Professional Documents

Culture Documents

Solution Cost Carter Usry 13th Edition

Uploaded by

Ulfa Fadilatul UlaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution Cost Carter Usry 13th Edition

Uploaded by

Ulfa Fadilatul UlaCopyright:

Available Formats

\

. l

7

:

I

:

:

:

I

t

l - |

l t

l l

I

l

I

:

:

I

r l

I

:

t :

l r

I

, '

i :

Tnblg of Conrerur

Part l-Costs: Concepts and Objectives

Management, the Controller, and Cost Accounting

Cost Concepts and the Cost accounting lnformation System l3

Cost Behavior Analysis 25

Part l-Cost Accumulation

4. Cost Systems and Cost Accumulation . . . . 6 |

5. Job Order Costing 80

6. Process Costing 102

7. The Cost of Quality and Accounting for Production Losses 145

8. Costing By-Products and Joint Products 178

Part 3-Planning and Control of Costs

Mat er i al s: Cont r ol l i ng, Cost i ng, and Pl anni ng . . . . . . . ' 203

Just-in-Time and Backflushing . Dg

Labor: Controlling and Accounting for Costs . )45

Factory Overhead: Planned, Actual, and Applied )7 |

Factory Overhead: Departmentalization 288

Activity Accounting: Activity-Based Costing

andAct i vi t y- BasedManagement . . . 319

Part 4-Budgeting and Standard Costs

15. Budgeting: Profits, Sales, Costs, and Expenses 340

16. Budgeting: Capital Expenditures, Research and

Development Expenditures, and Cash: PERT/Cost 385

Responsi bi l i tyAccounti ng and Reporti ng... 410

Standard Costing: Setting Standards and Analyzing Variances . . . . 443

Standard Costing: lncorporating Standards

t .

2.

3.

t 7 .

18.

t 9.

into the Accounting Records

- l l l -

488

Part 5-Analyris of Costs and Profits

Direct Costing and Cost-Volume-Profit Analysis

Differential Cost Analysis

Planning for Capital Expenditures . . .

Economic Evaluation of Capital Expenditures . . . .

Decision-Making under Uncertainty

5 t 3

543

588

6 r 8

65)

Profit Performance Measurements and

I

lntracompany Transfer Pricing 688

- . 1

I

- l v-

CHAPTER

1

DtscusstoN

OUESTIONS

Ot-1.

Plrnnhg ir hl drvobprnrnt

of e cqrrirron rl

of eglbnr. taaoutc.tr

md mer'ur'm'ntt by

which thr lchirvrmrnt

of obi'cilivtt cm b'

a.r.$.d Pbnnhg trkor hto eccornl thr irtrr'

Etitlt botwren thr orgrni:atkxr

errd itr rnvi'

tqln nl ir whrt'l|r b b br donr'

Cqrtrol ir thr

preolr by which trlrnrg"r

grutl

lhrt rr6urcrr rta obtrir'd rnd urd in

rn ollbbnt and .ttactiw ttlrnn.r !o crtty ot',l ttrt

pbn rnd rccornglirh thl orgrnizeti'cri'! obi'c'

tivor. Cotrtrol inpliot thrt

prrlocnrrc' 'tr{lut..

tn.ntr rto rrvilwod to drt.rmin. if corrrctivo

rtbn ir nquircd

Plennirg rnd cantrol rn htrnrbt'd' Canttol

ir crrrird out wilhh thr ortlblirhrd

plrnnhg

tnrnrworl elrd rrrrrr !o ovrludo enfqnrrrcr

b th.

Phn

rc ttrd o,Fnirrtisd obieclivor rto

rfiirwd.

Of

-2.

Shod.rrrge

plenr ucully d.d with r plrird of e

qu.ttar or I y..1, while long[nga

plmr ururlly

covrr thr.. to livo yern. Shon'rrngr Pbnt

|''

d.tdl.d rnangh b prrmit pnprntin of e csn'

Pl.l.

l.l of finrnchl rtrt.moritt u cf r lulun

dd., tiilb bng'nngo

plenr cubnindr h r wry

turnrnrrizrd rt ol lrpoc{rd ruultr or t hw

qurrditie<! obiostivtr, lrdr u firrtcld rdbr.

Ol-3. Lorg.rrngr

plrnl contrh

quenlitalive rtlultt'

wtrilr rtrdogtc ptrnr rn tfir l..|t quryltiti.bl. cil

r.[ pbnr. Lary'nngr

plrnr urudty lrlrnd lhrco

to tivo yorn hto tho futsrc, wtrib rlntogb

pbnr

tily csrlomPbta thodar fi much longnr prri'

odr. tmgFrrngr plrnr covrrirg r throo'lofivr'

yo|r poricd would br ytgr'd.vrty lht.. lo

fivo yln, or might br ryrtrrnrlialty updetrd

reclr you lo mdnlrh I compbtr

pbn, wtrilo

rtntrgic plrnr rrc lofirrbt.d rl inrgub irlrr'

vrb by en crmtLlly myrtrmrtic Prcort.

01-4. Accounlebility ir klmticrl with ruPonribilily

rccounling. Accosntrbilily dmlr with lhr dir'

c|rrtgo of

gr

irdivitulr rrrponrltility to echirvr

urignrd otrirctivu wibh hr e*l md .rP.ns'

.. dbrd fot.ito prdonnmcr end egrord to by

thr irdivilll

01

.5.

Thr cqfrolbr 6o nct ccnllol. bst ri! lh. csr'

trol tut of tht mrnrgori rl l ovrl l by i rrui ng

'

ttpodt pohthg out dcvielisc lrqn thl prcdctlr'

min d courta oa &iim.

Ol. Thr st d.plrtrnoflt ko.pt d.teil.d ncordr ol

.nattrdr. lrbor, lrsfory ovorhoad, |rld m..k.t'

hg rnd tdnhrttntiva axpon3.t: analyrs tirrr

corlr: irturr cgrtrol taPortt;

Ptaprt.t

cort

dudier tor plrnnhg end d*irbn tridhg; rnd

coordinrt.t cott rnd budgrt drte wilh olhrr

cr.trylnril.

O1.7. F

Pdrrct

roorrdr

rnd derign, thr rrrnufr'

Urhg cbperirr|.ntr nord ortinrtd cl nrlrrirl.

hbor, rnd rtrrdlirr

PtE.3l]

str; lor m.'ruting

srd offi ci rncy ol rchrdul i ng.

produci ng. rnd

htP.siing pmductr, tho drprrtm.ntt

n'od lo

bd |ha codt irun d. Thr plr:anrl drprrr'

tnlrt rrrpplba mpfoyror'wrg. r.1.3- Thr trs'

|Ury dfrytm-t n..dt rccounting, budg.lrlg.

rd nhtrd rlgo.tr h rhrduling culr roqur'

tnatrtl. Tho rnrrtothg dlgertmrnl n.'dt cott

irlsnrtirr h riting

prE.t. Tho ptblic rrblitu

dagrtltn-n nreir'hfornrtbn

qr

Ptc...

r'F'.

PtoaL,

end divUrndr h sdrr to infotm thl puts

Ia Tha Lgal'dapstrnrnt noods st hfo'mrtbn

br frqirg rrny dteirs ol thr snpany h can'

b.mfy wlh lhr lrw.

Ol. ltodrm trctlrluor h csrrnunrcatlcnt

giv. th'

contrdbr end rntf lh. m.ant to tnnttnil hfor'

mdin in thr torrn cl cruttr. sutye.t. end foo'

crtto i n r wry ntvrr bdorr

pori bl r' Profi t

oPPor t uni t i ar or conl r ol . cl i ont hl vo bol n

drbyrd or misrd rntiroly bxaurr ttn'ly hfot'

tilli*1 thrt mi!fit frrvr imprw.d lh' cosl 'nd

prolit poitbn of thr cornpeny w.s poorty cdtl'

mr,'rEsiad.

Ol-9. Thr budgot ir rn oclonlbt colt

plennrng tool

brcaser it (r) lupplilr hfonnation and lrrvrl

rl e rtrlderd of

prrlormarc. lor ct cdtttol by

thr luprrviroc rciponriOto lor cg (b) ptwitor

Jr ..tt mrthod for enticipeting

prolitr rt rn

$ticiPlt.d nlor'bvol;

(c) hrlpr in foncarling

trbl, cotl3. rrponra3. and

pro{ils lor t pricd

of orc

Yorr

or rrlr. h rdYs'tc..

Ol-tO. Thlr dendudr rill not nocr*arily bo rbb lo

pt.vonl rilntg.m.nt ftrud' but th'y do give

inttnrrl accounbtrtt scnr

guilanct on how lo

preerd il thry rncountar ! qu'stiaublr

prr'

ticr.

01-l l . CASB rtandard$

(l ) rnunci al r

a pri nci pl r or

pnrriy'rl lo b. lollow.'{

(b) Glablbh

Prtdictt

is 5rj rpptiod; (c) rpcfy crilrrie to br ornpbyrd

h rlcthg lrqrr allrnretivr

principbr rnd prl:'

t!.! in orlinrting rccutnubtng,

end rcporrr'g

cgltrrst cosb. Th. tttndatds

at' btcktd tsf lho

lutt torc. trld .l{.ct ol thr tew.

