Professional Documents

Culture Documents

Sansomita Journal Entries: Date Explanation Ref Debit Credit

Uploaded by

Hasan TarekOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sansomita Journal Entries: Date Explanation Ref Debit Credit

Uploaded by

Hasan TarekCopyright:

Available Formats

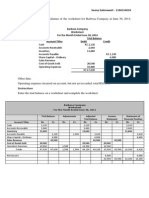

P(5)-1(A)

Sansomita

Journal Entries

Date Explanation Ref Debit Credit

1-Jul Marchandise Inv. 120 1800

Accountas Payable 201 1800

(To record purshased marchendised

inventory on account)

3-Jul Accounts Receivable 112 2000

Sales 401 2000

(marchandise sold on account)

Cost of goods sold 505 1200

Marchandise Inv. 120 1200

(Record cost of marchandise Sold)

9-Jul Acc.payable 201 1800

Marchandise Inv. 120 36

Cash 101 1764

(to record cost payment)

12-Jul Sales discount 414 20

Cash 101 1980

Acc. Receivable 112 2000

(received cash in discount period)

17-Jul Acc. receivable 112 1500

Sales 401 1500

(marchandise sold on account)

Cost of goods sold 505 900

Marchandise Inv. 120

(Cost of marchandise) 900

18-Jul Marchandise Inv. 120 1800

Acc.payable 201 1700

Cash 101 100

(Purchased marchandise on account)

20-Jul Acc.payable 201 300

Marchandise Inv. 120 300

(Returned Marchandise)

21-Jul Sales discount 414 15

Cash 101 1485

Accounts Receivable 112 1500

(received cash in discount period)

22-Jul Acc.Recevable 112 2250

Sales 401 2250

(marchandise sold on account)

Cost of goods sold 505 1350

Marchandise Inv. 120 1350

(Cost of marchandise)

30-Jul Acc.payable 201 1400

Cash 101 1400

(Payment cash within discount

period)

31-Jul Sales returns and allownce 412 200

Acc. Receivable 112 200

(Marchandise sales returns)

Marchandise Inv. 120 120

Cost of goods sold 505 120

(Cost of marchandise)

P(5)-2(A) OLIF Distributing Com.

Journal Entries

Date Explanation Ref Debit Credit

2-Apr Marchandise Inv. 120 6900

Acc. Payable 201 6900

(Purchased marchandise

on account)

4-Apr Acc. Receivable 112 5500

Sales 401 5500

(Marchandise sold on

account)

Cost of goods sold 505 4100

Marchandise Inv. 120 4100

(Cost of marchandise)

5-Apr Freight out 644 240

Cash 101 240

(Paid cash For Freight out)

6-Apr Acc.payable 201 500

Marchandise Inv. 120 500

(Received cash)

11-Apr Acc.payable 201 6400

Marchandise Inv. 120 64

Cash 101 6336

(Payment within cash

period)

13-Apr Sales discount 414 55

Cash 101 5445

Acc.Receivable 112 5500

(Received cash)

14-Apr Marchandise Inv. 120 3800

Cash 101 3800

(Purchased marchandise)

16-Apr Cash 101 500

Marchandise Inv. 120 500

(Received cash)

18-Apr Marchandise Inv. 120 4500

Acc.payable 201 4500

(Purchased marchandise

on account)

20-Apr Marchandise Inv. 120 100

Cash 101 100

(purchased marchandise )

23-Apr Cash 101 64000

Sales 401 64000

(marchandise sold in cash)

Cost of goods sold 505 5120

Marchandise Inv. 120 5120

(Cost of marchandise)

26-Apr Marchandise Inv. 120 2300

Cash 101 2300

(Purchased marchandise)

27-Apr Acc. Payable 201 4500

Marchandise Inv. 120 90

Cash 101 4110

(Paid cash For Marchandise)

29-Apr Sales returns And allowence 412 60

Cash 101 60

(Paid cash)

30-Apr Acc. Receivable 112 3700

Sales 401 3700

(Marchandice sold)

Cost of goods sold 505 2800

Marchandise Inv. 120 2800

(Cost of marchandise)

P(5)-2(A) Hafners Tennis Shop

Journal Entries

Date Explanation Ref Debit Credit

4-Apr Marchandise Inv. 120 840

Acc. Payable 201 840

(Credit M. Purchase)

