Professional Documents

Culture Documents

Derivative Report 26 MAY 2014

Uploaded by

PalakMisharaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivative Report 26 MAY 2014

Uploaded by

PalakMisharaCopyright:

Available Formats

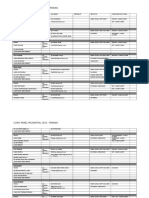

DAILY DERIVATIVE

REPORT

26

TH

MAY 2014

NIFTY FUTURE WRAP

29

TH

MAY 2014

SYMBOL SUPPORT RESISTANCE PARTICULARS CMP PRE CLOSE %CHANGE

NIFTY

S1-7230 R1- 7420

NIFTY

SPOT

7367.10 7276.40 1.25

S2-7160 R2-7455

NIFTY

FUTURES

7390.85 7293.70 1.33

TREND STRATEGY

BULLISH BUY ON DIPS

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

7187 7275 7333 7364 7421 7452 7540

DAILY DERIVATIVE REPORT

BANK NIFTY FUTURE WRAP

29

TH

MAY 2014

SYMBOL SUPPORT RESISTANCE PARTICULARS CMP PRE CLOSE %CHANGE

BANK NIFTY

S1-14300 R1-15440

BANK NIFTY

SPOT

15285.50 15055.55 1.53

S2-13900 R2-15990

BANK NIFTY

FUTURES

15375.15 15120.40 1.68

TREND STRATEGY

BULLISH BUY ON DIPS

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

14475 14865 15120 15255 15510 15645 16035

DAILY DERIVATIVE REPORT

FUTUREs FRONT

Long Build Up (Fresh Longs) Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

ASHOKLEY 2,034.00 2,807.00 38.0 33.50 15.9

JINDALSTEL 7,490.00 9,443.00 26.1 303.55 6.4

RECLTD 3,360.00 4,118.00 22.6 353.25 5.2

TATAPOWER 7,556.00 9,200.00 21.8 107.00 6.9

Short-Covering Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

HDFC 29,068.00 27,378.00 [5.8] 935.00 1.2

BHARTIARTL 17,006.00 16,059.00 [5.6] 344.45 3.0

TECHM 29,837.00 28,387.00 [4.9] 1,793.50 2.1

DIVISLAB 3,848.00 3,695.00 [4.0] 1,292.80 0.8

Short Build Up Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

IDEA 7,695.00 9,788.00 27.2 140.35 [0.1]

HAVELLS 1,516.00 1,785.00 17.7 936.25 [1.7]

COLPAL 918.00 1,048.00 14.2 1,355.00 [1.1]

INFY 26,053.00 28,420.00 9.1 3,039.85 [1.2]

Long Unwinding Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

- - - - - -

- - - - - -

- - - - - -

- - - - - -

DAILY DERIVATIVE REPORT

Top Gainers: Future Contract

Type Underlying Exp. Date Last Price Chg (%) OI ('000s)

FUTSTK RELCAPITAL 31-Jul-14 547.20 38.2 5.00

FUTSTK M&MFIN 31-Jul-14 316.50 31.9 2.00

FUTSTK RCOM 31-Jul-14 145.50 21.9 18.00

FUTSTK ASHOKLEY 31-Jul-14 32.85 18.8 253.00

Top Losers: Future Contract

Type Underlying Exp. Date Last Price Chg (%) OI ('000s)

FUTSTK TITAN 31-Jul-14 331.85 [3.7] 8.00

FUTSTK IBREALEST 26-Jun-14 94.45 [3.3] 1,500.00

FUTSTK IBREALEST 29-May-14 94.00 [3.2] 23,548.00

FUTSTK HDFCBANK 31-Jul-14 798.00 [2.9] 8.50

FII Trends In Future

Script

BUY

[RS.CR]

SELL

[RS.CR]

NET POSITIONS

[RS.CR]

CONTRACTS

['000S]

VALUE

[RS.CR]

INDEX FUTURES

79,231 72,045 264.69 497.407 18,182

STOCK FUTURES

140,317 172,891 [1,106.28] 1,406.256 49,140

DAILY DERIVATIVE REPORT

OPTIONs FRONT

Top Gainers: Options

Inst

Type

Underlying

Expiry

Date

Last

Price[Rs.]

Strike

Price[Rs.]

OPT Type

OPTSTK ABIRLANUVO 29-May-14 125.00 1,280.00 CE

OPTSTK SBIN 29-May-14 97.25 2,700.00 CE

OPTSTK SBIN 29-May-14 109.60 2,680.00 CE

OPTSTK GAIL 29-May-14 5.00 380.00 PE

Top Looser: Options

Inst

Type

Underlying

Expiry

Date

Last

Price[Rs.]

Strike

Price[Rs.]