Chapter 1

.

EXERCISES

Ei -1 The exerci se requi res turo exampl es of the i nseparabi l i ty of pl anni ng

and

contnol. Thrce are listed here, and the third one

gives two illustrations:

The most obvi ous erampl e of the i nseparabi l i ty of

pl anni ng

and con-

trot is found in the definition of control: managementb slrstematic effort

to achieve objectives by comparing

performance to

plans and taking

appropriate agtion to correct important differences. The definition shows

that the specific results of

planning ane an essential input to the control

phenoi nenon; there cannot be any such thi ng as a control effort wi thout

reference to some set of

plans.

A second exampl a of the i nseparabi l i ty of

pl anni ng and control

results from the fact that they are simultaneous' In practice, the imple-

mentation of the first steps of a

plan, and any control action needed in

those steps, are begun before al l

parts

of pl anni ng are compl ete. Earl y

results and the early findings of control activity can then be used in final-

izing later

parts

of the same

plan. An example is that a single annual

budget i s usual l y not compl etel y fi nal i zed before customer orders begi n

to be received lor that year, and consideration of the number of these

actual customer orders may

point to trends that need to be considered in

finalizing the budget. Even actual financial results of the early weeks and

months of the year can

provide a basis for better

'establistring

the budget

for the later portion of the year.

The most el egant exampl e of the i nseparabi l i ty of pl anni ng and con-

trol results fronr'the fact that both planning and control are complex

human acti vi ti es, and al most al l compl ex human acti vi ti es are pl anned

acti vi ti es and al so control l ed acti vi ti es. In other words, pl anni ng can be

so compl er that the

pl anni ng

effort i s i tsel f control l ed (and pl anned), and

control can be so compler that control activities are themselves planned

{and

controlled}. T\,rro illustrations of this are

provided

as follows:

(t)

A case i n whi ch pl anni ng

i s i tsel f pl anned

and control l ed i s when a

complieated budget (plan) is to be prepared. To facilitate the cre-

ati on of the budget, a detai l ed weekl y schedul e (another pl an) i s

first agreed upon, showing which steps in the preparation

of the

budget are to be carried out during each week. Because it is

desired that the creation of the budget not be allowed to fall far

behind schedule, the responsible manager will exercise control by

making comparisons between (a) the actual progress

made on the

budget each week and (b) the schedul e. The manager wi l l al so take

some correcti ve acti on i f the di fference between the schedul e and

the actual progress

i s consi dered i rnportant.

(21

A case i n whi ch control i s i tsel f pl anned i s when a manager deci des

what ki nds of control reports wi l l be used to compare actuat resutts

wi th pl ons

i n each future peri od

of busi ness operati ons. That deci -

si on, any efforts made to acqui re a suppl y of prepri nted

report

f or ms t o be f i l l ed i n each per i od,

and any changes i n t he desi gn of

' . q

a

ChaPter

t

El -1

(Concl uded)

the cost accounti ng

system to capture and compi l e the needed i nforma-

ti on about actuat resul ts

represent evi dence that the future.control acti v-

l ty i s bei ng

Pl anned.

El-2

(11 B

(21 A

(3) c

(41 A

(51 c

i Oi

B

-

al though the ti me frame i nvol ved i n thi s ki nd of

pl an

may be

.

extremely long, there is nothing strategic about this kind of plan

or deci-

si on. l n fl cti the

pl an and obl i gati on to pay off the bonds when they

come due i s so routi ne that management

woul d not consci ousl y

aPProach it as a decision.

E1- 3

(11

paragraph

(bl comes cl osest to descri bi ng

the ki nd of control used i n

mani gi ng a busi ness, atthough

i t i s descri bed i n a nonbusi ness setti ng.

There i s I

pl an l ormutated

i n advance,

there i s a measure

of actual

resutts, there i s a deci si on maker who compares actual resul ts wi th

pl ans, i here i s a sel ecti on of a correcti ve

acti on to bri ng resul ts cl oser i n

l i ne wi th tae

pl an, and there i s a foreshadowi ng

of repeated

peri odi c con-

trol acti vi ti es

(the remai ni ng

qui zzes)'

The fact i frat i l re measures of

ptanni ng and actual

performance ane

nonfi nanci al measures i s not the governi ng consi derati on.

Much pl anned

and actual i nformati on

used i n controtl i ng a busi ness i s non-fi nanci al '

i ncl udi ng some cost accounti ng

i nfor:mati on

such as the number of uni ts

produced, the

percentage of uni ts that were defecti ve,

and the percent-

age of avai l abl e machi ne ti me that was uti l i zed'

(21 R-ragraph (a) i s a

perfect exampl e of an engi neeri ng

control ' rather than

the ki nd of control managers use i n busi ness. The si mpl e

devi ce

descri bed, whi ch i s founi i n any home bathroom, i s the ki nd of control

devi ce dei i gned to moni tor a

physi cal condi ti on, and so i t i s anal ogous

to

; th;r;;;Jt or any of a varieiy of devices called

"industrial

controls."

of

course, devi ces of tni s ki nd art used i n manufacturi ng

and other busi -

nesses, but they do not possess the essenti al attri butes

of control i n the

sense used i n busi ness and i n cost accounti ng.

The devi ce

achi eves a

conti nuous moni tori ng of the resul ts, rather than a

peri odi c compari son

of resul ts wi th

pl ans, i here i s no human deci si on maker

who sel ects

a

correcti ve acti on to be taken. A human deci si on maker i s

probabl y-the

sal i ent attri bute of control i n managi ng a busi ness that i s mi ssi ng

i n

paragraph (al .

Chaoter

1

I

E1- 3

( Goncl uded)

Par agr aph( c} coul dbei nt er pr et edasanexamp| eof p| anni ng, but i t

tacks

som!

essentiar

inntfris'ot

"ontiolGven

though

the word

"con-

trol,,

is used

in its tast senili""i.

rn"-te

is no

periodic

comparison

of

actuar

resutts

with

plan" ;;;';;

provisioi

ioi

-moairyins

the treatment

based

on

periodic resuttsl

eor

"r-".ple,

the contract

requires

five treat-

ments

each

year, even i t no;";dt

are vi si bl e'

The acti ons

taken are

"r.r*J::l"jxtlil',";efers

to the concept

of contror

that appries

to

porice

work and mi ti tary

sci enc;:

ti ;;;sts

ot bei ng

abte

to

phvsi cal l v deter-

mine

each event ttrat ocJu;

il iot"

tocaiion-

and being

able to

prevent

certain

events

from o""rJring.

rn"

pot""li"i use of coetcive

fotee'

which

is very ctear

in

paragraprr rot,

i, alwayspreient

in achieving

this kind of

control.

ln

paragraph

(d), ti;;'r"

i" no inOi""tion

tft"t

resutts

wene

periodi-

cat t ycompanedwi t hpr ans. l r u| et hat says. ' obt ai nt heobi ect i veat any

cost " i ssomet i mesassoci at edwi t ht heseact i vi t i es'

- F

Chater

t

CASES

.

cl - 1

( 1} Yes, Wi | | i amshasanet hi ca| r esponsi bi l i t yt ot akeact i on.

d;'nilis

-itanaards

of Ethicat

Conducl states that manase-

ment accountants

t'shall

not commit acts contrary

to these standards nor

shal l they condone

the commi ssi on

of such acts by others wi thi n thei r

organizations.tt

l 2l ffhe

requi rement

does not ask whi ch standards

have been vi ol ated' but'

, - ' r at her r whi chonesappl yt oWl l i ams' si t uat i on' )

Management account ant shaveanesponsi bi l i t yt o:

cori-"i"n"":

perform

their

professional duties in accordance with

relevant

6n s, tegulations;

and technical-standards'

(Dumping toxic

wastes in a residential

landfill is

generally a violation of law.)

Confidentiatitv:

Refrain from disclosing

confidential information

""quf f i eof t hei rworkexcept whenaut hori ze. d. , u. n| ess

tegi tl y obti gated to do so

(Wi l l i ams my be l egal l y obl i gated to take

action and make certain disclosures'!

fnteqritv: Refrain from either actively or

passively subverting

the

\

attainmeffi the organizationb

legitimate

and ethical objectives'

(Wi l l i ams, avoi dancJot

the i ssue woutd

passi vel y subvert

attai nment of

ethical obiectives.)

Comm-unicate

unfavorable

as well as favorable information

and

pro-

fessi onatj udgments

or opi ni ons.

(Wi l l i ams i s obl i gated to report hi s unfa-

vorable tindings to appropriate

persons')

Retr?il tion, engaging in or supporting

any activity that would dis-

credit the

professionl (lflitlia1ns' sitence

would

provide support

to the

dumping activity and, ihus, could discredit

the profession')

'Obiectivitvi

Disclose fully all relevant information that could reason-

aory G eilffid to influ"ncJan

intended usefs understanding

of the

reportS, comments, and recommendati ons

presented' (Wi tl i ams shoul d

disclose his lindings to the'appropriate

persons')

(31 Atternative

(a|, to seek ttre adiice

of his immediate superior,

is appropri-

ate. This is itri first step he is reguired to take, unless the superior is

involved.

