Professional Documents

Culture Documents

VUL Mock Exam 1 - June 6, 2011 Version 1

Uploaded by

Anonymous iOYkz0wOriginal Description:

Copyright

Available Formats

Share this document

Read this document in other languages

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VUL Mock Exam 1 - June 6, 2011 Version 1

Uploaded by

Anonymous iOYkz0wCopyright:

Available Formats

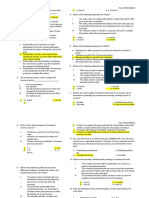

VUL MOCK EXAM 1

1. People generally invest their money to provide:

I.

II.

III.

IV.

an improvement in their financial position

a less comfortable standard of living

retirement income

funds for paying necessary expenses and taxes when the person dies

A.

B.

C.

D.

I,II & III

I, III & IV

I, II, & IV

II, III & IV

2. Which of the following funds comprises a higher proportion of equity and a lower proportion of fixedincome instruments?

A.

B.

C.

D.

Bond Funds

Cash Funds

Managed Funds

Mixed Funds

3. Which of the following are the main characteristics of Variable Life insurance policies?

I. The policies can be used for investments, as a source of regular savings and protection.

II. The withdrawal and protection benefit are determined by the investment performance of the

underlying assets

III. The net withdrawal values of the policies are the gross withdrawal values shown in the policy which

includes cash dividends up to the date of surrender, less all indebtedness, includes interests.

A.

B.

C.

D.

I only

II only

I & II only

I, II & III

4. Which of the following statements are FALSE?

I.

The policyholders may request a partial withdrawal of the policy and the amount will be met by

cashing the units at the offer price.

II. The structure of charges and the investment content of a Variable life policy are specified in the policy

document and the policy statement.

III. Some Variable Life policies grant loans to policyholders which is limited to a percentage of the cash

value.

IV. Commissions and office expenses are met by a variety of implicit charges, some of which are variable.

A.

B.

C.

D.

I & II only

I & III only

II & III only

All of the above

June 6, 2011 Version 1

Page 1 of 11

VUL MOCK EXAM 1

5. Which of the following statements about the feature of Regular Premium Variable Life Policy are TRUE?

I. Top-ups are usually allowed.

II. The level of cover can be varied.

III. Premium holidays are usually allowed.

A.

B.

C.

D.

I & II only

I & III only

II & III only

I, II & III

6. Which one of the following statements is NOT TRUE about the benefits of investing in a Variable life

insurance policy?

A. The fund provides a highly diversified portfolio, thus, lowering the risk of investment.

B. The fund relieves the investor from the hassle of administering his/her investment.

C. The fund ensures definite high yield for an investor since it is managed by professionals who are wellversed in the management of risk of investment portfolio.

D. The fund enables small investors to participate in a pool of diversified portfolio in which he/she is

unlikely to have access to with low investment capital.

7. Which of the following statements describes the difference between Variable Life insurance products and

Traditional participating products?

I.

Variable life insurance products allow policyholders to change the premium payments but traditional

participating life products do not.

II. Variable life insurance products can take the form of Whole Life or Endowment policies but

Traditional life policies can not.

III. Variable life insurance products allow the policyholders to pay future single premiums from time to

time to add more units to his account but traditional life participating products do not.

A.

B.

C.

D.

I only

I & III only

II & III only

I, II & III

8. Which of the following are some of the flexibility features of Variable life insurance policies?

I. Partial Withdrawal

II. Variation in sum assured

III. Guaranteed withdrawal values

A.

B.

C.

D.

II only

III only

I & II only

I, II & III

June 6, 2011 Version 1

Page 2 of 11

VUL MOCK EXAM 1

9. Which of the following statements about single premium variable life policies are TRUE?

I.

There is no fixed term in a single premium variable life policy and therefore, it is technically whole life

insurance.

II. Top-ups or single premium injections are allowed.

III. Policyholders have the flexibility of varying the life coverage.

A.

B.

C.

D.

