Professional Documents

Culture Documents

CPA Prep Module 5 Financial Accounting Week 9 In-Class Problems

Uploaded by

buuuubCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CPA Prep Module 5 Financial Accounting Week 9 In-Class Problems

Uploaded by

buuuubCopyright:

Available Formats

Module 5

Financial Accounting

Week 9

In-Class Problems

Chartered Professional Accountants of Canada, CPA Canada, CPA

are trademarks and/or certification marks of the Chartered Professional Accountants of Canada.

2014, Chartered Professional Accountants of Canada. All Rights Reserved.

Reproduced with permission of 2013 Institute of Chartered Accountants of Scotland and BPP Holdings Limited.

All Rights Reserved.

Module 5 Financial Accounting

ICP #1

Dunn Ltd. acquired 100% of the ordinary share capital of Brad Ltd. on June 1, 2011. Brads

statement of financial position as at June 1, 2011, included net assets of $28.4 million.

The following information regarding Brad as at June 1, 2011, is available:

Property with a net book value of $5.2 million. A market value of $7.5 million.

Finished goods with a cost of $2.2 million and a sales value of $3.1 million. Selling costs

are 5% of the sales value.

$8 million face value with 5% bonds issued by Brad in 2001. The bonds have a carrying

value of $7.2 million and fair value of $6.452 million.

In preparation for the acquisition, Dunn had developed a plan to downsize Brads

operations at a cost of $1.6 million (mainly made up of severance payment). The plan was

announced on June 4, 2011, and full details were formalized in July 2011.

Brad had an unlisted investment in its statement of financial position at cost of $2.4 million.

Latest earnings of the company were $670,000, and the directors of Dunn believe that a

P/E ratio of 4.5 is appropriate for the company.

Brad had unrecognized ongoing research and development activities as at June 1, 2011. It

is estimated that these have a fair value of $0.8 million as at June 1, 2011. They are

considered to be separately identifiable.

Brad has guaranteed the borrowings of an associate. As it is estimated that there is only a

5% chance that the guarantee on the $10 million borrowings would be called upon, the

guarantee was included as a contingent liability of Brad as at June 1, 2011.

Dunn paid the following for Brads shares:

Cash

Common shares

3% bonds (2013)

2 / 19

$11,200,000

4 million (market value $5.20 each)

$5 million (market value of $2.419m)

Module 5 Financial Accounting

Week 9 In-Class Problems

Merchant bank and legal fees regarding the takeover equalled $480,000. Dunn will pay an

additional $2.5 million in cash on June 1, 2013. A discount rate of 6.2% is appropriate.

Required:

Calculate the fair value of the net assets acquired by Brad and the goodwill arising on

acquisition.

Solution to ICP #1

Dunn Ltd.:

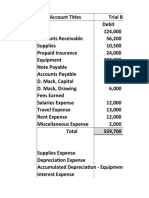

Net assets acquired (000s)

Per financial statements as at June 1, 2011

Add: increase in fair value of property ($7.5 million 5.2 million)

Add: increase in fair value of finished goods (calculation 1)

Add: reduction in bond liability ($7.2 million $6.452 million)

Add: increase in value of investment (calculation 3)

Add: value of research and development

Less: value of contingent liability (5% $10 million)

Fair value of net assets at June 1, 2011

$28,400

2,300

745

748

615

800

(500)

$33,108

Goodwill calculation:

Cost (calculation 4)

FV of net assets acquired (as above)

Goodwill

$36,636

33,108

$ 3,528

Calculations:

(in 000s)

1.

Inventories

Selling price

Less: selling costs (5%)

Per financial statements

Increase

2.

3 / 19

$ 3,100

(155)

$ 2,945

2,200

$ 745

Downsizing

The conditions for recognition of the provision are not met. Therefore, it should not be

included as at the date of acquisition. Brad had no obligation at the date of acquisition,

and therefore no provision should be made.

Module 5 Financial Accounting

3.

4.

Unlisted investments

Cost

Valuation ($670,000 4.5)

Increase in value

Week 9 In-Class Problems

$2,400

3,015

$ 615

Cost of investment

Cash on June 1, 2011

Additional consideration on June 1, 2013 [$2.5 million/(1.062)2]

Common shares (4 million $5.20)

3% bonds

$ 11,200

2,217

20,800

2,419

$ 36,636

Notes:

1. The bank and legal fees should not be included.

2. The additional cash is likely to be paid. It should be discounted to PV as it is not payable for

two years.

