Professional Documents

Culture Documents

ACCT Ch. 19 Test Bank

Uploaded by

The Lotus EaterOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT Ch. 19 Test Bank

Uploaded by

The Lotus EaterCopyright:

Available Formats

CHAPTER 19

ACCOUNTING FOR INCOME TAXES

IFRS questions are availa le at t!e en" o# t!is $!a%ter&

TRUE'FA(SE)Con$e%tual

Ans*er

F F T T F T F T F T F T T F F T T T F F

No&

1. 2. 3. 4. 5. 6. 7. #. &. 1(. 11. 12. 13. 14. 15. 16. 17. 1#. 1&. 2(.

+es$ri%tion

Taxable income. Use of pretax financial income. Taxable amounts. Deferred tax liability. Deductible amounts. Deferred tax asset. eed for !aluation allo"ance account. $ositi!e and ne%ati!e e!idence. 'omputation of income tax expense. Taxable temporary differences. Taxable temporary difference examples. $ermanent differences. )pplyin% tax rates to temporary differences. '*an%e in tax rates. )ccountin% for a loss carrybac+. Tax effect of a loss carryfor"ard. $ossible source of taxable income. 'lassification of deferred tax assets and liabilities. 'lassification of deferred tax accounts. ,et*od used for accountin% for income taxes.

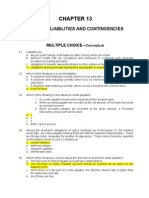

MU(TIP(E CHOICE)Con$e%tual

Ans*er

b c b a a b c d b c d c d d d b a

No&

21. 22. 23. 24. $ 25. 26. $ 27. 2#. 2&. 3(. 31. 32. 33. 34. 35. 36. 37.

+es$ri%tion

Differences bet"een taxable and accountin% income. Differences bet"een taxable and accountin% income. Determination of deferred tax expense. Differences arisin% from depreciation met*ods. Temporary difference and a re!enue item. .ffect of future taxable amount. 'auses of a deferred tax liability. Distinction bet"een temporary and permanent differences. /dentification of deductible temporary difference. /dentification of taxable temporary difference. /dentification of future taxable amounts. /dentify a permanent difference. /dentification of permanent differences. /dentification of temporary differences. Difference due to t*e e0uity met*od of in!estment accountin%. Difference due to unreali1ed loss on mar+etable securities. /dentification of deductible temporary differences.

19 ' 1 d

Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition 3#. /dentification of temporary difference.

)ccountin% for /ncome Taxes

19 ' 4

MU(TIP(E CHOICE)Con$e%tual 2$ont&3

Ans*er

c c b a d c d c b d d c c

$ -

No&

-

+es$ri%tion

)ccountin% for c*an%e in tax rate. )ppropriate tax rate for deferred tax amounts. 2eco%nition of tax benefit of a loss carryfor"ard. 2eco%nition of !aluation account for deferred tax asset. Definition of uncertain tax positions. 2eco%nition of tax benefit "it* uncertain tax position. 2easons for disclosure of deferred income tax information. 'lassification of deferred income tax on t*e balance s*eet. 'lassification of deferred income tax on t*e balance s*eet. 3asis for classification as current or noncurrent. /ncome statement presentation of a tax benefit from 45 carryfor"ard. 'lassification of a deferred tax liability. $rocedures for computin% deferred income taxes.

3&. 4(. 41. 42. 43. 44. 45. 46. 47. 4#. 4&. 5(. 51.

T*ese 0uestions also appear in t*e $roblem6-ol!in% -ur!i!al 7uide. T*ese 0uestions also appear in t*e -tudy 7uide. 8T*is topic is dealt "it* in an )ppendix to t*e c*apter.

MU(TIP(E CHOICE)Co.%utational

Ans*er

c b a a d c b d c d b d a a a c a b a a d b c d b d b b

No&

52 53. 54. 55. 56. 57. 5#. 5&. 6(. 61. 62. 63. 64. 65. 66. 67. 6#. 6&. 7(. 71. 72. 73. 74. 75. 76. 77. 7#. 7&.

+es$ri%tion

'alculate boo+ basis and tax basis of an asset. 'alculate deferred tax liability balance. 'alculate current9noncurrent portions of deferred tax liability. 'alculate income tax expense for t*e year. 'alculate amount of deferred tax asset to be reco%ni1ed. 'alculate current deferred tax liability. Determine income taxes payable for t*e year. 'alculate amount of deferred tax asset to be reco%ni1ed. 'alculate current9noncurrent portions of deferred tax liability. 'alculate amount deducted for depreciation on t*e tax return. 'alculate amount of deferred tax asset to be reco%ni1ed. 'alculate deferred tax asset "it* temporary and permanent differences. 'alculate amount of DT) !aluation account. 'alculate current portion of pro!ision for income taxes. 'alculate deferred portion of income tax expense. 'omputation of total income tax expense. 'alculate installment accounts recei!able. 'omputation of pretax financial income. 'alculate deferred tax liability amount. 'alculate income tax expense for t*e year. 'alculate income tax expense for t*e year. 'omputation of income tax expense. 'omputation of income tax expense. 'omputation of "arranty claims paid. 'alculate taxable income for t*e year. 'alculate deferred tax asset amount. 'alculate deferred tax liability balance. 'alculate income taxes payable amount.

19 ' 5

Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition

MU(TIP(E CHOICE)Co.%utational 2$ont&3

Ans*er

a b b a c d b b d d b a a d c

No&

#(. #1. #2. #3. #4. #5. #6. #7. ##. #&. &(. &1. &2. &3. &4.

+es$ri%tion

'alculate deferred tax asset amount. 'alculate taxable income for t*e year. 'alculate pretax financial income. 'alculate deferred tax liability "it* c*an%in% tax rates. 'alculate deferred tax liability amount. 'alculate income tax expense "it* c*an%in% tax rates. Determine c*an%e in deferred tax liability. 'alculate deferred tax liability "it* c*an%in% tax rates. 'alculate loss to be reported after 45 carrybac+. 'alculate loss to be reported after 45 carrybac+. 'alculate loss to be reported after 45 carryfor"ard. Determine income tax refund follo"in% an 45 carrybac+. 'alculate income tax benefit from an 45 carrybac+. 'alculate income tax payable after 45 carryfor"ard. 'alculate deferred tax asset after 45 carryfor"ard.

MU(TIP(E CHOICE)CPA A"a%te"

Ans*er

a a c d d b a a c c

No&

&5. &6. &7. &#. &&. 1((. 1(1. 1(2. 1(3. 1(4.

+es$ri%tion

Determine current income tax liability. Determine current income tax liability. Deferred tax liability arisin% from depreciation met*ods. Deferred tax liability "*en usin% e0uity met*od of in!estment accountin%. 'alculate deferred tax liability and income taxes currently payable. Determine current income tax expense. Deferred income tax liability from temporary and permanent differences. Deferred tax liability arisin% from installment met*od. Differences arisin% from depreciation and "arranty expenses. Deferred tax asset arisin% from "arranty expenses.

EXERCISES

Ite.

.1&61(5 .1&61(6 .1&61(7 .1&61(# .1&61(& .1&611( .1&6111 .1&6112 .1&6113

+es$ri%tion

'omputation of taxable income. Future taxable and deductible amounts :essay;. Deferred income taxes. Deferred income taxes. 2eco%nition of deferred tax asset. $ermanent and temporary differences. $ermanent and temporary differences. Temporary differences. 4peratin% loss carryfor"ard.

)ccountin% for /ncome Taxes

19 ' 8

PRO,(EMS

Ite.

$1&6114 $1&6115 $1&6116 $1&6117

+es$ri%tion

Differences bet"een accountin% and taxable income and t*e effect on deferred taxes. ,ultiple temporary differences. Deferred tax asset. /nterperiod tax allocation "it* c*an%e in enacted tax rates.

CHAPTER (EARNING O,6ECTI7ES

1. 2. 3. 4. 5. 6. 7. #. &. 1(. 811. /dentify differences bet"een pretax financial income and taxable income. Describe a temporary difference t*at results in future taxable amounts. Describe a temporary difference t*at results in future deductible amounts. .xplain t*e purpose of a deferred tax asset !aluation allo"ance. Describe t*e presentation of income tax expense in t*e income statement. Describe !arious temporary and permanent differences. .xplain t*e effect of !arious tax rates and tax rate c*an%es on deferred income taxes. )pply accountin% procedures for a loss carrybac+ and a loss carryfor"ard. Describe t*e presentation of deferred income taxes in financial statements. /ndicate t*e basic principles of t*e asset6liability met*od. Understand and apply t*e concepts and procedures of interperiod tax allocation.

19 ' <

Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition

SUMMAR9 OF (EARNING O,6ECTI7ES ,9 :UESTIONS

Item 1. 2. 3. 4. 24. 5. 6. 56. 7. &. 26. Type TF TF TF TF ,' TF TF ,' TF TF ,' TF TF TF ,' ,' TF TF TF TF TF TF ,' TF Item 21. 22.

$

Type ,' ,' ,' ,' ,' ,' ,' ,' TF ,' ,' ,' ,' ,' ,' ,' ,' ,' TF ,' ,' ,' ,' ,'

Item 23. &5. 54. 55. 5#. 63. 1(6. 1(7. 64. 67. &&. 34. 35. 36. 37. 3#. #3. #4. 42. ##. 47. 4#. 4&.

Type

Item

Type

Item

Type $ $ . . $ $ $ $

Item 116.

Type $

Item

Type

25. 52. 53. 5&. 61. 62. #. 65. 66.

1(. 11. 12. $ 27. 2#. 13. 14. 15. 16. 1#. 1&. 43. 2(. ote<

2&. 3(. 31. 32. 33.

-

3&. 4(. 17. 41. 44. 45. 46. 51.

(earnin/ O ;e$tive 1 ,' &6. ,' 114. ,' 1(5. . 115. (earnin/ O ;e$tive 1 ,' &7. ,' 1(7. ,' &#. ,' 1(#. ,' 1(6. . 114. (earnin/ O ;e$tive 4 ,' 1(#. . 114. . 1(&. . 115. . 113. . 116. (earnin/ O ;e$tive 5 ,' (earnin/ O ;e$tive 8 ,' 1((. ,' ,' 113. . (earnin/ O ;e$tive < ,' 6#. ,' 73. ,' 6&. ,' 74. ,' 7(. ,' 75. ,' 71. ,' 76. ,' 72. ,' 77. (earnin/ O ;e$tive = ,' #5. ,' #7. ,' #6. ,' 117. (earnin/ O ;e$tive > ,' #&. ,' &1. ,' &(. ,' &2. (earnin/ O ;e$tive 9 ,' 5(. ,' 1((. ,' 57. ,' 1(1. ,' 6(. ,' 1(2. (earnin/ O ;e$tive 1?

115. 116.

$ $

,' ,' ,' ,' ,' ,' $ ,' ,' ,' ,' ,'

7#. 7&. #(. #1. #2.

,' ,' ,' ,' ,'

11(. 111. 112. 114. 116.

. . . $ $

&3. &4. 1(3. 1(4. 116.

,' ,' ,' ,' $

113.

