Professional Documents

Culture Documents

Ap 5908

Uploaded by

Aiko E. LaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ap 5908

Uploaded by

Aiko E. LaraCopyright:

Available Formats

Page 1 of 6

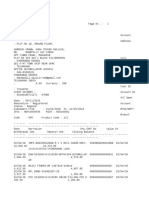

CEBU CPAR CENTER

Mandaue CIty

AUDITING PROBLEMS

COMPREHENSIVE PROBLEM

You were assigned to audit the financial statements of LARES Company for the year

ended December 31, 2005. The fieldwork has been completed and you are now going

over your audit findings to summarize your potential adjustments. The client is willing to

accept all the necessary adjustments in order for the financial statements to be presented

fairly in conformity with generally accepted accounting principles.

The following data were taken from your current working papers.

Cash account consists of the following items:

Petty cash fund

PBCom checking account

PNB current account

Total per GL

P 10,000

(15,000)

137,700

P 132,700

a. The count of the cashiers accountability on January 2, 2006, revealed total

currency and coins of P3,600. Unreplenished vouchers for various expenses

totaled P6,400, of which P1,200 pertains to January 2006.

b. On December 29, 2005, a check for P35,000 was drawn against PBCom current

account resulting in bank overdraft of P15,000. The check was picked up by the

supplier on January 3, 2006.

c. Bank reconciliation statement prepared by the cashier for the PNB account follows:

Bank balance

Add: Deposit in transit

Bank service charges

Total

Less: Outstanding checks

Check No.

567

589

617

626

Book balance

@

P 124,200

P 24,500

500

Amount

P 1,000

8,300

2,400

3,400

25,000

149,200

@

11,500

P 137,700

Check certified by the bank in December 2005.

All reconciling items were traced to the bank statement. Further investigation indicated

that the deposits in transit include a customers post-dated check amounting to P16,000.

The check represents a collection from account customer for sales made in the middle of

October 2005.

Your review of the clients internal control points out many weaknesses. Accordingly, you

did not perform tests of controls and you relied heavily on substantive procedures.

AP-5908

Page 2 of 6

Confirmation replies received directly from customers disclosed the following exceptions:

Confirmation

No.

Customers Comments

Audit Findings

5

The goods sold on December 1 The client failed to record credit

(Mang Bert) were returned on December 16, memo no. 23 for P12,000. The

2005.

merchandise was included in

the ending inventory at cost.

15

We do not owe this amount *

(Mang Jess) %#@ (bad word). We did not

receive any merchandise from

your company.

Investigation

revealed

that

goods sold for P16,000 were

shipped to Mang Jess on

December 29, 2005, terms FOB

shipping point. The goods were

lost in transit and the shipping

company has acknowledged its

responsibility for the lost of the

merchandise.

21

(Hercules)

I am entitled to a 10% employee Hercules is an employee of

discount. Your bill should be LARES.

Starting November

reduced by P1,200.

2005, all company employees

were entitled to a special

discount.

23

(Eric)

We have not yet sold the goods. Merchandise billed for P18,000

We will remit the proceeds as were consigned to Eric on

soon as the goods are sold.

December 30, 2005. The goods

cost P13,000.

34

(Mancio)

We do not owe you P20,000. The sale of merchandise on

We already paid our accounts December 18, 2005 was paid by

as evidenced by OR # 1234.

Mancio on January 6, 2006.

67

(Jimmy)

Reduce your bill by P1,500

This amount represents freight

paid by the customer for the

merchandise

shipped

on

December 17, 2005, terms, FOB

destination-collect.

From the schedule of accounts receivable as of December 31, 2005, you determined that

this account includes the following:

Accounts with debit balances:

60 days old and below

61 to 90 days

Over 90 days

Advances to officers

Accounts with credit balance

Accounts receivable per GL

P 238,500

117,200

85,400

P 441,100

16,400

(15,000)

P 442,500

The credit balance in customers account represents collection from a customer whose

account had been written-off as uncollectible in 2004.

Accounts receivable for more than a year totaling P21,000 should be written off.

AP-5908

Page 3 of 6

Based on your discussion with Eddie, LARES Credit Manager, you both agreed that an

allowance for doubtful accounts should be maintained using the following rates:

60 days old and below

61 to 90 days

Over 90 days

1%

2%

5%

The client determines its ending inventory by conducting a physical count at December 31

of each year. Compilation of physical inventory disclosed that tag numbers 143, 144, and

145 were not included in the inventory list.

