Professional Documents

Culture Documents

Act Exam 1

Uploaded by

aman_nsu100%(1)100% found this document useful (1 vote)

5K views14 pagesAct Exam 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAct Exam 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

5K views14 pagesAct Exam 1

Uploaded by

aman_nsuAct Exam 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 14

1.

The fixed cost per unit:

will increase as activity increases.

will increase as activity decreases and will decrease as activity increases.

will decrease as activity increases.

will remain constant.

will increase as activity decreases.

[The following information applies to the questions displayed below.]

Finished goods inventory, January 1, 2011 $ 31,000

Finished goods inventory, December 31,

2011

$ 25,800

2. If the cost of goods manufactured for the year was $402,000, what was the

cost of goods sold for the year?

$412,400.

None of these.

$407,200.

$417,600.

$402,000.

3. If the cost of goods sold for the year was $431,000, what was the cost of goods

manufactured for the year?

$420,600.

$431,000.

$425,800.

$403,900.

None of these.

[The following information applies to the questions displayed below.]

Universal Manufacturing uses a weighted-average process-costing system. All

materials are introduced at the start of manufacturing, and conversion costs are

incurred evenly throughout the process. The company's beginning and ending

work-in-process inventories totaled 13,100 units and 22,800 units, respectively,

with the latter units being 2/3 complete at the end of the period. Universal started

35,600 units into production and completed 25,900 units. Manufacturing costs

follow.

Beginning work in process: Materials, $67,800; conversion cost, $158,000

Current costs: Materials, $211,000; conversion cost, $524,000

4. Universal's equivalent-unit cost for materials is:

$4.22.

$7.72.

$5.72.

None of these.

$9.32.

5. Universal's equivalent-unit cost for conversion cost is:

$19.59.

None of these.

$12.30.

$16.59.

$23.79.

6. Which of the following is least likely to be classified as a batch-level activity in

an activity-based costing system?

Production setup.

Property taxes.

Shipping.

Quality assurance.

Receiving and inspection.

7. Aglow Company uses a process-cost system for its single product. Material A

is added at the beginning of the process; in contrast, material B is added when

the units are 50% complete. The firm's ending work-in-process inventory consists

of 4,000 units that are 75% complete. Which of the following correctly expresses

the equivalent units of production with respect to materials A and B in the ending

work-in-process inventory?

A, 4,000; B, 4,000.

A, 3,000; B, 3,000.

A, 4,000; B, 3,000.

A, 4,000; B, 0.

A, 3,000; B, 0.

8. A custom-home builder would likely utilize:

process costing.

mass customization.

process budgeting.

job-order costing.

joint costing.

9. Airstream builds recreational motor homes. All of the following activities add

value to the finished product except:

addition of exterior lights.

installation of carpet.

storage of the vehicle in the sales area.

assembly of the frame to the chassis.

final painting and polishing.

10. If a company sells goods that cost $41,000 for $54,800, the firm will:

reduce Finished-Goods Inventory by $54,800.

reduce Cost of Goods Sold by $41,000.

report sales revenue on the balance sheet of $54,800.

follow more than one of the above procedures.

reduce Finished-Goods Inventory by $41,000.

11. Which of the following statements about similarities between process costing

and job-order costing are true?

I. Both systems assign production costs to units of output.

II. Both systems require extensive knowledge of financial accounting.

III. The flow of costs through the manufacturing accounts is essentially the same.

II and III.

I, II, and III.

I and III.

III only.

I only.

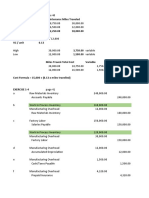

12. Job no. C12 was completed in November at a cost of $50,900, subdivided as

follows: direct material, $23,400; direct labor, $11,000; and manufacturing

overhead, $16,500. The journal entry to record the completion of the job is:

Cost of goods sold 50,900

Finished-goods

inventory

50,900

Finished-goods

inventory

50,900

Work-in-process

inventory

50,900

Work-in-process

inventory

50,900

Wages payable 11,000

Raw-material

inventory

23,400

Manufacturing

overhead

16,500

Finished-goods

inventory

50,900

Cost of goods

sold

50,900

Work-in-process

inventory

50,900

Finished-goods

inventory

50,900

13. Glass Industries reported the following data for the year just ended: sales

revenue, $1,750,000; cost of goods sold, $980,000; cost of goods manufactured,

$560,000; and selling and administrative expenses, $170,000. Glass' gross

margin would be:

$940,000.