4 / 19

Module 5 Financial Accounting

Week 9 In-Class Problems

ICP #2

On January 1, 2012, the Karen Company acquired 100% of the outstanding shares of the Liza

Company in return for cash of $4,500,000. The statements of financial position of both

companies and the fair values of Lizas assets and liabilities on the date of acquisition

immediately after the purchase were as follows:

Cash

Inventories

Investment in Liza

Land

Building and equipment (net)

Accrued liabilities

Long-term debt

Common shares

Retained earnings

Karen Company

SFP

$ 500,000

2,500,000

4,500,000

2,250,000

5,575,000

15,325,000

Liza Company

SFP

$ 162,500

2,505,000

1,480,000

1,735,000

$5,882,500

Liza Company

fair values

$ 162,500

2,450,000

2,450,000

4,000,000

5,000,000

3,875,000

15,325,000

$ 475,000

1,490,000

2,675,000

1,242,500

$5,882,500

475,000

$1,705,000

1,700,000

2,000,000

On the acquisition date, the building and equipment of Liza had a remaining useful life of 10

years, and the long-term debt matures on June 30, 2014.

The statement of financial position and statement of comprehensive income of both Karen and

Liza Company as at December 31, 2013, are on the following page.

5 / 19

Module 5 Financial Accounting

Week 9 In-Class Problems

Revenues

Karen

$ 8,270,000

Liza

$1,317,500

COGS

Depreciation expense

Other expenses

Net income

Retained earnings, beginning

Dividends

Retained earnings, ending

4,485,000

557,500

395,000

2,832,500

5,575,000

105,000

$ 8,302,500

730,000

173,500

232,500

181,500

1,542,500

75,000

$1,649,000

Cash

Inventories

Investment in Liza

Land

Building and equipment (net)

$ 3,457,500

3,432,500

4,500,000

2,250,000

4,460,000

$18,100,000

$ 1,251,000

2,250,000

Accrued liabilities

Long-term debt

Common shares

Retained earnings

$ 555,000

1,490,000

2,675,000

1,649,000

$6,369,000

797,500

4,000,000

5,000,000

8,302,500

$18,100,000

1,480,000

1,388,000

$6,369,000

Notes: A goodwill impairment test as at December 31, 2013, establishes the value of the

goodwill in the Liza Company at $300,000.

Required:

Part A:

1. Calculate the acquisition differential and goodwill.

2. Prepare the consolidated statement of financial position on the date of acquisition.

Part B:

1. Prepare the acquisition differential amortization schedule for 2012 and 2013.

2. Prepare the consolidated statement of comprehensive income and statement of financial

position. Provide proof of the 2013 consolidated net income and the consolidated retained

earnings at December 31, 2013.

6 / 19

Module 5 Financial Accounting

Week 9 In-Class Problems

Solution to ICP #2

Part A:

1.

Purchase price

Book value of net assets acquired ($2,675,000 + 1,242,500)

Acquisition differential

Fair value allocations:

Inventories (2,450,000 2,505,000)

Land (1,700,000 1,480,000)

Building and equipment (2,000,000 1,735,000)

Long-term debt (1,705,000 1,490,000)

Goodwill

$4,500,000

3,917,500

$ 582,500

($55,000)

220,000

265,000

(215,000)

2.

Karen Company

Consolidated statement of financial position

January 1, 2012

Cash (500 + 162.5)

Inventories (2,500 + 2,505 55)

Land (2,250 + 1,480 + 220)

Building and equipment (net) (5,575 + 1,735 + 265)

Goodwill (+367.5)

$ 662,500

4,950,000

3,950,000

7,575,000

367,500

17,505,000

Accrued liabilities (2,450 + 475)

Long-term debt (4,000 + 1,490 + 215)

Common shares

Retained earnings

2,925,000

5,705,000

5,000,000

3,875,000

17,505,000

7 / 19

215,000

$367,500

Module 5 Financial Accounting

Week 9 In-Class Problems

Part B:

1. Fair value differential amortization / goodwill impairment schedule:

Inventories

Land

Building and equipment

Long-term debt

Goodwill

At

acquisition

Jan. 1

($55,000)

220,000

265,000

(215,000)

367,500

$582,500

Amortization

Amortization

2012

2013

$55,000

(26,500)

(26,500)

86,000

86,000

(67,500)

$114,500

($8,000)

Balance

Dec. 31

$220,000

212,000

(43,000)

300,000

$689,000

2.

