Professional Documents

Culture Documents

Income Tax Challan - 280

Uploaded by

Subrata Sarkar0 ratings0% found this document useful (0 votes)

14K views1 pageINCOME TAX CHALLAN NO 280 IN EXCEL FORMAT

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentINCOME TAX CHALLAN NO 280 IN EXCEL FORMAT

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14K views1 pageIncome Tax Challan - 280

Uploaded by

Subrata SarkarINCOME TAX CHALLAN NO 280 IN EXCEL FORMAT

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

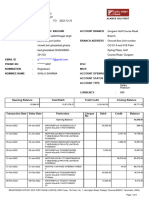

* Important : Please see notes overleaf before Single Copy (to be sent to the ZAO)

filling up the challan

Tax Applicable (Tick One)*

CHALLAN (0020) INCOME-TAX ON COMPANIES ✘ ` Assessment Year

NO./ (CORPORATION TAX)

ITNS 280 (0021) INCOME TAX (OTHER THAN

COMPANIES)

Permanent Account Number

Full Name

Complete Address with City & State

Tel. No. Pin

Type of Payment (Tick One)

Advance Tax (100) Surtax (102)

Self Assessment Tax (300) Tax on Distributed Profits of Domestic Companies (106)

Tax on Regular Assessment (400) Tax on Distributed Income to Unit Holders (107

DETAILS OF PAYMENTS Amount (in Rs. Only) FOR USE IN RECEIVING BANK

Income Tax Debit to A/c / Cheque credited on

Surcharge

Education Cess - -

Interest D D M M Y Y

Penalty

Others

Total SPACE FOR BANK SEAL

Total (in words)

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

Paid in Cash/Debit to A/c /Cheque No. Dated

Drawn on

(Name of the Bank and Branch)

Date: Rs.

Signature of person making payment

Taxpayers Counterfoil (To be filled up by tax payer)

PAN 0 0 0 0 0 0 0 0 0 0

Received from RAINBOW INFRASTRUCTURE PVT. LTD.

(Name)

Cash/ Debit to A/c /Cheque No. For Rs.

Rs. (in words)

Drawn on

(Name of the Bank and Branch)

on account of Companies / Other than Companies / Tax

Income Tax on (Strike out whichever is not applicable)

Type of Payment (To be filled up by person making the payment) Rs.

for the Assessment Year 0 0 0 0 - 0 0

You might also like

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- CBDT e Payment Request FormDocument2 pagesCBDT e Payment Request Formsaurabh100% (1)

- Declaration 3740587110895Document4 pagesDeclaration 3740587110895sakenderNo ratings yet

- Acknowledgement Slip Income Tax ReturnDocument4 pagesAcknowledgement Slip Income Tax ReturnBasit RiazNo ratings yet

- Declaration 3740587674245Document4 pagesDeclaration 3740587674245Adeel TahirNo ratings yet

- Certificate of Collection or Deduction of Tax-2018-19Document2 pagesCertificate of Collection or Deduction of Tax-2018-19Sarfraz Ali100% (1)

- Pay Bill New JEST Basit AliDocument4 pagesPay Bill New JEST Basit AliMujeeb Rehman PanhwarNo ratings yet

- Form IR8A Return of Employee's RemunerationDocument2 pagesForm IR8A Return of Employee's RemunerationNaga RajNo ratings yet

- Order Granted Reduced Withholding RateDocument2 pagesOrder Granted Reduced Withholding RateMuhammad HamzaNo ratings yet

- Exemption Certificate Us 159 (1) 153Document2 pagesExemption Certificate Us 159 (1) 153ijazaslam.huaweiNo ratings yet

- Acknowledgement Slip for Return of IncomeDocument4 pagesAcknowledgement Slip for Return of IncomeferozaNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9No ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- A Small Briefing On CSI PayrollDocument6 pagesA Small Briefing On CSI PayrollAjay PandeyNo ratings yet

- Schedule of Taxes - 2020-2021 South MCD (Commisioner Proposal)Document10 pagesSchedule of Taxes - 2020-2021 South MCD (Commisioner Proposal)Cool-tigerNo ratings yet

- Artifact 5 - Employee Pension Scheme Form 10 CDocument4 pagesArtifact 5 - Employee Pension Scheme Form 10 CSiva chowdaryNo ratings yet

- E-Invoice: Biller InformationDocument1 pageE-Invoice: Biller InformationEMMA CHUKYNo ratings yet

- Manage Distribution Sets and Payables CalendarsDocument5 pagesManage Distribution Sets and Payables CalendarskforkotaNo ratings yet