$1,020,000.

$380,000.

$1,190,000.

$770,000.

14. Product costs are:

expensed when incurred.

treated in the same manner as period costs.

treated in the same manner as advertising costs.

inventoried.

subtracted from cost of goods sold.

15. Equivalent-unit calculations are necessary to allocate manufacturing costs

between:

cost of goods manufactured and cost of goods sold.

units sold and ending work in process.

units completed and ending work in process.

beginning work in process and units completed.

cost of goods manufactured and beginning work in process.

16. A review of a company's Work-in-Process Inventory account found a debit for

materials of $67,000. If all procedures were performed in the correct manner, this

means that the firm:

was accounting for the usage of direct materials.

also recorded a credit to Manufacturing Supplies Inventory.

was accounting for the usage of indirect materials.

also recorded a credit to Raw-Material Inventory.

also recorded a credit to Raw-Material Inventory and was accounting for the usage of direct materials.

17. The following information relates to October:

Production supervisor's salary: $3,700

Factory maintenance wages: 259 hours at $ 10 per hour

The journal entry to record the preceding information is: Answer D

Manufacturing overhead 6,290

Wages payable 6,290

Work-in-process

inventory

6,290

Wages payable 6,290

Wages payable 6,290

Manufacturing overhead 6,290

Manufacturing overhead 2,590

Work-in-process inventory 3,700

Wages payable 6,290

Wages payable 6,290

Work-in-process inventory 6,290

18.

18. Which of the following activity cost pools and activity measures likely has the

lowest degree of correlation?

A

B

C

D

E

19. Unit costs in a process-costing system are derived by using:

in-process units.

equivalent units.

completed units.

physical units.

20. Which of the following inventories would a discount retailer such as Wal-Mart

report as an asset?

Finished goods.

All of the other answers are correct.

Work in process.

Merchandise inventory.

Raw materials.

21. Huxtable charges manufacturing overhead to products by using a

predetermined application rate, computed on the basis of machine hours. The

following data pertain to the current year:

Budgeted manufacturing overhead: $480,000

Actual manufacturing overhead: $ 440,000

Budgeted machine hours: 20,000

Actual machine hours: 16,000

Overhead applied to production totaled:

$ 600,000.

$ 550,000.

$ 384,000.

some other amount.

$ 352,000.

22. Aladin's customer service department follows up on customer complaints by

telephone inquiry. During a recent period, the department initiated 16,000 calls

and incurred costs of $400,000. If 3,430 of these calls were for the company's

wholesale operation (the remainder were for the retail division), costs allocated to

the wholesale operation under activity-based costing system should amount to:

$85,750.

$0.

$25.

$400,000.

$314,250.

23. The estimates used to calculate the predetermined overhead rate will virtually

always:

result in underapplied overhead that is closed to Cost of Goods Sold if it is immaterial in amount.

result in either underapplied or overapplied overhead that is closed to Cost of Goods Sold if it is immaterial in amount.

prove to be correct.

result in a year-end balance of zero in the Manufacturing Overhead account.

result in overapplied overhead that is closed to Cost of Goods Sold if it is immaterial in amount.

24. The accounting records of Reynolds Corporation revealed the following

selected costs: Sales commissions, $66,000; plant supervision, $280,000; and

administrative expenses, $197,000. Reynolds's period costs total:

$477,000.

$263,000.

$197,000.

$543,000.

$346,000.

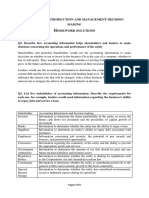

25. The accounting records of Bronco Company revealed the following

information:

Bronco's cost of goods manufactured is:

$522,000.

$519,000.

$571,000.

None of the other answers are correct.