Karen Company

Consolidated statement of comprehensive income

For the year ended December 31, 2013

Revenues (8,270 + 1.317.5 75 dividend of Liza)

COGS (4,485 + 730)

Depreciation expense (557.5 + 173.5 + 26.5 amort of AD)

Other expenses (395 + 232.5 86 amort of AD)

Goodwill impairment (67.5)

Net income and comprehensive income

$ 9,512,500

(5,215,000)

(757,500)

(541,500)

(67,500)

$ 2,931,000

Karen Company

Consolidated statement of retained earnings*

For the year ended December 31, 2013

Beg. retained earnings (Note 1)

Net earnings

Less: dividends

Ending retained earnings

Note 1:

Beginning retained earnings of Karen Company

R/E of Liza Jan. 1/13

$1,542,500

R/E of Liza acquisition

(1,242,500)

Post acquisition increase

$ 300,000

+/ Amort. of AD to date

114,500

Beginning consolidated retained earnings

8 / 19

5,989,500

2,931,000

(105,000)

$ 8,815,500

$ 5,575,000

414,500

$ 5,989,500

Module 5 Financial Accounting

Week 9 In-Class Problems

* As noted in Week 1, under IFRS, companies cannot continue to use the statement of

retained earnings and/or combine it with the statement of comprehensive income. Entities are

now required to show a separate statement of changes in equity that reconciles the opening

balance of each major category of shareholders equity (and in total) to the ending balance for

the year. Given the basic nature of the equity section in the ICPs, the term retained earnings

will be used for illustrative purposes.

Karen Company

Consolidated statement of financial position

December 31, 2013

Assets:

Cash (3,457.5 + 1,251)

Inventory (3,432.5 + 2,250)

Investment in Liza (4,500 4,500)

Land (2,250 + 1,480 + 220)

Building and equip net (4,460 + 1,388 + 212)

Goodwill (367.5 67.5)

Total

$ 4,708,500

5,682,500

3,950,000

6,060,000

300,000

$ 20,701,000

Liabilities and shareholders equity:

Accrued liabilities (797.5 + 555)

Long-term debt (4,000 + 1,490 + 43)

Common shares (5,000 only Karen)

Retained earnings (per above and see Note 2)

Total

$ 1,352,500

5,533,000

5,000,000

8,815,500

$ 20,701,000

Proof of 2013 consolidated net income:

Karens net income

Dividends received from Liza

Lizas net income

Amortization of fair value differential / goodwill impairment

Proof of consolidated R/E as at Dec. 31/13:

Karen retained earnings, December 31, 2013

Liza retained earnings, December 31, 2012

Liza retained earnings, January 1, 2012

Post-acquisition increase in retained earnings

Amortization of acquisition differential to date

Consolidated retained earnings

9 / 19

$2,832,500

(75,000)

$ 181,500

(8,000)

173,500

$2,931,000

$8,302,500

$1,649,000

1,242,500

$ 406,500

106,500

513,000

$8,815,500

Module 5 Financial Accounting

Week 9 In-Class Problems

ICP #3

On December 31, 2012, Patricia Inc. purchased 60% of the outstanding voting shares of Sara

Corp. for $1,800,000 in cash. The net assets of Sara were $2,250,000 ($2,000,000 common

shares plus $250,000 retained earnings), and Saras identifiable assets and liabilities with

differences between book and fair values were as follows:

Inventories

Plant and equipment (net)

Long-term liabilities

December 31, 2012

1,250,000

1,750,000

1,000,000

Fair values

1,125,000

2,000,000

900,000

On the date of purchase, Saras plant and equipment has an estimated useful life of 10 years,

while the long-term liabilities on that date mature on December 31, 2015. Patricia and Sara

both use the straight-line method of amortization.

The statements of comprehensive income for the year ending December 31, 2014, and the

statements of financial position as at December 31, 2014, of the Patricia and Sara companies

are as follows:

Statements of comprehensive income

For the year ending December 31, 2014

Sales

Other revenues

Cost of goods sold

Depreciation expense

Other expenses

Net income

10 / 19

Patricia

$6,250,000

250,000

6,500,000

3,000,000

1,000,000

2,000,000

6,000,000

$500,000

Sara

$3,250,000

75,000

3,325,000

1,875,000

625,000

450,000

2,950,000

$ 375,000

Module 5 Financial Accounting

Week 9 In-Class Problems

Statements of financial position

As at December 31, 2014

Cash

Accounts receivable

Inventories

Investment in Sara

Plant and equipment (net)

Current liabilities

Long-term liabilities

Common stock

Retained earnings

Patricia

$ 250,000

1,075,000

2,875,000

1,800,000

5,375,000

Sara

$ 175,000

450,000

1,000,000

2,125,000

$11,375,000

$3,750,000

$ 750,000

2,500,000

2,500,000

5,625,000

$ 100,000

1,000,000

2,000,000

650,000

$11,375,000

$3,750,000

Other information:

1. Dividends paid during 2014:

Patricia declared and paid $250,000.

Sara declared and paid $100,000.

2. At year-end, Sara still owes Patricia for $62,500 consulting fees earned during 2014.

3. It is the policy of Patricia to measure NCI based on a value using the imputed purchase

price.

4. Goodwill was tested for impairment in both 2013 ($40,000 of impairment) and 2014

($50,000 of impairment).

Required:

1. Prepare a consolidated statement of comprehensive income and a reconciliation of

retained earnings for the year ended December 31, 2014.

