fargo CMBS OutlookRyan JinNo ratings yet

- Why Do Companies Issue Debt When They Don't Seem To Need The MoneyDocument3 pagesWhy Do Companies Issue Debt When They Don't Seem To Need The MoneythebigpicturecoilNo ratings yet

- Dynashears Inc CaseDocument4 pagesDynashears Inc Casepratik_gaur1908No ratings yet

- Xavier University Financial Analysis of Limketkai Sons, IncDocument11 pagesXavier University Financial Analysis of Limketkai Sons, Incmichean mabaoNo ratings yet

- United Malayan Banking Corporation Berhad VDocument4 pagesUnited Malayan Banking Corporation Berhad VaishahNo ratings yet

- Port AgentsDocument11 pagesPort AgentstbalaNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document58 pagesFundamentals of Accountancy, Business and Management 2Carmina Dongcayan100% (1)

- Lges Job Request FormDocument3 pagesLges Job Request Formabubakarwahabi30No ratings yet

- Bank of Punjab: Internship Report ONDocument7 pagesBank of Punjab: Internship Report ONMuhammad FarhanNo ratings yet

- London Examinations Igcse: AccountingDocument24 pagesLondon Examinations Igcse: AccountingSadman DibboNo ratings yet

- s90 Users Guide 1 00 01Document250 pagess90 Users Guide 1 00 01Wijaksana DewaNo ratings yet

- Kotak Final Project Car FinancesDocument72 pagesKotak Final Project Car FinancesPrithviraj KumarNo ratings yet

- Electronic PaymentDocument8 pagesElectronic Paymentqa diiNo ratings yet

- Fintech Business ModelsDocument8 pagesFintech Business ModelsSarthak0% (1)

- Sol. Man. - Chapter 19 - Borrowing Costs - Ia Part 1B 1Document7 pagesSol. Man. - Chapter 19 - Borrowing Costs - Ia Part 1B 1Rezzan Joy Camara Mejia100% (2)

- Audit Program Liabilities Against AssetsDocument11 pagesAudit Program Liabilities Against AssetsRoemi Rivera Robedizo100% (3)

- Assistant Accountant JD - Colly MpofuDocument2 pagesAssistant Accountant JD - Colly Mpofupeter mulilaNo ratings yet

- Money and Credit Important Questions and Answers PDFDocument12 pagesMoney and Credit Important Questions and Answers PDFAkkajNo ratings yet

- Internship Sindh BankDocument34 pagesInternship Sindh BankKR Burki100% (1)

- Forward Rate CalculationDocument128 pagesForward Rate CalculationalexNo ratings yet

- Olea Vs CA DigestDocument2 pagesOlea Vs CA DigestT Cel MrmgNo ratings yet

- Customer Inquiry ReportDocument5 pagesCustomer Inquiry ReportWidia AprilianaNo ratings yet

- Sample - Gap Analysis IndonesiaDocument101 pagesSample - Gap Analysis IndonesiapalmkodokNo ratings yet

- Tire City IncDocument12 pagesTire City Incdownloadsking100% (1)

- Funding Grid ToolDocument3 pagesFunding Grid ToolSamuel Kagoru GichuruNo ratings yet

- MCCP LeafDocument2 pagesMCCP LeafManish GoelNo ratings yet

- Apds PerformDocument16 pagesApds PerformMaryroseNo ratings yet

- Capital MarketsDocument8 pagesCapital Marketsrupeshmore145No ratings yet

- CSAFP Remarks - AFPSLAI 40th AnniversaryDocument10 pagesCSAFP Remarks - AFPSLAI 40th AnniversaryLou LaraNo ratings yet

- Hyd LodgeDocument5 pagesHyd LodgeRammohanreddy RajidiNo ratings yet

- CH 06Document54 pagesCH 06Gisilowati Dian PurnamaNo ratings yet

- What Is Debt-to-Income (DTI) Ratio?Document5 pagesWhat Is Debt-to-Income (DTI) Ratio?Niño Rey LopezNo ratings yet

- 06 - 2pm - Hedge - Fund - Presentation - BourlandDocument20 pages06 - 2pm - Hedge - Fund - Presentation - BourlandHimanshu GondNo ratings yet

- Samba Financial GroupDocument17 pagesSamba Financial GroupNoor Ul AinNo ratings yet