Professional Documents

Culture Documents

Derivative Report 23 June 2014

Uploaded by

PalakMisharaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivative Report 23 June 2014

Uploaded by

PalakMisharaCopyright:

Available Formats

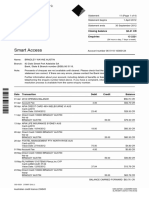

DAILY DERIVATIVE

REPORT

23

RD

JUNE 2014

NIFTY FUTURE WRAP

26

TH

JUNE2014

SYMBOL SUPPORT RESISTANCE PARTICULARS CMP PRE CLOSE %CHANGE

NIFTY

S1-7511 R1- 7575

NIFTY

SPOT

7511.45 7540.70 -0.39

S2-7450 R2-7620

NIFTY

FUTURES

7530.85 7560.10 -0.39

TREND STRATEGY

BULLISH BUY ON DIPS

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

7404 7472 7501 7540 7569 7608 7676

DAILY DERIVATIVE REPORT

BANK NIFTY FUTURE WRAP

26

TH

JUNE 2014

SYMBOL SUPPORT RESISTANCE PARTICULARS CMP PRE CLOSE %CHANGE

BANK NIFTY

S1-14945 R1-15385

BANK NIFTY

SPOT

14997.65 15067.40 -0.46

S2-14710 R2-15500

BANK NIFTY

FUTURES

15066.00 15111.85 -0.30

TREND STRATEGY

BULLISH BUY ON DIPS

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

14652 14880 14973 15108 15200 15335 15563

DAILY DERIVATIVE REPORT

FUTUREs FRONT

Long Build Up (Fresh Longs) Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

AXISBANK 23,078.00 25,786.00 11.7 1,872.10 1.4

JISLJALEQS 4,492.00 4,633.00 3.1 115.95 2.5

BAJAJ-AUTO 6,880.00 7,087.00 3.0 2,180.65 0.6

PETRONET 1,937.00 1,990.00 2.7 167.95 3.3

Short-Covering Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

BATAINDIA 1,968.00 1,845.00 [6.3] 1,198.95 1.7

SUNTV 1,360.00 1,289.00 [5.2] 431.50 2.5

ZEEL 7,108.00 6,835.00 [3.8] 282.25 1.6

MCDOWELL-N 15,003.00 14,447.00 [3.7] 2,580.00 3.0

Short Build Up Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

BPCL 6,507.00 7,745.00 19.0 552.70 [2.5]

JPASSOCIAT 13,439.00 14,877.00 10.7 71.90 [1.6]

HEROMOTOCO 8,911.00 9,810.00 10.1 2,531.00 [0.8]

SRTRANSFIN 2,115.00 2,290.00 8.3 859.50 [2.0]

Long Unwinding Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

APOLLOTYRE 4,413.00 4,203.00 [4.8] 193.70 [0.2]

NMDC 13,607.00 13,247.00 [2.7] 174.30 [1.7]

ACC 5,015.00 4,984.00 [0.6] 1,441.10 [1.2]

L&TFH 10,283.00 10,232.00 [0.5] 71.70 [0.3]

DAILY DERIVATIVE REPORT

Top Gainers: Future Contract

Type Underlying Exp. Date Last Price Chg (%) OI ('000s)

FUTSTK UNITECH 26-Jun-14 33.65 7.5 149,232.00

FUTSTK UNITECH 31-Jul-14 33.80 7.3 7,514.00

FUTSTK IFCI 28-Aug-14 40.55 6.4 171.00

FUTSTK TITAN 28-Aug-14 337.40 5.8 16.00

Top Losers: Future Contract

Type Underlying Exp. Date Last Price Chg (%) OI ('000s)

FUTSTK CROMPGREAV 28-Aug-14 192.45 [9.2] 2.00

FUTSTK IOC 28-Aug-14 320.00 [8.9] 10.00

FUTSTK SAIL 28-Aug-14 94.90 [6.1] 40.00

FUTSTK UBL 31-Jul-14 691.05 [4.8] 60.75

FII Trends In Future

Script

BUY

[RS.CR]

SELL

[RS.CR]

NET POSITIONS

[RS.CR]

CONTRACTS

['000S]

VALUE

[RS.CR]

INDEX FUTURES

67,932 62,203 216.13 354.092 13,417

STOCK FUTURES

105,262 97,309 308.03 1,530.606 55,404

DAILY DERIVATIVE REPORT

OPTIONs FRONT

Top Gainers: Options

Inst

Type

Underlying

Expiry

Date

Last

Price[Rs.]

