Professional Documents

Culture Documents

Holly Manufacturing Case Study ABC Costing

Uploaded by

kgalmai86Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Holly Manufacturing Case Study ABC Costing

Uploaded by

kgalmai86Copyright:

Available Formats

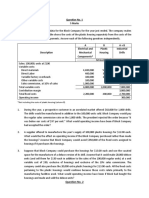

Holly Manufacturing Case

Holly Manufacturing Company produces two cello models. One is a standard acoustic cello that sells for $600 and is constructed

from medium-grade materials. The other model is a custom-made amplified cello with pearl inlays and a body constructed from special woods.

The custom cello sells for $900. Both cellos require 10 hours of direct labor to produce, but the custom cello is manufactured by more

experienced workers who are paid at a higher rate.

Most of Hollys sales come from the standard cello, but sales of the custom model have been growing. Following is the companys sales,

production, and cost information for last year:

Cello Standard Custom

Sales and production volume in units 900 100

Unit Selling Price $600.00 $900.00

Unit costs:

Direct materials $150.00 $375.00

Direct labor $180.00 $240.00

Manufacturing overhead* $135.00 $135.00

Total unit costs $465.00 $750.00

Unit Gross Profit $135.00 $150.00

Direct Labor Hours 10.00 10.00

Direct Labor Rate Per Hour $18.00 $24.00

*Manufacturing overhead costs:

Building depreciation $40,000

Maintenance 15,000.00

Purchasing 20,000.00

Inspection 12,000.00

Indirect materials 15,000.00

Supervision 30,000.00

Supplies 3,000.00

Total manufacturing overhead costs $135,000.00

These manufacturing overhead costs are fixed in nature: they do not vary with the volume of manufacturing activity.

The company allocates overhead costs using the traditional method. Its activity base is direct labor hours. The predetermined overhead rate,

based on 10,000 direct labor hours, is $13.50 ($135,000 10,000 direct labor hours).

Johann Brahms, president of Holly, is concerned that the traditional cost-allocation system the company is using may not be generating accurate

information and that the selling price of the custom cello may not be covering its true cost.

Questions To Be Answered

A. The cost-allocation system Holly has been using allocates 90% of overhead costs to the

standard cello because 90% of direct labor hours were spent on the standard model.

How much overhead was allocated to each of the two models last year?

Standard

Sales and production volume in

units

90%

Total manufacturing overhead

costs

135,000.00 $

Total overhead each model

121,500.00 $

Discuss why this might not be an accurate way to assign overhead costs to products.

B. How would the use of more than one cost pool improve Holly's cost allocation?

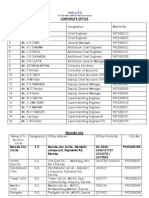

C. Holly's controller developed the following data for use in activity-based costing:

Manufacturing Standard

Overhead Cost Amount Cost Driver Cello

Building depreciation $40,000 Square footage 3,000

Maintenance $15,000 Direct labor hours 9,000

Purchasing $20,000 # of purchase orders 1,500

Inspection $12,000 # of inspections 400

Indirect materials $15,000 # of units manufactured 900

Supervision $30,000 # of inspections 400

Supplies $3,000 # of units manufactured 900

Total $135,000

Because by using the traditional method above, overhead rates are counted based on total manufacturing

can be easily manipulated by changing the production volume.

In fact, the major influence that differentiate between standard and custom cello is

method.

It will provide more accurate product costs by using more than one cost pool because

this case, the overhead costs should include direct materials and direct labor.

D. Use activity-based costing to allocate the costs of overhead per unit and in total to each model of cello.

Manufacturing

Overhead Cost Volume Amount

Cost Driver

Building depreciation 4,000 40,000 $ Square footage

Maintenance 10,000 15,000 $ Direct labor hours

Purchasing 2,000 20,000 $

# of purchase

orders

Inspection 1,000 12,000 $ # of inspections

Indirect materials 1,000 15,000 $

# of units

manufactured

Supervision 1,000 30,000 $ # of inspections

Supplies 1,000 3,000 $

# of units

manufactured

Total 20,000 135,000 $

E. Calculate the cost of a custom cello using activity-based costing.

Direct material $375.00

Direct labor $240.00

Overhead cost

for custom cello 435 $

Total

manufacturing

cost for custom

cello $1,050.00

F. Why is the cost different from the cost calculated using the traditional allocation method?

Compare the unit selling

price before and after using

activity-based method:

standard

Unit Selling Price 600.00 $

Traditional Method

The cost is different because the traditional method generalize the manufacturing overhead costs which in fact is different for each type

