Professional Documents

Culture Documents

Derivative Report 17 July 2014

Uploaded by

Stock Tips provider in IndiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivative Report 17 July 2014

Uploaded by

Stock Tips provider in IndiaCopyright:

Available Formats

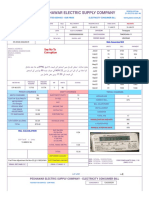

DAILY DERIVATIVE

REPORT

17

TH

JULY 2014

NIFTY FUTURE WRAP

31

ST

JULY 2014

SYMBOL SUPPORT RESISTANCE PARTICULARS CMP PRE CLOSE %CHANGE

NIFTY

S1-7535 R1- 7675

NIFTY

SPOT

7624.40 7526.65 1.30

S2-7445 R2-7750

NIFTY

FUTURES

7660.00 7538.60 1.61

TREND STRATEGY

BULLISH BUY ON DIPS

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

7365 7492 7576 7619 7703 7746 7873

DAILY DERIVATIVE REPORT

BANK NIFTY FUTURE WRAP

31

ST

JULY 2014

SYMBOL SUPPORT RESISTANCE PARTICULARS CMP PRE CLOSE %CHANGE

BANK NIFTY

S1-15010 R1-15450

BANK NIFTY

SPOT

15265.45 14891.90 2.51

S2-14590 R2-15550

BANK NIFTY

FUTURES

15339.00 14938.20 2.68

TREND STRATEGY

BULLISH BUY ON DIPS

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

14059 14444 14684 14829 15070 15214 15599

DAILY DERIVATIVE REPORT

FUTUREs FRONT

Long Build Up (Fresh Longs) Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

ZEEL 4,343.00 5,944.00 36.9 302.10 1.8

M&M 8,072.00 9,403.00 16.5 1,210.30 2.0

HEROMOTOCO 7,170.00 8,274.00 15.4 2,437.75 0.9

ADANIPORTS 4,986.00 5,738.00 15.1 284.75 7.9

Short-Covering Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

KOTAKBANK 13,752.00 12,787.00 [7.0] 887.20 1.5

BHARTIARTL 12,745.00 12,140.00 [4.8] 338.70 1.2

GRASIM 9,917.00 9,488.00 [4.3] 3,272.00 0.9

M&MFIN 6,744.00 6,632.00 [1.7] 259.30 3.1

Short Build Up Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

PFC 3,961.00 5,021.00 26.8 280.80 [5.4]

LICHSGFIN 13,686.00 17,265.00 26.2 309.25 [4.0]

RECLTD 3,628.00 4,521.00 24.6 328.45 [4.8]

CESC 2,576.00 3,089.00 19.9 631.95 [0.3]

Long Unwinding Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

- - - - - -

- - - - - -

- - - - - -

- - - - - -

DAILY DERIVATIVE REPORT

Top Gainers: Future Contract

Type Underlying Exp. Date Last Price Chg (%) OI ('000s)

FUTSTK BHARATFORG 25-Sep-14 696.00 11.2 3.00

FUTSTK IDFC 28-Aug-14 162.60 9.0 2,186.00

FUTSTK IDFC 31-Jul-14 161.55 9.0 84,176.00

FUTSTK IDFC 25-Sep-14 162.75 8.1 68.00

Top Losers: Future Contract

Type Underlying Exp. Date Last Price Chg (%) OI ('000s)

FUTSTK HDFC 25-Sep-14 973.15 [6.8] 0.75

FUTSTK PFC 28-Aug-14 281.70 [5.7] 438.00

FUTSTK PFC 31-Jul-14 280.10 [5.7] 10,042.00

FUTSTK RECLTD 28-Aug-14 329.40 [5.1] 266.00

FII Trends In Future

Script

BUY

[RS.CR]

SELL

[RS.CR]

NET POSITIONS

[RS.CR]

CONTRACTS

['000S]

VALUE

[RS.CR]

INDEX FUTURES

38,881 25,424 503.12 291.254 10,837

STOCK FUTURES

77,900 76,626 196.39 1,545.696 54,058

DAILY DERIVATIVE REPORT

OPTIONs FRONT

Top Gainers: Options

Inst

Type

Underlying

Expiry

Date

Last

Price[Rs.]

Strike

Price[Rs.]

OPT Type

OPTSTK RECLTD 31-Jul-14 6.75 310.00 PE

OPTSTK ADANIENT 31-Jul-14 5.40 550.00 CE

OPTSTK TATAMTRDVR 31-Jul-14 5.60 340.00 CE

OPTSTK ADANIPORTS 31-Jul-14 3.10 320.00 CE

Top Looser: Options

Inst

Type

Underlying

Expiry

Date

Last

Price[Rs.]

Strike

Price[Rs.]

