Professional Documents

Culture Documents

Valuation Formulae Sheet CEU 2014

Uploaded by

Melissa HarringtonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Formulae Sheet CEU 2014

Uploaded by

Melissa HarringtonCopyright:

Available Formats

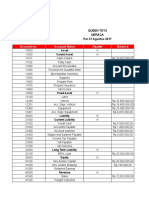

VALUATION

FORMULAE SHEET

Cost of Equity = Riskfree Rate + Country Premium + Beta (Mature market premium)

Cost of Equity = Riskfree Rate + Beta (Mature market premium + Country Premium)

Cost of Equity = Riskfree Rate + Beta (Mature market premium) + ! (Country Premium)

! = % of revenues domestically firm / % of revenues domestically avg firm

Levered Beta = Unlevered Beta {1+[(1-tax rate)(Debt/Equity)]}

Interest Coverage Ratio = EBIT / Interest Expenses

Cost of debt = Riskfree rate + Company default spread

EBIT (1-T)

- (Capex deprec)

- Change in non-cash Working Capital

= FCFF

EBIT (1-T) * (1 Reinvestment rate)

= FCFF

Net income

- (Capex deprec)

- Change in non-cash Working Capital

- (Debt principal repayment New debt issues)

- Preferred dividends paid

= Free cash flow to Equity

Net income

- ( 1 ") (Capex deprec)

- ( 1 - ") Change in non-cash Working Capital

= Free cash flow to Equity where " = Debt ratio

Adjusted Operating Earnings = Operating Earnings + Operating Lease Expenses

- Annual lease depreciation

Adjusted Operating Income = Operating income + R&D expenses

- Amortization of research asset

gEPS = Retained Earnings t-1 / NI t-1 * ROE

ROE = NI / BV of equity

gEBIT = (Net Capital Expenditures + Change in WC)/EBIT(1-t) * ROC

ROC = EBIT (1-T)/ BV capital

Expected growth rate

= Reinvestment rate *ROC t+1 + {(ROCt+1 ROCt))/ROCt}

You might also like

- Equations From DamodaranDocument6 pagesEquations From DamodaranhimaggNo ratings yet

- Derivatives Future & OptionsDocument6 pagesDerivatives Future & OptionsNiraj Kumar SahNo ratings yet

- Adidas Reebok Merger LBODocument2 pagesAdidas Reebok Merger LBOtiko bakashviliNo ratings yet

- TVM Exercises: - in The First Year: - in The Second YearDocument2 pagesTVM Exercises: - in The First Year: - in The Second YearCu Thi Hong NhungNo ratings yet

- 108 04 Merger Model AC Case Study AfterDocument2 pages108 04 Merger Model AC Case Study AfterPortgas H. NguyenNo ratings yet

- Free Cash Flows FCFF & FcfeDocument56 pagesFree Cash Flows FCFF & FcfeYagyaaGoyalNo ratings yet

- Real Options and Decision TreesDocument20 pagesReal Options and Decision TreesAmit BiswalNo ratings yet

- Derivatives 304Document105 pagesDerivatives 304Fazal RehmanNo ratings yet

- Weighted Average Cost of CapitalDocument3 pagesWeighted Average Cost of CapitalMohammed AldhounNo ratings yet

- Global Investments PPT PresentationDocument48 pagesGlobal Investments PPT Presentationgilli1trNo ratings yet

- Foreign Exchange Markets, End of Chapter Solutions.Document27 pagesForeign Exchange Markets, End of Chapter Solutions.PankajatSIBMNo ratings yet

- Chapter 16Document23 pagesChapter 16JJNo ratings yet

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- PDF Audit 1Document18 pagesPDF Audit 1Kali NazriNo ratings yet

- Chapter 10 Questions V2Document7 pagesChapter 10 Questions V2Lavanya KosuriNo ratings yet

- Assignment Cover Page: Your Assessment Will Not Be Accepted Unless All Fields Below Are CompletedDocument22 pagesAssignment Cover Page: Your Assessment Will Not Be Accepted Unless All Fields Below Are Completedkitty0812No ratings yet

- Chapter 25-Mergers & AcquisitionsDocument64 pagesChapter 25-Mergers & Acquisitionss1978bangaloreNo ratings yet

- Firm Valuation - FCFF & FCFEDocument5 pagesFirm Valuation - FCFF & FCFESunny BohraNo ratings yet

- Notes 7 External Funds NeededDocument17 pagesNotes 7 External Funds NeededCrina EdithNo ratings yet

- Elements of An Investment Policy Statement For Individual InvestorsDocument26 pagesElements of An Investment Policy Statement For Individual InvestorsRichardson HolderNo ratings yet