Atternative

(bl, communication

of confidential information

to

per-

aons outsi de the company, such as the l ocal newspaper, i s i nappropri ate

unl ess there i s a l egai obi i gati on to do so. l f regui red by l aq Wi l l i ams

shoul d contact the proper authori ti es.

Alternative

(c), contacting a member of the board of directors,

would

be i nappropri ate at thi s ti me. Wi l l i ams shoul d report the

probl em to suc-

cessi vei y tri gher l evel s wi thi n the company and turn to the board of

di rectors onl y i f the probl em i s not resol ved at l ower l evel s.

-l

Chaoter t

C1-1

(Concl uded)

(4) Wl i ams shoul d fol l ow the company' s establ i shed

pol i ci es

for resol vi ng

such i ssues, i f such

pol i ci es eri st. l f the i ssue i s not resol ved through

eri sti ng

pol i ci es, he shoutd

report the probl em to successi vel y hi gher

levels within the company

until it is resolved.

ffilliams

is not required to

report this action to his superior if his superior appeani to be involved in

the conflict. He is not to disclose the matter to

persons outside the orga-

nization, untess required by taw.) During these steps' Wlliams may clarify

relevant concepts by confidential discussion with an obiective advisor to

obtain an understanding of

possible courses of action. lf tfie conflict is

not resolved after erhausting all these coursies of action' VWlliams may

have no other recourse than to resi gn and submi t an i nformati ve memo-

randum to an appropriate

representative of the olganization.

Consultation

with one's personal attorney

is also appropriate.

c1- 2

(i

) 61he

requirement does not ask which standards

have been violated' but'

rather, which ones apply to the CFO'S behavior.)

Mana

ge

ment acco untants have a' nesponsibility to:

CompLtgnce: Perform their

professional duties.in accordance with

'

relevant tawC, regulations, and technical standards.

ffhe

CFO has asked

Deerling to account for informatlon in a way that is not in accordance

wi th generatl l l accepted accounti ng

pri nci pl es.)

Prepare comptete and clear reports and recommendations after

appropriate analyses of relevant and reliable informatlon.

[The

CFob

restrictions on disclosure will resutt in incomplete reports.)

Confidentialitv: Refrain lrom using or appearing to use confidential

information acquired in the course of their work for unethlcal or illegal

advantage, either

personally or through third

parties. (The CFO is

attempting to use confidential information to

protect the

fob

security and

bonuses of top management.|

Inteqriw; Avoid astual or apparent conflicts of intercst and advise

atl appropriate

parties of any

potential conflict.

fThe

CFO has failed to

avoid a conflict of interest and has not informed the stockholders of the

conflict.)

Refuse any gift, favor, or hospitality

that would influence or would

appear to i nfl uence thei r acti ons.

[The

GFO' s bonus appears to be an

i nfl uence on hi s acti ons.)

Refrai n from ei ther acti vel y or

passi vel y subverti ng the attai nment

of the organi zati on' s l egi ti mate and ethi cal obj ecti ves. (The CFO has sub-

verted the attainment of the organization's legitimate objective,

profit for

stockhol ders, by pursui ng, i nstead, the

j ob

securi ty and bonuses of top

management . )

Communi cate unfavorabl e as wel l as favorabl e i nformati on and

pro-

fessi onal

i udgments

or opi ni ons.

fl ' he

CFO i s attempti ng to restri ct di s-

cl osure of i nf ormat i on about t he acqui si t i on. |

I

-

F

!

:

Chaptor t

C1-2

(Conti nued)

Refrai n from engagi ng i n or supporti ng

any acti vi ty that woul d di s-

credi t the

professi on.

fi he

CFO' s acti ons coul d di scredi t the

professi on.)

Obiectivitv: Communicate

information

fairly and obiectively.

ffhe

CFO is attetnpting to unfairly control the information reported, resulting

in a rePort that is not obiective.)

Disclose futty all relevant information

that could reasonably be

expected to i nftuence an i ntended userb understandi ng of the reports'

comments, and recommendati ons

presented.

ffhe

CFO i s attempti ng to

restrist disclosure of relevant information.l

(21

fthe

requi rement does not ask whi ch standards have been vi ol ated' but'

r:rther, which ones apply to Deerling's situation.)

Management accountants have a nesponsi bi l i ty to:

Comol tence: Perform thei r professi onal duti es i n accordance wi th

rel evant l aws, regul ati ons, and techni cal standards.

(Deerl i ng i s bei ng

asked to vi ol ate

general ty accepted accounti ng

pri nci pl es.)

Prepare complete and clear reports and recommendations after

appropriate analyses of relevant and reliable information.

(Deerling is

being asked to

piepare an incomplete

report.i

ggg1iEe$bt6i

Refrain from using or appearing to use confidential

information acquireO in the course of their work for unethical or illegal

advantage ei ther

personal l y or through thi rd

parti es. (Deerl i ng must not

use the confi denti al i nformati on about the possi bl e takeover to hi s own

advantage or to that of the

person(s) mounting the takeover attempt.)

l nteqri w: Refuse any gi ft, favor, or hospi tal i ty that woul d i nfl uence

or woutd appear to i nfl uence thei r acti ons.

fi he

l ast sentence of the case

suggests that Deerl i ng i s consi dered

a member of the top management

gnoupr

so he may be el i gi bl e for a bonus.)

Refrain from either actively or

passively subverting

the attainment

of the organi zati on' s l egi ti mate and ethi cal obj ecti ves.

(Deerl i ng i s bei ng

asked to subvert the attainment of the organization's legitimate obiec-

tive, profit for stockholders, by

pursuing instead the

iob

security and

bonuses of top management.)

Gommuni cate unfavorabl e as wel l as favorabl e i nformati on and

pro-

fessi onal

j udgments

or opi ni ons.

(Deerl i ng i s bei ng asked to restri ct di s-

closure of information about the acquisition.)

Refrai n from engagi ng i n or supporti ng any acti vi ty

that woul d di s-

credi t the

professi on. (Deerl i ng i s bei ng asked to take acti ons that coul d

discredit the profession.)

Obi ecti vi tv: Communi cate i nformati on fai rl y and obj ecti vel y.

(Deerl i ng i s bei ng asked to prepare a report that i s not obi ecti ve.)

Di scl ose futl y atl rel evant i nformati on that coul d reasonabl y be

expected to i nfl uence an i ntended user' s understandi ng of the reports'

comment s, and recommendat i ons

present ed. (Deerl i ng i s bei ng asked

t o

restri ct di scl osure of rel evant i nformati on.)

Chaoter 1

C1-2

(Concluded)

(31 tf the company has esta-blished

policies for dealing with such issues,

Deerl i ng shoui a fi rst fol l ow

tAese pol i ci es. l f such pol i ci es do not eri st'

or i f they ane unsuccessful

i n resol vi ng the

probl em, Deerl i ng shoul d pre-

sent the

probl em to the chai rman of the board. Deerl i ngb i mmedi ate

superi or i s i nvol ved, so he need not be i nformed of thi s acti on. l f the

matter remai ns unnesol ved, Deerl i ng shoul d report to the audi t commi t-

tee, the board

of directors, and finally the maiority owners. During these

steps, Deerling may ctarify retevant concepts

by confidential discussion

with an objective advisor to obtain an understanding of

possible courses

of action. lf the conftict is not resolved after erhausting all these counses

of action, Deerling may have no other necourse than to rcsign and'submit

an informative memoriandum to an appnrpriate repnesentative of the

organization.

Consultation with one's personal attomey is also appropriate.

(4) The primary nesponsibility tho company must tulfill betore taking defen-

sive actions is its fiduciary nesponsibility

to stockholdens. Other respon-

sibilities inctude the effects that the takeover and defensive actions

would have on creditors, bondholders, empfoyees, customers' and the 3

community. The company also has a nesponsibility to inform its external

audi tors and l egal counsel to avoi d

putti ng them i n a compromi si ng

posi -

ti on.

c1-3

(f

l ffhe

requi rement does not ask whi ch standards have been vi ol ated' but'

rather, which ones apply to Dixon's behavior.)

Management accountants have a responsi bi l i ty to:

Comoetence: Mai ntai n an appropri ate l evel of

professi onal compe-

tence by ongoi ng devel opment of thei r knowl edge and ski l l s. (By system-

atically rejecting all minority applicants, Dixon is

ieopardizing

the level of

competence among the staff.)

Perform their professional duties in accordance with relevant laws,

regulations, and technical standards.

(Equaf opportunity in employment

is required by law.)

Inteqritv: Avoid actual or apparent conflicts of interest and advise

all appropriate parties

of any

potential conflict.

