Professional Documents

Culture Documents

Chapter09.Profit Planning, Activity-Based Budgeting, and E-Budgeting

Uploaded by

Anjo PadillaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter09.Profit Planning, Activity-Based Budgeting, and E-Budgeting

Uploaded by

Anjo PadillaCopyright:

Available Formats

Chapter 9: Profit Planning, Activity-Based Budgeting, and e-Budgeting

MULT PL! C"# C! $U!%T #&% 1. Generally speaking, budgets are not used to: A. identify a company's most profitable products. B. evaluate performance. C. create a plan of action. D. assist in t e control of profit and operations. !. facilitate communication and coordinate activities. Ans"er: A #$: 1 %ype: &C '. ( ic of t e follo"ing c oices correctly denotes managerial functions t at are commonly associated "it budgeting) *erformance Coordination *lanning !valuation of Activities A. +es +es ,o B. +es +es +es C. +es ,o ,o D. +es ,o +es !. ,o +es ,o Ans"er: B #$: 1 %ype: &C -. A formal budget program "ill almost al"ays result in: A. ig er sales. B. more cas inflo"s t an cas outflo"s. C. decreased e.penses. D. improved profits. !. a detailed plan against " ic actual results can be compared. Ans"er: ! #$: 1 %ype: &C, , /. A budget serves as a benc mark against " ic : A. actual results can be compared. B. allocated results can be compared. C. actual results become inconse0uential. D. allocated results become inconse0uential. !. cas balances can be compared to e.pense totals. Ans"er: A #$: 1 %ype: &C

234

Hilton, Managerial Accounting, Seventh Edition

1. % e compre ensive set of budgets t at serves as a company's overall financial plan is commonly kno"n as: A. an integrated budget. B. a pro2forma budget. C. a master budget. D. a financial budget. !. a rolling budget. Ans"er: C #$: 1 %ype: &C 3. A company's plan for t e ac0uisition of long2lived assets, suc as buildings and e0uipment, is commonly called a: A. pro2forma budget. B. master budget. C. financial budget. D. profit plan. !. capital budget. Ans"er: ! #$: 1 %ype: &C 4. (ilson Corporation is budgeting its e0uipment needs on an on2going basis, "it a ne" 0uarter being added to t e budget as t e current 0uarter is completed. % is type of budget is most commonly kno"n as a: A. capital budget. B. rolling budget. C. revised budget. D. pro2forma budget. !. financial budget. Ans"er: B #$: 1 %ype: &C 5. An organi6ation's budgets "ill often be prepared to cover: A. one mont . B. one 0uarter. C. one year. D. periods longer t an one year. !. all of t e above. Ans"er: ! #$: 1 %ype: &C 7. A manufacturing firm "ould begin preparation of its master budget by constructing a: A. sales budget. B. production budget. C. cas budget. D. capital budget. !. set of pro2forma financial statements. Ans"er: A #$: 1, / %ype: &C

235

Hilton, Managerial Accounting, Seventh Edition

18. ( A. B. C. D. !.

ic of t e follo"ing budgets is based on many ot er master2budget components) Direct labor budget. $ver ead budget. 9ales budget. Cas budget. 9elling and administrative e.pense budget.

Ans"er: D #$: 1, / %ype: , 11. % e budgeted income statement, budgeted balance s eet, and budgeted statement of cas flo"s comprise: A. t e final portion of t e master budget. B. t e depiction of an organi6ation's overall actual financial results. C. t e first step of t e master budget. D. t e portion of t e master budget prepared after t e sales forecast and before t e remainder of t e operational budgets. !. t e second step of t e master budget. Ans"er: A #$: 1, / %ype: &C 1'. ( A. B. C. D. !. ic of t e follo"ing budgets is prepared at t e end of t e budget2construction cycle) 9ales budget. *roduction budget. Budgeted financial statements. Cas budget. $ver ead budget.

Ans"er: C #$: 1, / %ype: , 1-. ( ic of t e follo"ing "ould depict t e logical order for preparing :1; a production budget, :'; a cas budget, :-; a sales budget, and :/; a direct2labor budget) A. 12-2/2'. B. '2-212/. C. '212-2/. D. -212/2'. !. -212'2/. Ans"er: D #$: 1, / %ype: ,

Chapter 9

236

1/. % e master budget contains t e follo"ing components, among ot ers: :1; direct2material budget, :'; budgeted balance s eet, :-; production budget, and :/; cas budget. ( ic of t ese components "ould be prepared first and " ic "ould be prepared last) <irst #ast A. 1 / B. 1 ' C. / D. ' !. / 1 Ans"er: D #$: 1, / %ype: , 11. A company's sales forecast "ould likely consider all of t e follo"ing factors e.cept: A. political and legal events. B. advertising and pricing policies. C. general economic and industry trends. D. top management's attitude to"ard decentrali6ed operating structures. !. competition. Ans"er: D #$: 1 %ype: &C 13. ( ic of t e follo"ing "ould be considered " en preparing a company's sales forecast) Anticipated General !.pected Advertising !conomic Competitive Campaigns %rends Actions A. +es +es ,o B. +es ,o +es C. +es ,o ,o D. +es +es +es !. ,o ,o +es Ans"er: D #$: 1 %ype: &C 14. ( ic of t e follo"ing statements best describes t e relations ip bet"een t e sales2forecasting process and t e master2budgeting process) A. % e sales forecast is typically completed after completion of t e master budget. B. % e sales forecast is typically completed appro.imately alf"ay t roug t e master2budget process. C. % e sales forecast is typically completed before t e master budget and as no impact on t e master budget. D. % e sales forecast is typically completed before t e master budget and as little impact on t e master budget. !. % e sales forecast is typically completed before t e master budget and as significant impact on t e master budget. Ans"er: ! #$: 1 %ype: ,

237

Hilton, Managerial Accounting, Seventh Edition

15. ( A. B. C. D. !.

ic of t e follo"ing organi6ations is not likely to use budgets) =anufacturing firms. =erc andising firms. <irms in service industries. ,onprofit organi6ations. ,one of t e above, as all are likely to use budgets.

Ans"er: ! #$: ' %ype: &C 17. Activity2based budgeting: A. begins "it a forecast of products and services to be produced, and customers served. B. ends "it a forecast of products and services to be produced, and customers served. C. parallels t e flo" of analysis t at is associated "it activity2based costing. D. reverses t e flo" of analysis t at is associated "it activity2based costing. !. is best described by c oices >A> and >D> above. Ans"er: ! #$: - %ype: &C '8. A company t at uses activity2based budgeting performs t e follo"ing: 1?*lans activities for t e budget period. '?<orecasts t e demand for products and services as "ell as t e customers to be served. -?Budgets t e resources necessary to carry out activities. ( A. B. C. D. !. ic of t e follo"ing denotes t e proper order of t e preceding activities) 12'2-. '212-. '2-21. -212'. -2'21.

Ans"er: B #$: - %ype: &C '1. 9anta <e Corporation as a ig ly automated production facility. ( ic of t e follo"ing correctly s o"s t e t"o factors t at "ould likely ave t e most direct influence on t e company's manufacturing over ead budget) A. 9ales volume and labor ours. B. Contribution margin and cas payments. C. *roduction volume and management @udgment. D. #abor ours and management @udgment. !. =anagement @udgment and indirect labor cost. Ans"er: C #$: / %ype: ,

Chapter 9

238

''. =ay *roduction Company, " ic uses activity2based budgeting, is in t e process of preparing a manufacturing over ead budget. ( ic of t e follo"ing "ould likely appear on t at budget) A. Batc 2level costs: *roduction setup. B. Anit2level costs: Depreciation. C. Anit2level costs: =aintenance. D. *roduct2level costs: Bnsurance and property ta.es. !. <acility and general operations2level costs: Bndirect material. Ans"er: A #$: / %ype: , '-. <ast%ec, " ic sells electronics in retail outlets and on t e Bnternet, uses activity2based budgeting in t e preparation of its selling, general, and administrative e.pense budget. ( ic of t e follo"ing costs "ould t e company likely classify as a unit2level e.pense on its budget) A. =edia advertising. B. &etail outlet sales commissions. C. 9alaries of "eb2site maintenance personnel. D. Administrative salaries. !. 9alary of sales manager employed at store no. '-. Ans"er: B #$: / %ype: , '/. ( ic of t e follo"ing "ould ave no effect, eit er direct or indirect, on an organi6ation's cas budget) A. 9ales revenues. B. $utlays for professional labor. C. Advertising e.penditures. D. &a" material purc ases. !. ,one of t e above, as all of t ese items "ould ave some influence. Ans"er: ! #$: / %ype: , '1. Atlanta 9porting Goods sells bicycles t roug out t e sout eastern Anited 9tates. % e follo"ing data "ere taken from t e most recent 0uarterly sales forecast: !.pected 9ales 1,488 units 1,518 units ',888 units !nd2of2=ont %arget Bnventory '88 units '48 units -18 units