$568,000.

26. Activity-based costing systems have a tendency to distort product costs.

27. At the Nassau Advertising Agency, partner and staff compensation cost is a

key driver of agency overhead. In light of this fact, which of the following is the

correct expression to determine the amount of overhead applied to a particular

client job?

None of these, because service providers do not apply overhead to jobs.

(Budgeted compensation budgeted overhead) budgeted compensation cost on the job.

(Budgeted overhead budgeted compensation) budgeted compensation cost on the job.

(Budgeted compensation budgeted overhead) actual compensation cost on the job.

(Budgeted overhead budgeted compensation) actual compensation cost on the job.

28. The following tasks are associated with an activity-based costing system:

1 Assignment of cost to products

2 Calculation of pool rates

3 Identification of cost drivers

4 Identification of cost pools

True

False

Which of the following choices correctly expresses the proper order of the

preceding tasks?

4, 3, 2, 1.

2, 4, 1, 3.

4, 2, 1, 3.

3, 4, 2, 1.

1, 2, 3, 4.

29. Michaella, Inc. uses a process-costing system. A newly-hired accountant

identified the following procedures that must be performed by the close of

business on Friday:

1Calculation of equivalent units

2Analysis of physical flows of units

3Assignment of costs to completed units and units still in process

4Calculation of unit costs

Which of the following choices correctly expresses the proper order of the

preceding tasks?

1, 4, 3, 2.

1, 2, 3, 4.

2, 1, 3, 4.

1, 2, 4, 3.

2, 1, 4, 3.

30. Serina Manufacturing recently sold goods that cost $35,000 for $45,000 cash.

The journal entries to record this transaction would include:

a debit to Finished-Goods Inventory for $35,000.

a credit to Profit on Sale for $10,000.

a credit to Work-in-Process Inventory for $35,000.

a debit to Sales Revenue for $45,000.

a credit to Sales Revenue for $45,000.

31. Ohio, Inc., which uses a process-cost accounting system, began operations

on January 1 of the current year. The company incurs conversion cost evenly

throughout manufacturing. If Ohio started work on 11,100 units during the period

and these units were 50% of the way through manufacturing, it would be correct

to say that the company has:

5,550 completed units.

5,550 in-process units.

11,100 equivalent units of production.

5,550 equivalent units of production.

11,100 physical units in production.

32. The accounting records of Diego Company revealed the following costs,

among others:

Costs that would be considered in the calculation of manufacturing

overhead total:

$442,000.

$186,000.

$171,000.

$149,000.

None of the other answers are correct.

33. Othello Manufacturing incurred $113,000 of direct labor and $13,400 of

indirect labor. The proper journal entry to record these events would include a

debit to Work-in-Process for:

$13,400.

$113,000.

$126,400.

$0 because Work-in-Process should be credited.

$0 because Work-in-Process is not affected.

34. Cosby uses a weighted-average process-costing system. All materials are

added at the beginning of the process; conversion costs are incurred evenly

throughout production. The company finished 40,000 units during the period and

had 15,000 units in progress at year-end, the latter at the 40% stage of

completion. Total material costs amounted to $220,000; conversion costs were

$414,000.

The cost of goods completed is:

$520,000.

$634,000.

None of the answers is correct.

$312,000.

$414,000.

35. [The following information applies to the questions displayed below.]

St. James, Inc., currently uses traditional costing procedures, applying

$1,162,400 of overhead to products Beta and Zeta on the basis of direct labor

hours. The company is considering a shift to activity-based costing and the

creation of individual cost pools that will use direct labor hours (DLH), production

setups (SU), and number of parts components (PC) as cost drivers. Data on the

cost pools and respective driver volumes follow.

Product

Pool No.1

(Driver: DLH)

Pool No.2

(Driver: SU)

Pool No.3

(Driver: PC)

Beta 1,700 35 2,750

Zeta 3,500 65 810

Pool Cost $364,000 $300,000 $498,400

The overhead cost allocated to Beta by using traditional costing procedures

would be closest to:

$584,015.

some other amount.

$380,015.

$782,385.