(Dixon's preiudice is in

conflict with the company's legat obligatibn to

provide

equal opportunity

empl oyment, and wi th the companyfs need for the most competent staff

regardless of race.)

Refrai n from ei ther acti vel y or

passi vel y

subverti ng the attai nment

of the organi zati onb l egi ti mate and ethi cal obj ecti ves.

ffhe

company' s

obi ecti ve of equal opportuni ty empl oyment i s bei ng subveded by Di xon' s

prej udi ce.!

(21

(3)

'l

L

!

l>

I

l>

I

fL

I

!

I

\'

,l

b

I

I

b

I

I

b

I

b

I

E

I

l-

(41

I

I

E

i

l-

I

\.

I

Chapter

t

Cl -3

(Concl uded)

\

b

Refrai n

from engagi ng

i n or supporti ng

any acti vi ty that woul d di s-

credit the

profession. (Such peristent, systematic

discrimination

in hir-

i ng coutd di scredi t the

professi on' )

ff[e

requirement

does not ask which standards

have been violated' but

iather, which on"" apply to Foxworthts

situation.)

Because management

accountants

may noi condone

the commission

of unethical acts by

;ihd *ig,in ttreir organizations,

all of the responsibilities listed in the

sol uti on to requi rement

(1) al so appl y to Foxworth' s

si tuati on.

In addi ti on,

the fol l owi ng aPPIY:

Management

accountants

have a responsibi|ity

to:

ConfiJentialitv: Refrain from disclosing

confidential information

acqui red i n the couor of thei r work except when authori zedr unl ess

l egal l y obl i gated to do so.

(Foxworth' s suspi ci ons

about Di xon' s behavi or

shoul d not be di scl osed i nappropri atel y'

See requi rement

(3)).

gbiectivitv:

Communicate

information

fairly and objectively'

(poxworttr is oOtigated to make obiective hiring recommendations to

bi ron, i n spi te oi tri s bel i ef that Di xon wi l l be prej udi ced i n acti ng on

them.)

Alternative

(a), discussion with the director of

personnel, who is one of

Dixonb

peets, is inappropriate at this time. lf, however, Foxworth

betieves the directoi bt

personnel is an obiective

pafty, Foxworth

may

discuss the matter with the director, confidentialln

to clarify

the relevant

concepts and to obtai n an understandi ng

of

possi bl e courses of acti on.

Alternative

(b), informal discussion

with a group of MAD senior man-

agement accountants, is inappropriate.

Alternative

(cl, piivate discussion

with the CFO, Dixon's superior, is

appropri ate. Because Foxworth has atready approached hi s i mmedi ate

superi or, Di xon, who i s i nvotved i n the confl i ct, i t i s not necessary for

Foxworth to inform him of this action.

Fonarorth shoul d fol l ow the company' s establ i shed

pol i ci es for deal i ng

with this type of conflict, if such

policies exist. lf policies do not exist' or

if they are-unsuccessfut in resolving the conflict, Foxworth should dis-

cuss ihe issue with the CFO. tf the matter remains unresolved, discus-

si ons wi th successi vel y hi gher l evel s of management, i ncl udi ng

the audi t

committee and the board of directors,

should follow. During these steps'

Foxurorth may discuss the matter confidentially

with an obiective

advisor

to cl ari fy the rel evant concepts and to obtai n an understandi ng of

possi -

bl e courses of acti on. l f the matter remai ns unresol ved after exhausti ng

al l of these steps, Foxworth may have no recourse other than to resi gn

and submi t an i nformati ve memorandum to an appropri ate representati ve

of the company. Consultation with one's personal attomey is also appropriate.

Chagter 1

c1-4

,

{1) ffhe

requirement does not ask lor a list of responsibllities Rodriguez has

viotated, merely which of the fifteen responsibilities apply to his

si tuati on.)

Management accountants have a nesponsibility to :

Comoetence: Perform their professional duties in accordance with

relevant laws, regulations, and technical standards.

ffhe

figures

Hodri guel i s bei ng asked to prepare mi ght amount to fraud i n the l oan

appl i cati on.)

Prepare complete and clear reports and recommendations after

appropriate analyses of relevant and reliable information.

flhe

reliability

of the information is in doubt, and the fact that certain sales figures are

or are not sufficient to

justify

the bank loan are not relevant to prepara-

ti on of the budget)

lnteoritv: Refrain from either actively or passively subverting the

attainment of the organization's legitimate and ethical objectives. (There

is a push to subvert legitimate objectives to the immediate need for a

bank l oan.)

Recognize and communicate professional

limitations or other con-

straints that would preclude

responsible

judgement

or successful per-

formance of an activity. (Rodriguez

has not expressed to Czeista the con-

flict between his desire to be a team player and his ethical responsibili-

ti es.)

Communicate unfavorable as well as favorable information and pro-

fessional

judgements

or opinions. (Rodriguez

is being asked to report

information that reflects so favorably on the company that lt may not be

j usti fi abl e.)

Refrain from engaging in or supporting any activity that woutd dis-

credit the profession.

(Preparing

a deliberately misleading budget as

' part

of a loan application could amount to obtaining mon-y by iraud.)

Obiectivitv: Communicate information fairly and objecfivety.

(Rodriguez

feels pnessuned

to abandon his objectivity in preparing

the

budget.)

Disclose

fully all relevant information that could reasonably

be

expected to influence

an intended user's understanding

of the reports,

commentsr

and recommendations

presented. (A comparison

of the new

targeted

sales figure with the actual sales of tlre coresponding periods

of past years

would be likely to influence the bank's understanding

of

just

how large

an increase in sares is being portrayed.)

12) Rodriguez

coutd have clearly stated his concerns to Czeisla at each

stage

of the budget's

creation and revision. He could have consulted

wi th the marketi ng

manager and producti on

manager.i

"r.ry stage,

rather

than onl y upon recei vi ng the i ni ti al budget

ol ata. He coutd present

the budget,

or a summa

ry

of i t, i n a comparati ve

form to hi ghl i ght the

differences

between

each guarterts

budget

and the actual resutts of the

corespondi ng

quarter

of the precedi ng

year,

and he coul d even

t 0

I

I

t t

I

I

!

I

\-

I

i

l>

I

L

I

I

b

I

b

I

:

I

!

I

b

Chapter

t

C1-4

(Concl uded)

calcutate the

percentage increase being budgeted and compare it with

actual

perceniage increases

that were achieved annually in the past. He

could have conJulted

with his staff superior at the headquarters of

Norttrwestern

(the parent company)

-

Gzeisla is his line superior'

according to the second sentence of the case'

(31 In addition to his ethical responsibiliUes

to CD, Rodriquez has ethical

responsibiliUes

to:

(a) The banks

(b) The management

accounting

profession

cl - 5

(1)

ffhe

requirement does not ask for a list of responsibilities

Jones has vio-

iated, merely which of the flfteen responslbilities

apply to his situation.)

Management accountants

have a responsibi||ty

to:

ConfiJentialitv: Refrain from disclosing confidentlal

information

acquirEA in the counse of their work except when authorized, unless

legally obligated to do so.

(lf Jones accepts the consulting engagement

with Crimson, lt is tikely she will be asked to disclose confidential SMI

information about the desired computer system')'

Refrain from using or appearing

to use confidential information

acquired in the counse of their work for unethical or illegal advantage

either

personalty or through third

parties,

[The

size of the consulting fee

suggests Grimson is seeking to buy confidential information to help win

the

job.)-

lnteqritv: Avoid actual or apparent conflicts of interest and advise

all approptiate

parties of any

potentiat conflict.

(The consulting

iob

would

constitute an apparent conflict of interest and

probably an actual one'

because Jones has been named to the SMI committee that will evaluate

and rank all the

proposats, inctuding Crimson's

proposal, which she

would have helped to write.)

Refrain from engaging in any activity that would

preiudice their abil-

ity to carry out their duUes ethically.

(The consulting

iob

with Crimson

would preiudice Jones'ability to evaluate and rank the

proposals for

SMl, because one of the proposats would be Jones' own work.)

Refuse any

gift, favor, or hospitality that would influence or would

appear to influence their actlons.

(Regardless of wbether the size of the

consulting fee is construed as being a

gift or favor, lt Is likely that other

gifts, favors, or hospitality will be extended to Jones by Grimson during

the counse of the consulting engagement)

Refrain from either actively or passively subverting the attainment

of the organization's legitimate and ethical objectives.

(SMl's legitimate

obiective of obtaining the best computer system at the best

price would

be subverted to Jones' personat need for money, as a resul t of Jones'

di sctosi ng cruci al i nformati on for Cri mson to i ncl ude i n i ts

proposal ,

especi al t y i f Cri mson mi ght not del i ver a syst em wi t h t he cruci al

attributes.)

I

L

I

It

I

!

b

I

b

l

lb

12

chaDrcr

t

C1-5

(Concl uded)

Recognize

and communicate

professional limitations

or other con-

straints

that would

precluJ" *=ponsible iudgmen-t

or sucoessful

perfor-

mance of an activity.