April =ay Cune

$n t e basis of t e information presented, o" many bicycles s ould t e company purc ase in =ay) A. 1,458. B. 1,7'8. C. ',818. D. ',1'8. !. 9ome ot er amount. Ans"er: B #$: / %ype: A

239 Hilton, Managerial Accounting, Seventh Edition

'3. 9"anson plans to sell 18,888 units of a particular product during Culy, and e.pects sales to increase at t e rate of 18D per mont during t e remainder of t e year. % e Cune -8 and 9eptember -8 ending inventories are anticipated to be 1,188 units and 718 units, respectively. $n t e basis of t is information, o" many units s ould 9"anson purc ase for t e 0uarter ended 9eptember -8) A. -1,518. B. -',118. C. -',718. D. --,'18. !. 9ome ot er amount. Ans"er: C #$: / %ype: A, , '4. +ork Corporation plans to sell /1,888 units of its single product in =arc . % e company as ',588 units in its =arc 1 finis ed2goods inventory and anticipates aving ',/88 completed units in inventory on =arc -1. $n t e basis of t is information, o" many units does +ork plan to produce during =arc ) A. /8,388. B. /1,/88. C. /-,588. D. /3,'88. !. 9ome ot er amount. Ans"er: A #$: / %ype: A '5. Coleman, Bnc., anticipates sales of 18,888 units, /5,888 units, and 11,888 units in Culy, August, and 9eptember, respectively. Company policy is to maintain an ending finis ed2goods inventory e0ual to /8D of t e follo"ing mont 's sales. $n t e basis of t is information, o" many units "ould t e company plan to produce in August) A. /3,588. B. /7,'88. C. /7,588. D. 1','88. !. 9ome ot er amount. Ans"er: B #$: / %ype: A

Chapter 9

24

'7. %elcer E Company ad -,888 units in finis ed2goods inventory on December -1. % e follo"ing data are available for t e upcoming year: Anits to be produced Desired ending finis ed2goods inventory Canuary 7,/88 ',188 <ebruary 18,'88 ',188

% e number of units t e company e.pects to sell in Canuary is: A. 3,788. B. 5,788. C. 7,/88. D. 7,788. !. 11,788. Ans"er: D #$: / %ype: A -8. %ide"ater plans to sell 51,888 units of product no. 47/ in =ay, and eac of t ese units re0uires t ree units of ra" material. *ertinent data follo". Actual =ay 1 inventory Desired =ay -1 inventory *roduct ,o. 47/ 11,888 units 14,888 units &a" =aterial '7,888 units '8,888 units

$n t e basis of t e information presented, o" many units of ra" material s ould %ide"ater purc ase for use in =ay production) A. ''5,888. B. '/3,888. C. '3/,888. D. '5',888. !. 9ome ot er amount. Ans"er: C #$: / %ype: A -1. An e.amination of 9 ort CorporationFs inventory accounts revealed t e follo"ing information: &a" materials, Cune 1: /3,888 units &a" materials, Cune -8: 11,888 units *urc ases of ra" materials during Cune: 151,888 units 9 ortFs finis ed product re0uires four units of ra" materials. $n t e basis of t is information, o" many finis ed products "ere manufactured during Cune) A. /1,888. B. /4,188. C. 14,418. D. 48,188. !. 9ome ot er amount. Ans"er: A #$: / %ype: A

24!

Hilton, Managerial Accounting, Seventh Edition

-'. ,guyen plans to sell /8,888 units of product no. 41 in Cune, and eac of t ese units re0uires five s0uare feet of ra" material. *ertinent data follo". Actual Cune 1 inventory !stimated Cune -8 inventory *roduct ,o. 41 1,188 /,-88 &a" =aterial 15,888 s0uare feet ) s0uare feet

Bf t e company purc ases '81,888 s0uare feet of ra" material during t e mont , t e estimated ra"2material inventory on Cune -8 "ould be: A. 11,888 s0uare feet. B. 1-,888 s0uare feet. C. '-,888 s0uare feet. D. '1,888 s0uare feet. !. some ot er amount. Ans"er: D #$: / %ype: A Ase t e follo"ing to ans"er 0uestions --2-/: ,ort "est manufactures a product re0uiring 8.1 ounces of platinum per unit. % e cost of platinum is appro.imately G-38 per ounceH t e company maintains an ending platinum inventory e0ual to 18D of t e follo"ing mont 's production usage. % e follo"ing data "ere taken from t e most recent 0uarterly production budget: *lanned production in units Culy 1,888 August 1,188 9eptember 758

--. % e cost of platinum to be purc ased to support August production is: A. G171,5/8. B. G175,888. C. G'88,138. D. G-71,358. !. 9ome ot er amount. Ans"er: A #$: / %ype: A -/. Bf it takes t"o direct labor ours to produce eac unit and ,ort "est's cost per labor our is G11, direct labor cost for August "ould be budgeted at: A. G13,188. B. G-1,'88. C. G--,888. D. G-/,588. !. 9ome ot er amount. Ans"er: C #$: / %ype: A

Chapter 9

242

-1. Ano makes all sales on account, sub@ect to t e follo"ing collection pattern: -8D are collected in t e mont of saleH 38D are collected in t e first mont after saleH and 18D are collected in t e second mont after sale. Bf sales for $ctober, ,ovember, and December "ere G48,888, G58,888, and G38,888, respectively, " at "ere t e firm's budgeted collections for December) A. G15,888. B. G33,888. C. G4-,888. D. G4/,888. !. 9ome ot er amount. Ans"er: C #$: / %ype: A -3. Iern's makes all sales on account, sub@ect to t e follo"ing collection pattern: '8D are collected in t e mont of saleH 48D are collected in t e first mont after saleH and 18D are collected in t e second mont after sale. Bf sales for $ctober, ,ovember, and December "ere G48,888, G38,888, and G18,888, respectively, " at "as t e budgeted receivables balance on December -1) A. G/8,888. B. G/3,888. C. G/7,888. D. G17,888. !. 9ome ot er amount. Ans"er: B #$: / %ype: A -4. Drago makes all sales on account, sub@ect to t e follo"ing collection pattern: -8D are collected in t e mont of saleH 38D are collected in t e first mont after saleH and 18D are collected in t e second mont after sale. Bf sales for Cune Culy, and August "ere G1'8,888, G138,888, and G''8,888, respectively, " at "ere t e firmFs budgeted collections for August and t e companyFs budgeted receivables balance on August -1) August August -1 Collections &eceivables Balance A. G13',888 G15',888 B. G14/,888 G148,888 C. G178,888 G11/,888 D. G'3',888 G 5',888 !. 9ome ot er combination of figures not listed above. Ans"er: B #$: / %ype: A

243

Hilton, Managerial Accounting, Seventh Edition

-5. Diego makes all purc ases on account, sub@ect to t e follo"ing payment pattern: *aid in t e mont of purc ase: -8D *aid in t e first mont follo"ing purc ase: 38D *aid in t e second mont follo"ing purc ase: 18D Bf purc ases for Canuary, <ebruary, and =arc "ere G'88,888, G158,888, and G'-8,888, respectively, " at "ere t e firm's budgeted payments in =arc ) A. G37,888. B. G1-5,888. C. G144,888. D. G174,888. !. 9ome ot er amount. Ans"er: D #$: / %ype: A -7. Brooklyn makes all purc ases on account, sub@ect to t e follo"ing payment pattern: *aid in t e mont of purc ase: -8D *aid in t e first mont follo"ing purc ase: 31D *aid in t e second mont follo"ing purc ase: 1D Bf purc ases for April, =ay, and Cune "ere G'88,888, G138,888, and G'18,888, respectively, " at "as t e firm's budgeted payables balance on Cune -8) A. G141,888. B. G147,888. C. G15-,888. D. G157,888. !. 9ome ot er amount. Ans"er: C #$: / %ype: A

Chapter 9

244

/8. (olfe, Bnc., began operations on Canuary 1 of t e current year "it a G1',888 cas balance. <orty percent of sales are collected in t e mont of saleH 38D are collected in t e mont follo"ing sale. 9imilarly, '8D of purc ases are paid in t e mont of purc ase, and 58D are paid in t e mont follo"ing purc ase. % e follo"ing data apply to Canuary and <ebruary: 9ales *urc ases $perating e.penses Canuary G-1,88 8 -8,888 4,888 <ebruary G11,888 /8,888 7,888

Bf operating e.penses are paid in t e mont incurred and include mont ly depreciation c arges of G',188, determine t e c ange in (olfe's cas balance during <ebruary. A. G',888 increase. B. G/,188 increase. C. G1,888 increase. D. G4,188 increase. !. 9ome ot er amount. Ans"er: B #$: / %ype: A Ase t e follo"ing to ans"er 0uestions /12/-: % e Grainger Company's budgeted income statement reflects t e follo"ing amounts: Canuary <ebruary =arc April 9ales G1'8,888 118,888 1'1,888 1-8,888 *urc ases G45,888 33,888 51,'18 5/,188 !.penses G'/,888 '/,'88 '4,888 '5,388

9ales are collected 18D in t e mont of sale, -8D in t e mont follo"ing sale, and 17D in t e second mont follo"ing sale. $ne percent of sales is uncollectible and e.pensed at t e end of t e year. Grainger pays for all purc ases in t e mont follo"ing purc ase and takes advantage of a -D discount. % e follo"ing balances are as of Canuary 1: Cas Accounts receivableJ Accounts payable G55,888 15,888 4',888

J$f t is balance, G-1,888 "ill be collected in Canuary and t e remaining amount "ill be collected in <ebruary. % e mont ly e.pense figures include G1,888 of depreciation. % e e.penses are paid in t e mont incurred.

