Professional Documents

Culture Documents

Karkits Corporation

Uploaded by

김우림Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Karkits Corporation

Uploaded by

김우림Copyright:

Available Formats

Working Trial Balance

The field work pertinent to the audit of the accounts of Karkits Corporation, a close corporation, for the

year ended December 31, 2007 has been completed by the staff of Go and Associates, CPAs. Shown

below are the unaudited trial balance and certain additional information pertaining thereto appearing in

the working papers.

Unaudited Balances, 12/31/07

Debit Credit

Petty Cash Fund P 15,000

Cash in Bank 243,600

Trading Securities 330,000

Accounts Receivable 3,544,000

Allowance for Uncollectible Accounts P 120,000

Advances to Officers and Employees 0

Inventories 4,398,900

Prepaid Insurance 29,400

Property, Plant, and Equipment, at cost 10,945,000

Accumulated Depreciation 703,500

Franchises 500,000

Licensing Agreement 216,000

Accounts Payable 2,141,550

Interest Payable 0

Accrued Expenses 598,020

Unearned Revenues 0

Income Taxes Payable 193,365

Dividends Payable 1,250,000

Current Portion of Long-Term Debt 0

Mortgage Payable 2,000,000

Bonds Payable 2,000,000

Discount on Bonds Payable 122,000

Ordinary Share Capital 5,000,000

Additional Paid in Capital 1,350,000

Retained Earnings, January 1, 2007 2,867,840

Sales 32,250,000

Cost of Goods Sold 18,169,950

Marketing and Administrative Expenses 8,900,400

Other Income 180,000

Interest Expense 404,320

Income Tax Expense 1,585,705

Dividends Declared 1,250,000

P 50,654,275 P 50,654,275

Additional Information:

1. A count of the petty cash fund on January 2, 2008 showed its composition as follows

Currency and coins P 6,000

Petty cash vouchers, all dated 2007, except for

P1,500 which pertains to 2008 6,000

Employees postdated check 3,000

Total P15,000

2. The following are some of the December 31, 2007 reconciling items noted for cash in bank:

a. Customers checks returned by the bank marked DAIF in December 2007, redeposited in

January 2008, P35,000.

b. A bank credit memo representing collection by bank from one of the companys major

customers, P40,000.

c. A check drawn by another company for P25,000 incorrectly charged by bank in December 2007.

d. Checks issued by the company in 2002 and not yet cleared by bank as of December 31, 2007,

P105,000.

e. The company wrote several checks at the end of 2007 for accounts payable that were held and

not mailed until January 15, 2008. These totaled P48,300 and were included in the outstanding

checks of December 31, 2007.

3. The trading securities portfolio for Karkits Corporation contained the securities listed below:

Market value

Cost Dec. 31, 2006 Dec. 31, 2007

Smart Co. common stock P 70,000 P 30,000 P 40,000

Globe Corp. common stock 100,000 120,000 150,000

Nokia Company common stock 210,000 180,000 160,000

P380,000 P330,000 P350,000

The above securities are listed in the stock exchanges.

4. The audit revealed that Accounts Receivable was composed of the following items:

Customers accounts P2,799,000

Advances to officers and employees 120,000

Selling price of merchandise sent to Mobiline

Corp. on consignment at 125% of cost and not

yet sold by Mobiline Corp. 625,000

P3,544,000

The company has been providing an allowance for doubtful accounts at 5% of the outstanding

customers balances.

5. A physical inventory of merchandise as of December 31, 2007 amounted to P4,398,900. The

following information has been found relating to certain inventory transactions:

a. A P35,000 shipment of goods to a customer on December 31, 2007, terms FOB destination,

was not included in the yearend inventory. The goods cost P26,000 and were received by the

customer on January 8, 2008. The sale was properly recorded in 2008.

b. An invoice for goods costing P35,000 was received and recorded as a purchase on December

31, 2007. The related goods, shippped FOB destination, were received on January 2, 2008

and, thus, were not included in the physical inventory.

c. Goods costing P27,000 were received from a vendor on January 5, 2008. The related invoice

was received and recorded on January 12, 2008. The goods were shipped on December 31,

2007, terms FOB shipping point.

d. Inventory cut-off tests indicate that P22,350 of inventory received on December 30, 2007 was

recorded as purchases and accounts payable in 2008. These items were included in the

inventory count at year end.

e. Inventory cut-off tests also indicate several sales invoices recorded in 2007 for goods that

were shipped in early 2008. The goods were not included in inventory, but were set aside in

a separate shipping area. The total amount of these shipments was P36,000. Cost is

P25,000.