TF = True6False ,' = ,ultiple '*oice . = .xercise $ = $roblem

)ccountin% for /ncome Taxes

19 ' =

TRUE'FA(SE)Con$e%tual

1. 2. 3. 4. 5. 6. 7. #. &. 1(. 11. 12. 13. 14. 15. 16. 17. 1#. Taxable income is a tax accountin% term and is also referred to as income before taxes. $retax financial income is t*e amount used to compute income tax payable. Taxable amounts increase taxable income in future years. ) deferred tax liability represents t*e increase in taxes payable in future years as a result of taxable temporary differences existin% at t*e end of t*e current year. Deductible amounts cause taxable income to be %reater t*an pretax financial income in t*e future as a result of existin% temporary differences. ) deferred tax asset represents t*e increase in taxes refundable in future years as a result of deductible temporary differences existin% at t*e end of t*e current year. ) company reduces a deferred tax asset by a !aluation allo"ance if it is probable t*at it "ill not reali1e some portion of t*e deferred tax asset. 'ompanies s*ould consider bot* positi!e and ne%ati!e e!idence to determine "*et*er it needs to record a !aluation allo"ance to reduce a deferred tax asset. ) company s*ould add a decrease in a deferred tax liability to income tax payable in computin% income tax expense. Taxable temporary differences "ill result in taxable amounts in future years "*en t*e related assets are reco!ered. .xamples of taxable temporary differences are subscriptions recei!ed in ad!ance and ad!ance rental receipts. $ermanent differences do not %i!e rise to future taxable or deductible amounts. 'ompanies must consider presently enacted c*an%es in t*e tax rate t*at become effecti!e in future years "*en determinin% t*e tax rate to apply to existin% temporary differences. >*en a c*an%e in t*e tax rate is enacted? t*e effect is reported as an ad@ustment to income tax payable in t*e period of t*e c*an%e. Under t*e loss carrybac+ approac*? companies must apply a current year loss to t*e most recent year first and t*en to an earlier year. T*e tax effect of a loss carryfor"ard represents future tax sa!in%s and results in t*e reco%nition of a deferred tax asset. ) possible source of taxable income t*at may be a!ailable to reali1e a tax benefit for loss carryfor"ards is future re!ersals of existin% taxable temporary differences. )n indi!idual deferred tax asset or liability is classified as current or noncurrent based on t*e classification of t*e related asset9liability for financial reportin% purposes.

19 ' > 1&. 2(.

Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition 'ompanies s*ould classify t*e balances in t*e deferred tax accounts on t*e balance s*eet as noncurrent assets and noncurrent liabilities. T*e F)-3 belie!es t*at t*e deferred tax met*od is t*e most consistent met*od for accountin% for income taxes.

True'False Ans*ers)Con$e%tual

Ite. 1. 2. 3. 4. 5. Ans& F F T T F Ite. 6. 7. #. &. 1(. Ans& T F T F T Ite. 11. 12. 13. 14. 15. Ans& F T T F F Ite. 16. 17. 1#. 1&. 2(. Ans& T T T F F

MU(TIP(E CHOICE)Con$e%tual

21. Taxable income of a corporation a. differs from accountin% income due to differences in intraperiod allocation bet"een t*e t"o met*ods of income determination. b. differs from accountin% income due to differences in interperiod allocation and permanent differences bet"een t*e t"o met*ods of income determination. c. is based on %enerally accepted accountin% principles. d. is reported on t*e corporationAs income statement. Taxable income of a corporation differs from pretax financial income because of $ermanent Differences o o Bes Bes Temporary Differences o Bes Bes o

22

a. b. c. d. 23.

T*e deferred tax expense is t*e a. increase in balance of deferred tax asset minus t*e increase in balance of deferred tax liability. b. increase in balance of deferred tax liability minus t*e increase in balance of deferred tax asset. c. increase in balance of deferred tax asset plus t*e increase in balance of deferred tax liability. d. decrease in balance of deferred tax asset minus t*e increase in balance of deferred tax liability.

)ccountin% for /ncome Taxes 24.

19 ' 9

,ac*inery "as ac0uired at t*e be%innin% of t*e year. Depreciation recorded durin% t*e life of t*e mac*inery could result in Future Taxable )mounts Bes Bes o o Future Deductible )mounts Bes o Bes o

a. b. c. d.

$

25.

) temporary difference arises "*en a re!enue item is reported for tax purposes in a period )fter it is reported 3efore it is reported in financial income in financial income a. Bes Bes b. Bes o c. o Bes d. o o )t t*e December 31? 2(1( balance s*eet date? Unru* 'orporation reports an accrued recei!able for financial reportin% purposes but not for tax purposes. >*en t*is asset is reco!ered in 2(11? a future taxable amount "ill occur and a. pretax financial income "ill exceed taxable income in 2(11. b. Unru* "ill record a decrease in a deferred tax liability in 2(11. c. total income tax expense for 2(11 "ill exceed current tax expense for 2(11. d. Unru* "ill record an increase in a deferred tax asset in 2(11. )ssumin% a 4(C statutory tax rate applies to all years in!ol!ed? "*ic* of t*e follo"in% situations "ill %i!e rise to reportin% a deferred tax liability on t*e balance s*eetD /. //. ///. /E. a. b. c. d. ) re!enue is deferred for financial reportin% purposes but not for tax purposes. ) re!enue is deferred for tax purposes but not for financial reportin% purposes. )n expense is deferred for financial reportin% purposes but not for tax purposes. )n expense is deferred for tax purposes but not for financial reportin% purposes.

26.

27.

item // only items / and // only items // and /// only items / and /E only

2#.

) ma@or distinction bet"een temporary and permanent differences is a. permanent differences are not representati!e of acceptable accountin% practice. b. temporary differences occur fre0uently? "*ereas permanent differences occur only once. c. once an item is determined to be a temporary difference? it maintains t*at statusF *o"e!er? a permanent difference can c*an%e in status "it* t*e passa%e of time. d. temporary differences re!erse t*emsel!es in subse0uent accountin% periods? "*ereas permanent differences do not re!erse.

19 ' 1? Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition

-

2&.

>*ic* of t*e follo"in% are temporary differences t*at are normally classified as expenses or losses t*at are deductible after t*ey are reco%ni1ed in financial incomeD a. )d!ance rental receipts. b. $roduct "arranty liabilities. c. Depreciable property. d. Fines and expenses resultin% from a !iolation of la". >*ic* of t*e follo"in% is a temporary difference classified as a re!enue or %ain t*at is taxable after it is reco%ni1ed in financial incomeD a. -ubscriptions recei!ed in ad!ance. b. $repaid royalty recei!ed in ad!ance. c. )n installment sale accounted for on t*e accrual basis for financial reportin% purposes and on t*e installment :cas*; basis for tax purposes. d. /nterest recei!ed on a municipal obli%ation. >*ic* of t*e follo"in% differences "ould result in future taxable amountsD a. .xpenses or losses t*at are tax deductible after t*ey are reco%ni1ed in financial income. b. 2e!enues or %ains t*at are taxable before t*ey are reco%ni1ed in financial income. c. 2e!enues or %ains t*at are reco%ni1ed in financial income but are ne!er included in taxable income. d. .xpenses or losses t*at are tax deductible before t*ey are reco%ni1ed in financial income. -tuart 'orporationAs taxable income differed from its accountin% income computed for t*is past year. )n item t*at "ould create a permanent difference in accountin% and taxable incomes for -tuart "ould be a. a balance in t*e Unearned 2ent account at year end. b. usin% accelerated depreciation for tax purposes and strai%*t6line depreciation for boo+ purposes. c. a fine resultin% from !iolations of 4-G) re%ulations. d. ma+in% installment sales durin% t*e year. )n example of a permanent difference is a. proceeds from life insurance on officers. b. interest expense on money borro"ed to in!est in municipal bonds. c. insurance expense for a life insurance policy on officers. d. all of t*ese. >*ic* of t*e follo"in% "ill not result in a temporary differenceD a. $roduct "arranty liabilities b. )d!ance rental receipts c. /nstallment sales d. )ll of t*ese "ill result in a temporary difference. ) company uses t*e e0uity met*od to account for an in!estment. T*is "ould result in "*at type of difference and in "*at type of deferred income taxD a. b. c. d. Type of Difference $ermanent $ermanent Temporary Temporary Deferred Tax )sset 5iability )sset 5iability

3(.

31.

32.

33.

34.

35.

)ccountin% for /ncome Taxes 36.

19 ' 11

) company records an unreali1ed loss on s*ort6term securities. T*is "ould result in "*at type of difference and in "*at type of deferred income taxD a. b. c. d. Type of Difference Temporary Temporary $ermanent $ermanent Deferred Tax 5iability )sset 5iability )sset

37.

>*ic* of t*e follo"in% temporary differences results in a deferred tax asset in t*e year t*e temporary difference ori%inatesD /. )ccrual for product "arranty liability. //. -ubscriptions recei!ed in ad!ance. ///. $repaid insurance expense. a. / and // only. b. // only. c. /// only. d. / and /// only. >*ic* of t*e follo"in% is not considered a permanent differenceD a. /nterest recei!ed on municipal bonds. b. Fines resultin% from !iolatin% t*e la". c. $remiums paid for life insurance on a companyHs '.4 "*en t*e company is t*e beneficiary. d. -toc+6based compensation expense. >*en a c*an%e in t*e tax rate is enacted into la"? its effect on existin% deferred income tax accounts s*ould be a. *andled retroacti!ely in accordance "it* t*e %uidance related to c*an%es in accountin% principles. b. considered? but it s*ould only be recorded in t*e accounts if it reduces a deferred tax liability or increases a deferred tax asset. c. reported as an ad@ustment to tax expense in t*e period of c*an%e. d. applied to all temporary or permanent differences t*at arise prior to t*e date of t*e enactment of t*e tax rate c*an%e? but not subse0uent to t*e date of t*e c*an%e. Tax rates ot*er t*an t*e current tax rate may be used to calculate t*e deferred income tax amount on t*e balance s*eet if a. it is probable t*at a future tax rate c*an%e "ill occur. b. it appears li+ely t*at a future tax rate "ill be %reater t*an t*e current tax rate. c. t*e future tax rates *a!e been enacted into la". d. it appears li+ely t*at a future tax rate "ill be less t*an t*e current tax rate. 2eco%nition of tax benefits in t*e loss year due to a loss carryfor"ard re0uires a. t*e establis*ment of a deferred tax liability. b. t*e establis*ment of a deferred tax asset. c. t*e establis*ment of an income tax refund recei!able. d. only a note to t*e financial statements.

3#.

3&.

4(.

41.

