Professional Documents

Culture Documents

MCS-Nurul Sari-Case 7.1 7.2 7.7

Uploaded by

Nurul SariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MCS-Nurul Sari-Case 7.1 7.2 7.7

Uploaded by

Nurul SariCopyright:

Available Formats

Name: Nurul Sari NIM: 1101002048 Case 7.1 ; 7.2 ; 7.

7

Case 7.1 : Investment center Problems (A)

The ABC Company has three division (A,B,C). Division A eclusively a marketing division. Division B exclusively a manufacturing division and Division C is both a manufacturing aand marketing division. The following are the financial facts for each of these divisions:

Current Assets Fixed Assets Total Assets Profit befor depreciation and market development cost Division A $ 100.000 $ $ 100.000 $ 200.000 Division B $ 100.000 $ 1.000.000 $ 1.100.000 $ 200.000 Division C $ 100.000 $ 500.000 $ 600.000 $ 200.000

Assume that the ABC Company depreciates fixed assets on a SLM over 10 years. To maintain its market and productive facilities, it has to invest $100,000 per year in market development in Division A and $50,000 per year in Division C. This is written off as an expense. It also has to replace 10% of its productive facilities each year. Under this equilibrium conditions, what are the annual rates of return earned by each of the division? Answer:

A 200.000 0 100.000 100.000 100.000 100,00% Division B 200.000 100.000 100.000 1.100.000 9,09% C 200.000 50.000 50.000 100.000 600.000 16,67% Total $ 600.000 $ 150.000 $ 150.000 $ 300.000 $ 1.800.000 16,67%

Profit befor depreciation and market development cost Less: Depreciation Less: Mrket Development Cost Net Profit Total Assets ROI = (Net Profit/Total Assets)*100

$ $ $ $

$ $ $ $ $

$ $ $ $ $

Case 7.2 : Investment Center Problems (B)

Layout and Marketing $ 200.000 $ $ 200.000 $ 400.000 Office Furniture $ 200.000 $ 1.000.000 $ 1.200.000 $ 400.000

Office Supplies $ $ $ $ 200.000 500.000 700.000 400.000

Current Assets Fixed Assets Total Assets Gross Profit From Sales

Name: Nurul Sari NIM: 1101002048 Case 7.1 ; 7.2 ; 7.7

The Complete Office Company depreciates all of its fixed assets over 10 years on SLM, and its calculates ROA on beginning of year gross book value of assets. The operating expense for each division (besides depreciation on fixed assets) are $200,000 for Layout and Marketing, $100,000 for Office Furniture, and $150,000 for Office Supplies. Please compute a ROA figure for each divisions for 1997 Answer:

Layout and Marketing $ 400.000 $ 200.000 $ 200.000 $ 200.000 100,00% Division Office Furniture 400.000 100.000 300.000 1.200.000 25,00%

Office Supplies $ $ $ $ 400.000 150.000 250.000 700.000 35,71%

Gross profit from sales Less: Operating Expense Net Profit Total Assets ROI = (Net Profit/Total Assets)*100

$ $ $ $

Total $ 1.200.000 $ 450.000 $ 750.000 $ 2.100.000 35,71%

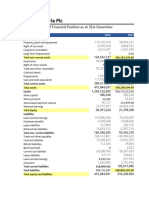

Case 7.7 : Marden Company

Cash AR Inventory Total Current Assets

$ 100 $ 800 $ 900 $ 1.800

AP Total Current Liabilities Debt

$ $ $

400 400 700

PPE, Cost Depreciation (SLM) PPE net Total Assets

$ 1.000 $ 400 $ 600 $ 2.400

Equity

$ $ $

1.300 2.000 2.400

Total Equities

Sales Cost Other than those list below Depreciation Allocated Share of Corporate expense Income before income tax

$ 4.000 $ 3.200,00 $ 100,00 $ 100,00 $ 600,00

Name: Nurul Sari NIM: 1101002048 Case 7.1 ; 7.2 ; 7.7

Recommended the best way of measuring the performance of the division manager. If you need additional information, make the assumption you believe to be most reasonable. Answer:

Major Ratios ROE ROA ROIC Profitability Ratios Profit Margin Gross Margin Turnover and Control ratios PE ratio Asset Turnover Fixed Asset Turnover Inventory Turnover Collection Period Day's sales in cash Payable period Leverage and Liquidity Ratios Assets to Equity Debt to Assets Debt to Equity Times Interest Earned Times Burden Covered Current Ratio Acid Test 46,15% 25,00%

15,00% 20,00% Market price/after tax income 1,67 6,67 5,00

184,62% 45,83% 84,62% 9,52 450,00% 2.25

There are many methods to evaluate the performance of each division. We can use profitability ratios, liquidity ratio and debt ratio and so on to do the measurement. Just like many big company in the world, ROI, the indicator of money gained or lost on an investment relative to the amount of money invested, is the most popular way to do the measurement. However, in my opinion, EVA or RI should be a better method to evaluate the performance of each division separately. Let use EVA to explain the reason of EVA being a better approach. EVA is net operating profit after taxes less the money cost of capital. If the company uses ROI to measure the performance, it cannot maximize the shareholders value. When there is a project which will increase the value of the company but will decrease the ROI result, the manager will cancel it. But if

Name: Nurul Sari NIM: 1101002048 Case 7.1 ; 7.2 ; 7.7

we use EVA method, we just need to calculate the capital cost rate. In addition, each investment has different capital cost. EVA method can use different interest rate for each investment. The most important reason is it can encourage division managers to do their best to add value for the whole company. After all, when the top manager measures the performance for each division, he should consider not only the value added for each department because of the different size, but also the trend of weight for total value added.

You might also like

- Case 10-1Document7 pagesCase 10-1thebruins100% (2)

- Ch7 Measuring and Controlling Assets EmployedDocument5 pagesCh7 Measuring and Controlling Assets EmployedKeren MilletNo ratings yet

- Reta Sharfina Tahar 1111002006 Case 10-1 Variance Analysis ProblemsDocument2 pagesReta Sharfina Tahar 1111002006 Case 10-1 Variance Analysis ProblemsTiffany SmithNo ratings yet

- (TA) Soal Jawab Problems 8.1Document3 pages(TA) Soal Jawab Problems 8.1Aida Fitria67% (3)

- Measuring and Controlling Assets Employed + DELL Case StudyDocument34 pagesMeasuring and Controlling Assets Employed + DELL Case Studykid.hahn100% (1)

- Accounts Payable Processes and Year-End ClosingDocument5 pagesAccounts Payable Processes and Year-End ClosingNovita WardaniNo ratings yet

- Chapter 13 - Overview of A Group AuditDocument48 pagesChapter 13 - Overview of A Group AuditGarini Putri ParamesthiNo ratings yet

- Transfer Price Case Study 2Document1 pageTransfer Price Case Study 2Professor Sameer Kulkarni100% (5)

- 6-1 Transfer PricingDocument16 pages6-1 Transfer Pricingvaish2u886267% (3)

- Ais 2015Document5 pagesAis 2015tafraciNo ratings yet

- Case 6-1 (ANDI DIAN AULIA-46117022)Document5 pagesCase 6-1 (ANDI DIAN AULIA-46117022)dianNo ratings yet

- HomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Document5 pagesHomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Nurul SariNo ratings yet

- Financial Statement Analysis HomeworkDocument2 pagesFinancial Statement Analysis HomeworkpratheekNo ratings yet

- Cost Management Blocher AnswerDocument2 pagesCost Management Blocher AnswerOscares Snow100% (4)

- Solved Jerry Goff President of Harmony Electronics Was Concerned AbouDocument2 pagesSolved Jerry Goff President of Harmony Electronics Was Concerned AbouDoreenNo ratings yet

- SHY Week 1 Assignment SolutionDocument2 pagesSHY Week 1 Assignment Solutionhy_saingheng_7602609No ratings yet