I & II

I & III

II & III

I, II, & III

10. The benefits of investing in variable life fund include:

I. Policyholders have access to a pooled and diversified portfolio of investment.

II. The policyholder can easily change the level of premium payments as the product design of variable

life insurance policies have clear structures which cater separately for investment and insurance

protection.

III. Policyholders can gain access to variable life funds managed by professional investment managers.

IV. The policyholder is relieved of the day to day administration of his investment.

A.

B.

C.

D.

I, II, & III

I, II, & IV

I, III, & IV

All of the above

11. The flexibility benefits of investing in variable life funds include:

I. Policyholders can easily change the level of sum insured and switch their investments between funds.

II. Policyholders can easily take premium holidays and add single premium top-ups.

III. Variable life insurance products have simple product design with a clear structure which caters

separately for investment and insurance protection.

IV. Policyholders can easily change the level of their premium payment.

A.

B.

C.

D.

I, II, & III

I, II, & IV

I, III, & IV

I, II, III, & IV

12. Which of the following statements describes the difference between variable life products and

participating products?

I.

Variable life products allow policyholders to pay top-up premiums from time to time to buy more units

for his account unlike traditional participating life policies.

II. Variable life products allow policyholders to take premium holiday unlike traditional participating life

products.

III. Variable life products can take the form of whole life or endowment policies unlike traditional

participating life products.

June 6, 2011 Version 1

Page 3 of 11

VUL MOCK EXAM 1

A.

B.

C.

D.

I

I & II

I & III

I, II, & III

13. Your client is a 35 year-old male, earning P35,000 a month, has savings, and with moderate risk tolerance.

What product would you recommend?

A.

B.

C.

D.

Participating whole life.

Endowment

Term

Variable life

14. In a Unit Trust investment, the duties of a Trustee include all of these EXCEPT:

A.

B.

C.

D.

Selects and manages the investments of the Trust.

Holds the pool of money and assets in trust on behalf of the investors.

Ensures that the fund managers adhere to the provisions of the trust deed.

Protects the interests of unit holders.

15. To the Policyowners, administration benefits under variable life include:

A. Engaging independent professional fund managers personally to manage the complicated transaction.

B. Constructing their own diversified portfolio.

C. Keeping track of their investment through the statements provided regularly by the insurance

company.

D. Exercising investment expertise by selecting funds that will give higher returns.

16. Which statement best describes Variable Life?

A.

B.

C.

D.

Fixed premium with returns that will not vary.

Fixed premium with returns that will vary.

Flexible premium with returns that will not vary.

Flexible premium with returns that will vary.

17. With traditional participating life insurance products, the allocations to policyowners of dividends:

I.

II.

III.

IV.

Are not directly linked to the investments of the life company.

Are smoothened

Do not have the highs and lows of investment returns in good times

Are not fixed

A.

B.

C.

D.

I & II

I, II, and III

I, II, IV

II and IV

June 6, 2011 Version 1

Page 4 of 11

VUL MOCK EXAM 1

18. Offer Price = P16

Bid Offer Spread = 4.5%

Units = 25,000

Policy fee = P1,800

Admin and Mortality Charges = P8,750

Top up fee 700

Admin top up P2,000

Presuming all charges are deducted by canceling units and that the Bid Price increases by 8%, what is the

withdrawal value after a year?

a.

b.

c.

d.

432,000

420,069.02

401,107.58

412,500

19. Which statements are FALSE regarding the difference between endowment policies and variable life

policies?

I. The benefits and risks of endowment and variable life policies directly accrue to the policyholders.

II. The premiums and benefits of the endowment policies are stated at its inception while those of

variable life policies are flexible as they are account driven.

III. Their policy values directly reflect the performance of the fund of the life company.

A.

B.

C.

D.

I & II

I & III

II & III

I, II & III

20. Which statement about cash is TRUE?

A.

B.

C.

D.

Investment in cash increases when there is a bull run in the stock market.

Investment in cash decreases when there is a rise in interest rates.

Amount invested in cash is dependent on the size of the cash flow requirement.

Its yield potential is high.

21. These statements are true EXCEPT

A.

B.