- 1a. IR8A (M) - YA 2012 - v1Document1 page1a. IR8A (M) - YA 2012 - v1freepublic9No ratings yet

- E Nomination PDFDocument2 pagesE Nomination PDFSagar RajputNo ratings yet

- PFD Misc - 1099 2019 016 9938 PDFDocument2 pagesPFD Misc - 1099 2019 016 9938 PDFTatianaNo ratings yet

- MGMT 343 Exam 2 ReviewDocument3 pagesMGMT 343 Exam 2 ReviewBreann MorrisNo ratings yet

- Form IR8A tax return guideDocument1 pageForm IR8A tax return guidegk9f5e6ho1owcldxNo ratings yet

- Quick-Start Guide - Online Pay Advices: Getting StartedDocument1 pageQuick-Start Guide - Online Pay Advices: Getting StartedFabiola BeltranNo ratings yet

- Contract of Employment - Valentin Ganchev - 220729 - 150023Document9 pagesContract of Employment - Valentin Ganchev - 220729 - 150023Valentin GanchevNo ratings yet

- CS Executive Direct TaxDocument477 pagesCS Executive Direct TaxJanhaviNo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- EPF Passbook Details for Financial Years 2020-2021 and 2021-2022Document2 pagesEPF Passbook Details for Financial Years 2020-2021 and 2021-2022ALLAM SWATHINo ratings yet

- Retained EarningsDocument24 pagesRetained EarningsravisankarNo ratings yet

- Quote Template 01Document1 pageQuote Template 01ModifiedTrendelen VergNo ratings yet

- Student Account SummaryDocument1 pageStudent Account SummaryBasel HamwiNo ratings yet

- Inter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)Document176 pagesInter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)pradeep ozaNo ratings yet

- Motor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleDocument3 pagesMotor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleHeart RockNo ratings yet

- Electronic Record and Signature DisclosureDocument4 pagesElectronic Record and Signature DisclosureVhince BaltoresNo ratings yet

- Profit and loss analysis of 5 yearsDocument5 pagesProfit and loss analysis of 5 yearspratikNo ratings yet

- Vihaan Direct Selling (India) Pvt. Ltd. - Account Summary PDFDocument2 pagesVihaan Direct Selling (India) Pvt. Ltd. - Account Summary PDFHemanth NalluriNo ratings yet

- NYS - 45 Fill inDocument2 pagesNYS - 45 Fill inSalameh LaurieNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact CentreDocument3 pagesVV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact Centrebra9tee9tiniNo ratings yet

- Cipl PancatirtaDocument2 pagesCipl Pancatirtak dodi priantoNo ratings yet

- Process and Guidelines For ID Card SubmissionDocument2 pagesProcess and Guidelines For ID Card SubmissionSunil Yadav0% (1)

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- Form PDF 332687981310321Document65 pagesForm PDF 332687981310321dhimanbasu1975No ratings yet

- Jagath Eb 04.05.20 PDFDocument1 pageJagath Eb 04.05.20 PDFsarveshvar sNo ratings yet

- ARC Current PayslipDocument1 pageARC Current PayslipSaiful IslamNo ratings yet

- DT RevisionDocument133 pagesDT RevisionharshallahotNo ratings yet

- E-Nomination Facility by Epfo On Unified Member PortalDocument10 pagesE-Nomination Facility by Epfo On Unified Member PortalUpasana Talapady100% (2)

- VAT FormDocument2 pagesVAT FormGbenga Ogunsakin67% (3)

- Aviva Pharmacist Liability Insurance Application 1Document3 pagesAviva Pharmacist Liability Insurance Application 1Anat HershkovitzNo ratings yet

- SIDS Health Care Pvt. LTD.: Payslip For January-2019Document1 pageSIDS Health Care Pvt. LTD.: Payslip For January-2019hitesh gandhiNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- EPOnlineSvcAccessApplnForm CompileDocument11 pagesEPOnlineSvcAccessApplnForm CompileRia ArguellesNo ratings yet

- Simulation 7 - Payroll Spring-2020Document13 pagesSimulation 7 - Payroll Spring-2020api-519066587No ratings yet

- MHBAN00187340000543428 NewDocument2 pagesMHBAN00187340000543428 NewSiddhartha SrivastavaNo ratings yet

- US1099Forms - Form 1099-NEC Copy BDocument2 pagesUS1099Forms - Form 1099-NEC Copy BSaurabh ChandraNo ratings yet