Strike

Price[Rs.]

OPT Type

OPTSTK JPASSOCIAT 26-Jun-14 0.50 50.00 PE

OPTSTK RPOWER 26-Jun-14 0.45 82.50 PE

OPTSTK HCLTECH 26-Jun-14 0.50 1,250.00 PE

OPTSTK AMBUJACEM 26-Jun-14 1.30 265.00 CE

Top Looser: Options

Inst

Type

Underlying

Expiry

Date

Last

Price[Rs.]

Strike

Price[Rs.]

OPT Type

OPTSTK CENTURYTEX 26-Jun-14 0.05 450.00 PE

OPTSTK UNIONBANK 26-Jun-14 0.05 257.50 CE

OPTSTK HAVELLS 26-Jun-14 0.10 1,220.00 CE

OPTSTK BANKBARODA 26-Jun-14 0.10 1,020.00 CE

FII Trends In Options

Script

BUY

[RS.CR]

SELL

[RS.CR]

NET POSITIONS

[RS.CR]

CONTRACTS

['000S]

VALUE

[RS.CR]

INDEX OPTIONS

556,829 560,402 [150.92] 1,762.192 66,618

STOCK OPTIONS

96,191 96,781 [19.81] 118.572 4,439

DAILY DERIVATIVE REPORT

PUT CALL RATIO: STOCK OPTION (OI WISE)

PUT CALL RATIO: STOCK OPTION (OPEN INTEREST WISE)

SCRIPT PUT CALL RATIO

MCLEODRUSS 516,000.00 316,000.00 1.63

AUROPHARMA 913,500.00 861,500.00 1.06

TCS 562,125.00 550,500.00 1.02

MARUTI 250,000.00 258,250.00 0.97

PUT CALL RATIO: STOCK OPTION (VOLUME WISE)

SCRIPT PUT CALL RATIO

JUBLFOOD 750.00 250.00 3.00

JUSTDIAL 9,125.00 8,750.00 1.04

INDUSINDBK 67,000.00 64,500.00 1.04

ASIANPAINT 183,000.00 180,000.00 1.02

PUT CALL RATIO: INDEX FUTURES (OPEN INTEREST WISE)

SCRIPT PUT CALL RATIO

BANKNIFTY 2,177,950.00 2,375,875.00 0.92

NIFTY 42,056,600.00 46,931,250.00 0.90

- - - -

PUT CALL RATIO: INDEX FUTURES (VOLUME WISE)

SCRIPT PUT CALL RATIO

NIFTY 81,797,300.00 93,475,700.00 0.88

BANKNIFTY 2,918,950.00 3,571,275.00 0.82

- - - -

DAILY DERIVATIVE REPORT

The information and views in this report, our website & all the service we provide are believed to

be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion.

Users have the right to choose the product/s that suits them the most.

Use of this report in no way constitutes a client/advisor relationship, all information we

communicate to you (the subscriber) either through our Web site or other forms of

communications, are purely for informational purposes only.

We recommend seeking individual investment advice before making any investment, for you are

assuming sole liability for your investments. Capital Stars will in no way have discretionary

authority over your trading or investment accounts.

All rights reserved.