- Adidas Reebok Merger Case StudyDocument2 pagesAdidas Reebok Merger Case StudyPriyanka Gupta100% (1)

- PPT-4 Parity Conditions and Currency ForecastingDocument42 pagesPPT-4 Parity Conditions and Currency ForecastingKamal KantNo ratings yet

- Akin SecurityAnalysisPresentation2014 1p80bskDocument50 pagesAkin SecurityAnalysisPresentation2014 1p80bskgarych72No ratings yet

- Elasticity EconomicsDocument14 pagesElasticity EconomicsYiwen LiuNo ratings yet

- FE 445 M1 CheatsheetDocument5 pagesFE 445 M1 Cheatsheetsaya1990No ratings yet

- Duration GAP AnalysisDocument5 pagesDuration GAP AnalysisShubhash ShresthaNo ratings yet

- Bond Valuation: Bond Analysis: Returns & Systematic RiskDocument50 pagesBond Valuation: Bond Analysis: Returns & Systematic RiskSamad KhanNo ratings yet

- Capital Asset Pricing Model and Modern Portfolio TheoryDocument12 pagesCapital Asset Pricing Model and Modern Portfolio TheorylordaiztrandNo ratings yet

- Fcffsimpleginzu ITCDocument62 pagesFcffsimpleginzu ITCPravin AwalkondeNo ratings yet

- Lecture 1 - Overview of Financial Statement AnalysisDocument80 pagesLecture 1 - Overview of Financial Statement Analysisadiba10mkt67% (3)

- Cap Budeting FinanaceDocument11 pagesCap Budeting FinanaceShah ZazaiNo ratings yet

- Introduction To Corporate Finance (Test Question With Answers)Document9 pagesIntroduction To Corporate Finance (Test Question With Answers)Haley James ScottNo ratings yet

- Hand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadDocument55 pagesHand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadHamad Bakar HamadNo ratings yet

- Product Life Cycle Costing / Whole Life Cycle Costing /life Cycle CostingDocument23 pagesProduct Life Cycle Costing / Whole Life Cycle Costing /life Cycle CostingTapiwa Tbone MadamombeNo ratings yet

- Week 2 Managerial FinanceDocument64 pagesWeek 2 Managerial FinanceCalista Elvina JesslynNo ratings yet

- Ifm-Chapter 9-Forecasting Financial Statement (Slide)Document36 pagesIfm-Chapter 9-Forecasting Financial Statement (Slide)minhhien222No ratings yet

- Answer: eDocument17 pagesAnswer: eMary Benedict AbraganNo ratings yet

- LN10 EitemanDocument35 pagesLN10 EitemanFong 99No ratings yet

- Asset Pricing ModelDocument15 pagesAsset Pricing ModelEnp Gus AgostoNo ratings yet

- Midsem Cheat Sheet (Finance)Document2 pagesMidsem Cheat Sheet (Finance)lalaran123No ratings yet

- Examples Self IFRS 9 PDFDocument9 pagesExamples Self IFRS 9 PDFErslanNo ratings yet

- FCFE Vs DCFF Module 8 (Class 28)Document9 pagesFCFE Vs DCFF Module 8 (Class 28)Vineet AgarwalNo ratings yet

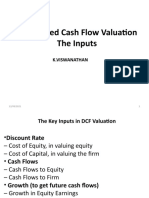

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDocument47 pagesDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNo ratings yet

- 324 - International Parity ConditionsDocument49 pages324 - International Parity ConditionsTamuna BibiluriNo ratings yet

- LBO in PracticeDocument12 pagesLBO in PracticeZexi WUNo ratings yet

- Damodaran - Corporate Finance - Measuring ReturnDocument91 pagesDamodaran - Corporate Finance - Measuring ReturntweetydavNo ratings yet

- Cost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast UniversityDocument23 pagesCost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast Universityasif rahanNo ratings yet

- Bond ValuationDocument17 pagesBond ValuationMatthew RyanNo ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalnigemahamatiNo ratings yet

- Quiz1 PDFDocument45 pagesQuiz1 PDFShami Khan Shami KhanNo ratings yet

- Financial Ratios of Keppel Corp 2008-1Document3 pagesFinancial Ratios of Keppel Corp 2008-1Kon Yikun KellyNo ratings yet

- Chapter 4 Financing Decisions PDFDocument72 pagesChapter 4 Financing Decisions PDFChandra Bhatta100% (1)

- Chapter 08 Stock ValuationDocument34 pagesChapter 08 Stock Valuationfiq8809No ratings yet

- 2.3 Fra and Swap ExercisesDocument5 pages2.3 Fra and Swap ExercisesrandomcuriNo ratings yet

