Professional Documents

Culture Documents

Time-Series Forecasting and Index Numbers: Learning Objectives

Uploaded by

Fayz Al FarisiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time-Series Forecasting and Index Numbers: Learning Objectives

Uploaded by

Fayz Al FarisiCopyright:

Available Formats

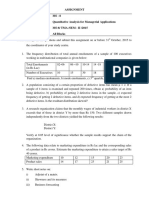

Students Solutions Manual and Study Guide: Chapter 15

Page 1

Chapter 15

Time-Series Forecasting and Index Numbers

LEARNING OBJECTIVES

This chapter discusses the general use of forecasting in business, several tools that

are available for making business forecasts, the nature of time-series data, and the

role of index numbers in business, thereby enabling you to:

1.

2.

3.

4.

5.

6.

Differentiate among various measurements of forecasting error, including mean

absolute deviation and mean square error, in order to assess which forecasting

method to use

Describe smoothing techniques for forecasting models, including nave, simple

average, moving average, weighted moving average, and exponential smoothing

Determine trend in time-series data by using linear regression trend analysis,

quadratic model trend analysis, and Holts two-parameter exponential smoothing

method

Account for seasonal effects of time-series data by using decomposition and

Winters three-parameter exponential smoothing method

Test for autocorrelation using the Durbin-Watson test, overcoming it by adding

independent variables and transforming variables and taking advantage of it

with autoregression

Differentiate among simple index numbers, unweighted aggregate price index

numbers, weighted aggregate price index numbers, Laspeyres price index

numbers, and Paasche price index numbers by defining and calculating each

Students Solutions Manual and Study Guide: Chapter 15

CHAPTER OUTLINE

15.1 Introduction to Forecasting

Time-Series Components

The Measurement of Forecasting Error

Error

Mean Absolute Deviation (MAD)

Mean Square Error (MSE)

15.2 Smoothing Techniques

Nave Forecasting Models

Averaging Models

Simple Averages

Moving Averages

Weighted Moving Averages

Exponential Smoothing

15.3 Trend Analysis

Linear Regression Trend Analysis

Regression Trend Analysis Using Quadratic Models

Holts Two-Parameter Exponential Smoothing Method

15.4 Seasonal Effects

Decomposition

Finding Seasonal Effects with the Computer

Winters Three-Parameter Exponential Smoothing Method

15.5 Autocorrelation and Autoregression

Autocorrelation

Ways to Overcome the Autocorrelation Problem

Addition of Independent Variables

Transforming Variables

Autoregression

15.6 Index Numbers

Simple Index Numbers

Unweighted Aggregate Price Indexes

Weighted Price Index Numbers

Laspeyres Price Index

Paasche Price Index

Page 2

Students Solutions Manual and Study Guide: Chapter 15

Page 3

KEY TERMS

Autocorrelation

Autoregression

Averaging Models

Cycles

Cyclical Effects

Decomposition

Deseasonalized Data

Durbin-Watson Test

Error of an Individual Forecast

Exponential Smoothing

First-Difference Approach

Forecasting

Forecasting Error

Index Number

Irregular Fluctuations

Laspeyres Price Index

Mean Absolute Deviation (MAD)

Mean Squared Error (MSE)

Moving Average

Nave Forecasting Methods

Paasche Price Index

Seasonal Effects

Serial Correlation

Simple Average

Simple Average Model

Simple Index Number

Smoothing Techniques

Stationary

Time-Series Data

Trend

Unweighted Aggregate Price

Index Number

Weighted Aggregate Price

Index Number

Weighted Moving Average

Students Solutions Manual and Study Guide: Chapter 15

Page 4

STUDY QUESTIONS

1. Shown below are the forecast values and actual values for six months of data:

Month

Actual Values

June

July

Aug.

Sept.

Oct.

Nov.

29

51

60

57

48

53

Forecast Values

40

37

49

55

56

52

The mean absolute deviation of forecasts for these data is __________. The mean square

error is __________________.

2. Data gathered on a given characteristic over a period of time at regular intervals are referred

to as ____________________________.

3. Time series data are thought to contain four elements: _______________, _______________,

_______________, and _______________.

4. Patterns of data behavior that occur in periods of time of less than 1 year are called

_____________________ effects.

5. Long-term time series effects are usually referred to as _______________.

6. Patterns of data behavior that occur in periods of time of more than 1 years are called

_______________________ effects.

7. Consider the time series data below. The equation of the trend line to fit these data is

__________________________________.

Year

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Sales

28

31

39

50

55

58

66

72

78

90

97

104

112

Students Solutions Manual and Study Guide: Chapter 15

Page 5

8. Time series data are deseasonalized by dividing the each data value by its associated value of

____________.

9. Perhaps the simplest of the time series forecasting techniques are

____________________________ models in which it is assumed that more recent time

periods of data represent the best predictions.

10. Consider the time-series data shown below:

Month

Volume

Jan.

Feb.

Mar.

Apr.

