Professional Documents

Culture Documents

Lease Vs Buying, Borrowing

Uploaded by

Zohaib HussainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lease Vs Buying, Borrowing

Uploaded by

Zohaib HussainCopyright:

Available Formats

SOME IMPORTANT POINTS ON LEASE VS BUYING/ BORROWING

• Lease vs. buying/ borrowing is a blend of investing and financing decision.

• Tax shield on depreciation is allowed only for lessor

• Lease rental is an expense for the lessee but and income for the lessor

First Approach

i. Investing decision is evaluated separately based on NPV.

ii. Identify all relevant operating Cash Flows including taxes and capital allowances.

iii. Discount rates always based on WACC or COC.

iv. If NPV is positive, proceed to the financing decision other wise Reject the

proposal.

Second Approach

i. Evaluate financing Decision: Only Cash Flows, which are relevant to the source

of finance, are considered. (Operating Cash Flows are ignored, because they are

same throughout the period).

1. LEASE

Note: Tax authorities consider all

Following Cash Flows are considered only leases as operating leases and

allow full lease rental as

1. Lease Rental deductible allowance

2. Tax Shield on lease rental

2. BUYING/ BORROWING

1. Cost of purchase

2. Tax Shield on Capital Allowance

3. Interest expense and its tax shield are considered only if annual interest payments

are made

4. Do not considered interest expense and its shield if lump sum amount of loan is

paid at the end of the period

After tax-borrowing rate is WAAC/COC is always higher than cost

taken as a yardstick, cost of of debt after tax because Ke is always >

capital (WAAC) is not

considered. Less costly option Kd And Ke is included in WACC

is adopted.

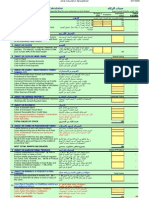

LEASE VS BUYING/ BORROWING

Method 1

Investment Decision at Cost of

Capital (Relevant Cash Flows)

Cost of Equipment

Operating Savings

Tax Effect on Savings

Capital Allowance

Negative NPV Positive NPV

(Reject)

Lease related Cash Flows Borrowing related Cash Flows

At after tax borrowing rate At after tax borrowing rate

1. Lease Rental 1- Loan Principal at Zero Year

2. Tax effect on lease rental 2- Tax Effect on Depreciation

LEASE VS BUYING/ BORROWING

Method 2

( Investing + Financing Decision )

(Combined)

Acquiring with borrowing Acquiring with leasing

Cost of purchase/ Loan Operating Savings

Principal Tax effect on saving

Operating savings Lease rental

Tax effect on operating Tax effect on lease rental

savings

Capital Allowance

(Discounted at after tax (Discounted at after tax

borrowing rate) borrowing rate)

You might also like

- 1655965117leases - IFRS 16Document9 pages1655965117leases - IFRS 16Akash BenedictNo ratings yet

- Adhish Sir'S Classes 1: Chapter - Cost of CapitalDocument8 pagesAdhish Sir'S Classes 1: Chapter - Cost of CapitaladhishcaNo ratings yet

- Insurance Claims For Loss of Stock and Loss of Profit 2 PDFDocument22 pagesInsurance Claims For Loss of Stock and Loss of Profit 2 PDFEswari Gk100% (1)

- Lease Finance and Investment Banking PDFDocument105 pagesLease Finance and Investment Banking PDFnayanNo ratings yet

- 20190228203746minicase FiDocument1 page20190228203746minicase FifauziahNo ratings yet

- 2.2-Module 2 Only QuestionsDocument46 pages2.2-Module 2 Only QuestionsHetviNo ratings yet

- Assignment 5 FinanceDocument3 pagesAssignment 5 FinanceAhmedNo ratings yet

- 18415compsuggans PCC FM Chapter7Document13 pages18415compsuggans PCC FM Chapter7Mukunthan RBNo ratings yet

- Ascertainment of ProfitDocument18 pagesAscertainment of ProfitsureshNo ratings yet

- Working Capital MGTDocument14 pagesWorking Capital MGTrupaliNo ratings yet

- Make or Buy DecisionDocument20 pagesMake or Buy DecisionNitin Agarwal100% (1)