OPT Type

OPTSTK APOLLOHOSP 31-Jul-14 0.10 1,160.00 CE

OPTSTK GODREJIND 31-Jul-14 0.10 400.00 CE

OPTSTK HINDUNILVR 31-Jul-14 0.10 720.00 CE

OPTSTK APOLLOHOSP 31-Jul-14 1.15 980.00 PE

FII Trends In Options

Script

BUY

[RS.CR]

SELL

[RS.CR]

NET POSITIONS

[RS.CR]

CONTRACTS

['000S]

VALUE

[RS.CR]

INDEX OPTIONS

273,453 287,744 [574.71] 1,594.307 59,296

STOCK OPTIONS

63,114 61,718 41.30 117.415 4,240

DAILY DERIVATIVE REPORT

PUT CALL RATIO: STOCK OPTION (OI WISE)

PUT CALL RATIO: STOCK OPTION (OPEN INTEREST WISE)

SCRIPT PUT CALL RATIO

ITC 7,167,000.00 4,986,000.00 1.44

JUSTDIAL 24,750.00 21,000.00 1.18

BATAINDIA 14,250.00 13,250.00 1.08

AXISBANK 816,750.00 859,000.00 0.95

PUT CALL RATIO: STOCK OPTION (VOLUME WISE)

SCRIPT PUT CALL RATIO

AXISBANK 1,168,250.00 1,145,250.00 1.02

PNB 229,500.00 229,000.00 1.00

AMBUJACEM 196,000.00 234,000.00 0.84

SUNPHARMA 141,000.00 169,500.00 0.83

PUT CALL RATIO: INDEX FUTURES (OPEN INTEREST WISE)

SCRIPT PUT CALL RATIO

BANKNIFTY 2,474,225.00 2,675,825.00 0.92

NIFTY 38,277,200.00 45,174,450.00 0.85

- - - -

PUT CALL RATIO: INDEX FUTURES (VOLUME WISE)

SCRIPT PUT CALL RATIO

NIFTY 86,166,500.00 92,119,700.00 0.94

BANKNIFTY 3,657,525.00 4,322,625.00 0.85

- - - -

DAILY DERIVATIVE REPORT

The information and views in this report, our website & all the service we provide are believed to

be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion.

Users have the right to choose the product/s that suits them the most.

Use of this report in no way constitutes a client/advisor relationship, all information we

communicate to you (the subscriber) either through our Web site or other forms of

communications, are purely for informational purposes only.

We recommend seeking individual investment advice before making any investment, for you are

assuming sole liability for your investments. Capital Stars will in no way have discretionary

authority over your trading or investment accounts.

All rights reserved.

OFFICE: - +91 731 4757600

MOB: +91 92000 99927

PHONE: +91 731 6790000

Email: info@capitalstars.com

CAPITAL STARS FINANCIAL

RESEARCH PRIVATE LIMITED

PLOT NO. 12, SCHEME NO. 78, PART II

VIJAYNAGAR INDORE 452001 (MP)

DAILY DERIVATIVE REPORT

CONTACT US

DISCLAIMER

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Finance Interview Prep: Key Accounting QuestionsDocument14 pagesFinance Interview Prep: Key Accounting Questionsmanish mishraNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Crisil Amfi Mutual Fund Report Digital Evolution PDFDocument56 pagesCrisil Amfi Mutual Fund Report Digital Evolution PDFShubham SinghNo ratings yet

- Derivative Report 01 July 2014Document8 pagesDerivative Report 01 July 2014PalakMisharaNo ratings yet

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 30 June 2014Document8 pagesDerivative Report 30 June 2014PalakMisharaNo ratings yet

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 25 June 2014Document8 pagesDerivative Report 25 June 2014PalakMisharaNo ratings yet

- Derivative Report 18 June 2014Document8 pagesDerivative Report 18 June 2014PalakMisharaNo ratings yet

- Derivative Report 23 June 2014Document8 pagesDerivative Report 23 June 2014PalakMisharaNo ratings yet

- Derivative Report 24 June 2014Document8 pagesDerivative Report 24 June 2014PalakMisharaNo ratings yet

- Derivative Report 17 June 2014Document8 pagesDerivative Report 17 June 2014PalakMisharaNo ratings yet

- Derivative Report 27 June 2014Document8 pagesDerivative Report 27 June 2014PalakMisharaNo ratings yet

- Derivative Report 18 June 2014Document8 pagesDerivative Report 18 June 2014PalakMisharaNo ratings yet

- Derivative Report 20 June 2014Document8 pagesDerivative Report 20 June 2014PalakMisharaNo ratings yet

- Derivative Report16 June 2014Document8 pagesDerivative Report16 June 2014PalakMisharaNo ratings yet

