Professional Documents

Culture Documents

Partnership Loss Realization Deficit Capital Accounts

Uploaded by

Clarize R. MabiogOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Loss Realization Deficit Capital Accounts

Uploaded by

Clarize R. MabiogCopyright:

Available Formats

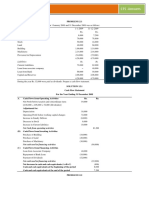

Chapter 4

Problem I

1: Gain on Realization Fully Allocated to Partners Capital Balances.

QRS Partnership

Statement of Realization and Liquidation

November 1 30, 20x4

Cash

Non-

Cash

Assets Liabilities Q, Loan

Q,

Capital

30%)

R,

Capital

(50%)

S,

Capital

(20%)

Balances before liquidation 24,000 84,000 12,000 2,400 9,600 48,000 36,000

Realization and distribution

of gain 96,000 (84,000) _____

______ 3,600 6,000 2,400

Balances after realization 120,000

12,000 2,400 13,200 54,000 38,400

Payment of liabilities (12,000)

(12,000)

Balances after payment of

liabilities 108,000

2,400 13,200 54,000 38,400

Payment to partners - loan (2,400)

(2,400) ______ ______ _______

Balances after payment of

partners loans 105,600

13,200 54,000 38,400

Payment to partners -

capital (105,600)

(13,200) (54,000) (38,400)

2: Loss on Realization Creates a Deficit Balance in Partners Capital Account Requiring Transfer

from Partners Loan Account (Right of Offset Exercised).

QRS Partnership

Statement of Realization and Liquidation

November 1 30, 20x4

Cash

Non-

Cash

Assets Liabilities Q, Loan

Q,

capital

(30%)

R,

Capital

(50%)

S,

Capital

(20%)

Balances before liquidation 24,000 84,000 12,000 2,400 9,600 48,000 36,000

Realization and distribution

of loss 48,000 (84,000) _____ ______ (10,800) (18,000) (7,200)

Balances after realization 72,000

12,000 2,400 (1,200) 30,000 28,800

Payment of liabilities (12,000)

(12,000)

Balances after payment of

liabilities 60,000

2,400 (1,200) 30,000

28,800

Offset deficit versus loans _______

(1,200) 1,200 _______ _______

Balances after offsetting 60,000

1,200

30,000 28,800

Payment to partners loan (1,200)

(1,200)

_______ ______

Balances after payment of

partners loans 58,800

30,000 28,800

Payment to partners -

capital (58,800)

(30,000) (28,800)

3: Loss on Realization Creates a Deficit Balance in Partners Capital Account Requiring Transfer

from Partners Loan Account (Right of Offset Exercised and Additional Capital Investment is

Required and Made).

QRS Partnership

Statement of Realization and Liquidation

November 1 30, 20x4

Cash

Non-

Cash

Assets Liabilities Q, Loan

Q,

capital

(30%)

R,

Capital

(50%)

S,

Capital

(20%)

Balances before liquidation 24,000 84,000 12,000 2,400 9,600 48,000 36,000

Realization and distribution

of loss 36,000 (84,000)

________ ________ (14,400) (24,000) (9,600)

Balances after realization 60,000

12,000 2,400 ( 4,800) 24,000 26,400

Payment of liabilities (12,000)

(12,000) ________ _______ _______ _______

Balances after payment of

liabilities 48,000

2,400 ( 4,800) 24,000 26,400

Offset loan versus deficit _______

(2,400) 2,400 _______ _______

Balances after offsetting

partners loan 48,000

(2,400) 24,000 26,400

Additional investment by Q __2,400

2,400 _______ _______

Balances after additional

Investment 50,400

24,000

26,400

Payment to partners -

capital (50,400)

(24,000) (26,400)

4: Loss on Realization Creates a Deficit Balance in One Partners Capital Account Requiring

Transfer Partners Loan Account (Right of Offset Is Exercised) and Additional Investment is

Required but not Made (Personally Insolvent).

QRS Partnership

Statement of Realization and Liquidation

November 1 30, 20x4

Cash

Non-

Cash

Assets Liabilities Q, Loan

Q,

capital

(30%)

R,

Capital

(50%)

S,

Capital

(20%)

Balances before liquidation 24,000 84,000 12,000 2,400 9,600 48,000 36,000

Realization and distribution

of gain 42,000 (84,000) _______ ________ (12,600) (21,000) (8,400)

Balances after realization 66,000

12,000 2,400 ( 3,000) 27,000 27,600

Payment of liabilities (12,000)

(12,000) _______ _______ _______ _______

Balances after payment of

liabilities 54,000

2,400 (3,000) 27,000 27,600

Offset loan versus deficit _______

(2,400) 2,400 ______ ______

Balances after offsetting 54,000

( 600) 27,000 27,600

Additional loss due to

insolvency of Q _______

600 ( 429) ( 171)

Balances after additional ,

Loss 54,000

26,571 27,429

Payment to partners -

capital (54,000)

(26,571) (27,429)

5: Loss on Realization Creates a Deficit Balance in One Partners Capital Account Requiring

Transfer Partners Loan Account (Right of Offset Is Exercised) and Additional Investment is

Required but not Made (Personally Insolvent).

