Professional Documents

Culture Documents

Eco Plastics Company

Uploaded by

Khai EmanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eco Plastics Company

Uploaded by

Khai EmanCopyright:

Available Formats

13/5/2014

Eco Plastics Company

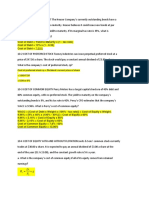

Integrative Case 4: Eco Plastics Company

This case focuses on determination of the cost of capital for a firm. The student determines the cost of individual

sources of financing, including long-term debt, preferred stock, and common stock. The cost of debt is adjusted

for Eco Plastics 40% tax bracket. The company is considering a new financial structure, with the replacement of

preferred stock financing with debt financing. Additional use of debt increases the common stockholders

required rate of return. The student is asked to compare the two weighted average costs of capital and identify

the better financial structure for Eco Plastics Company.

a. Cost of debt:

Proceeds from sale of $1,000 par value bond:

$1,000 (average discount & floatation costs)

$1,000 ($45 + $32) = $923

Subsequent payments: Interest payments ($1,000 0.105) + Par value

Before-tax cost of debt

N = 20, PV = $923, PMT = 105, FV = 1,000

Solve for I = 11.50%

After-tax cost of debt: ri = rd (1-T) = 11.5% (10.4) = 6.9%

b. Cost of preferred stock: rp = Dp Np

= (0.095 $95) ($95 - $7)

= $9.02 $88

= 10.25%

c. Cost of common stock: rj = RF + [bj (rm RF)]

= 0.04 + [1.3 (0.13 0.04)]

= 0.04 + [1.3 0.09]

= 0.04 + 0.1170

= 15.7%

d. Weighted average cost of capital: ra = (wi ri) + (wp rp) + (ws rn)

= (0.30 0.069) + (0.20 0.1025) + (0.50 0.157)

= 0.0207 + 0.0205 + 0.785

= 0.1197, or about 12%

e. 1. Change in risk Premium: Change in beta market risk premium

= (1.5 1.3) (0.13 0.04)

http://www.papercamp.com/print/Eco-Plastics-Company/98706

1/2

13/5/2014

Eco Plastics Company

= 0.2 0.09 = 0.018

Shareholders require 1.8% more per year

New cost of common equity: rj = RF + [bj (rm RF)]

= 0.04 + [1.5 (0.13 0.04)]

= 0.04 + [1.5 0.09]

= 0.04 + 0.1350

= 17.5%

Note: 17.5% 15.7% = 1.8%

2. Revised weighted average cost of capital: ra = (wi x ri) + (ws x rn)

= (0.50 0.069) + (0.50 0.175)

= 0.0345 + 0.0875

= 0.1220

3. Eco Plastics CFO should retain the cheaper current financial structure. Replacing preferred stock financing

with debt financing results in more risk to the stockholders. The increase in stockholders required rate of return

is more than offsets the advantage of using the low cost debt. If Eco Plastics CFO were to revise the capital

structure, share price would fall and shareholder wealth would not be maximized.

http://www.papercamp.com/print/Eco-Plastics-Company/98706

2/2

You might also like

- Case Solution On Eco PlasticDocument8 pagesCase Solution On Eco PlasticFilthy Rich100% (1)

- Birdie Golf-Hybrid Golf Merger AnalysisDocument8 pagesBirdie Golf-Hybrid Golf Merger AnalysisSiska Kurniawan0% (1)

- Nike CaseDocument7 pagesNike CaseNindy Darista100% (1)

- Identifying ZOPA: The Potential Zone of AgreementDocument2 pagesIdentifying ZOPA: The Potential Zone of AgreementFadhila Hanif100% (1)

- Warf Computers Case - CHAPTER 27 AnswersDocument3 pagesWarf Computers Case - CHAPTER 27 AnswersTrent100% (2)

- HOMEWORKDocument7 pagesHOMEWORKReinaldo RoseroNo ratings yet

- Maurice Nicoll The Mark PDFDocument4 pagesMaurice Nicoll The Mark PDFErwin KroonNo ratings yet

- Compare Two Proposed Printing Presses InvestmentDocument5 pagesCompare Two Proposed Printing Presses InvestmentNadya Azzura100% (1)

- Bethesda & GoodweekDocument8 pagesBethesda & GoodweekDian Pratiwi RusdyNo ratings yet

- Answers to Warm-Up Exercises E14Document10 pagesAnswers to Warm-Up Exercises E14Amanda Ng100% (1)

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Goodweek Tires, Inc - A tire producing companyDocument20 pagesGoodweek Tires, Inc - A tire producing companyMai Trần100% (1)

- Eastboro Machine Tools CorporationDocument32 pagesEastboro Machine Tools Corporationrifki100% (2)