- Investment PapersDocument6 pagesInvestment PapersAbhishek JainNo ratings yet

- Capital Structure TheoryDocument27 pagesCapital Structure Theoryaritraray100% (2)

- 16 - IND AS 108 - Operating Segment Final (R)Document18 pages16 - IND AS 108 - Operating Segment Final (R)S Bharhath kumarNo ratings yet

- Cma ProspectusDocument68 pagesCma ProspectusDeepak NimmojiNo ratings yet

- Business Policy and Strategy PDFDocument2 pagesBusiness Policy and Strategy PDFNishken100% (1)

- Working Capital Management in Reliance Industries LimitedDocument5 pagesWorking Capital Management in Reliance Industries LimitedVurdalack666No ratings yet

- Financial Modeling Chapter 2 Calculating Cost of Capital 2015Document64 pagesFinancial Modeling Chapter 2 Calculating Cost of Capital 2015NEERAJ N RCBSNo ratings yet

- Internship Report Final PDFDocument88 pagesInternship Report Final PDFSumaiya islamNo ratings yet

- SEBI ICDR Regulations 2018 Key Amendments 1Document19 pagesSEBI ICDR Regulations 2018 Key Amendments 1jimit0810No ratings yet

- Joint Products & by Products: Solutions To Assignment ProblemsDocument5 pagesJoint Products & by Products: Solutions To Assignment ProblemsXNo ratings yet

- BCG ApproachDocument2 pagesBCG ApproachAdhityaNo ratings yet

- 820001-Cost and Management AccountingDocument4 pages820001-Cost and Management AccountingsuchjazzNo ratings yet

- Ilide - Info Review Qs PRDocument93 pagesIlide - Info Review Qs PRMobashir KabirNo ratings yet

- Transfer Price Questuon Ca Final PDFDocument69 pagesTransfer Price Questuon Ca Final PDFCoc GamingNo ratings yet

- Integrated Materials ManagementDocument30 pagesIntegrated Materials Managementaharish_iitk0% (1)

- Contents of Offer DocumentDocument56 pagesContents of Offer Documentsandeep_agrawal95100% (2)

- Solutions - Income Tax Divyastra CH 7 - PGBPDocument26 pagesSolutions - Income Tax Divyastra CH 7 - PGBPArjun ThawaniNo ratings yet

- INTERMEDIATE TECHNICAL CERTIFICATE EXAMINATION JUNE 2022Document12 pagesINTERMEDIATE TECHNICAL CERTIFICATE EXAMINATION JUNE 2022serge folegweNo ratings yet

- Numericals On Cost of Capital and Capital StructureDocument2 pagesNumericals On Cost of Capital and Capital StructurePatrick AnthonyNo ratings yet

- Benefits of Harmonisation and ConvergenceDocument3 pagesBenefits of Harmonisation and ConvergencemclerenNo ratings yet

- Assessment of Working Capital Requirements Form # II: OperatingDocument10 pagesAssessment of Working Capital Requirements Form # II: OperatingSuzanne Davis100% (2)

- Cahpet 4.assssssssssssssssssssDocument57 pagesCahpet 4.assssssssssssssssssssSeifu Bekele100% (1)

- Study of Expenses in Different Branches of Hindustan Times at Western UP RegionDocument73 pagesStudy of Expenses in Different Branches of Hindustan Times at Western UP RegionGuman Singh0% (1)

- SFM - Forex - QuestionsDocument23 pagesSFM - Forex - QuestionsVishal SutarNo ratings yet

- Irctc Ipo PPT FM PDFDocument12 pagesIrctc Ipo PPT FM PDFAnshita JainNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan SNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Accounting For LeasesDocument4 pagesAccounting For LeasesSebastian MlingwaNo ratings yet

- Manpower PlanningDocument20 pagesManpower Planningroopak_iajNo ratings yet

- Dividend Policy - Sample Problems - ICAIDocument2 pagesDividend Policy - Sample Problems - ICAIgfahsgdahNo ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Presentation 2. Understanding The Interest Rates. The Yield To MaturityDocument30 pagesPresentation 2. Understanding The Interest Rates. The Yield To MaturitySadia SaeedNo ratings yet

- Pricing DecisionsDocument3 pagesPricing DecisionsMarcuz AizenNo ratings yet

- Budgeting and Variance AnalysisDocument43 pagesBudgeting and Variance AnalysisADITYAROOP PATHAKNo ratings yet