6-Apr Marchandise Inv. 120 40

Cash 101 40

(Payment on treight)

8-Apr Acc. Receivable 112 1150

Sales 401 1150

(Sales on account)

Cost of goods sold 505 790

Marchandise Inv. 120 790

(Cost of Marchandise)

10-Apr Acc. Payable 201 40

Marchandise Inv. 120 40

(allowence for damage

equal)

11-Apr Marchandise Inv. 120 420

Cash 101 420

(puchased Marchandise)

13-Apr Acc.payable 201 800

Marchandise Inv. 120 16

Cash 101 784

(Payment within discount

period)

14-Apr Marchandise Inv. 120 900

Acc.payable 201 900

(M. purchased on account)

15-Apr Cash 101 50

Marchandise Inv. 120 50

(Received cash for damage)

17-Apr Marchandise Inv. 120 30

Cash 101 30

(Payment on Freigh)

18-Apr Acc. Receivable 112 810

Sales 401 810

(Sales on account)

Cost of goods sold 500 530

Marchandise Inv. 120 530

(Cost of Marchandise)

20-Apr Cash 101 500

Acc.Receivable 112 500

(Collection onaccount)

21-Apr Acc.payable 201 900

Marchandise Inv. 120 27

Cash 101 873

(Payment within period)

27-Apr Sales returns 412 30

Acc. Receivable 112 30

(Record allowence)

30-Apr Cash 101 660

Acc.Receivable 112 660

(Collection onaccount)

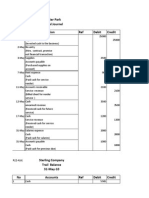

Hafners Tennis Shop

Trail Balance

No Accounts Ref Debit Credit

1 Cash 1623

2 Accounts receivable 770

3 Marchandise inventory 2487

4 Accounts payable 0

5 Capital 4200

6 Sales 1960

7 Sales returns and allowence 30

8 Cost of goods sold 1320

Total 6160 6160

P(5)-4(A) OILF DISTRIBUTION CO

Income Statement

Particulars Amount Amount

Sales 15600

Less: returns and allowence 60

Less: discount 55

Neat Sale 15485

Less: cost of goods sold 12020

53465

P(5)-5(A) Gordman Departmental Store

Income Statement

Particulars Amount Amount Amount

Revenue from Sale

Sales 71800

Less:Returns and allowence 8000

Neat sale 71000

COST OF GOODS SOLD

Beginning inventory 40500

Purchase 447000

Less:discount 12000

Purchase returns and

allowence 6400

Net purchase 428600

Add:Freight in 5600

COST OF GOODS PURCHASED 434200

Cost of goods available

For sale 474700

Ending inventory 75000

COST OF GOODS SOLD 399700

Gross profit 310300

Duckworth Store

Income Statement

Particulars Amount Amount Amount

Revanue From Sale

Sale 81000

Less:Returns and allowence 18000

Net sale 792000

Cost of goods sold

Begging Inventory 40000

Purchase 585000

Less:discount 6300

Purchase returns 2700

Net purchase 76000

Add:Freight in 4500

Cost of goods Purchased 580500

Cost of goods available 620500

for sale

Ending inventory 32600

587650

Gross profit 204100

You might also like

- Retail Math FormulasDocument2 pagesRetail Math Formulasfran100% (4)

- Management Advisory Services – Review QuizDocument14 pagesManagement Advisory Services – Review QuizTeofel John Alvizo PantaleonNo ratings yet

- Training On Oracle Work in ProcessDocument195 pagesTraining On Oracle Work in Processpraveen499100% (1)

- Chapter 4 AnswersDocument6 pagesChapter 4 AnswersDomingo PaguioNo ratings yet

- Ronald Hilton Chapter 3Document25 pagesRonald Hilton Chapter 3Swati67% (3)

- KuisDocument38 pagesKuismc2hin90% (1)

- Chapter 15 Multiple Choice Questions and ProblemsDocument14 pagesChapter 15 Multiple Choice Questions and Problemsmarycayton83% (6)

- Pilipinas Marketing ExercisesDocument16 pagesPilipinas Marketing Exercisesnigihayami210% (1)

- Chapter 5 - Inventories and Related ExpensesDocument13 pagesChapter 5 - Inventories and Related ExpensesiCayeeee100% (5)

- Annual Report Highlights of Dhaka Electric Supply CompanyDocument68 pagesAnnual Report Highlights of Dhaka Electric Supply CompanyHasan TarekNo ratings yet

