Professional Documents

Culture Documents

Assignment - Managerial Finance

Uploaded by

BoyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment - Managerial Finance

Uploaded by

BoyCopyright:

Available Formats

ASSIGNMENT

BMMF5103 Managerial Finance

by

LEONG KHAI SIANG

(CGS00661701)

Greenhill Learning Center

Open University Malaysia

No. 55-57, Persiaran Greenhill

30450 Ipoh

Perak Darul Ridzuan

QUESTION 1

a. A corporation has a current ratio of 5.65 when the industry average is 1.42. What could

be the reason for this disparity?

Answer:

Formula at current rate = Current Asset

Current Liability

The disparity can be due to higher current assets such as cash, debtors etc.

Besides, it is also done to lower current liability such as creditors, payables etc.

b. Determine the sales of a firm with the following financial information:

Current ratio: 2.40

Quick ratio: 1.50

Current liabilities: RM600,000

Inventory turnover: 6 times

Answer:

Current ratio = CA

CL

2.4 = CA

60, 000

CA = 2.4 x 60,000

= 1,440,000

Q ratio = CA Inventory

CL

1.5 = 1,440,000 Inventory

60, 000

Inventory = 1,440,000 ( 1.5 x 60,000 )

= 540,000

Cost of good sold = Sales (1 gross margin )

= 0.75 sales

Cost = Inventory turnover

Inventory

0.75 sales = 6

540,000

Sales = 6 x 540,000

0.75

= 4,322,000

c. Complete the balance sheet and sales information for Edelle Corporation using the

following financial data:

Debt / equity 50.0%

Quick ratio 1.40

Total asset turnover 1.60

Days outstanding - accounts receivable 30.00

Gross profit margin 25.0%

Inventory turnover 4.00 times

Cash Accounts payable

Accounts receivable Common stock 25,000

Inventory Retained earnings 26,000

Plant and equipment Total liabilities & equity

Total assets

Sales Cost of sales

Answer:

Debt = 50%

Equity

Debt = 50%

25K + 26K

Account payable = Debt = 50% x 51K

= 25,500

Total liability = Total asset

= 25,500 + 25K + 26K

= 76,500

Q

r

= Cash + Receivable = 1.4

CL

Cash + Receivable = 1.4 x 25,500

= 35,700

Asset turnover = Sales = 1.6

Assets

Sales = 1.6

76,500

Sales = 1.6 x 76,500

= 122,400

Day sales outstanding = Receivable

Sales/365

30 = Receivable

122,400/365

Account Receivable = 30 x 335.342

= 10,060

Cash + Receivable = 35,700

Cash = 35,700 10,060

= 25,640

Cost of good sales = Sales (1 gross margin )

(COGS) = 122,400 (1 25%)

= 91,800

Inventory turnover = COGS = 4

Inventory

Inventory = 91,800

4

= 22,950

Plant & equipment = Total Asset Inventory Cash Account Receivable

= 76,500 - 22,950 -25,640 10,060

= 17,850

QUESTION 2

a. Dynamo Pyro Bhd. (DPB) earned RM6.50 of cash flow per share last year.

(i) If DPB expects its cash flow to grow by 6% per year forever, what is the current value of

a share of DPB stock? Assume that the required rate of return is 14.5%.

Answer:

Share value = DIV ( 1 + g )

Req rate of return g

= 6.5 (1 + 6% )

14.5% - 6%

= 6.89

8.5%

= RM 81.06

(ii) If the current stock price is RM59.66, what is the markets expected growth rate

underlying the stock price. Assume the same discount rate and expected cash flow.

Share value = DIV (1 + g )

Req - g

59.66 = 6.5 ( 1 + g )

14.5% - g

59.66 (0.145 g ) = 6.5 + 6.5g

8.6507 59.66g = 66.16g

2.507 = 66.16g

g = 3.25%

b. The risk-free rate is 5.45%, and the market risk premium is 5.00%. Under consideration

for investment outlays are Projects Alpha, Beta, and Chi, with estimated betas of 0.6, 1.1,

and 1.8, respectively. What will be the required rates of return on these projects based on

the Security Market Line approach?

