Professional Documents

Culture Documents

Corporate Valuation: Home Assignment

Uploaded by

amol_more37Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Valuation: Home Assignment

Uploaded by

amol_more37Copyright:

Available Formats

Corporate valuation: Home Assignment

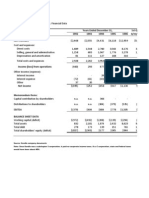

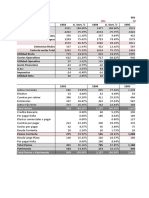

Ryder System is a full-service truck leasing, maintenance, and rental firm with operations in North America and Europe. The following are selected numbers from the financial statements for 1992 and 1993 (in millions).

1992 $5,192.0 ($3,678.5) ($573.5) $940.0 ($170.0) ($652.1) $117.9 $92.0 $2,000 mil 1993 $5,400.0 ($3848.0) ($580.0) $972.0 ($172.0) ($670.0) $130.0 <$370.0> $2,200 mil

Revenues (Less) Operating Expenses (Less) Depreciation = EBIT (Less) Interest Expenses (Less) Taxes = Net Income Working Capital Total Debt

The firm had capital expenditures of $800 million in 1992 and $850 million in 1993. The working capital in 1991 was $34.8 million, and the total debt outstanding in 1991 was $1.75 billion. There were 77 million shares outstanding, trading at $29 per share. A. Estimate the cash flows to equity in 1992 and 1993. B. Estimate the cash flows to the firm in 1992 and 1993. C. Assuming that revenues and all expenses (including depreciation and capital expenditures) increase 6%, and that working capital remains unchanged in 1994, estimate the projected cash flows to equity and the firm in 1994. (The firm is assumed to be at its optimal financial leverage.) D. How would your answer in (c) change if the firm planned to increase its debt ratio in 1994 by financing 75% of its capital expenditures (net of depreciation) with new debt issues?

You might also like

- Ficha 3Document3 pagesFicha 3Elsa MachadoNo ratings yet

- Problems and Solutions in Cash FlowsDocument5 pagesProblems and Solutions in Cash Flowsitishaagrawal41100% (1)

- 2 Cash - Flows QuestionsDocument4 pages2 Cash - Flows QuestionsAndré BravoNo ratings yet

- Fin PracticaDocument14 pagesFin PracticaChristian Diegho Vacadiez Laporta100% (1)

- Tire City Inc.Document6 pagesTire City Inc.Samta Singh YadavNo ratings yet

- Templates Business PlanDocument5 pagesTemplates Business PlanCar ClinicNo ratings yet

- Valuation: Cash Flows & Discount RatesDocument12 pagesValuation: Cash Flows & Discount RatesAnshik BansalNo ratings yet

- Analysis of Financial Statements (D'Leon)Document48 pagesAnalysis of Financial Statements (D'Leon)John SamonteNo ratings yet

- Exhibit 1 Kendle International Inc. Financial Data Years Ended December 31Document12 pagesExhibit 1 Kendle International Inc. Financial Data Years Ended December 31Kito Minying ChenNo ratings yet

- Cruz Janna Kassandra Midterm Practice ProblemsDocument6 pagesCruz Janna Kassandra Midterm Practice ProblemsMiguel PultaNo ratings yet

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Olive Inc A Canadian Company Whose Functional Currency Is Canadian PDFDocument1 pageOlive Inc A Canadian Company Whose Functional Currency Is Canadian PDFTaimour HassanNo ratings yet

- Hampton Machine Tool Company Cash Flow AnalysisDocument5 pagesHampton Machine Tool Company Cash Flow Analysisamsa100% (1)

- Value + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Document33 pagesValue + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Manabendra DasNo ratings yet

- Dell Annual ReportDocument55 pagesDell Annual ReportOmotoso EstherNo ratings yet

- EFM2e, CH 03, SlidesDocument36 pagesEFM2e, CH 03, SlidesEricLiangtoNo ratings yet

- Chap 1,3,4 Selected MCQsDocument8 pagesChap 1,3,4 Selected MCQsThúy An NguyễnNo ratings yet

- Revision - Income Stat and BS - V3Document4 pagesRevision - Income Stat and BS - V3betyibtihal03No ratings yet