G. At the current selling price, is the company covering its true cost of production? Briefly discuss

H. What should Holly Manufacturing do about the situation?

I. What should Holly Manufacturing do if the quantity of custom cellos sold at the new price falls to 50 per year?

J. What should Holly Manufacturing do about the situation if the price of the custom cello cannot exceed $900?

K. At a selling price of $1,000 each, what is the breakeven unit volume for the custom cello?

L. What are the lessons learned from this case?

No, it's not. The company LOSES money with amount of $150.00 by selling the custom cello by $900.00.

Increase the price of custom cello by at least $1,050.00

Holly Manufacturing Company produces two cello models. One is a standard acoustic cello that sells for $600 and is constructed

from medium-grade materials. The other model is a custom-made amplified cello with pearl inlays and a body constructed from special woods.

The custom cello sells for $900. Both cellos require 10 hours of direct labor to produce, but the custom cello is manufactured by more

Most of Hollys sales come from the standard cello, but sales of the custom model have been growing. Following is the companys sales,

431.67 $ 1,050.00 $

$168.33 -$150.00

These manufacturing overhead costs are fixed in nature: they do not vary with the volume of manufacturing activity.

The company allocates overhead costs using the traditional method. Its activity base is direct labor hours. The predetermined overhead rate,

based on 10,000 direct labor hours, is $13.50 ($135,000 10,000 direct labor hours).

Johann Brahms, president of Holly, is concerned that the traditional cost-allocation system the company is using may not be generating accurate

information and that the selling price of the custom cello may not be covering its true cost.

A. The cost-allocation system Holly has been using allocates 90% of overhead costs to the

standard cello because 90% of direct labor hours were spent on the standard model.

Custom

10%

135,000.00 $

13,500.00 $

Discuss why this might not be an accurate way to assign overhead costs to products.

B. How would the use of more than one cost pool improve Holly's cost allocation?

C. Holly's controller developed the following data for use in activity-based costing:

Custom

Cello

1,000

1,000

500

600

100

600

100

Because by using the traditional method above, overhead rates are counted based on total manufacturing overhead cost (that fixed for both standard and custom cello) and

In fact, the major influence that differentiate between standard and custom cello is located on the direct material and direct labor. These factors are discounted on this

will provide more accurate product costs by using more than one cost pool because both of activities related to and not related to production volume can be measured. In

D. Use activity-based costing to allocate the costs of overhead per unit and in total to each model of cello.

Standard Custom

Cello Cello Standard Custom

3,000 1,000 10 $ 30,000 $ 10,000 $

9,000 1,000 2 $ 13,500 $ 1,500 $

1,500 500 10 $ 15,000 $ 5,000 $

400 600 12 $ 4,800 $ 7,200 $

900 100 15 $ 13,500 $ 1,500 $

400 600 30 $ 12,000 $ 18,000 $

900 100 3 $ 2,700 $ 300 $

Total Overhead

Cost 91,500 $ 43,500 $

Overhead Cost

per Cello 101.67 $ 435 $

F. Why is the cost different from the cost calculated using the traditional allocation method?

custom standard custom

900.00 $ 431.67 $ 1,050.00 $

Difference 168.33 $ (150.00) $

Unit cost/ cost

driver

Cost Assigned

Traditional Method ABC Method

the traditional method generalize the manufacturing overhead costs which in fact is different for each type of cello.

G. At the current selling price, is the company covering its true cost of production? Briefly discuss

I. What should Holly Manufacturing do if the quantity of custom cellos sold at the new price falls to 50 per year?

J. What should Holly Manufacturing do about the situation if the price of the custom cello cannot exceed $900?

K. At a selling price of $1,000 each, what is the breakeven unit volume for the custom cello?

LOSES money with amount of $150.00 by selling the custom cello by $900.00.

