Professional Documents

Culture Documents

Basic S/O 210 210 Diluted S/O 215 215 EOY Price 73 54.88 FY 2012

Uploaded by

Michael Loeb0 ratings0% found this document useful (0 votes)

9 views57 pagesSpreadsheet showing Return on Tangible Capital calculations

Original Title

ROTC

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSpreadsheet showing Return on Tangible Capital calculations

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views57 pagesBasic S/O 210 210 Diluted S/O 215 215 EOY Price 73 54.88 FY 2012

Uploaded by

Michael LoebSpreadsheet showing Return on Tangible Capital calculations

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 57

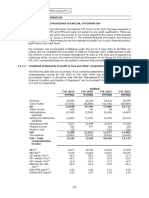

Basic S/O 210 210

Diluted S/O 215 215

EOY Price 73 54.88

FY2013 FY 2012

Revenue 11,764 8,186

EBIT as reported 1,550 1,297

5-year average operating margin (14.0%) 1,647 1,146

Special items average adjustment - -

EBIT adjusted 1,550 1,297

EBIT adjusted margin 13.2% 15.8%

Interest Expense 430 289

Pre-Tax Profits 1120 1009

EBT adjusted margin 9.5% 12.3%

After tax of 33% 1,039 869

Add: D&A 528 344

Subtract: CapEx 618 550

Cash Flow as adjusted 949 663

Cash Flow as adjusted margin 8.1% 8.1%

Cash Flow as reported

Tangible Capital:

Total Assets 17,099 16,015

Less: Unrestricted Cash 716 407

Less: Goodwill & Intangibles 11,237 11,081

Less: Current Liabilities 2,462 2,016

Net Tangible Capital (NTC) 2,683 2,510

EPV at 10% 9,490 6,628

Less: Total debt 8,141 8,326

Plus: Cash in excess of 1% of sales 946 534

Total EPV 2,295 (1,164)

Enterprise Value 22,855 19,578

EBITDA-CapEx 1,460.52 1,090.85

EV/(EBITDA-Capex) 16 18

Price/Pre-Tax Profit 14 12

EV/EBIT 15 18

ROTC (Operating Profit/NTC) 57.8% 51.7%

Basic S/O 88 94.6

Diluted S/O 102 108.1

EOY Price 33.34 20.69

FY2013 FY 2012

Revenue 2,247 2,135

EBIT as reported 482 417

5-year average operating margin (20.0%) 449 427

Special items average adjustment - -

EBIT adjusted 449 427

EBIT adjusted margin 20.0% 20.0%

Interest Expense 100 94

Pre-Tax Profits 349 333

EBT adjusted margin 15.5% 15.6%

After tax of 33% 234 223

Add: D&A 95 83

Subtract: CapEx 195 141

Cash Flow as adjusted 133 165

Cash Flow as adjusted margin 5.9% 7.7%

Cash Flow as reported

Tangible Capital:

Total Assets 2,534 2,424

Less: Unrestricted Cash 65 133

Less: Goodwill & Intangibles 545 511

Less: Current Liabilities 312 301

Net Tangible Capital (NTC) 1,613 1,480

EPV at 10% 1,334 1,647

Less: Total debt 8,141 8,326

Plus: Cash in excess of 1% of sales 946 534

Total EPV (5,861) (6,145)

Enterprise Value 22,855 13,725

EBITDA-CapEx 348.94 368.68

EV/(EBITDA-Capex) 65.50 37.23

Price/Pre-Tax Profit 9.75 6.72

EV/EBIT 24 23

ROTC (Operating Profit/NTC) 28% 29%

Basic S/O 548 638

Diluted S/O 553 644

EOY Price 69.06 51.67 38190.18

FY2013 FY 2012

Revenue 31,754 29,740

EBIT as reported 5,150 5,085

5-year average operating margin (16.0%) 5,081 4,758

Special items average adjustment - -

EBIT adjusted 5,081 4,758

EBIT adjusted margin 16.0% 16.0%

Interest Expense 840 842

Pre-Tax Profits 4241 3916

EBT adjusted margin 13.4% 13.2%

After tax of 33% 2,841 2,624

Add: D&A 2,828 2,437

Subtract: CapEx 3,409 2,960

Cash Flow as adjusted 2,260 2,101

Cash Flow as adjusted margin 7.1% 7.1%

Cash Flow as reported

Tangible Capital:

Total Assets 21,905 20,555

Less: Unrestricted Cash 1,635 1,427

Less: Goodwill & Intangibles 4,890 4,895

Less: Current Liabilities 6,530 5,541

Net Tangible Capital (NTC) 8,850 8,693

EPV at 10% 22,602 21,010

Less: Total debt 18,284 17,170

Plus: Cash in excess of 1% of sales 1,862 1,605

Total EPV 6,181 5,444

Enterprise Value 54,612 48,841

EBITDA-CapEx 4,500 4,235

EV/(EBITDA-Capex) 12.14 11.53

Price/Pre-Tax Profit 9.01 8.50

EV/EBIT 11 10

ROTC (Operating Profit/NTC) 57.4% 54.7%

Basic S/O 483 487.3

Diluted S/O 487 492.2

EOY Price 80.8 56.93

FY2013 FY 2012

Revenue 8,929 8,363

EBIT as reported 1,998 1,810

5-year average operating margin (21.0%) 1,875 1,756

Special items average adjustment - -

EBIT adjusted 1,875 1,756

EBIT adjusted margin 21.0% 21.0%

Interest Expense 9 8

Pre-Tax Profits 1866 1748

EBT adjusted margin 20.9% 20.9%

After tax of 33% 1,250 1,171

Add: D&A 317 320

Subtract: CapEx 175 140

Cash Flow as adjusted 1,393 1,351

Cash Flow as adjusted margin 15.6% 16.2%

Cash Flow as reported

Tangible Capital:

Total Assets 32,268 30,817

Less: Unrestricted Cash 1,274 1,161

Less: Goodwill & Intangibles 3,696 3,750

Less: Current Liabilities 6,530 5,541

Net Tangible Capital (NTC) 20,768 20,365

EPV at 10% 13,925 13,510

Less: Total debt 15 17

Plus: Cash in excess of 1% of sales 1,610 1,464

Total EPV 15,521 14,958

Enterprise Value 37,763 26,573

EBITDA-CapEx 2,017 1,936

EV/(EBITDA-Capex) 18.72 13.73

Price/Pre-Tax Profit 21.09 16.03

EV/EBIT 20 15

ROTC (Operating Profit/NTC) 9% 9%

Basic S/O 168 165.89

Diluted S/O 172 171.709

EOY Price 62.46 50.97

FY2013 FY 2012

Revenue 1,596 1,408

EBIT as reported 614 572

5-year average operating margin (38.0%) 606 535

Special items average adjustment - -

EBIT adjusted 606 535

EBIT adjusted margin 38.0% 38.0%

Interest Expense 76 72

Pre-Tax Profits 530 463

EBT adjusted margin 33.2% 32.9%

After tax of 33% 355 310

Add: D&A 137 107

Subtract: CapEx 146 74

Cash Flow as adjusted 347 342

Cash Flow as adjusted margin 21.7% 24.3%

Cash Flow as reported

Tangible Capital:

Total Assets 2,504 2,360

Less: Unrestricted Cash 124 67

Less: Goodwill & Intangibles 1,629 1,768

Less: Current Liabilities 431 585

Net Tangible Capital (NTC) 320 (61)

EPV at 10% 3,466 3,421

Less: Total debt 1,271 1,266

Plus: Cash in excess of 1% of sales 150 76

Total EPV 2,344 2,230

Enterprise Value 11,882 9,942

EBITDA-CapEx 598 567

EV/(EBITDA-Capex) 20 18

Price/Pre-Tax Profit 20 19

EV/EBIT 20 19

ROTC (Operating Profit/NTC) 190% -880%

Basic S/O 5 5.027509

Diluted S/O 5 5.237671

EOY Price 88.76 57.55

FY2013 FY 2012

Revenue 56 52

EBIT as reported 30 27

5-year average operating margin (50.0%) 28 26

Special items average adjustment - -

EBIT adjusted 28 26

EBIT adjusted margin 50.0% 50.0%

Interest Expense 0 0

Pre-Tax Profits 28 26

EBT adjusted margin 49.6% 49.2%

After tax of 33% 19 17

Add: D&A 0 0

Subtract: CapEx 21 24

Cash Flow as adjusted (2) (6)

Cash Flow as adjusted margin -3.9% -12.3%

Cash Flow as reported

Tangible Capital:

Total Assets 53 44

Less: Unrestricted Cash 8 2

Less: Goodwill & Intangibles - -

Less: Current Liabilities - -

Net Tangible Capital (NTC) 45 42

EPV at 10% (22) (64)

Less: Total debt - -

Plus: Cash in excess of 1% of sales 10 2

Total EPV (12) (62)

Enterprise Value 455 300

EBITDA-CapEx 7 2

EV/(EBITDA-Capex) 63 124

Price/Pre-Tax Profit 17 12

EV/EBIT 16 12

ROTC (Operating Profit/NTC) 62% 62%

Basic S/O 73 70

Diluted S/O 75 75

EOY Price 36.25 27.41

FY2013 FY 2012

Revenue 1,280 1,277

EBIT as reported 190 221

5-year average operating margin (16.0%) 205 204

Special items average adjustment - -

EBIT adjusted 205 204

EBIT adjusted margin 16.0% 16.0%

Interest Expense 0 0

Pre-Tax Profits 205 204

EBT adjusted margin 16.0% 16.0%

After tax of 33% 137 137

Add: D&A 0 0

Subtract: CapEx 21 24

Cash Flow as adjusted 116 113

Cash Flow as adjusted margin 9.1% 8.9%

Cash Flow as reported

Tangible Capital:

Total Assets 2,119 2,007

Less: Unrestricted Cash 78 51

Less: Goodwill & Intangibles 1,112 1,312

Less: Current Liabilities 322 319

Net Tangible Capital (NTC) 608 325

EPV at 10% 1,164 1,130

Less: Total debt 515 390

Plus: Cash in excess of 1% of sales 91 55

Total EPV 740 796

Enterprise Value 3,127 2,389

EBITDA-CapEx 184 181

EV/(EBITDA-Capex) 17 13

Price/Pre-Tax Profit 13 10

EV/EBIT 15 12

ROTC (Operating Profit/NTC) 34% 63%

Basic S/O 13 13

Diluted S/O 13 13

EOY Price 83.17 77.87

FY2013 FY 2012

Revenue 691 551

EBIT as reported 107 66 0.15497 0.118838

5-year average operating margin (12.0%) 83 66

Special items average adjustment - -

EBIT adjusted 83 66

EBIT adjusted margin 12.0% 12.0%

Interest Expense 0 0

Pre-Tax Profits 83 66

EBT adjusted margin 12.0% 11.9%

After tax of 33% 55 44

Add: D&A 0 0

Subtract: CapEx 11 10

Cash Flow as adjusted 45 35

Cash Flow as adjusted margin 6.5% 6.3%

Cash Flow as reported

Tangible Capital:

Total Assets 512 416

Less: Unrestricted Cash 114 108

Less: Goodwill & Intangibles 73 55

Less: Current Liabilities 102 80

Net Tangible Capital (NTC) 223 172

EPV at 10% 446 345

Less: Total debt - -

Plus: Cash in excess of 1% of sales 145 138

Total EPV 591 483

Enterprise Value 928 860

EBITDA-CapEx 72 57

EV/(EBITDA-Capex) 13 15

Price/Pre-Tax Profit 13 15

EV/EBIT 11 13

ROTC (Operating Profit/NTC) 37% 38%

Basic S/O 465 467

Diluted S/O 467 469

EOY Price 67.25 52.25

FY2013 FY 2012

Revenue 23,939 25,364

EBIT as reported 4,816 4,302

5-year average operating margin (12.0%) 4,309 4,566

Special items average adjustment - -

EBIT adjusted 4,309 4,566

EBIT adjusted margin 18.0% 18.0%

Interest Expense 0 0

Pre-Tax Profits 4309 4565

EBT adjusted margin 18.0% 18.0%

After tax of 33% 2,887 3,059

Add: D&A 0 0

Subtract: CapEx - -

Cash Flow as adjusted 2,887 3,059

Cash Flow as adjusted margin 12.1% 12.1%

Cash Flow as reported

Tangible Capital:

Total Assets 121,307 131,094

Less: Unrestricted Cash 2,543 2,041

Less: Goodwill & Intangibles - -

Less: Current Liabilities 17,285 17,396

Net Tangible Capital (NTC) 101,479 111,657

EPV at 10% 28,873 30,590

Less: Total debt - -

Plus: Cash in excess of 1% of sales 3,151 2,468

Total EPV 32,024 33,058

Enterprise Value 28,282 22,053

EBITDA-CapEx 4,309 4,566

EV/(EBITDA-Capex) 7 5

Price/Pre-Tax Profit 7 5

EV/EBIT 7 5

ROTC (Operating Profit/NTC) 4% 4%

Basic S/O 30 30

Diluted S/O 30 30

EOY Price 83 74.44

FY2013 FY 2012

Revenue 2,239 1,999

EBIT as reported 128 108

5-year average operating margin (5.0%) 112 100 0.057139 0.05398

Special items average adjustment - -

EBIT adjusted 112 100

EBIT adjusted margin 5.0% 5.0%

Interest Expense 4 5

Pre-Tax Profits 108 95

EBT adjusted margin 4.8% 4.7%

After tax of 33% 72 63

Add: D&A 0 0

Subtract: CapEx 70 53

Cash Flow as adjusted 3 11

Cash Flow as adjusted margin 0.1% 0.6%

Cash Flow as reported

Tangible Capital:

Total Assets 826 736

Less: Unrestricted Cash 91 68

Less: Goodwill & Intangibles 36 37

Less: Current Liabilities 275 235

Net Tangible Capital (NTC) 423 396

EPV at 10% 27 112

Less: Total debt - -

Plus: Cash in excess of 1% of sales 99 71

Total EPV 126 183

Enterprise Value 2,364 2,131

EBITDA-CapEx 42 48

EV/(EBITDA-Capex) 56 45

Price/Pre-Tax Profit 23 23

EV/EBIT 21 21

ROTC (Operating Profit/NTC) 26% 25%

Basic S/O 436 434

Diluted S/O 441 439

EOY Price 118.53 102.16

FY2013 FY 2012

Revenue 105,156 99,137

EBIT as reported 3,053 2,759

5-year average operating margin (2.8%) 2,944 2,776 0.029033 0.02783

Special items average adjustment - -

EBIT adjusted 2,944 2,776

EBIT adjusted margin 2.8% 2.8%

Interest Expense 99 95

Pre-Tax Profits 2845 2681

EBT adjusted margin 2.7% 2.7%

After tax of 33% 1,906 1,796

Add: D&A 946 908

Subtract: CapEx 2,083 1,480

Cash Flow as adjusted 769 1,224

Cash Flow as adjusted margin 0.7% 1.2%

Cash Flow as reported

Tangible Capital:

Total Assets 30,283 27,140

Less: Unrestricted Cash 4,000 3,000

Less: Goodwill & Intangibles - -

Less: Current Liabilities 13,257 12,260

Net Tangible Capital (NTC) 13,026 11,880

EPV at 10% 7,694 12,242

Less: Total debt 4,998 1,381

Plus: Cash in excess of 1% of sales 4,282 3,009

Total EPV 6,978 13,869

Enterprise Value 52,930 43,259

EBITDA-CapEx 1,807 2,204

EV/(EBITDA-Capex) 29 20

Price/Pre-Tax Profit 18 17

EV/EBIT 18 16

ROTC (Operating Profit/NTC) 23% 23%

Basic S/O 514 533

Diluted S/O 20 537

EOY Price 39.1 25.68

FY2013 FY 2012

Revenue 98,375 96,619

EBIT as reported 2,725 2,764

5-year average operating margin (2.7%) 2,656 2,609 0.0277 0.028607

Special items average adjustment - -

EBIT adjusted 2,656 2,609

EBIT adjusted margin 2.7% 2.7%

Interest Expense 443 462

Pre-Tax Profits 2213 2147

EBT adjusted margin 2.2% 2.2%

After tax of 33% 1,483 1,438

Add: D&A 1,703 1,652

Subtract: CapEx 2,330 2,062

Cash Flow as adjusted 856 1,028

Cash Flow as adjusted margin 0.9% 1.1%

Cash Flow as reported

Tangible Capital:

Total Assets 29,281 24,634

Less: Unrestricted Cash 301 138

Less: Goodwill & Intangibles 2,837 1,364

Less: Current Liabilities 10,705 11,061

Net Tangible Capital (NTC) 15,438 12,071

EPV at 10% 8,558 10,283

Less: Total debt 9,654 6,141

Plus: Cash in excess of 1% of sales (582) (782)

Total EPV (1,678) 3,360

Enterprise Value 11,018 20,713

EBITDA-CapEx 2,029 2,199

EV/(EBITDA-Capex) 5 9

Price/Pre-Tax Profit 0.4 6

EV/EBIT 4 8

ROTC (Operating Profit/NTC) 17% 22%

Basic S/O 133 145 157

Diluted S/O 149 156 164

EOY Price 49.61 59.41 38

At Current Values FY2013 FY 2012

Revenue 965 965 874

EBIT as reported 528 528 457 0.547341 0.523502 6618.817

5-year average operating margin (50.0%) 483 483 437

Special items average adjustment - - -

EBIT adjusted 483 483 437

EBIT adjusted margin 50.0% 50.0% 50.0%

Interest Expense 75 75 50

Pre-Tax Profits 408 408 387

EBT adjusted margin 42.3% 42.3% 44.3%

After tax of 33% 273 273 259

Add: D&A 61 61 55

Subtract: CapEx 66 66 53

Cash Flow as adjusted 268 268 261

Cash Flow as adjusted margin 27.8% 27.8% 29.9%

Cash Flow as reported

Tangible Capital:

Total Assets 2,661 2,661 2,062

Less: Unrestricted Cash 1,292 1,292 1,167

Less: Goodwill & Intangibles 53 53 53

Less: Current Liabilities 2,029 2,029 695

Net Tangible Capital (NTC) (713) (713) 148

EPV at 10% 2,683 2,683 2,608

Less: Total debt 750 750 1,085

Plus: Cash in excess of 1% of sales 1,714 1,714 1,548

Total EPV 3,646 3,646 3,071

Enterprise Value 6,408 8,292 5,765

EBITDA-CapEx 478 478 439

EV/(EBITDA-Capex) 13 17 13

Price/Pre-Tax Profit 18 23 16

EV/EBIT 13 17 13

ROTC (Operating Profit/NTC) -68% -68% 296%

Basic S/O 1211 1253

Diluted S/O 1215 1258

EOY Price 76.05 48.31

FY2013 FY 2012

Revenue 8,346 7,391

EBIT as reported 4,503 3,937

5-year average operating margin (50%) 4,173 3,696 0.53954 0.532675

Special items average adjustment - -

EBIT adjusted 4,173 3,696

EBIT adjusted margin 50.0% 50.0%

Interest Expense 14 20

Pre-Tax Profits 4159 3676

EBT adjusted margin 49.8% 49.7%

After tax of 33% 2,787 2,463

Add: D&A 258 230

Subtract: CapEx 155 96

Cash Flow as adjusted 2,890 2,597

Cash Flow as adjusted margin 34.6% 35.1%

Cash Flow as reported

Tangible Capital:

Total Assets 14,242 12,462

Less: Unrestricted Cash 3,000 1,500

Less: Goodwill & Intangibles 1,794 1,764

Less: Current Liabilities 6,032 4,906

Net Tangible Capital (NTC) 3,416 4,292

EPV at 10% 28,895 25,966

Less: Total debt - -

Plus: Cash in excess of 1% of sales 3,000 1,500

Total EPV 31,895 27,466

Enterprise Value 89,401 59,274

EBITDA-CapEx 4,276 3,830

EV/(EBITDA-Capex) 21 15

Price/Pre-Tax Profit 22.2 17

EV/EBIT 21 16

ROTC (Operating Profit/NTC) 122% 86%

Basic S/O 27 30

Diluted S/O 28 32

EOY Price 68.65 50.1

FY2013 FY 2012

Revenue 2,307 2,200

EBIT as reported 260 279

5-year average operating margin (11%) 254 242 0.11272 0.127009

Special items average adjustment - -

EBIT adjusted 254 242

EBIT adjusted margin 11.0% 11.0%

Interest Expense 33 16

Pre-Tax Profits 221 226

EBT adjusted margin 9.6% 10.3%

After tax of 33% 148 152

Add: D&A 207 187

Subtract: CapEx 158 208

Cash Flow as adjusted 198 130

Cash Flow as adjusted margin 8.6% 5.9%

Cash Flow as reported

Tangible Capital:

Total Assets 1,897 1,562

Less: Unrestricted Cash 300 225

Less: Goodwill & Intangibles 639 344

Less: Current Liabilities 631 564

Net Tangible Capital (NTC) 327 429

EPV at 10% 1,975 1,302

Less: Total debt 769 357

Plus: Cash in excess of 1% of sales 300 225

Total EPV 1,506 1,171

Enterprise Value 2,418 1,744

EBITDA-CapEx 303 221

EV/(EBITDA-Capex) 8 8

Price/Pre-Tax Profit 9 7

EV/EBIT 10 7

ROTC (Operating Profit/NTC) 78% 56%

Basic S/O 194 187

Diluted S/O 193.885 187

EOY Price 21.33 8.98

FY2013 FY 2012

Revenue 6,478 5,819

EBIT as reported 140 (22)

5-year average operating margin (1.0%) 65 58

Special items average adjustment - -

EBIT adjusted 65 58

EBIT adjusted margin 1.0% 1.0%

Interest Expense 112 124

Pre-Tax Profits -47 -66

EBT adjusted margin -0.7% -1.1%

After tax of 33% (31) (44)

Add: D&A 369 430

Subtract: CapEx 135 124

Cash Flow as adjusted 203 262

Cash Flow as adjusted margin 3.1% 4.5%

Cash Flow as reported

Tangible Capital:

Total Assets 5,684 5,291

Less: Unrestricted Cash 1,100 900

Less: Goodwill & Intangibles 1,844 1,735

Less: Current Liabilities 2,256 1,768

Net Tangible Capital (NTC) 484 887

EPV at 10% 2,026 2,618

Less: Total debt 1,530 1,678

Plus: Cash in excess of 1% of sales 1,035 842

Total EPV 1,531 1,782

Enterprise Value 4,631 2,515

EBITDA-CapEx 299 364

EV/(EBITDA-Capex) 15 7

Price/Pre-Tax Profit (88) (26)

EV/EBIT 71 43

ROTC (Operating Profit/NTC) 13% 7%

Basic S/O 42 42

Diluted S/O 42 42

EOY Price 91.93 52.81

FY2013 FY 2012

Revenue 825 724

EBIT as reported 268 212

5-year average operating margin (30.0%) 247 217

Special items average adjustment - -

EBIT adjusted 247 217

EBIT adjusted margin 30.0% 30.0%

Interest Expense 0 0

Pre-Tax Profits 247 217

EBT adjusted margin 30.0% 30.0%

After tax of 33% 166 146

Add: D&A 14 14

Subtract: CapEx 20 32

Cash Flow as adjusted 160 128

Cash Flow as adjusted margin 19.4% 17.6%

Cash Flow as reported

Tangible Capital:

Total Assets 997 726

Less: Unrestricted Cash 150 75

Less: Goodwill & Intangibles 1 1

Less: Current Liabilities 124 148

Net Tangible Capital (NTC) 722 501

EPV at 10% 1,598 1,276

Less: Total debt 146 50

Plus: Cash in excess of 1% of sales 142 68

Total EPV 1,594 1,294

Enterprise Value 3,854 2,189

EBITDA-CapEx 241 199

EV/(EBITDA-Capex) 16 11

Price/Pre-Tax Profit 16 10

EV/EBIT 16 10

ROTC (Operating Profit/NTC) 34% 43%

Basic S/O 141 134

Diluted S/O 149 145

EOY Price 21.31 13.61

FY2013 FY 2012

Revenue 5,479 5,758

EBIT as reported 461 446 0.084073 0.077497

5-year average operating margin (8.0%) 438 461

Special items average adjustment - -

EBIT adjusted 438 461

EBIT adjusted margin 8.0% 8.0%

Interest Expense 78 70

Pre-Tax Profits 360 390

EBT adjusted margin 6.6% 6.8%

After tax of 33% 241 262

Add: D&A 72 74

Subtract: CapEx 21 33

Cash Flow as adjusted 293 302

Cash Flow as adjusted margin 5.3% 5.3%

Cash Flow as reported

Tangible Capital:

Total Assets 2,941 3,178

Less: Unrestricted Cash 200 300

Less: Goodwill & Intangibles 1,274 1,277

Less: Current Liabilities 917 965

Net Tangible Capital (NTC) 550 636

EPV at 10% 2,928 3,024

Less: Total debt 1,585 1,660

Plus: Cash in excess of 1% of sales 200 300

Total EPV 1,543 1,665

Enterprise Value 4,554 3,331

EBITDA-CapEx 490 502

EV/(EBITDA-Capex) 9 7

Price/Pre-Tax Profit 9 5

EV/EBIT 10 7

ROTC (Operating Profit/NTC) 80% 72%

Basic S/O 150 155

Diluted S/O 151 156

EOY Price 58.19 48.68

FY2013 FY 2012

Revenue 3,256 3,121

EBIT as reported 621 595 0.190783 0.190522

5-year average operating margin (18.0%) 586 562

Special items average adjustment - -

EBIT adjusted 586 562

EBIT adjusted margin 18.0% 18.0%

Interest Expense 36 30

Pre-Tax Profits 550 532

EBT adjusted margin 16.9% 17.0%

After tax of 33% 368 356

Add: D&A 162 132

Subtract: CapEx 243 236

Cash Flow as adjusted 287 252

Cash Flow as adjusted margin 8.8% 8.1%

Cash Flow as reported

Tangible Capital:

Total Assets 2,434 2,284

Less: Unrestricted Cash 50 120

Less: Goodwill & Intangibles 0 0

Less: Current Liabilities 586 463

Net Tangible Capital (NTC) 1,797 1,700

EPV at 10% 2,873 2,524

Less: Total debt 881 427

Plus: Cash in excess of 1% of sales 18 89

Total EPV 2,010 2,186

Enterprise Value 9,628 7,916

EBITDA-CapEx 505 458

EV/(EBITDA-Capex) 19 17

Price/Pre-Tax Profit 16 14

EV/EBIT 16 14

ROTC (Operating Profit/NTC) 33% 33%

Basic S/O 29 29

Diluted S/O 29 29

EOY Price 147.58 156.81

FY2013 FY 2012

Revenue 2,385 2,130

EBIT as reported 310 283 0.129877 0.132799

5-year average operating margin (13.0%) 310 277

Special items average adjustment - -

EBIT adjusted 310 277

EBIT adjusted margin 13.0% 13.0%

Interest Expense 1 1

Pre-Tax Profits 309 276

EBT adjusted margin 13.0% 13.0%

After tax of 33% 207 185

Add: D&A 107 91

Subtract: CapEx 192 152

Cash Flow as adjusted 122 123

Cash Flow as adjusted margin 5.1% 5.8%

Cash Flow as reported

Tangible Capital:

Total Assets 1,181 1,268

Less: Unrestricted Cash 75 247

Less: Goodwill & Intangibles 203 210

Less: Current Liabilities 303 278

Net Tangible Capital (NTC) 600 534

EPV at 10% 1,216 1,235

Less: Total debt - -

Plus: Cash in excess of 1% of sales 51 226

Total EPV 1,267 1,460

Enterprise Value 4,198 4,393

EBITDA-CapEx 225 216

EV/(EBITDA-Capex) 19 20

Price/Pre-Tax Profit 14 17

EV/EBIT 14 16

ROTC (Operating Profit/NTC) 52% 52%

Basic S/O 31 32

Diluted S/O 31 32

EOY Price 530.75 300.18

FY2013 FY 2012

Revenue 3,215 2,731

EBIT as reported 533 456 0.165719 0.166909

5-year average operating margin (16.5%) 530 451

Special items average adjustment - -

EBIT adjusted 530 451

EBIT adjusted margin 16.5% 16.5%

Interest Expense 0 0

Pre-Tax Profits 530 451

EBT adjusted margin 16.5% 16.5%

After tax of 33% 355 302

Add: D&A 96 84

Subtract: CapEx 200 152

Cash Flow as adjusted 252 234

Cash Flow as adjusted margin 7.8% 8.6%

Cash Flow as reported

Tangible Capital:

Total Assets 2,009 1,669

Less: Unrestricted Cash 273 272

Less: Goodwill & Intangibles 22 22

Less: Current Liabilities 199 199

Net Tangible Capital (NTC) 1,515 1,176

EPV at 10% 2,515 2,337

Less: Total debt - -

Plus: Cash in excess of 1% of sales 241 245

Total EPV 2,756 2,582

Enterprise Value 16,362 9,296

EBITDA-CapEx 427 382

EV/(EBITDA-Capex) 38 24

Price/Pre-Tax Profit 31 21

EV/EBIT 31 21

ROTC (Operating Profit/NTC) 35% 38%

Basic S/O 55 54

Diluted S/O 55 54

EOY Price 160.91 133.05

FY2013 FY 2012

Revenue 1,924 1,700

EBIT as reported 749 700 0.389449 0.411582

5-year average operating margin (38.5%) 741 655

Special items average adjustment - -

EBIT adjusted 741 655

EBIT adjusted margin 38.5% 38.5%

Interest Expense 271 212

Pre-Tax Profits 470 443

EBT adjusted margin 24.4% 26.0%

After tax of 33% 315 297

Add: D&A 85 81

Subtract: CapEx 36 25

Cash Flow as adjusted 365 352

Cash Flow as adjusted margin 19.0% 20.7%

Cash Flow as reported

Tangible Capital:

Total Assets 6,149 5,460

Less: Unrestricted Cash 500 380

Less: Goodwill & Intangibles 4,533 4,159

Less: Current Liabilities 323 234

Net Tangible Capital (NTC) 793 687

EPV at 10% 3,650 3,521

Less: Total debt 5,700 3,599

Plus: Cash in excess of 1% of sales 481 363

Total EPV (1,570) 286

Enterprise Value 14,082 10,405

EBITDA-CapEx 791 710

EV/(EBITDA-Capex) 18 15

Price/Pre-Tax Profit 19 16

EV/EBIT 19 16

ROTC (Operating Profit/NTC) 93% 95%

Basic S/O 50 50

Diluted S/O 51 51

EOY Price 60 48.84

FY2013 FY 2012

Revenue 1,131 1,122

EBIT as reported 175 183 0.154422 0.162881

5-year average operating margin (16.0%) 181 179

Special items average adjustment - -

EBIT adjusted 181 179

EBIT adjusted margin 16.0% 16.0%

Interest Expense 0 0

Pre-Tax Profits 181 179

EBT adjusted margin 16.0% 16.0%

After tax of 33% 121 120

Add: D&A 32 32

Subtract: CapEx 45 36

Cash Flow as adjusted 109 116

Cash Flow as adjusted margin 9.6% 10.3%

Cash Flow as reported

Tangible Capital:

Total Assets 1,449 1,206

Less: Unrestricted Cash 361 136

Less: Goodwill & Intangibles 331 338

Less: Current Liabilities 208 175

Net Tangible Capital (NTC) 549 558

EPV at 10% 1,088 1,156

Less: Total debt 116 16

Plus: Cash in excess of 1% of sales 350 124

Total EPV 1,321 1,264

Enterprise Value 2,799 2,377

EBITDA-CapEx 169 175

EV/(EBITDA-Capex) 17 14

Price/Pre-Tax Profit 17 14

EV/EBIT 15 13

ROTC (Operating Profit/NTC) 33% 32%

Basic S/O 1082 1135

Diluted S/O 1089 1141

EOY Price 89.74 59.61

FY2013 FY 2012

Revenue 32,974 31,555

EBIT as reported 9,404 8,197 0.285194 0.259769

5-year average operating margin (26.0%) 8,573 8,204

Special items average adjustment - -

EBIT adjusted 8,573 8,204

EBIT adjusted margin 26.0% 26.0%

Interest Expense 1516 1746

Pre-Tax Profits 7057 6458

EBT adjusted margin 21.4% 20.5%

After tax of 33% 4,728 4,327

Add: D&A 32 32

Subtract: CapEx 45 36

Cash Flow as adjusted 4,716 4,322

Cash Flow as adjusted margin 14.3% 13.7%

Cash Flow as reported

Tangible Capital:

Total Assets 153,375 153,140

Less: Unrestricted Cash 18,000 20,750

Less: Goodwill & Intangibles - -

Less: Current Liabilities 73,528 71,967

Net Tangible Capital (NTC) 61,847 60,423

EPV at 10% 47,159 43,224

Less: Total debt 60,351 62,287

Plus: Cash in excess of 1% of sales 17,670 20,434

Total EPV 4,479 1,372

Enterprise Value 140,408 109,868

EBITDA-CapEx 8,561 8,200

EV/(EBITDA-Capex) 16 13

Price/Pre-Tax Profit 14 11

EV/EBIT 16 13

ROTC (Operating Profit/NTC) 14% 14%

Basic S/O 485 518 542 544 505 479

Diluted S/O 487 520 543 549 508 479

EOY Price 55.07 37.99 24.49 18.89 15.03 9.51

FY2013 FY 2012 FY2011 FY2010 FY2009 FY2008

Revenue 7,583 7,290 6,345 6,146 3,145 605

EBIT as reported 4,389 4,429 4,442 4,376 4,006 17

5-year average operating margin (50.0%) 3,792 3,645 3,173 3,073 1,573 302

Special items average adjustment - - (31) - - (57)

EBIT adjusted 3,792 3,645 3,204 3,073 1,573 74

EBIT adjusted margin 50.0% 50.0% 50.5% 50.0% 50.0% 12.2%

Interest Expense 445 485 498 432 62 12

Pre-Tax Profits 3347 3160 2706 2641 1511 62

EBT adjusted margin 44.1% 43.3% 42.6% 43.0% 48.0% 10.2%

After tax of 33% 2,242 2,117 1,813 1,769 1,012 41

Add: D&A 334 267 20 172 203 15

Subtract: CapEx 231 144 112 55 54 19

Cash Flow as adjusted 2,345 2,240 1,722 1,887 1,162 38

Cash Flow as adjusted margin 30.9% 30.7% 27.1% 30.7% 36.9% 6.2%

Cash Flow as reported

Tangible Capital:

Total Assets 79,340 73,491 68,784 60,785 46,021 39,892

Less: Unrestricted Cash 5,500 1,500 2,000 4,500 12,000 9,000

Less: Goodwill & Intangibles 469 475 443 444 451 459

Less: Current Liabilities 48,057 45,952 39,627 34,413 36,777 33,504

Net Tangible Capital (NTC) 25,314 25,564 26,713 21,427 (3,207) (3,070)

EPV at 10% 23,452 22,402 17,215 18,865 11,620 376

Less: Total debt 20,474 17,666 18,337 17,706 83 92

Plus: Cash in excess of 1% of sales 5,424 1,427 2,000 4,500 12,000 9,000

Total EPV 8,402 6,163 878 5,660 23,537 9,284

Enterprise Value 41,861 35,979 29,626 23,572 (4,284) (4,350)

EBITDA-CapEx 3,895 3,768 3,112 3,190 1,722 70

EV/(EBITDA-Capex) 11 10 10 7 (2) (62)

Price/Pre-Tax Profit 8 6 5 4 5 74

EV/EBIT 11 10 9 8 (3) (59)

ROTC (Operating Profit/NTC) 15% 14% 12% 14% -49% -2%

477 22

478 22

13.94 0

FY2007 FY2006

506 394

123 20

253 216 57.9% 60.8% 70.0% 71.2% 127.4% 2.8%

64 -

59 216

11.7% 55.0%

19 14

40 202

7.9% 51.4%

27 136

15 11

14 10

28 137

5.6% 34.8%

897

38 430

185 2,878

148 1,182

525 (4,490)

284 1,368

204 1,694

38 430

118 104

6,829 1,264

61 218

112 6

166 -

115 6

11% -5%

Basic S/O 3782 3809

Diluted S/O 3815 3822

EOY Price 58.66 43.24

FY2013 FY 2012

Revenue 96,606 97,013

EBIT as reported 33,016 37,683 0.341754 0.38843

5-year average operating margin (35.0%) 33,812 33,955

Special items average adjustment - -

EBIT adjusted 33,812 33,955

EBIT adjusted margin 35.0% 35.0%

Interest Expense 7102 8766

Pre-Tax Profits 26710 25189

EBT adjusted margin 27.6% 26.0%

After tax of 33% 17,896 16,876

Add: D&A 5,306 5,147

Subtract: CapEx 679 3,400

Cash Flow as adjusted 22,523 18,623

Cash Flow as adjusted margin 23.3% 19.2%

Cash Flow as reported

Tangible Capital:

Total Assets 2,415,689 2,359,141

Less: Unrestricted Cash 39,771 53,723

Less: Goodwill & Intangibles 49,699 50,410

Less: Current Liabilities 1,936,622 1,906,048

Net Tangible Capital (NTC) 389,597 348,960

EPV at 10% 225,228 186,233

Less: Total debt 267,889 249,024

Plus: Cash in excess of 1% of sales 39,771 53,723

Total EPV (2,890) (9,068)

Enterprise Value 451,900 360,573

EBITDA-CapEx 38,439 35,702

EV/(EBITDA-Capex) 12 10

Price/Pre-Tax Profit 8 7

EV/EBIT 13 11

ROTC (Operating Profit/NTC) 9% 10%

Basic S/O 210 210

Diluted S/O 210 210

EOY Price 10.02 13.72

FY2013 FY 2012

Revenue 4,033 3,797

EBIT as reported 229 237 0.056653 0.062316

5-year average operating margin (6.5%) 262 247

Special items average adjustment - -

EBIT adjusted 262 247

EBIT adjusted margin 6.5% 6.5%

Interest Expense 89 54

Pre-Tax Profits 174 193

EBT adjusted margin 4.3% 5.1%

After tax of 33% 116 129

Add: D&A 115 92

Subtract: CapEx 120 120

Cash Flow as adjusted 111 101

Cash Flow as adjusted margin 2.8% 2.7%

Cash Flow as reported

Tangible Capital:

Total Assets 2,180 2,049

Less: Unrestricted Cash 126 135

Less: Goodwill & Intangibles 70 67

Less: Current Liabilities 659 578

Net Tangible Capital (NTC) 1,325 1,269

EPV at 10% 1,112 1,014

Less: Total debt 771 650

Plus: Excess Cash 126 135

Total EPV 466 498

Enterprise Value 2,748 3,390

EBITDA-CapEx 257 219

EV/(EBITDA-Capex) 11 15

Price/Pre-Tax Profit 12 15

EV/EBIT 10 14

ROTC (Operating Profit/NTC) 20% 19%

Basic S/O 920 954

Diluted S/O 943 976

EOY Price 75.47 49.37

FY2013 FY 2012

Revenue 29,795 28,729

EBIT as reported 6,605 5,918 0.221681 0.205994

5-year average operating margin (22.0%) 6,555 6,320

Special items average adjustment - -

EBIT adjusted 6,555 6,320

EBIT adjusted margin 22.0% 22.0%

Interest Expense 1190 1253

Pre-Tax Profits 5365 5067

EBT adjusted margin 18.0% 17.6%

After tax of 33% 3,594 3,395

Add: D&A 886 892

Subtract: CapEx 602 643

Cash Flow as adjusted 3,878 3,644

Cash Flow as adjusted margin 13.0% 12.7%

Cash Flow as reported

Tangible Capital:

Total Assets 67,994 68,089

Less: Unrestricted Cash 1,700 2,700

Less: Goodwill & Intangibles 38,192 38,088

Less: Current Liabilities 8,383 9,799

Net Tangible Capital (NTC) 19,719 17,502

EPV at 10% 38,785 36,441

Less: Total debt 20,099 19,122

Plus: Excess Cash 1,700 2,700

Total EPV 20,386 20,019

Enterprise Value 89,537 64,622

EBITDA-CapEx 6,839 6,569

EV/(EBITDA-Capex) 13 10

Price/Pre-Tax Profit 13 10

EV/EBIT 14 10

ROTC (Operating Profit/NTC) 33% 36%

Basic S/O 998 1010

Diluted S/O 1006 1020

EOY Price 96.91 89.849

FY2013 FY 2012

Revenue 28,106 27,567

EBIT as reported 8,764 8,605 0.311834 0.312134

2-year average operating margin (31.0%) 8,713 8,546

Special items average adjustment - -

EBIT adjusted 8,713 8,546

EBIT adjusted margin 31.0% 31.0%

Interest Expense 522 517

Pre-Tax Profits 8191 8029

EBT adjusted margin 29.1% 29.1%

After tax of 33% 5,488 5,380

Add: D&A 1,585 1,489

Subtract: CapEx 2,825 3,049

Cash Flow as adjusted 4,248 3,819

Cash Flow as adjusted margin 15.1% 13.9%

Cash Flow as reported

Tangible Capital:

Total Assets 36,626 35,387

Less: Unrestricted Cash 2,299 1,836

Less: Goodwill & Intangibles 2,873 2,804

Less: Current Liabilities 3,170 3,403

Net Tangible Capital (NTC) 28,285 27,343

EPV at 10% 42,483 38,188

Less: Total debt 14,130 13,633

Plus: Excess Cash 2,299 1,836

Total EPV 30,652 26,392

Enterprise Value 109,323 103,460

EBITDA-CapEx 7,473 6,985

EV/(EBITDA-Capex) 15 15

Price/Pre-Tax Profit 12 11

EV/EBIT 13 12

ROTC (Operating Profit/NTC) 31% 31%

Basic S/O 10 10

Diluted S/O 10 10

EOY Price 11.72 8.3

FY2013 FY 2012

Revenue 112 95

EBIT as reported 22 17 0.197072 0.173419

2-year average operating margin (20.0%) 22 19

Special items average adjustment - -

EBIT adjusted 22 19

EBIT adjusted margin 20.0% 20.0%

Interest Expense 7 4

Pre-Tax Profits 16 15

EBT adjusted margin 14.2% 15.8%

After tax of 33% 11 10

Add: D&A 5 5

Subtract: CapEx 10 7

Cash Flow as adjusted 6 8

Cash Flow as adjusted margin 5.6% 8.5%

Cash Flow as reported

Tangible Capital:

Total Assets 223 192

Less: Unrestricted Cash 5 -

Less: Goodwill & Intangibles 100 95

Less: Current Liabilities 29 23

Net Tangible Capital (NTC) 89 74

EPV at 10% 63 81

Less: Total debt 70 57

Plus: Excess Cash 5 -

Total EPV (2) 24

Enterprise Value 177 137

EBITDA-CapEx 18 17

EV/(EBITDA-Capex) 10 8

Price/Pre-Tax Profit 7 5

EV/EBIT 8 7

ROTC (Operating Profit/NTC) 25% 26%

Basic S/O 3 3

Diluted S/O 3 3

EOY Price 17.1 11.55

FY2013 FY 2012

Revenue 90 84

EBIT as reported 6 5 0.065631 0.06353

2-year average operating margin (6.5%) 6 5

Special items average adjustment - -

EBIT adjusted 6 5

EBIT adjusted margin 6.5% 6.5%

Interest Expense 1 0

Pre-Tax Profits 5 5

EBT adjusted margin 5.9% 6.0%

After tax of 33% 4 3

Add: D&A 1 1

Subtract: CapEx 5 1

Cash Flow as adjusted 0 4

Cash Flow as adjusted margin 0.2% 4.5%

Cash Flow as reported

Tangible Capital:

Total Assets 68 68

Less: Unrestricted Cash 10 8

Less: Goodwill & Intangibles 4 4

Less: Current Liabilities 10 12

Net Tangible Capital (NTC) 44 44

EPV at 10% 2 38

Less: Total debt 23 24

Plus: Excess Cash 10 8

Total EPV (11) 22

Enterprise Value 69 53

EBITDA-CapEx 2 6

EV/(EBITDA-Capex) 28 9

Price/Pre-Tax Profit 11 7

EV/EBIT 12 10

ROTC (Operating Profit/NTC) 13% 13%

Basic S/O 24 23

Diluted S/O 24 24

EOY Price 46.78 36.37

FY2013 FY 2012

Revenue 819 776

EBIT as reported 91 97 0.11065 0.124292

2-year average operating margin (11.5%) 94 89

Special items average adjustment - -

EBIT adjusted 94 89

EBIT adjusted margin 11.5% 11.5%

Interest Expense 2 2

Pre-Tax Profits 92 87

EBT adjusted margin 11.2% 11.3%

After tax of 33% 62 59

Add: D&A 20 12

Subtract: CapEx 11 9

Cash Flow as adjusted 71 61

Cash Flow as adjusted margin 8.7% 7.9%

Cash Flow as reported

Tangible Capital:

Total Assets 795 579

Less: Unrestricted Cash 70 12

Less: Goodwill & Intangibles 315 218

Less: Current Liabilities 156 147

Net Tangible Capital (NTC) 254 203

EPV at 10% 708 613

Less: Total debt 143 25

Plus: Excess Cash 70 12

Total EPV 636 600

Enterprise Value 1,203 880

EBITDA-CapEx 103 92

EV/(EBITDA-Capex) 12 10

Price/Pre-Tax Profit 12 10

EV/EBIT 13 10

ROTC (Operating Profit/NTC) 37% 44%

Basic S/O 37 37

Diluted S/O 38 37

EOY Price 93.82 66.69

FY2013 FY 2012

Revenue 2,339 2,127

EBIT as reported 240 243 0.102711 0.114276

2-year average operating margin (10%) 234 213

Special items average adjustment - -

EBIT adjusted 234 213

EBIT adjusted margin 10.0% 10.0%

Interest Expense 20 18

Pre-Tax Profits 213 195

EBT adjusted margin 9.1% 9.2%

After tax of 33% 143 131

Add: D&A 91 78

Subtract: CapEx 73 65

Cash Flow as adjusted 162 144

Cash Flow as adjusted margin 6.9% 6.8%

Cash Flow as reported

Tangible Capital:

Total Assets 2,751 2,406

Less: Unrestricted Cash 40 30

Less: Goodwill & Intangibles 1,309 1,256

Less: Current Liabilities 418 407

Net Tangible Capital (NTC) 984 713

EPV at 10% 1,615 1,436

Less: Total debt 549 556

Plus: Excess Cash 40 30

Total EPV 1,106 910

Enterprise Value 4,074 3,020

EBITDA-CapEx 252 226

EV/(EBITDA-Capex) 16 13

Price/Pre-Tax Profit 17 13

EV/EBIT 17 14

ROTC (Operating Profit/NTC) 24% 30%

Basic S/O 33 38

Diluted S/O 34 39

EOY Price 57.61 31.33

FY2013 FY 2012

Revenue 1,167 1,020

EBIT as reported 46 55 0.039507 0.054078

2-year average operating margin (4.5%) 53 46

Special items average adjustment - -

EBIT adjusted 53 46

EBIT adjusted margin 4.5% 4.5%

Interest Expense 5 2

Pre-Tax Profits 47 44

EBT adjusted margin 4.0% 4.3%

After tax of 33% 32 30

Add: D&A 64 59

Subtract: CapEx 79 46

Cash Flow as adjusted 17 43

Cash Flow as adjusted margin 1.5% 4.2%

Cash Flow as reported

Tangible Capital:

Total Assets 602 592

Less: Unrestricted Cash 40 50

Less: Goodwill & Intangibles 171 181

Less: Current Liabilities 155 142

Net Tangible Capital (NTC) 235 220

EPV at 10% 170 426

Less: Total debt 230 229

Plus: Excess Cash 40 50

Total EPV (20) 247

Enterprise Value 2,176 1,399

EBITDA-CapEx 38 59

EV/(EBITDA-Capex) 57 24

Price/Pre-Tax Profit 42 28

EV/EBIT 41 30

ROTC (Operating Profit/NTC) 22% 21%

Basic S/O 33

Diluted S/O 34

EOY Price 57.61

FY2013

Revenue 746

EBIT as reported 135 0.180965

2-year average operating margin (18.5%) 138

Special items average adjustment -

EBIT adjusted 138

EBIT adjusted margin 18.5%

Interest Expense 52

Pre-Tax Profits 86

EBT adjusted margin 11.5%

After tax of 33% 58

Add: D&A 45

Subtract: CapEx 11

Cash Flow as adjusted 92

Cash Flow as adjusted margin 12.3%

Cash Flow as reported

Tangible Capital:

Total Assets 2,394

Less: Unrestricted Cash 260

Less: Goodwill & Intangibles 1,666

Less: Current Liabilities 107

Net Tangible Capital (NTC) 361

EPV at 10% 916

Less: Total debt 230

Plus: Excess Cash 260

Total EPV 946

Enterprise Value 1,956

EBITDA-CapEx 172

EV/(EBITDA-Capex) 11

Price/Pre-Tax Profit 23

EV/EBIT 14

ROTC (Operating Profit/NTC) 38%

Basic S/O 123.808 99 91 44 43 43

Diluted S/O 125.485 100 91 44 44 43

EOY Price 64.5 62.48 27 29.56 18.41 12.95

1H 2014 FY2013 FY 2012 FY2011 FY2010 FY2009

Revenue 4700 4,207 3,914 693 542 525

EBIT as reported 500 406 140 26 34 40

2-year average operating margin (7.0%) 423 294 274 49 38 37

Special items average adjustment 0 - - (31) - -

EBIT adjusted 423 294 274 80 38 37

EBIT adjusted margin 9.0% 7.0% 7.0% 11.5% 7.0% 7.0%

Interest Expense 56 104 92 6 7 7

Pre-Tax Profits 367 191 182 74 31 30

EBT adjusted margin 7.8% 4.5% 4.7% 10.6% 5.8% 5.6%

After tax of 33% 246 128 122 49 21 20

Add: D&A 166 119 183 23 16 15

Subtract: CapEx 100 71 83 15 13 11

Cash Flow as adjusted 312 176 222 57 25 24

Cash Flow as adjusted margin 6.6% 4.2% 5.7% 8.2% 4.5% 4.5%

Cash Flow as reported

Tangible Capital:

Total Assets 7,928 6,583 6,148 1,089 1,022 1,003

Less: Unrestricted Cash 280 250 430 50 50 35

Less: Goodwill & Intangibles 4,228 3,217 2,878 246 201 179

Less: Current Liabilities 1,357 1,375 1,182 240 192 144

Net Tangible Capital (NTC) 2,063 1,741 1,659 553 580 645

EPV at 10% 3,119 1,757 2,224 572 245 239

Less: Total debt 1,812 1,458 1,694 102 73 83

Plus: Excess Cash 280 250 430 50 50 35

Total EPV 1,587 549 961 520 223 191

Enterprise Value 9,625 7,479 3,722 1,360 826 609

EBITDA-CapEx 489 342 374 87 42 41

EV/(EBITDA-Capex) 20 22 10 16 20 15

Price/Pre-Tax Profit 22 33 13 18 26 19

EV/EBIT 23 25 14 17 22 17

ROTC (Operating Profit/NTC) 21% 17% 17% 14% 7% 6%

36 22 22

36 22 22

10.76 0 0

FY2008 FY2007 FY2006

605 506 394

17 123 20 0.096599 0.035773 0.037361 0.063418 0.075482

42 35 28

(57) 64 -

74 59 28

12.2% 11.7% 7.0%

12 19 14

62 40 13

10.2% 7.9% 3.4%

41 27 9

15 15 11

19 14 10

38 28 10

6.2% 5.6% 2.6%

913 897

15 38 430

179 185 2,878

154 148 1,182

565 525 (4,490)

376 284 102

92 204 1,694

15 38 430

299 118 (1,162)

467 166 1,264

70 61 29

7 3 44

6 - -

6 3 46

13% 11% -1%

Basic S/O 696 693

Diluted S/O 711 713

EOY Price 75.15 56.06

FY2013 FY 2012

Revenue 19,118 18,260

EBIT as reported 3,275 3,165 0.171299 0.173331

2-year average operating margin (17.0%) 3,250 3,104

Special items average adjustment - -

EBIT adjusted 3,250 3,104

EBIT adjusted margin 17.0% 17.0%

Interest Expense 146 158

Pre-Tax Profits 3104 2947

EBT adjusted margin 16.2% 16.1%

After tax of 33% 2,080 1,974

Add: D&A 895 840

Subtract: CapEx 552 458

Cash Flow as adjusted 2,423 2,356

Cash Flow as adjusted margin 12.7% 12.9%

Cash Flow as reported

Tangible Capital:

Total Assets 34,672 32,941

Less: Unrestricted Cash 2,500 1,000

Less: Goodwill & Intangibles 22,286 21,806

Less: Current Liabilities 4,527 4,206

Net Tangible Capital (NTC) 5,359 5,929

EPV at 10% 24,233 23,558

Less: Total debt 3,437 5,288

Plus: Excess Cash 2,500 1,000

Total EPV 23,296 19,271

Enterprise Value 54,368 44,264

EBITDA-CapEx 3,594 3,486

EV/(EBITDA-Capex) 15 13

Price/Pre-Tax Profit 17 14

EV/EBIT 17 14

ROTC (Operating Profit/NTC) 61% 52%

Basic S/O 486 531

Diluted S/O 495 538

EOY Price 86.05 57.51

FY2013 FY 2012

Revenue 13,794 13,887

EBIT as reported 3,836 3,901 0.278092 0.28091

2-year average operating margin (28%) 3,862 3,888

Special items average adjustment - -

EBIT adjusted 3,862 3,888

EBIT adjusted margin 28.0% 28.0%

Interest Expense 464 417

Pre-Tax Profits 3398 3471

EBT adjusted margin 24.6% 25.0%

After tax of 33% 2,277 2,326

Add: D&A 237 236

Subtract: CapEx 160 154

Cash Flow as adjusted 2,354 2,408

Cash Flow as adjusted margin 17.1% 17.3%

Cash Flow as reported

Tangible Capital:

Total Assets 23,829 22,250

Less: Unrestricted Cash 2,000 400

Less: Goodwill & Intangibles 11,358 11,373

Less: Current Liabilities 3,790 3,830

Net Tangible Capital (NTC) 6,681 6,647

EPV at 10% 23,539 24,078

Less: Total debt 11,867 8,131

Plus: Excess Cash 2,000 400

Total EPV 13,672 16,347

Enterprise Value 52,445 38,643

EBITDA-CapEx 3,939 3,970

EV/(EBITDA-Capex) 13 10

Price/Pre-Tax Profit 13 9

EV/EBIT 14 10

ROTC (Operating Profit/NTC) 58% 58%

Basic S/O 88 82

Diluted S/O 88 84

EOY Price 17.98 33.52

FY2013 FY 2012

Revenue 1,460 1,424

EBIT as reported 201 227 0.137785 0.15929

2-year average operating margin (14.5%) 212 206

Special items average adjustment - -

EBIT adjusted 212 206

EBIT adjusted margin 14.5% 14.5%

Interest Expense 94 111

Pre-Tax Profits 118 95

EBT adjusted margin 8.1% 6.7%

After tax of 33% 79 64

Add: D&A 166 167

Subtract: CapEx 166 192

Cash Flow as adjusted 79 39

Cash Flow as adjusted margin 5.4% 2.7%

Cash Flow as reported

Tangible Capital:

Total Assets 2,582 2,521

Less: Unrestricted Cash 100 30

Less: Goodwill & Intangibles 336 336

Less: Current Liabilities 253 246

Net Tangible Capital (NTC) 1,894 1,909

EPV at 10% 790 389

Less: Total debt 1,627 1,803

Plus: Excess Cash 100 30

Total EPV (737) (1,384)

Enterprise Value 3,112 4,573

EBITDA-CapEx 212 182

EV/(EBITDA-Capex) 15 25

Price/Pre-Tax Profit 13 29

EV/EBIT 15 22

ROTC (Operating Profit/NTC) 11% 11%

Basic S/O 23 16

Diluted S/O 23 16

EOY Price 28.03 16.77

FY2013 FY 2012

Revenue 702 279

EBIT as reported (52) (28) -0.07451 -0.10038

2-year average operating margin (-7.0%) (49) (20)

Special items average adjustment - -

EBIT adjusted (49) (20)

EBIT adjusted margin -7.0% -7.0%

Interest Expense 18 3

Pre-Tax Profits -67 -23

EBT adjusted margin -9.6% -8.2%

After tax of 33% (45) (15)

Add: D&A 21 3

Subtract: CapEx 71 83

Cash Flow as adjusted (96) (96)

Cash Flow as adjusted margin -13.6% -34.4%

Cash Flow as reported

Tangible Capital:

Total Assets 780 413

Less: Unrestricted Cash - 200

Less: Goodwill & Intangibles 549 78

Less: Current Liabilities 99 49

Net Tangible Capital (NTC) 132 86

EPV at 10% (958) (957)

Less: Total debt 1,458 1,694

Plus: Excess Cash - 200

Total EPV (2,416) (2,451)

Enterprise Value 2,095 1,757

EBITDA-CapEx (100) (100)

EV/(EBITDA-Capex) (21) (18)

Price/Pre-Tax Profit (9) (12)

EV/EBIT (43) (90)

ROTC (Operating Profit/NTC) -37% -23%

Basic S/O 145 144

Diluted S/O 146 146

EOY Price 38.5 71.95

FY2013 FY 2012

Revenue 1,591 1,370

EBIT as reported 391 376 0.245951 0.274701

2-year average operating margin (24.0%) 382 329

Special items average adjustment - -

EBIT adjusted 382 329

EBIT adjusted margin 24.0% 24.0%

Interest Expense 0 0

Pre-Tax Profits 382 329

EBT adjusted margin 24.0% 24.0%

After tax of 33% 256 220

Add: D&A 49 43

Subtract: CapEx 106 93

Cash Flow as adjusted 199 170

Cash Flow as adjusted margin 12.5% 12.4%

Cash Flow as reported

Tangible Capital:

Total Assets 1,250 1,051

Less: Unrestricted Cash 600 500

Less: Goodwill & Intangibles 28 15

Less: Current Liabilities 114 133

Net Tangible Capital (NTC) 508 403

EPV at 10% 1,985 1,701

Less: Total debt - -

Plus: Excess Cash 600 500

Total EPV 2,585 2,201

Enterprise Value 5,023 9,991

EBITDA-CapEx 325 279

EV/(EBITDA-Capex) 15 36

Price/Pre-Tax Profit 15 32

EV/EBIT 13 30

ROTC (Operating Profit/NTC) 75% 82%

Basic S/O 297 296

Diluted S/O 303 305

EOY Price 83.72 62.22

FY2013 FY 2012

Revenue 4,171 3,808

EBIT as reported 1,233 1,168 0.295613 0.306723

2-year average operating margin (29.0%) 1,210 1,104

Special items average adjustment - -

EBIT adjusted 1,210 1,104

EBIT adjusted margin 29.0% 29.0%

Interest Expense 30 50

Pre-Tax Profits 1180 1054

EBT adjusted margin 28.3% 27.7%

After tax of 33% 790 706

Add: D&A 232 242

Subtract: CapEx 129 135

Cash Flow as adjusted 893 813

Cash Flow as adjusted margin 21.4% 21.4%

Cash Flow as reported

Tangible Capital:

Total Assets 5,486 4,684

Less: Unrestricted Cash 900 300

Less: Goodwill & Intangibles 1,395 1,493

Less: Current Liabilities 1,280 1,265

Net Tangible Capital (NTC) 1,911 1,626

EPV at 10% 8,933 8,134

Less: Total debt 499 499

Plus: Excess Cash 900 300

Total EPV 9,334 7,935

Enterprise Value 24,966 19,176

EBITDA-CapEx 1,313 1,211

EV/(EBITDA-Capex) 19 16

Price/Pre-Tax Profit 22 18

EV/EBIT 21 17

ROTC (Operating Profit/NTC) 63% 68%

Basic S/O 365 364

Diluted S/O 366 365

EOY Price 41.55 32.17

FY2013 FY 2012

Revenue 2,519 2,326

EBIT as reported 983 905 0.390131 0.388961

2-year average operating margin (38.0%) 957 884

Special items average adjustment - -

EBIT adjusted 957 884

EBIT adjusted margin 38.0% 38.0%

Interest Expense 0 0

Pre-Tax Profits 957 884

EBT adjusted margin 38.0% 38.0%

After tax of 33% 641 592

Add: D&A 105 98

Subtract: CapEx 84 99

Cash Flow as adjusted 662 592

Cash Flow as adjusted margin 26.3% 25.4%

Cash Flow as reported

Tangible Capital:

Total Assets 6,370 6,164

Less: Unrestricted Cash 500 450

Less: Goodwill & Intangibles 581 579

Less: Current Liabilities 4,439 4,268

Net Tangible Capital (NTC) 850 866

EPV at 10% 6,622 5,918

Less: Total debt - -

Plus: Excess Cash 500 450

Total EPV 7,122 6,368

Enterprise Value 14,711 11,282

EBITDA-CapEx 978 883

EV/(EBITDA-Capex) 15 13

Price/Pre-Tax Profit 16 13

EV/EBIT 15 13

ROTC (Operating Profit/NTC) 113% 102%

Basic S/O 83 86

Diluted S/O 87 93

EOY Price 67.39 46.23

FY2013 FY 2012

Revenue 3,023 2,801

EBIT as reported 426 324 0.140987 0.115522

2-year average operating margin (12.5%) 378 350

Special items average adjustment - -

EBIT adjusted 378 350

EBIT adjusted margin 12.5% 12.5%

Interest Expense 34 6

Pre-Tax Profits 344 344

EBT adjusted margin 11.4% 12.3%

After tax of 33% 231 230

Add: D&A 119 138

Subtract: CapEx 80 51

Cash Flow as adjusted 269 317

Cash Flow as adjusted margin 8.9% 11.3%

Cash Flow as reported

Tangible Capital:

Total Assets 4,235 3,806

Less: Unrestricted Cash 1,000 650

Less: Goodwill & Intangibles 2,121 2,099

Less: Current Liabilities 587 625

Net Tangible Capital (NTC) 527 432

EPV at 10% 2,691 3,174

Less: Total debt 1,080 580

Plus: Excess Cash 1,000 650

Total EPV 2,611 3,244

Enterprise Value 5,926 4,234

EBITDA-CapEx 416 437

EV/(EBITDA-Capex) 14 10

Price/Pre-Tax Profit 17 13

EV/EBIT 16 12

ROTC (Operating Profit/NTC) 72% 81%

Basic S/O 1774 1777

Diluted S/O 1789 1789

EOY Price 35.08 25.26

FY2013 FY 2012

Revenue 35,299 35,015

EBIT as reported 3,971 3,637 0.112496 0.10387

2-year average operating margin (12.0%) 4,236 4,202

Special items average adjustment - -

EBIT adjusted 4,236 4,202

EBIT adjusted margin 12.0% 12.0%

Interest Expense 0 0

Pre-Tax Profits 4236 4202

EBT adjusted margin 12.0% 12.0%

After tax of 33% 2,838 2,815

Add: D&A 1,077 1,345

Subtract: CapEx 1,622 1,610

Cash Flow as adjusted 2,293 2,550

Cash Flow as adjusted margin 6.5% 7.3%

Cash Flow as reported

Tangible Capital:

Total Assets 72,557 75,477

Less: Unrestricted Cash 2,000 4,000

Less: Goodwill & Intangibles 47,591 48,292

Less: Current Liabilities 14,396 14,870

Net Tangible Capital (NTC) 8,570 8,315

EPV at 10% 22,930 25,502

Less: Total debt 14,482 15,574

Plus: Excess Cash 2,000 4,000

Total EPV 10,448 13,928

Enterprise Value 75,240 56,764

EBITDA-CapEx 3,691 3,937

EV/(EBITDA-Capex) 20 14

Price/Pre-Tax Profit 15 11

EV/EBIT 18 14

ROTC (Operating Profit/NTC) 49% 51%

Basic S/O 646 643

Diluted S/O 713 727

EOY Price 83.2 69.19

FY2013 FY 2012

Revenue 30,394 29,778

EBIT as reported 4,339 3,872 0.142747 0.130014

2-year average operating margin (13.0%) 3,951 3,871

Special items average adjustment - -

EBIT adjusted 3,951 3,871

EBIT adjusted margin 13.0% 13.0%

Interest Expense 14 15

Pre-Tax Profits 3937 3856

EBT adjusted margin 13.0% 12.9%

After tax of 33% 2,638 2,584

Add: D&A 593 593

Subtract: CapEx 370 372

Cash Flow as adjusted 2,861 2,805

Cash Flow as adjusted margin 9.4% 9.4%

Cash Flow as reported

Tangible Capital:

Total Assets 16,867 16,665

Less: Unrestricted Cash 5,000 6,000

Less: Goodwill & Intangibles 1,819 1,215

Less: Current Liabilities 8,161 8,109

Net Tangible Capital (NTC) 1,887 1,341

EPV at 10% 28,614 28,046

Less: Total debt 26 0

Plus: Excess Cash 5,000 6,000

Total EPV 33,588 34,046

Enterprise Value 54,328 44,302

EBITDA-CapEx 4,175 4,092

EV/(EBITDA-Capex) 13 11

Price/Pre-Tax Profit 15 13

EV/EBIT 14 11

ROTC (Operating Profit/NTC) 209% 289%

Basic S/O 357 376

Diluted S/O 361 380

EOY Price 88.58 61.89

FY2013 FY 2012

Revenue 5,535 4,487

EBIT as reported 1,998 1,855 0.360976 0.413417

2-year average operating margin (33.0%) 1,827 1,481

Special items average adjustment - -

EBIT adjusted 1,827 1,481

EBIT adjusted margin 33.0% 33.0%

Interest Expense 306 248

Pre-Tax Profits 1521 1233

EBT adjusted margin 27.5% 27.5%

After tax of 33% 1,019 826

Add: D&A 276 117

Subtract: CapEx 115 77

Cash Flow as adjusted 1,180 866

Cash Flow as adjusted margin 21.3% 19.3%

Cash Flow as reported

Tangible Capital:

Total Assets 14,979 12,930

Less: Unrestricted Cash 300 1,100

Less: Goodwill & Intangibles 8,906 7,010

Less: Current Liabilities 1,294 946

Net Tangible Capital (NTC) 4,479 3,874

EPV at 10% 11,798 8,659

Less: Total debt 6,482 5,212

Plus: Excess Cash 300 1,100

Total EPV 5,616 4,547

Enterprise Value 38,159 27,630

EBITDA-CapEx 1,988 1,521

EV/(EBITDA-Capex) 19 18

Price/Pre-Tax Profit 21 19

EV/EBIT 21 19

ROTC (Operating Profit/NTC) 41% 38%

Basic S/O 274 273

Diluted S/O 276 274

EOY Price 33.26 18.24

FY2013 FY 2012

Revenue 3,024 2,906

EBIT as reported 763 697 0.25236 0.239745

2-year average operating margin (23.0%) 696 668

Special items average adjustment - -

EBIT adjusted 696 668

EBIT adjusted margin 23.0% 23.0%

Interest Expense 0 0

Pre-Tax Profits 696 668

EBT adjusted margin 23.0% 23.0%

After tax of 33% 466 448

Add: D&A 116 92

Subtract: CapEx 115 77

Cash Flow as adjusted 467 463

Cash Flow as adjusted margin 15.4% 15.9%

Cash Flow as reported

Tangible Capital:

Total Assets 4,694 4,538

Less: Unrestricted Cash 2,000 1,600

Less: Goodwill & Intangibles 792 719

Less: Current Liabilities 1,912 2,012

Net Tangible Capital (NTC) (11) 206

EPV at 10% 4,666 4,632

Less: Total debt 506 906

Plus: Excess Cash 2,000 1,600

Total EPV 6,161 5,326

Enterprise Value 7,686 4,310

EBITDA-CapEx 696 684

EV/(EBITDA-Capex) 11 6

Price/Pre-Tax Profit 13 7

EV/EBIT 11 6

ROTC (Operating Profit/NTC) -6541% 324%

Basic S/O 116 120

Diluted S/O 121 120

EOY Price 29.02 18.24

FY2013 FY 2012

Revenue 1,778 1,631

EBIT as reported 425 405 0.239224 0.248606

2-year average operating margin (24.0%) 427 391

Special items average adjustment - -

EBIT adjusted 427 391

EBIT adjusted margin 24.0% 24.0%

Interest Expense 45 26

Pre-Tax Profits 382 366

EBT adjusted margin 21.5% 22.4%

After tax of 33% 256 245

Add: D&A 17 19

Subtract: CapEx 15 16

Cash Flow as adjusted 258 248

Cash Flow as adjusted margin 14.5% 15.2%

Cash Flow as reported

Tangible Capital:

Total Assets 1,450 2,176

Less: Unrestricted Cash - 750

Less: Goodwill & Intangibles 132 132

Less: Current Liabilities 327 330

Net Tangible Capital (NTC) 992 964

EPV at 10% 2,583 2,482

Less: Total debt 1,055 536

Plus: Excess Cash - 750

Total EPV 1,528 2,696

Enterprise Value 4,570 1,976

EBITDA-CapEx 429 395

EV/(EBITDA-Capex) 11 5

Price/Pre-Tax Profit 9 6

EV/EBIT 11 5

ROTC (Operating Profit/NTC) 43% 41%

Basic S/O 26 25

Diluted S/O 26 26

EOY Price 44.26 28.33

FY2013 FY 2012

Revenue 570 505

EBIT as reported 68 49

2-year average operating margin (10.0%) 57 51

Special items average adjustment - -

EBIT adjusted 57 51

EBIT adjusted margin 10.0% 10.0%

Interest Expense 0 0

Pre-Tax Profits 57 50

EBT adjusted margin 9.9% 9.9%

After tax of 33% 38 34

Add: D&A 12 11

Subtract: CapEx 17 16

Cash Flow as adjusted 33 28

Cash Flow as adjusted margin 5.9% 5.6%

Cash Flow as reported

Tangible Capital:

Total Assets 579 526

Less: Unrestricted Cash 125 125

Less: Goodwill & Intangibles - -

Less: Current Liabilities 84 73

Net Tangible Capital (NTC) 370 328

EPV at 10% 334 282

Less: Total debt 26 22

Plus: Excess Cash 125 125

Total EPV 434 386

Enterprise Value 1,045 624

EBITDA-CapEx 53 45

EV/(EBITDA-Capex) 20 14

Price/Pre-Tax Profit 20 15

EV/EBIT 18 12

ROTC (Operating Profit/NTC) 15% 15%

Basic S/O 116 120

Diluted S/O 121 120

EOY Price 29.02 18.24

FY2013 FY 2012

Revenue 3,869 3,915

EBIT as reported 403 534 0.104196 0.136478

2-year average operating margin (10.0%) 387 392

Special items average adjustment - -

EBIT adjusted 387 392

EBIT adjusted margin 10.0% 10.0%

Interest Expense 0 0

Pre-Tax Profits 387 392

EBT adjusted margin 10.0% 10.0%

After tax of 33% 259 262

Add: D&A 211 256

Subtract: CapEx 138 177

Cash Flow as adjusted 333 341

Cash Flow as adjusted margin 8.6% 8.7%

Cash Flow as reported

Tangible Capital:

Total Assets 6,773 7,860

Less: Unrestricted Cash 800 800

Less: Goodwill & Intangibles 1,855 2,302

Less: Current Liabilities 2,228 2,877

Net Tangible Capital (NTC) 1,890 1,881

EPV at 10% 3,330 3,413

Less: Total debt 3,346 3,642

Plus: Excess Cash 800 800

Total EPV 784 570

Enterprise Value 6,062 5,033

EBITDA-CapEx 461 470

EV/(EBITDA-Capex) 13 11

Price/Pre-Tax Profit 9 6

EV/EBIT 16 13

ROTC (Operating Profit/NTC) 20% 21%

Basic S/O 63 65

Diluted S/O 66 68

EOY Price 19.62 27.11

FY2013 FY 2012

Revenue 714 810

EBIT as reported 155 201 0.217007 0.248004

2-year average operating margin (22.0%) 157 178

Special items average adjustment - -

EBIT adjusted 157 178

EBIT adjusted margin 22.0% 22.0%

Interest Expense 0 0

Pre-Tax Profits 157 178

EBT adjusted margin 22.0% 22.0%

After tax of 33% 105 119

Add: D&A 15 14

Subtract: CapEx 30 54

Cash Flow as adjusted 90 79

Cash Flow as adjusted margin 12.6% 9.8%

Cash Flow as reported

Tangible Capital:

Total Assets 725 651

Less: Unrestricted Cash 20 40

Less: Goodwill & Intangibles 28 11

Less: Current Liabilities 83 93

Net Tangible Capital (NTC) 594 508

EPV at 10% 902 790

Less: Total debt 5 10

Plus: Excess Cash 20 40

Total EPV 917 820

Enterprise Value 1,271 1,826

EBITDA-CapEx 142 138

EV/(EBITDA-Capex) 9 13

Price/Pre-Tax Profit 8 10

EV/EBIT 8 10

ROTC (Operating Profit/NTC) 26% 35%

Basic S/O 62 65

Diluted S/O 63 66

EOY Price 129.25 79.25

FY2013 FY 2012

Revenue 4,466 4,567

EBIT as reported 698 693 0.156382 0.151668

2-year average operating margin (15.0%) 670 685

Special items average adjustment - -

EBIT adjusted 670 685

EBIT adjusted margin 15.0% 15.0%

Interest Expense 131 127

Pre-Tax Profits 539 558

EBT adjusted margin 12.1% 12.2%

After tax of 33% 361 374

Add: D&A 145 162

Subtract: CapEx 91 111

Cash Flow as adjusted 415 425

Cash Flow as adjusted margin 9.3% 9.3%

Cash Flow as reported

Tangible Capital:

Total Assets 6,717 6,731

Less: Unrestricted Cash 900 615

Less: Goodwill & Intangibles 3,311 3,323

Less: Current Liabilities 1,153 1,308

Net Tangible Capital (NTC) 1,353 1,486

EPV at 10% 4,153 4,249

Less: Total debt 1,999 2,139

Plus: Excess Cash 900 615

Total EPV 3,054 2,726

Enterprise Value 9,229 6,730

EBITDA-CapEx 724 736

EV/(EBITDA-Capex) 13 9

Price/Pre-Tax Profit 15 9

EV/EBIT 14 10

ROTC (Operating Profit/NTC) 50% 46%

Basic S/O 117 126

Diluted S/O 118 126

EOY Price 49.04 24.53

FY2013 FY 2012

Revenue 9,040 8,887

EBIT as reported 574 558 0.063444 0.062835

2-year average operating margin (6.0%) 542 533

Special items average adjustment - -

EBIT adjusted 542 533

EBIT adjusted margin 6.0% 6.0%

Interest Expense 6 4

Pre-Tax Profits 537 529

EBT adjusted margin 5.9% 6.0%

After tax of 33% 360 354

Add: D&A 167 177

Subtract: CapEx 126 140

Cash Flow as adjusted 401 391

Cash Flow as adjusted margin 4.4% 4.4%

Cash Flow as reported

Tangible Capital:

Total Assets 4,091 3,872

Less: Unrestricted Cash 500 300

Less: Goodwill & Intangibles 1,609 1,537

Less: Current Liabilities 1,726 1,454

Net Tangible Capital (NTC) 256 582

EPV at 10% 4,005 3,913

Less: Total debt 114 132

Plus: Excess Cash 500 300

Total EPV 4,391 4,081

Enterprise Value 5,420 2,933

EBITDA-CapEx 583 570

EV/(EBITDA-Capex) 9 5

Price/Pre-Tax Profit 11 6

EV/EBIT 10 5

ROTC (Operating Profit/NTC) 212% 92%

Basic S/O 41 40

Diluted S/O 43 42

EOY Price 15.75 15.34

FY2013 FY 2012

Revenue 574 407

EBIT as reported 74 44 0.129707 0.108633

2-year average operating margin (11.0%) 63 45

Special items average adjustment - -

EBIT adjusted 63 45

EBIT adjusted margin 11.0% 11.0%

Interest Expense 0 0

Pre-Tax Profits 63 45

EBT adjusted margin 11.0% 11.0%

After tax of 33% 42 30

Add: D&A 19 14

Subtract: CapEx 5 4

Cash Flow as adjusted 56 40

Cash Flow as adjusted margin 9.8% 9.8%

Cash Flow as reported

Tangible Capital:

Total Assets 978 585

Less: Unrestricted Cash 100 40

Less: Goodwill & Intangibles 527 363

Less: Current Liabilities 108 68

Net Tangible Capital (NTC) 243 115

EPV at 10% 564 400

Less: Total debt 295 69

Plus: Excess Cash 100 40

Total EPV 369 370

Enterprise Value 880 669

EBITDA-CapEx 77 55

EV/(EBITDA-Capex) 11 12

Price/Pre-Tax Profit 11 14

EV/EBIT 14 15

ROTC (Operating Profit/NTC) 26% 39%

You might also like

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- BTVN Chap 03Document14 pagesBTVN Chap 03Nguyen Phuong Anh (K16HL)No ratings yet