- CHP 23Document19 pagesCHP 23lena cpaNo ratings yet

- Radio Shack Financial Statement Analysis Abdyldaev ArsenDocument24 pagesRadio Shack Financial Statement Analysis Abdyldaev ArsenArsen AbdyldaevNo ratings yet

- Team 3:: 1. Sneha Neerugatti 2. D Pavan Kumar 3. Jaju RohithDocument18 pagesTeam 3:: 1. Sneha Neerugatti 2. D Pavan Kumar 3. Jaju RohithRohith JajuNo ratings yet

- Team 3:: 1. Sneha Neerugatti 2. D Pavan Kumar 3. Jaju RohithDocument18 pagesTeam 3:: 1. Sneha Neerugatti 2. D Pavan Kumar 3. Jaju RohithRohith JajuNo ratings yet

- The Levered Beta: Disney and Its DivisionsDocument11 pagesThe Levered Beta: Disney and Its DivisionsIvan GomezNo ratings yet

- ESKIMO PIE Case StudyDocument13 pagesESKIMO PIE Case StudyPablo Vera100% (1)

- Fin Midterm 1 PDFDocument6 pagesFin Midterm 1 PDFIshan DebnathNo ratings yet

- RSE Acquisition of Flinder ValvesDocument4 pagesRSE Acquisition of Flinder Valvesraulzaragoza0422100% (1)

- Case Study - Corp Finance - Padgett Paper ProductsDocument26 pagesCase Study - Corp Finance - Padgett Paper ProductsJed Estanislao100% (1)

- FactsheetDocument2 pagesFactsheetradityanationNo ratings yet

- Polaroid's Capital Structure and 1996 CaseDocument51 pagesPolaroid's Capital Structure and 1996 CaseShelly Jain100% (2)

- Sms '12 Hy ReportDocument44 pagesSms '12 Hy ReportBrooke CarterNo ratings yet

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsNo ratings yet

- Performance-Evaluation-and-Decentralization W - Answers PDFDocument8 pagesPerformance-Evaluation-and-Decentralization W - Answers PDFTh VNo ratings yet

- CH #3Document7 pagesCH #3Waleed Ayaz UtmanzaiNo ratings yet

- Equity Analysis and Evaluation - II Assignment December 23Document14 pagesEquity Analysis and Evaluation - II Assignment December 23sachin.saroa.1No ratings yet

- 2010 - Annual - Report - Cover:Layout 1 2/5/2010 4:12 PMDocument54 pages2010 - Annual - Report - Cover:Layout 1 2/5/2010 4:12 PMFoo Leung Tsz KinNo ratings yet

- Fbe 421: Financial Analysis & Valuation: Leveraged Buyouts (Lbos)Document40 pagesFbe 421: Financial Analysis & Valuation: Leveraged Buyouts (Lbos)Dinhkhanh NguyenNo ratings yet

- Comprehensive Problem 4 Solutions ManualDocument9 pagesComprehensive Problem 4 Solutions Manualfarsi786No ratings yet

- Tutorial 3Document6 pagesTutorial 3FEI FEINo ratings yet

- Assignment 3 SolutionDocument7 pagesAssignment 3 SolutionAaryaAustNo ratings yet

- Financial Statement AnalysisDocument48 pagesFinancial Statement AnalysisCheryl LowNo ratings yet

- Dell's Working CapitalDocument20 pagesDell's Working Capitalapi-371968795% (21)

- Dressen Abridged) (A)Document13 pagesDressen Abridged) (A)mithileshagrawalNo ratings yet

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Document11 pagesBCG Forage Core Strategy - Telco (Task 2 Additional Data)Akshay rajNo ratings yet

- BNFN 4309 - Topic 2 (Activity # 3) - AKDocument18 pagesBNFN 4309 - Topic 2 (Activity # 3) - AKabeerNo ratings yet

- Financial Analysis of Mahindra and MahindraDocument25 pagesFinancial Analysis of Mahindra and Mahindranamit_agarwal12No ratings yet

- Company A Financial Statement S$ Million Year 0 Year 1 Year 2 Total Total TotalDocument14 pagesCompany A Financial Statement S$ Million Year 0 Year 1 Year 2 Total Total TotalAARZOO DEWANNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderRenjul ParavurNo ratings yet

