Professional Documents

Culture Documents

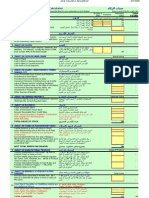

Income Tax Calclulator 2009 Working

Uploaded by

Zohaib Hussain0 ratings0% found this document useful (0 votes)

69 views3 pagespak law

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentpak law

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

69 views3 pagesIncome Tax Calclulator 2009 Working

Uploaded by

Zohaib Hussainpak law

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 3

Taxable Income

Particulars Rs.20000 Rs.25000 Rs.35000 Rs.40000

1 to Rs. 1 to Rs. 1 to Rs. 1 to Rs.

250,000 350000 400000 450000

Individual's taxable income ### ### -

Deduct base amount - - - -

1 minus 2 - ### ### -

Rate percentage 0.50% 0.75% 1.50% 2.50%

Multiply the amount at 3 by rate percentage - 2,250 6,000 -

Tax on base amount - - - -

Gross tax on taxable income - 2,250 6,000 -

Paid per month - 188 500 -

Taxable Income Taxable Income

Rs.450,00 Rs.550,00 Rs.650,00 Rs.750,00 Rs.900,00 Rs.850,00 Rs.950,00 Rs.1050,0 Rs.1200,0 Rs.1500,0

1 to 1 to 1 to 1 to 1 to 1 to 1 to 01 to 01 to 01 to

Rs.550,00 Rs.650,00 Rs.750,00 Rs.900,00 Rs.1,050, Rs.950,00 Rs.1050,0 Rs.1200,0 Rs.1500,0 Rs.1700,0

0 0 0 0 000 0 00 00 00 00

### - ### - - ### - - - -

- - - -

### - ### - - ### - - - -

3.50% 4.50% 6.00% 7.50% 9.00% 12.00%

17,500 - 42,000 - - ### - - - -

-

17,500 - 42,000 - - ### - - - -

1,458 - 3,500 - - 9,500 - - - -

Taxable Income

Rs.1700,0 Rs.2000,0 Rs.3150,0 Rs.3700,0 Rs.4450,0

01 to 01 to 01 to 01 to 01 to

Over

Rs.8,400,

Salary

Rs.2000,0 Rs.3150,0 Rs.3700,0 Rs.4450,0 Rs.8400,0

00 00 00 00 00

000 Amount

- - - - - - ###

- - - - - -

- - - - - -

- - - - - -

- - - - - -

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Cash BookDocument19 pagesCash BookZohaib HussainNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Ws2008 Wealth StatmentDocument10 pagesWs2008 Wealth StatmentZohaib HussainNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Pacific Security ServicesDocument1 pagePacific Security ServicesZohaib HussainNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Cblank Ledger BookDocument58 pagesCblank Ledger BookZohaib HussainNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Islamic Financial Accounting Standard 1 - MurabahaDocument12 pagesIslamic Financial Accounting Standard 1 - MurabahaPlatonic100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Pakistan Income Tax LawDocument22 pagesPakistan Income Tax Lawhssaroch75% (4)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Monthly Bank ReconciliationDocument1 pageMonthly Bank Reconciliationapi-3726455No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- برنامج حساب زكاه المالDocument3 pagesبرنامج حساب زكاه المالnewlife4me100% (10)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Income Tax Return E-Filing Guide (Salaried) - 2009Document16 pagesIncome Tax Return E-Filing Guide (Salaried) - 2009Zohaib HussainNo ratings yet

- Individuals Aop It ReturnDocument6 pagesIndividuals Aop It ReturnZohaib HussainNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Lease Vs Buying, BorrowingDocument3 pagesLease Vs Buying, BorrowingZohaib Hussain75% (4)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- ED Fair Value MeasurementDocument64 pagesED Fair Value MeasurementZohaib HussainNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Islamic Financial Accounting Standard 2 - IjarahDocument7 pagesIslamic Financial Accounting Standard 2 - IjarahPlatonic100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Refund ApplicationDocument1 pageRefund ApplicationZohaib HussainNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 29 Motivational QuotesDocument1 page29 Motivational QuotesZohaib HussainNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Companies Ordinance 1984Document419 pagesCompanies Ordinance 1984M Muneeb SaeedNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Salary Tax (2009 - 10)Document2 pagesSalary Tax (2009 - 10)Zohaib HussainNo ratings yet

- IFRS2009 in Your PocketDocument124 pagesIFRS2009 in Your PocketZohaib Hussain100% (1)

- Business Valuation TechniquesDocument1 pageBusiness Valuation TechniquesZohaib HussainNo ratings yet

- Transpo Printable Lecture4Document10 pagesTranspo Printable Lecture4Jabin Sta. TeresaNo ratings yet

