Professional Documents

Culture Documents

Problems Chapter 7

Uploaded by

Trang LeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems Chapter 7

Uploaded by

Trang LeCopyright:

Available Formats

12/10/13

Cash and Receivables

Print this page

PROBLEMS

P7-1.

(Determine Proper Cash Balance) 2 Francis Equipment Co. closes its books regularly on December 31, but at the end of 2014 it held its cash book open so that a more favorable balance sheet could be prepared for credit purposes. Cash receipts and disbursements for the first 10 days of January were recorded as December transactions. The information is given below. 1. January cash receipts recorded in the December cash book totaled $45,640, of which $28,000 represents cash sales, and $17,640 represents collections on account for which cash discounts of $360 were given. 2. January cash disbursements recorded in the December check register liquidated accounts payable of $22,450 on which discounts of $250 were taken. 3. The ledger has not been closed for 2014. 4. The amount shown as inventory was determined by physical count on December 31, 2014. The company uses the periodic method of inventory.

Instructions

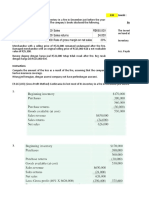

(a) (b) Prepare any entries you consider necessary to correct Francis's accounts at December 31. To what extent was Francis Equipment Co. able to show a more favorable balance sheet at December 31 by holding its cash book open? (Compute working capital and the current ratio.) Assume that the balance sheet that was prepared by the company showed the following amounts: Cash Accounts receivable Inventory Accounts payable Other current liabilities P7-2. (Bad-Debt Reporting) 5 The following are a series of unrelated situations. 1. Halen Company's unadjusted trial balance at December 31, 2014, included the following accounts. Debit Credit Allowance for doubtful accounts $4,000 Net sales $1,200,000

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs 1/9

Dr. $39,000 42,000 67,000

Cr.

$45,000 14,200

12/10/13

Cash and Receivables

Halen Company estimates its bad debt expense to be 1% of net sales. Determine its bad debt expense for 2014. 2. An analysis and aging of Stuart Corp. accounts receivable at December 31, 2014, disclosed the following. Amounts estimated to be uncollectible $ 180,000 Accounts receivable 1,750,000 Allowance for doubtful accounts (per books) 125,000 What is the net realizable value of Stuart's receivables at December 31, 2014? 3. Shore Co. provides for doubtful accounts based on 3% of credit sales. The following data are available for 2014. Credit sales during 2014 Allowance for doubtful accounts 1/1/14 Collection of accounts written off in prior years (customer credit was reestablished) Customer accounts written off as uncollectible during 2014 What is the balance in Allowance for Doubtful Accounts at December 31, 2014? 4. At the end of its first year of operations, December 31, 2014, Darden Inc. reported the following information. Accounts receivable, net of allowance for doubtful accounts $950,000 Customer accounts written off as uncollectible during 2014 24,000 Bad debt expense for 2014 84,000 What should be the balance in accounts receivable at December 31, 2014, before subtracting the allowance for doubtful accounts? 5. The following accounts were taken from Bullock Inc.'s trial balance at December 31, 2014. Debit Net credit sales Allowance for doubtful accounts $ 14,000 Accounts receivable 310,000 Credit $750,000 $2,400,000 17,000 8,000 30,000

If doubtful accounts are 3% of accounts receivable, determine the bad debt expense to be reported for 2014.

Instructions

Answer the questions relating to each of the five independent situations as requested. P7-3.