- Lasting Impressions Company1Document5 pagesLasting Impressions Company1Jenifer Galicia100% (3)

- LBO Valuation of Cheek ProductsDocument4 pagesLBO Valuation of Cheek ProductsEfri Dwiyanto100% (2)

- Integrative Case: 4 O'Grady Apparel CompanyDocument3 pagesIntegrative Case: 4 O'Grady Apparel CompanyMae Licuanan0% (1)

- Calculating the Present Value of Cash Flows from a Potential AcquisitionDocument3 pagesCalculating the Present Value of Cash Flows from a Potential AcquisitionIsmaeel TarNo ratings yet

- Final Exam Financial Management Antonius Cliff Setiawan 29119033Document20 pagesFinal Exam Financial Management Antonius Cliff Setiawan 29119033Antonius CliffSetiawan100% (4)

- Fonderia Di Torino ExcelDocument10 pagesFonderia Di Torino Excelpeachrose12100% (1)

- Answer of Integrative Case 1 (Track Software, LTD)Document2 pagesAnswer of Integrative Case 1 (Track Software, LTD)Mrito Manob67% (3)

- Fonderia Case Study SolutionDocument6 pagesFonderia Case Study SolutionVishal Sachin RauNo ratings yet

- Developing Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018Document5 pagesDeveloping Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018DenssNo ratings yet

- Goodweek Tires investment analysis and financial projectionsDocument7 pagesGoodweek Tires investment analysis and financial projectionsKishor MahmudNo ratings yet

- Mini Case Chapter 19Document10 pagesMini Case Chapter 19ricky setiawan100% (3)

- Ben's MBA Decision AnalysisDocument11 pagesBen's MBA Decision AnalysisanuragNo ratings yet

- This Study Resource Was: Integrative Case 7: Casa de DisenoDocument5 pagesThis Study Resource Was: Integrative Case 7: Casa de DisenoFikri N SetyawanNo ratings yet

- The MBA Decision: Current PositionDocument3 pagesThe MBA Decision: Current PositionParshant Gupta100% (1)

- Practice Your FV and PV SkillsDocument6 pagesPractice Your FV and PV SkillsIndra Zulhijayanto100% (2)

- CHAPTER 6 Case SolutionDocument3 pagesCHAPTER 6 Case SolutionJeffy Jan100% (2)

- Integrative Case 2 - Track Software, Inc.Document7 pagesIntegrative Case 2 - Track Software, Inc.Fiodor Ziu60% (5)

- Fonderia Di Torino SDocument15 pagesFonderia Di Torino SYrnob RokieNo ratings yet

- Fonderia DI TorinoDocument19 pagesFonderia DI TorinoA100% (3)

- Fonderia TorinoDocument3 pagesFonderia TorinoMatilda Sodji100% (1)

- Bethesda Mining CompanyDocument9 pagesBethesda Mining Companycharles100% (3)

- Agency Issues in AppleDocument5 pagesAgency Issues in AppleKhai EmanNo ratings yet

- Eco Plastic Case StudyDocument3 pagesEco Plastic Case StudyQistina100% (2)

- KeyWahlIndustries DuPontAnalysisDocument2 pagesKeyWahlIndustries DuPontAnalysisKhai EmanNo ratings yet

- Ch18Ross7edMINICASEThe Leveraged Buyout of Cheek Products LTDDocument2 pagesCh18Ross7edMINICASEThe Leveraged Buyout of Cheek Products LTDCatherine Li0% (1)

- Mini Case: Bethesda Mining Company: Disusun OlehDocument5 pagesMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- Eastboro Case SolutionDocument22 pagesEastboro Case Solutionuddindjm100% (2)

- Case Study LeasingDocument3 pagesCase Study LeasingNicolaus Chandra100% (2)

- Fonderia Di Torino (Final)Document4 pagesFonderia Di Torino (Final)Tracye Taylor100% (2)

- 2 Solucion Bethesda Mining CompanyDocument4 pages2 Solucion Bethesda Mining CompanyCelia Bonifaz Ordoñez100% (3)

- Case Study - Track SoftwareDocument6 pagesCase Study - Track SoftwareRey-Anne Paynter100% (14)

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- Chapter 1 3Document27 pagesChapter 1 3Marlon DominguezNo ratings yet

- Chapter - 14-Working Capital and Current Assets ManagementDocument8 pagesChapter - 14-Working Capital and Current Assets ManagementShota TsakashviliNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Bond interest, stock authorization, real rate of return problemsDocument3 pagesBond interest, stock authorization, real rate of return problemsNeryvelisse MedinaNo ratings yet

- Chapter 13 Solutions MKDocument26 pagesChapter 13 Solutions MKCindy Kirana17% (6)

- Tutorial 8 AnswerDocument3 pagesTutorial 8 AnswerHaidahNo ratings yet

- Encore 1Document3 pagesEncore 1gsurawijaya75% (4)