You might also like

- Chapter 8: Standard Cost Accounting - Materials, Labor, and Factory OverheadDocument67 pagesChapter 8: Standard Cost Accounting - Materials, Labor, and Factory OverheadSaeym SegoviaNo ratings yet

- Bài kiểm tra KTQTDocument10 pagesBài kiểm tra KTQTDUYÊN LÊ NGUYỄN MỸNo ratings yet

- Variance AnalysisDocument21 pagesVariance Analysismark anthony espiritu0% (1)

- Chapter 1 - Sheet1Document6 pagesChapter 1 - Sheet1ywcqbtdgyqNo ratings yet

- D. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionDocument4 pagesD. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionGuinevereNo ratings yet

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- A. $800,000 B. $600,000 C. $440,000 D. $200,000Document15 pagesA. $800,000 B. $600,000 C. $440,000 D. $200,000sino akoNo ratings yet

- Exercises On Chapter 12 PDFDocument4 pagesExercises On Chapter 12 PDFXiaj AuNo ratings yet

- Questions - Chapter 9Document5 pagesQuestions - Chapter 9sajedulNo ratings yet

- Cima Standard Costing and Variance Analysis Session 1 QuestionsDocument13 pagesCima Standard Costing and Variance Analysis Session 1 QuestionsKiri chrisNo ratings yet

- Standard Costing and Variance AnalysisDocument14 pagesStandard Costing and Variance AnalysisSaad Khan YTNo ratings yet

- P8-2A Bolus Computer Parts Inc. Cost Analysis and PricingDocument3 pagesP8-2A Bolus Computer Parts Inc. Cost Analysis and PricingkskimblerNo ratings yet

- ABC Analysis Reveals More Profitable ProductDocument4 pagesABC Analysis Reveals More Profitable ProductCristiano Jr.No ratings yet

- Budgeting QuizDocument3 pagesBudgeting QuizMay Grethel Joy PeranteNo ratings yet

- Variable Cost Analysis Using High-Low MethodDocument6 pagesVariable Cost Analysis Using High-Low MethodApoorva DhimarNo ratings yet

- Kasus Beauvellie Furniture-SendDocument5 pagesKasus Beauvellie Furniture-Send06. Ni Komang Ayu Trisia Dewi0% (1)

- ACTG 360 Midterm Exam ReviewDocument3 pagesACTG 360 Midterm Exam ReviewSubha ManNo ratings yet

- Cost AacctDocument19 pagesCost AacctKiraYamatoNo ratings yet

- 2988Document3 pages2988Alexis AlipudoNo ratings yet

- Accounting Homework Chapter 5Document3 pagesAccounting Homework Chapter 5Kimberly Garmon100% (2)

- Short Decision MakingDocument9 pagesShort Decision MakingJomar TeofiloNo ratings yet

- Practice Questions On Direct and Indirect Cost VariancesDocument8 pagesPractice Questions On Direct and Indirect Cost VariancesAishwarya RaoNo ratings yet

- Budgets For Control, Part 2Document29 pagesBudgets For Control, Part 2vukicevic.ivan5No ratings yet

- CH14 ABC systems 練習題Document3 pagesCH14 ABC systems 練習題sslbsNo ratings yet

- Problem 1Document5 pagesProblem 1Cường Trần MinhNo ratings yet

- Calculation of The Main Cost VariancesDocument5 pagesCalculation of The Main Cost Variancesphuc waytoodankNo ratings yet

- Miranda, Sweet (FactoryOverhead)Document5 pagesMiranda, Sweet (FactoryOverhead)Sweet Jenesie MirandaNo ratings yet

- AML-Excercise Week 1 & 2 (Reviandi Ramadhan)Document26 pagesAML-Excercise Week 1 & 2 (Reviandi Ramadhan)reviandiramadhanNo ratings yet