QRS Partnership

Statement of Realization and Liquidation

November 1 30, 20x4

Cash

Non-

Cash

Assets Liabilities Q, Loan

Q,

capital

(30%)

R,

Capital

(50%)

S,

Capital

(20%)

Balances before liquidation 24,000 84,000 12,000 2,400 9,600 48,000 36,000

Realization and distribution

of gain 24,000 (84,000) _______ _______ (18,000)

(30,000) (12,000)

Balances after realization 48,000

12,000 2,400 ( 8,400) 18,000 24,000

Payment of liabilities (12,000)

(12,000) _______ _______ _______ _______

Balances after payment of

liabilities 36,000

2,400 ( 8,400) 18,000 24,000

Offset loan versus deficit ______

(2,400) 2,400 ______ _______

Balances after offsetting 36,000

(6,000), 18,000 24,000

Additional investment by Q _3,600

_ 3,600 ______ _______

Balances after additional

investment 39,600

(2,400) 18,000 24,000

Additional loss due to ______

(1,714) ( 686)

insolvency of Q 2,400

Balances after additional

Loss 39,600

16,286 23,314

Payment to partners -

capital (39,600)

(16,286) (23,314)

6: Loss on Realization Creates a Deficit Balance in Partners Capital Account Requiring Transfer

Partners Loan Account (Right of Offset Is Exercised) and All Partners are Personally Solvent.

QRS Partnership

Statement of Realization and Liquidation

November 1 30, 20x4

Cash

Non-

Cash

Assets Liabilities Q, Loan

Q,

capital

(30%)

R,

Capital

(50%)

S,

Capital

(20%)

Balances before liquidation 24,000 84,000 12,000 2,400 9,600 48,000 36,000

Payment of liquidation

expenses (14,400) ______ ________ ________ (4,320) (7,200) (2,880)

Balances after payment of

liquidation expenses 9,600 84,000

12,000 2,400 5,280 40,800 33,120

Write-off goodwill and

prepaid expenses _______ (72,000) _______ ________ (21,600) (36,000) (14,400)

Balances after write-offs 9,600 12,000 12,000 2,400 (16,320) 4,800 18,720

Realization and distribution

of loss 1,200 (12,000) _______ ________ ( 3,240) ( 5,400) ( 2,160)

Balances after realization 10,800

12,000 2,400 ( 19,560) ( 600) 16,560

Payment of liabilities (10,800)

(10,800) ________ _______ ________ _______

Balances after payment of

Liabilities -0-

1,200 2,400 (19,560) ( 600) 16,560

Offset loan versus deficit ______

_______ (2,400) 2,400 _______ _______

Balances after offsetting -0-

1,200

(17,160) ( 600) 16,560

Additional investment by Q

and R 17,760

_______

17,160 600 ______

Balances after additional

Investment 17,760

1,200

16,560

Payment of liabilities (1,200)

(1,200)

_______

Balances after payment of

Liabilities 16,560

16,560

Payment to partners -

Capital (16,560)

(16,560)

7: Loss on Realization Creates a Deficit Balance in Partners Capital Account Requiring Transfer

Partners Loan Account (Right of Offset Is Exercised) with Revaluation of Assets.

QRS Partnership

Statement of Realization and Liquidation

November 1 30, 20x4

Cash

Non-

Cash

Assets Liabilities Q, Loan

Q,

capital

(30%)

R,

Capital

(50%)

S,

Capital

(20%)

Balances before liquidation 24,000 84,000 12,000 2,400 9,600 48,000 36,000

Increase in equipment

1,200

360 600 240

Decrease in furniture ______ (600) _______ ______ _(180) (300) (120)

Balances after revaluation 24,000 84,600 12,000 2,400 9,780 48,300 36,120

Refund of prepaid

expenses _6,960 (8,400) _______ ______ _(432) (720) (288)

Balances after refunds 30,960 76,200 12,000 2,400 9,348 47,580 35,832

Received noncash assets ______ (10,200) _______ ______ _____ (7,200) (3,000)

Balances after receipt

of noncash assets 30,960 66,000

12,000 2,400 9,348 40,380 32,832

Realization and distribution

of loss 32,400 (66,000) _______ ______

(

10,080) ( 16,800) ( 8,064)

Balances after realization 63,360

12,000 2,400 ( 732) 23,580 26,112

Payment of liabilities (12,000)

(12,000) _______ _______ _______ _______

Balances after payment of

liabilities 51,360

2,400 ( 732) 23,580 26,112

Offset loan versus deficit _______

( 732) 732 ______ ______

Balances after offsetting 51,360

1,668

23,580 26,112

Payment to partners -

loan (1,668)

(1,668) ______

_______

Balances after payment

of loans 49,692

23,580

26,112

Payment to partners-

capitals (49,692)

(23,580)

(26,112)