245

Hilton, Managerial Accounting, Seventh Edition

/1. Grainger's e.pected cas balance at t e end of Canuary is: A. G54,888. B. G57,138. C. G7',888. D. G7/,138. !. G11-,138. Ans"er: D #$: / %ype: A /'. Grainger's budgeted cas receipts in <ebruary are: A. G71,888. B. G71,888. C. G11-,878. D. G11-,3/8. !. G11/,888. Ans"er: ! #$: / %ype: A /-. Grainger's budgeted cas payments in <ebruary are: A. G41,338. B. G7/,538. C. G74,'88. D. G77,538. !. G18','88. Ans"er: B #$: / %ype: A //. !nd2of2period figures for accounts receivable and payables to suppliers "ould be found on t e: A. cas budget. B. budgeted sc edule of cost of goods manufactured. C. budgeted income statement. D. budgeted balance s eet. !. budgeted statement of cas flo"s. Ans"er: D #$: / %ype: &C /1. ( A. B. C. D. !. ic of t e follo"ing statements about financial planning models :<*=s; is :are; false) <*=s e.press a company's financial and operating relations ips in mat ematical terms. <*=s allo" a user to e.plore t e impact of c anges in variables. <*=s are commonly kno"n as >" at2if> models. <*=s ave become less popular in recent years because of computers and spreads eets. 9tatements >C> and >D> are bot false.

Ans"er: D #$: 1 %ype: &C

Chapter 9

246

/3. Consider t e follo"ing statements about budget administration: B.&egardless of si6e, t e budgeting process is a very formal process in all organi6ations. BB.% e budget manual is prepared to communicate budget procedures and deadlines to employees t roug out an organi6ation. BBB.!ffective internal control procedures re0uire t at t e budget director be an individual ot er t an t e controller. ( A. B. C. D. !. ic of t e above statements is :are; true) B only. BB only. BBB only. B and BB. B and BBB.

Ans"er: B #$: 3 %ype: , /4. ( ic of t e follo"ing statements concerning t e budget director is false) A. % e budget director is often t e organi6ation's controller. B. % e budget director as t e responsibility of specifying t e process by " ic budget data "ill be gat ered. C. % e budget director collects information and participates in preparing t e master budget. D. % e budget director communicates budget procedures and deadlines to employees t roug out t e organi6ation. !. % e budget director usually as t e aut ority to give final approval to t e master budget. Ans"er: ! #$: 3 %ype: &C /5. !2budgeting: A. often uses speciali6ed soft"are to streamline t e budgeting process. B. is an Bnternet2based budgeting procedure. C. re0uires significant net"ork security provisions. D. is becoming more commonplace as businesses e.pand t eir operations t roug out t e "orld. !. possesses all of t e above attributes. Ans"er: ! #$: 3 %ype: &C

247

Hilton, Managerial Accounting, Seventh Edition

/7. Consider t e follo"ing statements about 6ero2base budgeting: B.% e budget for virtually every activity in an organi6ation is initially set to t e level t at e.isted during t e previous year. BB.% e budget forces management to ret ink eac p ase of an organi6ation's operations before resources are allocated. BBB.%o receive funding for t e upcoming period, individual activities must be @ustified in terms of continued usefulness to t e organi6ation. ( A. B. C. D. !. ic of t e above statements is :are; true) BB only. BBB only. B and BB. BB and BBB. B, BB, and BBB.

Ans"er: D #$: 3 %ype: &C 18. Consider t e follo"ing statements about companies t at are involved "it international operations: B.Budgeting for t ese firms is often very involved because of fluctuating values in foreign currencies. BB.=ultinational firms may encounter yperinflationary economies. BBB.9uc organi6ations often face c anging la"s and political climates t at affect business activity. ( A. B. C. D. !. ic of t e above statements is :are; true) B only. BBB only. B and BB. BB and BBB. B, BB, and BBB.

Ans"er: ! #$: 3 %ype: &C 11. % e budgeting tec ni0ue t at focuses on different p ases of a product suc as planning and concept design, testing, manufacturing, and distribution and customer service is kno"n as: A. cas 2flo" budgeting. B. 6ero2base budgeting. C. base budgeting. D. compre ensive budgeting. !. life2cycle budgeting. Ans"er: ! #$: 4 %ype: &C

Chapter 9

248

1'. Consider t e follo"ing statements about budgeting and a product's life cycle: B.Budgets s ould focus on costs t at are incurred only after a product as been introduced to t e marketplace. BB.#ife2cycle costs "ould include t ose related to product planning, preliminary design, detailed design and testing, production, and distribution and customer service. BBB.( en a life cycle is s ort, companies must make certain t at before a commitment is made to a product, t e product's life2cycle costs are covered. ( A. B. C. D. !. ic of t e above statements is :are; true) B only. BB only. B and BB. BB and BBB. B, BB, and BBB.

Ans"er: D #$: 4 %ype: &C 1-. % e difference bet"een t e revenue or cost pro@ection t at a person provides, and a realistic estimate of t e revenue or cost, is called: A. passing t e buck. B. budgetary slack. C. false budgeting. D. participative budgeting. !. resource allocation processing. Ans"er: B #$: 5 %ype: &C 1/. Bf a manager builds slack into a budget, o" "ould t at manager andle estimates of revenues and e.penses) &evenues !.penses A. Anderestimate Anderestimate B. Anderestimate $verestimate C. $verestimate Anderestimate D. $verestimate $verestimate !. !stimate correctly !stimate correctly Ans"er: B #$: 5 %ype: &C

249

Hilton, Managerial Accounting, Seventh Edition

11 % e follo"ing events took place " en =anagers A, B, and C "ere preparing budgets for t e upcoming period: B.=anager A increased property ta. e.penditures by 'D " en s e "as informed of a recent rate ike by local aut orities. BB.=anager B reduced sales revenues by /D " en informed of recent aggressive actions by a ne" competitor. BBB.=anager C, " o supervises employees "it "idely varying skill levels, used t e ig est "age rate in t e department " en preparing t e labor budget. Assuming t at t e percentage amounts given are reasonable, " ic of t e preceding cases is :are; an e.ample of building slack in budgets) A. B only. B. BB only. C. BBB only. D. B and BB. !. BB and BBB. Ans"er: C #$: 5 %ype: , 13. Consider t e follo"ing statements about budgetary slack: B.=anagers build slack into a budget so t at t ey stand a greater c ance of receiving favorable performance evaluations. BB.Budgetary slack is used by managers to guard against uncertainty and unforeseen events. BBB.Budgetary slack is used by managers to guard against dollar cuts by top management in t e resource allocation process. ( A. B. C. D. !. ic of t e above statements is :are; true) B only. BB only. B and BB. BB and BBB. B, BB, and BBB.

Ans"er: ! #$: 5 %ype: &C 14. ( en an organi6ation involves its many employees in t e budgeting process in a meaningful "ay, t e organi6ation is said to be using: A. budgetary slack. B. participative budgeting. C. budget padding. D. imposed budgeting. !. employee2based budgeting. Ans"er: B #$: 5 %ype: &C

Chapter 9

25

15. ( A. B. C. D. !.

ic of t e follo"ing outcomes is :are; sometimes associated "it participative budgeting) !mployees make little effort to ac ieve budgetary goals. Budget preparation time can be some" at lengt y. % e problem of budget padding may arise. <inancial modeling becomes muc more difficult to undertake. Budget preparation time can be some" at lengt y and budget padding may arise.