(Bad-Debt ReportingAging) 5 Manilow Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in Manilow's Accounts Receivable account was $555,000 and Allowance for Doubtful Accounts had a credit balance of $40,000. The year-end balance reported in the balance sheet for Allowance for Doubtful Accounts will be based on the aging schedule shown below. Days Account Outstanding Amount Probability of Collection

2/9

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs

12/10/13

Cash and Receivables

Less than 16 days Between 16 and 30 days Between 31 and 45 days Between 46 and 60 days Between 61 and 75 days Over 75 days

$300,000 100,000 80,000 40,000 20,000 15,000

.98 .90 .85 .80 .55 .00

Instructions

(a) (b) (c) What is the appropriate balance for Allowance for Doubtful Accounts at year-end? Show how accounts receivable would be presented on the balance sheet. What is the dollar effect of the year-end bad debt adjustment on the before-tax income? (CMA adapted) P7-4. (Bad-Debt Reporting) 5 From inception of operations to December 31, 2014, Fortner Corporation provided for uncollectible accounts receivable under the allowance method. Provisions were made monthly at 2% of credit sales, bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account, and no year-end adjustments to the allowance account were made. Fortner's usual credit terms are net 30 days. The balance in Allowance for Doubtful Accounts was $130,000 at January 1, 2014. During 2014, credit sales totaled $9,000,000, interim provisions for doubtful accounts were made at 2% of credit sales, $90,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $15,000. Fortner installed a computer system in November 2014, and an aging of accounts receivable was prepared for the first time as of December 31, 2014. A summary of the aging is as follows. Classification by Month of Sale Balance in Each Category Estimated % Uncollectible November-December 2014 $1,080,000 2% July-October 650,000 10% January-June 420,000 25% Prior to 1/1/14 150,000 80% $2,300,000 Based on the review of collectibility of the account balances in the prior to 1/1/14 aging category, additional receivables totaling $60,000 were written off as of December 31, 2014. The 80% uncollectible estimate applies to the remaining $90,000 in the category. Effective with the year ended December 31, 2014, Fortner adopted a different method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Instructions

(a) Prepare a schedule analyzing the changes in Allowance for Doubtful Accounts for the year ended December 31, 2014. Show supporting computations in good form. (Hint: In computing the 12/31/14 allowance, subtract the $60,000 write-off.) (b) Prepare the journal entry for the year-end adjustment to Allowance for Doubtful Accounts balance as of December 31, 2014. (AICPA adapted) P7-5. (Bad-Debt Reporting) 5

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs 3/9

12/10/13

Cash and Receivables

Presented below is information related to the Accounts Receivable accounts of Gulistan Inc. during the current year 2014. 1. An aging schedule of the accounts receivable as of December 31, 2014, is as follows. Age Under 60 days 60-90 days 91-120 days Over 120 days

*

Net Debit Balance $172,342 136,490 39,924* 23,644 $372,400

% to Be Applied after Correction Is Made 1% 3% 6% $3,700 definitely uncollectible; estimated remainder uncollectible is 25%

The $3,240 write-off of receivables is related to the 91-to-120 day category.

2. The Accounts Receivable control account has a debit balance of $372,400 on December 31, 2014. 3. Two entries were made in the Bad Debt Expense account during the year: (1) a debit on December 31 for the amount credited to Allowance for Doubtful Accounts, and (2) a credit for $3,240 on November 3, 2014, and a debit to Allowance for Doubtful Accounts because of a bankruptcy. 4. Allowance for Doubtful Accounts is as follows for 2014. Allowance for Doubtful Accounts Nov. 3 Uncollectible accounts Jan. 1 Beginning balance 8,750 written off 3,240 Dec. 31 5% of $372,400 18,620 5. A credit balance exists in Accounts Receivable (60-90 days) of $4,840, which represents an advance on a sales contract.

Instructions

Assuming that the books have not been closed for 2014, make the necessary correcting entries. P7-6. (Journalize Various Accounts Receivable Transactions) 3 4 5

The balance sheet of Starsky Company at December 31, 2013, includes the following. Notes receivable $ 36,000 Accounts receivable 182,100 Less: Allowance for doubtful accounts 17,300 $200,800 Transactions in 2014 include the following. 1. Accounts receivable of $138,000 were collected including accounts of $60,000 on which 2% sales discounts were allowed. 2. $5,300 was received in payment of an account which was written off the books as worthless in 2013. 3. Customer accounts of $17,500 were written off during the year. 4. At year-end, Allowance for Doubtful Accounts was estimated to need a balance of $20,000. This estimate is based on an analysis of aged accounts receivable.