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDocument3 pagesMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNo ratings yet

- Audit procedures for capital stock, additional paid-in capital, and retained earnings accountsDocument3 pagesAudit procedures for capital stock, additional paid-in capital, and retained earnings accountsdedNo ratings yet

- Accounting For Business Combinations: Learning ObjectivesDocument41 pagesAccounting For Business Combinations: Learning Objectivesmohammad.mamdooh94720% (1)

- Applying FSA to Campbell SoupDocument9 pagesApplying FSA to Campbell SoupIlham Muhammad AkbarNo ratings yet

- 18-32 (Objectives 18-2, 18-3, 18-4, 18-6)Document8 pages18-32 (Objectives 18-2, 18-3, 18-4, 18-6)image4all100% (1)

- Comparing Planning and Control Systems of Texas Instruments and Hewlett-PackardDocument20 pagesComparing Planning and Control Systems of Texas Instruments and Hewlett-PackardNaveen SinghNo ratings yet

- Revenue Recognition and MeasurementDocument24 pagesRevenue Recognition and MeasurementPindi YulinarNo ratings yet

- ANALYZING FINANCIAL REPORTSDocument22 pagesANALYZING FINANCIAL REPORTSTia Permata SariNo ratings yet

- Important Note To InstructorsDocument21 pagesImportant Note To InstructorsHassan KhaledNo ratings yet

- Case 4 5 Dana Packaging and Ada PharmaDocument2 pagesCase 4 5 Dana Packaging and Ada PharmaSoorajKrishnanNo ratings yet

- Curriculum Module 2 QuestionsDocument21 pagesCurriculum Module 2 QuestionsEmin SalmanovNo ratings yet

- Akuntansi Keuangan Lanjutan - Chap 007Document39 pagesAkuntansi Keuangan Lanjutan - Chap 007Gugat jelang romadhonNo ratings yet

- The North Face Case Audit MaterialityDocument2 pagesThe North Face Case Audit MaterialityAjeng TriyanaNo ratings yet

- Cost and Management Accounting - Tugas 6 - 5 November 2019Document3 pagesCost and Management Accounting - Tugas 6 - 5 November 2019AlfiyanNo ratings yet

- Audit Chapter SolutionsDocument3 pagesAudit Chapter SolutionsJana WrightNo ratings yet

- Marden CompDocument6 pagesMarden CompDesy WulandariNo ratings yet

- 07 - Measuring and Controlling Assets EmployedDocument8 pages07 - Measuring and Controlling Assets EmployedJason KurniawanNo ratings yet

- The Lockit Company Manufactures Door Knobs For Residential Homes andDocument2 pagesThe Lockit Company Manufactures Door Knobs For Residential Homes andAmit PandeyNo ratings yet

- Resume Palepu Chapter 10Document14 pagesResume Palepu Chapter 10Fifi AiniNo ratings yet

- Audit 2 Week 6 AssignmentDocument11 pagesAudit 2 Week 6 AssignmentDewi RenitasariNo ratings yet

- Nucor Case Study Solution Performance MeasurementDocument9 pagesNucor Case Study Solution Performance MeasurementDickyWahyuChandraNo ratings yet

- Tugas Week 10Document6 pagesTugas Week 10Carissa WindyNo ratings yet

- Partnership in Class Questions 2015Document3 pagesPartnership in Class Questions 2015Nella KingNo ratings yet

- Tugas SPM 6-1Document13 pagesTugas SPM 6-1Reza Afrisal33% (3)

- CHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsDocument9 pagesCHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsKamran ShafiNo ratings yet

- ACCT-UB 3 - Financial Statement Analysis Module 5 HomeworkDocument2 pagesACCT-UB 3 - Financial Statement Analysis Module 5 HomeworkpratheekNo ratings yet

- Chapter 2 Basic Cost Management ConceptsDocument12 pagesChapter 2 Basic Cost Management ConceptsDella Putri100% (1)