Ans"er: ! #$: 5 %ype: &C 17. Company A uses a eavily participative budgeting approac " ereas at Company B, top management develops all budgets and imposes t em on lo"er2level personnel. ( ic of t e follo"ing statements is false) A. A's employees "ill likely be more motivated to ac ieve budgetary goals t an t e employees of Company B. B. B's employees may be some" at disenc anted because alt oug t ey "ill be evaluated against a budget, t ey really ad little say in budget development. C. Budget padding "ill likely be a greater problem at Company B. D. Budget preparation time "ill likely be longer at Company A. !. !t ical issues are more likely to arise at Company A, especially " en t e budget is used as a basis for performance appraisal. Ans"er: C #$: 5 %ype: , !'!(C %!% (evenue and La)or Budgeting*University %etting 38. Iirginia 9tate Aniversity :I9A; is preparing its master budget for t e upcoming academic year. Currently, 1',888 students are enrolled on campusH o"ever, t e admissions office is forecasting a 1D gro"t in t e student body despite a tuition ike to G58 per credit our. % e follo"ing additional information as been gat ered from an e.amination of university records and conversations "it university officials: I9A is planning to a"ard 118 tuition2free sc olars ips. % e average class as -8 students, and t e typical student takes 11 credit ours eac semester. !ac class is t ree credit ours. !ac faculty member teac es five classes during t e academic year. &e0uired: A.Compute t e budgeted tuition revenue for t e upcoming academic year. B.Determine t e number of faculty members needed to cover classes. C.Bn preparing t e university's master budget, s ould t e administration begin "it a forecast of students or a forecast of faculty members) Briefly e.plain. #$: / %ype: A, ,

25!

Hilton, Managerial Accounting, Seventh Edition

Ans"er: A. %otal student body: 1',888 K :1',888 . 1D; L 1',388H %uition2paying students: 1',388 2 118 L 1',/18H <orecasted tuition revenue: 1',/18 students . -8 credit ours . G58 L G'7,558,888 B. !ac student generates 18 >enrollments> per year :11 credit ours . ' semesters M - credit ours per class;. % us, 1'3,888 >enrollments> :1',388 students . 18; must be covered. Classes to be taug t: 1'3,888 M -8 students per class L /,'88 classesH <aculty needed: /,'88 classes M 1 classes per professor L 5/8 faculty C. % e university s ould begin "it a forecast of t e number of students. ( ile t e number of faculty may be a key driver for a variety of e.penditures, t e number of faculty is ig ly dependent on t e number of students. 9tudents :and tuition revenue; are akin to sales?t e starting point in t e budgeting process. Production Budget 31. % rifty Corporation as e.perienced a number of out2of2stock situations "it respect to its finis ed2goods inventories. Bnventory at t e end of =ay, for e.ample, "as only /8 units?an all2 time lo". =anagement desires to implement a policy " ereby finis ed2goods inventory is 48D of t e follo"ing mont 's sales. Budgeted sales for Cune, Culy, and August are e.pected to be /,188 units, 1,188 units, and /,788 units, respectively. &e0uired: Determine t e number of units t at % rifty must produce in Cune and Culy. #$: / %ype: A Ans"er: Budgeted sales in Cune :units; Add: Desired ending finis ed2goods inventory :1,188 . 48D; %otal finis ed units needed #ess: Beginning finis ed2goods inventory ,umber of units to be produced in Cune Budgeted sales in Culy :units; Add: Desired ending finis ed2goods inventory :/,788 . 48D; %otal finis ed units needed #ess: Beginning finis ed2goods inventory ,umber of units to be produced in Culy /,188 -,148 5,848 /8 5,8-8 1,188 -,/-8 5,1-8 -,148 /,738

Chapter 9

252

+irect-Material Purchases Budget 3'. %urbo =anufacturing plans to produce '8,888 units, '/,888 units, and -8,888 units, respectively, in $ctober, ,ovember, and December. !ac of t ese units re0uires four units of part no. 547, " ic t e company can purc ase for G4 eac . %urbo as -1,888 units of part no. 547 in stock on 9eptember -8. &e0uired: *repare a direct2material purc ases budget for $ctober and ,ovember if management desires to maintain an ending ra"2material inventory e0ual to /8D of t e follo"ing mont 's production usage. #$: / %ype: A Ans"er: *lanned production Anits of part no. 547 Anits of part no. 547 used in production Add: Desired ending inventoryJ %otal units of part no. 547 needed #ess: Beginning inventory of part no. 547 Anits of part no. 547 to be purc ased Cost per unit Cost of direct material purc ases J$ctober: '/,888 . / . /8DH ,ovember: -8,888 . / . /8D $ctober '8,888 ./ 58,888 -5,/88 115,/88 -1,888 5-,/88 . G4 G15-,588 ,ovember '/,888 ./ 73,888 /5,888 1//,888 -5,/88 181,388 . G4 G4-7,'88

253

Hilton, Managerial Accounting, Seventh Edition

Production and +irect-Material Purchases Budgets 3-. 9cot Company plans to sell /88,888 units of finis ed product in Culy '8.1. =anagement :1; anticipates a gro"t rate in sales of 1D per mont t ereafter and :'; desires a mont ly ending finis ed2goods inventory :in units; of 58D of t e follo"ing mont 's estimated sales. % ere are -88,888 completed units in t e Cune -8, '8.1 inventory. !ac unit of finis ed product re0uires four pounds of direct material at a cost of G1.18 per pound. % ere are 1,388,888 pounds of direct material in inventory on Cune -8, '8.1. &e0uired: A. *repare a production budget for t e 0uarter ended 9eptember -8, '8.1. ,ote: <or bot part >A> and part >B> of t is problem, prepare your budget on a 0uarterly :not mont ly; basis. B. Bndependent of your ans"er to part >A,> assume t at 9cot plans to produce 1,'88,888 units of finis ed product for t e 0uarter ended 9eptember -8. Bf t e firm desires to stock direct materials at t e end of t is period e0ual to '1D of current production usage, compute t e cost of direct material purc ases for t e 0uarter. #$: / %ype: A A. Ans"er: *ro@ected sales: Culy August :/88,888 . 1.81; 9eptember :/'8,888 . 1.81; Nuarterly total %otal 0uarterly sales Add: Desired 7O-8 inventory :/3-,818J . 58D; %otal units needed #ess: 3O-8 inventory %otal 0uarterly production re0uirement J$ctober sales: //1,888 . 1.81 L /3-,818 B. =aterial to be used in production :1,'88,888 . / pounds; Add: Desired 7O-8 inventory :/,588,888 . '1D; Direct materials needed #ess: 3O-8 inventory *ounds to be purc ased during t e 0uarter Direct material cost per pound %otal 0uarterly cost of purc ases /,588,888 1,'88,888 3,888,888 1,388,888 /,/88,888 . G1.18 G3,388,888

/88,888 /'8,888 //1,888 1,'31,888 1,'31,888 -48,//8 1,3-1,//8 -88,888 1,--1,//8

Chapter 9

254

Budget Lin,ages: Production, Materials, La)or, Balance %heet 3/. Atlantic Corporation assembles bicycles by purc asing frames, " eels, and ot er parts from various suppliers. Consider t e follo"ing data: % e company plans to sell '1,888 bicycles during eac mont of t e year's first 0uarter. A revie" of t e accounting records disclosed a finis ed2goods inventory of 1,/88 bicycles on Canuary 1 and an e.pected finis ed2goods inventory of 1,518 bicycles on Canuary -1. Atlantic as /,-88 " eels in inventory on Canuary 1, a level t at is e.pected to drop by 1D at mont 2end. Assembly time totals -8 minutes per bicycle, and "orkers are paid G1/ per our. Atlantic accounts for employee benefits as a component of direct labor cost. *ension and insurance costs average G' per our :total;H additionally, t e company pays 9ocial 9ecurity ta.es t at amount to 5D of gross "ages earned. &e0uired: A. Po" many bicycles does Atlantic e.pect to produce :i.e., assemble; in Canuary) B. Po" many " eels must be purc ased to satisfy production needs) C. Compute Atlantic's total direct labor cost. D. Briefly e.plain o" t e company's purc asing activity "ould affect t e end2of2period balance s eet. #$: / %ype: A, , Ans"er: A. <inis ed2goods inventory is e.pected to increase by /18 units :1,518 2 1,/88;. % us, t e company "ill assemble '1,/18 bicycles :'1,888 K /18;. B. C. Atlantic's production "ill re0uire 18,788 " eels :'1,/18 . ';. Given t at inventory "ill drop by '11 units :/,-88 . 1D;, t e company must purc ase 18,351 " eels :18,788 2 '11;. Assembly time: '1,/18 bicycles . -8O38 L 1',4'1 ours #abor cost: (ages: 1',4'1 ours . G1/ *ension and insurance: 1',4'1 ours . G' 9ocial 9ecurity ta.es: G145,118 . 5D %otal

G145,118 '1,/18 1/,'1' G'14,51'

D.