Answer:

Req rate of return = R

f

(risk free rate) + (market base premium)

= 5.45 % + 0.6 (5%)

= 8.45%

= 5.45% + 1.1 (5%)

= 10.95%

Chi = 5.45% + 1.8 (5%)

= 14.45%

c. A 12 year corporate bond with RM1,000 maturity value carries a 7.5% coupon rate. It

pays its interest payments semi-annually.

(i) If the bond is currently selling for RM961.88, what is the rate of return on this bond?

Answer:

Yield of maturity = annual interest income + par value CMP

Years

Par value + CMP

2

= (7.5% x 1,000) + 1000 961.88

12

1000 + 961.88

2

= 7.96%

(ii) If the bond sold for RM1,030.32, what is the rate of return on this bond?

Answer:

Return of rate = 75 + 1,000 1,030.32

12

1,000 + 1,030.32

2

= 7.14%

QUESTION 3

a. Your sister is celebrating her 28th birthday. She wants to start saving for retirement at age

58. She tells you that ideally she would like to withdraw RM50,000 on an annual basis

for at least 25 years starting the year after she retires. She says that she is comfortable

putting aside some money each year in an annuity and believes that she should be able to

earn an 8% rate of return.

(i) If your sister starts making annuity payments to her savings account at the end of this

year and makes her last deposit at age 58, how much must she deposit each year?

Answer:

Total money to withdraw = 50,000 x PVIFA

25,8

= 50,000 x 10.675 (from PVIF table)

= 533,750

533,750 = PMT x (1 + i )

n

1

i

533,750 = PMT x (1 + 0.08)

30

1

0.08

= PMT x (9.06 / 0.08)

PMT = 4,711.64

(ii) Your sister mentions that she already has a savings account of RM10,000, if she used that

money to start the account, how much must she deposit each year until she reaches age

58?

Future value of 10,000 deposit

FV = Principle (1 + i )

n

= 10,000 (1 + 0.08)

30

= 100,626.57

New value = 533,750 100,626.57

= 433,123.43

433,123.43 = PMT x (1 + i )

n

1

i

433,123.43 = PMT x (1 + 0.08)

30

1

0.08

= PMT x ( 9.06/0.08)

Deposit = 3,823.37

(iii) She suddenly remembers that her parents had bought her a life insurance policy that

matures on her 50th birthday for an amount of RM75,000. If she added that to the

retirement fund, along with her RM10,000 (year 0) savings account, how much must she

deposit each year until she reaches age 58.

Answer:

Insurance value = 75,000 x PVIFA

88.5%

(30 years) = 75,000 x 1.8509

= 138,817

Total money = 533,750 100,626.57 138,817

= 294,305.93

294,305.93 = PMT x (1 + i )

n

1

i

294,305.93 = PMT x (1 + 0.08)

30

1

0.08

= PMT x (9.06 / 0.08)

PMT = 4,711.64

b. Prepare the first three months of a loan amortization schedule for a RM200,000 thirty

year mortgage. The loan has a 6% APR interest rate and is compounded monthly. What

are the monthly payments?

Answer:

Monthly payment = Total loan i + i

(1 + ii)

n

1

i = 6%

12

= 0.5% (monthly)

n = 30 x 12

= 360

Month payment = 200,000 0.005 + 0.005

(150,005)

360

1

= 200,000 0.005 + 0.005

5.023

= 200,000 (0.005 + 9.9542 )

= 1,199.08

Month

Beginning

Balance

Installment Interest Principle

Year Ending

Balance

1 200,000.00 11,199.10 1,000.00 199.10 199,800.90

2 199,800.90 1,199.10 999.00 200.10 199,600.80

3 199,600.80 1,199.10 998.00 201.10 199,399.70

c. Assume that you are negotiating financing for a new automobile. You have been given

the choice between (1) a RM2,000 rebate and 9% (compounded monthly) financing or (2) no

rebate and 0.0% (compounded monthly) financing. Either loan would require monthly

payments for a two-year period; the cost of the vehicle is RM25,000. The RM2,000

rebate would immediately reduce the price of the vehicle. Calculate your monthly

payment under both alternatives. With which choice are you better off?

