Professional Documents

Culture Documents

HBS Mercury Case

Uploaded by

David PetruCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HBS Mercury Case

Uploaded by

David PetruCopyright:

Available Formats

Mercury Athletic Case

David Petru-Catalin (10824618)

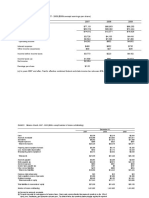

1a. What are the free cash flows from 2007 until 2011? Create a table. Check exhibit 6 for elements of

the calculation that are relevant but not in that table, and elements which you might need to remove.

Argue your choices (two or three lines of text / item)

Year

Total Revenue

Operating Expenses

Corporate Overhead

EBIT

Taxes

Depreciation

Capital Expenditure

Change in Working Capital

Free Cash Flow

2007

479,329

(423,837)

(8,487)

47,005

(18,802)

9,587

(11,983)

(11,084)

14,723

2008

489,028

(427,333)

(8,659)

53,036

(21,214)

9,781

(12,226)

(2,614)

26,763

2009

532,137

(465,110)

(9,422)

57,605

(23,042)

10,643

(13,303)

(9,434)

22,469

2010

570,319

(498,535)

(10,098)

61,686

(24,674)

11,406

(14,258)

(8,359)

25,801

2011

597,717

(522,522)

(10,583)

64,612

(25,845)

11,954

(14,943)

(5,998)

29,780

Assumptions:

-

All items necessary to determine EBIT for Mercury in the upcoming years were extracted from

Exhibit 6.

I used the tax rate of 40% which is provided in the text as the one used by Liedtke.

Depreciation and Capital Expenditure were also provided in Exhibit 6.

For determining the Change in WC I used Exhibit 7 (which provides forecasts for 2007 2011)

and Exhibit 4 (this was necessary to compute the change in WC between 2006 and 2007):

Accounts Receivable

Inventory

Prepaid Expenses

Current Assets

Accounts Payable

Accrued Expenses

Current Liabilities

Net Working Capital

Change in NWC

2006

45,910

73,149

10,172

129,231

16,981

18,810

35,791

93,440

2007

47,888

83,770

14,474

146,132

18,830

22,778

41,608

104,524

11,084

2008

48,857

85,465

14,767

149,089

18,985

22,966

41,951

107,138

2,614

2009

53,164

92,999

16,069

162,232

20,664

24,996

45,660

116,572

9,434

2010

56,978

99,672

17,222

173,872

22,149

26,792

48,941

124,931

8,359

2011

59,715

104,460

18,049

182,224

23,214

28,081

51,295

130,929

5,998

1b. Explain what it means to have a depreciation that is smaller than capital expenditures, and which

elements of the NPV calculation this might affect.

In such a situation, the company is investing strongly in its asset base in order to obtain higher growth in

the future. Even though the effect on cash flows will be negative in the short term (the capex outflow is

higher than depreciation), it is expected that the future growth rates in cash flows will also be higher

than in the case when less investments were made. Therefore, in my opinion, it is probable that the net

effects on NPV will be positive as long as the return on these investments exceeds the cost of capital.

1c. The womans casual line will be discontinued (that decision has been made and is irreversible).

Suppose that it emerges that in 2008, the will be an additional cash outflow of $130,000 to settle a

claim against this line based on an event in 2004. How will this affect the NPV calculation of Mercury

Athletic as a company? Does it matter if the company is acquired, continues as a daughter of West

Coast Fashions, or becomes a stand-alone company?

Mercury Athletic Case

David Petru-Catalin (10824618)

I assume that 130,000$ is actually 130,000$ * 1000$ as it is the case for all amounts listed in the case.

Because of the $130,000 cash outflow, the NPV will be lower than in the base case. If this outflow may

be treated as a deductible expense, then it will probably have a smaller impact if the company is

acquired, as long as the acquirers earnings exceed this amount due to the tax shield that arises with

deductible expenses. If the outflow is not deductible, then the net impact will be higher but a large

company may still absorb it easier than a small company.

If Mercury will continue as a stand-alone company, the 130,000$ will probably erase all its income and

the tax shield will be not available starting from a certain threshold. Such a high outflow at a given point

in time may even pose going-concern issues because it represents almost 50% of the shareholders

equity reported for 2006 270,592$.

1d. Argue which differences will be made to the projected cash flows if Mercury is acquired by a

competitor, as the case suggests.