*urc asing activity "ould likely affect t e balance s eet in several "ays. Atlantic's Cas account "ould decrease and any end2of2period obligations to suppliers "ould be disclosed as accounts payable. Bn addition, t e " eels on and at t e end of t e period "ould affect ra"2material inventories, and t e cost of " eels ac0uired and used "ould influence t e ending inventory of bicycles.

255

Hilton, Managerial Accounting, Seventh Edition

Production, Materials, and La)or Budgets 31. Cacobs manufactures t"o products: A and B. % e firm predicts a sales volume of 18,888 units for product A and ending finis ed2goods inventory of ',888 units. % ese numbers for product B are 1',888 and -,888, respectively. Cacobs currently as 4,888 units of A in inventory and 7,888 units of B. % e follo"ing ra" materials are re0uired to manufacture t ese products: &a" =aterial Q + R Cost per *ound G'.88 '.18 1.'1 &e0uired for *roduct A B ' pounds 1 pound 1 pound - pounds

*roduct A re0uires t ree ours of cutting time and t"o ours of finis ing timeH B re0uires one our and t ree ours, respectively. % e direct labor rate for cutting is G18 per our and G15 per our for finis ing. &e0uired: A. *repare a production budget in units. B. *repare a materials usage budget in pounds and dollars. C. *repare a direct labor budget in ours and dollars for product A. #$: / %ype: A Ans"er: A. 9ales volume in units Add: !nding finis ed2goods inventory %otal units re0uired #ess: Beginning finis ed2goods inventory %otal units to be produced B. &a" =aterial Asage Q: ' pounds . 1,888 +: 1 pound . 1,888H 1 pound . 3,888 R: - pounds . 3,888 Q: 18,888 pounds . G'.88 +: :1,888 K 3,888; pounds . G'.18 R: 15,888 pounds . G1.'1 %otal cost A 18,888 ',888 1',888 4,888 1,888 A 18,888 1,888 G'8,888 '4,188 '',188 G48,888 B 1',888 -,888 11,888 7,888 3,888 B 3,888 15,888

Chapter 9

256

C.

Cutting *roduction in units Direct labor ours per unit Asage in direct labor ours Direct labor rate Direct labor cost <inis ing *roduction in units Direct labor ours per unit Asage in direct labor ours Direct labor rate Direct labor cost %otal budgeted direct labor cost

1,888 . 11,888 . G18 G118,888 1,888 . ' 18,888 . G15 G158,888 G--8,888

Cash Collections 33. %ara Company as t e follo"ing istorical collection pattern for its credit sales: 48D collected in mont of sale 11D collected in t e first mont after sale 18D collected in t e second mont after sale /D collected in t e t ird mont after sale 1D uncollectible Budgeted credit sales for t e last si. mont s of t e year follo". Culy August 9eptember $ctober ,ovember December G-8,888 -1,888 /8,888 /1,888 18,888 /',188

&e0uired: A. Calculate t e estimated total cas collections during $ctober. B. Calculate t e estimated total cas collections during t e year's fourt 0uarter. #$: / %ype: A

257

Hilton, Managerial Accounting, Seventh Edition

Ans"er: A. =ont of 9ale Culy August 9eptember $ctober %otal B. =ont of 9ale Culy August 9eptember $ctober ,ovember December %otal

$ctober Collections G-8,888 . /D L G 1,'88 G-1,888 . 18D L -,188 G/8,888 . 11D L 3,888 G/1,888 . 48D L -1,188 G/','88 Credit 9ales G -8,888 -1,888 /8,888 /1,888 18,888 /',188 G'/',188 Amount Collected ,ovember December G 1,/88 /,888 3,418 -1,888 G/4,118 G 1,388 /,188 4,188 '7,418 G/-,-18 G1-',488

$ctober G 1,'88 -,188 3,888 -1,188 G/','88

%otal collections in t e fourt 0uarter Cash nflo-s and Cash Manage.ent

34. % e accounting records of Backspace, Bnc., revealed an accounts receivable balance of G171,888 on Canuary 1, '8.3. <orty percent of t e company's sales are for cas , and t e remaining 38D are on account. $f t e credit sales, -8D are collected in t e mont of sale and 48D are collected in t e follo"ing mont . %otal sales in Canuary and <ebruary are e.pected to amount to G188,888 and G1-8,888, respectively. Assume t at in t e latter alf of '8.3, Backspace ired a ne" sales manager " o aggressively tried to ma.imi6e t e company's market s are. 9 e implemented a compensation system for t e sales force t at "as 188D commission based, "it t e commission calculated on t e basis of gross sales dollars. 9ales volume increased dramatically in a very s ort period of time, and t e sales and collection patterns c anged, as follo"s: Cas sales: '8D Credit sales: 58D Collected in t e mont of sale Collected in t e mont follo"ing sale Ancollectible

11D 41D 18D

Chapter 9

258

&e0uired: A. Compute t e company's cas inflo"s for Canuary and <ebruary, '8.3. B. Determine t e outstanding receivables balance at t e end of <ebruary. C. Compare t e sales and collection patterns before and after t e arrival of t e ne" sales manager. Pave t ings improved or deteriorated) !.plain. D. $n t e basis of t e information presented, determine " at likely caused t e improvement or deterioration in collection patterns. #$: / %ype: A, , Ans"er: A. Canuary: Accounts receivable :G171,888; K Canuary cas sales :G188,888 . /8D; K Canuary credit sales collected in Canuary :G188,888 . 38D . -8D; L G/51,888 <ebruary: Canuary credit sales collected in <ebruary :G188,888 . 38D . 48D; K <ebruary cas sales :G1-8,888 . /8D; K <ebruary credit sales collected in <ebruary :G1-8,888 . 38D . -8D; L G114,/88

B. 9ince credit sales are collected over t"o mont s, 48D of <ebruary's credit sales are still

outstanding: G1-8,888 . 38D . 48D L G''',388

C. Alt oug sales ave increased, t e credit and collection patterns ave deteriorated. $ne of

t e company's likely ob@ectives is to accelerate cas inflo"s. ,otice t at in percentage terms, cas sales ave declined :/8D vs. '8D;H credit customers no" take longer to pay as @udged by collections in t e mont of sale :-8D vs. 11D;H and ig levels of uncollectibles ave arisen :8D vs. 18D;.

D. % e data reveal t at total sales increased as did t e percentage of sales made on credit. Bt

appears t at t e sales manager's emp asis on market s are may ave led to sales being made to poor credit risks Sas @udged by t e ig rate of uncollectibles and reduced percentages of sales being settled in t e mont of sale :bot cas and credit;T. % ese actions may ave been triggered by a commission system based on gross sales, t us >encouraging> employees to increase sales despite t e credit "ort iness and profitability of t e customer.

259

Hilton, Managerial Accounting, Seventh Edition

Cash Budgeting 35. &enson Corporation, a " olesaler, provided t e follo"ing information: =ont Canuary <ebruary =arc April =ay =erc andise *urc ases G1/',888 1/5,888 1-3,888 11/,888 138,888 9ales G14',888 133,888 131,888 145,888 133,888

Customers pay 38D of t eir balances in t e mont of sale, -8D in t e mont follo"ing sale, and 18D in t e second mont follo"ing sale. % e company pays all invoices in t e mont follo"ing purc ase and takes advantage of a -D discount on all amounts due. Cas payments for operating e.penses in =ay "ill be G117,188H &enson's cas balance on =ay 1 "as G1'4,588. &e0uired: Determine t e follo"ing: A. !.pected cas collections during =ay. B. !.pected cas disbursements during =ay. C. !.pected cas balance on =ay -1. #$: / %ype: A Ans"er: A. =ont =arc April =ay %otal B. 9ales G131,888 145,888 133,888 *ercent 18D -8D 38D Collections G 13,188 1-,/88 77,388 G137,188 G11/,888 /,3'8 G1/7,-58 117,188 G'35,558 G1'4,588 137,188 G'74,-88 '35,558 G '5,/'8

April purc ases to be paid in =ay #ess: -D cas discount ,et amount Add: Cas payments for e.penses %otal e.pected cas disbursements Balance, =ay 1 Add: !.pected collections 9ubtotal #ess: !.pected payments !.pected balance, =ay -1

C.