- Cost of Capital Interest Rate at Zero Level Risk + Premium For Business Risk + Premium For Financial RiskDocument6 pagesCost of Capital Interest Rate at Zero Level Risk + Premium For Business Risk + Premium For Financial RiskAjay GuptaNo ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalGagan RajpootNo ratings yet

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMera SamirNo ratings yet

- Datos del caso cost of capital analysisDocument2 pagesDatos del caso cost of capital analysisJavier GuajardoNo ratings yet

- Cost of Capital: Answers To Concepts Review and Critical Thinking Questions 1Document7 pagesCost of Capital: Answers To Concepts Review and Critical Thinking Questions 1Trung NguyenNo ratings yet

- Cost of Capital (Ch-3)Document26 pagesCost of Capital (Ch-3)Neha SinghNo ratings yet

- Chapter 12 - ET3Document6 pagesChapter 12 - ET3anthony.schzNo ratings yet

- Cost of CapitalDocument9 pagesCost of CapitalFahad RahimNo ratings yet

- Chapter 12Document44 pagesChapter 12Dashania GregoryNo ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalAsad AliNo ratings yet

- Cost of Capital Pretax and After-TaxDocument18 pagesCost of Capital Pretax and After-TaxBob MarshellNo ratings yet

- 3 Years: Airline AffiliatesDocument2 pages3 Years: Airline AffiliatesKhai EmanNo ratings yet

- Financial Statement v1Document49 pagesFinancial Statement v1Khai EmanNo ratings yet

- Vol, 2 - 1 - Rafidah, Et AlDocument14 pagesVol, 2 - 1 - Rafidah, Et AlKhai EmanNo ratings yet

- Introduction To Serverless Compute With Azure Functions: Callon Campbell Systems ArchitectDocument30 pagesIntroduction To Serverless Compute With Azure Functions: Callon Campbell Systems ArchitectKhai EmanNo ratings yet

- Fernandez and RaineyDocument9 pagesFernandez and RaineyKhai EmanNo ratings yet

- AirAsia's Financial Performance and Leverage RatiosDocument8 pagesAirAsia's Financial Performance and Leverage RatiosKhai EmanNo ratings yet

- Strategic Role of The Distribution Centre:: How To Turn Your Warehouse Into A DCDocument3 pagesStrategic Role of The Distribution Centre:: How To Turn Your Warehouse Into A DCKhai EmanNo ratings yet

- Pros and Cons of Having Bond As Source of FinancingDocument1 pagePros and Cons of Having Bond As Source of FinancingKhai EmanNo ratings yet

- AirAsia Strategy AnalysisDocument25 pagesAirAsia Strategy AnalysisKhai EmanNo ratings yet

- User Manual 1.1 Download Version (English)Document30 pagesUser Manual 1.1 Download Version (English)hairilmasonNo ratings yet

- Recruiting and Retaining Generation Y - A New WorkforceDocument111 pagesRecruiting and Retaining Generation Y - A New WorkforceKhai Eman100% (1)

- Anders LindgrenDocument62 pagesAnders LindgrenKhai EmanNo ratings yet

- 166 S00035Document6 pages166 S00035Khai EmanNo ratings yet

- HASSINDocument7 pagesHASSINKhai EmanNo ratings yet

- SeaTools For WindowsDocument22 pagesSeaTools For WindowsAndreas DelisNo ratings yet

- Sea Tools Dos GuideDocument24 pagesSea Tools Dos GuideYokesh MariappanNo ratings yet

- P7p55d-E LX Memory QVLDocument6 pagesP7p55d-E LX Memory QVLKhai EmanNo ratings yet

- Martin Manufacturing's 2009 Financial Ratios AnalysisDocument4 pagesMartin Manufacturing's 2009 Financial Ratios AnalysisKhai Eman50% (2)

- E5147 - P7P55D-E LXDocument70 pagesE5147 - P7P55D-E LXKhai EmanNo ratings yet

- Eid Ul FitrDocument2 pagesEid Ul FitrKhai EmanNo ratings yet

- Sea Tools Dos GuideDocument24 pagesSea Tools Dos GuideYokesh MariappanNo ratings yet

- Sea Tools Dos GuideDocument24 pagesSea Tools Dos GuideYokesh MariappanNo ratings yet

- Guideline ThesisDocument62 pagesGuideline ThesisKhai EmanNo ratings yet

- CIMB Member Rewards 2014Document19 pagesCIMB Member Rewards 2014Khai EmanNo ratings yet

- Home Broadband Comparison Tool v2Document22 pagesHome Broadband Comparison Tool v2Khai EmanNo ratings yet

- Bat Annual Report 2001Document102 pagesBat Annual Report 2001Khai EmanNo ratings yet