(Accepting-tfie

consutung iob

would

preclude

responsibte iudgment

in .rlfu"ting

and ranking

the

proposals for SMI; on

the otheirr-anu,Lthicat

llmitations-of

Jones' employment

at SMI would

preclude successful

performance of the consulting

engagement

for

Crimson,

Liplcially

li Crimson

does expect her to leveal crucial lnforma-

tion to fr"lp Lin ttre

ioU-her

ethical duty to SMI would

prevent her from

delivering

what Crimson is

paying for)'

Refiin from engagin! in or supporting

any activity-

that would dis-

credit ttre

profession. (Selling confidential SMI information

to a vendor

would be a discreditable

act)

Obiectivitv:

Gommunicaie

information

fairly and obiectively.

(Jones

would Ue unliLely

to communicate

obiective evaluations

of

proposals lf

she had tretpea write one of ttrem')

Disclose fully all relevant

information that could reasonably

be

expected to influence an intended useCs understanding

of the reports'

comments,

and recommendaUons

presented. (JoneslPtt ln writing the

Crimson

pioposat would be relevant information

in SMlts

use of her eval-

uations oi

pioPosals.)

(21 Jones might have disclosed, either orally or on her

personal vita sheet or

iob

application,

the extent of her involvement

on the SMI task force and

the committee.

(3) Jones could have first investigated

all her caneer opportunities

with firms

that

presented no potential conflict of interest of this kind, but for the

sake of the arE,ument, it is reasonable to assume she did exactly that

belore applyin! for a

position at Crimson. Knowing

that Crimson ls a sup-

plier of computer systems, Jones might have revised her

personal vita

sheet and the wording of her application

for this one

iob

interview to

lessen the chances of Grimsonis being tempted to

pursue an unethical

plan. (Of course, her invotvement in SMt's upcoming

purchase might have

become known to Grimson anryay, or it might have been known to

Grimson from other sources before her interview or even before her

application for the

position.)

(41 In addition to her ethical responsibilities

to SMI

(and her financial

responsibitity to the hospltal that provides treatment for her child)' Jones

has ethical responsibilities to:

(a)

her family

(b) the management accounti ng

professi on

(c) Crimson

I

I

I

I

I

I

S.

I

I

L

I

l-

I

b

I

o2-1.

(r)

I

S

I

\,

I

b

I

!

CGt it lha curnnt nrnetary Yaluo c' @'

nqnic tatou.cet

givon uP or to bo givcn

up i n obt ai ni ng

goodr and ! ' r vi ces'

Ecgrqnb toloulE.! tnay bo given up by

trandening cash or othcr

propcrty, bsuitg

capital stoih

prrloming rrvbe, or ircur-

ring liabilttbt.

Coclc rrc classifird er unexpirod or

expired. Uncxpired sl! at. aslet! and

apply to tho produclict cl fulure r.venues.

Erarnplet of uncrpired @sts at. invenlo-

rira, prepaH exPent.E, plant and equip'

ment. and i nvcstmcnts. Expi rcd corl s'

s'hi$ ngl costl bosnc eventually, are

thosc that er. not applbable to tho pro'

dus{bn ol luturr rcvonuos and are dodud-

r d l r om cur t anl t evonues or char ged

agohst retahrd oamings.

E:grncr in its broadesl

gense

hcludes

all expired catr; i.r., costl $'hich do not

havc any polential futurc cqlofiiic bene-

lil A mar prrcire ddinition linits thc use

cil the tcrm'axpcnlc'!o lhe et9ired cosls

ariring from uring or con3uming

goods

and srrviccr in tho preesa ol oblaining

rcvenuss: o.g.. co3l of goods sold and

markelhg and adrninistrative expenses.

(t) Cost of

9oo&

soH is an cxpired cosl

and may bc rclorred to ss atr erpensc in

t ho br oad t . n! o of t hc t cr m. On t he

incqnr stal.m.nt. it b most sften Uenti'

fi cd ar e co!| . l nvrnl ory hel d l or sal e

which is destroyed by an abnotmal casual'

ty strould be dssitied as a loss.

(2) Urnollectble accounts expnse is usu'

ally classilied as an exPenso. Howevcr,

some aulhorilicr belicvc thal it is more

desirablc to clasrify uncolleclible accounls

as a direct reductiqr of sales revenuc

(an

of l set t o r r vcnue) . An uncol l ect i bl e

accounl whi:h was nct proviJod for in the

annual adiustmcnt, such as bankruptcy of

a maior drbtor, may be classified as a

bes.

( 3) Dcpr cci al i on . xpen! c l or pl anl

rnachhcry is a corrpooent o{ factory over-

head ard r.presrnts thc rectassifbation of

a portlcn od thc mEdrinory cqsl to product

cct (hventory). Whcn the producl ir sold,

lho doprcciation bccomes a part of lho

co$ ol gods rold which is an oxponso.

Deprccbtian cl pbnt m*hinery durhg an

unplanned atd unptoductive perir:d cl iCle-

ncss, suctr as during a slriko, should be

classified as a lcs. The torm

'expense'

CHAPTER

2

DrscussloN ouEsTloNs

a2-2.

02-3.

shouH preferably be avoided rr'hon rnak'

hg relcrmce to

Productbn

coss-

(a) Orgattizatirr ccls arc tlnse cqsts that

benefil the lirm for its entire perird ol exs'

tcncs and aro most approprbtely classi'

fiod ss a rsrcurcnt asset. When lherc is

hilbl evijence that a firm's life is limiled'

thc orgranizatbn costs Crould be allocalcd

ovor t he f i r m' s l i l e a! an expeneo ot

shoul d bc amorti zed as a l osg whrn a

goi ng conccm foresees termi nal i on. In

praclice, however, orgranizalbn costs are

oftcn writlen ofl in the early years of a

firm's eristence.

(5) Spoiled gods reaulling from normal

menulacluring

preessing shoub be lreal'

cd as a cost of the prodwr rnanulastured.

Whcn t hc

Pr oducl

i s sol d' t ho cosl

becomes an expongs. SPoi l ed

goods

rcrul l i ng from an abnormal occurrenco

shouldbe clrssilied as a kr-ss.

Cost objrts are unils for wlrich atr arrangement

is mede lo accumulate and measure cosl. They

are imporlant because ol thc need lor multiple

dimensians ct dats (c.9., by produci' csltrasl" or

departtnent) to accornplish the varbus

PutPoses

of cost accounling, including cosl fhding'

pbn'

ning, ard contrcl.

(a) To ctassily costs as direst or indirct. the

col t accounl anl musl l i r st know l he

answens to lhe

questlcns

-Directly

traced

to what?' and' l ndi rectl y i denti fi ed wi l h

what ?' Ol her wi se, t her e i s no way l o

assess the direct or indirect nature ol a

cost. lt is the choice ol a cost obiecl lhat

answers lhose lwo qugstbns.

(b) For erample, lhe cost of a department's

manager's salary cannot be cbssified as

direct or indirecl without lelecting the cosl

object first. lf the cost obiect is a prcduct

uni t produced i n the manager' s deparl '

ment, thon the sabry is indirect. ll the cct

obj ect i r the departmonl , l he sal ary i s

direcl.

(a) The product unil, batch, or b is tho cost

obiect. (8e careful about the lack cl cbrily

of the term the

product' when it is nol

known whether il is intended to meen

(a) a

single unil, batch. or lol ol a

Ptoducl.

Bs

oppced lo (b) any large number ol benti'

cal unils. lt couH easily bc laken to meatr.

say,

Product

1321, as oPPosed to somo

other item in the cornpany's catalog' ancl

that could suggost the grand total ol ali

identical pieces ol t321

produced during

I

b

Ib)

b

l

:

i

:

I

!

I

\'

I

\.

\

t

l-

13

Q24.

14

lhc onliro

product lilc eycb. Thr rignili'

csnc. o{ lhb dbthstion it thal sstr. cGls.

eucn s!

product dceign' Ptotoqping,

8nd

hilial worker trahhg' arc dincl codr with

rosPccl to th. tolal of all unitc tvct

pto-

ducod, bul ero indirccl with tocPesl to e

eingle uil, bdch' or bl')

(b) A diaaggrcaatkrn

of ovcrhcad

would be

uselul for lny ltudy of lpw to brttlr rnan'

age cost!. or ol what cau!'s tl l'o b'

i ncur r r d. Rol al i vr l y l r w ol l ho coel e

i ncurrod.,i n a factory arc causl d by l he

rqrthe

proargin ol ale npre unit of

qte

producl.

(c) (l) A bstch of Henlical vnits'

(2) Th. rum o{ all Uenlical unils cver po-

duced.

(3) An activity or

proco3s carried out in

prroduclicr.

(4) A gtoup or

' ccl l '

ol machi nos and

workerc wilhin a d.Parimont-

(5) A departmcnt i n whi ch producti on

GUnS.

(6) A plant or clher produclion facility.

( 7) A et r at cgi c

Aoal

ol l he f i r m ( 1. 9. '

inprovod qualny).