2. Provide a proof of the ending consolidated retained earnings balance.

3. Prepare the consolidated statement of financial position as at December 31, 2014.

4. Provide a reconciliation of the non-controlling interest statement of financial position

account from the opening balance to the ending balance.

11 / 19

Module 5 Financial Accounting

Week 9 In-Class Problems

Solution to ICP #3

1.

Purchase price imputed at 100%: $1,800,000 / 0.6

Net assets acquired

Acquisition differential

Allocation

Inventories

Plant and equipment

Long-term liabilities

Goodwill

$3,000,000

2,250,000

750,000

(125,000)

250,000

100,000

225,000

$525,000

Acquisition differential amortization schedule

Inventories

Plant and equipment:

(10 yrs)

Long-term liabilities:

(3 yrs)

Goodwill

At acquisition

Dec. 31,

2012

($125,000)

250,000

Amortization

2013

$125,000

(25,000)

2014

($25,000)

Balance

Dec. 31,

2014

$200,000

100,000

(33,333)

(33,333)

33,334

525,000

$750,000

(40,000)

$26,667

(50,000)

($108,333)

435,000

$668,334

Consolidated retained earnings Jan. 1, 2014

Patricias R/E ($5,625,000 500,000 + 250,000)

Saras R/E ($650,000 375,000 + 100,000)

Less R/E at acquisition

Post-acquisition increase in R/E

Amortization of FV Increments

Subtotal

Patricias % ownership

Consolidated R/E Jan. 1, 2014

12 / 19

$5,375,000

$375,000

250,000

125,000

26,667

151,667

60%

91,000

$5,466,000

Module 5 Financial Accounting

Week 9 In-Class Problems

Consolidated statement of comprehensive income

For the year ended December 31, 2014

Sales ($6,250,000 + 3,250,000)

Other revenues (250,000 + 75,000 62,500 fees

60,000 dividends from Sara)

Cost of goods sold (3,000,000 + 1,875,000)

Depreciation (1,000,000 + 625,000 + 25,000 FV)

Other expenses (2,000,000 + 450,000 + 33,333 FV 62,500

fees

)

Goodwill impairment loss

Net income and comprehensive income

Attributed to:

Equity holders of Patricia (see below)

Non-controlling interest: $266,667 40%

Income attributed to the equity holders of Patricia:

Patricias income

Less dividends from Sara

Saras income

Amortization of FV increments

Subtotal

Patricias % ownership

Consolidated NI attributable to Patricias

equity holders

$9,500,000

202,500

(4,875,000)

(1,650,000)

(2,420,833)

(50,000)

$ 706,667

$ 600,000

106,667

$ 706,667

$ 500,000

(60,000)

$375,000

(108,333)

266,667

60%

160,000

$ 600,000

Consolidated statement of retained earnings*

For the year ended December 31, 2014

Consolidated retained earnings, beg. of year

Income for the year Patricia

Dividends Patricia paid

Consolidated retained earnings, end of year

* See note in ICP #2 regarding statement of retained earnings.

13 / 19

$5,466,000

600,000

(250,000)

$5,816,000

Module 5 Financial Accounting

2.

3.

4.

14 / 19

Patricias R/E

Saras R/E

Less: Saras R/E at acquisition

Saras post-acquisition increase in R/E

Amortization of FV incr (108,333 26,667)

Subtotal

Patricias % ownership

Consolidated retained earnings Dec. 31, 2014

Week 9 In-Class Problems

$5,625,000

$650,000

250,000

400,000

(81,666)

318,334

60%

191,000

$5,816,000

Consolidated statement of financial position

As at December 31, 2014

Cash (250,000 + 175,000)

Accounts receivable (1,075,000 + 450,000 62,500 fees)

Inventories (2,875,000 + 1,000,000)

Plant and equipment (5,375,000 + 2,125,000 + 200,000 FV)

Goodwill (525,000 40,000 50,000)

Total assets

$425,000

1,462,500

3,875,000

7,700,000

435,000

$13,897,500

Current liabilities (750,000 + 100,000 62,500 fees)

Current portion of long-term liabilities (1,000,000 33,334 FV)

Long-term liabilities

Common stock

Retained earnings

NCI (2,650,000 + 668,334) 40%

Total liabilities and shareholders equity

$787,500

966,666

2,500,000

2,500,000

5,816,000

1,327,334

$13,897,500

NCI, beg of year ($2,000,000 common stock + 375,000 R/E beg +

776,667 unamortized FV beg) 40%

NCI in Saras income

Dividends paid to NCI: $100,000 40%

NCI, end of year

$1,260,667

106,667

(40,000)

$1,327,334

Module 5 Financial Accounting

Week 9 In-Class Problems

ICP #4

Protect Company purchased 76% of the outstanding common shares of Secure Company on

December 31, 20X7, for $950,000. At that date, Secure had the following net assets:

Common shares

$300,000

Retained earnings $220,000

On the date of acquisition, all the assets and liabilities of Secure had fair values equal to their

carrying value except for the following:

Plant & equipment*

Bonds payable**

Book value

$300,000

$120,000

Fair value

$380,000

$140,000

* 10 years remaining useful life at acquisition date and no residual value.