May

1230

1211

1204

1189

1195

The forecast volumes for April, May, and June are _______, _______, and _______ using a

three-month moving average on the data shown above and starting in January. Suppose a

three-month weighted moving average is used to predict volume figures for April, May, and

June. The weights on the moving average are 3 for the most current month, 2 for the month

before, and 1 for the other month. The forecasts for April, May, and June are _______,

_______, and _______._ using a three-month moving average starting in January.

11. Consider the data below:

Month

Jan.

Feb.

Mar.

Apr.

May

Volume

1230

1211

1204

1189

1195

If exponential smoothing is used to forecast the Volume for May using = .2 and using the

January actual figure as the forecast for February, the forecast is ____________________. If

= .5 is used, the forecast is ___________________. If = .7 is used, the forecast is

_____________________. The alpha value of ________ produced the smallest error of

forecast.

12. ____________________________ occurs when the error terms of a regression forecasting

model are correlated. Another name for this is _____________________________.

13. The Durbin-Watson statistic is used to test for ______________________________.

Students Solutions Manual and Study Guide: Chapter 15

Page 6

14. Examine the data given below.

Year

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

126

203

211

223

238

255

269

271

276

286

289

294

305

311

324

338

34

51

60

57

64

66

80

93

92

97

101

108

110

107

109

116

The simple regression forecasting model developed from this data is

______________________. The value of R2 for this model is _________________. The

Durbin-Watson D statistic for this model is __________________. The critical value of

dL for this model using = .05 is _____________ and the critical value of dU for this

model is _____________. This model (does, does not, inconclusive) _______________

contain significant autocorrelation.

15. One way to overcome the autocorrelation problem is to add __________________________

to the analysis. Another way to overcome the autocorrelation problem is to transform

variables. One such method is the ___________________________________ approach.

16. A forecasting technique that takes advantage of the relationship of values to previous period

values is ______________________________. This technique is a multiple regression

technique where the independent variables are time-lagged versions of the dependent

variable.

Students Solutions Manual and Study Guide: Chapter 15

Page 7

17. Examine the price figures shown below for various years.

Year

2005

2006

2007

2008

2009

Price

23.8

47.3

49.1

55.6

53.0

The simple index number for 2008 using 2005 as a base year is _________________.

The simple index number for 2009 using 2006 as a base year is _________________.

18. Examine the price figures given below for four commodities.

Item

1

2

3

Year

2000

1.89

.41

.76

2007

1.90

.48

.73

2008

1.87

.55

.79

2009

1.84

.69

.82

The unweighted aggregate price index for 2007 using 2000 as a base year is

________________. The unweighted aggregate price index for 2008 using 2000 as

a base year is __________. The unweighted aggregate price index for 2009 using

2000 as a base year is _______________.

19. Weighted aggregate price indexes that are computed by using the quantities for the year of

interest rather than the base year are called __________________________ price indexes.

20. Weighted aggregate price indexes that are computed by using the quantities for the base year

are called ____________________________ price indexes.

21. Examine the data below.

Item

1

2

3

4

Quantity Quantity Price Price

2007

2009 2007 2009

23

27

1.33 1.45

8

6

5.10 4.89

61

72

.27

.29

17

24

1.88

2.11

Using 2007 as the base year

The Laspeyres price index for 2009 is _____________________.

The Paasche price index for 2009 is ______________________.

Students Solutions Manual and Study Guide: Chapter 15

Page 8

ANSWERS TO STUDY QUESTIONS

1. 7.83, 84.5,

13. Autocorrelation

2. Time Series Data

14.

y 93.602 2.023x , .916,

1.004, 1.10, 1.37, Does

3. Seasonal, Cyclical, Trend, Irregular

4. Seasonal

15. Independent Variables,

First-Differences

5. Trend

16. Autoregression

6. Cyclical

17. 233.6, 112.05

7. y = -14,030.35 + 7.038462 x

18. 101.6, 104.9, 109.5

8. S

19. Paasche

9. Naive Forecasting

20. Laspeyres

10. 1215, 1201.3, 1196, 1210.7,

1197.7, 1194.5

11. 1215.21, 1200.63, 1194.64, .7

12. Autocorrelation, Serial Correlation

21. 105.18, 106.82

Students Solutions Manual and Study Guide: Chapter 15

Page 9

SOLUTIONS TO PROBLEMS IN CHAPTER 15

15.1

Period

1

2

3

4

5

6

7

8

9

Total

MAD =

MSE =

15.3

e

no. forecasts

12.30

= 1.367

9

20.43

= 2.27

9

no. forecasts

Period Value F

1

2

3

4

5

6

e2

5.29

2.56

1.96

1.21

0.09

0.81

3.61

4.41

0.49

20.43

e

2.30

1.60

1.40

1.10

0.30

0.90

1.90

2.10

0.70

12.30

e

2.30

1.60

-1.40

1.10

0.30

-0.90

-1.90

-2.10

0.70

-0.30

19.4 16.6 2.8

23.6 19.1 4.5

24.0 22.0 2.0

26.8 24.8 2.0

29.2 25.9 3.3

35.5 28.6 6.9

Total

21.5

MAD =

MSE =

2.8

7.84

4.5 20.25

2.0

4.00

2.0

4.00

3.3 10.89

6.9 47.61

21.5 94.59

e

No.Forecasts

e2

215

.