C.

D.

No regular income may be gained from investing in commodities.

Investing in fixed deposits gives high guaranteed returns.

People invest money to enhance a comfortable standard of living.

People invest money to provide funds for the higher education of their children.

June 6, 2011 Version 1

Page 5 of 11

VUL MOCK EXAM 1

22. For variable life policy, the definition of selling price is:

A.

B.

C.

D.

The price at which units under the policy is offered for sale by the life company.

It is also known as the bid price.

The price at which units under the policy are bought back by the life company.

It is a fixed amount throughout the life of the policy.

23. Which statement regarding the risk of investment in variable life is TRUE?

A. Policyowners who are risk averse should not purchase life insurance policy with high protection and

guaranteed cash and maturity values.

B. Investments in variable life funds which are fully invested in units of equity funds are not suitable for

policyowners who can tolerate the risks of short term fluctuation in their cash value.

C. Policy owners who invest in variable life funds with high equity investment face greater risk but can

expect to achieve higher return than traditional life insurance policies with high equity investment.

D. Policy owners who are risk averse should buy variable life policies with high equity investment.

24. The statements below are true about top-up option of a variable life insurance product EXCEPT:

A. The policy owner pays further single premium to make a top-up.

B. Normally, policy owners are allowed to make a top-up on their policies at any time subject to a

minimum amount.

C. Policy owners may buy additional units of variable life fund and these units will be allocated to new

variable life insurance policies.

D. Further premiums at the time of top-up will be used in full after deducting charges to purchase

additional units of the variable life funds.

25. If the current offer price = P 2.50 and the Bid offer spread = 4%. Calculate the Bid Price

A.

B.

C.

D.

P 2.40

P2.50

P2.60

P2.70

26. Which of the following statements are FALSE?

I.

II.

III.

IV.

The bid-offer spread is used to provide death benefit for the variable life insurance policy.

The bid-price is always higher than the offer price.

The bid offer spread is usually about 5%.

There are two types of death benefit under the variable life insurance product. They may offer either

or both types depending on its product design and on the discretion of the policyholder.

A.

B.

C.

D.

I & II

II & III

II & IV

None of the above

June 6, 2011 Version 1

Page 6 of 11

VUL MOCK EXAM 1

27. Which is NOT a characteristic of a variable life policy?

A.

B.

C.

D.

It is used solely for investment purposes.

The commission and office expenses are met by explicit charges.

It has generally, though not necessarily, more exposure to equity investments.

Its cash value is usually the value of units allocated to the policy calculated at the prevailing bid price.

28. Which of the following statements about investment returns under a variable life insurance policy is NOT

TRUE?

A.

B.

C.

D.

It is assured.

It is not guaranteed.

It fluctuates based on the rise and fall of market prices.

It is linked to the performance of the investment fund managed by the life company.

29. Which statements are FALSE regarding the difference between endowment policies and variable life

policies?

I. The benefits and risks of endowment and variable life policies directly accrue to the policyholders.

II. The premiums and benefits of the endowment policies are stated at its inception while those of

variable life policies are flexible as they are account driven.

III. Their policy values directly reflect the performance of the fund of the life company.

A.

B.

C.

D.

I & II

I & III

II & III

I, II & III

30. What are the ADVANTAGES of investing in preferred shares?

I. It has priority on company assets during dissolution.

II. Has a benefit of capital appreciation.

III. The shareholder has the right to a fixed dividend.

A. I & II

B.I & III

C. II & III

D. I, II & III

31. Which of the following information is NOT required to be disclosed to policyholders of the variable life

policies?

A. The basis and frequency for valuing the assets

B. The number and value of units held at the beginning of the period; bought and sold during the period;

and held at the end of the period

C. The net withdrawal as of the statement date

D. The premiums received and charges levied during the period

June 6, 2011 Version 1

Page 7 of 11

VUL MOCK EXAM 1

32. The investment returns under variable life insurance policy

I.

II.

III.

IV.

Are not guaranteed

Are insured

Are linked to the performance of the investment fund managed by the life office

Fluctuate according to the rise and fall of market prices

A.