Instructions

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs 4/9

12/10/13

Cash and Receivables

Prepare all journal entries necessary to reflect the transactions above. P7-7. (Assigned Accounts ReceivableJournal Entries) 8 Salen Company finances some of its current operations by assigning accounts receivable to a finance company. On July 1, 2014, it assigned, under guarantee, specific accounts amounting to $150,000. The finance company advanced to Salen 80% of the accounts assigned (20% of the total to be withheld until the finance company has made its full recovery), less a finance charge of % of the total accounts assigned. On July 31, Salen Company received a statement that the finance company had collected $80,000 of these accounts and had made an additional charge of % of the total accounts outstanding as of July 31. This charge is to be deducted at the time of the first remittance due Salen Company from the finance company. (Hint: Make entries at this time.) On August 31, 2014, Salen Company received a second statement from the finance company, together with a check for the amount due. The statement indicated that the finance company had collected an additional $50,000 and had made a further charge of % of the balance outstanding as of August 31.

Instructions

Make all entries on the books of Salen Company that are involved in the transactions above. (AICPA adapted) P7-8. (Notes Receivable with Realistic Interest Rate) 6 On October 1, 2014, Arden Farm Equipment Company sold a pecan-harvesting machine to Valco Brothers Farm, Inc. In lieu of a cash payment Valco Brothers Farm gave Arden a 2-year, $120,000, 8% note (a realistic rate of interest for a note of this type). The note required interest to be paid annually on October 1. Arden's financial statements are prepared on a calendar-year basis.

Instructions

Assuming Valco Brothers Farm fulfills all the terms of the note, prepare the necessary journal entries for Arden Farm Equipment Company for the entire term of the note. P7-9. (Notes Receivable Journal Entries) 6 On December 31, 2014, Oakbrook Inc. rendered services to Beghun Corporation at an agreed price of $102,049, accepting $40,000 down and agreeing to accept the balance in four equal installments of $20,000 receivable each December 31. An assumed interest rate of 11% is imputed.

Instructions

Prepare the entries that would be recorded by Oakbrook Inc. for the sale and for the receipts and interest on the following dates. (Assume that the effective-interest method is used for amortization purposes.) (a) (b) (c) (d) (e) P7-10. December 31, 2014. December 31, 2015. December 31, 2016. December 31, 2017. December 31, 2018.

(Comprehensive Receivables Problem) 6

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs

5/9

12/10/13

Cash and Receivables

Braddock Inc. had the following long-term receivable account balances at December 31, 2013. Note receivable from sale of division $1,500,000 Note receivable from officer 400,000 Transactions during 2014 and other information relating to Braddock's long-term receivables were as follows. 1. The $1,500,000 note receivable is dated May 1, 2013, bears interest at 9%, and represents the balance of the consideration received from the sale of Braddock's electronics division to New York Company. Principal payments of $500,000 plus appropriate interest are due on May 1, 2014, 2015, and 2016. The first principal and interest payment was made on May 1, 2014. Collection of the note installments is reasonably assured. 2. The $400,000 note receivable is dated December 31, 2013, bears interest at 8%, and is due on December 31, 2016. The note is due from Sean May, president of Braddock Inc. and is collateralized by 10,000 shares of Braddock's common stock. Interest is payable annually on December 31, and all interest payments were paid on their due dates through December 31, 2014. The quoted market price of Braddock's common stock was $45 per share on December 31, 2014. 3. On April 1, 2014, Braddock sold a patent to Pennsylvania Company in exchange for a $100,000 zerointerest-bearing note due on April 1, 2016. There was no established exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2014, was 12%. The present value of $1 for two periods at 12% is 0.797 (use this factor). The patent had a carrying value of $40,000 at January 1, 2014, and the amortization for the year ended December 31, 2014, would have been $8,000. The collection of the note receivable from Pennsylvania is reasonably assured. 4. On July 1, 2014, Braddock sold a parcel of land to Splinter Company for $200,000 under an installment sale contract. Splinter made a $60,000 cash down payment on July 1, 2014, and signed a 4-year 11% note for the $140,000 balance. The equal annual payments of principal and interest on the note will be $45,125 payable on July 1, 2015, through July 1, 2018. The land could have been sold at an established cash price of $200,000. The cost of the land to Braddock was $150,000. Circumstances are such that the collection of the installments on the note is reasonably assured.