Problem II

DISCOUNT PARTNERSHIP

Schedule of Partnership Liquidation

January 14, 20x4

Capital Balances

Explanation Cash Other

Assets

Liabilities Dawson Feeney Hardin

Balances before realization P25,000 P120,000 P(40,000) P(31,000) P(65,000) P(9,000)

Sales of noncash assets 60,000 (120,000) ______ 18,000 24,000 18,000

Balances 85,000 0 (40,000) (13,000) (41,000) 9,000

Payment of liabilities (40,000) __________ 40,000 ________ ________ ________

Balances 45,000 0 0 (13,000) (41,000) 9,000

Allocation of Hardin's debit

balance

______ __________ ______ 3,857 5,143 (9,000)

Balances 45,000 0 0 (9,143) (35,857) 0

Distribution of cash to partners (45,000) __________ ______ 9,143 35,857 ________

Balances P 0 P 0 P 0 P 0 P 0 P 0

Problem III

1.

CDG Partnership

Statement of Realization and Liquidation

Lump-sum Liquidation on December 10, 20X6

Capital Balances

Noncash Carlos Dan Gail

Cash Assets Liabilities 20% 40% 40%

Preliquidation balances 25,000 475,000 (270,000) (120,000) (50,000) (60,000)

Sale of assets and distribution

of P215,000 loss 260,000 (475,000) 43,000 86,000 86,000

285,000 -0- (270,000) (77,000) 36,000 26,000

Cash contributed by Gail to

extent of positive net worth 25,000 (25,000)

310,000 -0- (270,000) (77,000) 36,000 1,000

Distribution of deficit of

insolvent partner: (1,000)

20/60(P1,000) 333

40/60(P1,000) 667

310,000 -0- (270,000) (76,667) 36,667 -0-

Contribution by Dan to

remedy deficit

36,667 (36,667)

346,667 -0- (270,000) (76,667) -0- -0-

Payment to creditors (270,000) 270,000

76,667 -0- -0- (76,667) -0- -0-

Payment to partner (76,667) 76,667

Post-liquidation balances -0- -0- -0-

-0- -0- -0-

2.

CDG Partnership

Net Worth of Partners

December 10, 20X6

Carlos Dan Gail

Personal assets, excluding

partnership capital interests 250,000 300,000 350,000

Personal liabilities (230,000) (240,000) (325,000)

Personal net worth, excluding

partnership capital interests, Dec. 1, 20X6 20,000 60,000 25,000

Contribution to partnership (36,667) (25,000)

Liquidating distribution from partnership 76,667 -0- -0-

Net worth, December 10, 20X6 96,667 23,333 -0-

This computation assumes that no other events occurred in the 10-day period that changed any

of the partners personal assets and personal liabilities. In practice, the accountant must be sure

that a computation of net worth is current and timely.

The table shows the effects of the transactions between the partnership and each partner. A

presumption of this table is that the personal creditors of Dan or Gail would not seek court action

to block the settlement transactions with the partnership. Upon winding up and liquidation, the

partnership does not have any priority to the partners personal assets. Thus, the personal

creditors may seek to block the transactions with the partnership in order to provide more

resources from which they can be paid. A partner who fails to remedy his or her deficit can be

sued by the other partners who had to make additional contributions or even by a partnership

creditor if the failed partner is liable to the partnership creditor. But those claims are not superior

to the other claims to the partners individual assets.

When accountants provide professional services to partnerships and to its partners, the

accountant should expect, at some time, legal suits involving the partnership and/or individual

partners. A strong and thorough understanding of the legal and accounting foundations of

partnerships will be very important to that accountant.

Problem IV

Noncash Capital and Loan Balances

Cash Assets Liabilities Merz Dechter Flowers

Beginning balances P 25,000 P200,000 P165,000 P 40,000 P30,000 P(10,000)

Liquidation expense (20,000) (8,000) (8,000) (4,000)

Sale of non-cash assets 160,000 (200,000) (16,000) (16,000) (8,000)

Payment of liabilities (165,000) (165,000)

Contribution by Flowers 10,000 10,000

Allocation of Flower's

deficit

(6,000) (6,000) 12,000

Distribution to partners (10,000) (10,000) 0 0

Ending balances 0 0 0 0 0 0

Problem V

Cash Liabilities Able Bower Cramer

Beginning: P20,000 P(30,000) P(10,000) P5,000 P15,000

Payment of liabilities (20,000) 20,000

P 0 P(10,000) P(10,000) P5,000 P15,000

Cramer/Bower pay in

from personal worth

to cover

deficit balances: 12,000 ________ ________ (2,000) (10,000)

P12,000 P(10,000) P(10,000) P3,000 P 5,000

Payment of liabilities (10,000) 10,000

P 2,000 P 0 P(10,000) P3,000 P 5,000

Allocation of

deficit balances: ______ ________ 8,000 (3,000) (5,000)

P 2,000 P 0 P (2,000) P 0 P 0

Able paid: (2,000) 2,000

P 0 P 0 P 0 P 0 P 0

Problem VI

Answer:

Cash 70,000

Arthur, Capital 6,000

Baker, Capital 15,000

Casey, Capital 9,000

Other Assets 100,000

To record realization of assets at a loss of $30,000, divided

among Arthur, Baker, and Casey in 2:5:3 ratio, respectively.