- Problems On Hire Purchase and LeasingDocument5 pagesProblems On Hire Purchase and Leasingprashanth mvNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Fake Payback PeriodDocument6 pagesFake Payback Periodakshit_vijNo ratings yet

- Ratio Analysis Formula Excel TemplateDocument5 pagesRatio Analysis Formula Excel TemplateTarun MittalNo ratings yet

- Associate Co. QuestionsDocument3 pagesAssociate Co. QuestionsSigei Leonard100% (2)

- Chapter 7 - Value of Supply - NotesDocument16 pagesChapter 7 - Value of Supply - NotesPuran GuptaNo ratings yet

- Banking CompaniesDocument68 pagesBanking CompaniesKiran100% (2)

- Securitization in India: Key Concepts and StructuresDocument31 pagesSecuritization in India: Key Concepts and StructuresAbhishek MalikNo ratings yet

- Final Accounts Illustration ProblemsDocument11 pagesFinal Accounts Illustration ProblemsSarath kumar CNo ratings yet

- Chapter 10 - Dividend PolicyDocument37 pagesChapter 10 - Dividend PolicyShubhra Srivastava100% (1)

- As-11 The Effects of Changes in Foreign Exchange RatesDocument21 pagesAs-11 The Effects of Changes in Foreign Exchange RatesDipen AdhikariNo ratings yet

- Leasing FundamentalsDocument18 pagesLeasing FundamentalsNeha GoyalNo ratings yet

- HASPACC 425 - Lease or Buy - HandoutDocument3 pagesHASPACC 425 - Lease or Buy - HandoutTawanda Tatenda HerbertNo ratings yet

- Capital Lease Vs Operating Lease PDFDocument6 pagesCapital Lease Vs Operating Lease PDFHassleBustNo ratings yet

- LeaseDocument1 pageLeasevanvunNo ratings yet

- Cash BookDocument19 pagesCash BookZohaib HussainNo ratings yet

- Ws2008 Wealth StatmentDocument10 pagesWs2008 Wealth StatmentZohaib HussainNo ratings yet

- Pacific Security ServicesDocument1 pagePacific Security ServicesZohaib HussainNo ratings yet

- Cblank Ledger BookDocument58 pagesCblank Ledger BookZohaib HussainNo ratings yet

- Islamic Financial Accounting Standard 1 - MurabahaDocument12 pagesIslamic Financial Accounting Standard 1 - MurabahaPlatonic100% (4)

- Pakistan Income Tax LawDocument22 pagesPakistan Income Tax Lawhssaroch75% (4)

- Monthly Bank ReconciliationDocument1 pageMonthly Bank Reconciliationapi-3726455No ratings yet

- برنامج حساب زكاه المالDocument3 pagesبرنامج حساب زكاه المالnewlife4me100% (10)

- Income Tax Return E-Filing Guide (Salaried) - 2009Document16 pagesIncome Tax Return E-Filing Guide (Salaried) - 2009Zohaib HussainNo ratings yet

- Individuals Aop It ReturnDocument6 pagesIndividuals Aop It ReturnZohaib HussainNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Business Valuation TechniquesDocument1 pageBusiness Valuation TechniquesZohaib HussainNo ratings yet

- ED Fair Value MeasurementDocument64 pagesED Fair Value MeasurementZohaib HussainNo ratings yet

- Islamic Financial Accounting Standard 2 - IjarahDocument7 pagesIslamic Financial Accounting Standard 2 - IjarahPlatonic100% (1)

- Refund ApplicationDocument1 pageRefund ApplicationZohaib HussainNo ratings yet

- 29 Motivational QuotesDocument1 page29 Motivational QuotesZohaib HussainNo ratings yet

- Companies Ordinance 1984Document419 pagesCompanies Ordinance 1984M Muneeb SaeedNo ratings yet

- Salary Tax (2009 - 10)Document2 pagesSalary Tax (2009 - 10)Zohaib HussainNo ratings yet

- IFRS2009 in Your PocketDocument124 pagesIFRS2009 in Your PocketZohaib Hussain100% (1)