OFFICE: - +91 731 4757600

MOB: +91 92000 99927

PHONE: +91 731 6790000

Email: info@capitalstars.com

CAPITAL STARS FINANCIAL

RESEARCH PRIVATE LIMITED

PLOT NO. 12, SCHEME NO. 78, PART II

VIJAYNAGAR INDORE 452001 (MP)

DAILY DERIVATIVE REPORT

CONTACT US

DISCLAIMER

You might also like

- Derivative Report 25 June 2014Document8 pagesDerivative Report 25 June 2014PalakMisharaNo ratings yet

- Derivative Report 17 June 2014Document8 pagesDerivative Report 17 June 2014PalakMisharaNo ratings yet

- Derivative Report 30 MAY 2014Document8 pagesDerivative Report 30 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 24 June 2014Document8 pagesDerivative Report 24 June 2014PalakMisharaNo ratings yet

- Derivative Report 18 June 2014Document8 pagesDerivative Report 18 June 2014PalakMisharaNo ratings yet

- Derivative Report 15 July 2014Document8 pagesDerivative Report 15 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 07 July 2014Document8 pagesDerivative Report 07 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 09 July 2014Document8 pagesDerivative Report 09 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 23 MAY 2014Document8 pagesDerivative Report 23 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 21 July 2014Document8 pagesDerivative Report 21 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 28 MAY 2014Document8 pagesDerivative Report 28 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 27 June 2014Document8 pagesDerivative Report 27 June 2014PalakMisharaNo ratings yet

- Derivative Report 22 MAY 2014Document8 pagesDerivative Report 22 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 14 August 2014Document8 pagesDerivative Report 14 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 16 July 2014Document8 pagesDerivative Report 16 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 21 August 2014Document8 pagesDerivative Report 21 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 25 August 2014Document8 pagesDerivative Report 25 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 01 July 2014Document8 pagesDerivative Report 01 July 2014PalakMisharaNo ratings yet

- Derivative Report 22 August 2014Document8 pagesDerivative Report 22 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 27 MAY 2014Document8 pagesDerivative Report 27 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 28 August 2014Document8 pagesDerivative Report 28 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 10 July 2014Document8 pagesDerivative Report 10 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 19 August 2014Document8 pagesDerivative Report 19 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 07 August 2014Document8 pagesDerivative Report 07 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 30 July 2014Document8 pagesDerivative Report 30 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 06 August 2014Document8 pagesDerivative Report 06 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 31 July 2014Document8 pagesDerivative Report 31 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 04 August 2014Document8 pagesDerivative Report 04 August 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 01 August 2014Document8 pagesDerivative Report 01 August 2014Stock Tips provider in IndiaNo ratings yet

- Daily Derivative 23 September 2013Document10 pagesDaily Derivative 23 September 2013hemanggorNo ratings yet

- Daily Derivative Report 30.09.13Document3 pagesDaily Derivative Report 30.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Derivative Report 19.09.13Document3 pagesDaily Derivative Report 19.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Derivative Report 11.09.13Document3 pagesDaily Derivative Report 11.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Trade Journal - 04.10.2013Document6 pagesDaily Trade Journal - 04.10.2013Randora LkNo ratings yet

- Daily Equity Report 6 February 2015Document4 pagesDaily Equity Report 6 February 2015NehaSharmaNo ratings yet

- Derivative Report 30 April 2014Document8 pagesDerivative Report 30 April 2014PalakMisharaNo ratings yet

- Daily Trade Journal - 30.01.2014Document6 pagesDaily Trade Journal - 30.01.2014Randora LkNo ratings yet

- Daily Equity Newsletter by Market Magnify 07-03-2012Document7 pagesDaily Equity Newsletter by Market Magnify 07-03-2012IntradayTips ProviderNo ratings yet

- Daily Derivatives: September 9, 2015Document3 pagesDaily Derivatives: September 9, 2015choni singhNo ratings yet

- WealthRays - Markets at Sep 26 2013Document3 pagesWealthRays - Markets at Sep 26 2013contact7925No ratings yet

- Special Report by Epic Reseach 08 August 2013Document4 pagesSpecial Report by Epic Reseach 08 August 2013EpicresearchNo ratings yet

