Professional Documents

Culture Documents

Stable Dividend

Uploaded by

anon-821638100%(2)100% found this document useful (2 votes)

5K views6 pagesDetails of what constitutes a Stable Dividend Policy

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDetails of what constitutes a Stable Dividend Policy

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

5K views6 pagesStable Dividend

Uploaded by

anon-821638Details of what constitutes a Stable Dividend Policy

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 6

Examination of 3 forms of a

Stable Dividend Policy

These examination requires addressing the following

questions:

2. What is their relative suitability ?

3. What are their implication to the shareholders & the

firm ?

4. Which form would find favour with the investors ?

Constant Payout Ratio guards against

overpayment as well as underpayment of dividends

because management can not pay dividends if there

are no profits & it can not withhold them when

profits are earned.

From the shareholder’s view point, this method

involves uncertainty & irregularity in regard to the

expected dividends.

Stable Rupee Dividend Plus Extra Dividend is

suitable for companies whose earnings fluctuate

widely. From the investor’s view point, the extra

dividend is of sporadic nature.

Constant Dividend Per Share gives an assured fixed amount

as dividends which has gradually & consistently increase over

the years.

Why should a firm follow stable dividend

policy ?

Various reasons are as follow:-:-

6. Desire for current income

7. Informational Contents

8. Requirements of Institutional Investors

# A company should seek stable dividend policy which avoids

occasional reduction of dividends. Investors favourably react to

the price of shares of such companies & there is a price

enhancing effect of such policy as it resolves the uncertainty

from the minds of the investors regarding the anticipated

stream of dividends.

EXAMPLE

X & Y ARE TWO FAST GROWING COMPANIES IN THE ENGINEERING INDUSTRY.

THEY ARE CLOSE COMPITITORS & THEIR ASSETS COMPOSITION, CAPITAL

STRUCTURE & PROFITABILITY RECORDS HAVE BEEN VERY SIMILAR FOR SEVERAL

YEARS. THE PRIMARY DIFFERENCE BETWEEN THEM FROM FINANCIAL

MANAGEMENT PERSPECTIVE IS THEIR DIVIDEND POLICY. THE COMPANY X TRIES

TO MAINTAIN A NON DECREASING DIVIDEND PER SHARE, WHILE THE COMPANY Y

MAINTAINS A CONSTANT DIVIDEND PAY OUT RATIO. THEIR RECENT EARNING PER

SHARE(EPS), DIVIDEND PER SHARE (DPS), & SHARE PRICE (P) HISTORY ARE AS

FOLLOWS:::::

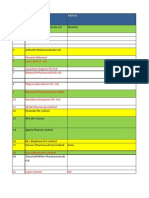

Year COMPANY X COMPANY Y

EPS DPS P(RANGE) EPS DPS P(RANGE

)

1 Rs 9.30 Rs 2 Rs 75-90 Rs 9.50 Rs Rs 60-80

2 7.40 2 55-80 7.00 1.90

1.40 25-65

3 10.50 2 70-110 10.50 2.10 35-80

4 12.75 2.25 85-135 12.25 2.45 80-120

5 20.00 2.50 135-200 20.25 4.05 110-225

6 16.00 2.50 150-190 17.00 3.40 140-180

7 19.00 2.50 155-210 20.00 4.00 130-190

QUESTIONS OF EXAMPLE

IN ALL CALCULATIONS BELOW THAT REQUIRE A SHARE PRICE, USE THE

AVERAGE OF THE TWO PRICES GIVEN IN THE SHARE PRICE RANGE.

(A) DETERMINE THE DIVIDEND PAYOUT RATIO (D/P) & PRICE TO

EARNINGS(P/E) RATIO FOR BOTH COMPANIES FOR ALL THE

YEARS.

(B) DETERMINE THE AVERAGE D/P & P/E FOR BOTH THE COMPANIES OVER

THE PERIOD 1 THROUGH 7.

(C) THE MANAGEMENT OF COMPANY Y IS PUZZLED AS TO WHY THEIR

SHARE PRICES ARE LOWER THAN THOSE OF COMPANY X, IN

SPITE OF THE BETTER PROFITABILITY RECORD PARTICULARLY

OF THE PAST 3 YEARS.

AS A FINANCIAL CONSULTANT, HOW WOULD YOU EXPLAIN THE

SITUATION ?????????