B.

C.

D.

I, II & III

I, II & IV

I, III & IV

II, III & IV

33. Which of the following are fixed income securities?

I.

II.

III.

IV.

V.

Corporate Stocks

Government Bonds

Preferred Shares

Money Market Instruments

Properties

A.

B.

C.

D.

I, II, III & IV only

I & III only

I, III & V only

All of the above

34. Which of the following investment options entitles the holder ownership and share of profits in the form

of dividends appreciation?

A.

B.

C.

D.

Cash

Bonds

Futures

Ordinary Shares

35. Which of the following statements are FALSE?

I. Higher capital gain is normally associated with lower risk

II. One way to lower risk in investment is to diversify

III. One method of measuring risk is to determine the average return and its standard deviation from

future data

IV. Diversification can be achieved by investing in different countries and / or types of assets

V. An investor can always choose an investment that is risk free

A.

B.

C.

D.

I, II & III only

II, III & IV only

I, III & V only

All of the above

June 6, 2011 Version 1

Page 8 of 11

VUL MOCK EXAM 1

36. The difference between the offer price and the bid price is?

A.

B.

C.

D.

Bid price spread

Offer price spread

Bid Offer spread

None of the above

37. Which of the following information must NOT be conveyed to the client in the sale of variable life

insurance policies?

A.

B.

C.

D.

Guaranteed Interest rate

Time horizon of the product

Benefits illustrations using 10% as the gross

Rate of return

38. Term insurance _______________

A. Provides for payment of the sum insured when the life insured survives a specific period.

B. Provides protection for a specific period and has no savings element.

C. Is the most complex and expensive of all the life insurance.

D. Provides for surrender or cash values on early termination of the insurance.

39. What are the disadvantages of investing in cash and deposits?

I. The safest type of investment.

II. They provide the lowest return.

III. There is reinvestment risk.

A. I only

B.II only

C. II & III only

D. I, II & III

40. Which of the following are types of corporate stocks?

I.

II.

III.

IV.

V.

Debenture Stocks

Government Stocks

Loan Stocks

Money Market Instruments

Convertible Stocks

A.

B.

C.

D.

I, II, & III only

I, II, III & IV only

I, III & V only

All of the above

June 6, 2011 Version 1

Page 9 of 11

VUL MOCK EXAM 1

41. Factors to consider in buying Properties:

I.

II.

III.

IV.

V.

Quality of land

The location of land

The value of building on land

The investment

Place of work

A.

B.

C.

D.

I, II & III only

II, III & IV only

I, III& V only

All of the above

42. What are the basic types of real estate investment?

I.

II.

III.

IV.

V.

Rural Property

Domestic Property

Agricultural Property

Commercial/Industrial Property

Foreign Property

A.

B.

C.

D.

I, II & III only

II, III & IV only

I, III& V only

All of the above

43. The amount of risk a person can take depends on:

I.

II.

III.

IV.

Age

Investment objective

Financial conditions

Personality

A.

B.

C.

D.

I & II only

II, III & IV only

I, II & III only

All of the above

44. All of these are mandatory provisions in a variable life contract EXCEPT:

A.

B.

C.

D.

Incontestability Provision

The Entire Insurance Contract Provision

Misstatement of Age or Sex Provision

None of the above

June 6, 2011 Version 1

Page 10 of 11

VUL MOCK EXAM 1

45. What is the Net Amount at Risk?

A.

B.

C.

D.

The minimum death benefit.

Excess between minimum death benefit and the value of the policyholders separate variable account.

The sum insured

The difference between the minimum death benefit and the sum assured.

46. If a policyholder fails to pay premium on time and there are no withdrawal values in the account, the

policy will:

A.

B.

C.

D.

Continue in full force for a period of grace.

Terminate immediately on the day premium is due.

Continue at a reduced sum assured.

Continue at the same sum assured for the same basic benefits.

47. If a policyholder returns the variable life insurance contract within the cooling-off period, he will receive:

A.

B.

C.

D.