$496,015.

36. Dixie Company, which applies overhead at the rate of 190% of direct material

cost, began work on job no. 101 during June. The job was completed in July and

sold during August, having accumulated direct material and labor charges of

$27,000 and $15,000, respectively. On the basis of this information, the total

overhead applied to job no. 101 amounted to:

$79,800.

$28,500.

$70,500.

$51,300.

$0.

37. Strong Company applies overhead based on machine hours. At the beginning

of 20x1, the company estimated that manufacturing overhead would be $559,000

and machine hours would total 21,500. By 20x1 year-end, actual overhead

totaled $587,900, and actual machine hours were 28,900. On the basis of this

information, the 20x1 predetermined overhead rate was:

$26 per machine hour.

$1.04 per machine hour.

$1.05 per machine hour.

$21 per machine hour.

$22 per machine hour.

38. In an activity-based costing system, direct materials used would typically be

classified as a unit-level cost.

True

False

39. [The following information applies to the questions displayed below.]

Haskins Textile Co. manufactures a variety of fabrics. All materials are

introduced at the beginning of production; conversion cost is incurred evenly

through manufacturing. The Weaving Department had 2,000 units of work in

process on April 1 that were 40% complete as to conversion costs. During April,

11,500 units were completed and on April 30, 3,000 units remained in production,

50% complete with respect to conversion costs.

The equivalent units of direct materials for April total:

15,300.

16,500.

11,500.

14,500.

15,700.

40. The equivalent units of conversion for April total:

11,500.

13,000.

15,600.

14,800.

13,800.

41. Which of the following statements about material requisitions is false?

Material requisitions authorize the transfer of materials from the production floor to the raw materials warehouse.

Material requisitions are often computerized.

Material requisitions contain information that is useful to the cost accounting department.

Material requisitions are routinely linked to a bill of materials that lists all of the materials needed to complete a job.

Material requisitions are a common example of source documents.

42. [The following information applies to the questions displayed below.]

Work-in-process inventory, January 1, 2011 $ 50,000

Work-in-process inventory, December 31, 2011 $ 55,500

Conversion costs during the year $ 422,000

If direct materials used during the year were $142,000, what was cost of goods

manufactured?

$553,000.

$147,500.

$558,500.

None of these.

$416,500.

43. If the cost of goods manufactured for the year was $574,000, what was the

amount of direct materials used during the year?

None of these.

$105,500.

$152,000.

$157,500.

$166,500.

44. Baxter Company, which pays a 11% commission to its salespeople, reported

sales revenues of $300,000 for the period just ended. If fixed and variable sales

expenses totaled $65,000, what would these expenses total at sales of

$240,000?

$32,000.

None of these.

$52,000.

$26,400.

$58,400.

45. Gilberto adds materials at the beginning of production and incurs conversion

cost uniformly throughout manufacturing. Consider the data that follow.

Units

Beginning work in process 24,400

Started in August 69,200

Production completed 59,600

Ending work in process, 40% completed 34,000

Conversion cost in the beginning work-in-process inventory totaled $203,000,

and August conversion cost totaled $306,000. Assuming use of the weighted-

average method, which of the following choices correctly depicts the number of

equivalent units for materials and the conversion cost per equivalent unit?

Equivalent Units:

Materials

Conversion Cost

Per Equivalent Unit

A. 59,600 $5.86

B. 73,200 $ 5.83

C. 73,200 $ 6.95

D. 93,600 $ 5.83

E. 93,600 $ 6.95

B

D

C

E

A

46. Consider the following statements regarding traditional costing systems:

I. Overhead costs are applied to products on the basis of volume-related

measures.

II. All manufacturing costs are easily traceable to the goods produced.

III. Traditional costing systems tend to distort unit manufacturing costs when

numerous goods are made that have widely varying production requirements.

Which of the above statements is (are) true?

I and III.

III only.

II only.

II and III.

I only.

47. [The following information applies to the questions displayed below.]

Riverside Florists uses an activity-based costing system to compute the cost of

making floral bouquets and delivering the bouquets to its commercial customers.