SOLUTION

D

(A) & (B) D/P & P/E RATIOS

YE COMPANY X COMPANY Y

AR EPS DPS D/P P P/E EPS DPS D/P P P/E

RATI RATIO RATI RATIO

1 9.30 2.00 O

21.5 82.50 8.87 9.50 1.90 O

20 70 7.37

2 7.40 2.00 27.5 67.50 9.12 7.00 1.40 20 45 6.43

3 10.50 2.00 19.0 90.00 8.57 10.5 2.10 20 57.50 5.48

0

4 12.75 2.25 17.6 110.0 8.63 12.2 2.45 20 100.0 8.16

0 5 0

5 20.00 2.50 12.5 167.5 8.37 20.2 4.05 20 167.5 8.27

0 5 0

6 16.00 2.50 15.6 170.0 10.62 17.0 3.40 20 160.0 9.41

0 0 0

7 19.00 2.50 13.2 182.5 9.6 20.0 4.00 20 160.0 8.00

0 0 0

94.95 15.7 16.6 870.0 9.16 96.5 19.30 20 760.0 7.88

5 0 0 0

(c) COMPANY X IS FOLLOWING A STABLE DIVIDEND POLICY WHEREAS

COMPANY Y IS FOLLOWING A STABLE DIVIDEND PAYOUT RATIO.

IN THE LATTER TYPE OF POLICY, SPORADIC DIVIDEND PAYMENTS

OCCUR WHICH MAKE ITS OWNERS VERY UNCERTAIN ABOUT THE

RETURNS THEY CAN EXPECT FROM THEIR INVESTMENT IN THE FIRM

&, THEREFORE, GENERALLY DEPRESS THE SHARE PRICES.

IT IS PROBABLY FOR THIS REASON THAT THE COMPANY X’S

AVERAGE PRICE PER SHARE EXHIBITED A CONSISTENT INCREASE

COMPARED TO COMPANY Y, VOLATILE PATTERN OF EARNINGS OF

BOTH COMPANIES (DURING THE LAST 3 YEARS) NOTWITHSTANDING.

SO COMPANY Y IS ADVISED TO FOLLOW A STABLE DIVIDEND POLICY.

You might also like

- AFM PPT FinalDocument45 pagesAFM PPT Final0nilNo ratings yet

- Numericals On Corporate ActionsDocument2 pagesNumericals On Corporate ActionsRENUKA THOTENo ratings yet

- Dividend PolicyDocument74 pagesDividend PolicyNithin KsNo ratings yet

- Bao2001 Group AssignmentS22018SunwayDocument4 pagesBao2001 Group AssignmentS22018SunwayDessiree ChenNo ratings yet

- Final RF1 Template SoftDocument8 pagesFinal RF1 Template Softrizza_rosalNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Dividend Decesion: A Strategic PerspectiveDocument34 pagesDividend Decesion: A Strategic PerspectivePrashant MittalNo ratings yet

- Dividend Policy Analysis: Submitted To: Prof. Sougata RayDocument8 pagesDividend Policy Analysis: Submitted To: Prof. Sougata Raysubhasis mahapatraNo ratings yet

- PUP Financial Forecasting TechniquesDocument7 pagesPUP Financial Forecasting TechniquesHambeca PHNo ratings yet

- Ca Inter FM Icai Past Year Q Ca Namir AroraDocument193 pagesCa Inter FM Icai Past Year Q Ca Namir AroraPankaj MeenaNo ratings yet

- Get the Full Version of Stock Analysis SoftwareDocument6 pagesGet the Full Version of Stock Analysis SoftwaresumanNo ratings yet

- Fund Economics DDocument4 pagesFund Economics Ddibart0No ratings yet

- Mid Term Financial Management SolutionsDocument4 pagesMid Term Financial Management SolutionsSonakshi BhatiaNo ratings yet

- The Dilemma at Day ProDocument7 pagesThe Dilemma at Day ProQistinaNo ratings yet

- Case Study 2Document10 pagesCase Study 2Cheveem Grace EmnaceNo ratings yet

- 2018 SIMR Bootcamp Valuation & ModelingDocument24 pages2018 SIMR Bootcamp Valuation & ModelingRahul GuptaNo ratings yet

- Financial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsDocument7 pagesFinancial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsnikunjNo ratings yet

- Valuation Model 1Document71 pagesValuation Model 1Tuan NguyenNo ratings yet

- THURGA Tutorial 5Document5 pagesTHURGA Tutorial 5thurgakannanNo ratings yet

- Biruk Zewdie AFM AssignmentDocument3 pagesBiruk Zewdie AFM AssignmentBura ZeNo ratings yet

- TakeHome Activity No 2Document10 pagesTakeHome Activity No 2Shai Rendon CandaoNo ratings yet