- Variable and Absorption Costing Income StatementsDocument5 pagesVariable and Absorption Costing Income StatementsMonica GarciaNo ratings yet

- Water Purification Business PlanDocument48 pagesWater Purification Business PlanHasan Tarek100% (1)

- VAT On Sale of Goods and PropertiesDocument55 pagesVAT On Sale of Goods and PropertiesNEstanda100% (1)

- NISSON DISTRIBUTING COMPANY GENERAL JOURNAL APRILDocument9 pagesNISSON DISTRIBUTING COMPANY GENERAL JOURNAL APRILbabe447No ratings yet

- Maine Department Store Financial StatementsRef Debit Credit201 15001201500120 10001011000112 25004012500505 12001201200201 300120300120 20001012000Document63 pagesMaine Department Store Financial StatementsRef Debit Credit201 15001201500120 10001011000112 25004012500505 12001201200201 300120300120 20001012000Protibibadi0% (1)

- Chart of Accounts: Angel Hardware Store'SDocument3 pagesChart of Accounts: Angel Hardware Store'SNathanielNo ratings yet

- Auditing ProblemsDocument9 pagesAuditing Problemsmharieee13No ratings yet

- Financial Accounting 3 Chapter 10Document36 pagesFinancial Accounting 3 Chapter 10Cloyd Angel C. YamutNo ratings yet

- General Ledger AccountsDocument3 pagesGeneral Ledger AccountsSulthan.DNo ratings yet

- KuisDocument22 pagesKuismc2hin9100% (1)

- Dok 1Document2 pagesDok 1amandasaraswati130No ratings yet

- Chapter 4 ExerciseDocument5 pagesChapter 4 ExerciseSeany SukmawatiNo ratings yet

- Freight in Expence Freight Out ExpenceDocument6 pagesFreight in Expence Freight Out ExpenceZhang MengNo ratings yet

- KuisDocument34 pagesKuismc2hin9No ratings yet

- Finman 108 (Quiz 4) ...Document6 pagesFinman 108 (Quiz 4) ...CHARRYSAH TABAOSARESNo ratings yet

- (A) Syres Corporation Statement of Cash Flows-Indirect Method For The Year Ended December 31, 2009Document4 pages(A) Syres Corporation Statement of Cash Flows-Indirect Method For The Year Ended December 31, 2009Badhan SahaNo ratings yet

- Midterm QuizDocument5 pagesMidterm QuizyelzNo ratings yet

- Peyton Approved1Document32 pagesPeyton Approved1arnuako25% (4)

- 2016 Vol 1 CH 4 AnswersDocument15 pages2016 Vol 1 CH 4 AnswersIsabella Sandigan Marilag100% (2)

- Advac2 - Chapter 12 SolutionsDocument21 pagesAdvac2 - Chapter 12 SolutionsEms DelRosarioNo ratings yet

- Nama: Fanky Puguh Prasetyo NPM: 1209010079Document2 pagesNama: Fanky Puguh Prasetyo NPM: 1209010079funkycansaNo ratings yet

- PIAC02 TaskDocument4 pagesPIAC02 TaskScribdTranslationsNo ratings yet

- Acctg4a 02042017 Exam Quiz1aDocument5 pagesAcctg4a 02042017 Exam Quiz1aPatOcampoNo ratings yet

- Victoria Home Garden inventory cost calculationsDocument6 pagesVictoria Home Garden inventory cost calculationsJenny BooNo ratings yet

- Forntier Park General Journel Date Titles & Explanation Ref Debit CreditDocument15 pagesForntier Park General Journel Date Titles & Explanation Ref Debit CreditHasan TarekNo ratings yet

- Revenue and Expense Budgets with Cash Flow AnalysisDocument4 pagesRevenue and Expense Budgets with Cash Flow AnalysisAdrià BurgellNo ratings yet

- Cash Flow Statement AnalysisDocument6 pagesCash Flow Statement AnalysisgauravpalgarimapalNo ratings yet

- Chapter5 P5 1B Page250Document1 pageChapter5 P5 1B Page250Thanh HằngNo ratings yet

- KuisDocument11 pagesKuismc2hin9No ratings yet

- Marking Scheme: Section ADocument8 pagesMarking Scheme: Section Aaegean123No ratings yet