= 3.583

6

94.59

= 15.765

6

No.Forecasts

Students Solutions Manual and Study Guide: Chapter 15

15.5

a.)

b.)

c.)

Page 10

4-mo. mov. avg.

44.75

52.75

61.50

64.75

70.50

81.00

error

14.25

13.25

9.50

21.25

30.50

16.00

4-mo. wt. mov. avg. error

53.25

5.75

56.375

9.625

62.875

8.125

67.25

18.75

76.375

24.625

89.125

7.875

difference in errors

14.25 - 5.75 = 8.5

3.626

1.375

2.5

5.875

8.125

In each time period, the four-month moving average produces greater errors of

forecast than the four-month weighted moving average.

15.7

Period

1

2

3

4

5

6

7

8

9

Value

9.4

8.2

7.9

9.0

9.8

11.0

10.3

9.5

9.1

=.3

Error

=.7

Error 3-mo.avg. Error

9.4

9.0

8.7

8.8

9.1

9.7

9.9

9.8

-1.2

-1.1

0.3

1.0

1.9

0.6

-0.4

-0.7

9.4

8.6

8.1

8.7

9.5

10.6

10.4

9.8

-1.2

-0.7

0.9

1.1

1.5

-0.3

-0.9

-0.7

8.5

8.4

8.9

9.9

10.4

10.3

0.5

1.4

1.1

0.4

-0.9

-1.2

Students Solutions Manual and Study Guide: Chapter 15

15.9

Year

1

2

3

4

5

6

7

8

9

10

11

12

13

No.Issues

332

694

518

222

209

172

366

512

667

571

575

865

609

Page 11

F(=.2)

332.0

404.4

427.1

386.1

350.7

315.0

325.2

362.6

423.5

453.0

477.4

554.9

F(=.9)

362.0

113.6

205.1

177.1

178.7

51.0

186.8

304.4

147.5

122.0

387.6

54.1

332.0

657.8

532.0

253.0

213.4

176.1

347.0

495.5

649.9

578.9

575.4

836.0

362.0

139.8

310.0

44.0

41.4

189.9

165.0

171.5

78.9

3.9

289.6

227.0

e = 2289.9

For = .2, MAD =

2289.9

= 190.8

12

For = .9, MAD =

2023.0

= 168.6

12

= .9 produces a smaller mean average error.

e =2023.0

Students Solutions Manual and Study Guide: Chapter 15

15.11 Trend line:

Page 12

Members = 145,392.3 64.6354 Year

R2 = 91.44% se = 215.1158

F = 117.365, reject the null hypothesis.

Students Solutions Manual and Study Guide: Chapter 15

Page 13

15.13

Month

Broccoli

Jan.(yr. 1)

Feb.

Mar.

Apr.

May

June

132.5

164.8

141.2

133.8

138.4

150.9

July

146.6

Aug.

146.9

12-Mo. Mov.Tot.

2-Yr.Tot.

TC

SI

3282.8

136.78

93.30

3189.7

132.90

90.47

3085.0

128.54

92.67

3034.4

126.43

98.77

2996.7

124.86

111.09

2927.9

122.00

100.83

2857.8

119.08

113.52

2802.3

116.76

117.58

2750.6

114.61

112.36

2704.8

112.70

92.08

2682.1

111.75

99.69

2672.7

111.36

102.73

1655.2

1627.6

1562.1

Sept.

138.7

1522.9

Oct.

128.0

1511.5

Nov.

112.4

1485.2

Dec.

121.0

1442.7

Jan.(yr. 2)

104.9

1415.1

Feb.

99.3

Mar.

102.0

Apr.

122.4

May

112.1

June

108.4

1387.2

1363.4

1341.4

1340.7

1332.0

July

Aug.

Sept.

Oct.

Nov.

Dec.

119.0

119.0

114.9

106.0

111.7

112.3

Students Solutions Manual and Study Guide: Chapter 15

15.15 Regression Analysis

The regression equation is:

Predictor

Coef

Constant

1.454756

Housing

0.460811

s = 1.0368

Food

8.5

7.8

4.1

2.3

3.7

2.3

3.3

4.0

4.1

5.7

5.8

3.6

1.4

2.1

2.3

2.8

3.2

2.6

2.2

2.2

2.3

2.8

1.5

3.6

2.7

2.3

3.3

3.0

2.4

t 1

Food = 1.454756 + 0.460811 Housing

t-ratio

p

4.27

0.0002

6.83

0.0000

R-sq = 63.4%

Housing

15.7

11.5

7.2

2.7

4.1

4.0

3.0

3.0

3.8

3.8

4.5

4.0

2.9

2.7

2.5

2.6

2.9

2.6

2.3

2.2

3.5

4.2

3.1

2.2

3.0

4.0

2.1

4.9

5.9

(e e

Page 14

Y

8.6895

6.7541

4.7726

2.6989

3.3441

3.2980

2.8372

2.8372

3.2058

3.2058

3.5284

3.2980

2.7911

2.6989

2.6068

2.6529

2.7911

2.6529

2.5146

2.4685

3.0676

3.3902

2.8833

2.4685

2.8372

3.2980

2.4225

3.7127

4.1735

R-sq(adj) = 62.0%

e

-0.1895

1.0459

-0.6726

-0.3989

0.3559

-0.9980

0.4628

1.1628

0.8942

2.4942

2.2716

0.3020

-1.3911

-0.5989

-0.3068

0.1471

0.4089

-0.0529

-0.3146

-0.2685

-0.7676

-0.5902

-1.3833

1.1315

-0.1372

-0.9980

0.8775

-0.7127

-1.7735

e2

0.0359

1.0939

0.4524

0.1592

0.1267

0.9960

0.2142

1.3521

0.7995

6.2208

5.1601

0.0912

1.9352

0.3587

0.0941

0.0216

0.1672

0.0028

0.0990

0.0721

0.5892

0.3483

1.9134

1.2802

0.0188

0.9960

0.7700

0.5080

3.1454

29.0224

et et-1

1.2354

-1.7185

0.2737

0.7549

-1.3539

1.4608

0.7000

-0.2687

1.6000

-0.2226

-1.9696

-1.6931

0.7922

0.2922

0.4539

0.2616

-0.4618

-0.2618

0.0460

-0.4991

0.1774

-0.7931

2.5147

-1.2687

-0.8608

1.8755

-1.5903

-1.0608

)2 = 1.526 + 2.953 + 0.075 + 0.570 + 1.833 + 2.134 + 0.490 +

0.072 + 2.560 + 0.050 + 3.879 + 2.867 + 0.628 + 0.085 +

0.206 + 0.069 + 0.213 + 0.069 + 0.002 + 0.249 + 0.031 +

0.629 + 6.324 + 1.609 + 0.741 + 3.518 + 2.529 + 1.125

= 37.036

Students Solutions Manual and Study Guide: Chapter 15

Page 15

= 29.0224

Critical values of D: Using 1 independent variable, n = 29, and = .05,

dL = 1.34 and dU = 1.48

Since D = 1.28 is less than dL, the decision is to reject the null hypothesis.

There is significant autocorrelation.

Students Solutions Manual and Study Guide: Chapter 15

Page 16

15.17 The regression equation is:

Failed Bank Assets = 1,379 + 136.68 Number of Failures

y = 21,881 (million $)

for x= 150:

R2 = 37.9%

adjusted R2 = 34.1%

se = 13,833

F = 9.78, p = .006

The Durbin Watson statistic for this model is:

D = 2.49

The critical table values for k = 1 and n = 18 are dL = 1.16 and dU = 1.39. Since

the observed value of D = 2.49 is above dU, the decision is to fail to reject the null

hypothesis. There is no significant autocorrelation.

Failed Bank Assets

8,189

104

1,862

4,137

36,394

3,034

7,609

7,538

56,620

28,507

10,739

43,552

16,915

2,588

825

753

186

27

Number of Failures

11

7

34

45

79

118

144

201

221

206

159

108

100

42

11

6

5

1

y

2,882.8

2,336.1

6,026.5

7,530.1

12,177.3

17,507.9

21,061.7

28,852.6

31,586.3

29,536.0

23,111.9

16,141.1

15,047.6

7,120.0

2,882.8

2,199.4

2,062.7

1,516.0

e

5,306.2

-2,232.1

-4,164.5

-3,393.1

24,216.7

-14,473.9

-13,452.7

-21,314.6

25,033.7

- 1,029.0

-12,372.9

27,410.9

1,867.4

- 4,532.0

- 2,057.8

- 1,446.4

- 1,876.7

- 1,489.0

e2

28,155,356

4,982,296

17,343,453

11,512,859

586,449,390

209,494,371

180,974,565

454,312,622

626,687,597

1,058,894

153,089,247

751,357,974

3,487,085

20,539,127

4,234,697

2,092,139

3,522,152

2,217,144

Students Solutions Manual and Study Guide: Chapter 15

15.19

Starts

333.0

270.4

281.1

443.0

432.3

428.9

443.2

413.1

391.6

361.5

318.1

308.4

382.2

419.5

453.0

430.3

468.5

464.2

521.9

550.4

529.7

556.9

606.5

670.1

745.5

756.1

826.8

lag1

*

333.0

270.4

281.1

443.0

432.3

428.9

443.2

413.1

391.6

361.5

318.1

308.4

382.2

419.5

453.0

430.3

468.5

464.2

521.9

550.4

529.7

556.9

606.5

670.1

745.5

756.1

Page 17

lag2

*

*

333.0

270.4

281.1

443.0

432.3

428.9

443.2

413.1

391.6

361.5

318.1

308.4

382.2

419.5

453.0

430.3

468.5

464.2

521.9

550.4

529.7

556.9

606.5

670.1

745.5

The model with 1 lag:

Housing Starts = -8.87 + 1.06 lag 1

F = 198.67

p = .000 R2 = 89.2% adjusted R2 = 88.8% se = 48.52

The model with 2 lags:

Housing Starts = 13.66 + 1.0569 lag 2

F = 72.36

p = .000 R2 = 75.9% adjusted R2 = 74.8% Se = 70.84

The model with 1 lag is the best model with a strong R2 = 89.2%. The model

with 2 lags is relatively strong also.