Trade Accounts Payable 65,000

Cash 65,000

To record payment of liabilities.

Arthur, Capital 20,000

Loan Receivable from Arthur 20,000

To offset Arthur's loan account against Arthur's capital

account.

Arthur, Capital 14,000

Loan Payable to Baker 20,000

Casey, Capital 1,000

Cash 35,000

To record payments to partners, computed as follows:

Arthur Baker Casey

Capital account balances P70,000 P80,000 P55,000

Add: Loan payable to Baker 30,000

Less: Loan receivable from Arthur (20,000)

Loss on realization of assets,

P30,000 (6,000) (15,000) (9,000)

Balances P44,000 P95,000 P46,000

Maximum potential additional loss

of P150,000 (P250,000 P100,000 =

P150,000) divided in 2:5:3 ratio (30,000) (75,000) (45,000)

Cash payments P14,000 P20,000 P 1,000

Multiple Choice Problems

1. c JJ CC TT Total

Profit ratio 40% 50% 10% 100%

Prior capital (160,000) (45,000) (55,000) (260,000)

Loss on sale

of inventory 24,000 30,000 6,000 60,000

(136,000) (15,000) (49,000) (200,000)

2. a Prior capital (160,000) (45,000) (55,000) (260,000)

Loss on sale

of inventory 72,000 90,000 18,000 180,000

(88,000) 45,000 (37,000) (80,000)

Allocate Charles'

capital deficit: (45,000)

JJ = .40/.50 36,000

TT = .10/.50 9,000

(52,000) -0- (28,000) (80,000)

3. c (P234,000 P434,000) x 20% = P40,000

4. d

A B C

Capital before realization 80,000 90,000 130,000

Liquidation expenses (3,600) (2,400) (6,000)

Loss on sale (134 - 434) (90,000) (60,000) (300,000)

(13,600) 27,600 (176,000)

5. a

Capital before realization - C 130,000

Liquidation expenses (12,000 x 50%) (6,000)

Share on loss on realization (132,000)

Capital balance after realization ( 8,000)

Total loss on realization: P132,000/50% (264,000)

Non-cash assets 434,000

Proceeds 170,000

6. c

X Y Z

Capital before realization 130,000 130,000 100,000

Divided by: 50% 30% 20%

Loss absorption abilities 260,000 260,000 500,000

7. d P80,000 (P150,000 P50,00) x 50% = P30,000

8. b

T D H

Capital before realization 40,000 10,000 15,000

Loss on sale (85,000 33,000) (26,000) (15,600) (10,400)

14,000 ( 5,600) 4,600

Additional loss (5:2) (4,000) 5,600 ( 1,600)

10,000 3,000

9. c

T D H

Capital before realization 40,000 10,000 15,000

Loss on sale (85,000 65,000) (10,000) (6,000) (4,000)

30,000 4,000 11,000

10. a

T D H

Capital before realization 40,000 10,000 15,000

Loss on sale (85,000 21,100) (31,950) (19,170) (12,780)

8,050 ( 9,170) 2,220

Additional loss (5:2) (6,550) 9,170 (2,620)

1,500 ( 400)

Additional loss ( 400) 400

1,100

11. b

K L M

Capital before realization 60,000 40,000 80,000

Liquidation expenses (2,000) ( 4,000) ( 4,000)

Loss on sale (300 - 180) (24,000) (48,000) ( 48,000)

34,000 (12,000) 28,000

Additional loss (2:4) ( 4,000) 12,000 ( 8,000)

30,000 20,000

12. d

K L M

Capital before realization 60,000 40,000 80,000

Liquidation expenses (2,000) ( 4,000) ( 4,000)

Loss on sale (300 - 180) (24,000) (48,000) ( 48,000)

34,000 (12,000) 28,000

Additional investment _____ 12,000 ______

34,000 28,000

13. a

Cash, beginning P90,000

Payment of liquidation expenses ( 5,000)

Payment of liabilities ( 60,000)

Payment to partners P25,000

14. d

H I J Total

Capital before realization 80,000 110,000 140,000 330,000

Loss on sale (2:4:4) (61,000) (122,000) (122,000) (305,000)

19,000 (12,000) 18,000 25,000

Additional loss (2:4) ( 4,000) 12,000 ( 8,000)

15,000 10,000

15. c

P Q R

Capital before realization 70,000 50,000 100,000

Liquidation expenses (1,600) ( 3,200) ( 3,200)