19 ' 11 Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition 42. 2eco%ni1in% a !aluation allo"ance for a deferred tax asset re0uires t*at a company a. consider all positi!e and ne%ati!e information in determinin% t*e need for a !aluation allo"ance. b. consider only t*e positi!e information in determinin% t*e need for a !aluation allo"ance. c. ta+e an a%%ressi!e approac* in its tax plannin%. d. pass a reco%nition t*res*old? after assumin% t*at it "ill be audited by taxin% aut*orities. Uncertain tax positions /. )re positions for "*ic* t*e tax aut*orities may disallo" a deduction in "*ole or in part. //. /nclude instances in "*ic* t*e tax la" is clear and in "*ic* t*e company belie!es an audit is li+ely. ///. 7i!e rise to tax expense by increasin% payables or increasin% a deferred tax liability. a. /? //? and ///. b. / and /// only. c. // only. d. / only. >it* re%ard to uncertain tax positions? t*e F)-3 re0uires t*at companies reco%ni1e a tax benefit "*en a. it is probable and can be reasonably estimated. b. t*ere is at least a 51C probability t*at t*e uncertain tax position "ill be appro!ed by t*e taxin% aut*orities. c. it is more li+ely t*an not t*at t*e tax position "ill be sustained upon audit. d. )ny of t*e abo!e exist. ,a@or reasons for disclosure of deferred income tax information is :are; a. better assessment of 0uality of earnin%s. b. better predictions of future cas* flo"s. c. t*at it may be *elpful in settin% %o!ernment policy. d. all of t*ese. )ccountin% for income taxes can result in t*e reportin% of deferred taxes as any of t*e follo"in% except a. a current or lon%6term asset. b. a current or lon%6term liability. c. a contra6asset account. d. )ll of t*ese are acceptable met*ods of reportin% deferred taxes. Deferred taxes s*ould be presented on t*e balance s*eet a. as one net debit or credit amount. b. in t"o amounts< one for t*e net current amount and one for t*e net noncurrent amount. c. in t"o amounts< one for t*e net debit amount and one for t*e net credit amount. d. as reductions of t*e related asset or liability accounts.

43.

44.

45.

46.

47.

)ccountin% for /ncome Taxes 4#.

19 ' 14

Deferred tax amounts t*at are related to specific assets or liabilities s*ould be classified as current or noncurrent based on a. t*eir expected re!ersal dates. b. t*eir debit or credit balance. c. t*e len%t* of time t*e deferred tax amounts "ill %enerate future tax deferral benefits. d. t*e classification of t*e related asset or liability. Tanner? /nc. incurred a financial and taxable loss for 2(1(. Tanner t*erefore decided to use t*e carrybac+ pro!isions as it *ad been profitable up to t*is year. Go" s*ould t*e amounts related to t*e carrybac+ be reported in t*e 2(1( financial statementsD a. T*e reduction of t*e loss s*ould be reported as a prior period ad@ustment. b. T*e refund claimed s*ould be reported as a deferred c*ar%e and amorti1ed o!er fi!e years. c. T*e refund claimed s*ould be reported as re!enue in t*e current year. d. T*e refund claimed s*ould be s*o"n as a reduction of t*e loss in 2(1(. ) deferred tax liability is classified on t*e balance s*eet as eit*er a current or a noncurrent liability. T*e current amount of a deferred tax liability s*ould %enerally be a. t*e net deferred tax conse0uences of temporary differences t*at "ill result in net taxable amounts durin% t*e next year. b. totally eliminated from t*e financial statements if t*e amount is related to a noncurrent asset. c. based on t*e classification of t*e related asset or liability for financial reportin% purposes. d. t*e total of all deferred tax conse0uences t*at are not expected to re!erse in t*e operatin% period or one year? "*ic*e!er is %reater. )ll of t*e follo"in% are procedures for t*e computation of deferred income taxes except to a. identify t*e types and amounts of existin% temporary differences. b. measure t*e total deferred tax liability for taxable temporary differences. c. measure t*e total deferred tax asset for deductible temporary differences and operatin% loss carrybac+s. d. )ll of t*ese are procedures in computin% deferred income taxes.

4&.

5(.

51.

Multi%le C!oi$e Ans*ers)Con$e%tual

Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans&

21. 22. 23. 24. 25.

b c b a a

26. 27. 2#. 2&. 3(.

b c d b c

31. 32. 33. 34. 35.

d c d d d

36. 37. 3#. 3&. 4(.

b a d c c

41. 42. 43. 44. 45.

b a d c d

46. 47. 4#. 4&. 5(.

c b d d c

51.

19 ' 15 Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition

MU(TIP(E CHOICE)Co.%utational

Use t*e follo"in% information for 0uestions 52 and 53. )t t*e be%innin% of 2(1(? $itman 'o. purc*ased an asset for I6((?((( "it* an estimated useful life of 5 years and an estimated sal!a%e !alue of I5(?(((. For financial reportin% purposes t*e asset is bein% depreciated usin% t*e strai%*t6line met*odF for tax purposes t*e double6declinin%6 balance met*od is bein% used. $itman 'o.Hs tax rate is 4(C for 2(1( and all future years. 52. )t t*e end of 2(1(? "*at is t*e boo+ basis and t*e tax basis of t*e assetD 3oo+ basis Tax basis a. I44(?((( I31(?((( b. I4&(?((( I31(?((( c. I4&(?((( I36(?((( d. I44(?((( I36(?((( )t t*e end of 2(1(? "*ic* of t*e follo"in% deferred tax accounts and balances is reported on $itmanHs balance s*eetD )ccount J 3alance a. Deferred tax asset I52?((( b. Deferred tax liability I52?((( c. Deferred tax asset I7#?((( d. Deferred tax liability I7#?((( 5e*man 'orporation purc*ased a mac*ine on Kanuary 2? 2((&? for I2?(((?(((. T*e mac*ine *as an estimated 56year life "it* no sal!a%e !alue. T*e strai%*t6line met*od of depreciation is bein% used for financial statement purposes and t*e follo"in% ,)'2amounts "ill be deducted for tax purposes< 2((& 2(1( 2(11 I4((?((( 64(?((( 3#4?((( 2(12 2(13 2(14 I23(?((( 23(?((( 116?(((

53.

54.

)ssumin% an income tax rate of 3(C for all years? t*e net deferred tax liability t*at s*ould be reflected on 5e*manAs balance s*eet at December 31? 2(1(? s*ould be Deferred Tax 5iability 'urrent oncurrent I( I72?((( I4?#(( I67?2(( I67?2(( I4?#(( I72?((( I(

a. b. c. d.

Use t*e follo"in% information for 0uestions 55 t*rou%* 57. ,at*is 'o. at t*e end of 2(1(? its first year of operations? prepared a reconciliation bet"een pretax financial income and taxable income as follo"s< $retax financial income I 5((?((( .stimated liti%ation expense 1?25(?((( /nstallment sales :1?(((?(((; Taxable income I 75(?(((

)ccountin% for /ncome Taxes

19 ' 18

T*e estimated liti%ation expense of I1?25(?((( "ill be deductible in 2(12 "*en it is expected to be paid. T*e %ross profit from t*e installment sales "ill be reali1ed in t*e amount of I5((?((( in eac* of t*e next t"o years. T*e estimated liability for liti%ation is classified as noncurrent and t*e installment accounts recei!able are classified as I5((?((( current and I5((?((( noncurrent. T*e income tax rate is 3(C for all years. 55. T*e income tax expense is a. I15(?(((. b. I225?(((. c. I25(?(((. d. I5((?(((. T*e deferred tax asset to be reco%ni1ed is a. I(. b. I75?((( current. c. I375?((( current. d. I375?((( noncurrent. T*e deferred tax liabilityLcurrent to be reco%ni1ed is a. I75?(((. b. I225?(((. c. I15(?(((. d. I3((?(((.

56.

57.

Use t*e follo"in% information for 0uestions 5# t*rou%* 6(. Gop+ins 'o. at t*e end of 2(1(? its first year of operations? prepared a reconciliation bet"een pretax financial income and taxable income as follo"s< $retax financial income .stimated liti%ation expense .xtra depreciation for taxes Taxable income I 75(?((( 1?(((?((( :1?5((?(((; I 25(?(((

T*e estimated liti%ation expense of I1?(((?((( "ill be deductible in 2(11 "*en it is expected to be paid. Use of t*e depreciable assets "ill result in taxable amounts of I5((?((( in eac* of t*e next t*ree years. T*e income tax rate is 3(C for all years. 5#. /ncome tax payable is a. I(. b. I75?(((. c. I15(?(((. d. I225?(((. T*e deferred tax asset to be reco%ni1ed is a. I75?((( current. b. I15(?((( current. c. I225?((( current. d. I3((?((( current.

5&.

19 ' 1< Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition 6(. T*e deferred tax liability to be reco%ni1ed is 'urrent oncurrent a. I15(?((( I3((?((( b. I15(?((( I225?((( c. I( I45(?((( d. I( I375?((( .c+ert 'orporationAs partial income statement after its first year of operations is as follo"s< /ncome before income taxes /ncome tax expense 'urrent Deferred et income I3?75(?((( I1?(35?((( &(?((( 1?125?((( I2?625?(((

61.

.c+ert uses t*e strai%*t6line met*od of depreciation for financial reportin% purposes and accelerated depreciation for tax purposes. T*e amount c*ar%ed to depreciation expense on its boo+s t*is year "as I1?5((?(((. o ot*er differences existed bet"een boo+ income and taxable income except for t*e amount of depreciation. )ssumin% a 3(C tax rate? "*at amount "as deducted for depreciation on t*e corporationAs tax return for t*e current yearD a. I1?2((?((( b. I1?425?((( c. I1?5((?((( d. I1?#((?((( 62. 'ross 'ompany reported t*e follo"in% results for t*e year ended December 31? 2(1(? its first year of operations< 2((7 /ncome :per boo+s before income taxes; I 75(?((( Taxable income 1?2((?((( T*e disparity bet"een boo+ income and taxable income is attributable to a temporary difference "*ic* "ill re!erse in 2(11. >*at s*ould 'ross record as a net deferred tax asset or liability for t*e year ended December 31? 2(1(? assumin% t*at t*e enacted tax rates in effect are 4(C in 2(1( and 35C in 2(11D a. I1#(?((( deferred tax liability b. I157?5(( deferred tax asset c. I1#(?((( deferred tax asset d. I157?5(( deferred tax liability 63. /n 2(1(? Mrause 'ompany accrued? for financial statement reportin%? estimated losses on disposal of unused plant facilities of I1?5((?(((. T*e facilities "ere sold in ,arc* 2(11 and a I1?5((?((( loss "as reco%ni1ed for tax purposes. )lso in 2(1(? Mrause paid I1((?((( in premiums for a t"o6year life insurance policy in "*ic* t*e company "as t*e beneficiary. )ssumin% t*at t*e enacted tax rate is 3(C in bot* 2(1( and 2(11? and t*at Mrause paid I7#(?((( in income taxes in 2(1(? t*e amount reported as net deferred income taxes on MrauseAs balance s*eet at December 31? 2(1(? s*ould be a a. I42(?((( asset. b. I36(?((( asset. c. I36(?((( liability. d. I45(?((( asset.

)ccountin% for /ncome Taxes 64.