** 5 years until maturity at acquisition date.

The financial statements for both companies as at December 31, 20X9, are as follows:

Cash

Accounts receivable

Inventories

Investment in Secure

Notes receivable Secure

Land

Plant and equipment (net)

Accounts payable

Bonds payable

Notes payable Protect

Common shares

Retained earnings

15 / 19

Statements of financial position

Protect

Secure

$ 50,000

$ 190,000

235,000

132,000

206,000

208,000

950,000

20,000

265,000

130,000

874,000

270,000

$2,600,000

$ 930,000

$ 200,000

610,000

900,000

890,000

$2,600,000

$ 65,000

120,000

20,000

300,000

425,000

$ 930,000

Module 5 Financial Accounting

Week 9 In-Class Problems

Statements of comprehensive income

Protect

$990,000

(570,000)

(31,000)

(55,000)

(175,000)

159,000

Revenues

Cost of goods sold

Interest expense

Depreciation expense

Other expenses

Net income

Secure

$623,000

(301,000)

(9,000)

(30,000)

(85,000)

198,000

Statements of retained earnings*

Retained earnings, beginning

Net income

Dividends declared

Retained earnings, ending

Protect

831,000

159,000

(100,000)

$ 890,000

Secure

247,000

198,000

(20,000)

$ 425,000

*As noted in Week 1, under /FRS, companies cannot continue to use the statement of retained

earnings and/or combine it with the statement of comprehensive income. Entities are now

required to show a separate statement of changes in equity that reconciles the opening

balance of each major category of shareholders' equity (and in total) to the ending balance for

the year. Given the basic nature of the equity section in the /CPs, the term "retained earnings"

will be used for illustrative purposes.

Other information:

During 20X9, Secure sold inventory to Protect for $50,000 that had a cost to Secure of

$30,000. At the end of 20X9, 25% of the inventory remained unsold by Protect and was

included in ending inventory.

During 20X9, Protect provided management services (included in revenues) to Secure

(included in other expenses) and invoiced Secure $10,000. At year-end, $2,000 of the

$10,000 remained unpaid by Secure and was included in regular payables and receivables.

On January 1, 20X9, Protect advanced $20,000 to Secure, and Secure signed a note with

no set terms for repayment but which indicated that interest of 5% would be due on

December 31 each year. The interest was paid by Secure on that date and Protect included

the receipt of interest in its revenues for the year.

Protect measures NCI based on a value using the imputed purchase price.

Impairment testing indicated that the goodwill for Secure was impaired by $70,000 at

December 31, 20X9.

16 / 19

Module 5 Financial Accounting

Week 9 In-Class Problems

Required:

1. Prepare a consolidated statement of income and a reconciliation of retained earnings for

the year ended December 31, 20X9.

2. Prepare the consolidated statement of financial position as at December 31, 20X9. (Also

prepare a reconciliation of the NCI to prove the ending balance on the statement of

financial position.)

Solution to ICP #4

1.

Purchase price imputed at 100%: $950,000/76%

Net assets acquired ($300,000 + 220,000)

Acquisition differential

Fair value allocations:

P&E

Bonds payable

Goodwill

$1,250,000

520,000

730,000

$80,000

(20,000)

60,000

$670,000

Amortization schedule for acquisition differential:

P & E (10 yrs)

B/P (5 yrs)

Goodwill

At acquisition

Dec. 31, 20X7

$80,000

(20,000)

670,000

$730,000

Amortization

20X8

20X9

(8,000)

(8,000)

4,000

4,000

(70,000)

(4,000)

(74,000)

Balance

Dec. 31, 20X9

$64,000

(12,000)

600,000

$652,000

Consolidated retained earnings Jan. 1, 20X9

Protects R/E

Secures R/E

Less R/E at acquisition

Post-acquisition increase in R/E

Amortization of acquisition differential

Subtotal

Protects % ownership

Consolidated R/E Jan. 1, 20X9

17 / 19

$831,000

$247,000

(220,000)

27,000

(4,000)

23,000

76%

17,480

$848,480

Module 5 Financial Accounting

Week 9 In-Class Problems

Consolidated statement of comprehensive income

For the year ended December 31, 20X9

Revenues ($990 + 623 15.2 dividends from Secure 50 internal sale

10 mgmt fees 1 interest on loan)

Cost of goods sold (570 + 301 50 internal sale +

5 unrealized profit)

