Professional Documents

Culture Documents

(5%) of The Gross Payment (7%) of Gross Payments

Uploaded by

naztig_017Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(5%) of The Gross Payment (7%) of Gross Payments

Uploaded by

naztig_017Copyright:

Available Formats

Question: Which of the following statements is correct regarding standard input tax?

Input tax that can be directly attributable to VAT taxable sales of goods and services to the Government

shall be credited against output taxes arising from sales to non-Government entities

The government or any of its political subdivisions, instrumentalities or agencies as well as purchasers in

the course of trade or business shall deduct and withhold a final VAT due at the rate of five percent (5%)

of the gross payment

Should actual input VAT attributable to sale to government exceeds seven percent (7%) of gross payments,

the excess must be closed to expense or cost

The standard input tax is in lieu of the actual input VAT directly attributable or ratably

apportioned to sales of goods or services to government or any of its political subdivisions,

instrumentalities on agencies including GOCCs

You might also like

- VAT Withholding RulesDocument2 pagesVAT Withholding RulesMary Joy NavajaNo ratings yet

- VAT Withholding RulesDocument2 pagesVAT Withholding RulesCatherine Rae EspinosaNo ratings yet

- Implementing withholding VAT on gov transactionsDocument2 pagesImplementing withholding VAT on gov transactionsCkey ArNo ratings yet

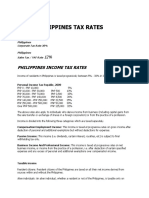

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesJL GEN0% (1)

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesRonel CacheroNo ratings yet

- Categories of Income and Tax RatesDocument5 pagesCategories of Income and Tax RatesRonel CacheroNo ratings yet

- Philippines Income Tax Rates Guide - Individual, Corporate, Capital GainsDocument6 pagesPhilippines Income Tax Rates Guide - Individual, Corporate, Capital GainsKristina AngelieNo ratings yet

- Tax On CorporationsDocument6 pagesTax On CorporationsJumen Gamaru TamayoNo ratings yet

- Section 4.110-4 of RR 16-05Document4 pagesSection 4.110-4 of RR 16-05fatmaaleahNo ratings yet

- Implementing VAT withholding on gov't transactionsDocument1 pageImplementing VAT withholding on gov't transactionsDavid Dave FuaNo ratings yet

- RMC 85 - 2017 From PWCDocument2 pagesRMC 85 - 2017 From PWCAbbeyNo ratings yet

- VAT on sales to government limited to 7% input taxDocument3 pagesVAT on sales to government limited to 7% input taxAnonymous OzIYtbjZ60% (5)

- RMC No 85-2017Document2 pagesRMC No 85-2017Karen Balisacan Segundo Ruiz100% (1)

- Understand VAT Principles in 40 CharactersDocument2 pagesUnderstand VAT Principles in 40 CharactersCali Shandy H.No ratings yet

- Philippines Corporate Tax RatesDocument2 pagesPhilippines Corporate Tax RatesAike SadjailNo ratings yet

- GST (Goods and Services Tax) : Biggest Tax Reform Since Independence .Document24 pagesGST (Goods and Services Tax) : Biggest Tax Reform Since Independence .Rohit KumarNo ratings yet

- Philippines Tax Rates Guide for Individuals and BusinessesDocument3 pagesPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoNo ratings yet

- Business and Tax Laws: INC Guntur Puttu Guru PrasadDocument28 pagesBusiness and Tax Laws: INC Guntur Puttu Guru PrasadPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- TaxationDocument3 pagesTaxationErwin MacaspacNo ratings yet

- VAT, WHT and CIT SummaryDocument8 pagesVAT, WHT and CIT Summarymariko1234No ratings yet

- Vol7 - No2.pdf.. TaxationDocument6 pagesVol7 - No2.pdf.. TaxationReyboom BautistaNo ratings yet

- Tunisia Tax Guide - 2019 - 0Document10 pagesTunisia Tax Guide - 2019 - 0Sofiene CharfiNo ratings yet

- VATPT For PicpaDocument73 pagesVATPT For PicpaJoy Superales SalaoNo ratings yet

- Income Taxation Finals - CompressDocument9 pagesIncome Taxation Finals - CompressElaiza RegaladoNo ratings yet

- Withholding Tax Guide for Philippines BusinessesDocument4 pagesWithholding Tax Guide for Philippines BusinessesJera Realyn SabayNo ratings yet

- Withholding Tax Guide for Philippines BusinessesDocument3 pagesWithholding Tax Guide for Philippines BusinessesJera Realyn SabayNo ratings yet

- Taxation Structure in PakistanDocument8 pagesTaxation Structure in PakistanIkra MalikNo ratings yet

- Tax Structure in IndiaDocument42 pagesTax Structure in Indiadinesh_raj_6No ratings yet

- Business Tax ClassificationsDocument2 pagesBusiness Tax ClassificationsAlberto NicholsNo ratings yet

- Tax DiscussionDocument10 pagesTax DiscussionMaisie ZabalaNo ratings yet

- Taxation in the Philippines: An Overview of Key Types and RatesDocument14 pagesTaxation in the Philippines: An Overview of Key Types and RatesBJ AmbatNo ratings yet