Answer:

Option I 2,000 rebate with 9% compounded monthly

New price = 25,000 2,000

= 23,000

Monthly payment = loan i + i

(1 + i)

n

1

i = 9%

12

= 0.75%

n = 2 x 12

= 24

MP = 23,000 0.0075 + 0.0075

(1 + 0.075)

24

1

= 23K 0.0075 + 0.0075

0.1964

= 23K ( 0.046 )

= 1,050.75

Option 2 0% Interest installment & 0 rebate

Installment = 25,000

24

= 1,041.67

Hence, option 2 is preferably due to its lower installment.

QUESTION 4

a. Nickson bought 100 shares ofPristonBhd stock for RM24 per share on January 1, 2009. He

received a dividend of RM2 per share at the end of 2009 and RM3 per share at the end of 2010.

At the end of 2011, Nickson collected a dividend of RM4 per share and sold his stock for RM18

per share. What was Nicksons realized return during the three year holding period?

Answer:

Capital gain = 18 24

= 6

Dividend income = 2 + 3 + 4

= 9

Total return = -6 + 9

= 3

Realized return = 3 x (100/24)

= 12.5%

a. Given an expected return for the market of 12 percent, with a standard deviation of 20

percent, and a risk-free rate of 8 percent, consider the following data:

Stock Beta Ri(%)

1 0.8 12

2 1.2 13

3 0.6 11

(i) Calculate the required rate of return for each stock using the SML.

Stock Beta R

i

(%) Req rate of return (Rs)

1 0.8 12 8 + (0.8) (12-8) = 11.2

2 1.2 13 8 + (1.2) (12-8) = 12.8

3 0.6 11 8 + (0.6) (12-8) = 10.4

(ii) Assume that an analyst, using fundamental analysis, develops the estimates labeled Ri for

these stocks. Which stock would be recommended for purchase?

Answer: It would be Stock 1 recommended to purchase. (highest between Rs and Ri)

b. Why is market risk sometimes said to be the relevant risk for a portfolio manager?

What is the measure of market risk?

Answer:

Market Risk cant diversify and cant be removed or eliminated. For example: market risk = interest

rate, government policy, war.

specific risk

market risk

c. Suppose the Security Market Line (SML) has a risk-free rate of 5 percent and an

expected market return of 15 percent. Now suppose that the SML shifts, changing slope,

so that kRF is still 5 percent but kM is now 16 percent. What does this shift suggest about

investors risk aversion? If the slope were to change downward, what would that suggest?

Answer:

This shift is suggest to increase in risk premium. For instance, 16% to 5 % = 11% before 15% -

5% = 10% higher risk premium indicates higher risk so investor need to be more risk averse.

Apart from that, downward slope indicate to risk.

QUESTION 5

a. Discuss the different forms of market efficiency under the Efficient Market Hypothesis

(EMH)? Are market anomalies consistent with the concept of EMH?

Answer:

The efficient Market Hypothesis (EMH) gives rise to forecasting tests that mirror those

adopted when testing the optimality of a forecast in the context of given information set.

However, there are also important differences arising from the fact that market efficiency

tests rely on establishing profitable trading opportunities in real time. Forecasters constantly

search for predictable patterns and affect prices when they attempt to exploit trading

opportunities. Stable forecasting patterns are therefore unlikely to persist for long periods of

time and will self-destruct when discovered by a large number of investors. This gives rise to

non-stationarities in the time series of financial returns and complicates both formal tests of

market efficiency and the search for successful forecasting approaches.

Market efficiency can be defined as a securities market is efficient if security prices fully

reflect the information available. Besides, it is also understandable that the market is efficient

with respect to some specified information system, if and only if security prices act as if

everyone observes the information. The importance of market efficiency includes

encouraging share buying, whereby the investors need to know that they are paying a fair

price and that they will be able to sell at a fair price. Besides, it provides signals to Company

Managers in pursuit of maximizing shareholders wealth, need to get feedback on their

decisions. Furthermore, it can help in allocating resources. For instance: Allocation

Efficiency requires both operating and pricing efficiency.