68,400 46,800 96,800

Divided by: 20% 40% 40%

Loss absorption abilities 342,000 117,000 242,000

Selling Price 183,000

Book value 300,000

Loss (117,000)

or,

Quincy capital before liquidation..P 50,000

Less: Share in liquidation expenses (P8,000 x 40%). 3,200

Quincy capital before realization of non-cash assets.P 46,800

Less: Cash received by Quincy (minimum). 0

Share in the loss on realizationP 46,800

Divided by: Profit and loss ratio.. 40%

Loss on realization..P117,000

Less; Non-cash assets...................... 300,000

Proceeds from saleP183,000

16. a installment liquidation (refer for more problems in Chapter 5)

INTERESTS PAYMENTS ___

P Q R P Q R Total

Balances before realization

Totall interests... P 70,000 P 50,000 P100,000

Divided by: P&L ratio 20% 40% 40%

Loss absorption abilities.. P350,000 P125,000 P250,000

Priority I. (100,000) 0 P20,000 P20,000

P250,000 P125,000 P250,000

Priority II (125,000) (125,000) 25,000 P50,000 75,000

P125,000 P125,000 P125,000 P75,000 P 4,500 P50,000 P95,000

Cash, beginning P 90,000

Add (deduct):

Liquidation expenses paid ( 8,000)

Payment of liabilities (170,000)

Proceeds from sale of assets (?) 108,000

Payment to partner before payment to Renquist (priority I only) P 20,000

17. No answer available Justice P15,533

J Z D Total

Capital balances 23,000 22,000 (14,000) 31,000

Potential loss from Douglass (40:35) (7,467) (6,533) 14,000 0

15,533 15,467 0 31,000

Note:

1. Regardless there is a forthcoming contribution to be made by Douglass, it is assumed that the P14,000 deficit

may not be recovered for purposes of distribution of cash.

2. The P31,000 cannot be distributed in accordance with profit and loss ratio for reason that the capital balances of

Justice and Zobart is not the same with the P&L ratio (H: 20/42 =48%; J: 22/42 = 52%)

or, alternatively: Using Cash Payment Priority Program (refer to Chapter 5)

J Z D

Capital balances 23,000 22,000 (14,000)

Additional contribution 0 0 14,000

Capital balances 23,000 22,000

Divided by: Profit and loss ratio 40/75 35/75

Loss absorption power 43,125 47,143

Loss to reduce Z to D:

(4,018 x 35/55 = 1,875) 4,018

Balances 43,125 43,125

Cash available P31,000

Less: Priority I to Douglass (P4,018 x 35/75) 1,875 P 1,875

P29,125

Less: P& L (40:35) (29,125) P15,533 13,592

P15,533 P15,467

18. a - (P100,000 P72,000 P3,000 = P25,000)

19. b - (P40,000 + P10,000 P2,000 P4,000 = P44,000)

20. a

B P L S

Capital before realization 25,000 110,000 100,000 65,000

Loss on sale (4:2:1:3) (60,000) ( 30,000) (15,000) (45,000)

(35,000) 80,000 85,000 20,000

Additional loss (2:1:3) (35,000) (11,667) ( 5,833) (17,500)

15,000 68,333 79,167 2,500

21. b- refer to No. 20

22. c refer to No. 20

23. a

B P L S

Capital before realization 25,000 110,000 100,000 65,000

Loss on sale (3:2:1:4)) (45,000) ( 30,000) (15,000) (60,000)

(20,000) 80,000 85,000 5,000

Additional loss (2:1:4) (20,000) ( 5,714) ( 2,857) (11,429)

74,286 82,143 ( 6,429)

Additional loss (2:1) ( 4,286) ( 2,143) 6,429

70,000 80,000

24. a refer to No. 23

25. d refer to No. 23

26. b

Assets: Fair Value

Cash P 25,000

Accounts receivable (net) 26,000

Inventory 46,000

Equipment 84,000 P181,000

Liabilities:

Accounts payable 50,000

Net Assets equivalent to Investment P131,000

27. c

Net Assets, at book value (P100,000 + P50,000) P150,000

Net assets at fair value 131,000

Net adjustments P 19,000

For Wilfred: P19,000 x 70% P 13,300

For Mike: P19,000 x 30% P 5,700

Wilfred: P100,000 P13,300 (refer to No. 27)= P86,700

28. d Mike: P50,000 P5,700 (refer to No. 27) = P44,300

29. c [P131,000 (10,000 shares x P10 par)] = P31,000

30. b

Accumulated depreciation 70,000

K, capital (P150,000 + P10,000 + P10,000 P70,000) 100,000

Machinery, at cost 150,000

Rice [P110,000 (P150,000 P70,000)] x 1/3 10,000

Long [P110,000 (P150,000 P70,000)] x 1/3 10,000

31. c

X Y Z Total

Capital before realization 90,000 60,000 30,000 180,000

Loss on sale (35%:35%:30%) (42,000) (42,000) (36,000) *(120,000)

48,000 18,000) ( 6,000) 60,000

*balancing figure total reduction in capital

32. c this problem is more on installment liquidation principles.