19 ' 1=

Gorner 'orporation *as a deferred tax asset at December 31? 2(11 of I#(?((( due to t*e reco%nition of potential tax benefits of an operatin% loss carryfor"ard. T*e enacted tax rates are as follo"s< 4(C for 2((#N2(1(F 35C for 2(11F and 3(C for 2(12 and t*ereafter. )ssumin% t*at mana%ement expects t*at only 5(C of t*e related benefits "ill actually be reali1ed? a !aluation account s*ould be establis*ed in t*e amount of< a. I4(?((( b. I16?((( c. I14?((( d. I12?((( >atson 'orporation prepared t*e follo"in% reconciliation for its first year of operations< $retax financial income for 2(11 I1?2((?((( Tax exempt interest :1((?(((; 4ri%inatin% temporary difference :3((?(((; Taxable income I#((?((( T*e temporary difference "ill re!erse e!enly o!er t*e next t"o years at an enacted tax rate of 4(C. T*e enacted tax rate for 2(11 is 2#C. >*at amount s*ould be reported in its 2(11 income statement as t*e current portion of its pro!ision for income taxesD a. I224?((( b. I32(?((( c. I336?((( d. I4#(?(((

65.

Use t*e follo"in% information for 0uestions 66 and 67. ,itc*ell 'orporation prepared t*e follo"in% reconciliation for its first year of operations< $retax financial income for 2(11 Tax exempt interest 4ri%inatin% temporary difference Taxable income I &((?((( :75?(((; :225?(((; I6((?(((

T*e temporary difference "ill re!erse e!enly o!er t*e next t"o years at an enacted tax rate of 4(C. T*e enacted tax rate for 2(11 is 35C. 66. >*at amount s*ould be reported in its 2(11 income statement as t*e deferred portion of income tax expenseD a. I&(?((( debit b. I12(?((( debit c. I&(?((( credit d. I1(5?((( credit /n ,itc*ellHs 2(11 income statement? "*at amount s*ould be reported for total income tax expenseD a. I33(?((( b. I315?((( c. I3((?((( d. I21(?(((

67.

19 ' 1> Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition 6#. ."in% 'ompany sells *ouse*old furniture. 'ustomers "*o purc*ase furniture on t*e installment basis ma+e payments in e0ual mont*ly installments o!er a t"o6year period? "it* no do"n payment re0uired. ."in%As %ross profit on installment sales e0uals 4(C of t*e sellin% price of t*e furniture. For financial accountin% purposes? sales re!enue is reco%ni1ed at t*e time t*e sale is made. For income tax purposes? *o"e!er? t*e installment met*od is used. T*ere are no ot*er boo+ and income tax accountin% differences? and ."in%As income tax rate is 3(C. /f ."in%As December 31? 2(11? balance s*eet includes a deferred tax liability of I3((?((( arisin% from t*e difference bet"een boo+ and tax treatment of t*e installment sales? it s*ould also include installment accounts recei!able of a. I2?5((?(((. b. I1?(((?(((. c. I75(?(((. d. I3((?(((. 6&. Fer%uson 'ompany *as t*e follo"in% cumulati!e taxable temporary differences< 12931911 I1?35(?((( 1293191( I&6(?(((

T*e tax rate enacted for 2(11 is 4(C? "*ile t*e tax rate enacted for future years is 3(C. Taxable income for 2(11 is I2?4((?((( and t*ere are no permanent differences. Fer%usonAs pretax financial income for 2(11 is a. I3?75(?(((. b. I2?7&(?(((. c. I2?(1(?(((. d. I1?(5(?(((. Use t*e follo"in% information for 0uestions 7( t*rou%* 72. 5yons 'ompany deducts insurance expense of I#4?((( for tax purposes in 2(1(? but t*e expense is not yet reco%ni1ed for accountin% purposes. /n 2(11? 2(12? and 2(13? no insurance expense "ill be deducted for tax purposes? but I2#?((( of insurance expense "ill be reported for accountin% purposes in eac* of t*ese years. 5yons 'ompany *as a tax rate of 4(C and income taxes payable of I72?((( at t*e end of 2(1(. T*ere "ere no deferred taxes at t*e be%innin% of 2(1(. 7(. >*at is t*e amount of t*e deferred tax liability at t*e end of 2(1(D a. I33?6(( b. I2#?#(( c. I12?((( d. I( >*at is t*e amount of income tax expense for 2(1(D a. I1(5?6(( b. I1((?#(( c. I#4?((( d. I72?(((

71.

)ccountin% for /ncome Taxes 72.

19 ' 19

)ssumin% t*at income tax payable for 2(11 is I&6?(((? t*e income tax expense for 2(11 "ould be "*at amountD a. I12&?6(( b. I1(7?2(( c. I&6?((( d. I#4?#((

Use t*e follo"in% information for 0uestions 73 and 74. Mraft 'ompany made t*e follo"in% @ournal entry in late 2(1( for rent on property it leases to Danford 'orporation. 'as* Unearned 2ent 6(?((( 6(?(((

T*e payment represents rent for t*e years 2(11 and 2(12? t*e period co!ered by t*e lease. Mraft 'ompany is a cas* basis taxpayer. Mraft *as income tax payable of I&2?((( at t*e end of 2(1(? and its tax rate is 35C. 73. >*at amount of income tax expense s*ould Mraft 'ompany report at t*e end of 2(1(D a. I53?((( b. I71?((( c. I#1?5(( d. I113?((( )ssumin% t*e taxes payable at t*e end of 2(11 is I1(2?(((? "*at amount of income tax expense "ould Mraft 'ompany record for 2(11D a. I#1?((( b. I&1?5(( c. I112?5(( d. I123?((( T*e follo"in% information is a!ailable for Messler 'ompany after its first year of operations< /ncome before taxes Federal income tax payable Deferred income tax /ncome tax expense et income I25(?((( I1(4?((( :4?(((; 1((?((( I15(?(((

74.

75.

Messler estimates its annual "arranty expense as a percenta%e of sales. T*e amount c*ar%ed to "arranty expense on its boo+s "as I&5?(((. )ssumin% a 4(C income tax rate? "*at amount "as actually paid t*is year for "arranty claimsD a. I1(5?((( b. I1((?((( c. I&5?((( d. I#5?(((

19 ' 1? Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition Use t*e follo"in% information for 0uestions 76N7#. )t t*e be%innin% of 2(1(F .lep*ant? /nc. *ad a deferred tax asset of I4?((( and a deferred tax liability of I6?(((. $re6tax accountin% income for 2(1( "as I3((?((( and t*e enacted tax rate is 4(C. T*e follo"in% items are included in .lep*antHs pre6tax income< /nterest income from municipal bonds )ccrued "arranty costs? estimated to be paid in 2(11 4peratin% loss carryfor"ard /nstallment sales re!enue? "ill be collected in 2(11 $repaid rent expense? "ill be used in 2(11 76. I24?((( I52?((( I3#?((( I26?((( I12?(((

>*at is .lep*ant? /nc.Hs taxable income for 2(1(D a. I3((?((( b. I252?((( c. I34#?((( d. I452?((( >*ic* of t*e follo"in% is re0uired to ad@ust .lep*ant? /nc.Hs deferred tax asset to its correct balance at December 31? 2(1(D a. ) debit of I2(?#(( b. ) credit of I15?2(( c. ) debit of I15?2(( d. ) debit of I16?#(( T*e endin% balance in .lep*ant? /ncHs deferred tax liability at December 31? 2(1( is a. I&?2(( b. I15?2(( c. I1(?4(( d. I31?2((

77.

7#.

Use t*e follo"in% information for 0uestions 7& and #(. 2o"en? /nc. *ad pre6tax accountin% income of I&((?((( and a tax rate of 4(C in 2(1(? its first year of operations. Durin% 2(1( t*e company *ad t*e follo"in% transactions< 2ecei!ed rent from Kane? 'o. for 2(11 ,unicipal bond income Depreciation for tax purposes in excess of boo+ depreciation /nstallment sales re!enue to be collected in 2(11 7&. I32?((( I4(?((( I2(?((( I54?(((

For 2(1(? "*at is t*e amount of income taxes payable for 2o"en? /ncD a. I3(1?6(( b. I327?2(( c. I343?2(( d. I3#6?4((

)ccountin% for /ncome Taxes #(.

19 ' 11

)t t*e end of 2(1(? "*ic* of t*e follo"in% deferred tax accounts and balances is reported on 2o"en? /nc.Hs balance s*eetD )ccount J 3alance a. Deferred tax asset I12?#(( b. Deferred tax liability I12?#(( c. Deferred tax asset I2(?#(( d. Deferred tax liability I2(?#(( 3ased on t*e follo"in% information? compute 2(11 taxable income for -out* 'o. assumin% t*at its pre6tax accountin% income for t*e year ended December 31? 2(11 is I23(?(((. Future taxable Temporary difference :deductible; amount /nstallment sales I1&2?((( Depreciation I6(?((( Unearned rent :I2((?(((; a. b. c. d. I2#2?((( I17#?((( I4#2?((( I222?(((

#1.

#2.

Flemin% 'ompany *as t*e follo"in% cumulati!e taxable temporary differences< 12931911 1293191( I64(?((( I&((?((( T*e tax rate enacted for 2(11 is 4(C? "*ile t*e tax rate enacted for future years is 3(C. Taxable income for 2(11 is I1?6((?((( and t*ere are no permanent differences. Flemin%Hs pretax financial income for 2(11 is< a. b. c. d. I&6(?((( I1?34(?((( I1?73(?((( I2?24(?(((

#3.

5arsen 'orporation reported I1((?((( in re!enues in its 2(1( financial statements? of "*ic* I44?((( "ill not be included in t*e tax return until 2(11. T*e enacted tax rate is 4(C for 2(1( and 35C for 2(11. >*at amount s*ould 5arsen report for deferred income tax liability in its balance s*eet at December 31? 2(1(D a. I15?4(( b. I17?6(( c. I1&?6(( d. I22?4((

19 ' 11 Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition #4. Duncan /nc. uses t*e accrual met*od of accountin% for financial reportin% purposes and appropriately uses t*e installment met*od of accountin% for income tax purposes. $rofits of I3((?((( reco%ni1ed for boo+s in 2(1( "ill be collected in t*e follo"in% years< 'ollection of $rofits 2(11 I 5(?((( 2(12 I1((?((( 2(13 I15(?((( T*e enacted tax rates are< 4(C for 2(1(? 35C for 2(11? and 3(C for 2(12 and 2(13. Taxable income is expected in all future years. >*at amount s*ould be included in t*e December 31? 2(1(? balance s*eet for t*e deferred tax liability related to t*e abo!e temporary differenceD a. I17?5(( b. I75?((( c. I&2?5(( d. I12(?((( #5. )t December 31? 2(1( 2aymond 'orporation reported a deferred tax liability of I&(?((( "*ic* "as attributable to a taxable type temporary difference of I3((?(((. T*e temporary difference is sc*eduled to re!erse in 2(14. Durin% 2(11? a ne" tax la" increased t*e corporate tax rate from 3(C to 4(C. 2aymond s*ould record t*is c*an%e by debitin% a. 2etained .arnin%s for I3(?(((. b. 2etained .arnin%s for I&?(((. c. /ncome Tax .xpense for I&?(((. d. /ncome Tax .xpense for I3(?(((. $almer 'o. *ad a deferred tax liability balance due to a temporary difference at t*e be%innin% of 2(1( related to I6((?((( of excess depreciation. /n December of 2(1(? a ne" income tax act is si%ned into la" t*at lo"ers t*e corporate rate from 4(C to 35C? effecti!e Kanuary 1? 2(12. /f taxable amounts related to t*e temporary difference are sc*eduled to be re!ersed by I3((?((( for bot* 2(11 and 2(12? $almer s*ould increase or decrease deferred tax liability by "*at amountD a. Decrease by I3(?((( b. Decrease by I15?((( c. /ncrease by I15?((( d. /ncrease by I3(?((( ) reconciliation of 7entry 'ompanyAs pretax accountin% income "it* its taxable income for 2(1(? its first year of operations? is as follo"s< $retax accountin% income .xcess tax depreciation Taxable income I3?(((?((( :&(?(((; I2?&1(?(((

#6.