Basically, there are three forms of market efficiency as below:

(i) Weak Form Efficient Market

- Market prices reflect all historical information.

- RandomWalk.

(ii) Semi-strong Form Efficient Market

- Market Prices reflect publicly available information.

(iii)Strong Form Efficient Market

- Market prices reflect all information, both public and private.

b. Conventional wisdom has long held that diversification of a stock portfolio should be

across industries. Does the correlation coefficient indirectly recommend the same thing?

Answer:

No, because different industry and minral correlation coefficient. As example

a. What are the assumptions in the CAPM? Can these be relaxed without destroying the

conclusions of the model?

Answer:

The Capital Asset Pricing Model (CAPM) is a theory based upon the above theory of portfolio

selection. The basic premise is that in capital markets people are rewarded for bearing risk. Any

asset is priced in equilibrium so that if the asset is risky people receive a higher rate of return

than they would receive if they held a risk free asset. This higher rate of return is called a risk

premium. But the market does not reward people for bearing unnecessary risk, risk that can be

avoided by diversification. The risk premium on an asset is thus not related to its standalone risk,

but rather to its contribution to an efficiently diversified portfolio. Any efficiently diversified

portfolio can be constructed by mixing a risk free asset and a tangency portfolio of risky assets.

The CAPM model is based upon two assumptions:

Assumption 1: Investors agree on their forecasts of the expected rates of return, risks and

correlations for every asset. They therefore hold risky assets in the same proportions. (Note:

different investors may have differing levels of risk aversion so they may mix the optimal

portfolio of risky assets with the risk free asset in differing proportions.)

Assumptions 2: Investors generally behave rationally. In equilibrium, the prices of all assets have

adjusted so that the market clears. It follows that in equilibrium because all investors hold risky

assets in their portfolios in the same optimal proportions that for the market to clear the market

values of those assets must adjust so that the total market value of each asset is the same

CP O&G

proportion of the total value of all the risky assets as its proportion in the optimal portfolio. A

portfolio which holds assets in the same proportions as they are held in the market is called a

market portfolio. The implication of the CAPM model is that the Market portfolio is the optimal

portfolio.

QUESTION 6

Write a short essay (minimum 250 words) to discuss the importance of good corporate

governance and its effects on firms value. The essay has to be original (evidence of plagiarism,

i.e. cut-and-paste, etc., will result in zero mark). Your arguments must be supported by factual

evidence and, if necessary,sources of reference must be listed down.

Answer:

The essence of good corporate governance is to ensure trustworthy relations between the

corporation and its stakeholders. Therefore, good governance involves a lot more than

compliance. Nevertheless, good corporate governance is a culture and a climate of

accountability, consistency, effectiveness, fairness, responsibility and transparency that is

deployed throughout the organization.

In an organization, good corporate governance could support in effective decision making. This

effective decision making in a well-governed organization is based on a well balanced

accountability framework that is clear communication and understanding across the organization

and understanding across the organization of roles and responsibilities. Apart of that, it also

robust performance, financial, risk and information management systems as well as the high

standards of conduct.

Organizations with good corporate governance have the capacity to maintain high-quality

services and to deliver improvement. Poor governance arrangements set the framework within

which the organizational systems and processes fail to detect or anticipate serious service and

financial failures. Good governance in organizations, based on openness, clarity and honest

accountability enhances public trust and civic engagement.

As conclusion, good corporate governance is a must for complex and dynamic business

environment to ensure long-term sustainability nowadays. So, it should be cultivated and

practiced regularly within the current structure of the business. Undoubtedly, corporations that

genuinely recognize and embrace the principles of good governance will derive enormous

benefits, the availability and lower cost of capital, the ability to attract talent clients and business

partners, improved competitiveness and financial performance, and truly sustainable long-term

growth. With that, good corporate governance is also very important for sustainable

development, not only for the individual company, but also for the economy as a whole.

Therefore, the quality of governance should be continuously improved and good governance

should be promoted.