- Derivative Report 3rd June 2014Document8 pagesDerivative Report 3rd June 2014PalakMisharaNo ratings yet

- Derivative Report12 June 2014Document8 pagesDerivative Report12 June 2014PalakMisharaNo ratings yet

- Derivative Report 30 MAY 2014Document8 pagesDerivative Report 30 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report13 June 2014Document8 pagesDerivative Report13 June 2014PalakMisharaNo ratings yet

- Derivative Report 23 MAY 2014Document8 pagesDerivative Report 23 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 27 MAY 2014Document8 pagesDerivative Report 27 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 28 MAY 2014Document8 pagesDerivative Report 28 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 02 MAY 2014Document8 pagesDerivative Report 02 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 26 MAY 2014Document8 pagesDerivative Report 26 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 22 MAY 2014Document8 pagesDerivative Report 22 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Special Research Report On NickelDocument8 pagesSpecial Research Report On NickelPalakMisharaNo ratings yet

- Derivative Report 30 April 2014Document8 pagesDerivative Report 30 April 2014PalakMisharaNo ratings yet

- Agri Weekly Report 21st AprilDocument9 pagesAgri Weekly Report 21st AprilPalakMisharaNo ratings yet

- Major Parts in A Business Plan - Home WorkDocument3 pagesMajor Parts in A Business Plan - Home Workأنجز للخدمات الطلابيةNo ratings yet

- The Funding Cost of Chinese Local Government DebtDocument48 pagesThe Funding Cost of Chinese Local Government Debt袁浩森No ratings yet

- Organogram 3-10-2018Document1 pageOrganogram 3-10-2018IqraNo ratings yet

- Bangladesh Business Structure ReportDocument32 pagesBangladesh Business Structure ReportMd. Tareq AzizNo ratings yet

- Tugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, DDocument19 pagesTugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, Dbizantium greatNo ratings yet

- Risk Management Dissertation PDFDocument8 pagesRisk Management Dissertation PDFHelpWithCollegePaperWritingUK100% (1)

- For A New Coffe 2 6Document2 pagesFor A New Coffe 2 6Chanyn PajamutanNo ratings yet

- Class XII - Portions For Term I Exam-Commerce 2023-24Document2 pagesClass XII - Portions For Term I Exam-Commerce 2023-24mohammad sidaanNo ratings yet

- KKD Major ProjectDocument22 pagesKKD Major Projectvivek1119No ratings yet

- GRP 1 MarketingDocument10 pagesGRP 1 Marketingnyaradzo mapfumoNo ratings yet

- Prayer Before Study: Saint Thomas AquinasDocument98 pagesPrayer Before Study: Saint Thomas AquinasGea MarieNo ratings yet

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- Reverse LogisticDocument8 pagesReverse LogisticĐức Tiến LêNo ratings yet

- Land Use Patterns in CitiesDocument46 pagesLand Use Patterns in Citiesarnav saikiaNo ratings yet

- Chapter 1 Differing Perspectives On Quality - Revision1Document20 pagesChapter 1 Differing Perspectives On Quality - Revision1Moon2803No ratings yet

- Cost Accounting4&Cost ManagementDocument10 pagesCost Accounting4&Cost ManagementJericFuentesNo ratings yet

- Financial Statement Analysis of Lakshmigraha Worldwide IncDocument77 pagesFinancial Statement Analysis of Lakshmigraha Worldwide IncSurendra SkNo ratings yet

- Analysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Document13 pagesAnalysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Customize essayNo ratings yet

- USAIDDocument344 pagesUSAIDJoshua Ladia100% (1)

- COI - MelvanoDocument1 pageCOI - MelvanoSushantNo ratings yet

- Applied Economics: January 2020Document18 pagesApplied Economics: January 2020Jowjie TVNo ratings yet

- Customer Updation Form For Non IndividualDocument3 pagesCustomer Updation Form For Non IndividualThamilarasan PalaniNo ratings yet

- DI Chapter 5 - CaseletsDocument4 pagesDI Chapter 5 - CaseletsDibyendu RoyNo ratings yet

- Customer Satisfaction Towards Honda Two Wheeler: Presented By: Somil Modi (20152002) BBA-MBA 2015Document9 pagesCustomer Satisfaction Towards Honda Two Wheeler: Presented By: Somil Modi (20152002) BBA-MBA 2015Inayat BaktooNo ratings yet

- ACTG240 - Ch01Document44 pagesACTG240 - Ch01xxmbetaNo ratings yet

- Xcostman Pa1Document2 pagesXcostman Pa1Aaliyah Christine GuarinNo ratings yet

- Active Vs PassiveDocument6 pagesActive Vs PassiveYingying SheNo ratings yet

- Ass 2016Document6 pagesAss 2016annaNo ratings yet