Company personnel who earn $240,000 typically perform both tasks; other firm-

wide overhead is expected to total $70,000. These costs are allocated as follows:

Bouquet

Production Delivery Other

Wages and salaries 70% 20% 10%

Other overhead 50% 30% 20%

Riverside anticipates making 23,500 bouquets and 3,000 deliveries in the

upcoming year.

The cost of wages and salaries and other overhead that would be charged to

each bouquet made is closest to:

some other amount.

$10.24.

$8.64.

$13.19.

$14.44.

48. The cost of wages and salaries and other overhead that would be charged to

each delivery is closest to:

some other amount.

$23.00.

$30.12.

$23.68.

$44.00.

49. Which of the following is true concerning cost drivers for the predetermined

overhead rate in a process-costing system?

Predetermined overhead rates are not used in a process-costing system.

If direct labor hours is the cost driver, direct labor and manufacturing overhead may be combined into the single element of conversion cost.

If direct material cost is the cost driver, direct labor and direct materials may be combined into the single element of prime cost.

Cost drivers are irrelevant in process-costing systems.

If direct labor cost is the cost driver, direct labor and manufacturing overhead may be combined into the single element of conversion cost.

50. Many traditional costing systems:

write off manufacturing overhead as an expense of the current period.

use a host of different cost drivers (e.g., number of production setups, inspection hours, orders processed) to improve the accuracy of product costing.

trace manufacturing overhead to individual activities and require the development of numerous activity-costing rates.

combine widely varying elements of overhead into a single cost pool.

produce results far superior to those achieved with activity-based costing.

You might also like

- Managerial EconomicsDocument219 pagesManagerial Economicsashishpandey1261100% (2)

- Acct 2 0Document9 pagesAcct 2 0Kamran HaiderNo ratings yet

- YuurwDocument37 pagesYuurwagnesNo ratings yet

- TB Incremental AnalysisDocument41 pagesTB Incremental AnalysisBusiness MatterNo ratings yet

- Case Study of Costs ConceptDocument21 pagesCase Study of Costs ConceptHosanna AleyeNo ratings yet

- Session 10-14 PGDM 2020-21Document44 pagesSession 10-14 PGDM 2020-21Krishnapriya NairNo ratings yet

- To PrintDocument52 pagesTo Printmashta04No ratings yet

- Module 1 PDFDocument13 pagesModule 1 PDFWaridi GroupNo ratings yet

- Alfred Marshall's Contributions to Neoclassical EconomicsDocument26 pagesAlfred Marshall's Contributions to Neoclassical EconomicsDogusNo ratings yet

- Additional Aspects of Costing SystemsDocument28 pagesAdditional Aspects of Costing SystemsKağan GrrgnNo ratings yet

- Simple Regression Model ExplainedDocument41 pagesSimple Regression Model Explainedhien05No ratings yet

- CH4 - MC ConceptsDocument12 pagesCH4 - MC ConceptsKatsuhira KizunaNo ratings yet

- MCQ 12765 KDocument21 pagesMCQ 12765 Kcool_spNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- Quiz On National Income AggregatesDocument5 pagesQuiz On National Income AggregatesKave MathiNo ratings yet

- Answers to Activity 1 WorksheetDocument5 pagesAnswers to Activity 1 WorksheetjangjangNo ratings yet

- Shukrullah Assignment No 2Document4 pagesShukrullah Assignment No 2Shukrullah JanNo ratings yet

- Managerial Accounting Assign C1 062112naDocument17 pagesManagerial Accounting Assign C1 062112naYani Gemuel GatchalianNo ratings yet

- Chapter 6 CostDocument144 pagesChapter 6 CostMaria LiNo ratings yet

- Chapter 1 Quiz ExampleDocument10 pagesChapter 1 Quiz ExampleVictor GarciaNo ratings yet

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Document50 pagesCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNo ratings yet

- Question Bank - Practical QuestionsDocument10 pagesQuestion Bank - Practical QuestionsNeel KapoorNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Ch4-Budgetary ControlDocument13 pagesCh4-Budgetary ControlBinish JavedNo ratings yet