- What Is Output?Document1 pageWhat Is Output?Kathrine CruzNo ratings yet

- VAT vs Sales Tax: Key Differences Explained in 40 CharactersDocument12 pagesVAT vs Sales Tax: Key Differences Explained in 40 Charactersdarshan1793No ratings yet

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Document19 pagesChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholNo ratings yet

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Document19 pagesChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholNo ratings yet

- Tax On ServiceDocument21 pagesTax On ServiceHazel-mae LabradaNo ratings yet

- Taxation ProjectDocument14 pagesTaxation ProjectrahulkoduvanNo ratings yet

- Portfolio Sa Ekonomiks: Grace P. Navarro IV-Sobriety Mrs. DimaanoDocument6 pagesPortfolio Sa Ekonomiks: Grace P. Navarro IV-Sobriety Mrs. DimaanoRona Mae Ocampo ResareNo ratings yet

- TAXATIONDocument21 pagesTAXATIONRichelle Ann CarinoNo ratings yet

- The Philippines Income TaxDocument8 pagesThe Philippines Income TaxmendozaivanrichmondNo ratings yet

- TAXATION - Value-Added TaxDocument10 pagesTAXATION - Value-Added TaxJohn Mahatma Agripa100% (2)

- Taxation in India: Direct and Indirect Taxes ExplainedDocument4 pagesTaxation in India: Direct and Indirect Taxes ExplainedKushal SharmaNo ratings yet

- Witholding TaxegsDocument14 pagesWitholding TaxegsJean Marie Vianney NDAYIZIGIYENo ratings yet

- Goods Sold' Shall Include The Invoice Cost of TheDocument9 pagesGoods Sold' Shall Include The Invoice Cost of TheChaze CerdenaNo ratings yet

- Income Tax - Chap 07Document6 pagesIncome Tax - Chap 07ZainioNo ratings yet

- LESOTHO TAX SYSTEMDocument6 pagesLESOTHO TAX SYSTEMhenryxmphana3No ratings yet

- VAT SCOPE GOODS SERVICES EXEMPTDocument24 pagesVAT SCOPE GOODS SERVICES EXEMPTNoriel Justine QueridoNo ratings yet

- Taxation SchemeDocument27 pagesTaxation SchemeCristina Atienza SamsamanNo ratings yet

- German Tax GuideDocument10 pagesGerman Tax GuideandrogynusNo ratings yet

- VAT ReviewerDocument3 pagesVAT ReviewerCJ LopezNo ratings yet

- Company Tax in The EU - Germany: What Profits Do You Pay Company Tax On?Document12 pagesCompany Tax in The EU - Germany: What Profits Do You Pay Company Tax On?Nadine DiamanteNo ratings yet

- Taxation BrigiDocument3 pagesTaxation BrigiMari SzanyiNo ratings yet

- Japan Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreDocument15 pagesJapan Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreKris MehtaNo ratings yet

- Highlights of the CREATE Law: Tax Reforms and IncentivesDocument3 pagesHighlights of the CREATE Law: Tax Reforms and IncentivesChristine Rufher FajotaNo ratings yet

- Tax Rates and Exemptions for Corporations Under CREATE LawDocument18 pagesTax Rates and Exemptions for Corporations Under CREATE Lawjdy managbanagNo ratings yet

- Ra 9337Document39 pagesRa 9337KcompacionNo ratings yet

- Ra 9337Document34 pagesRa 9337Inayab AtienzaNo ratings yet

- Corporate Income TaxationDocument39 pagesCorporate Income TaxationVinz G. VizNo ratings yet

- Topic: Sales Tax Course: Tax ManagemnetDocument40 pagesTopic: Sales Tax Course: Tax ManagemnetMirza Ghous MohammadNo ratings yet

- Output Tax Alone Output Tax Less Lower of Actual Input Tax or 70% of Output Tax Input Tax AloneDocument1 pageOutput Tax Alone Output Tax Less Lower of Actual Input Tax or 70% of Output Tax Input Tax Alonenaztig_017No ratings yet

- T48Document1 pageT48naztig_017No ratings yet

- Question: Which of The Following Is Not Considered An Export Sale For Value Added Tax Purposes?Document1 pageQuestion: Which of The Following Is Not Considered An Export Sale For Value Added Tax Purposes?naztig_017No ratings yet

- Sale of Electricity by Generation Companies Sale of Electricity by Transmission Companies Sale of Electricity by Distribution CompaniesDocument1 pageSale of Electricity by Generation Companies Sale of Electricity by Transmission Companies Sale of Electricity by Distribution Companiesnaztig_017No ratings yet

- T44Document1 pageT44naztig_017No ratings yet

- It Is A Regressive Tax It Is Imposed On The Sale of Goods and Services As Well As Importation of Goods It Can Be Shifted by The Seller To The BuyerDocument1 pageIt Is A Regressive Tax It Is Imposed On The Sale of Goods and Services As Well As Importation of Goods It Can Be Shifted by The Seller To The Buyernaztig_017No ratings yet