- Att - 1619504089277 - Fundamental Analysis On Hul1Document12 pagesAtt - 1619504089277 - Fundamental Analysis On Hul1Zenyoga Meditation MusicNo ratings yet

- Adventa 3Q10-20100928-Not Flexible EnoughDocument5 pagesAdventa 3Q10-20100928-Not Flexible EnoughPiyu MahatmaNo ratings yet

- 1.3 ActivityDocument9 pages1.3 ActivityRonald MalicdemNo ratings yet

- Evaluating Reliance's Dividend Policy and ValuationDocument11 pagesEvaluating Reliance's Dividend Policy and ValuationYash Aggarwal BD20073No ratings yet

- LBO Valuation of Cheek ProductsDocument4 pagesLBO Valuation of Cheek ProductsEfri Dwiyanto100% (2)

- Extraordinary When One Looks at The Performance of The Broader Universe" As Well As WhenDocument9 pagesExtraordinary When One Looks at The Performance of The Broader Universe" As Well As Whenravi_405No ratings yet

- Philippine Health Insurance Corporation: Subject: ofDocument3 pagesPhilippine Health Insurance Corporation: Subject: ofDane EnternaNo ratings yet

- Skills-Building Exercises: Dang Thi Hoai Thuong - 1582381Document10 pagesSkills-Building Exercises: Dang Thi Hoai Thuong - 1582381Thuong DangNo ratings yet

- BankersBall Compensation Report 2007 2008Document17 pagesBankersBall Compensation Report 2007 2008clmagnaye100% (2)

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- Ea - 2 2 02 0202020202020202020202Document41 pagesEa - 2 2 02 0202020202020202020202Loydifer ..No ratings yet

- Mod 4 Valuation and ConceptsDocument5 pagesMod 4 Valuation and Conceptsvenice cambryNo ratings yet

- University of Antique: College of Business & AccountancyDocument10 pagesUniversity of Antique: College of Business & AccountancyKhel Agana VisenNo ratings yet

- STCInd 2019 Sal Survey ReportDocument22 pagesSTCInd 2019 Sal Survey ReportJayalakshmidhanNo ratings yet

- Understanding the Value of Common StocksDocument12 pagesUnderstanding the Value of Common StocksMonalisa SethiNo ratings yet

- Statistics for Managers: Key InsightsDocument15 pagesStatistics for Managers: Key InsightsKuldeep GadhiaNo ratings yet

- Ooredoo AssignmentDocument27 pagesOoredoo AssignmentAravind Kumar SNo ratings yet

- Patanjali DCF ValuationDocument5 pagesPatanjali DCF ValuationAakash RathorNo ratings yet

- Case Study 2: Growing Pains ForecastDocument15 pagesCase Study 2: Growing Pains ForecastCheveem Grace Emnace100% (1)

- Financial Model Forecasting - Case StudyDocument15 pagesFinancial Model Forecasting - Case Study唐鹏飞No ratings yet

- IRRBB Basic WorkingDocument19 pagesIRRBB Basic WorkingGaurav GuptaNo ratings yet

- F - Analysis - HorizontalDocument14 pagesF - Analysis - Horizontaljaneferrarin551No ratings yet

- Article GoodlossesbadlossesDocument13 pagesArticle GoodlossesbadlossesRatan Lal SharmaNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 26 09 09Document1 pageDividend Yield Stocks - HDFC Sec - 26 09 09vishalknoxNo ratings yet

- Grace PresentationDocument21 pagesGrace PresentationLeonardus FelixNo ratings yet

- MBA FF Group Project Assignment Fall 2020 - Group B3 (Indus Motor)Document28 pagesMBA FF Group Project Assignment Fall 2020 - Group B3 (Indus Motor)Aliza RizviNo ratings yet

- Diversification Strategy Versus MarketDocument17 pagesDiversification Strategy Versus MarketNorth WestNo ratings yet

- Akansh Arora FM AssignmentDocument17 pagesAkansh Arora FM AssignmentAKANSH ARORANo ratings yet

- Corporate Finance Earnings SurpriseDocument23 pagesCorporate Finance Earnings SurpriseDRISHTI RAJPALNo ratings yet

- MS - Good Losses, Bad LossesDocument13 pagesMS - Good Losses, Bad LossesResearch ReportsNo ratings yet

- Equity DailyDocument4 pagesEquity DailyArvsrvNo ratings yet

- Philippine Health C Rporation: Philheal CircularDocument2 pagesPhilippine Health C Rporation: Philheal CircularEman MayugaNo ratings yet

- Mergers and AquisationsDocument10 pagesMergers and AquisationsNeeraj KumarNo ratings yet