Because of the synergies that are expected to arise in the case Mercury is acquired by a competitor

(such as a more efficient inventory system), the cash flows will increase and therefore, the NPV of

Mercury will be positively impacted. Because of the synergies expected after the acquisition which

translate into higher future cash flows, the competitor may pay a higher price for the company than

other investors (such as the management in the MBO scenario) which do not have capabilities of

increasing future cash flows through synergies.

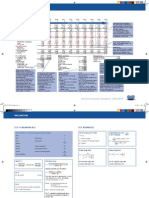

2a. Determine the asset beta for each of the competitors mentioned in exhibit 3. Use a beta for debt

of zero, except for Kingsley Coulter, Surfside and general Shoe Corp., use a beta of debt of 0.2 for

those companies.

For each company in Exhibit 3, I first computed the debt weight in total invested capital as D/D+E =

D/E/1+D/E. For example, for D&B Shoe Company D/D+E = 29.9% / (29.9% + 1) = 23.02%

Then, I gathered all the other necessary inputs from Exhibit 4 and computed the asset beta for each

competitor.

Company

D&B Shoe Company

Marina Wilderness

General Shoe Corp.

Kinsley Coulter Products

Victory Athletic

Surfside Footwear

Alpine Company

Heartland Outdoor

Footwear

Templeton Athletic

Equity Beta

(E)

2.68

1.94

1.92

1.12

0.97

2.13

1.27

76.98%

108.23%

75.64%

66.80%

82.17%

74.46%

77.82%

0

0

0.2

0.2

0

0.2

0

23.02%

-8.23%

24.36%

33.20%

17.83%

25.54%

22.18%

Asset Beta

(U )

2.1

2.1

1.5

0.8

0.8

1.6

1.0

1.01

107.18%

-7.18%

1.1

0.98

70.13%

29.87%

0.7

E/(D+E)

Debt Beta

(D )

D/(D+E)

For example D&B Shoe Company:

Asset Beta (u) = E/(E+D)*E+D/(E+D)* D= 76.98%*2.68 + 23.02%*0 = 2.1

The average of the competitors is 1.28.

Mercury Athletic Case

David Petru-Catalin (10824618)

2b. Calculate the equity beta of Mercury Athletic after the MBO, for various levels of debt. (use the

following percentages for debt/total value: 0%, 10%, 25%, 40% , 50%, 60%, 75%)

Asset Beta

(U )

1.28

1.28

1.28

1.28

1.28

1.28

1.28

D/(D+E)

0%

10%

25%

40%

50%

60%

75%

D/E

0.11

0.33

0.67

1.00

1.50

3.00

Debt Beta

(D )

0

0

0

0

0

0

0

(U ) less

(D )

1.28

1.28

1.28

1.28

1.28

1.28

1.28

Equity Beta

(E)

1.28

1.42

1.71

2.13

2.56

3.20

5.12

For each debt level: E = u + (D/E)* (u - D). I assumed that D is equal to zero, since there is no data to

this variable in the text.

For example at the 11% level: E = 1.28 + 11% * (1.28 0) = 1.42

2c. Calculate the WACC for each scenario of 2b, assuming a cost of debt of 6%.

First of all, I estimated the unlevered cost of equity. We can use the CAPM model for this purpose:

rE = rf + u * (rM - rf ) = 4.93% + 1.28 * 5% = 11.3% (I used the 20 yr US bond as the risk free rate because

of the long term horizon of the company)

Unlevered Cost

of Equity (rU)

11.3%

11.3%

11.3%

11.3%

11.3%

11.3%

11.3%

11.3%

D/E

0.11

0.25

0.33

0.67

1.00

1.50

3.00

D/(D+E)

0%

10%

20%

25%

40%

50%

60%

75%

Cost of Debt

(rD )

6%

6%

6%

6%

6%

6%

6%

6%

(U ) less Cost of

WACC

WACC

E/(D+E)

Tax Rate

Equity (rE)

(unlevered)

(levered)

(D )

5%

11.3%

100%

11.330%

40%

11.3%

5%

11.9%

90%

11.330%

40%

11.1%

5%

12.7%

80%

11.330%

40%

10.9%

5%

13.1%

75%

11.330%

40%

10.7%

5%

14.9%

60%

11.330%

40%

10.4%

5%

16.7%

50%

11.330%

40%

10.1%

5%

19.3%

40%

11.330%

40%

9.9%

5%

27.3%

25%

11.330%

40%

9.5%

According to the text, the cost of debt remains at 6% at all levels of leverage. The cost of equity

increases as the debt levels increase. For example, at 10% debt, rE = rU + D/E * (rU rD) = 11.3% +

11.1% * (11.3% - 6%) =11.9%. Overall, the WACC (unlevered) will be the same at all debt levels in a

world without taxes and without costs of financial distress.