#7.

T*e excess tax depreciation "ill result in e0ual net taxable amounts in eac* of t*e next t*ree years. .nacted tax rates are 4(C in 2(1(? 35C in 2(11 and 2(12? and 3(C in 2(13. T*e total deferred tax liability to be reported on 7entryAs balance s*eet at December 31? 2(1(? is a. I36?(((. b. I3(?(((. c. I31?5((. d. I27?(((.

)ccountin% for /ncome Taxes ##.

19 ' 14

M*an? /nc. reports a taxable and financial loss of I65(?((( for 2(11. /ts pretax financial income for t*e last t"o years "as as follo"s< 2((& 2(1( I3((?((( 4((?(((

T*e amount t*at M*an? /nc. reports as a net loss for financial reportin% purposes in 2(11? assumin% t*at it uses t*e carrybac+ pro!isions? and t*at t*e tax rate is 3(C for all periods affected? is a. I65(?((( loss. b. I 6(6. c. I1&5?((( loss. d. I455?((( loss. Use t*e follo"in% information for 0uestions #& and &(. >ilcox 'orporation reported t*e follo"in% results for its first t*ree years of operation< 2(1( income :before income taxes; 2(11 loss :before income taxes; 2(12 income :before income taxes; I 1((?((( :&((?(((; 1?(((?(((

T*ere "ere no permanent or temporary differences durin% t*ese t*ree years. )ssume a corporate tax rate of 3(C for 2(1( and 2(11? and 4(C for 2(12. #&. )ssumin% t*at >ilcox elects to use t*e carrybac+ pro!ision? "*at income :loss; is reported in 2(11D :)ssume t*at any deferred tax asset reco%ni1ed is more li+ely t*an not to be reali1ed.; a. I:&((?(((; b. I 6(6 c. I:#7(?(((; d. I:55(?(((; )ssumin% t*at >ilcox elects to use t*e carryfor"ard pro!ision and not t*e carrybac+ pro!ision? "*at income :loss; is reported in 2(11D a. I:&((?(((; b. I:54(?(((; c. I 6(6 d. I:#7(?(((; 2odd 'o. reports a taxable and pretax financial loss of I4((?((( for 2(11. 2oddAs taxable and pretax financial income and tax rates for t*e last t"o years "ere< 2((& 2(1( I4((?((( 4((?((( 3(C 35C

&(.

&1.

T*e amount t*at 2odd s*ould report as an income tax refund recei!able in 2(11? assumin% t*at it uses t*e carrybac+ pro!isions and t*at t*e tax rate is 4(C in 2(11? is a. I12(?(((. b. I14(?(((. c. I16(?(((. d. I1#(?(((.

19 ' 15 Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition &2. ic+erson 'orporation be%an operations in 2((7. T*ere *a!e been no permanent or temporary differences to account for since t*e inception of t*e business. T*e follo"in% data are a!ailable< Bear .nacted Tax 2ate Taxable /ncome Taxes $aid 2((& 45C I75(?((( I337?5(( 2(1( 4(C &((?((( 36(?((( 2(11 35C 2(12 3(C /n 2(11? ic+erson *ad an operatin% loss of I&3(?(((. >*at amount of income tax benefits s*ould be reported on t*e 2(11 income statement due to t*is lossD a. I4(&?5(( b. I373?5(( c. I372?((( d. I27&?(((

Use t*e follo"in% information for 0uestions &3 and &4. 4peratin% income and tax rates for '.K. 'ompanyHs first t*ree years of operations "ere as follo"s< /ncome J .nacted tax rate 2(1( I1((?((( 35C 2(11 :I25(?(((; 3(C 2(12 I42(?((( 4(C &3. )ssumin% t*at '.K. 'ompany opts to carrybac+ its 2(11 45? "*at is t*e amount of income tax payable at December 31? 2(12D a. I6#?((( b. I16#?((( c. I123?((( d. I1(#?((( )ssumin% t*at '.K. 'ompany opts only to carryfor"ard its 2(11 45? "*at is t*e amount of deferred tax asset or liability t*at '.K. 'ompany "ould report on its December 31? 2(11 balance s*eetD )mount J Deferred tax asset or liability a. I75?((( Deferred tax liability b. I#7?5(( Deferred tax liability c. I1((?((( Deferred tax asset d. I75?((( Deferred tax asset

&4.

Multi%le C!oi$e Ans*ers)Co.%utational

Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans&

52. 53. 54. 55. 56. 57.

c b a a d c

5#. 5&. 6(. 61. 62. 63.

b d c d b d

64. 65. 66. 67. 6#. 6&.

a a a c a b

7(. 71. 72. 73. 74. 75.

a a d b c d

76. 77. 7#. 7&. #(. #1. #2.

b d b b a b b

#3. #4. #5. #6. #7. ##.

a c d b b d

#&. &(. &1. &2. &3. &4.

d b a a d c

)ccountin% for /ncome Taxes

19 ' 18

MU(TIP(E CHOICE)CPA A"a%te"

&5. ,uno1 'orp.As boo+s s*o"ed pretax financial income of I1?5((?((( for t*e year ended December 31? 2(11. /n t*e computation of federal income taxes? t*e follo"in% data "ere considered< 7ain on an in!oluntary con!ersion I65(?((( :,uno1 *as elected to replace t*e property "it*in t*e statutory period usin% total proceeds.; Depreciation deducted for tax purposes in excess of depreciation deducted for boo+ purposes 1((?((( Federal estimated tax payments? 2(11 125?((( .nacted federal tax rate? 2(11 3(C >*at amount s*ould ,uno1 report as its current federal income tax liability on its December 31? 2(11 balance s*eetD a. I1((?((( b. I13(?((( c. I225?((( d. I255?((( &6. Gaa% 'orp.As 2(11 income statement s*o"ed pretax accountin% income of I75(?(((. To compute t*e federal income tax liability? t*e follo"in% 2(11 data are pro!ided< /ncome from exempt municipal bonds I 3(?((( Depreciation deducted for tax purposes in excess of depreciation deducted for financial statement purposes 6(?((( .stimated federal income tax payments made 15(?((( .nacted corporate income tax rate 3(C >*at amount of current federal income tax liability s*ould be included in Ga%%As December 31? 2(11 balance s*eetD a. I4#?((( b. I66?((( c. I75?((( d. I1&#?((( &7. 4n Kanuary 1? 2(11? 7ore? /nc. purc*ased a mac*ine for I72(?((( "*ic* "ill be depreciated I72?((( per year for financial statement reportin% purposes. For income tax reportin%? 7ore elected to expense I#(?((( and to use strai%*t6line depreciation "*ic* "ill allo" a cost reco!ery deduction of I64?((( for 2(11. )ssume a present and future enacted income tax rate of 3(C. >*at amount s*ould be added to 7oreAs deferred income tax liability for t*is temporary difference at December 31? 2(11D a. I43?2(( b. I24?((( c. I21?6(( d. I1&?2((

19 ' 1< Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition &#. 4n Kanuary 1? 2(11? $iper 'orp. purc*ased 4(C of t*e !otin% common stoc+ of 3et1? /nc. and appropriately accounts for its in!estment by t*e e0uity met*od. Durin% 2(11? 3et1 reported earnin%s of I36(?((( and paid di!idends of I12(?(((. $iper assumes t*at all of 3et1As undistributed earnin%s "ill be distributed as di!idends in future periods "*en t*e enacted tax rate "ill be 3(C. /%nore t*e di!idend6recei!ed deduction. $iperAs current enacted income tax rate is 25C. T*e increase in $iperAs deferred income tax liability for t*is temporary difference is a. I72?(((. b. I6(?(((. c. I43?2((. d. I2#?#((. Folt1 'orp.As 2(1( income statement *ad pretax financial income of I25(?((( in its first year of operations. Folt1 uses an accelerated cost reco!ery met*od on its tax return and strai%*t6line depreciation for financial reportin%. T*e differences bet"een t*e boo+ and tax deductions for depreciation o!er t*e fi!e6year life of t*e assets ac0uired in 2(1(? and t*e enacted tax rates for 2(1( to 2(14 are as follo"s< 2(1( 2(11 2(12 2(13 2(14 3oo+ 4!er :Under; Tax I:5(?(((; :65?(((; :15?(((; 6(?((( 7(?((( Tax 2ates 35C 3(C 3(C 3(C 3(C

&&.

T*ere are no ot*er temporary differences. /n Folt1As December 31? 2(1( balance s*eet? t*e noncurrent deferred income tax liability and t*e income taxes currently payable s*ould be oncurrent Deferred /ncome Taxes /ncome Tax 5iability 'urrently $ayable a. I3&?((( I5(?((( b. I3&?((( I7(?((( c. I15?((( I6(?((( d. I15?((( I7(?((( 1((. Didde 'orp. prepared t*e follo"in% reconciliation of income per boo+s "it* income per tax return for t*e year ended December 31? 2(11< 3oo+ income before income taxes I1?2((?((( )dd temporary difference 'onstruction contract re!enue "*ic* "ill re!erse in 2(12 16(?((( Deduct temporary difference Depreciation expense "*ic* "ill re!erse in e0ual amounts in eac* of t*e next four years :64(?(((; Taxable income I72(?((( DiddeAs effecti!e income tax rate is 34C for 2(11. >*at amount s*ould Didde report in its 2(11 income statement as t*e current pro!ision for income taxesD a. I54?4(( b. I244?#(( c. I4(#?((( d. I462?4((

)ccountin% for /ncome Taxes 1(1.

19 ' 1=

/n its 2(1( income statement? 'o*en 'orp. reported depreciation of I1?11(?((( and interest re!enue on municipal obli%ations of I21(?(((. 'o*en reported depreciation of I1?65(?((( on its 2(1( income tax return. T*e difference in depreciation is t*e only temporary difference? and it "ill re!erse e0ually o!er t*e next t*ree years. 'o*enAs enacted income tax rates are 35C for 2(1(? 3(C for 2(11? and 25C for 2(12 and 2(13. >*at amount s*ould be included in t*e deferred income tax liability in Gert1As December 31? 2(1( balance s*eetD a. I144?((( b. I1#6?((( c. I225?((( d. I262?5(( Dunn? /nc. uses t*e accrual met*od of accountin% for financial reportin% purposes and appropriately uses t*e installment met*od of accountin% for income tax purposes. /nstallment income of I&((?((( "ill be collected in t*e follo"in% years "*en t*e enacted tax rates are< 'ollection of /ncome .nacted Tax 2ates 2(1( I &(?((( 35C 2(11 1#(?((( 3(C 2(12 27(?((( 3(C 2(13 36(?((( 25C T*e installment income is DunnAs only temporary difference. >*at amount s*ould be included in t*e deferred income tax liability in DunnAs December 31? 2(1( balance s*eetD a. I225?((( b. I256?5(( c. I2#3?5(( d. I315?(((

1(2.