You might also like

- The Collected Letters of Flann O'BrienDocument640 pagesThe Collected Letters of Flann O'BrienSean MorrisNo ratings yet

- Hollywood Game Plan 20 Page Sample PDFDocument20 pagesHollywood Game Plan 20 Page Sample PDFMichael Wiese Productions0% (1)

- Barge Ro-Ro RampsDocument5 pagesBarge Ro-Ro RampsBoyNo ratings yet

- Checklist For Mold RemediationDocument2 pagesChecklist For Mold Remediation631052No ratings yet

- SPMT Loading Diagrams X24 Doku 20130305Document56 pagesSPMT Loading Diagrams X24 Doku 20130305BoyNo ratings yet

- SPMT Loading Diagrams X24 Doku 20130305Document56 pagesSPMT Loading Diagrams X24 Doku 20130305BoyNo ratings yet

- Spiral Granny Square PatternDocument1 pageSpiral Granny Square PatternghionulNo ratings yet

- Goldhofer Spec For ProcedureDocument6 pagesGoldhofer Spec For ProcedureBoyNo ratings yet

- Skype Sex - Date of Birth - Nationality: Curriculum VitaeDocument4 pagesSkype Sex - Date of Birth - Nationality: Curriculum VitaeSasa DjurasNo ratings yet

- PLJ-8LED Manual Translation enDocument13 pagesPLJ-8LED Manual Translation enandrey100% (2)

- It’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceFrom EverandIt’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceNo ratings yet

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- HR Performance Management McqsDocument31 pagesHR Performance Management McqsMeet SejpalNo ratings yet

- Scheuerle SPMT SpecDocument17 pagesScheuerle SPMT SpecBoy100% (2)

- Fin Model Class2 Excel NPV Irr, Mirr SlidesDocument5 pagesFin Model Class2 Excel NPV Irr, Mirr SlidesGel viraNo ratings yet

- Siegfried Kracauer - Photography (1927)Document17 pagesSiegfried Kracauer - Photography (1927)Paul NadeauNo ratings yet

- 4th Summative Test Science 6Document5 pages4th Summative Test Science 6ANNALIZA FIECASNo ratings yet

- SRS documentation of Virtual Classroom System , SRS documentation of Personal Identity Management ,SRS documentation of EMentoring for women system , SRS Documentation of Employee Performance Management SRS Documentation of Online TicketingDocument79 pagesSRS documentation of Virtual Classroom System , SRS documentation of Personal Identity Management ,SRS documentation of EMentoring for women system , SRS Documentation of Employee Performance Management SRS Documentation of Online Ticketingsaravanakumar1896% (26)

- Analysis of The Somalian Telecommunication IndustryDocument6 pagesAnalysis of The Somalian Telecommunication IndustryHND Assignment Help50% (4)

- Developing Marketing Strategies and Plans: BMMK 5103 - Chapter 2Document46 pagesDeveloping Marketing Strategies and Plans: BMMK 5103 - Chapter 2BoyNo ratings yet

- Kuratko 8e CH 09Document24 pagesKuratko 8e CH 09BoyNo ratings yet

- Kuratko 8e CH 12Document21 pagesKuratko 8e CH 12BoyNo ratings yet

- Name: Rajiv Gupta Roll No: 048 Mbaex 8102 Data Analysis and Optimization Professor: Amit Kumar Bardhan (Ab)Document3 pagesName: Rajiv Gupta Roll No: 048 Mbaex 8102 Data Analysis and Optimization Professor: Amit Kumar Bardhan (Ab)Rajiv GuptaNo ratings yet

- FMS MITO NC NC054LD CompleteDocument47 pagesFMS MITO NC NC054LD CompleteShashi YadavNo ratings yet

- Fms Previous Yr PaperDocument18 pagesFms Previous Yr PaperAnmol BhasinNo ratings yet

- Sem 2 Economics AssignmentDocument12 pagesSem 2 Economics Assignmentjagrit garg100% (1)

- Digital Payments IndiaDocument6 pagesDigital Payments IndiaPranav TyagiNo ratings yet