A refund equal to the market value of the units plus initial charges.

All premiums paid.

A refund equal to the market value of the units only.

Nothing.

48. Which of the following statements about investment objectives is FALSE?

A.

B.

C.

D.

People invest money to enhance a comfortable standard of living

People invest money to provide funds for higher education for their children

Investment in commodities produce no regular income

People invest money in equities to produce high and guaranteed income

49. The disadvantage of fixed income securities include

I. The coupon rate is fixed and cannot respond to inflation

II. The investors are expose to market specific risks

III. Fluctuations in bond prices may lead to capital losses

A. II and III only

B. I and II only

C. I, II and III

D. I and III only

50. Which of the following statements about rebating are TRUE?

I. Rebating is prohibited under the Insurance Code

II. Rebating deals with offering the prospect a special inducement to purchase a policy

III. Rebating will enhance the sales performance and uphold the prestige of an agent

A. I and II

B. I and III

C. II and III

June 6, 2011 Version 1

Page 11 of 11

You might also like

- Vul Mock Exam 2Document15 pagesVul Mock Exam 2Mark Glenn Baluarte100% (3)

- IC Exam Reviewer For VULDocument9 pagesIC Exam Reviewer For VULjohninopatin94% (17)

- STD InsCom VUL Reviewer 2019 0121Document12 pagesSTD InsCom VUL Reviewer 2019 0121Bestfriend Ng Lahat100% (1)

- Axa Philippines Mock Exam-Investment Link Products (Vul)Document7 pagesAxa Philippines Mock Exam-Investment Link Products (Vul)SHAMIR LUSTRE100% (1)

- VulDocument18 pagesVulAnna Kristine M. Nepomuceno100% (1)

- Vul/Ulp Mock Exams Vul Mock Exam (Document23 pagesVul/Ulp Mock Exams Vul Mock Exam (Sheryl Grace BaranganNo ratings yet

- Review Philam ExamDocument10 pagesReview Philam Examroyce542No ratings yet

- Variable IC Mock Exam - 02062020 PDFDocument30 pagesVariable IC Mock Exam - 02062020 PDFMikaella Sarmiento100% (1)

- VULDocument15 pagesVULlancekim21No ratings yet

- VUL ReviewerDocument11 pagesVUL ReviewerJohn Joshua JJ Jimenez100% (1)

- VUL Mock Exam 2 WITH EXPLANATIONS Answer KeyDocument16 pagesVUL Mock Exam 2 WITH EXPLANATIONS Answer KeyFranz JosephNo ratings yet

- VUL Mock Exam Part 2Document2 pagesVUL Mock Exam Part 2Millet Plaza Abrigo95% (19)

- Answer Key - Ic - Mock Exam - Set B PDFDocument8 pagesAnswer Key - Ic - Mock Exam - Set B PDFZyzy Lepiten75% (28)

- Answer Key - Ic - Mock Exam - Set A PDFDocument9 pagesAnswer Key - Ic - Mock Exam - Set A PDFZyzy Lepiten80% (46)

- Answer Key - Ic - Mock Exam - Set C PDFDocument10 pagesAnswer Key - Ic - Mock Exam - Set C PDFZyzy Lepiten84% (25)

- VUL Simulated Exam 1Document17 pagesVUL Simulated Exam 1Ernie Ladores100% (5)

- VUL Mock ExamDocument5 pagesVUL Mock ExamMillet Plaza Abrigo93% (15)

- Traditional Mock ExamDocument5 pagesTraditional Mock ExamMicol Villaflor Ü80% (5)

- 2Document3 pages2bea67% (3)

- Answer Key - Iiap - Mock Exam 2Document10 pagesAnswer Key - Iiap - Mock Exam 2Zyzy Lepiten85% (20)

- IIAP Mock 1 Answer KeyDocument6 pagesIIAP Mock 1 Answer KeyTGiF Travel0% (1)

- Std-Ic Vul Simulated Exam (Questionnaire) - FinalDocument10 pagesStd-Ic Vul Simulated Exam (Questionnaire) - FinalRey Bautista69% (13)