- Income Tax Calclulator 2009 WorkingDocument3 pagesIncome Tax Calclulator 2009 WorkingZohaib HussainNo ratings yet

- Transfer AgreementDocument2 pagesTransfer AgreementHuntnPeteNo ratings yet

- Spring 2024 Template Feasibility Study by Saeed AlMuharramiDocument29 pagesSpring 2024 Template Feasibility Study by Saeed AlMuharramiMaathir Al ShukailiNo ratings yet

- Financial Forecasts and Determination of Financial Feasibility BTLED STUDDocument23 pagesFinancial Forecasts and Determination of Financial Feasibility BTLED STUDjared catanguiNo ratings yet

- PrivatizationDocument69 pagesPrivatizationgakibhaiNo ratings yet

- Railway Reports Discussion-Rajnish KumarDocument65 pagesRailway Reports Discussion-Rajnish KumarIndian Railways Knowledge PortalNo ratings yet

- Executive SummaryDocument7 pagesExecutive SummaryAshi GargNo ratings yet

- Chapter 17 & Chapter 18 (1) NewDocument66 pagesChapter 17 & Chapter 18 (1) NewAlief AmbyaNo ratings yet

- International Capital MarketDocument2 pagesInternational Capital MarketPhuc LeNo ratings yet

- Learning The LegaleseDocument30 pagesLearning The LegaleseapachedaltonNo ratings yet

- 7 Mega Trades That Could Hand You A 7 Figure PayouDocument30 pages7 Mega Trades That Could Hand You A 7 Figure Payouyeahitsme604No ratings yet

- UBS PagesDocument52 pagesUBS PageschristinaNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipNilesh SurvaseNo ratings yet

- Finance - Cost of Capital TheoryDocument30 pagesFinance - Cost of Capital TheoryShafkat RezaNo ratings yet

- Issai 1450 PNDocument5 pagesIssai 1450 PNMian Tahir WaseemNo ratings yet

- Meridan Golf and Sports Was Formed On July 1 2014Document1 pageMeridan Golf and Sports Was Formed On July 1 2014Hassan JanNo ratings yet

- Chapter 17 Homework ProblemsDocument5 pagesChapter 17 Homework ProblemsAarti JNo ratings yet

- FIAC6211 - Workbook 2023Document88 pagesFIAC6211 - Workbook 2023Panashe SimbiNo ratings yet

- SCL - I. Letters of CreditDocument5 pagesSCL - I. Letters of CreditlealdeosaNo ratings yet

- MDF Lorine PDFDocument2 pagesMDF Lorine PDFyou jiaNo ratings yet

- Major Role and Goal of IFI's: Financial Institution International Law International InstitutionsDocument4 pagesMajor Role and Goal of IFI's: Financial Institution International Law International Institutionslordnikon123No ratings yet

- How To Register Your CPNDocument15 pagesHow To Register Your CPNMaryUmbrello-Dressler81% (37)

- RTC Ruling on Metrobank Writ of Possession UpheldDocument2 pagesRTC Ruling on Metrobank Writ of Possession UpheldLaw StudentNo ratings yet

- P2P Interview Questions and Answer 3Document13 pagesP2P Interview Questions and Answer 3Raju Bothra100% (2)

- Flybe Group PLC FLYBGB Annual Report For Period End 31mar2015 English PDFDocument136 pagesFlybe Group PLC FLYBGB Annual Report For Period End 31mar2015 English PDFtheredcornerNo ratings yet

- Pangan CompanyDocument18 pagesPangan CompanyWendy Lupaz80% (5)

- Shopify Commerce Singapore Pte. Ltd. billing details for Whole FoodsDocument2 pagesShopify Commerce Singapore Pte. Ltd. billing details for Whole FoodsAshok Kumar MohantyNo ratings yet

- Q1 Exports: Bed Wear Cotton ClothDocument10 pagesQ1 Exports: Bed Wear Cotton ClothSaqib RehanNo ratings yet

- Indian Retail Sector - AnalysisDocument15 pagesIndian Retail Sector - AnalysisPromodkumar kpNo ratings yet

- SBD HPPWD Final2016Document108 pagesSBD HPPWD Final2016KULDEEP KAPOORNo ratings yet

- OlaDocument2 pagesOlaanderspeh.realestateNo ratings yet