Chapter 9

26

nterpretation of Budget +ata 37. 9tiles !nterprises reported t e follo"ing cas collections in Culy and August from credit sales: <rom Cune receivables <rom Culy sales <rom August sales Culy G --,888 181,888 August G /1,888 135,888

% e company sells a single product for G'8, and all sales are collected over a t"o2mont period. &e0uired: A. Determine t e number of units t at "ere sold in Culy. B. Determine t e percent of credit sales collected in t e mont of sale and t e percent of sales collected in t e mont follo"ing sale. C. Po" many units "ere sold in August) D. Determine t e accounts receivable balance as of August -1. #$: / %ype: A, , Ans"er: A. Culy sales: G181,888 K G/1,888 L G118,888H G118,888 M G'8 L 4,188 units

B. Culy sales collected in Culy: G181,888 M G118,888 L 48D

9eventy percent of credit sales are collected in t e mont of saleH t e remaining -8D are collected in t e mont follo"ing sale.

C. 9eventy percent of August sales "ere collected in AugustH t us, total August sales L

G135,888 M 8.48, or G'/8,888. August sales in units: G'/8,888 M G'8 L 1',888

D. G'/8,888 2 G135,888 L G4',888

26!

Hilton, Managerial Accounting, Seventh Edition

Cash and the Budgeting Process 48. 9 erman Company provides services in t e retail flooring industry. % e follo"ing information is available for '8.1: %"enty percent of t e firmFs services are for cas and t e remaining 58D are on account. $f t e credit services, /8D are collected in t e mont t at t e service is provided, "it t e remaining 38D collected in t e follo"ing mont . 9ervices provided in Canuary are e.pected to total G'18,888 and gro" at t e rate of 1D per mont t ereafter. CanuaryFs cas collections are e.pected to be G'/8,/88, and mont 2end receivables are forecast at G1'8,888. =ont ly cas operating costs and depreciation during t e first 0uarter of t e year are appro.imated at G'18,888 and G11,888, respectively. 9 ermanFs December -1, '8./ balance s eet revealed accounts payable balances of G'5,888. % is amount is related to t e companyFs operating costs and is e.pected to gro" to G-3,888 by t e end of '8.1Fs first 0uarter. All operating costs are paid "it in -8 days of incurrence. Company policy re0uires t at a G'8,888 minimum cas balance be maintained, and 9 ermanFs '8./ year2end balance s eet s o"ed t at t e firm "as in compliance "it policy by aving cas of G'-,888. &e0uired: A. Determine t e sales revenue earned t at "ill appear on t e income statement for t e 0uarter ended =arc -1, '8.1. B. Compute t e companyFs first20uarter cas collections. C. Compute t e cas balance t at "ould appear on t e =arc -1, '8.1 balance s eet. D. ( at are some possible actions t e company could pursue if, at any time during t e 0uarter, it finds t at t e cas balance as fallen belo" t e stated minimum. #$: / %ype: A, , Ans"er: A. % e income statement "ill report revenues earned of G455,1'1 SG'18,888 K :G'18,888 . 1.81 L G'3',188; K :G'3',188 . 1.81 L G'41,3'1;T. B. Collections for t e first 0uarter total G433,''1 :G'/8,/88 K G'13,188 K G'37,-'1;: Canuary: Given <ebruary: Canuary receivables <ebruary cas services: G'3',188 . '8D <ebruary credit services: G'3',188 . 58D . /8D =arc : <ebruary credit services: G'3',188 . 58D . 38D =arc cas services: G'41,3'1 . '8D =arc credit services: G'41,3'1 . 58D . /8D G'/8,/88 G1'8,888 1',188 5/,888 G1'3,888 11,1'1 55,'88 G'37,-'1

G'13,188

Chapter 9

262

263

Hilton, Managerial Accounting, Seventh Edition

C. % e ending cas balance is G/4,''1: G'-,888 :Canuary 1 balance; K G433,''1 :collections; 2 G'5,888 :December payables; 2 G418,888 :mont ly cas e.penses . -; K G-3,888 :=arc payables;. D. 9everal possible actions include securing a s ort2term loan or line of credit, "orking "it clients in an attempt to accelerate inflo"s, and "orking "it vendors to temporarily delay payments. % e goal is to ave added funds on and so t at operations continue smoot ly and are not disrupted because of sporadic or ongoing s ortages. Budgeted nco.e %tate.ent/ Partial Balance %heet 41. % e follo"ing information relates to D<( Corporation: All sales are on account and are budgeted as follo"s: <ebruary, G-18,888H =arc , G-38,888H and April, G/88,888. D<( collects 48D of its sales in t e mont of sale and -8D in t e follo"ing mont . Cost of goods sold averages 38D of sales. *urc ases total 31D of t e follo"ing mont 's sales and are paid in t e mont follo"ing ac0uisition. Cas operating e.penses total G38,888 per mont and are paid " en incurred. =ont ly depreciation amounts to G15,888. 9elected amounts taken from t e Canuary -1 balance s eet "ere: accounts receivable, G111,888H plant and e0uipment :net;, G184,888H and retained earnings, G51,888. &e0uired: A. *repare a budgeted income statement t at summari6es activity for t e t"o mont s ended =arc -1, '8.1. B. Compute t e amounts t at "ould appear on t e =arc -1 balance s eet for accounts receivable, plant and e0uipment :net;, and retained earnings. #$: / %ype: A Ans"er: A. Bncome 9tatement for t e %"o =ont s !nded =arc -1, '8.1 G418,888 /'3,888 G'5/,888 G1'8,888 -3,888 113,888 G1'5,888

9ales revenue :G-18,888 K G-38,888; Cost of goods sold :G418,888 . 38D; Gross margin $perating e.penses: Cas operating e.penses :G38,888 . '; Depreciation :G15,888 . '; ,et income B.

Accounts receivable: G111,888 2 G111,888 K G-18,888 2 :G-18,888 . 48D; K G-38,888 2 :G-18,888 . -8D; 2 :G-38,888 . 48D; L G185,888 *lant and e0uipment :net;: G184,888 2 G15,888 2 G15,888 L G41,888 &etained earnings: G51,888 K G1'5,888 L G'1-,888

Chapter 9

264

+ %CU%% #& $U!%T #&% Purposes of Budgeting %yste.s 4'. Discuss t e importance of budgeting and identify five purposes of budgeting systems. #$: 1 %ype: &C Ans"er: Budgets aid in determining o" to ac0uire resources, and " en and o" t ese resources s ould be used. Bn plain and simple terms, a formal budgeting program is a key ingredient to effective management. % e five purposes of budgeting are to: 1. develop a plan of action. '. facilitate communication of t e plan and coordinate various vie"s "it in an organi6ation. -. allocate limited resources effectively and efficiently. /. serve as a benc mark to control profit and operations. 1. evaluate performance and provide incentives to managers. %ales 0orecast 4-. #ist several factors t at an organi6ation mig t consider " en developing a sales forecast. #$: 1 %ype: &C Ans"er:

*ast sales levels and economic trends for t e firm as "ell as for t e industry as a " ole General conditions in t e economy suc as gro"t or decline, recession or boom, etc. !.ternal forces suc as "eat er or potential strikes *olitical or legal factors suc as litigation or ne" legislation *ricing policies of t e organi6ation Advertising and promotion plans Competitors' actions *otential for ne" product lines =arket researc studies

265

Hilton, Managerial Accounting, Seventh Edition

Budgetary %lac, 4/. %ara *ineno, ne"2accounts manager at !ast Bank of Clarion, as been asked to pro@ect o" many ne" accounts s e "ill open during '8.'. % e local economy as been gro"ing, and t e bank as e.perienced a 18D increase in t e number of ne" accounts over eac of t e past five years. Bn '8.1, t e bank ad 18,888 accounts. %ara is paid a salary, plus a bonus of G'8 for every ne" account above t e budgeted amount. % us, if t e annual budget calls for 1,888 ne" accounts, and 1,858 ne" accounts are obtained, er bonus "ill be G1,388 :58 . G'8;. *ineno believes t at t e local economy "ill continue to gro" at t e same rate in '8.' as it as in recent years. 9 e decided to submit a pro@ection of 488 ne" accounts for '8.'. &e0uired: +our consulting firm as been ired by t e bank president to make recommendations for improving t e bank's operation. (rite a memorandum to t e president defining and e.plaining t e negative conse0uences of budgetary slack. Also discuss t e bank's bonus system for t e ne"2 accounts manager and o" t e bonus program tends to encourage budgetary slack. #$: 5 %ype: &C Ans"er: =emorandum Date: %oday %o: *resident, !ast Bank of Clarion <rom: B.=. 9tudent and Associates 9ub@ect: Budgetary slack Budgetary slack is t e difference bet"een a budget estimate t at a person provides and a realistic determination of t e amount. % e practice of creating budgetary slack is called padding t e budget. % e primary negative conse0uence of slack is t at it undermines t e credibility and usefulness of t e budget as a planning and control tool. ( en a budget includes slack, t e amounts in t e budget no longer portray a realistic vie" of future operations. % e bank's bonus system for t e ne"2accounts manager tends to encourage budgetary slack. 9ince t e manager's bonus is determined by t e number of ne" accounts opened in e.cess of t e budgeted number, t ere is an incentive for t e manager to understate er activity pro@ections. % ere is evidence of t is be avior, as a 18D increase over t e bank's current 18,888 accounts "ould be 1,888 ne" accounts in '8.'. %ara's pro@ection, o"ever, is only 488.