- Assignment 3Document7 pagesAssignment 3Abdullah ghauriNo ratings yet

- Exchange Rate Risk & Cost of CapitalDocument22 pagesExchange Rate Risk & Cost of CapitalmonuNo ratings yet

- Valuation Basics Free CashflowsDocument3 pagesValuation Basics Free CashflowsChandan KumarNo ratings yet

- Cheat Sheet of The GODS.v2.0 PDFDocument8 pagesCheat Sheet of The GODS.v2.0 PDFCorina Ioana BurceaNo ratings yet

- Corporate Finance: RF M ErDocument3 pagesCorporate Finance: RF M ErFarin KaziNo ratings yet

- FormulasDocument2 pagesFormulasSana KhanNo ratings yet

- Harvard Fin AccountingDocument12 pagesHarvard Fin AccountingBharathi Raju100% (1)

- AF210 Revision Package Test 2 - QuestionsDocument2 pagesAF210 Revision Package Test 2 - QuestionsShweta ChandraNo ratings yet

- MGT 101 SampleDocument9 pagesMGT 101 SampleWaleed AbbasiNo ratings yet

- LCCI Certificate in Accounting L3 ASE20097 June 2016Document20 pagesLCCI Certificate in Accounting L3 ASE20097 June 2016lee jess100% (2)

- Putriayu Komputer AkuntansiDocument4 pagesPutriayu Komputer AkuntansiCindo Ardilah Syah100% (1)

- Financial Statement Analysis 2020Document26 pagesFinancial Statement Analysis 2020Dennis AleaNo ratings yet

- 5 Worksheet FormatDocument1 page5 Worksheet FormatRJ DAVE DURUHANo ratings yet

- Paper 2Document7 pagesPaper 2Suppy PNo ratings yet

- FinanceDocument22 pagesFinanceromit.jaink1No ratings yet

- Format & ListDocument2 pagesFormat & ListJyotirmoy Chowdhury100% (1)

- Endole Company Report - 09519832Document31 pagesEndole Company Report - 09519832lchenhan94No ratings yet

- Exercise#1 Earlmathew VisarraDocument2 pagesExercise#1 Earlmathew VisarraMathew VisarraNo ratings yet

- ACCT1100 PA1 AssignmentSolutionManual 1Document6 pagesACCT1100 PA1 AssignmentSolutionManual 1Chi IuvianamoNo ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement AnalysisSitio BayabasanNo ratings yet

- Afar Short Quiz Business Combination 01Document3 pagesAfar Short Quiz Business Combination 01Sharmaine Clemencio0No ratings yet

- 도로설계기준, 2016Document332 pages도로설계기준, 2016suni soonNo ratings yet

- CLA215 - FASB, Statement of Financial Accounting Concepts No 6Document58 pagesCLA215 - FASB, Statement of Financial Accounting Concepts No 6Eric Lie100% (1)

- Chapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongDocument12 pagesChapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongMai Phương NguyễnNo ratings yet

- PFRS For SMEs - Summary NotesDocument5 pagesPFRS For SMEs - Summary NotesMaha Bianca Charisma CastroNo ratings yet

- Practice BK Question BankDocument24 pagesPractice BK Question BankKrina JainNo ratings yet

- Mock Cpa Board Examination Ul Cpa Review CenterDocument18 pagesMock Cpa Board Examination Ul Cpa Review CenterasdfghjNo ratings yet

- 2008 LCCI Level 1 (1017) Specimen Paper AnswersDocument4 pages2008 LCCI Level 1 (1017) Specimen Paper AnswersTszkin PakNo ratings yet

- Sail IndiaDocument24 pagesSail IndiaAswini Kumar BhuyanNo ratings yet

- IMChap 004Document38 pagesIMChap 004Aaron Hamilton100% (4)

- Physical Fitness Gym Business PlanDocument28 pagesPhysical Fitness Gym Business Planabasyn_university83% (6)

- FIN1161 - Introduction To Finance For Business - Report 2Document6 pagesFIN1161 - Introduction To Finance For Business - Report 2thunlagbd230128No ratings yet

- Ia3 Midterm ExamDocument7 pagesIa3 Midterm ExamJalyn Jalando-onNo ratings yet

- Detailed Lesson Plan - Fabm 1 (Second)Document12 pagesDetailed Lesson Plan - Fabm 1 (Second)Maria Benna Mendiola100% (5)

- IND As - 21 Foreign Exchange Change EffectsDocument38 pagesIND As - 21 Foreign Exchange Change EffectsWill RobinsonNo ratings yet

- Exercises (7-27-18)Document2 pagesExercises (7-27-18)Justin ManaogNo ratings yet