- FAC133 FM - Capital Budgeting SumsDocument9 pagesFAC133 FM - Capital Budgeting SumsVedant Vinod MaheshwariNo ratings yet

- Implementation of National Academic DepositoryDocument2 pagesImplementation of National Academic DepositoryWasim KhanNo ratings yet

- 0fa74module 1bDocument2 pages0fa74module 1bDev Sharma100% (1)

- BA7401 International Business ManagementDocument166 pagesBA7401 International Business ManagementSathish Kumar100% (1)

- Nature and Objectives of Management AccountingDocument13 pagesNature and Objectives of Management AccountingpfungwaNo ratings yet

- Marketing Exam Questions and AnswersDocument2 pagesMarketing Exam Questions and AnswersAAKNo ratings yet

- AssignmentDocument2 pagesAssignmentnavneet26101988No ratings yet

- Chapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsDocument54 pagesChapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsViruchika PahujaNo ratings yet

- BMTC SWOT AnalysisDocument6 pagesBMTC SWOT AnalysisVishwas JNo ratings yet

- ACPC Cut Off 2019 For MBADocument9 pagesACPC Cut Off 2019 For MBAParth PatelNo ratings yet

- Chapter 1Document29 pagesChapter 1Mai Lê NguyễnNo ratings yet

- Ba Mba ZC411 Ec 2R Ak 1605956849492Document2 pagesBa Mba ZC411 Ec 2R Ak 1605956849492AAKNo ratings yet

- Financial Management Course OutlineDocument2 pagesFinancial Management Course OutlineRosenna99No ratings yet

- Register for NAD ID to access academic recordsDocument14 pagesRegister for NAD ID to access academic recordsPagan jatarNo ratings yet

- Microeconomics Individual AssignmentDocument5 pagesMicroeconomics Individual AssignmentYuenJinNo ratings yet

- Bhat Bhateni GroupDocument23 pagesBhat Bhateni Groupprakash_ghimire755183% (6)

- GE Nine MatrixDocument9 pagesGE Nine MatrixSiddhartha GhoshNo ratings yet

- University of Sargodha BBA Program DetailsDocument44 pagesUniversity of Sargodha BBA Program DetailsMuhammad SaadNo ratings yet

- Kubs Pros PDFDocument43 pagesKubs Pros PDFSan Lizas AirenNo ratings yet

- ONICRADocument5 pagesONICRAYatin DhallNo ratings yet

- "Impact of Artificial Intelligence On Financial MarketDocument7 pages"Impact of Artificial Intelligence On Financial MarketDivya GoyalNo ratings yet

- Green Heaven Institute of Management and Research, NagpurDocument21 pagesGreen Heaven Institute of Management and Research, NagpurPrasad Mujumdar100% (1)

- Market Demand Forecasting TechniquesDocument115 pagesMarket Demand Forecasting TechniquesSandeep SayalNo ratings yet

- Tybcom Syllabus GoaDocument17 pagesTybcom Syllabus GoamasoodNo ratings yet

- E-commerce Project ReportDocument47 pagesE-commerce Project ReportOcto ManNo ratings yet

- Internship Report Vineeth SM 4sh21ba104Document53 pagesInternship Report Vineeth SM 4sh21ba104vineeth smNo ratings yet

- POM - Royale Business SchoolDocument354 pagesPOM - Royale Business Schoolyadavboyz100% (1)

- Videocon ProjectDocument58 pagesVideocon Projectmrinal_kakkar8215100% (2)

- Myntra - Media StrategyDocument13 pagesMyntra - Media StrategyPiyush KumarNo ratings yet

- Multiple regression-new-IMCDocument9 pagesMultiple regression-new-IMCankit rajNo ratings yet

- Devesh EadrDocument49 pagesDevesh EadrDevesh pawar100% (1)

- Presentation1 AirtelDocument11 pagesPresentation1 AirtelRuchika JainNo ratings yet

- Bharathiar University, Coimbatore Bharathiar University, Coimbatore - 641 046Document2 pagesBharathiar University, Coimbatore Bharathiar University, Coimbatore - 641 046Rishe SandoshNo ratings yet