OPT Type

OPTSTK CESC 29-May-14 0.05 550.00 PE

OPTSTK SUNPHARMA 29-May-14 0.05 720.00 CE

OPTSTK TATAPOWER 29-May-14 0.15 91.70 PE

OPTSTK ABIRLANUVO 29-May-14 0.50 1,240.00 PE

FII Trends In Options

Script

BUY

[RS.CR]

SELL

[RS.CR]

NET POSITIONS

[RS.CR]

CONTRACTS

['000S]

VALUE

[RS.CR]

INDEX OPTIONS

370,643 329,225 1,480.18 2,499.989 90,812

STOCK OPTIONS

53,080 54,666 [49.52] 115.194 4,180

DAILY DERIVATIVE REPORT

PUT CALL RATIO: STOCK OPTION (OI WISE)

PUT CALL RATIO: STOCK OPTION (OPEN INTEREST WISE)

SCRIPT PUT CALL RATIO

MARUTI 346,875.00 227,000.00 1.53

BANKINDIA 2,061,000.00 1,520,000.00 1.36

PNB 988,000.00 759,500.00 1.30

SSLT 4,888,000.00 3,900,000.00 1.25

PUT CALL RATIO: STOCK OPTION (VOLUME WISE)

SCRIPT PUT CALL RATIO

BATAINDIA 4,500.00 2,750.00 1.64

TCS 697,500.00 659,000.00 1.06

SUNTV 31,000.00 30,000.00 1.03

AXISBANK 765,000.00 774,250.00 0.99

PUT CALL RATIO: INDEX FUTURES (OPEN INTEREST WISE)

SCRIPT PUT CALL RATIO

BANKNIFTY 2,979,025.00 2,807,300.00 1.06

NIFTY 48,992,000.00 54,425,300.00 0.90

- - - -

PUT CALL RATIO: INDEX FUTURES (VOLUME WISE)

SCRIPT PUT CALL RATIO

BANKNIFTY 3,308,650.00 4,065,600.00 0.81

NIFTY 91,481,700.00 113,151,250.00 0.81

- - - -

DAILY DERIVATIVE REPORT

The information and views in this report, our website & all the service we provide are believed to

be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion.

Users have the right to choose the product/s that suits them the most.

Use of this report in no way constitutes a client/advisor relationship, all information we

communicate to you (the subscriber) either through our Web site or other forms of

communications, are purely for informational purposes only.

We recommend seeking individual investment advice before making any investment, for you are

assuming sole liability for your investments. Capital Stars will in no way have discretionary

authority over your trading or investment accounts.

All rights reserved.

OFFICE: - +91 731 4757600

MOB: +91 92000 99927

PHONE: +91 731 6790000

Email: info@capitalstars.com

CAPITAL STARS FINANCIAL

RESEARCH PRIVATE LIMITED

PLOT NO. 12, SCHEME NO. 78, PART II

VIJAYNAGAR INDORE 452001 (MP)

DAILY DERIVATIVE REPORT

CONTACT US

DISCLAIMER

You might also like

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 04 July 2014Document8 pagesDerivative Report 04 July 2014PalakMisharaNo ratings yet

- Derivative Report 24 June 2014Document8 pagesDerivative Report 24 June 2014PalakMisharaNo ratings yet

- Derivative Report 27 June 2014Document8 pagesDerivative Report 27 June 2014PalakMisharaNo ratings yet

- Derivative Report 30 June 2014Document8 pagesDerivative Report 30 June 2014PalakMisharaNo ratings yet

- Derivative Report 01 July 2014Document8 pagesDerivative Report 01 July 2014PalakMisharaNo ratings yet

- Derivative Report 25 June 2014Document8 pagesDerivative Report 25 June 2014PalakMisharaNo ratings yet

- Derivative Report16 June 2014Document8 pagesDerivative Report16 June 2014PalakMisharaNo ratings yet

- Derivative Report 18 June 2014Document8 pagesDerivative Report 18 June 2014PalakMisharaNo ratings yet

- Derivative Report 20 June 2014Document8 pagesDerivative Report 20 June 2014PalakMisharaNo ratings yet

- Derivative Report 17 June 2014Document8 pagesDerivative Report 17 June 2014PalakMisharaNo ratings yet

- Derivative Report13 June 2014Document8 pagesDerivative Report13 June 2014PalakMisharaNo ratings yet

- Derivative Report 23 June 2014Document8 pagesDerivative Report 23 June 2014PalakMisharaNo ratings yet

- Derivative Report 18 June 2014Document8 pagesDerivative Report 18 June 2014PalakMisharaNo ratings yet

- Derivative Report12 June 2014Document8 pagesDerivative Report12 June 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 30 MAY 2014Document8 pagesDerivative Report 30 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 28 MAY 2014Document8 pagesDerivative Report 28 MAY 2014PalakMisharaNo ratings yet