- Process CostingDocument69 pagesProcess CostingmhdjNo ratings yet

- Ch09 Inventory Costing and Capacity AnalysisDocument13 pagesCh09 Inventory Costing and Capacity AnalysisChaituNo ratings yet

- Objective Type QuestionsDocument62 pagesObjective Type Questionsmosib7467% (3)

- Econ Assignment AnswersDocument4 pagesEcon Assignment AnswersKazımNo ratings yet

- Horngren Ima15 Im 07Document19 pagesHorngren Ima15 Im 07Ahmed AlhawyNo ratings yet

- CVP Analysis TechniquesDocument45 pagesCVP Analysis TechniquesYitera SisayNo ratings yet

- Standard Costing Summary For CA Inter, CMA Inter, CS ExecutiveDocument5 pagesStandard Costing Summary For CA Inter, CMA Inter, CS Executivecd classes100% (1)

- 2009-02-05 171631 Lynn 1Document13 pages2009-02-05 171631 Lynn 1Ashish BhallaNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument19 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionKang ChulNo ratings yet

- Chapter 1 - Introduction ToDocument30 pagesChapter 1 - Introduction ToCostAcct1No ratings yet

- Blocher8e EOC SM Ch04 FinalDocument46 pagesBlocher8e EOC SM Ch04 FinalDiah ArmelizaNo ratings yet

- Management AccountingDocument145 pagesManagement AccountingSaad kaleemNo ratings yet

- Cost II Chapter ThreeDocument11 pagesCost II Chapter ThreeSemira100% (1)

- Duo PLC Produces Two Products A and B Each HasDocument2 pagesDuo PLC Produces Two Products A and B Each HasAmit Pandey50% (2)

- BEP Sums QuestionsDocument7 pagesBEP Sums QuestionsPavan AcharyaNo ratings yet

- Fma Past Paper 3 (F2)Document24 pagesFma Past Paper 3 (F2)Shereka EllisNo ratings yet

- Relevant Costs 4Document6 pagesRelevant Costs 4Franklin Evan PerezNo ratings yet

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerNo ratings yet

- CA Inter Paper 6 Compiler 8-8-22Document316 pagesCA Inter Paper 6 Compiler 8-8-22KaviyaNo ratings yet

- Chapter 5 NotesDocument6 pagesChapter 5 NotesXenia MusteataNo ratings yet

- 5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument37 pages5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsLiyana ChuaNo ratings yet

- The Utease CorporationDocument8 pagesThe Utease CorporationFajar Hari Utomo0% (1)

- MA-16-How Well Am I Doing - Financial Statement AnalysisDocument72 pagesMA-16-How Well Am I Doing - Financial Statement AnalysisAna Patricia Basa MacapagalNo ratings yet

- A. Williams Module 2Document16 pagesA. Williams Module 2awilliams2641No ratings yet

- Module 1 - Introduction and Management Decision Making - Homework SolutionsDocument4 pagesModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelNo ratings yet

- Product Costing: Job and Process Operations: Learning Objectives - Coverage by QuestionDocument45 pagesProduct Costing: Job and Process Operations: Learning Objectives - Coverage by QuestionJoeNo ratings yet

- Chapter 4Document45 pagesChapter 4Yanjing Liu67% (3)

- CVP Multiple Product DiscussionDocument5 pagesCVP Multiple Product DiscussionheyheyNo ratings yet

- Quiz Bee WordDocument7 pagesQuiz Bee WordVince De GuzmanNo ratings yet

- Management Accounting Practice Questions ABC CostingDocument6 pagesManagement Accounting Practice Questions ABC CostingSayantan NandyNo ratings yet

- Process Costing Chapter ReviewDocument63 pagesProcess Costing Chapter ReviewDanna ClaireNo ratings yet

- Chap009 MaDocument57 pagesChap009 MamaglennaNo ratings yet

- 74757bos60489 cp14Document77 pages74757bos60489 cp14Vansh AmeraNo ratings yet

- Catalog: Chapter 3 (Complementary)Document24 pagesCatalog: Chapter 3 (Complementary)gridmonkeyNo ratings yet