Chapter 9

266

Participative Budgeting 41. Cames Corporation, ead0uartered in C icago, as a manufacturing plant in Dallas. *lant managers desire to participate in t e company's budget efforts, " ic , for t e past 18 years, ave been andled solely by top e.ecutives in C icago. Dallas managers feel t at by becoming involved, t ey can make great strides in terms of improving operating performance of t eir aging facility. &e0uired: Briefly discuss t is situation, focusing on t e benefits and problems of letting Dallas managers participate in t e company's budgetary efforts. #$: 5 %ype: &C, , Ans"er: *articipative budgets "ill make t e plant managers feel t at t eir opinions are valued by top management and, generally speaking, t e plant managers "ill ave a better attitude about trying to ac ieve t e budget. Additionally, it is possible in t is case t at t e participative approac "ill result in a more realistic budget document. C icago personnel may be too far removed from daily activities in Dallas to get an accurate picture of on2going operations. $n t e negative side, a participative budget may take longer to prepare and may lead to some local in2fig ting " en compared "it one t at is imposed from corporate ead0uarters. Also, participative budgets may ave some padding or slack, as t e Dallas managers are faced "it an aging facility. % is facility may be inefficient and, "it t eir participation, managers may bend t e numbers a bit to improve appearance.

267

Hilton, Managerial Accounting, Seventh Edition

You might also like

- 01 x01 Basic ConceptsDocument10 pages01 x01 Basic ConceptsXandae MempinNo ratings yet

- Orang Co. perpetual inventory system calculationsDocument3 pagesOrang Co. perpetual inventory system calculationsJobelle Candace Flores AbreraNo ratings yet

- Case Study On Google S Steep Learning Curve in ChinaDocument3 pagesCase Study On Google S Steep Learning Curve in ChinaKutoo BayNo ratings yet

- Accounting Information Systems: An OverviewDocument3 pagesAccounting Information Systems: An OverviewRafael Capunpon VallejosNo ratings yet

- Basic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingDocument107 pagesBasic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingKang JoonNo ratings yet

- Chap007 Profit PlanningDocument88 pagesChap007 Profit PlanningLizette Allison Ballesteros100% (2)

- SEATWORKDocument4 pagesSEATWORKMarc MagbalonNo ratings yet

- ObliCon Part 4Document2 pagesObliCon Part 4Wawex DavisNo ratings yet

- Ho Abc0abmDocument5 pagesHo Abc0abmAngel Alejo AcobaNo ratings yet

- Instruction: Write The Letter of Your Choice On The Space Provided Before The NumberDocument4 pagesInstruction: Write The Letter of Your Choice On The Space Provided Before The NumberASDDD100% (2)

- Saint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Document4 pagesSaint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Esheikell ChenNo ratings yet

- Chapter10.Standard Costing Operational Performance Measures and The Balanced Scorecard PDFDocument36 pagesChapter10.Standard Costing Operational Performance Measures and The Balanced Scorecard PDFJudy Anne SalucopNo ratings yet

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- Baggayao WACC PDFDocument7 pagesBaggayao WACC PDFMark John Ortile BrusasNo ratings yet

- Capitalizable Make-Ready Costs Related To A New Machine Do Not IncludeDocument1 pageCapitalizable Make-Ready Costs Related To A New Machine Do Not Includejahnhannalei marticioNo ratings yet

- Installment Sales & Long-Term ConsDocument6 pagesInstallment Sales & Long-Term ConsSirr JeyNo ratings yet

- Exam Chap 13Document59 pagesExam Chap 13oscarv89100% (2)

- Standard Costing and Variance AnalysisDocument10 pagesStandard Costing and Variance AnalysisAnne Danica TanNo ratings yet

- Fischer - Pship LiquiDocument7 pagesFischer - Pship LiquiShawn Michael DoluntapNo ratings yet

- BACC3115-Cost Accounting Midterm Exam PRDocument6 pagesBACC3115-Cost Accounting Midterm Exam PRVahia Ralliza Dotarot0% (1)

- MASDocument46 pagesMASKyll Marcos0% (1)

- COSTDocument6 pagesCOSTJO SH UANo ratings yet

- QuizDocument9 pagesQuizCertified Public AccountantNo ratings yet

- TAX. M-1401 Estate Tax: Basic TerminologiesDocument33 pagesTAX. M-1401 Estate Tax: Basic TerminologiesJimmyChaoNo ratings yet

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- Chapter 13 - Tor F and MCDocument13 pagesChapter 13 - Tor F and MCAnika100% (1)

- Factory OverheadDocument2 pagesFactory OverheadKeanna Denise GonzalesNo ratings yet

- MAS Review CVP and Variable CostingDocument7 pagesMAS Review CVP and Variable CostingAizzy ManioNo ratings yet

- Chapter 3 Cost Behavior Analysis and UseDocument45 pagesChapter 3 Cost Behavior Analysis and UseMarriel Fate Cullano100% (1)

- Cost AccountingDocument9 pagesCost AccountingCyndy VillapandoNo ratings yet

- Financial Management 2Document6 pagesFinancial Management 2Julie R. UgsodNo ratings yet

- Chap 07 - Study GuideDocument8 pagesChap 07 - Study Guidedimitra triantosNo ratings yet

- Actg 10 - MAS Midterm ExamDocument24 pagesActg 10 - MAS Midterm Examjoemel091190100% (1)

- CVP AnalysisDocument51 pagesCVP AnalysisMonaliza MalapitNo ratings yet

- 10 X08 BudgetingDocument13 pages10 X08 Budgetingjenna hannahNo ratings yet

- Exercises - Job Order CostingDocument7 pagesExercises - Job Order CostingJericho DupayaNo ratings yet

- Quiz 6 Process Costing SolutionsDocument7 pagesQuiz 6 Process Costing SolutionsralphalonzoNo ratings yet

- Midterm - Set ADocument8 pagesMidterm - Set ACamille GarciaNo ratings yet

- True / False: You Answered Correctly!Document6 pagesTrue / False: You Answered Correctly!Shaina Kaye De GuzmanNo ratings yet

- P 1Document4 pagesP 1Kenneth Bryan Tegerero TegioNo ratings yet

- Test 5Document2 pagesTest 5Kim LimosneroNo ratings yet

- Cost and Management Accounting Framework ModuleDocument14 pagesCost and Management Accounting Framework ModuleHeart Erica AbagNo ratings yet

- Essay on Activity-Based Costing for Ingersol DraperiesDocument13 pagesEssay on Activity-Based Costing for Ingersol DraperiesLhorene Hope DueñasNo ratings yet

- Quiz (Relevant - Costing) - MT - ContDocument3 pagesQuiz (Relevant - Costing) - MT - ContExequielCamisaCrusperoNo ratings yet

- NFJPIA - Mockboard 2011 - MAS PDFDocument7 pagesNFJPIA - Mockboard 2011 - MAS PDFDanica PelenioNo ratings yet

- 15 Activity Based Management and Costing IM May 2014Document10 pages15 Activity Based Management and Costing IM May 2014erjan nina bombayNo ratings yet

- 13 x11 Financial Management A Financial Planning & StrategiesDocument9 pages13 x11 Financial Management A Financial Planning & StrategiesRod Lester de GuzmanNo ratings yet

- Chap 3Document30 pagesChap 3Thiru VenkatNo ratings yet

- 25 Profit-Performance Measurements & Intracompany Transfer PricingDocument13 pages25 Profit-Performance Measurements & Intracompany Transfer PricingLaurenz Simon ManaliliNo ratings yet

- Calculating Economic Order Quantity and Inventory Costs Using EOQ ModelDocument1 pageCalculating Economic Order Quantity and Inventory Costs Using EOQ ModelROB101512No ratings yet

- MA - HiltonDocument37 pagesMA - HiltonJ T100% (1)

- ACC561 Final ExamDocument7 pagesACC561 Final ExamRogue PhoenixNo ratings yet

- CA"H #$%& E"T'MAT'%( CHAPTE A(D !!'") A(ADocument77 pagesCA"H #$%& E"T'MAT'%( CHAPTE A(D !!'") A(ANguyễn Minh ThôngNo ratings yet

- Cpa Questions Part XDocument10 pagesCpa Questions Part XAngelo MendezNo ratings yet

- Latihan Budget 20142015Document48 pagesLatihan Budget 20142015AnnaNo ratings yet