M K C Total

Capital before realization 100,000 175,000 75,000 350,000

Loss on sale (50%:30%:20%) (162,500) (97,500) (65,000) *(325,000)

( 62,500) 77,500 10,000 **25,000

Additional loss (3:2) 62,500 (37,500) (25,000) ______-

40,000 (15,000) 25,000

Additional loss (15,000) 15,000 -0-

25,000

*balancing figure total reduction in capital

Payment to partners: P200,000 P25,000 P150,000 = P25,000**

Theories

True or False

1. True 6. True

2. False 7. True

3. False 8. True

4. False 9. False

5. False 10, True

Multiple Choice Theories

1. c 6. b 11. b 16. d

2. b 7. c 12. a 17. b

3. d 8. a 13. d 18. a

4. b 9. c 14. b

5. d 10, d 15, c

You might also like

- RIBA AgreementDocument60 pagesRIBA AgreementMadhini Prathaban100% (1)

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- Bankruptcy GuideDocument160 pagesBankruptcy GuideSimon M Brookim100% (3)

- Sol. Man. Chapter 4 Partnership Liquidation 2020 EditionDocument30 pagesSol. Man. Chapter 4 Partnership Liquidation 2020 EditionJennifer RelosoNo ratings yet

- Wiley GAAP 2016: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2016: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Guide To Consolidation Journal EntriesDocument9 pagesGuide To Consolidation Journal EntriesClarize R. MabiogNo ratings yet

- Guide To Consolidation Journal EntriesDocument9 pagesGuide To Consolidation Journal EntriesClarize R. MabiogNo ratings yet

- IAS 19 - Employee BenefitsDocument1 pageIAS 19 - Employee BenefitsClarize R. MabiogNo ratings yet

- BI Form ECC ApplicationDocument1 pageBI Form ECC ApplicationRuel Dc100% (1)

- Chapter 13Document25 pagesChapter 13Clarize R. Mabiog50% (2)

- Substantive Tests of Income Statement AccountsDocument5 pagesSubstantive Tests of Income Statement AccountsxxxxxxxxxNo ratings yet

- Applied Auditing by CabreraDocument25 pagesApplied Auditing by CabreraClarize R. Mabiog67% (9)

- Dayag Chapter 4Document17 pagesDayag Chapter 4Clifford Angel Matias71% (7)

- Solution Chapter 4Document14 pagesSolution Chapter 4Roselle Manlapaz Lorenzo100% (1)

- Adv Acc Chapter4Document13 pagesAdv Acc Chapter4Reanne Claudine LagunaNo ratings yet

- QRS Partnership Statement of Realization and LiquidationDocument13 pagesQRS Partnership Statement of Realization and LiquidationMazikeen DeckerNo ratings yet

- Solution Chapter 4Document11 pagesSolution Chapter 4accounts 3 lifeNo ratings yet

- QRS Partnership Liquidation Statements for Varying Non-Cash Asset Realization AmountsDocument8 pagesQRS Partnership Liquidation Statements for Varying Non-Cash Asset Realization Amountschxrlttx100% (2)

- To Record Sales of AssetsDocument9 pagesTo Record Sales of AssetsGena HamdaNo ratings yet

- Plywood Project Report by Yogesh AgrawalDocument22 pagesPlywood Project Report by Yogesh AgrawalYOGESH AGRAWALNo ratings yet

- Module 5: Accounting For Special Transactions Partnership Dissolution Part 1Document3 pagesModule 5: Accounting For Special Transactions Partnership Dissolution Part 1Angel AlforqueNo ratings yet

- ACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYDocument8 pagesACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYRuhan SinghNo ratings yet

- Module 15Document3 pagesModule 15Jhon Ferdlee Bahandi BenitezNo ratings yet

- Solution Chapter 5Document22 pagesSolution Chapter 5Roselle Manlapaz LorenzoNo ratings yet

- Partnership LiquidationDocument2 pagesPartnership LiquidationRomel Paul Taguinod GeronimoNo ratings yet

- Introduction To Management AccountingDocument5 pagesIntroduction To Management AccountingDechen WangmoNo ratings yet

- Audit of CoE, CB, AB, SES and PPE - SW10Document8 pagesAudit of CoE, CB, AB, SES and PPE - SW10d.pagkatoytoyNo ratings yet

- Quiz 1 partnership accounting problems and solutionsDocument4 pagesQuiz 1 partnership accounting problems and solutionsdianel villarico100% (2)

- Advanced Accounting Part 1 Quiz SolutionsDocument20 pagesAdvanced Accounting Part 1 Quiz SolutionsNikki GarciaNo ratings yet

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Advance AccountingDocument16 pagesAdvance AccountingMicro MaxxNo ratings yet

- No safe paymentsDocument5 pagesNo safe paymentsMoon YoungheeNo ratings yet

- Ifrint 2022 Jun ADocument10 pagesIfrint 2022 Jun AKareem KhaledNo ratings yet

- Accountant 17-07-2023Document3 pagesAccountant 17-07-2023mrsiranjeevi44No ratings yet

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- Receivables AuditDocument32 pagesReceivables AuditCertified PANo ratings yet