- Cost Accounting 6Document5 pagesCost Accounting 6Frenz VerdidaNo ratings yet

- Relevant CostingDocument7 pagesRelevant CostingVassy EsperatNo ratings yet

- Analyze variances in material, labor, and production for a manufacturing companyDocument4 pagesAnalyze variances in material, labor, and production for a manufacturing companyteddyNo ratings yet

- Quiz-No 5Document5 pagesQuiz-No 5El AnonNo ratings yet

- Managerial Accounting 5th Edition Jiambalvo Solutions Manual 1Document36 pagesManagerial Accounting 5th Edition Jiambalvo Solutions Manual 1crystalhensonfxjemnbkwg100% (23)

- M11 CHP 10 1 Standard Costs 2011 0524Document58 pagesM11 CHP 10 1 Standard Costs 2011 0524Rose Ann De Guzman67% (3)

- WK4 Written Assignment MADocument4 pagesWK4 Written Assignment MAsamuel olusholaNo ratings yet

- Quiz 2Document4 pagesQuiz 2Bảo QuỳnhNo ratings yet

- Variable and Absorption CostingDocument13 pagesVariable and Absorption CostingJerome LauderbaughNo ratings yet

- Comprehensive Case 2 Chapters 5-10Document10 pagesComprehensive Case 2 Chapters 5-10Ato SumartoNo ratings yet

- BDocument3 pagesBAmit KumarNo ratings yet

- Managerial Accounting Homework on Costing MethodsDocument5 pagesManagerial Accounting Homework on Costing MethodsOvidiaNo ratings yet

- Direct Costing and Absorption Costing QuestionsDocument1 pageDirect Costing and Absorption Costing QuestionsALLIA LOPEZNo ratings yet

- Item To Classify Standard Actual Type of VarianceDocument7 pagesItem To Classify Standard Actual Type of Variancedavid johnsonNo ratings yet

- BACOSTMX Module 8 Self-ReviewerDocument10 pagesBACOSTMX Module 8 Self-ReviewerAlyssa CaddawanNo ratings yet

- Bài tập nhóm số 6 - nhóm 4Document11 pagesBài tập nhóm số 6 - nhóm 4Lúa PhạmNo ratings yet

- Exercise 7 Estimation of Raw Materials and Cost RequirementsDocument6 pagesExercise 7 Estimation of Raw Materials and Cost RequirementsPhilip ArpiaNo ratings yet

- Standard Costing Quiz PrintingDocument9 pagesStandard Costing Quiz PrintingLovErsMaeBasergoNo ratings yet

- Bcom MADocument21 pagesBcom MAAbl SasankNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingTaha JavaidNo ratings yet

- ABC SystemDocument11 pagesABC SystemSyarifatuz Zuhriyah UmarNo ratings yet

- Latihan Target CostingDocument7 pagesLatihan Target CostingAlvira FajriNo ratings yet

- Cost Behavior Analysis & Variable Costing FormulasDocument7 pagesCost Behavior Analysis & Variable Costing FormulasNaba ZehraNo ratings yet

- Unit Costs Under Traditional Costing MethodDocument2 pagesUnit Costs Under Traditional Costing MethodMary67% (3)

- BA 115 Module 2A Problem SetsDocument15 pagesBA 115 Module 2A Problem SetsPaul Rainer De VillaNo ratings yet

- ABC-sample ProblemDocument5 pagesABC-sample ProblemLee Jap OyNo ratings yet

- Example-2 With SolutionDocument4 pagesExample-2 With SolutionDeepNo ratings yet

- ExerDocument4 pagesExerdianne ballonNo ratings yet

- Managerial Accounting Exercises Chapter 12Document6 pagesManagerial Accounting Exercises Chapter 12Angelica Lorenz100% (1)

- Solutions-Chapter 6Document4 pagesSolutions-Chapter 6Saurabh SinghNo ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Contact UsDocument12 pagesContact UsShital KiranNo ratings yet

- Negative Impact of Technology Transfer On Host CountryDocument3 pagesNegative Impact of Technology Transfer On Host CountryQuynh Huong Tran100% (3)

- 01-Cys Hospital Floor Plan - Mep - Propose-191118 PDFDocument12 pages01-Cys Hospital Floor Plan - Mep - Propose-191118 PDFSonghengNo ratings yet