- Name - KEYDocument30 pagesName - KEYjhouvanNo ratings yet

- WCM Assignment 1Document3 pagesWCM Assignment 1gfdsa12345No ratings yet

- FIN 500 TEST # 1 (CHAPTER 2-3-4) : Multiple ChoiceDocument11 pagesFIN 500 TEST # 1 (CHAPTER 2-3-4) : Multiple ChoicemarkomatematikaNo ratings yet

- Analysis of Financial Statements: Why Are Ratios Useful?Document26 pagesAnalysis of Financial Statements: Why Are Ratios Useful?MostakNo ratings yet

- XLS EngDocument21 pagesXLS EngRudra BarotNo ratings yet

- Performance Evaluation in Decentralized FirmsDocument27 pagesPerformance Evaluation in Decentralized FirmsXinjie MaNo ratings yet

- AnnualDocument112 pagesAnnualRamchundar KarunaNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Banking & Insurance: Session 1 CH 1: Basics of BankingDocument39 pagesBanking & Insurance: Session 1 CH 1: Basics of Bankingamol_more37No ratings yet

- B & I-Session Plan - SemIIIDocument9 pagesB & I-Session Plan - SemIIIamol_more37No ratings yet

- UNIT 1 Indian Financial SystemDocument50 pagesUNIT 1 Indian Financial Systemamol_more37No ratings yet

- NCRD SIPSTER Finance Timetable Sem IIIDocument8 pagesNCRD SIPSTER Finance Timetable Sem IIIamol_more37No ratings yet

- A.F.M. Course ContentDocument1 pageA.F.M. Course Contentamol_more37No ratings yet

- Capital Structure TheoriesDocument47 pagesCapital Structure Theoriesamol_more37No ratings yet

- Industry Analysis 13Document37 pagesIndustry Analysis 13amol_more37No ratings yet

- LEVERAGE-ANALYSIS-TYPESDocument8 pagesLEVERAGE-ANALYSIS-TYPESamol_more37No ratings yet

- LeverageDocument29 pagesLeverageamol_more370% (1)

- Capital Structure TheoriesDocument47 pagesCapital Structure Theoriesamol_more37No ratings yet

- Financial Markets and Institutions ExplainedDocument78 pagesFinancial Markets and Institutions Explainedamol_more37100% (1)

- Assignment ItDocument8 pagesAssignment Itamol_more37No ratings yet

- Basics of International Financial Management (IFMDocument26 pagesBasics of International Financial Management (IFMamol_more37No ratings yet

- Company AnalysisDocument44 pagesCompany Analysisamol_more37No ratings yet

- Capital Structure TheoriesDocument4 pagesCapital Structure Theoriesamol_more37No ratings yet

- Capital Structure Decisions EBIT-EPS AnalysisDocument12 pagesCapital Structure Decisions EBIT-EPS Analysisamol_more37No ratings yet

- Alance Sheet of CiplaDocument4 pagesAlance Sheet of Ciplaamol_more37No ratings yet

- AmolDocument24 pagesAmolamol_more37No ratings yet

- Alance Sheet of CiplaDocument4 pagesAlance Sheet of Ciplaamol_more37No ratings yet

- 4 P's of NikeDocument9 pages4 P's of Nikerukbuk1100% (8)

- Feasibility Analysis, Company Valuation, Project FinancingDocument2 pagesFeasibility Analysis, Company Valuation, Project Financingamol_more37No ratings yet

- Amol MoreDocument3 pagesAmol Moreamol_more37No ratings yet

- 19260comp Sugans Finalold Mics Cp3Document275 pages19260comp Sugans Finalold Mics Cp3amol_more37No ratings yet

- 3.negotiable Instrument ActDocument25 pages3.negotiable Instrument ActMayur N MalviyaNo ratings yet

- 3.negotiable Instrument ActDocument25 pages3.negotiable Instrument ActMayur N MalviyaNo ratings yet

- 1 Research MethodologyDocument35 pages1 Research Methodologyamol_more37No ratings yet