- Quiz - Chapter 4 - Partnership Liquidation - 2021 EditionDocument7 pagesQuiz - Chapter 4 - Partnership Liquidation - 2021 EditionYam SondayNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Chapter 5 - Adv Acc 1Document18 pagesChapter 5 - Adv Acc 1Maurice AgbayaniNo ratings yet

- Cash Flow 8 AprilDocument17 pagesCash Flow 8 AprilMayank MalhotraNo ratings yet

- SolutionChapter5 1Document20 pagesSolutionChapter5 1Jan Reynan CadienteNo ratings yet

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- Partnership Liquidation: Problem MDocument8 pagesPartnership Liquidation: Problem MMiko ArniñoNo ratings yet

- Corporate Liquidation - Theory and ProblemsDocument20 pagesCorporate Liquidation - Theory and ProblemsCarl Dhaniel Garcia SalenNo ratings yet

- Answer: Amazon Ltd. 2009 2008 Increase (Decrease) Working Capital Increase Decrease Current AssetsDocument2 pagesAnswer: Amazon Ltd. 2009 2008 Increase (Decrease) Working Capital Increase Decrease Current AssetsmaryamambakhutwalaNo ratings yet

- 9 Receivable Financing DiscountingDocument8 pages9 Receivable Financing DiscountingAYEZZA SAMSONNo ratings yet

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Document18 pagesAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Stella SabaoanNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Normal RoundDocument23 pagesNormal RoundPatrick Kyle AgraviadorNo ratings yet

- Installment LiquidationDocument5 pagesInstallment LiquidationsunshineNo ratings yet

- Chapter 11 Advacc 1 DayagDocument17 pagesChapter 11 Advacc 1 Dayagchangevela67% (6)

- Gat Prin & Pract of Fin Acct Nov 2006Document10 pagesGat Prin & Pract of Fin Acct Nov 2006samuel_dwumfourNo ratings yet

- GT Company (GTC) : Balance Sheet As On 31 March .Document1 pageGT Company (GTC) : Balance Sheet As On 31 March .Karthikeyan RamamoorthyNo ratings yet

- Long Method Problem 1 Cash DistributionDocument43 pagesLong Method Problem 1 Cash DistributionJayChrome de la TorreNo ratings yet

- 8905 Corporate Liquidation Answers PDFDocument14 pages8905 Corporate Liquidation Answers PDFYADAO, EloisaNo ratings yet

- 8905 Corporate Liquidation Answers PDFDocument14 pages8905 Corporate Liquidation Answers PDFJamaica David100% (2)

- IllustrationDocument10 pagesIllustrationAmaris AyeshaNo ratings yet

- Christian Colleges in Southeast AsiaDocument17 pagesChristian Colleges in Southeast AsiaPia De LaraNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- Cash Flow NewDocument4 pagesCash Flow NewAnkur GoyalNo ratings yet

- Wiley GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiley GAAP 2019: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2019: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- Answers To Multiple Choice - Theoretical: Charged To Specific JobDocument11 pagesAnswers To Multiple Choice - Theoretical: Charged To Specific JobJennifer Marie AlmueteNo ratings yet

- Strategic Planning Goal Setting 2Document8 pagesStrategic Planning Goal Setting 2Clarize R. MabiogNo ratings yet

- Kintsugi: Mindmap OutlineDocument1 pageKintsugi: Mindmap OutlineClarize R. MabiogNo ratings yet

- Guide To Business CombinationsDocument6 pagesGuide To Business CombinationsClarize R. MabiogNo ratings yet

- Highway MaterialsDocument4 pagesHighway MaterialsClarize R. MabiogNo ratings yet

- Answers and solutions to multiple choice and problems on process costingDocument6 pagesAnswers and solutions to multiple choice and problems on process costingsweetwinkle09No ratings yet

- 2009 F-9 Class NotesDocument4 pages2009 F-9 Class NotesClarize R. MabiogNo ratings yet

- Strategic Management Full NotesDocument135 pagesStrategic Management Full NotesClarize R. MabiogNo ratings yet

- Labor Management RelationDocument29 pagesLabor Management RelationClarize R. MabiogNo ratings yet

- Chapter13 - AnswerDocument5 pagesChapter13 - AnswerxxxxxxxxxNo ratings yet

- IAS 2 - InventoriesDocument1 pageIAS 2 - InventoriesClarize R. MabiogNo ratings yet

- Chapter10 - AnswerDocument21 pagesChapter10 - Answershanerikim100% (1)

- Chapter 19Document5 pagesChapter 19Clarize R. MabiogNo ratings yet

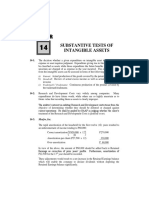

- Chapter 14Document25 pagesChapter 14Clarize R. Mabiog100% (1)

- Personality DevelopmentDocument24 pagesPersonality DevelopmentMarilou Jumalon MontefalconNo ratings yet

- Chapter15 - Answer PDFDocument14 pagesChapter15 - Answer PDFAvon Jade RamosNo ratings yet