- Rinci: NO Kode Pelanggan Nama Pelanggan Kode BarangDocument8 pagesRinci: NO Kode Pelanggan Nama Pelanggan Kode BarangYudhi ChandraNo ratings yet

- Daily Option News Letter: 25/june/2014Document7 pagesDaily Option News Letter: 25/june/2014api-256777091No ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091No ratings yet

- Pre - Market ActionDocument24 pagesPre - Market ActionVivaan AgarwalNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091No ratings yet

- Equity Analysis Equity Analysis - Weekl WeeklyDocument8 pagesEquity Analysis Equity Analysis - Weekl WeeklyTheequicom AdvisoryNo ratings yet

- Stock Option Analysis by Theequicom For 4 June 2014Document7 pagesStock Option Analysis by Theequicom For 4 June 2014tinaroy7119No ratings yet

- Daily Equity Newsleter 29/OCT./2014Document8 pagesDaily Equity Newsleter 29/OCT./2014api-234732356No ratings yet

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Document7 pagesStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Riya VermaNo ratings yet

- Capvision Daily Report 30-05-2014Document7 pagesCapvision Daily Report 30-05-2014NehaThakurNo ratings yet

- Equity Analysis - DailyDocument7 pagesEquity Analysis - Dailyapi-198466611No ratings yet

- Equity Analysis - DailyDocument7 pagesEquity Analysis - Dailyapi-198466611No ratings yet

- Stock Market Prediction For 22 MayDocument7 pagesStock Market Prediction For 22 MayTheequicom AdvisoryNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091No ratings yet

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Document11 pagesWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalNo ratings yet

- Daily Derivatives Snapshot: Nifty Futures, Options OI & Pivot PointsDocument3 pagesDaily Derivatives Snapshot: Nifty Futures, Options OI & Pivot Pointschoni singhNo ratings yet

- Kase on Technical Analysis Workbook: Trading and ForecastingFrom EverandKase on Technical Analysis Workbook: Trading and ForecastingNo ratings yet

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 04 July 2014Document8 pagesDerivative Report 04 July 2014PalakMisharaNo ratings yet

- Derivative Report 01 July 2014Document8 pagesDerivative Report 01 July 2014PalakMisharaNo ratings yet

- Derivative Report 20 June 2014Document8 pagesDerivative Report 20 June 2014PalakMisharaNo ratings yet

- Derivative Report 27 June 2014Document8 pagesDerivative Report 27 June 2014PalakMisharaNo ratings yet

- Derivative Report 30 June 2014Document8 pagesDerivative Report 30 June 2014PalakMisharaNo ratings yet

- Derivative Report16 June 2014Document8 pagesDerivative Report16 June 2014PalakMisharaNo ratings yet

- Derivative Report12 June 2014Document8 pagesDerivative Report12 June 2014PalakMisharaNo ratings yet

- Derivative Report13 June 2014Document8 pagesDerivative Report13 June 2014PalakMisharaNo ratings yet

- Derivative Report 3rd June 2014Document8 pagesDerivative Report 3rd June 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 28 MAY 2014Document8 pagesDerivative Report 28 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 23 MAY 2014Document8 pagesDerivative Report 23 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 26 MAY 2014Document8 pagesDerivative Report 26 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 27 MAY 2014Document8 pagesDerivative Report 27 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 22 MAY 2014Document8 pagesDerivative Report 22 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Special Research Report On NickelDocument8 pagesSpecial Research Report On NickelPalakMisharaNo ratings yet

- Derivative Report 02 MAY 2014Document8 pagesDerivative Report 02 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 30 April 2014Document8 pagesDerivative Report 30 April 2014PalakMisharaNo ratings yet

- Agri Weekly Report 21st AprilDocument9 pagesAgri Weekly Report 21st AprilPalakMisharaNo ratings yet

- Introduction and Company Profile: Retail in IndiaDocument60 pagesIntroduction and Company Profile: Retail in IndiaAbhinav Bansal0% (1)