1(3.

For calendar year 2(1(? Mane 'orp. reported depreciation of I1?2((?((( in its income statement. 4n its 2(1( income tax return? Mane reported depreciation of I1?#((?(((. ManeAs income statement also included I225?((( accrued "arranty expense t*at "ill be deducted for tax purposes "*en paid. ManeAs enacted tax rates are 3(C for 2(1( and 2(11? and 24C for 2(12 and 2(13. T*e depreciation difference and "arranty expense "ill re!erse o!er t*e next t*ree years as follo"s< Depreciation Difference >arranty .xpense 2(11 I24(?((( I 45?((( 2(12 21(?((( 75?((( 2(13 15(?((( 1(5?((( I6((?((( I225?((( T*ese "ere ManeAs only temporary differences. /n ManeAs 2(1( income statement? t*e deferred portion of its pro!ision for income taxes s*ould be a. I2((?7((. b. I112?5((. c. I1(1?7((. d. I1(&?#((.

19 ' 1> Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition 1(4. >ri%*t 'o.? or%ani1ed on Kanuary 2? 2(1(? *ad pretax accountin% income of I##(?((( and taxable income of I1?6((?((( for t*e year ended December 31? 2(1( T*e only temporary difference is accrued product "arranty costs "*ic* are expected to be paid as follo"s< 2(11 2(12 2(13 2(14 I24(?((( 12(?((( 12(?((( 24(?(((

T*e enacted income tax rates are 35C for 2(1(? 3(C for 2(11 t*rou%* 2(13? and 25C for 2(14. /f >ri%*t expects taxable income in future years? t*e deferred tax asset in >ri%*tAs December 31? 2(1( balance s*eet s*ould be a. I144?(((. b. I16#?(((. c. I2(4?(((. d. I252?(((.

Multi%le C!oi$e Ans*ers)CPA A"a%te"

Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans& Ite. Ans&

&5. &6.

a a

&7. &#.

c d

&&. 1((.

d b

1(1. 1(2.

a a

1(3. 1(4.

c c

+ERI7ATIONS ) Co.%utational

No& Ans*er

52. c

+erivation

I6((?((( N O:I6((?((( N I5(?(((; 5;P = I4&(?(((F I6((?((( N :6((?((( 195 2; = I36(?(((. :I4&(?((( N I36(?(((; .4( = I52?(((. :I64(?((( N I4((?(((; Q 3(C = I72?(((. /ncome tax payable = :I75(?((( Q 3(C; = I225?((( '*an%e in deferred tax liability = :I1?(((?((( Q 3(C; = I3((?((( '*an%e in deferred tax asset = :I1?25(?((( Q 3(C; = I375?((( I225?((( R I3((?((( N I375?((( = I15(?(((. :I1?25(?((( Q 3(C; = I375?(((. :I5((?((( Q 3(C; = I15(?(((. :I25(?((( Q 3(C; = I75?(((. :I1?(((?((( Q 3(C; = I3((?(((. :I1?5((?((( Q 3(C; = I45(?(((.

53. 54. 55.

b a a

56. 57. 5#. 5&. 6(.

d c b d c

)ccountin% for /ncome Taxes

19 ' 19

+ERI7ATIONS ) Co.%utational 2$ont&3

No& Ans*er

61. d

+erivation

:3(C Q Temporary Difference; = I&(?(((F Temporary Difference = :I&(?((( S 3(C; = I3((?(((F I1?5((?((( R I3((?((( = I1?#((?(((. :I1?2((?((( N I75(?(((; Q 35C = I157?5((. :I1?5((?((( Q 3(C; = I45(?(((. I#(?((( .5( = I4(?(((. I#((?((( .2# = I224?(((. I225?((( Q .4( = I&(?((( debit. :I6((?((( Q .35; R :I225?((( Q .4(; = I3((?(((. I3((?((( S 3(C = I1?(((?((( temporary difference I1?(((?((( S 4(C = I2?5((?(((. I2?4((?((( R :I1?35(?((( N I&6(?(((; = I2?7&(?(((. I#4?((( Q .4( = I33?6((. I72?((( R :I#4?((( Q .4(; = I1(5?6((. I&6?((( N :I2#?((( Q .4(; = I#4?#((. I&2?((( N :I6(?((( Q .35; = I71?(((. I1(2?((( R :I3(?((( Q .35; = I112?5((. I&5?((( N :I4?((( S .4(; = I#5?(((. I3((?((( N I24?((( R I52?((( N I3#?((( N I26?((( N I12?((( = I252?(((. :I52?((( .4(; N I4?((( = I16?#((. :I26?((( R I12?(((; .4( = I15?2((. I&((?((( R I32?((( N I4(?((( N I2(?((( N I54?((( = I#1#?((( I#1#?((( .4( = I327?2((. I32?((( .4( = I12?#(( DT). I23(?((( 6 I1&2?((( N I6(?((( R I2((?((( = I17#?(((. I1?6((?((( N :I&((?((( N I64(?(((; = I1?34(?(((.

62. 63. 64. 65. 66. 67. 6#. 6&. 7(. 71. 72. 73. 74. 75. 76. 77. 7#. 7&.

b d a a a c a b a a d b c d b d b b

#(. #1. #2.

a b b

19 ' 4? Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition

+ERI7ATIONS ) Co.%utational 2$ont&3

No& Ans*er

#3. #4. #5. #6. #7. ##. #&. &(. &1. &2. &3. &4. a c d b b d d b a a d c

+erivation

I44?((( .35 = I15?4((. :I5(?((( .35; R O:I1((?((( R I15(?(((; .3(P = I&2?5((. I3((?((( :.4( N .3(; = I3(?((( /T.. I3((?((( Q :.35 N .4(; = I15?((( decrease. :I3(?((( Q 35C; R :I3(?((( Q 35C; R :I3(?((( Q 3(C; = I3(?(((. I65(?((( N :3(C Q I65(?(((; = I455?(((. :I1((?((( Q 3(C; = I3(?(((F I#((?((( Q 4(C = I32(?(((F :I&((?((( N I3(?((( N I32(?(((; = I55(?(((. :I&((?((( Q 4(C; = I36(?(((F I&((?((( N I36(?((( = I54(?(((. :I4((?((( Q 3(C; = I12(?(((. :I75(?((( Q .45; R O:I&3(?((( N I75(?(((; Q .4(P = I4(&?5((. OI42(?((( N :I25(?((( N I1((?(((;P .4( = I1(#?(((. I25(?((( .4( = I1((?(((.

+ERI7ATIONS ) CPA A"a%te"

No& Ans*er

&5. &6. &7. &#. &&. 1((. 1(1. 1(2. a a c d d b a a

+erivation

:I1?5((?((( N I65(?((( N I1((?(((; Q 3(C = I225?(((F I225?((( N I125?((( = I1((?(((. :I75(?((( N I3(?((( N I6(?(((; Q 3(C = I1&#?(((F I1&#?((( N I15(?((( = I4#?(((. :I#(?((( R I64?((( N I72?(((; Q 3(C = I21?6((. :I36(?((( N I12(?(((; Q 4(C = I&6?(((F I&6?((( Q 3(C = I2#?#((. :I5(?((( Q 3(C; = I15?(((F :I25(?((( N I5(?(((; Q 35C = I7(?(((. :I72(?((( Q 34C; = I244?#((. :I1#(?((( Q 3(C; R :I1#(?((( Q 25C; R :I1#(?((( Q 25C; = I144?(((. :I1#(?((( Q 3(C; R :I27(?((( Q 3(C; R :I36(?((( Q 25C; = I225?(((.

)ccountin% for /ncome Taxes

19 ' 41

+ERI7ATIONS ) CPA A"a%te" 2$ont&3

No& Ans*er

1(3. c

+erivation

:I24(?((( N I45?(((; Q 3(C = I5#?5((F :I21(?((( N I75?(((; Q 24C = I32?4((F :I15(?((( N I1(5?(((; Q 24C = I1(?#((F I5#?5(( R I32?4(( R I1(?#(( = I1(1?7((. :I24(?((( R I12(?((( R I12(?(((; Q 3(C = I144?(((F I24(?((( Q 25C = I6(?(((F I144?((( R I6(?((( = I2(4?(((.

1(4.

EXERCISES

E@& 19'1?8L'omputation of taxable income. T*e records for 3osc* 'o. s*o" t*is data for 2(11< 7ross profit on installment sales recorded on t*e boo+s "as I36(?(((. 7ross profit from collections of installment recei!ables "as I27(?(((. 5ife insurance on officers "as I3?#((. ,ac*inery "as ac0uired in Kanuary for I3((?(((. -trai%*t6line depreciation o!er a ten6year life :no sal!a%e !alue; is used. For tax purposes? ,)'2- depreciation is used and 3osc* may deduct 14C for 2(11. /nterest recei!ed on tax exempt /o"a -tate bonds "as I&?(((. T*e estimated "arranty liability related to 2(11 sales "as I1&?6((. 2epair costs under "arranties durin% 2(11 "ere I13?6((. T*e remainder "ill be incurred in 2(12. $retax financial income is I6((?(((. T*e tax rate is 3(C.

Instru$tions :a; $repare a sc*edule startin% "it* pretax financial income and compute taxable income. :b; $repare t*e @ournal entry to record income taxes for 2(11. Solution 19'1?8 :a; $retax financial income $ermanent differences 5ife insurance Tax6exempt interest Temporary differences /nstallment sales :I36(?((( N I27(?(((; .xtra depreciation :I42?((( N I3(?(((; >arranties :I1&?6(( N I13?6((; Taxable income I6((?((( 3?#(( :&?(((; :&(?(((; :12?(((; 6?((( I4&#?#(( 17#?44( 1?#(( 3(?6((

:b;

/ncome Tax .xpense OI14&?64( R :I3(?6(( N I1?#((;P ............... Deferred Tax )sset :3(C Q I6?(((; ............................................ Deferred Tax 5iability :3(C Q I1(2?(((; ..........................

19 ' 41 Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition /ncome Tax $ayable :3(C Q I4&#?#((; ........................... 14&?64(

)ccountin% for /ncome Taxes E@& 19'1?<LFuture taxable and deductible amounts. Define temporary differences? future taxable amounts? and future deductible amounts. Solution 19'1?<

19 ' 44

Temporary differences are differences bet"een t*e tax basis of an asset or liability and its reported amount in t*e financial statements t*at "ill result in taxable amounts or deductible amounts in future years. Future taxable amounts increase taxable income in future years and cause a deferred tax liability to be recorded. Future deductible amounts decrease taxable income in future years and cause a deferred tax asset to be recorded.