Further investigation revealed the following:

Tag No.

143

200 units costing P8 per unit

144

800 units costing P15 per unit. Goods are held on consignment from

Lareng Co.

145

Cancelled tag

Your review of purchase transactions made a few days before and after December 31,

2005 revealed the following:

a. Merchandise costing P8,000 was received on January 3, 2006. The related invoice

was received and recorded on January 5, 2006. The invoice showed that the

shipment was made by the vendor on December 27, 2005; FOB destination.

b. Merchandise with a cost of P14,000 was received on December 31, 2005 and the

invoice was not recorded. The invoice was discovered at the Purchasing Officers

desk and was stamped On Consignment from Kolokoy Company.

c. Merchandise received on January 3, 2006 costing P17,000 was entered in the

voucher register on the same day. Shipment was made by the vendor FOB

shipping point on December 31, 2005.

An analysis of 2005 transactions affecting the Available-for-Sale Securities and related

accounts follows:

Jan. 01

Jan. 02

July 01

Sept. 08

Dec. 31

Available-for-sale Securities

Balance

Purchased 10,000 Super Co. common shares

Purchased P100,000,12% face value Mighty Co.

bonds

Purchased 500 LARES Co.s shares

Balance

P 240,000

250,000

100,000

6,000

P 596,000

a. The January 1 balance represents the cost of 10,000 shares of Super Co.s

common stock acquired on January 2, 2004.

b. On January 2, 2005, LARES purchased 10,000 additional shares of Super Co.s

common stock for P250,000 when the book value of Supers stockholders equity

was P2,500,000.

c. From Super Companys financial statements, you were able to obtain the following

information:

Net income

Dividends

2004

100,000

-

2005

250,000

170,000

AP-5908

Page 4 of 6

There are no other stockholders equity transactions that transpired in 2004 or 2005

for Super Company other than the above information.

At the end of 2005, the Super Co.s common share was selling at P26 per share

while LARES Co.s stock was selling at P15 per share.

d. Other income includes dividend of P34,000 received from Super Co. in 2005.

e. The client does not intend to hold Mighty bonds to maturity. The bonds pay interest

semi-annually on July 1 and January 1. Maturity date is 4 years from the date of

purchase. The Mighty bonds were selling at par at December 31, 2005.

Examination of the equipment and related accumulated depreciation account revealed the

following:

EQUIPMENT

01/01/2005

04/01/2005

07/01/2005

09/30/2005

12/31/2005

Balance

Proceeds from sale of equipment

Cash paid to acquire new equipment

Repair of equipment

Balance

P 640,000

(10,000)

70,000

5,000

P 705,000

01/01/2005

12/31/2005

12/31/2005

Accumulated Depreciation

Balance

Depreciation 2005

Balance

P 340,000

141,000

P 481,000

a. On April 1, an equipment costing P50,000, with a carrying value of P20,000 on the

date of sale was sold for P10,000.

b. Old equipment was traded-in for new equipment with a market value of P75,000.

The old equipment was bought for P60,000. The carrying value of this equipment

on January 1, 2005 was P5,000.

c. Annual depreciation is computed at 20%.

immaterial.

Salvage values of equipment are

Examination of subsequent disbursements revealed that expenses for telephone,

electricity, and water in 2005 totaling P32,000 were not recorded in the books.

On November 2, 2005, LARES Company issued P400,000 face value bonds. The bonds,

which will mature on January 1, 2010, pay interest of 12% every January 1. The bonds

were issued to give the bondholders a 14% yield.

From the minutes of the board of directors meetings, you gathered the following

information:

a. During the year 2005, the company issued 10,000 shares of its P10 par value

common stock for P12 each. The entire amount was credited to the common stock

account.

b. On December 31, 2005, the board of directors declared a 10% stock dividend to

stockholders on record as of January 16, 2006 distributable on January 31, 2006.

Presented on the next page are the unadjusted balances taken from the working trial

balance.