- Rockboro Machine Tools Financial StrategyDocument10 pagesRockboro Machine Tools Financial StrategyPatcharanan SattayapongNo ratings yet

- I Have Learned The: TH THDocument12 pagesI Have Learned The: TH THmayankNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 8 Branch AccountsDocument62 pages8 Branch AccountsAnilNo ratings yet

- Digital HR Transformation at WorkplaceDocument3 pagesDigital HR Transformation at Workplaceharmain khalilNo ratings yet

- Isca MCQ BookDocument113 pagesIsca MCQ BookAmmy GaikwadNo ratings yet

- Gutierrez Corporation’s department A should sell component C to department B at P96 per unitDocument4 pagesGutierrez Corporation’s department A should sell component C to department B at P96 per unitRoseann KimNo ratings yet

- FARR CeramicsDocument17 pagesFARR CeramicsKawsurNo ratings yet

- Chapter 01Document8 pagesChapter 01Anh MusicNo ratings yet

- ACC311-Finalterm Solved MCQ'sDocument6 pagesACC311-Finalterm Solved MCQ'sZeeNo ratings yet

- Guide to First PFRS Financial StatementsDocument2 pagesGuide to First PFRS Financial StatementsRicaNo ratings yet

- BUSI 1043: INTRODUCTION TO FINANCIAL ACCOUNTING UNIT 3 EXERCISEDocument4 pagesBUSI 1043: INTRODUCTION TO FINANCIAL ACCOUNTING UNIT 3 EXERCISERichard MamisNo ratings yet

- Elevator PitchDocument3 pagesElevator PitchDipanshu SinghNo ratings yet

- Mumbai Pharma CompanyDocument8 pagesMumbai Pharma CompanyPankaj BaghNo ratings yet

- Sanjoy Das 23-021: Ans of Question 01 Ans of ADocument2 pagesSanjoy Das 23-021: Ans of Question 01 Ans of ASanjoy dasNo ratings yet

- Prime KSI Printable Chocolate Bar Wrapper Templates Novelty - Etsy UKDocument1 pagePrime KSI Printable Chocolate Bar Wrapper Templates Novelty - Etsy UKdjskdkNo ratings yet

- The BIG Partnership Has Decided To Liquidate at December 31Document6 pagesThe BIG Partnership Has Decided To Liquidate at December 31deepak_baidNo ratings yet

- 1530255040711Document11 pages1530255040711Chethan DurganNo ratings yet

- M.H. Alshaya: An International Retail Franchise OperatorDocument4 pagesM.H. Alshaya: An International Retail Franchise OperatorSaurabh DwivediNo ratings yet

- P - S4FIN - 1709.pdf-10 Question PDFDocument5 pagesP - S4FIN - 1709.pdf-10 Question PDFanon_286810595No ratings yet

- Performance Management Questionnaire for EmployeesDocument2 pagesPerformance Management Questionnaire for EmployeesAbhisek SarkarNo ratings yet

- Labor CasesDocument4 pagesLabor CasesDonnie Ray SolonNo ratings yet

- Om102 Chap7 Process StrategyDocument37 pagesOm102 Chap7 Process StrategyJanela Ledesma ClavecillasNo ratings yet

- Updated PS Addendum ManilaDocument1 pageUpdated PS Addendum ManilaJennell ArellanoNo ratings yet

- Rapport Textile Ethiopië PDFDocument38 pagesRapport Textile Ethiopië PDFgarmentdirectorate100% (1)

- CIDC Model EPC Agreement 22032018Document342 pagesCIDC Model EPC Agreement 22032018Chetan Kumar jainNo ratings yet

- MARKETING MANAGEMENT Report Ice TeaDocument12 pagesMARKETING MANAGEMENT Report Ice TeaHamza SabirNo ratings yet

- Test Bank For M Finance 3rd Edition by CornettDocument36 pagesTest Bank For M Finance 3rd Edition by Cornettcorinneheroismf19wfo100% (42)

- Reserach DraftDocument2 pagesReserach DraftMEGHA PALANDENo ratings yet

- FAQs On Entity Master 1Document13 pagesFAQs On Entity Master 1Shinil NambrathNo ratings yet

- Momo Statement ReportDocument9 pagesMomo Statement ReportPius AwuahNo ratings yet

- Artificial Intelligence IN Insurance: Team MembersDocument10 pagesArtificial Intelligence IN Insurance: Team MembersASHWINI KUMAR 22No ratings yet

- Nature and Scope of BusinessDocument15 pagesNature and Scope of BusinessNayan MaldeNo ratings yet