The WACC (levered) will decrease the more debt the company contracts because of the tax shield and

because the cost of debt remains constant. For example, at 75% debt, WACC (levered) = rE*E/(D+E) +

rD*(1-t)*D/(D+E) = 25% * 27.3% + 75%*6%*(1-40%) = 9.5%.

2d. Explain if your results would be different in the US (tax rate of 40%, as given in the case) compared

to the Netherlands (with a tax rate of 25%). Reflect on the likelihood that a MBO would be successful

in both countries.

US has a higher tax rate and therefore the value of the tax shield provided by debt exceeds the one in

the Netherlands. This results is a lower WACC and consequently in a higher firm value. Therefore in the

case of an MBO in the US, the managers (acquirers) would be able to justify paying a higher price for the

firm in comparison to the Netherlands where the lower tax rate decreases the value of the tax shield.

Mercury Athletic Case

David Petru-Catalin (10824618)

3a. Based on your answers at 1a and 2c (assume 40% debt), calculate the (sum of the) present value of

the cash flows for 2007-2011.

Period

Year

Free Cash Flow

Terminal Value

WACC (levered, 40% debt)

Discount factor

Discounted cash flows

Enterprise Value

1

2007

14,723

2

2008

26,763

3

2009

22,469

4

2010

25,801

5

2011

29,780

0.91

13,340

0.82

21,970

0.74

16,712

0.67

17,387

0.61

18,183

10.4%

87,592

3b. Construct a terminal value, based on the following growth rates: 1%, 3%, and 5%.

For growth rate 1%: TV = 29,780 * (1.01) / (10.4% - 1%) = 321,003

For growth rate 3%: TV = 29,780 * (1.03) / (10.4% - 3%) = 416,195

For growth rate 5%: TV = 29,780 * (1.05) / (10.4% - 5%) = 582,294

3c. Argue which growth rate you find most reasonable, and why.

I believe that the 5% growth rate is most reasonable due to the following arguments:

-

The growth rate of the companys revenues since the acquisition was 10.5%

The revenue growth rate of similar companies between 2000 and 2006 averaged 9.7% (Exhibit

3)

The company is diversified both in terms of product lines and geographically in terms of sales

and therefore is both stable and connected to global GDP growth rate which historically has

averaged around 4% according to http://www.worldeconomics.com/

3d. Determine the value of Mercury Athletic, based on your answers for 3a-c.

Period

Year

Free Cash Flow

Terminal Value

WACC (levered, 40% debt)

Discount factor

Discounted cash flows

Enterprise Value

1

2007

14,723

2

2008

26,763

3

2009

22,469

4

2010

25,801

5

2011

29,780

582,294

0.91

13,340

0.82

21,970

0.74

16,712

0.67

17,387

0.61

373,722

10.4%

443,131

Taking into account the assumptions resulted from questions 3a-c, the enterprise value of Mercury

Athletic at The beginning of 2007 is approx. 443 mln $.

You might also like

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- Mercury Athletic Footwear Acquisition AnalysisDocument8 pagesMercury Athletic Footwear Acquisition AnalysisVaidya Chandrasekhar100% (1)

- Mercury AthleticDocument17 pagesMercury Athleticgaurav100% (1)

- Mercury Athletic (Student Templates) FinalDocument6 pagesMercury Athletic (Student Templates) FinalGarland GayNo ratings yet

- Group19 Mercury AthleticDocument11 pagesGroup19 Mercury AthleticpmcsicNo ratings yet

- Fin 321 Case PresentationDocument19 pagesFin 321 Case PresentationJose ValdiviaNo ratings yet

- MercuryDocument5 pagesMercuryமுத்துக்குமார் செNo ratings yet

- Mercury Athletic Case PDFDocument6 pagesMercury Athletic Case PDFZackNo ratings yet

- Mercury Athletic Footwear - Valuing The Opportunity: FINS 3625 - Case Study Written ComponentDocument9 pagesMercury Athletic Footwear - Valuing The Opportunity: FINS 3625 - Case Study Written ComponentBharat KoiralaNo ratings yet

- Mercury Athletic FootwearDocument9 pagesMercury Athletic FootwearJon BoNo ratings yet

- Mercury Athletic Footwear Acquisition AnalysisDocument9 pagesMercury Athletic Footwear Acquisition Analysisandy117950% (2)

- Mercury Athletic SlidesDocument28 pagesMercury Athletic SlidesTaimoor Shahzad100% (3)