- Financial Statement Analysis Chapter 2 SummaryDocument6 pagesFinancial Statement Analysis Chapter 2 SummaryVan Iklil BachdimNo ratings yet

- Activity Based CostingDocument49 pagesActivity Based CostingEdson EdwardNo ratings yet

- Case 6-1 Transfer Pricing ProblemDocument4 pagesCase 6-1 Transfer Pricing ProblemNur Kumala Dewi75% (4)

- Cup CorporationDocument17 pagesCup Corporationandri100% (1)

- Sea Gull AirframesDocument10 pagesSea Gull AirframesRigoreBiasNo ratings yet

- Chap 014Document46 pagesChap 014'Qy Qizwa Andini'No ratings yet

- Chap 016Document63 pagesChap 016Morisa Septiani100% (2)

- Tugas 1Document2 pagesTugas 1sella50% (2)

- Time DrivenDocument2 pagesTime DrivenwellaNo ratings yet

- Pertemuan Asistensi 8 (Performance Measurement)Document2 pagesPertemuan Asistensi 8 (Performance Measurement)Sholkhi ArdiansyahNo ratings yet

- Exercises IA 2Document7 pagesExercises IA 2Hanna Melody50% (2)

- Final Review Session SPR12RปDocument10 pagesFinal Review Session SPR12RปFight FionaNo ratings yet

- Investments in Assets Both A Strategic and A Control IssueDocument31 pagesInvestments in Assets Both A Strategic and A Control Issuenimesh01No ratings yet

- Investments in Assets Both A Strategic and A Control IssueDocument36 pagesInvestments in Assets Both A Strategic and A Control IssueSeiji LidasanNo ratings yet

- MCD2010 - T8 SolutionsDocument9 pagesMCD2010 - T8 SolutionsJasonNo ratings yet

- Measuring and Controlling Assets EmployedDocument39 pagesMeasuring and Controlling Assets Employedsumitchawla12No ratings yet

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsNo ratings yet

- KLCP Codec LogDocument5 pagesKLCP Codec LogNurul SariNo ratings yet

- Reflects The Condition in IndonesiaDocument1 pageReflects The Condition in IndonesianurulsiuulNo ratings yet

- Over The Years), It Is Time To "Disinvest" or Reduce Further Investments Into This AssetDocument1 pageOver The Years), It Is Time To "Disinvest" or Reduce Further Investments Into This AssetNurul SariNo ratings yet

- Tugas MCS-Nurul Sari (1101002048) - Case 4.4Document8 pagesTugas MCS-Nurul Sari (1101002048) - Case 4.4Nurul SariNo ratings yet

- HomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Document5 pagesHomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Nurul SariNo ratings yet

- Tugas MCS-Nurul Sari (1101002048) - Case 3.1 3.3Document6 pagesTugas MCS-Nurul Sari (1101002048) - Case 3.1 3.3Nurul SariNo ratings yet

- HomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Document5 pagesHomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Nurul SariNo ratings yet

- Tugas MCS-Nurul Sari (1101002048) - Case 4.4Document8 pagesTugas MCS-Nurul Sari (1101002048) - Case 4.4Nurul SariNo ratings yet

- MCS Case1 Nurul Sari (1101002048)Document3 pagesMCS Case1 Nurul Sari (1101002048)Nurul SariNo ratings yet

- The Following Is The Unadjusted Trial Balance For Rainbow LodgeDocument3 pagesThe Following Is The Unadjusted Trial Balance For Rainbow LodgeCharlotteNo ratings yet

- Cambridge IGCSE: Accounting 0452/22Document20 pagesCambridge IGCSE: Accounting 0452/22Valerine VictoriaNo ratings yet

- PMC BANK AR 2019 Website FinalDocument88 pagesPMC BANK AR 2019 Website FinalnewsofthemarketNo ratings yet

- Wapda InternshipDocument59 pagesWapda InternshipMubashir HussainNo ratings yet

- Intermediate Accounting Vol 1 Canadian 2nd Edition Lo Test Bank 1Document91 pagesIntermediate Accounting Vol 1 Canadian 2nd Edition Lo Test Bank 1anthony100% (44)