E@& 19'1?=LDeferred income taxes. $ole 'o. at t*e end of 2(1(? its first year of operations? prepared a reconciliation bet"een pretax financial income and taxable income as follo"s< $retax financial income .xtra depreciation ta+en for tax purposes .stimated expenses deductible for taxes "*en paid Taxable income I 42(?((( :1?(5(?(((; #4(?((( I 21(?(((

Use of t*e depreciable assets "ill result in taxable amounts of I35(?((( in eac* of t*e next t*ree years. T*e estimated liti%ation expenses of I#4(?((( "ill be deductible in 2(13 "*en settlement is expected. Instru$tions :a; $repare a sc*edule of future taxable and deductible amounts. :b; $repare t*e @ournal entry to record income tax expense? deferred taxes? and income taxes payable for 2(1(? assumin% a tax rate of 4(C for all years.

Solution 19'1?= :a; Future taxable :deductible; amounts .xtra depreciation 5iti%ation :b; 2(11 I35(?((( 2(12 I35(?((( 2(13 Total

I35(?((( I1?(5(?((( :#4(?(((; :#4(?(((; 16#?((( 336?((( 42(?((( #4?(((

/ncome Tax .xpense :I#4?((( R I42(?((( N I336?(((; ............. Deferred Tax )sset :I#4(?((( Q 4(C; ........................................ Deferred Tax 5iability :I1?(5(?((( Q 4(C; ....................... /ncome Tax $ayable :I21(?((( Q 4(C; ...........................

19 ' 45 Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition E@& 19'1?>LDeferred income taxes. Gunt 'o. at t*e end of 2(1(? its first year of operations? prepared a reconciliation bet"een pretax financial income and taxable income as follo"s< $retax financial income I 75(?((( .stimated expenses deductible for taxes "*en paid 1?2((?((( .xtra depreciation :1?35(?(((; Taxable income I 6((?((( .stimated "arranty expense of I#((?((( "ill be deductible in 2(11? I3((?((( in 2(12? and I1((?((( in 2(13. T*e use of t*e depreciable assets "ill result in taxable amounts of I45(?((( in eac* of t*e next t*ree years. Instru$tions :a; $repare a table of future taxable and deductible amounts. :b; $repare t*e @ournal entry to record income tax expense? deferred income taxes? and income taxes payable for 2(1(? assumin% an income tax rate of 4(C for all years. Solution 19'1?> :a; 2(11 Future taxable :deductible; amounts >arranties I:#((?(((; .xcess depreciation 45(?((( 2(12 2(13 Total

I:3((?(((; I:1((?(((; I:1?2((?(((; 45(?((( 45(?((( 1?35(?((( 3((?((( 4#(?((( 54(?((( 24(?(((

:b;

/ncome Tax .xpense OI24(?((( R :I54(?((( N I4#(?(((;P.......... Deferred Tax )sset :I1?2((?((( Q 4(C;...................................... Deferred Tax 5iability :I1?35(?((( Q 4(C; ....................... /ncome Tax $ayable :I6((?((( Q 4(C; ...........................

E@& 19'1?9L2eco%nition of deferred tax asset. :a; :b; Describe a deferred tax asset. >*en s*ould a deferred tax asset be reduced by a !aluation allo"anceD

Solution 19'1?9 :a; :b; ) deferred tax asset is t*e deferred tax conse0uences attributable to deductible temporary differences and operatin% loss carryfor"ards. ) deferred tax asset s*ould be reduced by a !aluation allo"ance if? based on all a!ailable e!idence? it is more li+ely t*an not t*at some portion or all of t*e deferred tax asset "ill not be reali1ed. ,ore li+ely t*an not means a le!el of li+eli*ood t*at is at least sli%*tly more t*an 5(C.

)ccountin% for /ncome Taxes E@& 19'11?L$ermanent and temporary differences.

19 ' 48

5isted belo" are items t*at are treated differently for accountin% purposes t*an t*ey are for tax purposes. /ndicate "*et*er t*e items are permanent differences or temporary differences. For temporary differences? indicate "*et*er t*ey "ill create deferred tax assets or deferred tax liabilities. 1. /n!estments accounted for by t*e e0uity met*od. 2. )d!ance rental receipts. 3. Fine for pollutin%. 4. .stimated future "arranty costs. 5. .xcess of contributions o!er pension expense. 6. .xpenses incurred in obtainin% tax6exempt re!enue. 7. /nstallment sales. #. .xcess tax depreciation o!er accountin% depreciation. &. 5on%6term construction contracts. 1(. $remiums paid on life insurance of officers :company is t*e beneficiary;.

Solution 19'11? 1. 2. 3. 4. 5. 6. 7. #. &. 1(. Temporary difference? deferred tax liability. Temporary difference? deferred tax asset. $ermanent difference. Temporary difference? deferred tax asset. Temporary difference? deferred tax liability. $ermanent difference. Temporary difference? deferred tax liability. Temporary difference? deferred tax liability. Temporary difference? deferred tax liability. $ermanent difference.

E@& 19'111L$ermanent and temporary differences. /ndicate and explain "*et*er eac* of t*e follo"in% independent situations s*ould be treated as a temporary difference or a permanent difference. :a; For accountin% purposes? a company reports re!enue from installment sales on t*e accrual basis. For income tax purposes? it reports t*e re!enues by t*e installment met*od? deferrin% reco%nition of %ross profit until cas* is collected.

:b; $retax accountin% income and taxable income differ because #(C of di!idends recei!ed from U.-. corporations "as deducted from taxable income? "*ile 1((C of t*e di!idends recei!ed "as reported for financial statement purposes. :c; .stimated "arranty costs :co!erin% a t*ree6year "arranty; are expensed for accountin% purposes at t*e time of sale but deducted for income tax purposes "*en paid.

19 ' 4< Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition Solution 19'111 :a; Te.%orarA "i##eren$e& T*is difference in t*e timin% of re!enue reco%nition for pretax financial income and taxable income "ill initially increase pretax financial income? but "ill increase taxable income by t*e amount of deferred %ross profits as cas* is collected in subse0uent years. )ssumin% t*e estimate as to collectibility of installment recei!ables is !alid? t*e total amounts reported as %ross profits for accountin% purposes and for tax purposes "ill be e0ual o!er t*e life of a %roup of installment recei!ables. T*e time la% bet"een t*e accrual for accountin% purposes and t*e reco%nition for tax purposes "ill result in credit entries to a companyAs deferred tax liability as lon% as installment sales are le!el or increasin%. T*e credit entries related to particular installment recei!ables "ill be Tdra"n do"n?T or re!ersed? *o"e!er? "*en t*e recei!ables are collected. Per.anent "i##eren$e& T*is difference in pretax financial income and taxable income "ill ne!er re!erse because present tax la"s allo" a company t*at o"ns stoc+ in anot*er U.-. corporation to deduct #(C of t*e di!idends it recei!es from t*at company. Taxes "ill not be paid on t*e di!idends deducted and t*ere are no tax conse0uences for t*ose di!idends? e!en t*ou%* t*ey are reco%ni1ed as income for boo+ purposes. Te.%orarA "i##eren$e& T*e full estimated t*ree years of "arranty expenses reduce t*e current yearAs pretax financial income? but "ill reduce taxable income in !aryin% amounts eac* year as paid. )ssumin% t*e estimate for eac* "arranty is !alid? t*e total amounts deducted for accountin% and for tax purposes "ill be e0ual o!er t*e t*ree6year period for eac* "arranty. T*is is an example of an expense t*at? in t*e first period? reduces pretax financial income more t*an taxable income and? in later years? re!erses and reduces taxable income "it*out affectin% pretax financial income.

:b;

:c;

E@& 19'111LTemporary differences. T*ere are four types of temporary differences. For eac* type< :1; indicate t*e cause of t*e difference? :2; %i!e an example? and :3; indicate "*et*er it "ill create a taxable or deductible amount in t*e future. Solution 19'111 :a; 2e!enues or %ains are taxable after t*ey are reco%ni1ed in pretax financial income. .xamples are installment sales? lon%6term construction contracts? and t*e e0uity met*od of accountin% for in!estments. T*ey result in future taxable amounts.

:b; 2e!enues or %ains are taxable before t*ey are reco%ni1ed in pretax financial income. .xamples are subscriptions recei!ed in ad!ance and rents recei!ed in ad!ance. T*ey result in future deductible amounts. :c; .xpenses or losses are deductible before t*ey are reco%ni1ed in pretax financial income. .xamples are extra depreciation? prepaid expenses? and pension fundin% in excess of pension expense. T*ey result in future taxable amounts. .xpenses or losses are deductible after t*ey are reco%ni1ed in pretax financial income. .xamples are "arranty expenses? estimated liti%ation losses? and unreali1ed loss on mar+etable securities. T*ey result in future deductible amounts.

:d;

)ccountin% for /ncome Taxes E@& 19'114L4peratin% loss carryfor"ard.

19 ' 4=

/n 2(1(? its first year of operations? Mimble 'orp. *as a I&((?((( net operatin% loss "*en t*e tax rate is 3(C. /n 2(11? Mimble *as I36(?((( taxable income and t*e tax rate remains 3(C. Instru$tions )ssume t*e mana%ement of Mimble 'orp. t*in+s t*at it is more li+ely t*an not t*at t*e loss carryfor"ard "ill not be reali1ed in t*e near future because it is a ne" company :t*is is before results of 2(11 operations are +no"n;. :a; :b; >*at are t*e entries in 2(1( to record t*e tax loss carryfor"ardD >*at entries "ould be made in 2(11 to record t*e current and deferred income taxes and to reco%ni1e t*e loss carryfor"ardD :)ssume t*at at t*e end of 2(11 it is more li+ely t*an not t*at t*e deferred tax asset "ill be reali1ed.;

Solution 19'114 :a; Deferred Tax )sset :I&((?((( Q 3(C;......................................... 3enefit Due to 5oss 'arryfor"ard..................................... 3enefit Due to 5oss 'arryfor"ard................................................. )llo"ance to 2educe Deferred Tax )sset to .xpected 2eali1able Ealue........................................... :b; /ncome Tax .xpense :I36(?((( Q 3(C;...................................... Deferred Tax )sset........................................................... )llo"ance to 2educe Deferred Tax )sset to .xpected 2eali1able Ealue...................................................................... 3enefit Due to 5oss 'arryfor"ard..................................... 27(?((( 27(?((( 27(?((( 27(?((( 1(#?((( 1(#?((( 1(#?((( 1(#?(((

19 ' 4> Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition

PRO,(EMS

Pr& 19'115LDifferences bet"een accountin% and taxable income and t*e effect on deferred taxes. T*e follo"in% differences enter into t*e reconciliation of financial income and taxable income of )bbott 'ompany for t*e year ended December 31? 2(1(? its first year of operations. T*e enacted income tax rate is 3(C for all years. $retax accountin% income .xcess tax depreciation 5iti%ation accrual Unearned rent re!enue deferred on t*e boo+s but appropriately reco%ni1ed in taxable income /nterest income from e" Bor+ municipal bonds Taxable income 1. 2. 3. 4. I7((?((( :32(?(((; 7(?((( 5(?((( :2(?(((; I4#(?(((

.xcess tax depreciation "ill re!erse e0ually o!er a four6year period? 2(1162(14. /t is estimated t*at t*e liti%ation liability "ill be paid in 2(14. 2ent re!enue "ill be reco%ni1ed durin% t*e last year of t*e lease? 2(14. /nterest re!enue from t*e e" Bor+ bonds is expected to be I2(?((( eac* year until t*eir maturity at t*e end of 2(14.