- Chapter13 - AnswerDocument5 pagesChapter13 - AnswerxxxxxxxxxNo ratings yet

- Chapter 21 2014 Answer PDFDocument6 pagesChapter 21 2014 Answer PDFClarize R. MabiogNo ratings yet

- Audit Liabilities Accounts Receivable PayableDocument18 pagesAudit Liabilities Accounts Receivable PayableClarize R. Mabiog100% (1)

- Preparation Audited Financial Statements Chapter 22Document25 pagesPreparation Audited Financial Statements Chapter 22Clarize R. MabiogNo ratings yet

- Access Controls and Backup ControlsDocument2 pagesAccess Controls and Backup ControlsClarize R. MabiogNo ratings yet

- Rural Bank vs. CA AtaDocument5 pagesRural Bank vs. CA Atacmv mendozaNo ratings yet

- Modern Advanced Accounting in Canada Canadian 8th Edition Hilton Solutions ManualDocument107 pagesModern Advanced Accounting in Canada Canadian 8th Edition Hilton Solutions ManualLoriStricklandrdycf100% (16)

- Irs Dsa Pia Pod FormDocument3 pagesIrs Dsa Pia Pod Formapi-326615022No ratings yet

- A Study On Insolvency and Bankruptcy CodeDocument62 pagesA Study On Insolvency and Bankruptcy Codeapeksha bhoirNo ratings yet

- Unit 14Document4 pagesUnit 14Oktawia TwardziakNo ratings yet

- Partnership Creditors Preferred Over Individual CreditorsDocument2 pagesPartnership Creditors Preferred Over Individual CreditorsJanice100% (1)

- 62) de Barreto v. Villanueva WDocument2 pages62) de Barreto v. Villanueva WRain HofileñaNo ratings yet

- Corporate LiquidationDocument9 pagesCorporate Liquidationacctg2012100% (2)

- Involuntary Insolvency: Least Sixty (60) Days or That The Debtor Has Failed Generally To Meet Its LiabilitiesDocument49 pagesInvoluntary Insolvency: Least Sixty (60) Days or That The Debtor Has Failed Generally To Meet Its LiabilitiesDonna DelgadoNo ratings yet

- AMLA and Financial Rehabilitation Act SummaryDocument35 pagesAMLA and Financial Rehabilitation Act SummaryMarysol Grace A. MagalonaNo ratings yet

- A.M. No. 12-12-11-SC (Financial Rehabilitation Rules of Procedure 2013)Document46 pagesA.M. No. 12-12-11-SC (Financial Rehabilitation Rules of Procedure 2013)Anonymous zDh9ksnNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010 SummaryDocument33 pagesFinancial Rehabilitation and Insolvency Act of 2010 SummaryMargo Wan RemolloNo ratings yet

- CASE 1. Non-Cash Assets Are Sold For P 580,000Document3 pagesCASE 1. Non-Cash Assets Are Sold For P 580,000Riza Mae AlceNo ratings yet

- Corporate Rescue Mechanisms Eng PDFDocument7 pagesCorporate Rescue Mechanisms Eng PDFTan KSNo ratings yet

- Chapter1 Nature and Form of The ContractDocument25 pagesChapter1 Nature and Form of The ContractJulienne UntalascoNo ratings yet

- RFBT Answer KeyDocument13 pagesRFBT Answer KeyAbigail PadillaNo ratings yet

- Petitioner Respondent: Second DivisionDocument9 pagesPetitioner Respondent: Second DivisionPreciousGanNo ratings yet

- Article - Prerna Tomar - CompressedDocument16 pagesArticle - Prerna Tomar - CompressedprernaNo ratings yet

- Banking Bar QsDocument9 pagesBanking Bar Qschan.aNo ratings yet

- A14 - New Delhi PDFDocument5 pagesA14 - New Delhi PDFVbs ReddyNo ratings yet

- Cases On IbcDocument20 pagesCases On IbcShatakshi SinghNo ratings yet

- Template Yuriska IndoDocument9 pagesTemplate Yuriska IndoExo IndonesiaNo ratings yet

- Supreme Court Invalidates P6.2B Compromise Deal Between PNCC and CreditorDocument9 pagesSupreme Court Invalidates P6.2B Compromise Deal Between PNCC and CreditorLeighNo ratings yet

- The Abrams, Bartle, and Creighton Partnership Began The Process of Liquidation With The Following Balance SheetDocument2 pagesThe Abrams, Bartle, and Creighton Partnership Began The Process of Liquidation With The Following Balance Sheetelsana philipNo ratings yet

- Syllabus Part 1Document11 pagesSyllabus Part 1Jofrank David RiegoNo ratings yet

- James A Hooper BankruptcyDocument2 pagesJames A Hooper BankruptcyThe Con Man ComethNo ratings yet

- 1990-2006 Mercantile LawDocument428 pages1990-2006 Mercantile LawSPINDRY100% (1)

- Ba QA 2015 Suggested AnswersDocument15 pagesBa QA 2015 Suggested Answerspoontin rilakkuma100% (1)