- Assignment No 2 25032021 080720amDocument1 pageAssignment No 2 25032021 080720amLord Manga D kageNo ratings yet

- Political Factors:: Pestel Analysis of The Wives of Migrant Workers Who Reside in KeralaDocument4 pagesPolitical Factors:: Pestel Analysis of The Wives of Migrant Workers Who Reside in KeralaShaina DewanNo ratings yet

- Chapter 2 - Solved ProblemsDocument26 pagesChapter 2 - Solved ProblemsDiptish RamtekeNo ratings yet

- Value Chain in E-Commerce (M5)Document3 pagesValue Chain in E-Commerce (M5)SagarNo ratings yet

- Infosys Fundamental Analysis and Future OutlookDocument10 pagesInfosys Fundamental Analysis and Future OutlookMayank TeotiaNo ratings yet

- Assignment Module On Chapter 3. E-CommerceDocument18 pagesAssignment Module On Chapter 3. E-CommerceJohn Richard RiveraNo ratings yet

- Analytics for Competitive Advantage Using Data Decisions OperationsDocument15 pagesAnalytics for Competitive Advantage Using Data Decisions OperationshariniNo ratings yet

- Entrepreneurship Development ProjectDocument90 pagesEntrepreneurship Development ProjectVAIBHAV JAIN 1923671No ratings yet

- Analysis of Marketing Strategy of Coca Cola and PepsiDocument48 pagesAnalysis of Marketing Strategy of Coca Cola and Pepsianish_10677953No ratings yet

- MBA Business Environment REPORTDocument13 pagesMBA Business Environment REPORTHareesh ChowtipalliNo ratings yet

- Indian Oil CorporationDocument101 pagesIndian Oil CorporationNeha DhawanNo ratings yet

- HMT CompleteDocument34 pagesHMT CompletemundawalaNo ratings yet

- Marketing in Indian EconomyDocument15 pagesMarketing in Indian Economyshivakumar NNo ratings yet

- Winter Internship Report DV YaDocument70 pagesWinter Internship Report DV YaDivyaNo ratings yet

- PayTM Lucky Lifafa Campaign Case Study 182 PDFDocument3 pagesPayTM Lucky Lifafa Campaign Case Study 182 PDFAnjali AnantaNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Typical Setup For LoadoutDocument1 pageTypical Setup For LoadoutBoyNo ratings yet

- Typical Setup For WeighingDocument1 pageTypical Setup For WeighingBoyNo ratings yet

- Timber BoxDocument1 pageTimber BoxBoyNo ratings yet

- Loadout Beam Removal Step 4Document1 pageLoadout Beam Removal Step 4BoyNo ratings yet

- Declaration of ManufacturerDocument16 pagesDeclaration of ManufacturerBoyNo ratings yet

- THP SL - 26420Document1 pageTHP SL - 26420BoyNo ratings yet

- Techn Data THP-SL 4 - 36 ToDocument1 pageTechn Data THP-SL 4 - 36 ToBoyNo ratings yet

- PST SL - 60644Document1 pagePST SL - 60644Boy100% (1)

- PST SLE Declaration PDFDocument10 pagesPST SLE Declaration PDFBoyNo ratings yet

- Sykes Pump CertificateDocument1 pageSykes Pump CertificateBoyNo ratings yet

- Roro Ramp CalDocument2 pagesRoro Ramp CalBoyNo ratings yet

- Kencana HL SDN BHD Plem Loadout Procedure Revision: 0 - Sample Operator CertificateDocument1 pageKencana HL SDN BHD Plem Loadout Procedure Revision: 0 - Sample Operator CertificateBoyNo ratings yet

- Certificate Water Hose SunwayDocument1 pageCertificate Water Hose SunwayBoyNo ratings yet

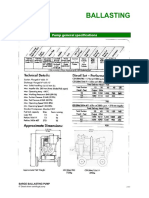

- Pump General Specifications: 6" Diesel Driven Centrifugal PumpDocument1 pagePump General Specifications: 6" Diesel Driven Centrifugal PumpBoyNo ratings yet