Instructions

(a) (b) (c) P7-11. (Income Effects of Receivables Transactions) 8 9 Prepare the long-term receivables section of Braddock's balance sheet at December 31, 2014. Prepare a schedule showing the current portion of the long-term receivables and accrued interest receivable that would appear in Braddock's balance sheet at December 31, 2014. Prepare a schedule showing interest revenue from the long-term receivables that would appear on Braddock's income statement for the year ended December 31, 2014.

Sandburg Company requires additional cash for its business. Sandburg has decided to use its accounts receivable to raise the additional cash and has asked you to determine the income statement effects of the following contemplated transactions. 1. On July 1, 2014, Sandburg assigned $400,000 of accounts receivable to Keller Finance Company. Sandburg received an advance from Keller of 80% of the assigned accounts receivable less a commission of 3% on the advance. Prior to December 31, 2014, Sandburg collected $220,000 on the assigned accounts receivable, and remitted $232,720 to Keller, $12,720 of which represented interest on the advance from Keller.

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs 6/9

12/10/13

Cash and Receivables

2. On December 1, 2014, Sandburg sold $300,000 of net accounts receivable to Wunsch Company for $270,000. The receivables were sold outright on a without recourse basis. 3. On December 31, 2014, an advance of $120,000 was received from First Bank by pledging $160,000 of Sandburg's accounts receivable. Sandburg's first payment to First Bank is due on January 30, 2015.

Instructions

Prepare a schedule showing the income statement effects for the year ended December 31, 2014, as a result of the above facts. *P7-12. (Petty Cash, Bank Reconciliation) 10 Bill Jovi is reviewing the cash accounting for Nottleman, Inc., a local mailing service. Jovi's review will focus on the petty cash account and the bank reconciliation for the month ended May 31, 2014. He has collected the following information from Nottleman's bookkeeper for this task. Petty Cash 1. The petty cash fund was established on May 10, 2014, in the amount of $250. 2. Expenditures from the fund by the custodian as of May 31, 2014, were evidenced by approved receipts for the following. Postage expense $33.00 Mailing labels and other supplies 65.00 I.O.U. from employees 30.00 Shipping charges (to customer) 57.45 Newspaper advertising 22.80 Miscellaneous expense 15.35 On May 31, 2014, the petty cash fund was replenished and increased to $300; currency and coin in the fund at that time totaled $26.40. Bank Reconciliation THIRD NATIONAL BANK BANK STATEMENT Disbursements Receipts Balance Balance, May 1, 2014 $8,769 Deposits $28,000 Note payment direct from customer (interest of $30) 930 Checks cleared during May $31,150 Bank service charges 27 Balance, May 31, 2014 6,522

Nottleman's Cash Account Balance, May 1, 2014 $ 8,850 Deposits during May 2014 31,000 Checks written during May 2014 (31,835) Deposits in transit are determined to be $3,000, and checks outstanding at May 31 total $850. Cash on hand (besides petty cash) at May 31, 2014, is $246.

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs 7/9

12/10/13

Cash and Receivables

Instructions

(a) (b) (c) *P7-13. Prepare the journal entries to record the transactions related to the petty cash fund for May. Prepare a bank reconciliation dated May 31, 2014, proceeding to a correct cash balance, and prepare the journal entries necessary to make the books correct and complete. What amount of cash should be reported in the May 31, 2014, balance sheet?