- Pay ACT Internet BillDocument2 pagesPay ACT Internet BillRaghavendra RaoNo ratings yet

- Tax FormDocument2 pagesTax FormRoulaBeblidakiNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Tariff Guide Tariff Guide: Business BankingDocument1 pageTariff Guide Tariff Guide: Business BankingGideon MarshallNo ratings yet

- Cashback Redemption Form PDFDocument1 pageCashback Redemption Form PDFBADRI VENKATESHNo ratings yet

- Application Form For CSWIP 10 Year Re-CertificationDocument7 pagesApplication Form For CSWIP 10 Year Re-Certificationchandana kumar0% (1)

- Personal Finance - Simulation 2Document11 pagesPersonal Finance - Simulation 2api-256424425No ratings yet

- IDFCFIRSTBankstatement 10078073407 125932259Document9 pagesIDFCFIRSTBankstatement 10078073407 125932259Ashwani KumarNo ratings yet

- Unit ThreeDocument22 pagesUnit ThreeEYOB AHMEDNo ratings yet

- Market Strategies of HDFC Bank and Icici BankDocument65 pagesMarket Strategies of HDFC Bank and Icici BankSwati Jaiswal100% (1)

- Temenos - Country Model Banks Generic ATM Framework Gpack - Atmi User GuideDocument91 pagesTemenos - Country Model Banks Generic ATM Framework Gpack - Atmi User GuideShaqif Hasan SajibNo ratings yet

- AR - Direct DebitDocument37 pagesAR - Direct DebitObilesu Rekatla100% (2)

- HDFC Bank Statement 1st Apr To Aug 2010 ScorpioDocument10 pagesHDFC Bank Statement 1st Apr To Aug 2010 ScorpioscorpioassociatsNo ratings yet

- E-Commerce Notes Jwfiles PDFDocument91 pagesE-Commerce Notes Jwfiles PDFSrithanDevulapalliNo ratings yet

- Apply to Ontario medical schools with OMSASDocument62 pagesApply to Ontario medical schools with OMSASNisa SulistiaNo ratings yet

- September 2022Document4 pagesSeptember 2022Devina Sangkar100% (1)

- Public Service Commission, West Bengal: 161A, S. P. Mukherjee Road, Kolkata-700026 Advertisement No. 26 /2019Document3 pagesPublic Service Commission, West Bengal: 161A, S. P. Mukherjee Road, Kolkata-700026 Advertisement No. 26 /2019Sibasish SarkhelNo ratings yet

- DDS File Format & ArchitectureDocument14 pagesDDS File Format & ArchitectureSalmanFatehAliNo ratings yet

- Negotiable Instruments Case DigestDocument29 pagesNegotiable Instruments Case DigestEvin Megallon Villaruben100% (1)

- ABFL Facility TermsDocument11 pagesABFL Facility Termskumar kattasarvanNo ratings yet

- RB NotesDocument35 pagesRB NotesmyokhinewinNo ratings yet

- RTB 29 FAQsDocument25 pagesRTB 29 FAQsLeah FlorentinoNo ratings yet

- 02 2014Document146 pages02 2014Marcos Verdugo39% (59)

- Credit Cards SO APIDocument524 pagesCredit Cards SO APIfirepenNo ratings yet

- Apr 2015Document8 pagesApr 2015sun colorparkNo ratings yet

- Jagriti CUSTOMER ATTITUDE TOWARDS HDFC CREDIT CARDSDocument103 pagesJagriti CUSTOMER ATTITUDE TOWARDS HDFC CREDIT CARDSAkash SinghNo ratings yet

- The Wooden Nickel CaseDocument9 pagesThe Wooden Nickel CaseCat ValentineNo ratings yet

- Final Year Project-Study On Customer Awareness Towards SBI E Banking ServicesDocument28 pagesFinal Year Project-Study On Customer Awareness Towards SBI E Banking ServicesRahul Sah100% (1)

- Unit Profit Protection Manual 2022Document104 pagesUnit Profit Protection Manual 2022Niyati NagdaNo ratings yet

- Meezan BankDocument56 pagesMeezan BankKhurram ShahzadNo ratings yet

- Non Resident Account: Tax InvoiceDocument2 pagesNon Resident Account: Tax InvoiceEmanuelsön Caverä BreezÿNo ratings yet

- Analysis of Online Marketing Website MakeMyTripDocument19 pagesAnalysis of Online Marketing Website MakeMyTripAbhendu Chandra SahaNo ratings yet

- Ofs ResponsesDocument30 pagesOfs Responsesnana yaw0% (1)