- Pump Spec PDFDocument1 pagePump Spec PDFBoyNo ratings yet

- Bmet 5103 Entrepreneurship Course Overview: DR Shishi Kumar Piaralal (Shashi) +6019-2631571 (Whatsapp, Viber) May 2014Document12 pagesBmet 5103 Entrepreneurship Course Overview: DR Shishi Kumar Piaralal (Shashi) +6019-2631571 (Whatsapp, Viber) May 2014BoyNo ratings yet

- Ballasting Pump Spec - ProcedureDocument3 pagesBallasting Pump Spec - ProcedureBoyNo ratings yet

- BMET5103 Entrepreneurship Full VersionDocument85 pagesBMET5103 Entrepreneurship Full VersionBoyNo ratings yet

- Essential Skills For EntrepreneursDocument3 pagesEssential Skills For EntrepreneursBoyNo ratings yet

- Entrepreneurs PresentationDocument11 pagesEntrepreneurs Presentationandro92No ratings yet

- OUM Business School Assignment on HR Planning, Recruitment and SelectionDocument3 pagesOUM Business School Assignment on HR Planning, Recruitment and SelectionBoyNo ratings yet

- Oum Business School: - AssignmentDocument6 pagesOum Business School: - AssignmentBoyNo ratings yet

- Location: Connectivity To The MuseumDocument7 pagesLocation: Connectivity To The MuseumAbhishek AjayNo ratings yet

- Hilton 5-29 Case SolutionDocument4 pagesHilton 5-29 Case SolutionPebbles RobblesNo ratings yet

- Corporate GovernanceDocument35 pagesCorporate GovernanceshrikirajNo ratings yet

- Performance of a Pelton WheelDocument17 pagesPerformance of a Pelton Wheellimakupang_matNo ratings yet

- ROM Magazine V1i6Document64 pagesROM Magazine V1i6Mao AriasNo ratings yet

- Conservation of Kuttichira SettlementDocument145 pagesConservation of Kuttichira SettlementSumayya Kareem100% (1)

- Mapeflex Pu50 SLDocument4 pagesMapeflex Pu50 SLBarbara Ayub FrancisNo ratings yet

- ABRAMS M H The Fourth Dimension of A PoemDocument17 pagesABRAMS M H The Fourth Dimension of A PoemFrancyne FrançaNo ratings yet

- Research of William Wells at HarvardDocument10 pagesResearch of William Wells at HarvardARGHA MANNANo ratings yet

- UK Commutator Maintenance CatalogueDocument9 pagesUK Commutator Maintenance CatalogueCarlosNo ratings yet

- 1 s2.0 S0959652619316804 MainDocument11 pages1 s2.0 S0959652619316804 MainEmma RouyreNo ratings yet

- Earth and Beyond PDFDocument5 pagesEarth and Beyond PDFNithyananda Prabhu100% (1)

- Programming Language II CSE-215: Dr. Mohammad Abu Yousuf Yousuf@juniv - EduDocument34 pagesProgramming Language II CSE-215: Dr. Mohammad Abu Yousuf Yousuf@juniv - EduNaruto DragneelNo ratings yet

- Principal Component Analysis of Protein DynamicsDocument5 pagesPrincipal Component Analysis of Protein DynamicsmnstnNo ratings yet

- Amma dedicates 'Green Year' to environmental protection effortsDocument22 pagesAmma dedicates 'Green Year' to environmental protection effortsOlivia WilliamsNo ratings yet

- Classification of Methods of MeasurementsDocument60 pagesClassification of Methods of MeasurementsVenkat Krishna100% (2)

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDocument31 pagesThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloNo ratings yet

- Illegal FishingDocument1 pageIllegal FishingDita DwynNo ratings yet

- AIIMS Mental Health Nursing Exam ReviewDocument28 pagesAIIMS Mental Health Nursing Exam ReviewImraan KhanNo ratings yet

- Lending Tree PDFDocument14 pagesLending Tree PDFAlex OanonoNo ratings yet

- Hotels Cost ModelDocument6 pagesHotels Cost ModelThilini SumithrarachchiNo ratings yet