(Bank Reconciliation and Adjusting Entries) 10 The cash account of Aguilar Co. showed a ledger balance of $3,969.85 on June 30, 2014. The bank statement as of that date showed a balance of $4,150. Upon comparing the statement with the cash records, the following facts were determined. 1. There were bank service charges for June of $25. 2. A bank memo stated that Bao Dai's note for $1,200 and interest of $36 had been collected on June 29, and the bank had made a charge of $5.50 on the collection. (No entry had been made on Aguilar's books when Bao Dai's note was sent to the bank for collection.) 3. Receipts for June 30 for $3,390 were not deposited until July 2. 4. Checks outstanding on June 30 totaled $2,136.05. 5. The bank had charged the Aguilar Co.'s account for a customer's uncollectible check amounting to $253.20 on June 29. 6. A customer's check for $90 had been entered as $60 in the cash receipts journal by Aguilar on June 15. 7. Check no. 742 in the amount of $491 had been entered in the cash journal as $419, and check no. 747 in the amount of $58.20 had been entered as $582. Both checks had been issued to pay for purchases of equipment.

Instructions

(a) (b) *P7-14. Prepare a bank reconciliation dated June 30, 2014, proceeding to a correct cash balance. Prepare any entries necessary to make the books correct and complete.

(Bank Reconciliation and Adjusting Entries) 10 Presented below is information related to Haselhof Inc. Balance per books at October 31, $41,847.85; receipts $173,523.91; disbursements $164,893.54. Balance per bank statement November 30, $56,274.20. The following checks were outstanding at November 30. 1224 $1,635.29 1230 2,468.30 1232 2,125.15 1233 482.17 Included with the November bank statement and not recorded by the company were a bank debit memo for $27.40 covering bank charges for the month, a debit memo for $372.13 for a customer's check returned and marked NSF, and a credit memo for $1,400 representing bond interest collected by the bank in the name of Haselhof Inc. Cash on hand at November 30 recorded and awaiting deposit amounted to $1,915.40.

Instructions

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs 8/9

12/10/13

Cash and Receivables

(a) (b) *P7-15.

Prepare a bank reconciliation (to the correct balance) at November 30, for Haselhof Inc. from the information above. Prepare any journal entries required to adjust the cash account at November 30.

(Loan Impairment Entries) 11 On January 1, 2014, Botosan Company issued a $1,200,000, 5-year, zero-interest-bearing note to National Organization Bank. The note was issued to yield 8% annual interest. Unfortunately, during 2015 Botosan fell into financial trouble due to increased competition. After reviewing all available evidence on December 31, 2015, National Organization Bank decided that the loan was impaired. Botosan will probably pay back only $800,000 of the principal at maturity.

Instructions

(a) (b) (c) (d) Prepare journal entries for both Botosan Company and National Organization Bank to record the issuance of the note on January 1, 2014. (Round to the nearest $10.) Assuming that both Botosan Company and National Organization Bank use the effective-interest method to amortize the discount, prepare the amortization schedule for the note. Under what circumstances can National Organization Bank consider Botosan's note to be impaired? Compute the loss National Organization Bank will suffer from Botosan's financial distress on December 31, 2015. What journal entries should be made to record this loss?

Copyright 2012 John Wiley & Sons, Inc. All rights reserved.

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDYueGZvcm0.enc?course=crs

9/9

You might also like

- Chapter 7Document28 pagesChapter 7Shibly SadikNo ratings yet

- Tugas Akuntansi Keuangan LanjutanDocument8 pagesTugas Akuntansi Keuangan LanjutanMin DaeguNo ratings yet

- Chapter 21 Latihan SoalDocument10 pagesChapter 21 Latihan SoalJulyaniNo ratings yet

- Accounting Changes and Error Corrections Tutorial (3753)Document3 pagesAccounting Changes and Error Corrections Tutorial (3753)Rawan YasserNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- Intermediate Accounting III Homework Chapter 18Document15 pagesIntermediate Accounting III Homework Chapter 18Abdul Qayoum Awan100% (1)

- Tugas AKM II Minggu 9Document2 pagesTugas AKM II Minggu 9Clarissa NastaniaNo ratings yet

- ACCT550 Homework Week 1Document6 pagesACCT550 Homework Week 1Natasha DeclanNo ratings yet