Interest expense (31 + 9 4 AD 1 interest on loan)

Depreciation (55,000 + 30,000 + 8,000 AD)

Other expenses (175 + 85 + 70 GW impairmt 10 mgmt fees)

Net income and comprehensive income

Attributed to:

Equity holders of Protect (schedule)

Non-controlling shareholders: $119,000 24%

$1,536,800

(826,000)

(35,000)

(93,000)

(320,000)

$ 262,800

$ 234,240

28,560

$ 262,800

Calculations:

Interest on loan = 20,000 5% = 1,000

Unrealized profit = 25% (50,000 30,000) = 5,000

Profit attributed to the equity holders of Protect

Protect profit for the year

Less: dividends from Secure

Secure profit for the year

$198,000

Less: amortization of acquisition differential

(74,000)

Less: unrealized profit in inventory of Protect

(5,000)

Subtotal

119,000

Protects % ownership

76%

Consolidated NI attributable to Protects equity holders

$ 159,000

(15,200)

90,440

$ 234,240

Consolidated statement of retained earnings

For the year ended December 31, 20X9

Consolidated retained earnings, beginning of year

Protects net income for the year

Dividends paid by Protect

Consolidated retained earnings, end of year

18 / 19

$ 848,480

234,240

(100,000)

$ 982,720

Module 5 Financial Accounting

2.

Week 9 In-Class Problems

Consolidated statement of financial position

As at December 31, 20X9

Cash (50,000 + 190,000)

Accounts receivable (235,000 + 132,000 2,000 internal )

Inventories (206,000 + 208,000 5,000 unrealized profit)

Investment in Secure (950,000 950,000)

Notes receivable Secure (20,000 20,000)

Land (265,000 + 130,000)

P & E (874,000 + 270,000 + 64,000 AD)

Goodwill (670,000 70,000 GW impairment)

Total assets

$240,000

365,000

409,000

395,000

1,208,000

600,000

$3,217,000

Accounts payable (200,000 + 65,000 2,000 internal)

Bonds payable (610,000 + 120,000 + 12,000 AD)

Notes payable Protect (20,000 20,000)

Common stock

Retained earnings

NCI (725,000 + 652,000 unamort AD 5,000 unreaized profit) 24%

Total liabilities and shareholders equity

263,000

742,000

900,000

982,720

329,280

$3,217,000

Reconciliation of NCI:

NCI, beginning of year ($300,000 common stock

+ 247,000 retained earnings beg + 726,000 unamortized AD beg) 24%

NCI in Secures income

Dividends paid to NCI: $20,000 24%

NCI, end of year

19 / 19

$305,520

28,560

(4,800)

$329,280

You might also like

- J.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleNo ratings yet

- JPM Mortgage WarningsDocument21 pagesJPM Mortgage WarningsZerohedgeNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Managerial FinanceDocument7 pagesManagerial FinanceHafsa Siddiq0% (1)

- ACCT3302 Financial Statement Analysis Tutorial 2: Accrual Accounting and Income DeterminationDocument3 pagesACCT3302 Financial Statement Analysis Tutorial 2: Accrual Accounting and Income DeterminationDylan AdrianNo ratings yet

- Financial AccountingDocument104 pagesFinancial AccountingRuban ThomasNo ratings yet

- CMA2 P1 A Budgeting Alpha Tech P3694Q3Document4 pagesCMA2 P1 A Budgeting Alpha Tech P3694Q3Omnia HassanNo ratings yet

- SEx 9Document24 pagesSEx 9Amir Madani100% (1)

- Financial Accounting Ch 5 Exercises & Problems AnswersDocument13 pagesFinancial Accounting Ch 5 Exercises & Problems AnswersHumza Abbasi0% (3)

- Annex P Communications Plan AppendixDocument5 pagesAnnex P Communications Plan AppendixAnggrek DelNo ratings yet

- Pro Forma Financial Statements4Document50 pagesPro Forma Financial Statements4SakibMDShafiuddinNo ratings yet

- GB922 InformationFramework Concepts R9 0 V7-14Document57 pagesGB922 InformationFramework Concepts R9 0 V7-14youssef MCHNo ratings yet

- Finacc Quiz 2Document11 pagesFinacc Quiz 2Chayne RodilNo ratings yet

- Insurance CompaniesDocument59 pagesInsurance CompaniesParag PenkerNo ratings yet

- Fa Mod1 Ont 0910Document511 pagesFa Mod1 Ont 0910subash1111@gmail.comNo ratings yet

- SP 07 Sop Customer PropertyDocument13 pagesSP 07 Sop Customer PropertyLoemban S Jody100% (1)

- Introduction To SHRM: By: Sonam Sachdeva Assistant Professor GibsDocument65 pagesIntroduction To SHRM: By: Sonam Sachdeva Assistant Professor GibsRicha Garg100% (1)