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet

- Chapter 3. Exhibits y AnexosDocument24 pagesChapter 3. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Financial Accounting AssignmentDocument14 pagesFinancial Accounting AssignmentPoojith KumarNo ratings yet

- Particulars 2018-19 2017-18 Liquidity AnalysisDocument10 pagesParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiNo ratings yet

- Analisis ProspektifDocument9 pagesAnalisis ProspektifEvelDerizkyNo ratings yet

- Ratio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosDocument10 pagesRatio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosKAVYA GUPTANo ratings yet

- Project EngieDocument32 pagesProject EngieVijendra Kumar DubeyNo ratings yet

- Chapter 2. Exhibits y AnexosDocument20 pagesChapter 2. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic Treesara_AlQuwaifliNo ratings yet

- SGR Calculation Taking Base FY 2019Document38 pagesSGR Calculation Taking Base FY 2019Arif.hossen 30No ratings yet

- Latihan Tugas ALK - Prospective AnalysisDocument3 pagesLatihan Tugas ALK - Prospective AnalysisSelvy MonibollyNo ratings yet

- Walmart Valuation ModelDocument179 pagesWalmart Valuation ModelHiếu Nguyễn Minh HoàngNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic TreemonemNo ratings yet

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmNo ratings yet

- Drivers: FY 19 FY 20 FY 21 FY 22Document6 pagesDrivers: FY 19 FY 20 FY 21 FY 22Ammon BelyonNo ratings yet

- Cariboo Case StudyDocument6 pagesCariboo Case Studyzahraa aabedNo ratings yet

- 02 06 BeginDocument6 pages02 06 BeginnehaNo ratings yet

- Ümmüşnur Özcan-Proforma Questions Part2Document9 pagesÜmmüşnur Özcan-Proforma Questions Part2UMMUSNUR OZCANNo ratings yet

- ALK CH 9Document10 pagesALK CH 9Anisa Margi0% (1)

- Interim Report q3 2023Document26 pagesInterim Report q3 2023jvnshrNo ratings yet

- Tire City SpreadsheetDocument7 pagesTire City Spreadsheetp23ayushsNo ratings yet

- Add Dep Less Tax OCF Change in Capex Change in NWC FCFDocument5 pagesAdd Dep Less Tax OCF Change in Capex Change in NWC FCFGullible KhanNo ratings yet

- Case StudyDocument9 pagesCase Studyzahraa aabedNo ratings yet

- Income Statement: Company NameDocument9 pagesIncome Statement: Company NameAkshay SinghNo ratings yet

- S6 E Working FinalDocument9 pagesS6 E Working FinalROHIT PANDEYNo ratings yet

- EVA ExampleDocument27 pagesEVA Examplewelcome2jungleNo ratings yet

- TargetDocument8 pagesTargetGLORIA GUINDOS BRETONESNo ratings yet

- The Unlevered FCF María DuqueDocument9 pagesThe Unlevered FCF María DuqueRicardo PuyolNo ratings yet

- 02 04 EndDocument6 pages02 04 EndnehaNo ratings yet

- Normalized Measures - Revenues and Profit Market Value and AssetsDocument15 pagesNormalized Measures - Revenues and Profit Market Value and AssetsNikith NatarajNo ratings yet

- Coca Cola Vs Pepsi Financial AnalysisDocument8 pagesCoca Cola Vs Pepsi Financial Analysismarco.peralta2901No ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- PV OIl Financial Spreadsheet AnalysisDocument32 pagesPV OIl Financial Spreadsheet AnalysisNguyễn Minh ThànhNo ratings yet

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocument9 pagesMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarNo ratings yet

- Financial Information Disney Corp: Millons of Dollars Except Per ShareDocument12 pagesFinancial Information Disney Corp: Millons of Dollars Except Per ShareFernando Martin VallejosNo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- University of Bohol City of Tagbilaran: Case Analysis # 2Document7 pagesUniversity of Bohol City of Tagbilaran: Case Analysis # 2Jonie Ann BangahonNo ratings yet

- Cloudpoint Technology Berhad IPO Prospectus 9 May 2023 Part 2Document154 pagesCloudpoint Technology Berhad IPO Prospectus 9 May 2023 Part 2Oliver Oscar100% (1)

- 40 CrosDocument11 pages40 CrosAijaz AslamNo ratings yet

- SGR Calculation Taking Base FY 2019Document17 pagesSGR Calculation Taking Base FY 2019Arif.hossen 30No ratings yet

- November 2016 Reading Between The Lines by Dhiraj Dave Version 1Document22 pagesNovember 2016 Reading Between The Lines by Dhiraj Dave Version 1Abhinav SrivastavaNo ratings yet

- DATEDocument10 pagesDATEbiancaftw90No ratings yet

- Description Variable 2008: Financial Leverege (Nfo/cse)Document9 pagesDescription Variable 2008: Financial Leverege (Nfo/cse)Nizam Uddin MasudNo ratings yet

- Income Statement: Excess CashDocument9 pagesIncome Statement: Excess CashAlejandra San Roman AmadorNo ratings yet

- Donam Corporate FinanceDocument9 pagesDonam Corporate FinanceMAGOMU DAN DAVIDNo ratings yet

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDocument19 pagesKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNo ratings yet

- DataDocument11 pagesDataA30Yash YellewarNo ratings yet

- Ind AS Balance Sheet of Dr. Reddy Labs 2020 2021: Non-Current AssetsDocument24 pagesInd AS Balance Sheet of Dr. Reddy Labs 2020 2021: Non-Current Assetssumeet kumarNo ratings yet

- Mehak Bluntly MediaDocument18 pagesMehak Bluntly Mediahimanshu sagarNo ratings yet

- RequiredDocument3 pagesRequiredKplm StevenNo ratings yet

- A2.1 Roe 1Document14 pagesA2.1 Roe 1monemNo ratings yet

- Anchor Compa CommonDocument14 pagesAnchor Compa CommonCY ParkNo ratings yet

- IndusDocument5 pagesIndusFateen HabibNo ratings yet

- AbuDhabi Hotels - Case ExhibitsDocument14 pagesAbuDhabi Hotels - Case ExhibitsNandini RayNo ratings yet

- Case Study 2Document4 pagesCase Study 2Sarwanti PurwandariNo ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- CAPS - New Paper Sludge Drying TechnologyDocument28 pagesCAPS - New Paper Sludge Drying TechnologyMichael LoebNo ratings yet

- Buff Write UpDocument12 pagesBuff Write UpMichael LoebNo ratings yet

- TSU Write UpDocument15 pagesTSU Write UpMichael LoebNo ratings yet

- TGNA Research NotesDocument18 pagesTGNA Research NotesMichael LoebNo ratings yet

- SRCL Research NotesDocument5 pagesSRCL Research NotesMichael LoebNo ratings yet

- Summary of Chapter: 1 Goals and Governance of The Firm: Corporate Finance HW: 1Document2 pagesSummary of Chapter: 1 Goals and Governance of The Firm: Corporate Finance HW: 1RachelNo ratings yet

- Leasing RossDocument15 pagesLeasing Rosstinarosa13No ratings yet

- Financial Ratio AnalysisDocument47 pagesFinancial Ratio AnalysisUlash KhanNo ratings yet

- BDODocument6 pagesBDOVince Raphael MirandaNo ratings yet

- 1.0 Group of Company 1.1 1.2 1.3 1.4 1.5: 1 Enterprise StructureDocument52 pages1.0 Group of Company 1.1 1.2 1.3 1.4 1.5: 1 Enterprise StructureMd Mukul HossainNo ratings yet

- Working Capital ManagementDocument84 pagesWorking Capital ManagementRaj VermaNo ratings yet

- Report MIC 2022Document87 pagesReport MIC 2022dwi handariniNo ratings yet

- Activity 1Document9 pagesActivity 1JESSA ANN A. TALABOC100% (3)

- Mercury Action Athletic Synergies & AssumptionsDocument10 pagesMercury Action Athletic Synergies & AssumptionsSimón SegoviaNo ratings yet

- Clothing Business PlanDocument30 pagesClothing Business PlanBabmani Mani50% (2)

- Comprehensive Case 2 A202 - StudentsDocument22 pagesComprehensive Case 2 A202 - Studentslim qsNo ratings yet

- Chapter 6 - Accounting For Revenue and Other ReceiptsDocument7 pagesChapter 6 - Accounting For Revenue and Other ReceiptsAdan EveNo ratings yet

- A CountsDocument12 pagesA CountsRavi UdeshiNo ratings yet

- The Balance Sheet: Assets Liabilities and Stockholder's Equity 2012 2011 2012 2011Document23 pagesThe Balance Sheet: Assets Liabilities and Stockholder's Equity 2012 2011 2012 2011Phạm Ngô Diễm QuỳnhNo ratings yet

- Chapter 6 Accounting Information SystemDocument11 pagesChapter 6 Accounting Information SystemRica de guzmanNo ratings yet

- Ecobank GhanaDocument8 pagesEcobank GhanaFuaad DodooNo ratings yet

- Accounting Policies and Procedures Manual (Draft)Document30 pagesAccounting Policies and Procedures Manual (Draft)Malaking Pulo Multi-Purpose CooperativeNo ratings yet

- 6.inventory & PPE - LatestDocument122 pages6.inventory & PPE - Latestrugprince100% (1)

- Industrial Profile: Hutti Gold Mines Company LimitedDocument78 pagesIndustrial Profile: Hutti Gold Mines Company LimitedVeereshNo ratings yet

- Summary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheDocument28 pagesSummary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheSangram PandaNo ratings yet

- LKT Sipd 2018Document91 pagesLKT Sipd 2018Oktavia IsnaniaNo ratings yet

- Foundations of Accounting-2Document89 pagesFoundations of Accounting-2SWAPNIL BHISE100% (1)

- Key Lecture Concepts: Master Budget: Operational and Financial BudgetsDocument13 pagesKey Lecture Concepts: Master Budget: Operational and Financial BudgetsaNo ratings yet

- BA544 Chap 004Document46 pagesBA544 Chap 004Umit Kaukenova100% (1)

- Valuation: The Valuation Principle: The Foundation of Financial Decision Making ValuationDocument15 pagesValuation: The Valuation Principle: The Foundation of Financial Decision Making ValuationWensky RagpalaNo ratings yet

- IAS 17 Leases STDocument11 pagesIAS 17 Leases STDesmanto HermanNo ratings yet

- AFR Revision - Qns-AnsDocument63 pagesAFR Revision - Qns-AnsDownloder UwambajimanaNo ratings yet

- Introduction To Financial AccountingDocument30 pagesIntroduction To Financial AccountingNagaraj SavanurNo ratings yet

- Branch Accounts Theory and ProblemsDocument18 pagesBranch Accounts Theory and Problemsjacky111100% (1)

- Non Profit OrganisationsDocument28 pagesNon Profit OrganisationsSubham Jaiswal0% (1)