- Agri Weekly Report 21st AprilDocument9 pagesAgri Weekly Report 21st AprilPalakMisharaNo ratings yet

- Derivative Report 23 MAY 2014Document8 pagesDerivative Report 23 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 22 MAY 2014Document8 pagesDerivative Report 22 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 3rd June 2014Document8 pagesDerivative Report 3rd June 2014PalakMisharaNo ratings yet

- Derivative Report 27 MAY 2014Document8 pagesDerivative Report 27 MAY 2014PalakMisharaNo ratings yet

- Special Research Report On NickelDocument8 pagesSpecial Research Report On NickelPalakMisharaNo ratings yet

- Derivative Report 30 April 2014Document8 pagesDerivative Report 30 April 2014PalakMisharaNo ratings yet

- Derivative Report 02 MAY 2014Document8 pagesDerivative Report 02 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cognitive Clusters in SpecificDocument11 pagesCognitive Clusters in SpecificKarel GuevaraNo ratings yet

- Family Preparedness PlanDocument6 pagesFamily Preparedness PlanSabrinaelyza UyNo ratings yet

- Metal Oxides Semiconductor CeramicsDocument14 pagesMetal Oxides Semiconductor Ceramicsumarasad1100% (1)

- Hong Kong A-Level Chemistry Book 3ADocument69 pagesHong Kong A-Level Chemistry Book 3AMARENG BERNABENo ratings yet

- Assessing Student Learning OutcomesDocument20 pagesAssessing Student Learning Outcomesapi-619738021No ratings yet

- PExam 2020Document126 pagesPExam 2020Omama MaazNo ratings yet

- Rumi and ReligionDocument2 pagesRumi and ReligionJustin LiewNo ratings yet

- SpringDocument4 pagesSpringarun123123No ratings yet

- RRR Media Kit April 2018Document12 pagesRRR Media Kit April 2018SilasNo ratings yet

- Polymer Science: Thermal Transitions in PolymersDocument20 pagesPolymer Science: Thermal Transitions in Polymerstanveer054No ratings yet

- What Are Your Observations or Generalizations On How Text/ and or Images Are Presented?Document2 pagesWhat Are Your Observations or Generalizations On How Text/ and or Images Are Presented?Darlene PanisaNo ratings yet

- English A June 2008 p2Document9 pagesEnglish A June 2008 p2LilyNo ratings yet

- Math 2 Unit 9 - Probability: Lesson 1: "Sample Spaces, Subsets, and Basic Probability"Document87 pagesMath 2 Unit 9 - Probability: Lesson 1: "Sample Spaces, Subsets, and Basic Probability"Anonymous BUG9KZ3100% (1)

- Uc 3525 ADocument17 pagesUc 3525 AespaguetesNo ratings yet

- User Manual - Numrolgy SoftwareDocument14 pagesUser Manual - Numrolgy SoftwareComputershastriNoproblem0% (1)

- Ukraine and Russia E IRDocument287 pagesUkraine and Russia E IRtatgirNo ratings yet

- Ra 11223 PDFDocument34 pagesRa 11223 PDFNica SalazarNo ratings yet

- Benedict - Ethnic Stereotypes and Colonized Peoples at World's Fairs - Fair RepresentationsDocument16 pagesBenedict - Ethnic Stereotypes and Colonized Peoples at World's Fairs - Fair RepresentationsVeronica UribeNo ratings yet

- Financial Reporting Statement Analysis Project Report: Name of The Company: Tata SteelDocument35 pagesFinancial Reporting Statement Analysis Project Report: Name of The Company: Tata SteelRagava KarthiNo ratings yet

- Chicago TemplateDocument4 pagesChicago TemplateJt MetcalfNo ratings yet

- EOD Stanags Overview April 2021Document12 pagesEOD Stanags Overview April 2021den mas paratate leo egoNo ratings yet

- Independence Day Resurgence ScriptDocument60 pagesIndependence Day Resurgence ScriptdavidNo ratings yet

- Unit Test Nervous System 14.1Document4 pagesUnit Test Nervous System 14.1ArnelNo ratings yet

- Clinnic Panel Penag 2014Document8 pagesClinnic Panel Penag 2014Cikgu Mohd NoorNo ratings yet

- Adventures in PioneeringDocument202 pagesAdventures in PioneeringShawn GuttmanNo ratings yet

- Sample ResumeDocument3 pagesSample Resumeapi-380209683% (6)

- Amity Online Exam OdlDocument14 pagesAmity Online Exam OdlAbdullah Holif0% (1)

- Footprints 080311 For All Basic IcsDocument18 pagesFootprints 080311 For All Basic IcsAmit PujarNo ratings yet

- Assignment No.7Document2 pagesAssignment No.7queen estevesNo ratings yet

- GEd 105 Midterm ReviewerDocument17 pagesGEd 105 Midterm ReviewerAndryl MedallionNo ratings yet