- A.T. Kearney ATK Casebook consulting case interview book科尔尼咨询案例面试Document25 pagesA.T. Kearney ATK Casebook consulting case interview book科尔尼咨询案例面试issac li100% (1)

- Philippine Business Course SyllabusDocument11 pagesPhilippine Business Course SyllabusJerrick Ivan YuNo ratings yet

- Financial Analysis ProjectionsDocument6 pagesFinancial Analysis ProjectionsAshish AgarwalNo ratings yet

- Income Tax Procedure PracticeU 12345 RB PDFDocument41 pagesIncome Tax Procedure PracticeU 12345 RB PDFBrindha BabuNo ratings yet

- Saxo Outrageous PredictionsDocument26 pagesSaxo Outrageous PredictionsZerohedge75% (4)

- Trading Journal - CC 0.01BTC To 0.1BTC Challange IgorDocument70 pagesTrading Journal - CC 0.01BTC To 0.1BTC Challange IgorCryptoFlitsNo ratings yet

- Key Contacts JharkhandDocument4 pagesKey Contacts JharkhandNataliya DudaNo ratings yet

- Costs of Doing Business in Thailand: Utility RatesDocument5 pagesCosts of Doing Business in Thailand: Utility RatesColin HolmesNo ratings yet

- Jadrolinija - Raspored 2014Document6 pagesJadrolinija - Raspored 2014PolluxWhaleNo ratings yet

- India and Singapore Trade RalationDocument13 pagesIndia and Singapore Trade RalationManish DhuriaNo ratings yet

- CV Khairul Dwiputro-2023Document5 pagesCV Khairul Dwiputro-2023Rezki FahrezaNo ratings yet

- Glossary of Banking ServicesDocument6 pagesGlossary of Banking ServicesKarthik GottipatiNo ratings yet

- Postgraduate Courses in Economics and Econometrics 2014 PDFDocument20 pagesPostgraduate Courses in Economics and Econometrics 2014 PDFFaculty of Business and Economics, Monash UniversityNo ratings yet

- Pre-Feasibility Study for Dermatology Hospital in Jordan's Dead SeaDocument52 pagesPre-Feasibility Study for Dermatology Hospital in Jordan's Dead SeaKlare MontefalcoNo ratings yet

- TAMP BriefingDocument17 pagesTAMP Briefingdragon 999999100% (1)

- Hospitality Criteria For Staff of Resorts Oct.'19Document8 pagesHospitality Criteria For Staff of Resorts Oct.'19Ahmed GhazyNo ratings yet

- LOLIMSA Carmel2012 EssaludSoftware CompetitivenessDocument5 pagesLOLIMSA Carmel2012 EssaludSoftware Competitivenessjulioqt007No ratings yet

- IYF8 GV LV YIWKdbyDocument14 pagesIYF8 GV LV YIWKdbyArshadNo ratings yet

- Lower Taxes: Supporting Households, Driving Investment and Creating JobsDocument19 pagesLower Taxes: Supporting Households, Driving Investment and Creating JobsLeeNo ratings yet

- Bao Cao N100 91332-06020Document2 pagesBao Cao N100 91332-06020anhthoNo ratings yet

- China-Pakistan Economic Corridor Challenges Opportunities and The Way ForwardDocument5 pagesChina-Pakistan Economic Corridor Challenges Opportunities and The Way ForwardMahrukh ChohanNo ratings yet

- Project Report On Amul DairyDocument81 pagesProject Report On Amul Dairydhhruti77% (39)

- Futurology in PerspectiveDocument10 pagesFuturology in Perspectivefx5588No ratings yet

- HomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Document5 pagesHomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Nurul SariNo ratings yet

- Construction Industry in PakistanDocument7 pagesConstruction Industry in Pakistansajjadmubin75% (4)

- Central Bank and Monetary Policy ExplainedDocument70 pagesCentral Bank and Monetary Policy ExplainedKoon Sing ChanNo ratings yet

- Porter's Five Forces Analysis of the Indian Retail IndustryDocument38 pagesPorter's Five Forces Analysis of the Indian Retail Industryvintosh_pNo ratings yet