- Mercury QuestionsDocument6 pagesMercury Questionsapi-239586293No ratings yet

- Mercury Athletic QuestionsDocument1 pageMercury Athletic QuestionsRazi UllahNo ratings yet

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Mercury Athletic Footwear Case SolutionDocument3 pagesMercury Athletic Footwear Case SolutionDI WU100% (2)

- ANALYSIS OF ACQUISITION OF MERCURY ATHLETIC BY ACTIVE GEARDocument9 pagesANALYSIS OF ACQUISITION OF MERCURY ATHLETIC BY ACTIVE GEARVedantam GuptaNo ratings yet

- MERCURY ATHLETIC FOOTWEAR COST OF CAPITAL ANALYSISDocument16 pagesMERCURY ATHLETIC FOOTWEAR COST OF CAPITAL ANALYSISBharat KoiralaNo ratings yet

- Heritage CaseDocument3 pagesHeritage CaseGregory ChengNo ratings yet

- Mercury Athletic Case SectionBDocument15 pagesMercury Athletic Case SectionBVinith VemanaNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- Mercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinDocument7 pagesMercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinFaith AllenNo ratings yet

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- AirThread ConnectionDocument26 pagesAirThread ConnectionAnandNo ratings yet

- AirThread Valuation MethodsDocument21 pagesAirThread Valuation MethodsSon NguyenNo ratings yet

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- Mercury Athletic Footwear - Valuing The OpportunityDocument55 pagesMercury Athletic Footwear - Valuing The OpportunityKunal Mehta100% (2)

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Airthread Connections NidaDocument15 pagesAirthread Connections NidaNidaParveen100% (1)

- New Heritage ExhibitsDocument4 pagesNew Heritage ExhibitsBRobbins12100% (16)

- Analyzing Mercury Athletic Footwear AcquisitionDocument5 pagesAnalyzing Mercury Athletic Footwear AcquisitionCuong NguyenNo ratings yet

- Air Thread ReportDocument13 pagesAir Thread ReportDHRUV SONAGARA100% (2)

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Ocean Carriers MemoDocument2 pagesOcean Carriers MemoAnkush SaraffNo ratings yet

- Mercury Athletic FootwearDocument4 pagesMercury Athletic FootwearMahnoor MaalikNo ratings yet

- Mercury - Case SOLUTIONDocument36 pagesMercury - Case SOLUTIONSwaraj DharNo ratings yet

- Valuation of AirThreadConnectionsDocument3 pagesValuation of AirThreadConnectionsmksscribd100% (1)

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Ocean CarriersDocument17 pagesOcean CarriersMridula Hari33% (3)

- AIRTHREAD ACQUISITION Revenue and Expense ProjectionsDocument24 pagesAIRTHREAD ACQUISITION Revenue and Expense ProjectionsHimanshu AgrawalNo ratings yet

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- Ocean Carrier CaseDocument17 pagesOcean Carrier CasechiaweesengNo ratings yet

- Valuation of Airthread April 2012Document26 pagesValuation of Airthread April 2012Perumalla Pradeep KumarNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- Airthread DCF Vs ApvDocument6 pagesAirthread DCF Vs Apvapi-239586293No ratings yet

- 128,000 forecasted sales in 2012Document8 pages128,000 forecasted sales in 2012chopra98harsh3311100% (4)

- NHDC Solution EditedDocument5 pagesNHDC Solution EditedShreesh ChandraNo ratings yet

- FlashMemory Beta NPVDocument7 pagesFlashMemory Beta NPVShubham Bhatia100% (1)

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- GRETA Chinh SuaDocument10 pagesGRETA Chinh SuaHưng NguyễnNo ratings yet

- Managerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFKimberlyLinesrb100% (8)

- Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions ManualDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manualc03a8stone100% (16)

- Leverage and Financing for Symonds ElectronicsDocument9 pagesLeverage and Financing for Symonds ElectronicsThomas Roberts100% (1)

- Syndicate 7 - Nike Inc. Cost of CapitalDocument8 pagesSyndicate 7 - Nike Inc. Cost of CapitalAnthony Kwo100% (1)

- Chapter 6 Review in ClassDocument32 pagesChapter 6 Review in Classjimmy_chou1314No ratings yet

- Business Valuation ModelDocument14 pagesBusiness Valuation Modeldagagovind7No ratings yet

- AnswersDocument11 pagesAnswerscatcat1122No ratings yet

- Nike Inc - Cost of Capital - Syndicate 10Document16 pagesNike Inc - Cost of Capital - Syndicate 10Anthony KwoNo ratings yet