Students Solutions Manual and Study Guide: Chapter 15

15.21 Year

1950

1955

1960

1965

1970

1975

1980

1985

1990

1995

2000

2005

Price

22.45

31.40

32.33

36.50

44.90

61.24

69.75

73.44

80.05

84.61

87.28

89.56

15.23

Page 18

a.) Index1950

100.0

139.9

144.0

162.6

200.0

272.8

310.7

327.1

356.6

376.9

388.8

398.9

b.) Index1980

32.2

45.0

46.4

52.3

64.4

87.8

100.0

105.3

114.8

121.3

125.1

128.4

Year

Totals

1995

1.53

2.21

1.92

3.38

2002

1.40

2.15

2.68

3.10

2009

2.17

2.51

2.60

4.00

9.04

9.33

11.28

Index1995 =

9.04

(100) = 100.0

9.04

Index2002 =

9.33

(100) = 103.2

9.04

Index2009 =

1128

.

(100) = 124.8

9.04

Students Solutions Manual and Study Guide: Chapter 15

15.25

Page 19

Item

Quantity

2000

Price

2000

Price

2007

Price

2008

Price

2009

1

2

3

4

21

6

17

43

0.50

1.23

0.84

0.15

0.67

1.85

0.75

0.21

0.68

1.90

0.75

0.25

0.71

1.91

0.80

0.25

P2000Q2000 P2007Q2000 P2008Q2000

Totals

P2009Q2000

10.50

7.38

14.28

6.45

14.07

11.10

12.75

9.03

14.28

11.40

12.75

10.75

14.91

11.46

13.60

10.75

38.61

46.95

49.18

50.72

46.95

(100) = 121.6

38.61

2008 2000

2000 2000

49.18

(100) = 127.4

38.61

2009 2000

2000 2000

50.72

(100) = 131.4

38.61

Index2007 =

2007 2000

2000 2000

Index2008 =

Index2009 =

Students Solutions Manual and Study Guide: Chapter 15

15.27 a)

Page 20

The linear model:

Yield = 9.96 - 0.14 Month

F = 219.24 p = .000

R2 = 90.9

se = .3212

The quadratic model:

Yield = 10.4 - 0.252 Month + .00445 Month2

F = 176.21 p = .000

R2 = 94.4%

se = .2582

In the quadratic model, both t ratios are significant,

for x: t = - 7.93, p = .000 and for x2d: t = 3.61, p = .002

The linear model is a strong model. The quadratic term adds some

predictability but has a smaller t ratio than does the linear term.

b)

x

10.08

10.05

9.24

9.23

9.69

9.55

9.37

8.55

8.36

8.59

7.99

8.12

7.91

7.73

7.39

7.48

7.52

7.48

7.35

7.04

6.88

6.88

7.17

7.22

MAD =

F

9.65

9.55

9.43

9.46

9.29

8.96

8.72

8.37

8.27

8.15

7.94

7.79

7.63

7.53

7.47

7.46

7.35

7.19

7.04

6.99

e

.04

.00

.06

.91

.93

.37

.73

.25

.36

.42

.55

.31

.11

.05

.12

.42

.47

.31

.13

.23

e = 6.77

6.77

= .3385

20

Students Solutions Manual and Study Guide: Chapter 15

c)

= .3

e

x

F

10.08

10.05 10.08 .03

9.24 10.07 .83

9.23 9.82 .59

9.69 9.64 .05

9.55 9.66 .11

9.37 9.63 .26

8.55 9.55 1.00

8.36 9.25 .89

8.59 8.98 .39

7.99 8.86 .87

8.12 8.60 .48

7.91 8.46 .55

7.73 8.30 .57

7.39 8.13 .74

7.48 7.91 .43

7.52 7.78 .26

7.48 7.70 .22

7.35 7.63 .28

7.04 7.55 .51

6.88 7.40 .52

6.88 7.24 .36

7.17 7.13 .04

7.22 7.14 .08

e = 10.06

MAD=.3 =

Page 21

= .7

F

10.08

10.06

9.49

9.31

9.58

9.56

9.43

8.81

8.50

8.56

8.16

8.13

7.98

7.81

7.52

7.49

7.51

7.49

7.39

7.15

6.96

6.90

7.09

e =

10.06

= .4374

23

e

.03

.82

.26

.38

.03

.19

.88

.45

.09

.57

.04

.22

.25

.42

.04

.03

.03

.14

.35

.27

.08

.27

.13

5.97

MAD=.7 =

5.97

= .2596

23

= .7 produces better forecasts based on MAD.

d).

MAD for b) .3385, c) .4374 and .2596. Exponential smoothing with = .7

produces the lowest error (.2596 from part c).