Instru$tions :a; $repare a sc*edule of future taxable and :deductible; amounts. :b; $repare a sc*edule of t*e deferred tax :asset; and liability. :c; -ince t*is is t*e first year of operations? t*ere is no be%innin% deferred tax asset or liability. 'ompute t*e net deferred tax expense :benefit;. :d; $repare t*e @ournal entry to record income tax expense? deferred taxes? and t*e income taxes payable for 2(1(. Solution 19'115 :a; 2(11 Future taxable :deductible; amounts< Depreciation I#(?((( 5iti%ation Unearned rent Future Taxable :Deductible; )mounts I32(?((( :7(?(((; :5(?(((; I2((?((( 2(12 I#(?((( 2(13 I#(?((( 2(14 Total

I#(?((( I32(?((( :7(?(((; :7(?(((; :5(?(((; :5(?(((;

:b; Temporary Differences Depreciation 5iti%ation Unearned rent Totals :c; Deferred tax expense Deferred tax benefit et deferred tax expense

Tax 2ate 3(C 3(C 3(C

Deferred Tax :)sset; 5iability I&6?((( I:21?(((; :15?(((; I:36?(((; I&6?(((

I&6?((( :36?(((; I6(?(((

)ccountin% for /ncome Taxes Solution 19'115 :cont.; :d; /ncome Tax .xpense :I144?((( R I6(?(((;................................. Deferred Tax )sset ...................................................................... Deferred Tax 5iability ....................................................... /ncome Tax $ayable :I4#(?((( Q 3(C; ........................... 2(4?((( 36?(((

19 ' 49

&6?((( 144?(((

Pr& 19'118L,ultiple temporary differences. T*e follo"in% information is a!ailable for t*e first t*ree years of operations for 'ooper 'ompany< 1. Bear 2(1( 2(11 2(12 Taxable /ncome I5((?((( 33(?((( 4((?(((

2. 4n Kanuary 2? 2(1(? *ea!y e0uipment costin% I6((?((( "as purc*ased. T*e e0uipment *ad a life of 5 years and no sal!a%e !alue. T*e strai%*t6line met*od of depreciation is used for boo+ purposes and t*e tax depreciation ta+en eac* year is listed belo"< 2(1( I1&#?((( 2(11 I27(?((( Tax Depreciation 2(12 2(13 I&(?((( I42?((( Total I6((?(((

3. 4n Kanuary 2? 2(11? I24(?((( "as collected in ad!ance for rental of a buildin% for a t*ree6 year period. T*e entire I24(?((( "as reported as taxable income in 2(11? but I16(?((( of t*e I24(?((( "as reported as unearned re!enue at December 31? 2(11 for boo+ purposes. 4. T*e enacted tax rates are 4(C for all years. Instru$tions :a; $repare a sc*edule comparin% depreciation for financial reportin% and tax purposes. :b; Determine t*e deferred tax :asset; or liability at t*e end of 2(1(. :c; $repare a sc*edule of future taxable and :deductible; amounts at t*e end of 2(11. :d; $repare a sc*edule of t*e deferred tax :asset; and liability at t*e end of 2(11. :e; 'ompute t*e net deferred tax expense :benefit; for 2(11. :f; $repare t*e @ournal entry to record income tax expense? deferred income taxes? and income tax payable for 2(11. Solution 19'118 :a; Bear 2(1( 2(11 2(12 2(13 2(14 Depreciation for Financial 2eportin% $urposes I12(?((( 12(?((( 12(?((( 12(?((( 12(?((( I6((?((( Depreciation for Tax $urposes I1&#?((( 27(?((( &(?((( 42?((( 6(6 I6((?((( Temporary Difference I :7#?(((; :15(?(((; 3(?((( 7#?((( 12(?((( I 6(6

19 ' 5? Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition Solution 19'118 :cont.; :b; 2(11 Future taxable :deductible; amounts< Depreciation I:15(?(((; 2(12 I3(?((( 2(13 I7#?((( 2(14 I12(?((( Total I7#?(((

Deferred tax liability< I7#?((( Q 4(C = I31?2(( at t*e end of 2(1(. :c; Future taxable :deductible; amounts< Depreciation 2ent :d; Temporary Differences Depreciation 2ent Totals :e; 2(12 I3(?((( :#(?(((; 2(13 I7#?((( :#(?(((; 2(14 I12(?((( Total I22#?((( :16(?(((; Deferred Tax :)sset; 5iability I&1?2(( I:64?(((; I:64?(((; I&1?2((

Future Taxable :Deductible; )mounts I22#?((( :16(?(((; I 6#?(((

Tax 2ate 4(C 4(C

Deferred tax asset at end of 2(11 Deferred tax asset at be%innin% of 2(11 Deferred tax :benefit; Deferred tax liability at end of 2(11 Deferred tax liability at be%innin% of 2(11 Deferred tax expense Deferred tax :benefit; Deferred tax expense et deferred tax benefit for 2(11

I:64?(((; 6(6 I:64?(((; I&1?2(( 31?2(( I6(?((( I:64?(((; 6(?((( I :4?(((; 12#?((( 64?((( 6(?((( 132?(((

:f;

/ncome Tax .xpense :I132?((( N I4?(((;................................... Deferred Tax )sset....................................................................... Deferred Tax 5iability........................................................ /ncome Tax $ayable :I33(?((( Q 4(C;............................

Pr& 19'11<LDeferred tax asset. Farmer /nc. be%an business on Kanuary 1? 2(1(. /ts pretax financial income for t*e first 2 years "as as follo"s< 2(1( 2(11 I24(?((( 56(?(((

T*e follo"in% items caused t*e only differences bet"een pretax financial income and taxable income.

)ccountin% for /ncome Taxes Pr& 19'11< :cont.;

19 ' 51

1. /n 2(1(? t*e company collected I1#(?((( of rentF of t*is amount? I6(?((( "as earned in 2(1(F t*e ot*er I12(?((( "ill be earned e0ually o!er t*e 2(11N2(12 period. T*e full I1#(?((( "as included in taxable income in 2(1(. 2. T*e company pays I1(?((( a year for life insurance on officers. 3. /n 2(11? t*e company terminated a top executi!e and a%reed to I&(?((( of se!erance pay. T*e amount "ill be paid I3(?((( per year for 2(11N2(13. T*e 2(11 payment "as made. T*e I&(?((( "as expensed in 2(11. For tax purposes? t*e se!erance pay is deductible as it is paid. T*e enacted tax rates existin% at December 31? 2(1( are< 2(1( 2(11 3(C 35C 2(12 2(13 4(C 4(C

Instru$tions :a; Determine taxable income for 2(1( and 2(11. :b; Determine t*e deferred income taxes at t*e end of 2(1(? and prepare t*e @ournal entry to record income taxes for 2(1(. :c; $repare a sc*edule of future taxable and :deductible; amounts at t*e end of 2(11. :d; $repare a sc*edule of t*e deferred tax :asset; and liability at t*e end of 2(11. :e; 'ompute t*e net deferred tax expense :benefit; for 2(11. :f; $repare t*e @ournal entry to record income taxes for 2(11. :%; -*o" *o" t*e deferred income taxes s*ould be reported on t*e balance s*eet at December 31? 2(11. Solution 19'11< :a; $retax financial income $ermanent differences< 5ife insurance Temporary differences< 2ent -e!erance pay Taxable income :b; Future taxable :deductible; amounts< 2ent Tax rate Deferred tax :asset; liability 2(1( I24(?((( 1(?((( 25(?((( 12(?((( 6(6 I37(?((( 2(11 I:6(?(((; 35C I:21?(((; 2(11 I56(?((( 1(?((( 57(?((( :6(?(((; 6(?((( I57(?((( 2(12 I:6(?(((; 4(C I:24?(((; Total I:12(?(((; I:45?(((; 66?((( 45?((( 111?((( at end of 2(1(

/ncome Tax .xpense :I111?((( N I45?(((;................................. Deferred Tax )sset....................................................................... /ncome Tax $ayable :I37(?((( Q 3(C;..........................

19 ' 51 Test ,an- #or Inter.e"iate A$$ountin/0 T!irteent! E"ition Solution 19'11< :cont.; :c; Future taxable :deductible; amounts< 2ent -e!erance pay :d; Temporary Difference 2ent -e!erance pay Totals :e; 2(12 I:6(?(((; :3(?(((; 2(13 I:3(?(((; Tax 2ate 4(C 4(C I:4#?(((; :45?(((; I :3?(((; 1&6?5(( 3?((( 1&&?5(( Total I:6(?(((; :6(?(((; Deferred Tax :)sset; 5iability I:24?(((; :24?(((; I:4#?(((;

Future Taxable :Deductible; )mounts I :6(?(((; :6(?(((; I:12(?(((;

Deferred tax asset at end of 2(11 Deferred tax asset at be%innin% of 2(11 et deferred tax :expense; for 2(11

:f;

/ncome Tax .xpense :I1&&?5(( N I3?(((;................................... Deferred Tax )sset....................................................................... /ncome Tax $ayable :I57(?((( Q 35C;............................

:%;

T*e deferred income taxes s*ould be reported on t*e December 31? 2(11 balance s*eet as follo"s< 'urrent assets Deferred tax asset :I&(?(((8 Q 4(C; I36?((( 4t*er assets Deferred tax asset :I3(?((( Q 4(C; 8I6(?((( R I3(?((( I12?(((

Pr& 19'11=L/nterperiod tax allocation "it* c*an%e in enacted tax rates. ,urp*y 'ompany purc*ased e0uipment for I1#(?((( on Kanuary 2? 2(1(? its first day of operations. For boo+ purposes? t*e e0uipment "ill be depreciated usin% t*e strai%*t6line met*od o!er t*ree years "it* no sal!a%e !alue. $retax financial income and taxable income are as follo"s< 2(1( 2(11 2(12 $retax financial income I224?((( I26(?((( I3((?((( Taxable income 2((?((( 26(?((( 324?((( T*e temporary difference bet"een pretax financial income and taxable income is due to t*e use of accelerated depreciation for tax purposes. Instru$tions :a; $repare t*e @ournal entries to record income taxes for all t*ree years :expense? deferrals? and liabilities; assumin% t*at t*e enacted tax rate applicable to all t*ree years is 3(C. :b; $repare t*e @ournal entries to record income taxes for all t*ree years :expense? deferrals? and liabilities; assumin% t*at t*e enacted tax rate as of 2(1( is 3(C but t*at in t*e middle of 2(11? 'on%ress raises t*e income tax rate to 35C retroacti!e to t*e be%innin% of 2(11.

)ccountin% for /ncome Taxes Solution 19'11= :a; 3oo+ depreciation Tax depreciation Temporary difference 2(1( 2(1( I 6(?((( #4?((( I:24?(((; 2(11 I6(?((( 6(?((( I 6(6 2(12 I6(?((( 36?((( I24?((( Total I1#(?((( 1#(?((( I 6(6 67?2((

19 ' 54