- Model Exam Work Out FADocument5 pagesModel Exam Work Out FAnewaybeyene5No ratings yet

- Ch19 LectureDocument19 pagesCh19 LectureBarbaraCelarentNo ratings yet

- Answer in BudgetingDocument9 pagesAnswer in BudgetingkheymiNo ratings yet

- Syllabus AnswerDocument24 pagesSyllabus AnswerasdfNo ratings yet

- 04sol-Investments WB 1stDocument21 pages04sol-Investments WB 1stNJ SyNo ratings yet

- Revenue Net Sales/Turnover Cost of Sales:: Income Statement For The Year Ended 31.12.10Document2 pagesRevenue Net Sales/Turnover Cost of Sales:: Income Statement For The Year Ended 31.12.10Ashish SinghNo ratings yet

- Accounting 1BDocument22 pagesAccounting 1BMijo CruzNo ratings yet

- Audit CompletionDocument5 pagesAudit CompletionEunice CoronadoNo ratings yet

- Exercises in MerchandisingDocument10 pagesExercises in MerchandisingJhon Robert BelandoNo ratings yet

- Chapter 13 - Gross Profit MethodDocument7 pagesChapter 13 - Gross Profit MethodLorence IbañezNo ratings yet

- Statement of Cost Goods ManufactureDocument2 pagesStatement of Cost Goods ManufactureAdrian ChrissanjayaNo ratings yet

- Financial Accounting: Accounting For Merchandising OperationsDocument4 pagesFinancial Accounting: Accounting For Merchandising OperationsAhmed TarekNo ratings yet

- Hà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICEDocument7 pagesHà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICE31231020411No ratings yet

- Net Purchases As of 31-MayDocument4 pagesNet Purchases As of 31-Mayooagentx44No ratings yet

- UBER ValuationDocument41 pagesUBER ValuationShrey JainNo ratings yet

- Exercise 2 Income Statement - MerchandisingzzzsDocument2 pagesExercise 2 Income Statement - MerchandisingzzzsMarc Viduya0% (1)

- Exercise 4 AccountingDocument4 pagesExercise 4 AccountingnimnimNo ratings yet

- P5 2122021Document5 pagesP5 2122021Sher KurniaNo ratings yet

- 1Document21 pages1Hasan TarekNo ratings yet

- BEFTN Bank Branch Routing Numbers-Appendix IIDocument146 pagesBEFTN Bank Branch Routing Numbers-Appendix IIRownakul100% (8)

- Green HRMDocument10 pagesGreen HRMHasan TarekNo ratings yet

- SO23 Supplier ColorcardDocument1 pageSO23 Supplier ColorcardHasan TarekNo ratings yet

- Pizza HutDocument5 pagesPizza HutHasan Tarek100% (1)

- SWOTDocument2 pagesSWOTHasan TarekNo ratings yet

- Enron Scandal: A Corporate View: Analyzed and Prepared by Group 6Document17 pagesEnron Scandal: A Corporate View: Analyzed and Prepared by Group 6PankajYadavNo ratings yet

- PizzaHut ReportDocument19 pagesPizzaHut ReportDaniel KarthikNo ratings yet

- Vital Role of Sampling in Garment ManufacturingDocument5 pagesVital Role of Sampling in Garment ManufacturingHasan TarekNo ratings yet

- Green HRMDocument10 pagesGreen HRMHasan TarekNo ratings yet

- Chp-15 Conflict & Negotiation FinalDocument53 pagesChp-15 Conflict & Negotiation FinalHasan Tarek100% (1)

- Chp-3 & 4-Values, Attitue and Job Satisfaction FinalDocument41 pagesChp-3 & 4-Values, Attitue and Job Satisfaction FinalHasan TarekNo ratings yet

- Final Professional BDocument2 pagesFinal Professional BHasan TarekNo ratings yet

- Developing Agri Business Strategy in BangladeshDocument0 pagesDeveloping Agri Business Strategy in BangladeshOoAIDoONo ratings yet