AP-5908

Page 5 of 6

LARES Company

December 31, 2005

Debit

Cash

Accounts receivable

Allowance for doubtful accounts

Interest receivable

Advances to officers and employees

Inventory

Available-for-sale securities

Investment in Associate

Equipment

Accumulated depreciation

Accounts payable

Accrued expenses

Bank overdraft

Customers credit balance

Interest payable

Bonds payable

Discount on bonds payable

Common stock, P10 par

Stock dividends distributable

Additional paid-in capital

Retained earnings

Treasury stocks

Net sales

Cost of sales

Other income

Investment income

Operating expenses

Other expenses

Finance cost

Credit

P132,700

442,500

P15,000

367,200

596,000

705,000

481,000

168,175

28,600

416,000

670,000

80,000

90,975

1,053,500

525,400

42,450

276,900

-

P3,045,700

P3,045,700

AP-5908

Page 6 of 6

INSTRUCTIONS: Select the best answer from choices: A, B, C, and D that corresponds to

the audited balance of the account or account classification. Disregard tax implications.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

Cash

Accounts receivable

Allowance for doubtful accounts

Interest receivable

Advances to officers and employees

Inventory

Available-for-sale securities

Investment in associate

Equipment

Accumulated depreciation

Total assets

Accounts payable

Accrued expenses

Bank overdraft

Customers' credit balance

Interest payable

Bonds payable

Discount on bonds payable

Total liabilities

Common stock, P10 par

Stock dividends distributable

Additional paid-in capital

Retained earnings, 1/1/2005

Retained earnings, 12/31/2005

Treasury stock

Total stockholders equity

Net sales

Cost of sales

Other income

Investment income

Operating expenses

Other expenses

Finance cost

Net income

Cash shortage

Petty cash fund

Depreciation expense

Bond discount amortization

Implied goodwill

A

B

C

D

146,000

144,400

147,400

143,400

424,400

387,400 418,400

403,400

12,952

8,958

9,000

7,942

12,000

5,975

11,975

6,000

20,000

16,400

2,600

19,000

367,800

353,200

371,800

384,800

106,000

590,000

100,000

490,000

506,000

516,000

700,000

600,000

705,000

605,000

451,000

401,000

431,000

371,000

1,785,658 1,779,658 1,793,658 1,798,658

168,175

212,175

185,175

220,175

32,000

28,600

26,800

60,600

35,000

15,000

20,000

15,000

16,400

10,000

48,960

48,800

48,773

48,000

376,000

416,000

376,960

400,000

24,000

23,040

23,227

670,548

697,548

657,548

705,548

670,000

645,000

550,000

650,000

65,000

97,500

96,750

64,500

100,000

80,000

122,250

132,250

111,975

112,975

90,975

100,975

242,360

239,360

233,360

252,360

4,500

5,000

6,000

1,088,110 1,080,110 1,074,110 1,093,110

1,023,500 1,034,300 1,040,300 1,022,300

523,800

537,800

510,600

524,800

69,450

13,450

8,450

19,450

49,000

48,000

50,000

318,815

321,100

298,542

300,042

18,773

40,000

10,000

8,000

48,773

48,000

8,773

235,135

229,135

243,135

248,135

1,200

3,600

2,600

6,400

3,600

5,200

4,800

122,000

141,000

123,500

121,000

800

960

773

40,000

10,000

20,000

-

40. Based on the above and the result your audit, you will most likely issue

a. Unqualified opinion with explanatory paragraph

b. Qualified or disclaimer of opinion

c. Qualified or adverse opinion

d. Unqualified opinion.

- End of AP-5908 -

AP-5908

You might also like

- Variable Costing Tool for ManagementDocument47 pagesVariable Costing Tool for ManagementAiko E. Lara86% (7)

- Test Bank - Chapter 2 Cost ConceptsDocument36 pagesTest Bank - Chapter 2 Cost ConceptsAiko E. Lara71% (7)

- Template Financial Forecast ModelDocument46 pagesTemplate Financial Forecast ModelMLastTry100% (2)

- Act130 Testbank FinalsDocument220 pagesAct130 Testbank FinalsMelanie SamsonaNo ratings yet

- First American Corporation - Wikipedia, The Free EncyclopediaDocument6 pagesFirst American Corporation - Wikipedia, The Free EncyclopediaDileep BhatNo ratings yet

- Test Bank - Chapter18 FS AnalysisDocument87 pagesTest Bank - Chapter18 FS AnalysisAiko E. LaraNo ratings yet