Students Solutions Manual and Study Guide: Chapter 15

e)

TCSI

10.08

10.05

4 period

moving tots

Page 22

8 period

moving tots

TC

SI

76.81

9.60

96.25

75.92

9.49

97.26

75.55

9.44

102.65

75.00

9.38

101.81

72.99

9.12

102.74

70.70

8.84

96.72

68.36

8.55

97.78

66.55

8.32

103.25

65.67

8.21

97.32

64.36

8.05

100.87

62.90

7.86

100.64

61.66

7.71

100.26

60.63

7.58

97.49

59.99

7.50

99.73

59.70

7.46

100.80

59.22

7.40

101.08

58.14

7.27

101.10

56.90

7.11

99.02

56.12

7.02

98.01

56.12

7.02

98.01

38.60

9.24

38.21

9.23

37.71

9.69

37.84

9.55

37.16

9.37

35.83

8.55

34.87

8.36

33.49

8.59

33.06

7.99

32.61

8.12

31.75

7.91

31.15

7.73

30.51

7.39

30.12

7.48

29.87

7.52

29.83

7.48

29.39

7.35

28.75

7.04

28.15

6.88

27.97

6.88

28.15

7.17

7.22

Students Solutions Manual and Study Guide: Chapter 15

1st Period

2nd Period

3rd Period

4th Period

Page 23

102.65 97.78 100.64

101.81 103.25 100.26

96.25 102.74 97.32

97.26 96.72 100.87

100.80 98.01

101.08 98.01

97.49 101.10

99.73 99.02

The highs and lows of each period (underlined) are eliminated and the others are

averaged resulting in:

1st

2nd

3rd

4th

total

Seasonal Indexes:

99.82

101.05

98.64

98.67

398.18

Since the total is not 400, adjust each seasonal index by multiplying by

1.004571 resulting in the final seasonal indexes of:

1st 100.28

2nd 101.51

3rd 99.09

4th 99.12

15.29

Item

1

2

3

4

5

6

Totals

2005

3.21

0.51

0.83

1.30

1.67

0.62

8.14

2006

3.37

0.55

0.90

1.32

1.72

0.67

8.53

2007

3.80

0.68

0.91

1.33

1.90

0.70

9.32

2008

3.73

0.62

1.02

1.32

1.99

0.72

9.40

Index2005 = 2005 100 =

8.14

(100)

8.14

= 100.0

8.53

(100)

8.14

= 104.8

2000

Index2006 = 2006 100 =

2000

Index2007 =

2007

2000

100 =

9.32

(100)

8.14

= 114.5

Index2008 =

2008

2000

100 =

9.40

(100)

8.14

= 115.5

Index2009 =

2009

2000

100 =

9.29

(100)

8.14

= 114.1

2009

3.65

0.59

1.06

1.30

1.98

0.71

9.29

400

=

398.18

Students Solutions Manual and Study Guide: Chapter 15

15.31

Year

Quantity

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

6559

6022

6439

6396

6405

6391

6152

7034

7400

8761

9842

10065

10298

10209

10500

9913

9644

9952

9333

9409

9143

9512

9430

9513

10085

Page 24

b) = .2

F

a) moving average

e

F

6340.00

6285.67

6413.33

6397.33

6316.00

6525.67

6862.00

7731.67

8667.67

9556.00

10068.33

10190.67

10335.67

10207.33

10019.00

9836.33

9643.00

9564.67

9295.00

9354.67

9361.67

9485.00

56.00

119.33

22.33

245.33

718.00

874.33

1899.00

2110.33

1397.33

742.00

140.67

309.33

422.67

563.33

67.00

503.33

234.00

421.67

217.00

75.33

151.33

600.00

6022.00

6022.00

6105.40

6163.52

6211.82

6247.65

6228.52

6389.62

6591.69

7025.56

7588.84

8084.08

8526.86

8863.29

9190.63

9335.10

9396.88

9507.91

9472.93

9460.14

9396.71

9419.77

9421.82

9440.05

e =11,889.67

MADmoving average =

MAD=.2 =

c)

e

numberforecasts

e

numberforecasts

290.60

241.48

179.18

95.65

805.48

1010.38

2169.31

2816.45

2476.16

2213.93

1682.14

1636.71

722.37

308.90

555.12

174.91

63.93

317.14

115.29

10.23

91.18

644.95

e =18,621.46

11,889.67

= 540.44

22

18,62146

.

= 846.43

22

The three-year moving average produced a smaller MAD (540.44) than did

exponential smoothing with = .2 (MAD = 846.43). Using MAD as the

criterion, the three-year moving average was a better forecasting tool than the

exponential smoothing with = .2.

Students Solutions Manual and Study Guide: Chapter 15

Page 25

15.33

Month

Chem

Jan(1)

Feb

Mar

Apr

May

June

23.701

24.189

24.200

24.971

24.560

24.992

12m tot 2yr tot

TC

SI

TCI

288.00

July

22.566

575.65

23.985

94.08

23.872

23.917

575.23

23.968

100.29

24.134

23.919

576.24

24.010

104.32

24.047

23.921

577.78

24.074

100.17

24.851

23.924

578.86

24.119

95.50

24.056

23.926

580.98

24.208

93.32

23.731

23.928

584.00

24.333

95.95

24.486

23.931

586.15

24.423

98.77

24.197

23.933

587.81

24.492

103.23

23.683

23.936

589.05

24.544

103.59

24.450

23.938

590.05

24.585

102.44

24.938

23.940

592.63

24.693

107.26

24.763

23.943

595.28

24.803

97.12

25.482

23.945

597.79

24.908

99.05

24.771

23.947

601.75

25.073

103.98

25.031

23.950

605.59

25.233

96.41

25.070

23.952

607.85

25.327

94.07

24.884

23.955

287.65

Aug

24.037

287.58

Sept

25.047

Oct

24.115

Nov

23.034

Dec

22.590

Jan(2)