- Weekly Home Learning Plan: Grade 8 - Quarter 2. Week 7Document3 pagesWeekly Home Learning Plan: Grade 8 - Quarter 2. Week 7Danmer Jude TorresNo ratings yet

- The 24-Inch Gauge and The Common Gavel - An Entered Apprentice Mason's Perspective On The Medical ProfessionDocument4 pagesThe 24-Inch Gauge and The Common Gavel - An Entered Apprentice Mason's Perspective On The Medical ProfessionMarcelo Carlos RibeiroNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Technical Information Bulletins Ajax # 010717Document28 pagesTechnical Information Bulletins Ajax # 010717harley florezNo ratings yet

- Case Digest 16Document2 pagesCase Digest 16Mavic MoralesNo ratings yet

- Refrigerant Color Code ChartDocument11 pagesRefrigerant Color Code ChartJeffcaster ComelNo ratings yet

- Civil-Engineering-Final-Year-Project-Quarry Dust As A Substitute of River Sand in Concrete Mixes PDFDocument75 pagesCivil-Engineering-Final-Year-Project-Quarry Dust As A Substitute of River Sand in Concrete Mixes PDFVEERKUMAR GNDEC100% (1)

- EIM GRADE 9 10 Q4 Module 1b - National Electrical Code NEC Provisions in Installing Wiring Devices - GFCI. - FinalDocument23 pagesEIM GRADE 9 10 Q4 Module 1b - National Electrical Code NEC Provisions in Installing Wiring Devices - GFCI. - FinalTitser Ramca100% (3)

- Binac Ao STR EET: Vicinity Map & Street View, Source Google MapsDocument17 pagesBinac Ao STR EET: Vicinity Map & Street View, Source Google MapsBee AnquilianoNo ratings yet

- Examiner's report on F6 Taxation (UK) December 2010 paperDocument3 pagesExaminer's report on F6 Taxation (UK) December 2010 paperyorcpl200No ratings yet

- Moot CourtDocument7 pagesMoot CourtsushmaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- DaloDocument2 pagesDalojosua tuisawauNo ratings yet

- Eugenics in The United StatesDocument14 pagesEugenics in The United StatesSnark Jacobs100% (1)

- 4front Projects: BbbeeDocument12 pages4front Projects: BbbeeBrand Media OfficeNo ratings yet

- Theoretical Framework for Measuring Job Satisfaction (SampleDocument4 pagesTheoretical Framework for Measuring Job Satisfaction (SampleJoseEdgarNolascoLucesNo ratings yet

- The Refugees - NotesDocument1 pageThe Refugees - NotesNothing Means to meNo ratings yet

- B152 01 00 00 00Document517 pagesB152 01 00 00 00lsep_bellaNo ratings yet

- UK & India Health Insurance Actuarial ExamDocument4 pagesUK & India Health Insurance Actuarial ExamVignesh SrinivasanNo ratings yet

- Calculate Size of Transformer / Fuse / Circuit Breaker: Connected Equipment To TransformerDocument16 pagesCalculate Size of Transformer / Fuse / Circuit Breaker: Connected Equipment To TransformerHari OM MishraNo ratings yet

- 'S Outfits and Emergency Escape Breathing Devices (Eebd)Document11 pages'S Outfits and Emergency Escape Breathing Devices (Eebd)Thurdsuk NoinijNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2018 Nutrition Month ReportDocument1 page2018 Nutrition Month ReportAnn RuizNo ratings yet

- Barangay Ordinance Vaw 2018Document7 pagesBarangay Ordinance Vaw 2018barangay artacho1964 bautista100% (3)

- Affidavit of UNDERTAKING AlbayDocument2 pagesAffidavit of UNDERTAKING AlbayEppie SeverinoNo ratings yet

- HZB-15S Service ManualDocument20 pagesHZB-15S Service ManualJason Cravy100% (1)

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Early Methods of Fire-Lighting and the Invention of MatchesDocument11 pagesEarly Methods of Fire-Lighting and the Invention of MatchesVogware Academy JindNo ratings yet

- Soa Group Health TrackDocument2 pagesSoa Group Health TrackwasabiwafflesNo ratings yet

- Measles/ Rubella & VPD Surveillance:: Allotment of EPID Number and Outbreak IDDocument7 pagesMeasles/ Rubella & VPD Surveillance:: Allotment of EPID Number and Outbreak IDDevendra Singh TomarNo ratings yet

- Osteo Book Final 2014Document51 pagesOsteo Book Final 2014hyanandNo ratings yet

- Hybridization Review WorksheetDocument6 pagesHybridization Review WorksheetRejed VillanuevaNo ratings yet