- CPA Review: Code of Ethics for Professional Accountants in the PhilippinesDocument20 pagesCPA Review: Code of Ethics for Professional Accountants in the PhilippinesJedidiah SmithNo ratings yet

- Test Bank - Chapter15 Capital Budgeting2Document29 pagesTest Bank - Chapter15 Capital Budgeting2Aiko E. Lara100% (1)

- Real Estate Fund PPM ExcerptDocument18 pagesReal Estate Fund PPM Excerptnzcruiser100% (1)

- Test Bank - Chapter 3 Job Order CostingDocument36 pagesTest Bank - Chapter 3 Job Order CostingAiko E. Lara81% (21)

- Test Bank - Chapter 9 Profit PlanningDocument34 pagesTest Bank - Chapter 9 Profit PlanningAiko E. Lara67% (3)

- Test Bank - Chapter17 Cash FlowsDocument51 pagesTest Bank - Chapter17 Cash FlowsAiko E. Lara100% (4)

- Process Costing Systems & Equivalent UnitsDocument51 pagesProcess Costing Systems & Equivalent UnitsAiko E. Lara83% (18)

- Test Bank - Chapter16 ABC ApproachDocument31 pagesTest Bank - Chapter16 ABC ApproachAiko E. Lara50% (2)

- Test Bank - Chapter14 Capital BudgetingDocument35 pagesTest Bank - Chapter14 Capital BudgetingAiko E. Lara100% (8)

- Board of Directors Project ReportDocument25 pagesBoard of Directors Project ReportAnubhuti Varma100% (1)

- MODFIN2 Calendar PDFDocument1 pageMODFIN2 Calendar PDFMich ClementeNo ratings yet

- Segment Reporting, Profitability Analysis, and Decentralization Ch 12Document32 pagesSegment Reporting, Profitability Analysis, and Decentralization Ch 12Aiko E. LaraNo ratings yet

- College of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMDocument4 pagesCollege of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMPpp BbbNo ratings yet

- Relevant Costs for Decision-MakingDocument43 pagesRelevant Costs for Decision-MakingAiko E. Lara93% (14)

- Test Bank Chapter 1 Managerial AccountingDocument9 pagesTest Bank Chapter 1 Managerial AccountingGelyn CruzNo ratings yet

- Test Bank Chapter 1 Managerial AccountingDocument9 pagesTest Bank Chapter 1 Managerial AccountingGelyn CruzNo ratings yet

- Audit of Liabilities AdjustmentsDocument27 pagesAudit of Liabilities AdjustmentsChinee CastilloNo ratings yet

- ABC Costing: Activity Rates & Product CostsDocument44 pagesABC Costing: Activity Rates & Product CostsAiko E. Lara100% (5)

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Document14 pagesNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasNo ratings yet

- Audit of Cash and ReceivablesDocument21 pagesAudit of Cash and ReceivablesAiko E. Lara100% (2)

- Aut 1090Document7 pagesAut 1090Aiko E. LaraNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- Seatwork-Hedging of A Net Investment in Foreign OperationDocument1 pageSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacNo ratings yet

- Auditing Problems Intangibles Impairment and Revaluation PDFDocument44 pagesAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaNo ratings yet

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- Seatwork - Advacc1Document2 pagesSeatwork - Advacc1David DavidNo ratings yet

- TERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Document3 pagesTERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Millen Austria0% (1)

- Planning an Audit of Financial StatementsDocument10 pagesPlanning an Audit of Financial StatementsTrixie Pearl TompongNo ratings yet

- Name: - Date: - Year &sec. - ScoreDocument10 pagesName: - Date: - Year &sec. - ScorePigging Etchuzera0% (1)

- Multiple Choice ProblemsDocument3 pagesMultiple Choice ProblemsZvioule Ma FuentesNo ratings yet

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- AP 5906q ReceivablesDocument3 pagesAP 5906q ReceivablesJulia MirhanNo ratings yet

- CH 13Document19 pagesCH 13pesoload100No ratings yet

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- Seatwork in Audit 2-3Document8 pagesSeatwork in Audit 2-3Shr BnNo ratings yet

- Quiz Recl FinancingDocument1 pageQuiz Recl FinancingLou Brad IgnacioNo ratings yet

- CBS Corporation Purchased 10Document12 pagesCBS Corporation Purchased 10Stella SabaoanNo ratings yet