6. The prepaid insurance account contains the premium costs of two policies:

Policy A. cost of P13,200, two-year term taken on September 1, 2007

Policy B. cost of P16,200, three-year term taken on April 1, 2007

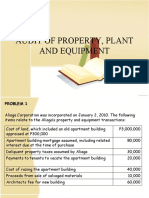

7. The Property, Plant, and Equipment account of the company is composed of the following:

Land and Building P 8,600,000

Furniture and Fixtures 2,177,000

Leasehold Improvements 168,000

Total P10,945,000

At the beginning of 2007, the company purchased land and building for P8,600,000, which included

P180,000 of realty tax in arrears for prior years. A mortgage of P2,000,000 was assumed by the

company on the purchase. Twenty percent of the purchase price should be allocated to the land,

and the balance to the building. In order to make the building suitable for the use of the company,

remodeling costs in the amount of P900,000 were incurred and this was charged to Repairs and

Maintenance Expense. Such remodeling necessitates demolition of a portion of the building which

resulted in recovery of salvage materials, sold for P30,000 cash and recorded as Scrap Income.

No depreciation has been recognized on the building for 2007 which has an estimated useful life of

50 years and salvage value of P250,000.

On May 1, 2007, costs of P168,000 were incurred to improve leased office premises. The leasehold

improvements have a useful life of 8 years. The related lease, which terminates on December 31,

2013 is renewable for an additional 6 year term. The decision to renew will be made in 2008 based

on office space needs at that time. No depreciation has been recorded yet on the leasehold

improvements for 2007.

8. A franchise agreement was acquired at the beginning of 2007 for P500,000. No amortization has

been recorded for 2007. A ten-year amortization period is to be used.

9. The companys Licensing Agreement account has a balance of P216,000. Original amount was

P360,000 and is being amortized on a five year basis starting in January 2005. As of year end,

amortization has not been recorded.

10. You were furnished with the schedule of Accounts Payable and Accrued Expenses as of December 31,

2007. Your verification disclosed the following:

a. Payment to Dela Cruz Company, a supplier, amounting to P126,000 was erroneously debited to

the account of De Leon Corporation, another supplier.

b. The following unpaid vouchers have not been recorded as of year-end:

Light, telephone, and water bills for December totaling P22,800.

Property taxes for the last quarter of 2007 due on the first week of

January, 2008, P10,000.

Various payroll taxes, P18,000.

11. Rent was received from a tenant in December 2007. The amount of P130,000, was recorded as

income at that time even though the rental pertains to 2008.

12. The mortgage on land and building assumed by the company is payable in installment of P500,000

every January 1, starting on January 1, 2008. Interest of 20% per annum is payable semiannually

every January 1 and July 1.

13. The bonds payable represented a 9%, P2,000,000 face value bonds which were issued on January 1,

2007 to yield 10%. The company uses the interest method of amortizing bond discount. Interest is

payable annually on January 1. No interest accrual nor bond discount amortization was recorded

during 2007.

14. Assume that there are no reconciling items between book income and taxable income. The tax rate

is 32%.

Prepare a list of audit adjusting entries and compute for the adjusted balances of the following:

A B C D

1. Petty Cash Fund P 15,000 P 9,000 P 7,500 P 6,000

2. Cash in Bank P 296,900 P 326,900 P 353,600 P 401,900

3. Trading Securities P 380,000 P 350,000 P 330,000 P 300,000

4. Accounts Receivable P 3,198,000 P 2,798,500 P 2,794,000 P 2,758,000

5. Allowance for Uncollectible Accts. P 159,900 P 139,925 P 139,700 P 137,900

6. Advances to Officers and Empl. Zero P 3,000 P 120,000 P 123,000

7. Inventories P 4,451,900 P 4,476,900 P 4,964,250 P 4,976,900

8. Prepaid Insurance P 12,850 P 21,125 P 23,150 P 23,700

9. Land P 1,864,000 P 1,720,000 P 1,690,000 P 1,684,000

10. Building P 7,780,000 P 7,750,000 P 7,636,000 P 7,606,000

11. Accumulated Deprn-Building P 155,000 P 150,000 P 150,600 P 147,120

12. Net book value of Leasehold

Improvements

P 168,000

P 154,000

P 151,200

P 150,600

13. Franchise P 500,000 P 450,000 P 400,000 P 350,000

14. Licensing Agreement, net P 72,000 P 144,000 P 288,000 P 428,000

15. Accounts Payable P 2,239,200 P2,212,200 P 2,204,200 P 2,155,900

16. Accrued Expenses P 547,220 P 598,020 P 648,820 P 848,820

17. Unearned Revenues Zero P 21,667 P 65,000 P 130,000

18. Interest Payable P 180,000 P 200,000 P 380,000 P 580,000

19. Income Taxes Payable P 163,477 P 203,365 P 210,943 P 759,620

20. Dividends Payable Zero P 250,000 P 625,000 P 1,250,000

21. Current Portion of LT Debt Zero P 500,000 P 1,000,000 P 1,500,000

22. Discount on Bonds Payable P 129,800 P 122,000 P 114,200 P 109,800

23. Common Stock P 5,000,000 P 4,000,000 P 3,500,000 P 3,000,000

24. Retained Earnings P 7,192,630 P 7,091,630 P 4,923,953 P 4,240,165

25. Sales P32,214,000 P31,625,000 P31,600,000 P31,589,000

26. Cost of Goods Sold P17,659,300 P17,631,300 P17,606,300 P17,579,300

27. Marketing & Adm. Expenses P 8,386,800 P 8,372,470 P 8,368,650 P 8,220,450

28. Other Income P 40,000 P 45,000 P 50,000 P 70,000

29. Interest Expense P 1,392,120 P 792,120 P 624,620 P 504,320

30. Net Income P 3,306,113 P 4,872,160 P 4,640,913 P 2,921,834

You might also like

- AP.2908 EquityDocument5 pagesAP.2908 EquityKj TaccabanNo ratings yet

- Print ExamDocument14 pagesPrint ExamkristinamanalangNo ratings yet

- Account Statement 010721 210122Document30 pagesAccount Statement 010721 210122PhanindraNo ratings yet

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDocument13 pagesAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoNo ratings yet

- Springfield Development Corporation, Inc. vs. Presiding Judge, RTC, Misamis Oriental, Br. 40, Cagayan de Oro City, 514 SCRA 326, February 06, 2007Document20 pagesSpringfield Development Corporation, Inc. vs. Presiding Judge, RTC, Misamis Oriental, Br. 40, Cagayan de Oro City, 514 SCRA 326, February 06, 2007TNVTRLNo ratings yet

- SY1920 1st Sem ACCO4083 - 3rd EvaluationDocument9 pagesSY1920 1st Sem ACCO4083 - 3rd EvaluationPaul Adriel BalmesNo ratings yet

- 47 - Financial Reporting and Changing PricesDocument3 pages47 - Financial Reporting and Changing PricesYvonne Joy Mondano TehNo ratings yet

- Ap CceDocument209 pagesAp CceTrisha RafalloNo ratings yet

- C. A Review Engagement Focuses On Providing Limited Assurance On Financial Statement of A PrivateDocument13 pagesC. A Review Engagement Focuses On Providing Limited Assurance On Financial Statement of A PrivateNoroNo ratings yet

- C. The Results of Operations, Cash Flow, and The Balance Sheet As If The Parent and Subsidiary Were A Single EntityDocument13 pagesC. The Results of Operations, Cash Flow, and The Balance Sheet As If The Parent and Subsidiary Were A Single EntityAlijah MercadoNo ratings yet

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Auditing Gray 2015 CH 15 Assurance Engagements Internal AuditDocument46 pagesAuditing Gray 2015 CH 15 Assurance Engagements Internal AuditAdzhana AprillaNo ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- ACTIVITY 3 - Operating Segments PDFDocument3 pagesACTIVITY 3 - Operating Segments PDFEstilo0% (2)

- Chapter 18 (Answers)Document3 pagesChapter 18 (Answers)arnel gallarteNo ratings yet

- Acctg7 - CH 9Document29 pagesAcctg7 - CH 9Jao FloresNo ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Chapter 18 AnswerDocument10 pagesChapter 18 AnswerMjVerba100% (1)