- Services Rendered by Banks, Non-Bank Financial Intermediaries Generation, Transmission and Distribution of Electricity Services Rendered by Professionals Such As Cpas, Physicians and LawyersDocument1 pageServices Rendered by Banks, Non-Bank Financial Intermediaries Generation, Transmission and Distribution of Electricity Services Rendered by Professionals Such As Cpas, Physicians and Lawyersnaztig_017No ratings yet

- Question: A VAT Subject Real Estate Dealer Sold A Residential Lot On January 15, 2014. The FollowingDocument1 pageQuestion: A VAT Subject Real Estate Dealer Sold A Residential Lot On January 15, 2014. The Followingnaztig_017No ratings yet

- Question: MR Cruz, A Senior Citizen, Was Engaged in The Manufacture and Sale of "Badi" in The MarketDocument1 pageQuestion: MR Cruz, A Senior Citizen, Was Engaged in The Manufacture and Sale of "Badi" in The Marketnaztig_017No ratings yet

- T38Document1 pageT38naztig_017No ratings yet

- Export Sales of Goods Foreign Currency Denominated Sale Sale of Gold To The BSPDocument1 pageExport Sales of Goods Foreign Currency Denominated Sale Sale of Gold To The BSPnaztig_017No ratings yet

- T37Document1 pageT37naztig_017No ratings yet

- Valid Because VAT Is A Consumption Tax Due Process and Equality Are Not Violated The Progressive System of Taxation Is Not ProhibitedDocument1 pageValid Because VAT Is A Consumption Tax Due Process and Equality Are Not Violated The Progressive System of Taxation Is Not Prohibitednaztig_017No ratings yet

- Manufacturer of Canned Goods Manufacturer of Packed Juices Manufacturer of Dried FishDocument1 pageManufacturer of Canned Goods Manufacturer of Packed Juices Manufacturer of Dried Fishnaztig_017No ratings yet

- Question: One of The Following Is Required To Issue Receipts or Sales Invoice Seller of Merchandise Whose Sales Amounted To P25 or MoreDocument1 pageQuestion: One of The Following Is Required To Issue Receipts or Sales Invoice Seller of Merchandise Whose Sales Amounted To P25 or Morenaztig_017No ratings yet

- Question: Zambales Land, A Domestic Corporation Duly Authorized To Engage in Real Estate DevelopmentDocument1 pageQuestion: Zambales Land, A Domestic Corporation Duly Authorized To Engage in Real Estate Developmentnaztig_017No ratings yet

- Question: Transitional Input Tax Rate IsDocument1 pageQuestion: Transitional Input Tax Rate Isnaztig_017No ratings yet

- Question: Jun, A Hobbyist Of: Car PartsDocument1 pageQuestion: Jun, A Hobbyist Of: Car Partsnaztig_017No ratings yet

- Question: The Person Who Is Not VAT Registered But Issues A VAT Invoice Shall Be Subjected To TheDocument1 pageQuestion: The Person Who Is Not VAT Registered But Issues A VAT Invoice Shall Be Subjected To Thenaztig_017No ratings yet

- Question: Members of The KBP Regularly Receives Broadcast Orders From The Philippine InformationDocument1 pageQuestion: Members of The KBP Regularly Receives Broadcast Orders From The Philippine Informationnaztig_017No ratings yet

- Sale of Goods Importation Sale of ServicesDocument1 pageSale of Goods Importation Sale of Servicesnaztig_017No ratings yet

- Question: The Following Can Avail of The Input Tax Credit ExceptDocument1 pageQuestion: The Following Can Avail of The Input Tax Credit Exceptnaztig_017No ratings yet

- Question: B Development Corporation, A Real Estate Developer Organized in The 1970s, Bought SeveralDocument1 pageQuestion: B Development Corporation, A Real Estate Developer Organized in The 1970s, Bought Severalnaztig_017No ratings yet

- Question: Which of The Following Cannot Avail of Input Tax Credit?Document1 pageQuestion: Which of The Following Cannot Avail of Input Tax Credit?naztig_017No ratings yet

- Question: A Taxpayer Was Registered Under The VAT System in The Second Month of The Second CalendarDocument1 pageQuestion: A Taxpayer Was Registered Under The VAT System in The Second Month of The Second Calendarnaztig_017No ratings yet

- Question: Jose, A Sole Proprietor, Buys and Sells "Kumot at Kulambo" Both of Which Are Subject To ValueDocument1 pageQuestion: Jose, A Sole Proprietor, Buys and Sells "Kumot at Kulambo" Both of Which Are Subject To Valuenaztig_017No ratings yet

- Question: The Ambassador of The United States of America Decided To Go On Vacation in The ShangrilaDocument1 pageQuestion: The Ambassador of The United States of America Decided To Go On Vacation in The Shangrilanaztig_017No ratings yet

- T22Document1 pageT22naztig_017No ratings yet

- Sale of Real Property Ordinarily Held For Sale Sale of Real Property in Installments Sale of Real Property Lot at Below P2,500,000Document1 pageSale of Real Property Ordinarily Held For Sale Sale of Real Property in Installments Sale of Real Property Lot at Below P2,500,000naztig_017No ratings yet