- Exam Review Unit I - Chapters 1-3Document24 pagesExam Review Unit I - Chapters 1-3Aaron DownsNo ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Manual Company Return 11GHA BL v1.0Document76 pagesManual Company Return 11GHA BL v1.0aman_nsuNo ratings yet

- Dick Spencer-Student Example 1Document25 pagesDick Spencer-Student Example 1aman_nsu0% (1)

- Manual Company Return 11GHA BL v1.0 PDFDocument76 pagesManual Company Return 11GHA BL v1.0 PDFaman_nsuNo ratings yet

- Empowering Women Through ICT-Based Business Initiatives: An Overview of Best Practices in E-Commerce/E-Retailing ProjectsDocument18 pagesEmpowering Women Through ICT-Based Business Initiatives: An Overview of Best Practices in E-Commerce/E-Retailing Projectsaman_nsuNo ratings yet

- Links For MGT 585 CasesDocument1 pageLinks For MGT 585 Casesaman_nsuNo ratings yet

- Ch. 12 Examples-IllustrationsDocument6 pagesCh. 12 Examples-Illustrationsaman_nsuNo ratings yet

- Schein (1996)Document12 pagesSchein (1996)Søren Rinnov ØstergaardNo ratings yet

- Culture Assignment (40 Points Total-8% of Your Grade) : InstructionsDocument1 pageCulture Assignment (40 Points Total-8% of Your Grade) : Instructionsaman_nsuNo ratings yet

- Ice MarketingDocument2 pagesIce Marketingaman_nsuNo ratings yet

- Solved Examples Ch10Document8 pagesSolved Examples Ch10aman_nsuNo ratings yet

- Individual Behavior Assignment InstructionsDocument2 pagesIndividual Behavior Assignment Instructionsaman_nsuNo ratings yet

- Culture Article 1Document8 pagesCulture Article 1aman_nsuNo ratings yet

- Chap 0010Document35 pagesChap 0010aman_nsuNo ratings yet

- Bayesian Rule - Example 2Document2 pagesBayesian Rule - Example 2aman_nsu100% (1)

- Confidence Intervals for the Sample Mean with Known σDocument7 pagesConfidence Intervals for the Sample Mean with Known σaman_nsuNo ratings yet

- Chap 012Document13 pagesChap 012aman_nsuNo ratings yet

- 578assignment2 F14 SolDocument15 pages578assignment2 F14 Solaman_nsuNo ratings yet

- Ch3 ExamplesDocument1 pageCh3 Examplesaman_nsuNo ratings yet

- Bayesian Rule - Example 2Document2 pagesBayesian Rule - Example 2aman_nsu100% (1)

- Chap 0010Document35 pagesChap 0010aman_nsuNo ratings yet

- Chap 4Document26 pagesChap 4aman_nsuNo ratings yet

- Descriptive Statistics: Tabular and Graphical Methods: Mcgraw-Hill/IrwinDocument40 pagesDescriptive Statistics: Tabular and Graphical Methods: Mcgraw-Hill/Irwinaman_nsuNo ratings yet

- Act 525Document6 pagesAct 525aman_nsu0% (1)

- An Introduction To Business Statistics: Mcgraw-Hill/IrwinDocument18 pagesAn Introduction To Business Statistics: Mcgraw-Hill/Irwinaman_nsuNo ratings yet

- BA 578 Assignment Sol Due Sept 15Document15 pagesBA 578 Assignment Sol Due Sept 15aman_nsuNo ratings yet

- Milkshakes and The Decision That Could Lead To DisasterDocument32 pagesMilkshakes and The Decision That Could Lead To Disasteraman_nsuNo ratings yet

- My Analytical PartDocument40 pagesMy Analytical Partaman_nsuNo ratings yet

- Question EnglishDocument2 pagesQuestion Englishaman_nsuNo ratings yet

- IGCSE Economics NotesDocument26 pagesIGCSE Economics NotesEsheng100% (1)

- Cost Accounting/Series-4-2011 (Code3017)Document17 pagesCost Accounting/Series-4-2011 (Code3017)Hein Linn Kyaw100% (2)