- MA2E Relevant Cost ExercisesDocument6 pagesMA2E Relevant Cost ExercisesRolan PalquiranNo ratings yet

- Module 13 Other Professional ServicesDocument18 pagesModule 13 Other Professional ServicesYeobo DarlingNo ratings yet

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- PRTC 1st Preboard Solution GuideDocument48 pagesPRTC 1st Preboard Solution GuideAnonymous Lih1laax100% (2)

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- BAC 318 Final Examination With AnswersDocument10 pagesBAC 318 Final Examination With Answersjanus lopez100% (1)

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- Auditing Practice Problem 6Document2 pagesAuditing Practice Problem 6Jessa Gay Cartagena TorresNo ratings yet

- Homework on investment property analysisDocument2 pagesHomework on investment property analysisCharles TuazonNo ratings yet

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- Some Advac Problems by DayagDocument6 pagesSome Advac Problems by DayagElijah Montefalco100% (1)

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Far TB2Document195 pagesFar TB2MarieJoiaNo ratings yet

- Not For Profit Organization and Government Accounting HandoutDocument6 pagesNot For Profit Organization and Government Accounting HandoutNicoleNo ratings yet

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Auditing Problems SolvedDocument9 pagesAuditing Problems SolvedGlizette SamaniegoNo ratings yet

- This Study Resource Was: Consignment SalesDocument3 pagesThis Study Resource Was: Consignment SalesKez MaxNo ratings yet

- AP03-03-Audit of Liabilities - EncryptedDocument7 pagesAP03-03-Audit of Liabilities - EncryptedMark Ehrolle S. SisonNo ratings yet

- Practical Accounting 2 Review Prelim Exam SolutionsDocument5 pagesPractical Accounting 2 Review Prelim Exam SolutionsRen EyNo ratings yet

- Auditing Multiple ChoiceDocument18 pagesAuditing Multiple ChoiceAken Lieram Ats AnaNo ratings yet

- Unit 7 Audit of Property Plant and Equipment Handout Final t21516Document10 pagesUnit 7 Audit of Property Plant and Equipment Handout Final t21516Mikaella BengcoNo ratings yet

- Afar 01 Partnership FormationDocument2 pagesAfar 01 Partnership FormationJohn Laurence LoplopNo ratings yet

- Attachments - Rainbow RowellDocument29 pagesAttachments - Rainbow RowellAlvin Yerc0% (1)

- Quiz Number One Without AnswerDocument8 pagesQuiz Number One Without AnswerKpop updates 24/7No ratings yet

- PAS 11: Long-term construction contractsDocument5 pagesPAS 11: Long-term construction contractsLester John Mendi0% (1)

- Far - Pre BoardDocument17 pagesFar - Pre BoardClene DoconteNo ratings yet

- Auditing Problems Usl PDFDocument226 pagesAuditing Problems Usl PDFmusic niNo ratings yet

- FinAcc 1 Quiz 6Document10 pagesFinAcc 1 Quiz 6Kimbol Calingayan100% (1)

- Temporary Differences and Deferred Tax Assets & Liabilities ExplainedDocument6 pagesTemporary Differences and Deferred Tax Assets & Liabilities ExplainedLeng ChhunNo ratings yet

- CCE ReceivablesDocument5 pagesCCE ReceivablesJane TuazonNo ratings yet

- Problem 4Document6 pagesProblem 4jhobsNo ratings yet

- Cpar - Ap 09.15.13Document18 pagesCpar - Ap 09.15.13KamilleNo ratings yet

- AP 5905Q InventoriesDocument3 pagesAP 5905Q Inventoriesaldrin elsisuraNo ratings yet

- AP-5906 ReceivablesDocument5 pagesAP-5906 Receivablesjhouvan100% (1)

- Easy Round-APDocument69 pagesEasy Round-APDaneen GastarNo ratings yet

- CAT-CB Questionnaires (Encoded)Document13 pagesCAT-CB Questionnaires (Encoded)Anob Ehij100% (1)

- Auditing 1 Final ExamDocument8 pagesAuditing 1 Final ExamEdemson NavalesNo ratings yet

- Pre-Lim in Aut PCCDocument6 pagesPre-Lim in Aut PCCAiko E. Lara100% (1)