O2-5. A cost system ir a combinalim of prcedures

and rccordc dnignrd to providc the various

types of informEtiqr reguired in thr conducl o{

the enterprise; including cosl lhdhg, planning,

and cqllrol.

02. A gnod hformatinn rystem_reguires lhe crtab'

l i ghment of (a) l ong.rangr obi ccl i vcr; (b) an

organization phn rhoing dclegated rreponsibi l'

itier in dotail; (c) ddailcd phns for luture opera'

tbna, botr bng and rhod-lem; 8nd (d) pree-

dures for i mpl omcnl i ng and control l i ng l hese

plans.

A2-7. A charl of accountr ia ncccraary to clarrify

accounthg data, ro that thr data may bc uni-'

formly rccordrd in

irumals

and posted to lhe

ledger accountr.

02. Advantagcr of tho rlectronic data processing

lyllem for rccord keeping are: spced. larger

!torag., ringb rntry ol mulliplo transaclions.

aul omal i c conl rol fl aturel , and f l exi bi l i ty i n

r.port lonrlats.

O2-9. Thc ldbrrhg poceived

weaknessos wore mon-

lined h lh. text

(a) Tndi ti onel m.rrur.r ettompl to rcrvc

rniny purprg,

arrd ar a rcault lhey arc

not univorrslly rcanrdcd ar srrving any

qt.

purp6.

iJcally.

( b) Tr edi t i onal mea. ur . l ar o r l l ect cd by

accannting ctroicor that arc rrl ahrayr rol-

cvant to lh. purpo.. al hard; cramples od

thrsr clrobcs aro c6l flow agsumptisrs

and arbhrary fircd et allocatixrs.

(c) Tradi ti onal meesuro! arr cal cul ated by

sy3lcns lhat aro ueually sbw to rospond

to cfnn gin g srditiorrs.

Chapter 2

(d) Tndhbnal

m.lrurot of plenl uliliz'atton

c8n t .m lo ancourago orrrrutilizatbn of

caPritY'

(e) Tradi ti onal

m.l tuto! of offi ci rncy err

cilton rcPorted b bl.. ato t@ 899m9ai-

.4 lrd rt. .rry b mbhlrrPrct-

02-10. Nqtthancbt

pcrlonnerrr rn aaur.t rr. basod

an rinplr count! or clh.r phyrical date rathor

tun dlocat.d eunlhg dala. thry !n uncql-

nocird to tho grnrral fhrrcial rccounlirg rys-

trn, and thoy en cfrorn to rrflcl me sPecifb

alp-t ol

Prdorrnrncr.

O2-1 1. Four rrampbr ol nonl i nanci al prrl ormancc

mcasunrs

givcn h tho lort and the a.rpects of

portonnancr hry mi1t'tl b. ustd lo nsrits, an

(a) rcrap woi ghl .s r p.tc.nl ag. of l ol el

shppcd wcigfiB lo rnslitot cffbiency of a

- prs.s, pariicr.rlarly cllbioncy of matcrial

u8al

(b) proccring limo er r p.rc.ntaP of total

timc; to nsrita

qade etlicicnry or inv.nte

rY vclcitY

(c) dbtancc rrcvcd by a unil while insUc thr

plant to nutitc rinplifbalbn of a prarrs

(d) ruggcrl i cnr P.r

y.rt

P.r

cmpl oyoe: l o

rrr itor rnPryea ilotvrmrnl

O2-12- Tht cfiallcngr

poscd by lhr ircrrasod inlcrcrl h

'

nqrfinanciel

pldornam maarBurcs ir to defho

thc cost accountanl't rob broadly cnough lo

irctude rEr. rnasuror that arr nol preceded by

dolhr signs and thst at ncl thi lo the financial

eccqlnting !)rrlsn.

Q2-13. Cctr an most co,lutbnly claroified borrd st

lhcir rcbtictshP to

(a) thc produci (a ahgb bstch' lctt' or unit of

tho gmdorrrubo);

(b) thc Yolurnr od Elivity;

(c) tho manulacturing dcparlmcnts,

Ptsca!-

.t. o6t c||ltoili s othcr aubdivbixts:

(d) thc accounthg

Pctii;

(e) a

Propecd

decbirr, Elitn, or cvalualbn.

O2-t4. lrdircct rnstedab an thco rnslorials nroded for

tho csnplotion of lhc product bul whorc con'

aumptict is eithcr so amall or rc cornplex that

thcir trestment ar dirccl nralorialr would no( bc

foasible. For eramplo, nailr uerd lo mako the

product arc irdirccl malorialr.

02.15. lndirrt labor. in csltrasl to direct labor, b labor

rrponded lhat doo not efbc{ thr cqrrtrustiqt

or thr snpoilion of tho lhirhrd

Produc.t.

For

orarnple. thc labor of custodians ie indirct labor.

02-16. (a) A cervicr dcpartmont ir onc that ir not

diroc'tly cngngod in production, brtrl rrndrra

a partbular t!rp. of rrybo for the bonolit

od otrcr drpartmcntr. Erarmhr cf rorvbo

dopartmonl! aro rrceiving, ltor.rooms,

mai nl enancc, ti mekeepi ng,

payrol l , and

calelcria-

(b) Produchg dcparimentr clauify thcir aharo

of rorvice departmrnl .xpcnr.t ar indi-

rccl ovorhoad cp.nac8.

:

(c)

(b)

L

I

L

L

I

!

I

I

L

I

i

!

I

s

I

tr

L

I

!

I

I

b

I

I

!

I

t

t

I

\,

I

b

I

I

t-

Cluptar 2

@-17.

(r) Cepital expcndilunr are irdended lo beno.

lil nprt Oran

ql.

accounting

pcricd. Thr

oxprndiluru rhould lhoroforr br rccordrd

by e cfrargr to an ac!.t ac@snt for dls'

tin !o thc periodt bcncfiled.

Fbvrnuo cxprndi turcr brncfi l thr

oporationc of |hr cunrnt

perird mly. Thry

rhoul d bo rocordrd by chargrr l o thr

appmprialr ctp.ilta accounts.

It e ccpilal elgcndituro ir irnproperty clar'

ri fi rd ar .n axpantc' 8tl el r, rrtai nrd

oamings, and hcsnr for thl perird will bo

undrrstEted. In future

pcrids, hqnr will

br overstaled by any arnount thst would

havr bcen arrpdiecd had thc epcndiluro

born proprrl y capi tal i zrd. Anrtr and

rrtained eamings will bo undersialod st

tul urc bal anc. !h..13 by ruccorai vrl y

rrnaller amounts unlil the erct ha! becn

fulty countebalrnced.

lf a rovenuo elgonditurc ie improprrty

capilali:ed, asset!. rclained earninS' and

incqno for lhc period will br overstaled.

lrsnc will bo underslated in subrcquent

periodr as the impropedy c.Fitalized ilerrt

b cfiarged to thr goratbns of thoc peri'

ods. Agsets and retained earnings will

cqrlinuc to be ov.rstatod in subscqucnt

bal ance sheots by succesri vel y smal l er

t5

arnounlr until thc improperty capilalized

ilom has bocn canplelely writlcn ofl.

Tho basic critrrkxt for classifying eutbys

er rovonu. or capital cxpondituros is the

prriod of brncfit. Thr amount ot detail

n.cossary lo mairnah subsUiary rccotds.

tfu rratcriality of lho ctgrnditurcs, and thc

canrirtrncy wilh which vari<rur crprndi'

turu roc'rrt ftun period lo pcriod arc dtlr

crileria generally eqrridered in ertablish'

h9 a capitalizatbn poli;Y.

Firmr lnqurntty ortablirh ctt stbiltary

rrnount bckrw wtrich all oxpendilurrts ate

oxpenscd, inespectivr ol their period ol

benefiL Thr level at which thb arnount b

rot b dctrmined by itr materiality h rrb'

tirr to the rizr of hr firm. The obirtivr o{

sucfi a policy is to avoid lho rxpcnso ol

mai ntai ni ng exccssi vcl y detai l ed sub'

rUiary rccordc. E:genditurer for iternt thal

tall belnw th. lot snlounl but a't tnatorbl

in thc aggregale shouH be cePitalized, il

tctal expenditures lor these items vary sig'

nificantly lrom period to period. A capilal'

i zati on pol i cy l hat roasonabl y appl i es

lhcsc criteria, although il disreganls the

pedod cl benefil and is thsrefore bcking in

thooretical

just if ication, will not sign il icantty

misstatr periodic incomo.

t 6

Chaotar 2

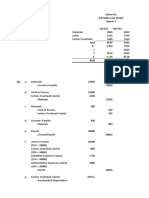

s16, 957, 500

17r458, 350

gERCISES

38

+ 33

= 39

Prime

cost

Sg

.31

= 94 variable

convet:ion

cost

S

* Si

. ir

= $io

variable

manufacturing

cost

ii,oob

fired + (Slo r 5oo)

= $6'0oo

E2-2

',({}

$1o

+ $15

+ 38

= $?1

convorcion

co'st

izi

$32

+ $t

o = $42 Primc

cost

i - i 332+i . i o* i r s i $3=$60v ar i ab| ec os t

i oi

(($sz

+

${o

+g{5 +

$6

+$5) x 12' ooo)

i

1ss

x 8,ooo)

=

$8{6' 000

+

$ 24' ooo.