23.347

288.66

289.12

289.74

291.24

292.76

Feb

24.122

293.39

Mar

25.282

294.42

Apr

25.426

294.63

May

25.185

295.42

June

26.486

297.21

July

24.088

Aug

24.672

Sept

26.072

Oct

24.328

298.07

299.72

302.03

303.56

Nov

23.826

304.29

Students Solutions Manual and Study Guide: Chapter 15

Dec

24.373

Jan(3)

24.207

Feb

25.772

Page 26

610.56

25.440

95.81

25.605

23.957

613.27

25.553

94.73

25.388

23.959

614.89

25.620

100.59

25.852

23.962

616.92

25.705

107.34

25.846

23.964

619.39

25.808

104.46

25.924

23.966

622.48

25.937

99.93

25.666

23.969

625.24

26.052

109.24

26.608

23.971

627.35

26.140

94.95

26.257

23.974

629.12

26.213

97.51

25.663

23.976

631.53

26.314

103.44

26.131

23.978

635.31

26.471

96.90

26.432

23.981

639.84

26.660

95.98

26.725

23.983

644.03

26.835

94.54

26.652

23.985

647.65

26.985

93.82

26.551

23.988

652.98

27.208

97.16

26.517

23.990

659.95

27.498

106.72

27.490

23.992

666.46

27.769

104.37

27.871

23.995

672.57

28.024

101.43

28.145

23.997

679.39

28.308

106.50

28.187

24.000

686.66

28.611

93.48

28.294

24.002

694.30

28.929

100.13

29.082

24.004

701.34

29.223

105.34

29.554

24.007

706.29

29.429

97.16

29.466

24.009

306.27

307.00

307.89

Mar

27.591

309.03

Apr

26.958

310.36

May

June

25.920

312.12

28.460

313.12

July

24.821

314.23

Aug

25.560

Sept

27.218

Oct

25.650

Nov

25.589

Dec

25.370

314.89

316.64

318.67

321.17

322.86

Jan(4)

25.316

324.79

Feb

26.435

328.19

Mar

29.346

331.76

Apr

28.983

334.70

May

28.424

337.87

June

30.149

July

26.746

341.52

345.14

Aug

28.966

349.16

Sept

30.783

352.18

Oct

28.594

354.11

Students Solutions Manual and Study Guide: Chapter 15

Nov

28.762

Dec

29.018

Jan(5)

28.931

Page 27

710.54

29.606

97.14

30.039

24.011

715.50

29.813

97.33

30.484

24.014

720.74

30.031

96.34

30.342

24.016

725.14

30.214

100.80

30.551

24.019

727.79

30.325

106.75

30.325

24.021

730.25

30.427

101.57

29.719

24.023

733.94

30.581

100.53

30.442

24.026

738.09

30.754

106.63

30.660

24.028

Year2

95.95

98.77

103.23

103.59

102.44

107.26

97.12

99.05

103.98

96.41

94.07

95.81

Year3

94.73

100.59

107.34

104.46

99.93

109.24

94.95

97.51

103.44

96.90

95.98

94.54

356.43

359.07

361.67

Feb

30.456

363.47

Mar

32.372

364.32

Apr

30.905

365.93

May

30.743

368.01

June

32.794

370.08

July

Aug

Sept

Oct

Nov

Dec

29.342

30.765

31.637

30.206

30.842

31.090

Seasonal Indexing:

Month

Year1

Jan

Feb

Mar

Apr

May

June

July

94.08

Aug

100.29

Sept

104.32

Oct

100.17

Nov

95.50

Dec

93.32

Total

Year4

93.82

97.16

106.72

104.37

101.43

106.50

93.48

100.13

105.34

97.16

97.14

97.33

Adjust each seasonal index by 1200/1199.88 = 1.0001

Year5

96.34

100.80

106.75

101.57

100.53

106.63

Index

95.34

99.68

106.74

103.98

100.98

106.96

94.52

99.59

104.15

97.03

95.74

95.18

1199.88

Students Solutions Manual and Study Guide: Chapter 15

Page 28

Final Seasonal Indexes:

Month

Jan

Feb

Mar

Apr

May

June

July

Aug

Sept

Oct

Nov

Dec

Index

95.35

99.69

106.75

103.99

100.99

106.96

94.53

99.60

104.16

97.04

95.75

95.19

15.35

Item

Margarine (lb.)

Shortening (lb.)

Milk (1/2 gal.)

Cola (2 liters)

Potato Chips (12 oz.)