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahNo ratings yet

- Bab 9 AkmDocument44 pagesBab 9 Akmcaesara geniza ghildaNo ratings yet

- P7-5 Consolidated ComputationsDocument5 pagesP7-5 Consolidated ComputationsRima WahyuNo ratings yet

- CH16Document80 pagesCH16mahinNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Consignments Ch6 DrebbinDocument12 pagesConsignments Ch6 DrebbinindahmuliasariNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- ACC-423 Learning Team B Week 2 Textbook ProblemsDocument10 pagesACC-423 Learning Team B Week 2 Textbook ProblemsdanielsvcNo ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Body EmailDocument2 pagesBody Emailferry firmannaNo ratings yet

- Audit 12 - Rizq Aly AfifDocument2 pagesAudit 12 - Rizq Aly AfifRizq Aly AfifNo ratings yet

- The Zinn Company Plans To Issue 10 000 000 of 20 Year BondsDocument1 pageThe Zinn Company Plans To Issue 10 000 000 of 20 Year BondsAmit PandeyNo ratings yet

- Chapter 20Document9 pagesChapter 20ezanswersNo ratings yet

- AKL 1 Tugas 1Document3 pagesAKL 1 Tugas 1Dwi PujiNo ratings yet

- Case 6-49 - MaDocument4 pagesCase 6-49 - MaAFIFAH KHAIRUNNISA SUBIYANTORO 1No ratings yet

- ch03, AccountingDocument27 pagesch03, AccountingEkta Saraswat Vig50% (2)

- Haglund Department Store Balanced ScorecardDocument8 pagesHaglund Department Store Balanced Scorecardrendra kusuma0% (1)

- Pertemuan 8 Chapter 17Document29 pagesPertemuan 8 Chapter 17Jordan Siahaan100% (1)

- Chapter 12: Derivatives and Foreign Currency Transactions: Advanced AccountingDocument52 pagesChapter 12: Derivatives and Foreign Currency Transactions: Advanced AccountingindahmuliasariNo ratings yet

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- Chapter 3Document13 pagesChapter 3ashibhallauNo ratings yet

- Udah Bener'Document4 pagesUdah Bener'Shafa AzahraNo ratings yet

- Ade Siti Mariam 183112340350061Document2 pagesAde Siti Mariam 183112340350061Ade siti mNo ratings yet

- 1.kieso 2020-1118-1183Document66 pages1.kieso 2020-1118-1183dindaNo ratings yet

- Newman Hardware Store Completed The Following Merchandising Tran PDFDocument1 pageNewman Hardware Store Completed The Following Merchandising Tran PDFAnbu jaromiaNo ratings yet

- Pertemuan 11 - Dividen PDFDocument30 pagesPertemuan 11 - Dividen PDFayu utamiNo ratings yet

- Question and Answer - 60Document31 pagesQuestion and Answer - 60acc-expertNo ratings yet

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- CH 02Document55 pagesCH 02Kokoh HengkyNo ratings yet

- Rangkuman Chapter 9 Cost of CapitalDocument4 pagesRangkuman Chapter 9 Cost of CapitalDwi Slamet RiyadiNo ratings yet

- Acc3 5Document4 pagesAcc3 5dinda ardiyaniNo ratings yet

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

- Be16 P16 2aDocument7 pagesBe16 P16 2aLisa Hammerle ClarkNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- CH 08Document10 pagesCH 08Antonios FahedNo ratings yet

- P11Document7 pagesP11Arif RahmanNo ratings yet

- 9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Document4 pages9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Christy Angkouw0% (1)

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDocument3 pagesMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNo ratings yet

- Activity-Based Costing and Management Systems Chapter ReviewDocument63 pagesActivity-Based Costing and Management Systems Chapter ReviewVanessa HaliliNo ratings yet