- Trad Reviewer John Aldrin PDFDocument26 pagesTrad Reviewer John Aldrin PDFDrin Garrote Toribio100% (3)

- Answer Key - Life - Mock Exam 1Document8 pagesAnswer Key - Life - Mock Exam 1Alex MacasaetNo ratings yet

- Ic - Mock Exam - Set CDocument11 pagesIc - Mock Exam - Set CZyzy Lepiten100% (1)

- Rai Ic - Trad (9426)Document30 pagesRai Ic - Trad (9426)jeffrey resos100% (1)

- VUL Mock ExamDocument5 pagesVUL Mock ExamMillet Plaza Abrigo100% (2)

- Insurance Commission Licensure Examination Reviewer Variable Universal Life (Vul)Document16 pagesInsurance Commission Licensure Examination Reviewer Variable Universal Life (Vul)Dave Panulaya100% (3)

- D. Applicant-Owned: GREEN 7 - Manulearn MOCK ExamDocument23 pagesD. Applicant-Owned: GREEN 7 - Manulearn MOCK ExamAlron Dela Victoria AncogNo ratings yet

- IC Traditonal Life ReviewerDocument29 pagesIC Traditonal Life ReviewerSheena Fatima100% (4)

- STD-Insurance Commission TRAD REVIEWER Rev1 PDFDocument24 pagesSTD-Insurance Commission TRAD REVIEWER Rev1 PDFJomar Carabot100% (1)

- Manulife - Mock Exam Set BDocument8 pagesManulife - Mock Exam Set BCrislyn Macapangal - Camella100% (5)

- Manu LifeDocument19 pagesManu LifeHarold MillaresNo ratings yet

- IC Mock Exam As of June-10 Answer KeyDocument25 pagesIC Mock Exam As of June-10 Answer KeyTGiF TravelNo ratings yet

- Insurance Commission Exam ReviewerDocument5 pagesInsurance Commission Exam ReviewerApolinar Alvarez Jr.97% (38)

- VUL Simulated Exam PDFDocument2 pagesVUL Simulated Exam PDFNato50% (4)

- VUL Mock ExamDocument5 pagesVUL Mock ExamZurc Nuaj III100% (1)

- IIAP Mock Exam Reviewer Answer Key - LifeDocument13 pagesIIAP Mock Exam Reviewer Answer Key - LifeJanine Semper100% (1)

- Ic Trad Life Mock Exam 1Document9 pagesIc Trad Life Mock Exam 1Cris Rivera75% (4)

- IC Exam Reviewer For TRADDocument8 pagesIC Exam Reviewer For TRADjohninopatinNo ratings yet

- Reviewer 1Document24 pagesReviewer 1Alron Dela Victoria AncogNo ratings yet

- IIAP Mock 2 Answer KeyDocument7 pagesIIAP Mock 2 Answer KeyTGiF TravelNo ratings yet

- IIAP Mock 3 Answer KeyDocument3 pagesIIAP Mock 3 Answer KeyTGiF TravelNo ratings yet

- Iiap Reviewer NewDocument18 pagesIiap Reviewer Newcindy100% (3)

- Traditional Life Mock Exam 03102015 v.1Document8 pagesTraditional Life Mock Exam 03102015 v.1francis50% (2)

- VL Mock Exam - Set2 PDFDocument12 pagesVL Mock Exam - Set2 PDFmaria Fe torres100% (2)

- SLTCDocument8 pagesSLTCjack r100% (1)

- TRad 2 - Print - QuizizzDocument25 pagesTRad 2 - Print - QuizizzJoelyca Sescon100% (2)

- Exam MockDocument9 pagesExam MockJim Akino100% (1)

- Mock ExamsDocument7 pagesMock ExamsJim AkinoNo ratings yet

- VUL Insurance Concepts Accreditation MaterialDocument13 pagesVUL Insurance Concepts Accreditation MaterialLady Glorien cayonNo ratings yet