- ADV2 Chapter12 QADocument4 pagesADV2 Chapter12 QAMa Alyssa DelmiguezNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- RFJPIA Cup Level 5 - Auditing Problems: Elimination RoundDocument14 pagesRFJPIA Cup Level 5 - Auditing Problems: Elimination RoundCristal YpilNo ratings yet

- Audit of Property, Plant and EquipmentDocument26 pagesAudit of Property, Plant and EquipmentJoseph SalidoNo ratings yet

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboNo ratings yet

- Activity 2Document5 pagesActivity 2Lala FordNo ratings yet

- Morales, Jonalyn M.Document7 pagesMorales, Jonalyn M.Jonalyn MoralesNo ratings yet

- Audit of Receivables: Cebu Cpar Center, IncDocument10 pagesAudit of Receivables: Cebu Cpar Center, IncEvita Ayne TapitNo ratings yet

- Chapter 14 AnsDocument9 pagesChapter 14 AnsDave ManaloNo ratings yet

- Accounts Receivable Accounts Payable: A. P19,500 GainDocument6 pagesAccounts Receivable Accounts Payable: A. P19,500 GainTk KimNo ratings yet

- Module 1.5 - Corporate Liquidation PDFDocument3 pagesModule 1.5 - Corporate Liquidation PDFMila MercadoNo ratings yet

- Philippine MysteriesDocument41 pagesPhilippine MysteriesYes ChannelNo ratings yet

- QuizDocument11 pagesQuizJuan Rafael FernandezNo ratings yet

- Cpar - Ap 09.15.13Document18 pagesCpar - Ap 09.15.13KamilleNo ratings yet

- Test Bank Assurance Principles CparlDocument56 pagesTest Bank Assurance Principles Cparlcherry padreNo ratings yet

- Accounting MidTermDocument16 pagesAccounting MidTermPrincess Claris Araucto33% (3)

- Audit of SHE 1Document2 pagesAudit of SHE 1Raz MahariNo ratings yet

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Nfjpia Nmbe Afar 2017 AnsDocument10 pagesNfjpia Nmbe Afar 2017 AnshyosungloverNo ratings yet

- APSETADocument11 pagesAPSETAMark Bryan Ferrer Ramos0% (1)

- Module QuizsDocument24 pagesModule QuizswsviviNo ratings yet

- ACC 403 Final ExamDocument5 pagesACC 403 Final Examcaponegirl250% (2)

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- AC11 - Chaapter 7Document34 pagesAC11 - Chaapter 7anon_467190796100% (1)

- Integrated Review Ceu PDFDocument28 pagesIntegrated Review Ceu PDFHello Kitty100% (1)

- Cash and ReceivablesDocument2 pagesCash and ReceivablesPrima FacieNo ratings yet

- AC11 Chapter 4 CompilationDocument35 pagesAC11 Chapter 4 Compilationanon_467190796No ratings yet

- OPT QuizDocument5 pagesOPT QuizAngeline VergaraNo ratings yet

- Accounting ProbDocument2 pagesAccounting ProbLino GumpalNo ratings yet

- Straight ProblemsDocument12 pagesStraight Problemsnana100% (2)

- MergerDocument3 pagesMergerJohn BalanquitNo ratings yet

- AGS CUP 6 Auditing Final RoundDocument19 pagesAGS CUP 6 Auditing Final RoundKenneth RobledoNo ratings yet

- Advanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Document6 pagesAdvanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Jem ValmonteNo ratings yet

- ProblemsDocument4 pagesProblemsUNKNOWNNNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document7 pagesApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNo ratings yet

- Franchise AccountingDocument5 pagesFranchise AccountingJose SasNo ratings yet

- Module 1.3 - Partnership Dissolution PDFDocument3 pagesModule 1.3 - Partnership Dissolution PDFMila MercadoNo ratings yet

- CH 7 AnswersDocument5 pagesCH 7 Answersthenikkitr0% (1)

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- S SdfafdafdafdafDocument8 pagesS SdfafdafdafdafMark Domingo MendozaNo ratings yet

- 5rd Batch - P1 - Final Pre-Boards - EditedDocument11 pages5rd Batch - P1 - Final Pre-Boards - EditedKim Cristian Maaño0% (1)