- EOC Ross 7th Edition Case SolutionsDocument6 pagesEOC Ross 7th Edition Case SolutionsKhan Abdullah0% (1)

- Corpolaw Outline 2 DigestDocument24 pagesCorpolaw Outline 2 DigestAlexPamintuanAbitanNo ratings yet

- Mining Operational ExcellenceDocument12 pagesMining Operational ExcellencegarozoNo ratings yet

- Demand Management: Leading Global Excellence in Procurement and SupplyDocument7 pagesDemand Management: Leading Global Excellence in Procurement and SupplyAsif Abdullah ChowdhuryNo ratings yet

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityFrom EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityRating: 4 out of 5 stars4/5 (2)

- BAC Q4 2013 PresentationDocument25 pagesBAC Q4 2013 PresentationZerohedgeNo ratings yet

- Financial Reporting & AnalysisDocument11 pagesFinancial Reporting & AnalysisSalman FarooqNo ratings yet

- Team Go For It Chapter17 FIN 2600 CorrectedDocument14 pagesTeam Go For It Chapter17 FIN 2600 CorrectedThái TranNo ratings yet

- F7 ACCA June 2013 Exam: BPP AnswersDocument16 pagesF7 ACCA June 2013 Exam: BPP Answerskumassa kenya100% (1)

- Financial PlanningDocument28 pagesFinancial Planningdabigshow85No ratings yet

- Illustration On AFN (FE 12)Document39 pagesIllustration On AFN (FE 12)Jessica Adharana KurniaNo ratings yet

- Problem BankDocument10 pagesProblem BankSimona NistorNo ratings yet

- 2012results FL FLDocument9 pages2012results FL FLPatricia bNo ratings yet

- BofA Q3 2014 PresentaitonDocument28 pagesBofA Q3 2014 PresentaitonZerohedgeNo ratings yet

- Laquayas Research Paper - NetflixDocument18 pagesLaquayas Research Paper - Netflixapi-547930687No ratings yet

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountDocument7 pagesSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirNo ratings yet

- A Level Recruitment TestDocument9 pagesA Level Recruitment TestFarrukhsgNo ratings yet

- Review Questions - 1Document3 pagesReview Questions - 1nlNo ratings yet

- Exhibit 99.1 Message To ShareholdersDocument8 pagesExhibit 99.1 Message To ShareholdersWilliam HarrisNo ratings yet

- Infosys Results Q2-2005-06Document4 pagesInfosys Results Q2-2005-06Niranjan PrasadNo ratings yet

- Financial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsDocument10 pagesFinancial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsBilal RazzaqNo ratings yet

- FMGT 1321 Midterm 1 Review Questions: InstructionsDocument7 pagesFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- MAA716 - T2 - 2012 v2Document11 pagesMAA716 - T2 - 2012 v2ssusasi4769No ratings yet

- Financial Forecasting and PlanningDocument39 pagesFinancial Forecasting and PlanningTaqiya NadiyaNo ratings yet

- Strong 1Q Results and Capital StrengthDocument46 pagesStrong 1Q Results and Capital Strengthsandeeppal02No ratings yet

- Qbe 10-KDocument183 pagesQbe 10-Kftsmall0% (1)

- Acct1511 Final VersionDocument33 pagesAcct1511 Final VersioncarolinetsangNo ratings yet

- Traveler Group consolidated SoFPDocument6 pagesTraveler Group consolidated SoFPNeel ShahNo ratings yet

- Cash Flow Statement 2019 HL Question Worked SolutionDocument5 pagesCash Flow Statement 2019 HL Question Worked SolutionConor MurphyNo ratings yet

- Analyze Dell's FinancialsDocument18 pagesAnalyze Dell's FinancialsSaema JessyNo ratings yet

- Q1 2013 Investor Presentation Unlinked FINALDocument14 pagesQ1 2013 Investor Presentation Unlinked FINALMordechai GilbertNo ratings yet

- P2Document20 pagesP2Jemson YandugNo ratings yet

- Financial Plan BreakdownDocument8 pagesFinancial Plan BreakdownViet Quang TranNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- 2008 F F3250 Exam 1 KeyDocument8 pages2008 F F3250 Exam 1 Keyproject44No ratings yet

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Assignment - FSAB - Submission 06 May 2023Document4 pagesAssignment - FSAB - Submission 06 May 2023Amisha BoolkanNo ratings yet

- Final Review Session SPR12RปDocument10 pagesFinal Review Session SPR12RปFight FionaNo ratings yet

- Unaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)Document2 pagesUnaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)nayanghimireNo ratings yet

- Q1 2000 Results and Acquisition of Safety 1stDocument1 pageQ1 2000 Results and Acquisition of Safety 1stsalehin1969No ratings yet