- VUL Mock Exam Reviewer Set 2 For ACE With Answers 2Document11 pagesVUL Mock Exam Reviewer Set 2 For ACE With Answers 2Theo AgustinoNo ratings yet

- Variable Life Licensing Mock ExamDocument8 pagesVariable Life Licensing Mock ExamLance LimNo ratings yet

- VARIABLE LIFE REVIEWER 140 Items With Answer Key TrainersDocument25 pagesVARIABLE LIFE REVIEWER 140 Items With Answer Key Trainersjima jam selomandinNo ratings yet

- VARIABLE LIFE REVIEWER - Intermediary ExamDocument25 pagesVARIABLE LIFE REVIEWER - Intermediary ExamJohn Michael FernandezNo ratings yet

- Variable Life Licensing Mock Exam Set D 2Document13 pagesVariable Life Licensing Mock Exam Set D 2Neil ArmstrongNo ratings yet

- VUL MOck 2Document10 pagesVUL MOck 2Franz JosephNo ratings yet

- IC Exam Reviewer VUL No AnswerDocument12 pagesIC Exam Reviewer VUL No AnswerRoxanne Reyes-LorillaNo ratings yet

- Vul QuestionnaireDocument14 pagesVul QuestionnaireKyla Bianca Cuenco TadeoNo ratings yet

- SunLEARN Variable Life InsuranceDocument10 pagesSunLEARN Variable Life InsuranceLady Glorien cayonNo ratings yet

- Abuan grL20091 14s759 30jul1965Document2 pagesAbuan grL20091 14s759 30jul1965Anonymous iOYkz0wNo ratings yet

- Garcia grL20357 21s1056 25nov1967Document1 pageGarcia grL20357 21s1056 25nov1967Anonymous iOYkz0wNo ratings yet

- Bagatsing V RamirezDocument3 pagesBagatsing V RamirezAnonymous iOYkz0wNo ratings yet

- Gamido gr114829 242s83 01mar1995Document3 pagesGamido gr114829 242s83 01mar1995Anonymous iOYkz0wNo ratings yet

- Chong gr148280 10jul2007Document10 pagesChong gr148280 10jul2007Anonymous iOYkz0wNo ratings yet

- Permanent gr140608 439s1 23sept2004Document5 pagesPermanent gr140608 439s1 23sept2004Anonymous iOYkz0wNo ratings yet

- 9.. Tigno gr129416 25nov2001 444s61Document8 pages9.. Tigno gr129416 25nov2001 444s61Anonymous iOYkz0wNo ratings yet

- Conwi v. Cir, 213 Scra 83Document4 pagesConwi v. Cir, 213 Scra 83Anonymous iOYkz0wNo ratings yet

- Heirs 108scra43 grL46892Document10 pagesHeirs 108scra43 grL46892Anonymous iOYkz0wNo ratings yet

- Dela Cruz Ac6294 442scra407Document5 pagesDela Cruz Ac6294 442scra407Anonymous iOYkz0wNo ratings yet

- Evidence Assigned CasesDocument7 pagesEvidence Assigned CasesAnonymous iOYkz0wNo ratings yet

- Taxation CasesDocument110 pagesTaxation CasesAnonymous iOYkz0wNo ratings yet

- Definition of Terms-TAXDocument5 pagesDefinition of Terms-TAXAnonymous iOYkz0wNo ratings yet

- Case Digests Labor Relations - Closure of BusinessDocument8 pagesCase Digests Labor Relations - Closure of BusinessAnonymous iOYkz0w100% (1)

- The BASEL CONVENTION - Environment and Natural Resources LawDocument5 pagesThe BASEL CONVENTION - Environment and Natural Resources LawAnonymous iOYkz0wNo ratings yet

- Labor Relations CasesDocument5 pagesLabor Relations CasesAnonymous iOYkz0wNo ratings yet

- Forward Contract Vs Futures ContractDocument4 pagesForward Contract Vs Futures ContractabdulwadoodansariNo ratings yet

- The Index Trading Course - FontanillsDocument432 pagesThe Index Trading Course - Fontanillskaddour7108100% (1)