- Unit - 4: Managing FinanceDocument27 pagesUnit - 4: Managing FinanceAnshika SinghNo ratings yet

- FPP ManualDocument323 pagesFPP ManualNorwegian79No ratings yet

- Maruthi Car Dealership Capital Budgeting Case StudyDocument1 pageMaruthi Car Dealership Capital Budgeting Case Studypillaiwarm0% (2)

- Recent Trends in Indias Foreign TradeDocument25 pagesRecent Trends in Indias Foreign TradePiYaSaiNiNo ratings yet

- Managementaccoun00anth 1Document536 pagesManagementaccoun00anth 1rudypatilNo ratings yet

- Texas Comptroller Glenn Hegar's Revised Revenue ForecastDocument31 pagesTexas Comptroller Glenn Hegar's Revised Revenue ForecastdmnpoliticsNo ratings yet

- Tax Freeze Guidance DocumentDocument20 pagesTax Freeze Guidance DocumentjspectorNo ratings yet

- Personal Budget Tracking Spreadsheet to Optimize Monthly Cash FlowDocument12 pagesPersonal Budget Tracking Spreadsheet to Optimize Monthly Cash FlowAeronn Jass SongaliaNo ratings yet

- BestDocument11 pagesBestWajihaNo ratings yet

- Botswana: 2021 Article Iv Consultation-Press Release Staff Report and Statement by The Executive Director For BotswanaDocument67 pagesBotswana: 2021 Article Iv Consultation-Press Release Staff Report and Statement by The Executive Director For BotswanayasirNo ratings yet

- Test Bank Chapter 2 Budget ConstraintDocument13 pagesTest Bank Chapter 2 Budget ConstraintRahul100% (1)

- Republic Act No 9679 PAG IBIGDocument17 pagesRepublic Act No 9679 PAG IBIGJnot VictoriknoxNo ratings yet

- Budgeting PDFDocument28 pagesBudgeting PDFreenza velascoNo ratings yet

- Internal Audit ChecklistDocument44 pagesInternal Audit ChecklistGlenn Padilla100% (3)

- 2approaches To MCSDocument13 pages2approaches To MCSNurul Hannani HashimNo ratings yet

- CMASyllabusDocument3 pagesCMASyllabusAakash murarkaNo ratings yet

- 10 Flexible BUdgets & Performance AnalysisDocument382 pages10 Flexible BUdgets & Performance AnalysisEdlene Quisora80% (5)

- RWJ Chapter 1Document29 pagesRWJ Chapter 1Umar ZahidNo ratings yet

- Union Budget 2021-22 Content and Q&A PDF by Affairscloud 1Document37 pagesUnion Budget 2021-22 Content and Q&A PDF by Affairscloud 1premNo ratings yet

- The Role of Management Accounting in The OrganizationDocument12 pagesThe Role of Management Accounting in The OrganizationGourav SharmaNo ratings yet

- PPP in Road Sector: A Study About India: Ms. Ruchi SharmaDocument7 pagesPPP in Road Sector: A Study About India: Ms. Ruchi SharmaChalamaiah VadlamudiNo ratings yet

- Accounts AssignmentDocument6 pagesAccounts AssignmentmariyaNo ratings yet

- Earned Value AnimationDocument5 pagesEarned Value AnimationLai QuocNo ratings yet

- Program, Projects, Activities: Republic of The Philippines Barangay - City of ZamboangaDocument5 pagesProgram, Projects, Activities: Republic of The Philippines Barangay - City of ZamboangaArman BentainNo ratings yet

- Bba 2012Document134 pagesBba 2012gbulani11No ratings yet

- A Project Report On TaxationDocument68 pagesA Project Report On TaxationDinesh ChahalNo ratings yet

- Act Exam 1Document14 pagesAct Exam 1aman_nsu100% (1)

- BRIC Countries in Comparative Perspective: Kristalina GeorgievaDocument28 pagesBRIC Countries in Comparative Perspective: Kristalina GeorgievaabhisilkNo ratings yet