- Act Part5Document1 pageAct Part5Moe ChannelNo ratings yet

- CH 01Document71 pagesCH 01Arya WisanggeniNo ratings yet

- ch04 PDFDocument4 pagesch04 PDFMosharraf HussainNo ratings yet

- PR Akmen 3Document3 pagesPR Akmen 3Achmad Faizal AzmiNo ratings yet

- IPSAS Explained: A Summary of International Public Sector Accounting StandardsFrom EverandIPSAS Explained: A Summary of International Public Sector Accounting StandardsNo ratings yet

- Problems Chapter 7 PDFDocument9 pagesProblems Chapter 7 PDFCa AdaNo ratings yet

- Lecture 4 & 5Document2 pagesLecture 4 & 5Marwan DawoodNo ratings yet

- Ose Pa1Document17 pagesOse Pa1gladys manaliliNo ratings yet

- Preparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...Document5 pagesPreparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...ehab_ghazallaNo ratings yet

- Exam 1 Study Guide Chapter Questions TypesDocument3 pagesExam 1 Study Guide Chapter Questions TypesTrang LeNo ratings yet

- 1130 Emily Sprainis A3 O2Document3 pages1130 Emily Sprainis A3 O2Trang LeNo ratings yet

- ESCH WebRequest Fall 2015Document2 pagesESCH WebRequest Fall 2015Trang LeNo ratings yet

- Assignment 6, Option 2 (Chapter 6: Behavioral Modeling)Document1 pageAssignment 6, Option 2 (Chapter 6: Behavioral Modeling)Trang LeNo ratings yet

- MBA CSU Admission ProcessDocument2 pagesMBA CSU Admission ProcessTrang LeNo ratings yet

- MIS 4374 Lecture 01Document51 pagesMIS 4374 Lecture 01Trang LeNo ratings yet

- 1130 Emily Sprainis A3 O2Document3 pages1130 Emily Sprainis A3 O2Trang LeNo ratings yet

- Adjusting Entries HandoutDocument3 pagesAdjusting Entries HandoutTrang LeNo ratings yet

- NCAA Database Design with Deletion ConstraintsDocument5 pagesNCAA Database Design with Deletion ConstraintsTrang Le75% (4)

- 3304 Chapter 3 Text SolutionsDocument32 pages3304 Chapter 3 Text SolutionsTrang LeNo ratings yet

- Appendix 7B Impairments of ReceivablesDocument3 pagesAppendix 7B Impairments of ReceivablesTrang LeNo ratings yet

- Appendix 7B Impairments of ReceivablesDocument3 pagesAppendix 7B Impairments of ReceivablesTrang LeNo ratings yet

- Solutions To Chapter 2 Why Corporations NeedDocument5 pagesSolutions To Chapter 2 Why Corporations NeedfarhanahmednagdaNo ratings yet

- Notes ReceivableDocument7 pagesNotes ReceivableTrang Le100% (3)

- Brief Exercises CHAPTER 7Document3 pagesBrief Exercises CHAPTER 7Trang LeNo ratings yet

- De 1Document4 pagesDe 1Trang LeNo ratings yet

- Accounts ReceivableDocument9 pagesAccounts ReceivableTrang LeNo ratings yet

- GMAT Idiom ListDocument8 pagesGMAT Idiom ListTrang LeNo ratings yet

- Estimating Confidence IntervalsDocument2 pagesEstimating Confidence IntervalsTrang LeNo ratings yet

- Exam 2Document3 pagesExam 2Trang LeNo ratings yet

- Summary of Stat 581/582: Text: A Probability Path by Sidney Resnick Taught by Dr. Peter OlofssonDocument26 pagesSummary of Stat 581/582: Text: A Probability Path by Sidney Resnick Taught by Dr. Peter OlofssonTrang LeNo ratings yet

- Civil-Preweek 2018 DDocument50 pagesCivil-Preweek 2018 DMary Ann AguilaNo ratings yet

- Thanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooDocument33 pagesThanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooEva LopenaNo ratings yet

- DocsDocument2 pagesDocsMohsin ShaikhNo ratings yet

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsDocument107 pagesNon-Integrated, Integrated & Reconciliation of Cost and Financial Accountsanon_67206536267% (3)