=

$84O' OOO

t ot al cost i ncurred

wi t h 12' OOO

uni t s

Produced

and 8, OOO uni t s sol d

E2-3 First Method:

Sa|es(ti l g' 95o' ooox85o/o|...............x.........

Lcsr: variable costs

(irrrizr,o00 x 85chl"' $9'q1?'1?o

FiXgd COSTS...""tr"tt""t"t""t!t"t""tt"t'

7t623tOOO

E,.-l

(rl

l2l

(3)

(4)

E24

OperaUng

l oss.-...

Second Method:

l st St ap:

2nd Step:

Salgg

(tlt9r95orooo

I 857o)..' ........o"""""""

L.ass: variable costs

(sl6195715OO r .58).' ... s9r835' 350

Firgd costs .............,.............,.............

!1623

|AOO

OpgraUng

l oSs """"t""t"' o"""t' tor"""""""o"

$16, 957, 500

1714581350 -

s

(500,8501

-

1 . d

2 . b

3 . b

4 . 4

5 . t

g . c

7. c

8. I

s

(5OO,85O)

Variable costs sl 1, 57l , Ooo

= .59 vari abl e cost rati o

l 9A sal es s l 9, 95O, OOO

l_

I

!

I

I

L

I

L

!

I

!

I

b

:

l

b

1 7

Clppter2

E2i5

The cost of direct labor Par

computer

is sloo' ooo'

calculated

as follows:

'

-"t--l ' ri na aac:l ---- """' $6ootooo Gi vgn)

Total manufacturing

cost"""'o""""""""'

L,gsspri mocost.....r...............o.........""""

3OOtOOo

(gi Ven)

EquaI sovorheadGoSt . . . . . . . . . . . . . . . . . . . . t . . . . . . . . . $3oo' o09

COnVgfSiOn

COSt...............................""""

$4OOtOOO

(giVgn)

Less overtlgad

cost..,' ...................o.....""

3OOtooo

(calculated abovel

EqUatS difgCt 1abOf ,..,....-o........-...............

SIOOtOOO

E24 Ttre amount

of factory

overhead

lows:

cost

per bl ade i s 93O0,

cal cul ated as fol -

3l , OOO

( gi venf

4OO

(gi venl

Lee

Total manufacturing

cost' .' .""""t""""""

Lgss convgrsion

cost"""' o"""""""' o"""'

Equals dirgct matgrial cost.""""""""""'

Direst labor cost

= 116 of direet

material

cost

= 1t 6 x 3600

= $1OO

b

Convgrsi on

cost t t "t t t t "t """"t t t t "t t t t t "ot t ""

Lgss dirggt labor C(13t"""""""""r"o""""

Equatrsove.fieadcost..............................

E2-7 The direct labor cost

per system is S200'

Total manufagturing

costs """""""""""'

Lgss

pri me Cost """""t""t"t"tt""""tt""t'

Equals overfi

gad

GoSt """""""""""""""

ConYgrsion cost.........t"""' i"to"t"""t"t""

Lgss overhgad cost o'..""'r"'o'o"""""'o""'

Equals dirgct tabor cosl..' .......r...""""""

sitoo

cal cul ated

as fol l ows:

S1,00O

(gi venl

8oO

(givenl

s 200

gAoO

(given|

2OO

(calculated abovel

Szoo

s400

l oo

(givenl

(calculated above|

1

b

!

!

I

\,

I

t 8

Chaoter 2

Ez-g The ampunt of faetory oyerhead cost

per machino is $1'5OO' calculated \-

as follows:

Total manuf-acturing

c95t......,....r....' .......r

S3TOOO

(given) L

Lgss conversi on

cost..,.......r.......,.,..........

2,.OOO

(gi ven)

Equatsdi rcctmatgri al cost......-.-' .".........

SITOOO

Direst lalor Gost

= 112 oI direet material cost

= 112 r $l ' 0O0

=

95OO

Conversi on cost..

.... $2' OOO

(given)

Lgss dirgct labor cost..............................

5OO

(calculated above|

Equal sovgr hgadcoSt . . . . . . . . . i . . . . . . . r . . . . . . . . . . . .

Sl 15OO

E2-9

(1) The.rclevant cost obiects are:

(a) An item of mErchandise. t

(bl The use of a bank credit catd'

(21 lt implies that cash-paying customers are

paying a part of the cost of the

banks'fees for

processing credit card transactionsr bscause these fees

are paid by the merchant who then necover them in the form of slightly

hi gher pri ces for al l mel chandi se,

(3) The competitive implications ana that the

prices paid by cash customens

are too high to be competitive with the

prices chargad by merchants who

deal only in cash, and the

prices paid by customens using bank credit

cards arp too low to reflect all the costs of a credit sala.

(4)

The raason lor not reducing all prices and charging extra for the use of a

credit card is because of the psychological effect of an extra charge. To

customsrs, lt sounds like a penalty, as If the merchant wants to discour-

age the use of bank credit cards. A discount for cash customers has a

positive

connotation, even if

prices

marked on menchandise are higher to

v

begin with. Raising all

prices

and offering a cash discount

yields the

aame net rsvenue as leaving prices

alone and charging extra for using a

'

bank credlt card, but the former method feels better to the customer

-

than the latter.

t 9

2

s14

(3)

>

I

\-

l

t-

L

I

t

I

I

t

L-

I

I

bt

L

L

I

L

L

1

It

E2. -1O

,

(f

l

Thc rolovant cost obfecta arr:

(al A repalr.

(b) A

PlckuP

and daflvery

l1l

JTRSb rpalr

pricor Include an sllocaUon of thc cost of

picking up and

dallvering traAors, ln addlUon to thc cost of thc rtpainl' administraUvo

coata, markeUng costs, end profll CompeUtont

rcpair prices raflect only

tic cost of the llpalrs, adminlgtrstlve snd marko$ng costs' and

profit.

GompeUtort 8hould bc ablc to

prlcc thclr rcpalr rcrvlces lower, because

tSey do not have to reflect

plckup and dellvery costs in repair prices.

F2-11

Cluplx2

(11 Dl rect l ebor

Variable factory ove rh ead

Fi fed faCtOfy OVgfh

gad...............o......o....o.o..ro.........o............."r

Gonvemion cogt..

(21 Dlrect matoriaf

0umberf

Di r Ogt 1abOf . . . o. . r . . . o. . . . . . r . . r . . . . . . . r r r . r . . . . . . r . . o. . . . . . . . . o. o. . . . . ot . . . . . . . t . . t o. . t

Prime GOSI...............r..............

a a a a a o a a a t a a

a a a l a a a o a l a a

s

q

$ 1 1

sl 2

sl 2

2

5

sl e

sl 2

2

5

1

s20

I

b

I

I

lE

I

I

I

(4) Dlrect material

0

umberl ...'.........o'.......

Dlroct labor

Variablg factory ovgrfieSd .........o.........r.............' ..........oo.......' .

Variable markoting

Total variable cost.

I

\'

a a a t a a a a a a a

Chaoter 2

20

E2-11

(Goncluded)

(5) Total cost

=

(6)

rr)

total vari abl e manufacturi ng

cost

+total vari abl e marketi ng cost

+ total fixed cost

2, OOOr ( $12+32+$51

+ l r g OOr $ 1

+

2,OOO' x ($4

+

$3.50)

=

$38, OOo

+

$l ' 9Oo

+

${5' 0oo

=

55419OO

r

The volume used here to catculate

total fixed cost is the 2'OOo-unit vot-

ume levol that was used originally

to calculate the amounts of fixed

costs

per unit, as stated in the data

given in the exercise. The 2'OOO-

unit tevel of

production stated in requirement

(5) is not the reason that

2,OOO is used here to calculate total fixed cost'

The data i ndi cate the bookcases are made of l umber, and some exampl es

of the indirect materials used in making wooden bookcases would be

gl ue, sandpaperr and nai l s.

An estimate of costs referred to in the answer to requirement (6! would

be i nctuded i n the vari abl e factory overhead of 55

per uni t.

;

E2-12 Factory overhead = 113 x prime cost, so:

Total

manufacturing

cost

= prime cost + factory overhead

= pri me cost + (113 x

Pri me

cost)

= 4i:3 r prime cosl;

mufti pl yi ng both si des by 314 gi ves:

Total

314 x manufacturi ng = 314 x 413 x pri me

cost

cost

3l 4xS2O, OOO = 1 x pr i me cost

$15, OOO

= pr i me cost .

Pri me cost .....................

Less di rect materi al cost.......

Di roct l abor cost.......

s15, OOO

12, OOO (gi ven)

s 3,ooo

2l

(3)

(41

i

'

S

I

I

L

L

L

L

L

I

I

!

I

I

b

L

!

L

!

I

!