- Chapter 5 Internal Enviroment Analysis PDFDocument31 pagesChapter 5 Internal Enviroment Analysis PDFsithandokuhleNo ratings yet

- Ambiente Marketing Plan Mid-Term FinalDocument10 pagesAmbiente Marketing Plan Mid-Term Finalapi-550044935No ratings yet

- 07 Cafmst14 - CH - 05Document52 pages07 Cafmst14 - CH - 05Mahabub AlamNo ratings yet

- Volume Spread Analysis Improved With Wyckoff 2Document3 pagesVolume Spread Analysis Improved With Wyckoff 2ngocleasing86% (7)

- Cannibalization: This Module Covers The Concepts of Cannibalization and Fair Share DrawDocument12 pagesCannibalization: This Module Covers The Concepts of Cannibalization and Fair Share DrawVishal GargNo ratings yet

- Green Resorts Promote SustainabilityDocument2 pagesGreen Resorts Promote SustainabilitySheryl ShekinahNo ratings yet

- Mobile AccessoriesDocument27 pagesMobile AccessoriesDiya BoppandaNo ratings yet

- Scope Statement: Project Name Date Project Number Project ManagerDocument3 pagesScope Statement: Project Name Date Project Number Project ManagerKamal BhatiaNo ratings yet

- Staff WelfareDocument2 pagesStaff Welfaremalikiamcdonald23No ratings yet

- Air France Case StudyDocument7 pagesAir France Case StudyKrishnaprasad ChenniyangirinathanNo ratings yet

- EF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Document44 pagesEF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Sikha SharmaNo ratings yet

- Marketing Plan Termite CompanyDocument15 pagesMarketing Plan Termite CompanyJessey RiveraNo ratings yet

- 2022 Logistics 05 Chap 08 PlanningRes CapaMgmt Part 1Document37 pages2022 Logistics 05 Chap 08 PlanningRes CapaMgmt Part 1Chíi KiệttNo ratings yet

- Bank Statement SummaryDocument4 pagesBank Statement SummaryMr SimpleNo ratings yet

- Department of Labor: DekalbDocument58 pagesDepartment of Labor: DekalbUSA_DepartmentOfLabor50% (2)

- Dan Loeb Sony LetterDocument4 pagesDan Loeb Sony LetterZerohedge100% (1)

- 22 Immutable Laws of Marketing SummaryDocument2 pages22 Immutable Laws of Marketing SummaryWahid T. YahyahNo ratings yet

- Oswal Woolen MillsDocument76 pagesOswal Woolen MillsMohit kolliNo ratings yet

- TD Sequential Best PDFDocument23 pagesTD Sequential Best PDFancutzica2000100% (4)

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Document10 pagesCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashNo ratings yet

- Advertising Effectiveness of Coca ColaDocument28 pagesAdvertising Effectiveness of Coca Colar01852009paNo ratings yet

- Chapter 7Document42 pagesChapter 7Apef Yok100% (1)

- Module 11 Applied Economic Quarter 2 Week 15 16Document11 pagesModule 11 Applied Economic Quarter 2 Week 15 16nikkaella RiveraNo ratings yet

- Furniture Industry in IndiaDocument38 pagesFurniture Industry in IndiaCristiano Ronaldo100% (1)

- M1 C2 Case Study WorkbookDocument25 pagesM1 C2 Case Study WorkbookfenixaNo ratings yet

- What Dubai Silicon Oasis DSO Free Zone OffersDocument3 pagesWhat Dubai Silicon Oasis DSO Free Zone OffersKommu RohithNo ratings yet

- Nepal Telecom's recruitment exam questionsDocument16 pagesNepal Telecom's recruitment exam questionsIvan ClarkNo ratings yet

- FinanceanswersDocument24 pagesFinanceanswersAditi ToshniwalNo ratings yet

- Alibaba VsDocument16 pagesAlibaba VsAlejandro EspinozaNo ratings yet