- Managerial Accounting Session 1: Optimal Pricing and Opportunity CostDocument31 pagesManagerial Accounting Session 1: Optimal Pricing and Opportunity CostVarsha ShirsatNo ratings yet

- Most Common Finance Interview QuestionsDocument20 pagesMost Common Finance Interview QuestionsAyushiNo ratings yet

- Working Capital in C.L. GUPTADocument106 pagesWorking Capital in C.L. GUPTAprince395No ratings yet

- Nestle Financial Statements - Keystone BankDocument15 pagesNestle Financial Statements - Keystone Bankemmanuelleonard54No ratings yet

- Problem 2-4Document6 pagesProblem 2-4Dan Shadrach DapegNo ratings yet

- HANSSON PRIVATE LABEL Income Statement and Cash Flow AnalysisDocument34 pagesHANSSON PRIVATE LABEL Income Statement and Cash Flow Analysisincognito12312333% (3)

- Vidya Mandir Ind. PU College Accountancy 2 PUC Assessment 1-July 2020 Total Marks:30 Answer All QuestionsDocument2 pagesVidya Mandir Ind. PU College Accountancy 2 PUC Assessment 1-July 2020 Total Marks:30 Answer All QuestionsBlahjNo ratings yet

- Accounting For Business: Ratio Analysis 1: Profitability, Efficiency and PerformanceDocument40 pagesAccounting For Business: Ratio Analysis 1: Profitability, Efficiency and PerformanceegNo ratings yet

- Oracle R12 E-Business Tax Design DocumentDocument7 pagesOracle R12 E-Business Tax Design Documentorafinr12docs100% (2)

- Proposal AirbnbDocument2 pagesProposal Airbnbkyaka herman ceaserNo ratings yet

- Form PDF 763181760311022Document88 pagesForm PDF 763181760311022safiNo ratings yet

- Financial Management MCQ QuestionsDocument8 pagesFinancial Management MCQ QuestionsAbhijeet Singh BaghelNo ratings yet

- A Guide To Understanding The Budget in Pakistan (English)Document48 pagesA Guide To Understanding The Budget in Pakistan (English)Shahriar Kabir0% (1)

- Taxation Case Digest Local TaxationDocument8 pagesTaxation Case Digest Local TaxationYsabelleNo ratings yet

- Chapter 19Document42 pagesChapter 19Karissa GaviolaNo ratings yet

- January 31,1955 Vol.181 No.5399 PDFDocument56 pagesJanuary 31,1955 Vol.181 No.5399 PDFSaikotkhan0No ratings yet

- Accounting For Governmental / Chapter 4Document9 pagesAccounting For Governmental / Chapter 4Kenneth BunnarkNo ratings yet

- London Youth SymphonyDocument14 pagesLondon Youth SymphonyAB D'oria0% (1)

- Super Asia Agri Final For 2nd Print PDFDocument72 pagesSuper Asia Agri Final For 2nd Print PDFSeemab Sheikh QurashiNo ratings yet

- CH 05Document72 pagesCH 05Angela KuswandiNo ratings yet

- CPA FAR F-1 NotesDocument25 pagesCPA FAR F-1 NotesRob Ricco100% (4)

- CAHPTER 3. Analisis Keuangan (Analysis of Financial Statements) MankeuDocument12 pagesCAHPTER 3. Analisis Keuangan (Analysis of Financial Statements) MankeuKezia NatashaNo ratings yet

- Topic 2: Basic Accounting ConceptsDocument38 pagesTopic 2: Basic Accounting ConceptsShanti GunaNo ratings yet

- BADVAC3X - 2T 2021 Final Exam: Government and Non-For-Profit AccountingDocument33 pagesBADVAC3X - 2T 2021 Final Exam: Government and Non-For-Profit AccountingJennalyn DamasoNo ratings yet

- Business PlanDocument13 pagesBusiness PlanKambaii100% (1)