Ctuotar2

c2-1

(11

CASES

The

percentage

profit margin will be 82.5oh, calculated

as follows:

Rgvenugs

(92 r 4)..............,,o........................

Cost of

iuice

(S2o r 4| .....' ....""""t"' r"""""

t

Cost of ong de|ivery

"""""""""x""""""t""

Profi t ...............ro....,......................o.......r.......

Revenues

(S2 r 1!

Percentage

profit margin

=

36' 60

profit divided by SB revenue

= 8.2' 5oh'

(21 The

percentage profit margin will be 6ooh, calculated

as follows:

s.80

. 60

s.20

. 60

s!.o0

1 . 4 0

s6. 60

s2.o0

. 80

sl . 20

Cost of

iuice

(S.2o r 1) .....' ....-............' o""o"'

Gost of ono dgl i very ..' ...""' o""""o"""' o"""o'

PrOf i t . . o. . . . . . . . . . . . . . . . . "' o""' r""""""""""t "' e""'

Percentago

profit margin

= $1.2O

profit divided by s2 revenue

= 609/o'

The manager i s treati ng the menu i tem as the cost obi ect, for erampl e'

one

gl ass of orange

i ui ce.

The rpfinement of the definition of cost obiect that would result in the

ptanned profit margin is the use of two different

kinds of cost obiect'

the

Item and the deti vJry, whi ch can be

pri ced separatel y at S.8O and $2' 4O'

respectively.

I

z

Chaoter 2

C2-l

(Concluded)

(5) For an order

consisting of four

gtasses of orange iuice,

the

profit margin

will be 75e/ot calculated as follows:

Revenues:

($.8O X 4).........' ...

+

( 92. 4O X 1) . . t t " t t " " " " ' i " " " " t " t " " " t " " t " ' o" '

9.80

.60

9.20

. 60

s3.20

2. 40

$5.60

1. 40

9{.20

$ . 80

2. 40

$3.20

.80

Percentage

profit margin

=

90.2o

profit divided by $5.oo

nevenue

= 75oh.

For an order consi sti ng of one

gl ass of orange

i ui ce,

the

profi t margi n wi l l

af so be 75oh, cal cul ated as fol l ows:

Cost of

iuicg

($.2O I 4) ."""""""""""t""""'

Gost of ong dglivgry .........--....-..........o...o.r."'

Pr Of i t . . . t . . . . aaa. . . . . . a. . . . a. t ""t """"t "t """"t "o""t '

COSt Of

! ui ce

. . . . . . . . . . . . . . . . . . . . . . . . t . . . . . . . . . . . o. . " o" " t t '

Cost of ong delivery .............................o......'

RgVgnUgS:

( $. 8O X' l ) . . . . . . . . . . . . r . . . . . . . . . . . . r . o. . . . . . . . . . . . . . . . . . . . ot '

+

($2.4O X 1) ..............................................t..

(6)

PrOfi t ........o....t........

s2.40

Percentage profit margin =

$2.4O

profit divided by $3.2o nevenue

= 75oh.

The food seryice managerb

plan allocates the delivery costs over an

arbitrarily selected number of items

(two). This

plan would result in high-

or-than-planned

pnofit margin

pencentages on noom servico orders that

contain more than two items, as demonstrated in the answer to require-

ment (t). Prices on these olde6 would be higher than those of a Gom-

petitor

wlro traces costs mone carefully to cost obiects and sets

prices

sccordingty. The

plan would also result in lower-than-planned

profit mar-

gins

on room service orders containinE only one item, as demonstrated

in the answer to requirement (21. Prices on these orders would be lower

than what is needed to achieve the target

profitability.

23

I

L

l

t-

I

I

I

l-

l

b

I

!

L

L

I

L

t

L

I

E

l

b

L

I

l-

\,

I

b

Clppter2

c2-2,

(il The cost objects tor which somo amount of cost is identified in the case,

and tho amount of cost idenUlied lor each' ate:

(al A new product variation

r

Zsggo (which means all units of Zeggo ever

to be producodl' S25O'OOO.

(bl A batch of Zeggo' S1'OOO.

(cl A unlt of Zeggo, $5 + $1O

=

$15.

(Notlce the $1o indirect cost

amount Includes all Indireet production costsr so it must include the

,

$1 amount stated in the problem, along with an allocation or averag-

ing of the $1r0Oo-perbatch

setup costs, a shar of the S25O,OOO

cost amount, and a sharo of any other indirect manufacturing costs.

It would be double-counUng to add the $1 and arrive at a total of

$16

per uni l |

(21 The other items mentioned in the caso that could serve as cost obiects,

and a

purposo each one could sorvr ano:

(al

CCN Company, which is the relevant cost obiect when external

financial statements are prepared.

(bl The assembly line on which Zeggo and other

products are to be pro-

duced. This cost object would be relevant in a decision on whether

to discontinue

production

of all the

products produced on the par-

ticular line, or a decision to shut down the line and shift its produc-

tion to other lines due to a redustion in customer orders.

(31 The totat "o.t erpected to result from

producing the first batch of 3oo

unlts of Zeggo is:

Cost accounted for as direct cost of a unit....,.....

Cost treated as indirect by the CCN s1ctem........

uni ts

Add: setup cost

s1, 8OO

. . . r . . o. r . . . . . . . r . . t r . . . . . . . 1

t OOO

Tot al Co*. . . . . r. . . . . . . . r. . . . . . . . . . . . . . . . . . . r. . . . . . . . . o. . . . r. . . . . rr. rr. s2,8oo

The cost erpected to result from producing ono mone unit of Zeggo is 35

+ $ 1 = 3 6 .

For the first batch of 3OO units, the CCN cost accounting system will

report a cost of:

(35

di rect cost + $1o i ndi rect cost al l ocati on) x 3oO uni ts =

S15 r 3OO =

s4,5OO

$ 5

1

S o

x 3OO

I

(41

(5)

i

t-

I

v

I

L

L

I

L

i-

L

L

I

I

!

L

L

I

b

t

O3-l . The total dollar amount of a fixed cost is con-

stant at difrerent levels of acttvity within the rele-

vant range, but fi xed cosl per uni t ot acti vi ty

varies. In confasl the total amount of a variable

cost varies al differeil levels ol acwity, but the

variable cost pr unit remains consEnt wilhin lhe

rel evant range. A semi vari abl e cost contai ns

both frxed and variable elements. Consequently,

both total semi vari abl e cost and semi vari abl e

cost per unil vary with changes in activity.

Q3-2. The relevant range is the range of activity over

which a fixed cost remains constant in tolal or a

variable cost remains constant per unit of activi-

ty. The underlying assumptions about the rela-

tionship of the activity and lhe incunence ot cosl

change oul si de the rel evanl range of acti vi ty.

Consequently, the amount of fixed cost or the

variable cost rate musl be recomputed for aclivi-

ty above or below the relevant range.

O3-3. The fixed and variable componenls ol a semi-

variable cost should be segregated in order to

plan, analyze, control, measure. and evaluate

costs at difterent levels of actMty. Separation ol

the fixed and variable componenls of semivari-

able cost is necessary lo:

CHAPTER 3

DISCUSSION QUESTIONS

03.

semi vari abl e costs are: (1) the hi gh and l ow

points melhort: (2) lhe statistacal scanergraph

method; and (3) the method of least sguares.

The high and low points method has the advan-

lage ol being simple to compute, but it has the

disadvantage ol using only two data points in O|e

computation, thereby resulting in a signilicant

potential lor bias and inaccuracy in cosl esti-

mates. The scanergraph has the aclvantage ot

using all of the available data. but it has the dis-

advantage of determining the fixed and vanable

components on the basis of a line drawn by vGu.

al inspection tirough a plot ot the data, thereby

resul ti ng i n bi as and i naccuracy i n cost esl i -

mal es. The method of l easl squares has the

advant age ol accur at el y descr i bi ng a l i ne

through all the available data, thereby resulting

in unbiased estimates of the fixed and variable

elements ol cost. but il has the increased disad-

vantage of computational complexity.

The $2OO in.lhe equation, referred to as the y

inlercept, is an estimate ol the tixed

portion

of

indirect supplies cost. The $4 in the equation,

referrecl to as the slope of the regression equa-

tion, is an estimate ol the variable cost a:isociat-

ed with a unit change in machine hours. These

est i mat es may not be per l ect l y accur at e

because they were deri ved l rom a sampl e ol

data that may not be entirely representative of

the universe population, and because activities

not i ncl uded i n t he r egr essi on equat i on may

have some influence on the cost being predict-

ed.

The coeffi ci enl ol correl ati on, denoted r, i s a

measure of the extent to which two variables are

related linearly. lt is a measure of lhe covariation

of the dependent and i ndepenctent vari abl es.

and its sign indicates whether the independent

variable has a posilive or negative relaUorship to

the dependent variable. The coeffcient ot dster-

mination is the square of the coefficint of corre-

lation and is denoted F. fne coefficient of d6ter-

mination is a more easity interpretsd measure ot

the covariation than b the coefficient