- AIOU Advanced Financial Accounting Assignment GuideDocument5 pagesAIOU Advanced Financial Accounting Assignment GuideAbdullah ShahNo ratings yet

- Online Presentation 11-1-11Document18 pagesOnline Presentation 11-1-11Hari HaranNo ratings yet

- Financial Statements ExplainedDocument36 pagesFinancial Statements ExplainedTakouhiNo ratings yet

- CF XiaomiDocument11 pagesCF XiaomiNimish DubeyNo ratings yet

- BofA Q1 EarningsDocument26 pagesBofA Q1 EarningsZerohedgeNo ratings yet

- Financial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFDocument48 pagesFinancial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFthomasowens1asz100% (7)

- Chapter1A - Financial Accounting, Fourth Canadian EditionDocument14 pagesChapter1A - Financial Accounting, Fourth Canadian EditionMuktar Ibrahim BockNo ratings yet

- f9 2014 Dec QDocument13 pagesf9 2014 Dec QreadtometooNo ratings yet

- FINAL EXAM Winter 2014Document8 pagesFINAL EXAM Winter 2014denisemriceNo ratings yet

- Chapter 3 Lecture Hand-Outs - Problem SolvingDocument5 pagesChapter 3 Lecture Hand-Outs - Problem SolvingLuzz LandichoNo ratings yet

- Assignment 3 SolutionsDocument2 pagesAssignment 3 SolutionsHennrocksNo ratings yet

- 4Q12 Earnings PresentationDocument9 pages4Q12 Earnings PresentationFibriaRINo ratings yet

- Mcpe ProgramDocument6 pagesMcpe ProgramdoparindeNo ratings yet

- Chapter 1 - An Overview of Accounting Information SystemDocument62 pagesChapter 1 - An Overview of Accounting Information SystemMei Chun TanNo ratings yet

- Cleartrip Flight Domestic E-TicketDocument3 pagesCleartrip Flight Domestic E-TicketsantoshNo ratings yet

- Laporan Drama Looks Get in The WayDocument14 pagesLaporan Drama Looks Get in The WayIka IrawatiNo ratings yet

- Trial Balance Accounting RecordsDocument8 pagesTrial Balance Accounting RecordsKevin Espiritu100% (1)

- 5834 GETCO 15-31-53 STC 75 2020 WEB Tender Upkeep Switch Yard 66kV Hansalpur Group SSDocument92 pages5834 GETCO 15-31-53 STC 75 2020 WEB Tender Upkeep Switch Yard 66kV Hansalpur Group SSKhozema GoodluckNo ratings yet

- Union Voices: Tactics and Tensions in UKDocument3 pagesUnion Voices: Tactics and Tensions in UKLalit ModiNo ratings yet

- Showcasing Authentic Caribbean Products at Summer Fancy Food ShowDocument28 pagesShowcasing Authentic Caribbean Products at Summer Fancy Food ShowrudyspamNo ratings yet

- Mercedes-Benz SA Limited: 1. DefinitionsDocument3 pagesMercedes-Benz SA Limited: 1. DefinitionsvikasNo ratings yet

- NebicoDocument6 pagesNebicomaharjanaarya21No ratings yet

- Organizational Management: Management TheoriesDocument4 pagesOrganizational Management: Management TheoriesOSHIENo ratings yet

- Ghani Glass AccountsDocument28 pagesGhani Glass Accountsumer2118No ratings yet

- Human Resource Department: Subject: General PolicyDocument19 pagesHuman Resource Department: Subject: General PolicyAhmad HassanNo ratings yet

- Cost Accounting For Decision-MakingDocument56 pagesCost Accounting For Decision-MakingRita ChingNo ratings yet

- Eleanor Shaw CVDocument1 pageEleanor Shaw CVEllie JeanNo ratings yet

- B4U GLOBAL NEW PRESENTATION Updated 25 July 2020Document47 pagesB4U GLOBAL NEW PRESENTATION Updated 25 July 2020Dep RessedNo ratings yet

- Tax Invoice SummaryDocument1 pageTax Invoice SummaryAkshay PatilNo ratings yet

- Huge Collection of 900s Finacle Menu - Finacle Commands - Finacle Wiki, Finacle Tutorial & Finacle Training For BankersDocument27 pagesHuge Collection of 900s Finacle Menu - Finacle Commands - Finacle Wiki, Finacle Tutorial & Finacle Training For BankersShadab ArfiNo ratings yet

- Us Lisega Catalog 2020 PDFDocument289 pagesUs Lisega Catalog 2020 PDFozkanhasan100% (1)

- WA CalculationsDocument3 pagesWA CalculationsAhmed EzzNo ratings yet

- Taxation Management AssignmentDocument12 pagesTaxation Management AssignmentJaspreetBajajNo ratings yet