- Functional and activity-based budgeting guideDocument5 pagesFunctional and activity-based budgeting guidePATRICIA PEREZNo ratings yet

- Identifying Profit Centers and Calculating Residual IncomeDocument1 pageIdentifying Profit Centers and Calculating Residual IncomePramod DubeyNo ratings yet

- Uas AkmenDocument17 pagesUas Akmenabdul aziz faqihNo ratings yet

- Chapter 6 CostDocument144 pagesChapter 6 CostMaria LiNo ratings yet

- True/False Questions: Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-7Document165 pagesTrue/False Questions: Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 6-7Thuhoai NguyenNo ratings yet

- Chapter07 - AnswerDocument17 pagesChapter07 - AnswerLenie Lyn Pasion TorresNo ratings yet

- Chapter13 - AnswerDocument5 pagesChapter13 - AnswerxxxxxxxxxNo ratings yet

- Public Sector: Ccountability in OvernanceDocument3 pagesPublic Sector: Ccountability in OvernanceAnjo PadillaNo ratings yet

- Chapter15 - Answer PDFDocument14 pagesChapter15 - Answer PDFAvon Jade RamosNo ratings yet

- Chapter04 - AnswerDocument7 pagesChapter04 - AnswerAnjo PadillaNo ratings yet

- Chapter19 - AnswerDocument27 pagesChapter19 - AnswerxxxxxxxxxNo ratings yet

- CHAPTER 5 AUDIT OF EXPENDITURE CYCLEDocument4 pagesCHAPTER 5 AUDIT OF EXPENDITURE CYCLEAnjo PadillaNo ratings yet

- Audit Financing Investing Cycle Tests Controls TransactionsDocument6 pagesAudit Financing Investing Cycle Tests Controls TransactionsAvon Jade RamosNo ratings yet

- 12 x10 Financial Statement AnalysisDocument22 pages12 x10 Financial Statement AnalysisRaffi Tamayo92% (25)

- Partnership Formation and Operations Exercises and Problems1,670,000518,0001,152,0001,792,000256,000160,000198,000(16,000)(120,000)2,270,000Document21 pagesPartnership Formation and Operations Exercises and Problems1,670,000518,0001,152,0001,792,000256,000160,000198,000(16,000)(120,000)2,270,000Jayson Villena Malimata100% (2)

- Overview of Audit ProcessDocument3 pagesOverview of Audit ProcessCristy Estrella0% (1)

- 07 X07 A ResponsibilityDocument12 pages07 X07 A ResponsibilityJohnMarkVincentGiananNo ratings yet

- 21 x12 ABC DDocument5 pages21 x12 ABC DAnjo PadillaNo ratings yet

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerAubreyNo ratings yet

- AnjojdsjdlaDocument0 pagesAnjojdsjdlaAnjo PadillaNo ratings yet

- 16 x11 FinMan DDocument8 pages16 x11 FinMan DErwin Cajucom50% (2)

- 07 X07 A ResponsibilityDocument12 pages07 X07 A ResponsibilityJohnMarkVincentGiananNo ratings yet

- MAS PreweekDocument46 pagesMAS Preweekclaire_charm27100% (1)

- 13 x11 Financial Management A Financial Planning & StrategiesDocument9 pages13 x11 Financial Management A Financial Planning & StrategiesRod Lester de GuzmanNo ratings yet

- 12 x10 Financial Statement AnalysisDocument22 pages12 x10 Financial Statement AnalysisRaffi Tamayo92% (25)

- 1558 NDocument5 pages1558 NAnjo PadillaNo ratings yet

- BudgetingDocument23 pagesBudgetingShiela Marquez100% (6)

- 09 X07 C ResponsibilityDocument9 pages09 X07 C ResponsibilityAnjo PadillaNo ratings yet

- 21 x12 ABC DDocument5 pages21 x12 ABC DAnjo PadillaNo ratings yet

- Capital Budgeting Process ExplainedDocument35 pagesCapital Budgeting Process ExplainedAnjo PadillaNo ratings yet

- 09 X07 C ResponsibilityDocument9 pages09 X07 C ResponsibilityAnjo PadillaNo ratings yet

- SCHEDULEDocument2 pagesSCHEDULEAnjo PadillaNo ratings yet

- Past CPA Board On MASDocument22 pagesPast CPA Board On MASJaime Gomez Sto TomasNo ratings yet

- Basic Concepts (Cost Accounting)Document9 pagesBasic Concepts (Cost Accounting)alexandro_novora6396No ratings yet

- Device Interface Device Type (Router, Switch, Host) IP Address Subnet Mask Default GatewayDocument2 pagesDevice Interface Device Type (Router, Switch, Host) IP Address Subnet Mask Default GatewayRohit Chouhan0% (1)

- Calibration Motion Control System-Part2 PDFDocument6 pagesCalibration Motion Control System-Part2 PDFnurhazwaniNo ratings yet

- PharmacologyAnesthesiology RevalidaDocument166 pagesPharmacologyAnesthesiology RevalidaKENT DANIEL SEGUBIENSE100% (1)

- Socially Responsible CompaniesDocument2 pagesSocially Responsible CompaniesItzman SánchezNo ratings yet

- Periodic ClassificationDocument4 pagesPeriodic ClassificationtusharNo ratings yet

- IntroductionDocument34 pagesIntroductionmarranNo ratings yet

- Childrens Ideas Science0Document7 pagesChildrens Ideas Science0Kurtis HarperNo ratings yet

- Easa Ad Us-2017-09-04 1Document7 pagesEasa Ad Us-2017-09-04 1Jose Miguel Atehortua ArenasNo ratings yet

- Key formulas for introductory statisticsDocument8 pagesKey formulas for introductory statisticsimam awaluddinNo ratings yet

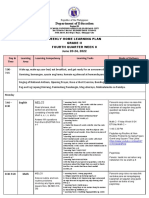

- Department of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Document8 pagesDepartment of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Evelyn DEL ROSARIONo ratings yet

- VEGA MX CMP12HP Data SheetDocument2 pagesVEGA MX CMP12HP Data SheetLuis Diaz ArroyoNo ratings yet

- Benjie Reyes SbarDocument6 pagesBenjie Reyes Sbarnoronisa talusobNo ratings yet

- Tender34 MSSDSDocument76 pagesTender34 MSSDSAjay SinghNo ratings yet

- IP68 Rating ExplainedDocument12 pagesIP68 Rating ExplainedAdhi ErlanggaNo ratings yet

- HistoryDocument144 pagesHistoryranju.lakkidiNo ratings yet

- Variable Speed Pump Efficiency Calculation For Fluid Flow Systems With and Without Static HeadDocument10 pagesVariable Speed Pump Efficiency Calculation For Fluid Flow Systems With and Without Static HeadVũ Tuệ MinhNo ratings yet

- Planview Innovation Management Maturity Model PDFDocument1 pagePlanview Innovation Management Maturity Model PDFMiguel Alfonso Mercado GarcíaNo ratings yet

- SQL Server 2008 Failover ClusteringDocument176 pagesSQL Server 2008 Failover ClusteringbiplobusaNo ratings yet

- What is zone refining processDocument1 pageWhat is zone refining processKeshav MadanNo ratings yet

- Development of Rsto-01 For Designing The Asphalt Pavements in Usa and Compare With Aashto 1993Document14 pagesDevelopment of Rsto-01 For Designing The Asphalt Pavements in Usa and Compare With Aashto 1993pghasaeiNo ratings yet

- Corn MillingDocument4 pagesCorn Millingonetwoone s50% (1)

- SD-SCD-QF75 - Factory Audit Checklist - Rev.1 - 16 Sept.2019Document6 pagesSD-SCD-QF75 - Factory Audit Checklist - Rev.1 - 16 Sept.2019Lawrence PeNo ratings yet

- USA V BRACKLEY Jan6th Criminal ComplaintDocument11 pagesUSA V BRACKLEY Jan6th Criminal ComplaintFile 411No ratings yet

- Feasibility StudyDocument47 pagesFeasibility StudyCyril Fragata100% (1)

- Computer Portfolio (Aashi Singh)Document18 pagesComputer Portfolio (Aashi Singh)aashisingh9315No ratings yet

- TransistorDocument1 pageTransistorXhaNo ratings yet

- Environment ManagerDocument234 pagesEnvironment ManagerAbhishek kumarNo ratings yet

- Major Bank Performance IndicatorsDocument35 pagesMajor Bank Performance IndicatorsAshish MehraNo ratings yet

- Ca. Rajani Mathur: 09718286332, EmailDocument2 pagesCa. Rajani Mathur: 09718286332, EmailSanket KohliNo ratings yet

- Factsheet B2B PunchOut en 140623Document2 pagesFactsheet B2B PunchOut en 140623Curtis GibsonNo ratings yet