- Sps. Larrobis v. Philippine Veterans Bank (G.R. No. 135706)Document2 pagesSps. Larrobis v. Philippine Veterans Bank (G.R. No. 135706)Silver Anthony Juarez Patoc100% (1)

- Agent Short Sale SecretsDocument3 pagesAgent Short Sale SecretsJOHN DEERENo ratings yet

- Sais Registration Procedure 1st Sem 2019-2020Document3 pagesSais Registration Procedure 1st Sem 2019-2020Kane CarolNo ratings yet

- Security Bank v. RTC Makati, 263 SCRA 453 (1996)Document3 pagesSecurity Bank v. RTC Makati, 263 SCRA 453 (1996)Fides DamascoNo ratings yet

- Monato Credit Cooperative ArticlesDocument12 pagesMonato Credit Cooperative ArticlesMarceliano Monato IIINo ratings yet

- Exhibit 1 CNAM China Armco Metals Securites Fraud LawsuitDocument19 pagesExhibit 1 CNAM China Armco Metals Securites Fraud LawsuitAdam LemboNo ratings yet

- Bank negligence results in damages awardDocument4 pagesBank negligence results in damages awardPatrick D GuetaNo ratings yet

- Case Study - Club MedDocument118 pagesCase Study - Club MedUtsab BagchiNo ratings yet

- Investor+Agreement Final+07+17Document5 pagesInvestor+Agreement Final+07+17Carl Jayvhan RitoNo ratings yet

- TPA ProjectDocument9 pagesTPA Projectसौम्या जैनNo ratings yet

- Cosumers Perception Towards Insurance - Project ReportDocument112 pagesCosumers Perception Towards Insurance - Project Reportkamdica93% (54)

- Project Management Chapter 10 THE COST OF CAPITAL Math SolutionsDocument4 pagesProject Management Chapter 10 THE COST OF CAPITAL Math Solutionszordan rizvyNo ratings yet

- Final Askari Bank Report HamzaDocument41 pagesFinal Askari Bank Report HamzaSO HaNo ratings yet

- Demand For Loan Restructure - BTBDocument5 pagesDemand For Loan Restructure - BTBwrmarleyNo ratings yet

- Sales 1477-1496Document4 pagesSales 1477-1496gapexceptionalNo ratings yet

- The Manitoba Housing Authority Application GuidelinesDocument8 pagesThe Manitoba Housing Authority Application GuidelinesRobin ParkNo ratings yet

- Glossary of Terms in Treasury ManagementDocument91 pagesGlossary of Terms in Treasury ManagementaasisranjanNo ratings yet

- Annex I: Please Delete Whichever Is InappropriateDocument21 pagesAnnex I: Please Delete Whichever Is InappropriateVintonius Raffaele PRIMUSNo ratings yet

- Bank Guarantee Types and UsesDocument12 pagesBank Guarantee Types and UsesmydeanzNo ratings yet

- Special & Technical Knowledge for Real EstateDocument6 pagesSpecial & Technical Knowledge for Real EstateJuan Carlos NocedalNo ratings yet

- Enriquez v. Ramos 6 SCRA 219 (1962)Document8 pagesEnriquez v. Ramos 6 SCRA 219 (1962)Neil bryan MoninioNo ratings yet

- History of New Century Mortgage and Home123 CorpDocument5 pagesHistory of New Century Mortgage and Home123 Corp83jjmackNo ratings yet

- Simple Mortgage Deed GuideDocument15 pagesSimple Mortgage Deed GuideHarshmander RastogiNo ratings yet

- Case Study 6Document2 pagesCase Study 6Santosh KumarNo ratings yet

- Pittman v. Home Owners' Loan Corp., 308 U.S. 21 (1939)Document5 pagesPittman v. Home Owners' Loan Corp., 308 U.S. 21 (1939)Scribd Government DocsNo ratings yet

- Negotiation of Negotiable Receipt by DeliveryDocument1 pageNegotiation of Negotiable Receipt by DeliveryTiffany HuntNo ratings yet