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- P1 2ND Preboard PDFDocument9 pagesP1 2ND Preboard PDFmaria evangelistaNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Lawsuit Filed Against River City FirearmsDocument39 pagesLawsuit Filed Against River City FirearmsJulia HuffmanNo ratings yet

- Accounting Fraud Auditing and The Role of Government Sanctions in China 2015 Journal of Business ResearchDocument10 pagesAccounting Fraud Auditing and The Role of Government Sanctions in China 2015 Journal of Business ResearchAquamarine EmeraldNo ratings yet

- CTA CasesDocument177 pagesCTA CasesJade Palace TribezNo ratings yet

- 11 PDF Original PDFDocument5 pages11 PDF Original PDFMEKTILIA MAPUNDANo ratings yet

- Final Managerial AccountingDocument8 pagesFinal Managerial Accountingdangthaibinh0312No ratings yet

- G.R. No. 68166 February 12, 1997 Heirs of Emiliano Navarro, Petitioner, Intermediate Appellate Court & Heirs of Sinforoso Pascual, RespondentsDocument3 pagesG.R. No. 68166 February 12, 1997 Heirs of Emiliano Navarro, Petitioner, Intermediate Appellate Court & Heirs of Sinforoso Pascual, RespondentssophiabarnacheaNo ratings yet

- UKDCA FlyerDocument1 pageUKDCA FlyerUnion userNo ratings yet

- Business Law Dissertation TopicsDocument7 pagesBusiness Law Dissertation TopicsCustomWrittenCollegePapersSingapore100% (1)

- List of Cases Selected For Audit Through Computer Ballot - Income TaxDocument49 pagesList of Cases Selected For Audit Through Computer Ballot - Income TaxFahid AslamNo ratings yet

- Editorial by Vishal Sir: Click Here For Today's Video Basic To High English Click HereDocument22 pagesEditorial by Vishal Sir: Click Here For Today's Video Basic To High English Click Herekrishna nishadNo ratings yet

- Deed of Absolute Sale of Real Property in A More Elaborate Form PDFDocument2 pagesDeed of Absolute Sale of Real Property in A More Elaborate Form PDFAnonymous FExJPnC100% (2)

- AWS QuestionnaireDocument11 pagesAWS QuestionnaireDavid JosephNo ratings yet

- Cash and Cash EquivalentDocument2 pagesCash and Cash EquivalentJovani Laña100% (1)

- About Dhanalaxmi Bank KarthikDocument4 pagesAbout Dhanalaxmi Bank KarthikYkartheek GupthaNo ratings yet

- 1035RISE Vs RAISE Vs ARISEDocument13 pages1035RISE Vs RAISE Vs ARISEEric Aleksa EraNo ratings yet

- Guide To Confession: The Catholic Diocese of PeoriaDocument2 pagesGuide To Confession: The Catholic Diocese of PeoriaJOSE ANTONYNo ratings yet

- Retro 80s Kidcore Arcade Company Profile Infographics by SlidesgoDocument35 pagesRetro 80s Kidcore Arcade Company Profile Infographics by SlidesgoANAIS GUADALUPE SOLIZ MUNGUIANo ratings yet

- NCP CarsDocument7 pagesNCP CarsNayab NoorNo ratings yet

- LAW Revision Question 3Document4 pagesLAW Revision Question 3Nur Aishah RaziNo ratings yet

- Seminar On Business Valuation (Property Related) IsmDocument166 pagesSeminar On Business Valuation (Property Related) IsmrokiahhassanNo ratings yet

- September PDFDocument402 pagesSeptember PDFNihal JamadarNo ratings yet

- LabelsDocument34 pagesLabelsRoVin CruzNo ratings yet

- Second Semester of Three Year LL.B. Examination, January 2011 CONTRACT - II (Course - I)Document59 pagesSecond Semester of Three Year LL.B. Examination, January 2011 CONTRACT - II (Course - I)18651 SYEDA AFSHANNo ratings yet

- SystemupdateDocument9 pagesSystemupdatealishaNo ratings yet

- Scenes From The Last Days of Communism in West Bengal by INDRAJIT HAZRADocument22 pagesScenes From The Last Days of Communism in West Bengal by INDRAJIT HAZRAdonvoldy666No ratings yet

- VDC: The Weekly Statistical ReportDocument8 pagesVDC: The Weekly Statistical ReportimpunitywatchNo ratings yet