- Mercury Athletic Footwear: Ashutosh DashDocument49 pagesMercury Athletic Footwear: Ashutosh DashSaurabh ChhabraNo ratings yet

- Test 11 SolutionsDocument29 pagesTest 11 SolutionsNguyệt LinhNo ratings yet

- How To Make Effective CVDocument3 pagesHow To Make Effective CVAAKIB HAMDANINo ratings yet

- Inclusive Green GrowthDocument192 pagesInclusive Green GrowthLiz Yoha AnguloNo ratings yet

- SWOTDocument9 pagesSWOTrohit_bijalwanNo ratings yet

- Chapter 2Document22 pagesChapter 2Van DuNo ratings yet

- 10 Simple Steps On How To Start An Online Grocery Business V3.0Document17 pages10 Simple Steps On How To Start An Online Grocery Business V3.0bernbilazonNo ratings yet

- UUM College Group Project on Evaluating Employee Performance of Work from HomeDocument50 pagesUUM College Group Project on Evaluating Employee Performance of Work from HomeKauthamen AppuNo ratings yet

- Manu 2Document224 pagesManu 2Temp RoryNo ratings yet

- The Ultimate Guide To Marketing Strategy: How To 10X Your ROIDocument35 pagesThe Ultimate Guide To Marketing Strategy: How To 10X Your ROImystratexNo ratings yet

- Purnima BhasinDocument2 pagesPurnima BhasinASHWANI CHAUHANNo ratings yet

- Sky Builders Private LimitedDocument67 pagesSky Builders Private LimitedMohaneshwaranNo ratings yet

- Principles of Supply Chain Management A Balanced Approach 4th Edition Wisner Solutions ManualDocument36 pagesPrinciples of Supply Chain Management A Balanced Approach 4th Edition Wisner Solutions Manualoutlying.pedantry.85yc100% (27)

- Quality Management and Supply Chain Management in SonyDocument12 pagesQuality Management and Supply Chain Management in SonyPavan NaiduNo ratings yet

- July, 2022 3Document3 pagesJuly, 2022 3Kristine Joy Recopelacion TuanNo ratings yet

- 2022 Product Benchmarks ReportDocument50 pages2022 Product Benchmarks ReportLan LiNo ratings yet

- What makes a coffee shop successful on Street 51Document3 pagesWhat makes a coffee shop successful on Street 51Lorraine SabbaghNo ratings yet

- Jacobs Pellet Mill BrochureDocument6 pagesJacobs Pellet Mill BrochureFreddy FiallosNo ratings yet

- Digital Marketing Blogs For Marketing D2C CompetitionDocument7 pagesDigital Marketing Blogs For Marketing D2C Competitionmohit kumarNo ratings yet

- Investment Pattern Of Investors QuestionnaireDocument19 pagesInvestment Pattern Of Investors QuestionnaireVinita Solanki 24No ratings yet

- Cover Letter Examples For Students and Recent GraduatesDocument5 pagesCover Letter Examples For Students and Recent Graduatesezknbk5h100% (1)

- Coca-Cola BPR Case Study: Implementing SAP for Improved Supply Chain ManagementDocument9 pagesCoca-Cola BPR Case Study: Implementing SAP for Improved Supply Chain ManagementCes San0% (1)

- Placement-Brochure 2020 PDFDocument68 pagesPlacement-Brochure 2020 PDFVinay Kumar MutyalaNo ratings yet

- BASF Report 2019Document301 pagesBASF Report 2019swarnaNo ratings yet

- Chap 7+ 8 Documents+Daybook - SolutionDocument8 pagesChap 7+ 8 Documents+Daybook - SolutionBilal GouriNo ratings yet

- Material Flow Analysis Adapted To An Industrial Area: Cristina Sendra, Xavier Gabarrell, Teresa VicentDocument10 pagesMaterial Flow Analysis Adapted To An Industrial Area: Cristina Sendra, Xavier Gabarrell, Teresa VicentramiraliNo ratings yet

- Cards Data SheetDocument12 pagesCards Data SheetRoshan ZamirNo ratings yet

- DIMR MCQ Economy of Network IndustriesDocument8 pagesDIMR MCQ Economy of Network IndustriesMahima SinghNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument6 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETChristine Daine BaccayNo ratings yet

- Accounting Paper 1 Multiple ChoiceDocument12 pagesAccounting Paper 1 Multiple ChoiceJasleen KaurNo ratings yet

- Đề thi thử KPMG TaxDocument53 pagesĐề thi thử KPMG TaxĐặng Trần Huyền TrâmNo ratings yet