- Getco ProfileDocument38 pagesGetco ProfileHasan TarekNo ratings yet

- ADJUSTING JOURNALSDocument27 pagesADJUSTING JOURNALSHasan TarekNo ratings yet

- Getco ProfileDocument38 pagesGetco ProfileHasan TarekNo ratings yet

- Paper 05 PDFDocument12 pagesPaper 05 PDFHasan TarekNo ratings yet

- Chapter 6Document5 pagesChapter 6Hasan TarekNo ratings yet

- Chapter 17Document4 pagesChapter 17Hasan TarekNo ratings yet

- Ch1 Ten PrinciplesDocument29 pagesCh1 Ten PrinciplesHeta ShastriNo ratings yet

- Forntier Park General Journel Date Titles & Explanation Ref Debit CreditDocument15 pagesForntier Park General Journel Date Titles & Explanation Ref Debit CreditHasan TarekNo ratings yet

- Chapter 08Document41 pagesChapter 08Hasan TarekNo ratings yet

- Annual Report 2013Document77 pagesAnnual Report 2013Hasan TarekNo ratings yet

- Chapter 07Document38 pagesChapter 07Hasan TarekNo ratings yet

- Chapter 08Document41 pagesChapter 08Hasan TarekNo ratings yet

- Chapter 07Document38 pagesChapter 07Hasan TarekNo ratings yet

- AC17-602P-REGUNAYAN-Midterm Examination Chapters 3 & 4Document13 pagesAC17-602P-REGUNAYAN-Midterm Examination Chapters 3 & 4Marco RegunayanNo ratings yet

- Campari Financial Model Operating ModelDocument99 pagesCampari Financial Model Operating ModelPietro SantoroNo ratings yet

- Insurance Claim PDFDocument15 pagesInsurance Claim PDFbinuNo ratings yet

- Hongren CH 17Document68 pagesHongren CH 17Sindymhn100% (1)

- Sujide, Kendrew Statement of Comprehensive IncomeDocument5 pagesSujide, Kendrew Statement of Comprehensive IncomeKendrew SujideNo ratings yet

- Intermediate Accounting - MidtermsDocument9 pagesIntermediate Accounting - MidtermsKim Cristian MaañoNo ratings yet

- Name: - BlockDocument6 pagesName: - BlockDexter Saguyod ApolonioNo ratings yet

- Cost System and Cost Accumulation - Kelompok 6Document9 pagesCost System and Cost Accumulation - Kelompok 6JessicaTheLazy PlayerNo ratings yet

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- LSPU Self-Paced Learning Module on Strategic ManagementDocument20 pagesLSPU Self-Paced Learning Module on Strategic ManagementJamie Rose AragonesNo ratings yet

- AssignmentDocument6 pagesAssignmentIrishNo ratings yet

- SAMCIS - AE212 - Module 5 ACCOUNTING FOR FACTORY OVERHEADDocument29 pagesSAMCIS - AE212 - Module 5 ACCOUNTING FOR FACTORY OVERHEADUchayyaNo ratings yet

- Cost Accounting MCQs and ProblemsDocument5 pagesCost Accounting MCQs and ProblemsEnbathamizhanNo ratings yet

- Accounting Assignment 06A 207Document12 pagesAccounting Assignment 06A 207Aniyah's RanticsNo ratings yet

- Chapter 4 Job Order CostingDocument1 pageChapter 4 Job Order Costingagm25No ratings yet

- Akbi 1Document34 pagesAkbi 1Rizki Anissa0% (1)

- GROUP ASSIGNMENTDocument12 pagesGROUP ASSIGNMENTAn Phan Thị HoàiNo ratings yet

- Analyzing Financial Performance Reports Chapter 19Document2 pagesAnalyzing Financial Performance Reports Chapter 19Kunjan ChaudharyNo ratings yet

- Cost Terms, Concepts, and Classifications: Solutions To QuestionsDocument14 pagesCost Terms, Concepts, and Classifications: Solutions To QuestionsTrishia OliverosNo ratings yet

- Inventory Valuation MethodsDocument2 pagesInventory Valuation MethodsVel JuneNo ratings yet

- Petty Cash Book ReconciliationDocument7 pagesPetty Cash Book ReconciliationWahyu PutriNo ratings yet

- Accounting ActivitiesDocument25 pagesAccounting Activitiesjoshua korylle mahinayNo ratings yet

- Tutorial 1a - Budgeting Functional QDocument4 pagesTutorial 1a - Budgeting Functional QNur Dina AbsbNo ratings yet

- Unit - 1 - Acma CMC 653Document128 pagesUnit - 1 - Acma CMC 653sakshiNo ratings yet

- A141 Tutorial 6Document7 pagesA141 Tutorial 6CyrilraincreamNo ratings yet