- AP Lecture SW SheDocument23 pagesAP Lecture SW SheMary Dale Joie BocalaNo ratings yet

- Dividend PolicyDocument16 pagesDividend PolicyJhaden CatudioNo ratings yet

- 2023 Global Market Outlook Full ReportDocument16 pages2023 Global Market Outlook Full ReportMimi KamilNo ratings yet

- Cumulative Normal Distribution Calculator and Inverse CDF Calculator Exam MFE Questions and SolutionsDocument39 pagesCumulative Normal Distribution Calculator and Inverse CDF Calculator Exam MFE Questions and SolutionsAbhinav ShahNo ratings yet

- The Impacts of Oil Price and Exchange Rate On Vietnamese Stock MarketDocument8 pagesThe Impacts of Oil Price and Exchange Rate On Vietnamese Stock MarketSATYAM MISHRANo ratings yet

- CM101 - D&B - Securities OverviewDocument104 pagesCM101 - D&B - Securities Overviewankitgupta2k52477100% (6)

- Trader Vic IntroDocument12 pagesTrader Vic Intromatrixit0% (1)

- Lec No.6 - Ch.2 - Dilutive Securities and Earnings Per ShareDocument16 pagesLec No.6 - Ch.2 - Dilutive Securities and Earnings Per Shareamir rabieNo ratings yet

- 10 1016@j Iref 2020 06 026Document47 pages10 1016@j Iref 2020 06 026Graphix GurujiNo ratings yet

- Class NotesDocument16 pagesClass NotesAnika Tabassum RodelaNo ratings yet

- Blockchain Gateway For Sustainability Linked Bonds PDFDocument46 pagesBlockchain Gateway For Sustainability Linked Bonds PDFGovind MafourNo ratings yet

- What Is Double Diagonal Spread - FidelityDocument8 pagesWhat Is Double Diagonal Spread - FidelityanalystbankNo ratings yet

- A Study On Working Capital Management in IndianDocument14 pagesA Study On Working Capital Management in IndianNeethu GesanNo ratings yet

- Birch Paper CompanyDocument38 pagesBirch Paper CompanyAbhijan Carter BiswasNo ratings yet

- Issuances On Archax FlyerDocument3 pagesIssuances On Archax FlyerWalid El AmineNo ratings yet

- Advanced Financial ManagementDocument107 pagesAdvanced Financial ManagementdirectoricpapNo ratings yet

- Resume Joana de S Saad 1688571509Document2 pagesResume Joana de S Saad 1688571509Hola HoolaNo ratings yet

- DocxDocument15 pagesDocxjhouvanNo ratings yet

- Kevlar ButterflyDocument20 pagesKevlar Butterflyadoniscal100% (1)

- JPM 2010 Annual ReviewDocument300 pagesJPM 2010 Annual ReviewMatt CareyNo ratings yet

- Presentation - Management of RiskDocument34 pagesPresentation - Management of RiskGopal SharmaNo ratings yet

- CaiaDocument2 pagesCaiaOsiris316No ratings yet

- Economic Bubbles American English StudentDocument6 pagesEconomic Bubbles American English StudentValentina AlvarezNo ratings yet

- CA StatementDocument3 pagesCA Statementapi-3698382No ratings yet

- FinQuiz - Smart Summary - Study Session 8 - Reading 28Document3 pagesFinQuiz - Smart Summary - Study Session 8 - Reading 28RafaelNo ratings yet

- Reliance Securities Requires MBA Students For Summer Internship: Designation: Management Trainee Project Duration: 2 Months Project DetailsDocument2 pagesReliance Securities Requires MBA Students For Summer Internship: Designation: Management Trainee Project Duration: 2 Months Project Detailsnishantjain95No ratings yet

- Quantopian Risk Model: Is The Return On TimeDocument16 pagesQuantopian Risk Model: Is The Return On Timezhouh1998No ratings yet

- Corporate Valuation Modeling For Strategic FinanciDocument15 pagesCorporate Valuation Modeling For Strategic FinancinadiahalusNo ratings yet