- Income From Capital Gain, Income From Household Property, Income From Other SourcesDocument24 pagesIncome From Capital Gain, Income From Household Property, Income From Other Sourcesamol_more37No ratings yet

- Theories of Leadership: Session-2Document33 pagesTheories of Leadership: Session-2amol_more37No ratings yet

- Team Work and Team BuildingDocument21 pagesTeam Work and Team Buildingjyoti_tatkareNo ratings yet

- Hsslive-XII-economics - Macro - EconomicsDocument3 pagesHsslive-XII-economics - Macro - Economicscsc kalluniraNo ratings yet

- AHAP Insurance Financial SummaryDocument2 pagesAHAP Insurance Financial SummaryluvzaelNo ratings yet

- Excel Clarkson LumberDocument9 pagesExcel Clarkson LumberCesareo2008No ratings yet

- VaucheDocument1 pageVauchedepazzaidaNo ratings yet

- St. Mary's Financial Accounting Comprehensive ExerciseDocument5 pagesSt. Mary's Financial Accounting Comprehensive ExerciseOrnet Studio100% (1)

- Bank Reconciliation NotesDocument3 pagesBank Reconciliation Notesjudel ArielNo ratings yet

- Unit - Ii Entrepreneurial Idea and InnovationDocument49 pagesUnit - Ii Entrepreneurial Idea and InnovationAkriti Sonker0% (1)

- ProblemsDocument28 pagesProblemsKevin NguyenNo ratings yet

- Mitsui OSK Lines Vs Orient Ship AgencyDocument108 pagesMitsui OSK Lines Vs Orient Ship Agencyvallury chaitanya RaoNo ratings yet

- Solution 1Document5 pagesSolution 1frq qqrNo ratings yet

- Estimating the Cost of Short-Term Credit OptionsDocument6 pagesEstimating the Cost of Short-Term Credit OptionsKristine AlcantaraNo ratings yet

- N26 StatementDocument4 pagesN26 StatementCris TsauNo ratings yet

- 2026 SyllabusDocument28 pages2026 Syllabussatkargulia601No ratings yet

- Ch08 ReceivablesDocument42 pagesCh08 ReceivablesGelyn CruzNo ratings yet

- Quizzer ReviewDocument6 pagesQuizzer ReviewRobert CastilloNo ratings yet

- Budget Planning and ControlDocument9 pagesBudget Planning and ControlDominic Muli100% (6)

- Financial Engineering and Security DesignDocument12 pagesFinancial Engineering and Security DesignMagnus BytingsvikNo ratings yet

- LLP Notes As Per DU SyllabusDocument39 pagesLLP Notes As Per DU SyllabusAryan GuptaNo ratings yet

- Intra Firm Ratio Analysis of Financial Statements of Bharti Realty Holdings Ltd.Document37 pagesIntra Firm Ratio Analysis of Financial Statements of Bharti Realty Holdings Ltd.DevNo ratings yet

- Top 12 Webinars Traders Should Watch To Learn About Technical AnalysisDocument15 pagesTop 12 Webinars Traders Should Watch To Learn About Technical Analysiswolf1No ratings yet

- Intercompany transactions elimination for consolidated financial statementsDocument13 pagesIntercompany transactions elimination for consolidated financial statementsicadeliciafebNo ratings yet

- EF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Document30 pagesEF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Mamta Patel100% (1)

- 22BSPHH01C1222 - Subham Deb - IrDocument22 pages22BSPHH01C1222 - Subham Deb - Irnilesh.das22hNo ratings yet

- Virginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionDocument27 pagesVirginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionWilliamsNo ratings yet

- DMGT104 Financial Accounting PDFDocument317 pagesDMGT104 Financial Accounting PDFNani100% (1)

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- Market MetricsDocument3 pagesMarket MetricsMichael KozlowskiNo ratings yet

- Case Delta Beverage Group 7Document8 pagesCase Delta Beverage Group 7Wouter Hendriksen100% (1)

- PUP Review Handout 3 OfficialDocument2 pagesPUP Review Handout 3 OfficialDonalyn CalipusNo ratings yet

- Analisis Foda AirbnbDocument4 pagesAnalisis Foda AirbnbEliana MorilloNo ratings yet