- Testbank CoverDocument1 pageTestbank CoverAiko E. LaraNo ratings yet

- Aut 588Document13 pagesAut 588Aiko E. LaraNo ratings yet

- AUt 1088Document12 pagesAUt 1088Aiko E. LaraNo ratings yet

- Part 3 Auditing FinalsDocument1 pagePart 3 Auditing FinalsAiko E. LaraNo ratings yet

- Aut 589Document15 pagesAut 589Aiko E. LaraNo ratings yet

- Auditing Theory ChallengeDocument15 pagesAuditing Theory ChallengeAiko E. LaraNo ratings yet

- Aut 1089Document22 pagesAut 1089Aiko E. LaraNo ratings yet

- CPA Auditing Theory and Practice GuideDocument8 pagesCPA Auditing Theory and Practice GuideAiko E. LaraNo ratings yet

- Aut 590Document6 pagesAut 590Aiko E. LaraNo ratings yet

- CPA Auditing Theory and Practice GuideDocument8 pagesCPA Auditing Theory and Practice GuideAiko E. LaraNo ratings yet

- Auditing QuizzerDocument32 pagesAuditing QuizzerAiko E. Lara0% (1)

- Acquisition of Emerald Sdn Bhd and Move S/B (39Document9 pagesAcquisition of Emerald Sdn Bhd and Move S/B (39Razanna HanimNo ratings yet

- Financial Modeling For Coal Project - 2022 Course FlyerDocument2 pagesFinancial Modeling For Coal Project - 2022 Course FlyernuzululNo ratings yet

- Ma 2 - Past Year Questions - PMDocument10 pagesMa 2 - Past Year Questions - PMAna FarhanaNo ratings yet

- 1575048558619Document37 pages1575048558619Manepalli SaikiranNo ratings yet

- Corporate Liquidation ProcessDocument40 pagesCorporate Liquidation ProcessLeny Lyn AnihayNo ratings yet

- ICDRDocument32 pagesICDRrohitjpatel786100% (1)

- Mutual Fund Research PaperDocument22 pagesMutual Fund Research PaperSourav PaulNo ratings yet

- Pecora FinalReportDocument402 pagesPecora FinalReportAdelino MartinsNo ratings yet

- End Term ACF 2021 Set 2Document2 pagesEnd Term ACF 2021 Set 2pranita mundraNo ratings yet

- Unit 3 Exam Review - Chapters 7-9Document6 pagesUnit 3 Exam Review - Chapters 7-9Vhia Rashelle GalzoteNo ratings yet

- HiddnDocument86 pagesHiddnMeruemNo ratings yet

- Shareholder's EquityDocument18 pagesShareholder's EquityShashank0% (1)

- Investment portfolio valuation analysisDocument15 pagesInvestment portfolio valuation analysisManvi JainNo ratings yet

- FM SolvingProblemCasesDocument3 pagesFM SolvingProblemCasesMickee IndicoNo ratings yet

- NCFM Model TestDocument15 pagesNCFM Model TestAnonymous 3rDDX3No ratings yet

- What Is A Balance Sheet AuditDocument6 pagesWhat Is A Balance Sheet AuditSOMOSCONo ratings yet

- Trading and Profit and Loss Account Format: DR CRDocument14 pagesTrading and Profit and Loss Account Format: DR CRHarshini AkilandanNo ratings yet

- FM NCPDocument33 pagesFM NCPSmrithi BakkaNo ratings yet

- (Issue of Debentures) ::/ . Q R R Irill IDocument2 pages(Issue of Debentures) ::/ . Q R R Irill IPoonam SharmaNo ratings yet

- Answer 1 (1) : The Insolvency and Bankruptcy Code, 2016 Innoventive Industries Ltd. vs. ICICI Bank & Anr (2017) 1 SCC 356Document6 pagesAnswer 1 (1) : The Insolvency and Bankruptcy Code, 2016 Innoventive Industries Ltd. vs. ICICI Bank & Anr (2017) 1 SCC 356Usmaa HashmiNo ratings yet

- Uneeso Ent P2Document4 pagesUneeso Ent P2Otai Ezra100% (1)

- Search Fund Primer '09Document92 pagesSearch Fund Primer '09Nikolay TsvetkovNo ratings yet

- Module 5 - Audit of InventoriesDocument23 pagesModule 5 - Audit of InventoriesIvan LandaosNo ratings yet

- Solved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFDocument1 pageSolved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFAnbu jaromiaNo ratings yet