Total

Index2007 =

2007

Price Quantity

1.26

21

0.94

5

1.43

70

1.05

12

2.81

27

7.49

P

P

(100)

7.49

(100) = 100.0

7.49

P

P

(100)

7.73

(100) = 103.2

7.49

P

P

(100)

8.37

(100) = 111.8

7.49

2007

2007

Index2008 =

2008

2007

Index2009 =

2008

Price Quantity

1.32

23

0.97

3

1.56

68

1.02

13

2.86

29

7.73

2009

2007

2009

Price Quantity

1.39

22

1.12

4

1.62

65

1.25

11

2.99

28

8.37

Students Solutions Manual and Study Guide: Chapter 15

P2007Q2007

P2008Q2007

P2009Q2007

26.46

4.70

100.10

12.60

75.87

219.73

27.72

4.85

109.20

12.24

77.22

231.23

29.19

5.60

113.40

15.00

80.73

243.92

Totals

IndexLaspeyres2008 =

IndexLaspeyres2009 =

Total

Page 29

P

P

2008

Q2007

2007

Q2007

P

P

2009

Q2007

2007

Q2007

(100) =

23123

.

(100) = 105.2

219.73

(100) =

243.92

(100) = 111.0

219.73

P2007Q2008

P2007Q2009

P2008Q2008

P2009Q2009

28.98

2.82

97.24

13.65

81.49

224.18

27.726

3.76

92.95

11.55

78.68

214.66

30.36

2.91

106.08

13.26

82.94

235.55

30.58

4.48

105.30

13.75

83.72

237.83

IndexPaasche2008 =

IndexPaasche2009 =

P

P

2008

Q2008

2007

Q2008

P

P

2009

Q2009

2007

Q2009

(100) =

23555

.

(100) = 105.1

224.18

(100) =

237.83

(100) = 110.8

214.66

Students Solutions Manual and Study Guide: Chapter 15

15.37 Year

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

x

118.5

123.0

128.5

133.6

137.5

141.2

144.8

148.5

152.8

156.8

160.4

163.9

169.6

176.4

180.3

184.8

189.5

195.7

Page 30

Fma

Fwma

SEMA

SEWMA

125.9

130.7

135.2

139.3

143.0

146.8

150.7

154.6

158.5

162.7

167.6

172.6

177.8

182.8

128.4 134.56

133.1 111.30

137.3

92.16

141.1

85.10

144.8

96.04

148.8

99.50

152.7

93.61

156.6

86.03

160.3 123.77

164.8 188.38

170.3 161.93

175.4 150.06

180.3 137.48

184.9 167.70

82.08

65.93

56.25

54.17

63.52

64.80

58.68

53.14

86.12

135.26

100.80

89.30

85.56

115.78

SE = 1,727.60

1,111.40

MSEma =

SE

1727.60

= 123.4

No. Forecasts

14

MSEwma =

SE

11114

.

= 79.39

No. Forecasts

14

The weighted moving average does a better job of forecasting the data using

MSE as the criterion.

Students Solutions Manual and Study Guide: Chapter 15

Page 31

15.39

Qtr TSCI 4qrtot

Year1 1 54.019

2 56.495

213.574

3 50.169

211.470

4 52.891

210.076

Year2 1 51.915

213.326

2 55.101

217.671

3 53.419

222.819

4 57.236

230.206

Year3 1 57.063

237.160

2 62.488

243.258

3 60.373

248.918

4 63.334

254.810

Year4 1 62.723

257.693

2 68.380

260.805

3 63.256

263.527

4 66.446

263.158

Year5 1 65.445

263.147

2 68.011

263.573

3 63.245

257.842

4 66.872

253.421

Year6 1 59.714

248.264

2 63.590

3 58.088

4 61.443

8qrtot

TC

425.044 53.131

SI

TCI

94.43

51.699 53.722

421.546 52.693 100.38

52.341 55.945

423.402 52.925

98.09

52.937 58.274

430.997 53.875 102.28

53.063 60.709

440.490 55.061

97.02

55.048 63.249

453.025 56.628 101.07

56.641 65.895

467.366 58.421

97.68

58.186 68.646

480.418 60.052 104.06

60.177 71.503

492.176 61.522

98.13

62.215 74.466

503.728 62.966 100.58

62.676 77.534

512.503 64.063

97.91

63.957 80.708

518.498 64.812 105.51

65.851 83.988

524.332 65.542

96.51

65.185 87.373

526.685 65.836 100.93

65.756 90.864

526.305 65.788

99.48

66.733 94.461

526.720 65.840 103.30

65.496 98.163

521.415 65.177

97.04

65.174 101.971

511.263 63.908 104.64

66.177 105.885

501.685 62.711

95.22

60.889 109.904

491.099 61.387 103.59

61.238 114.029

Students Solutions Manual and Study Guide: Chapter 15

Quarter

1

2

3

4

Page 32

Year1

Year2

Year3

Year4

Year5

Year6

Index

97.68

104.06

98.13

100.58

97.91

105.51

96.51

100.93

99.48

103.30

97.04

104.64

95.22

103.59

94.43

100.38

98.09

102.28

97.02

101.07

97.89

103.65

96.86

100.86

Total

399.26

Adjust the seasonal indexes by:

400

= 1.00185343

399.26

Adjusted Seasonal Indexes:

Quarter

Index

1

2

3

4

98.07

103.84

97.04

101.05

Total

400.00

15.41 Linear Model: y = 53.41032 + 0.532488 x

R2 = 55.7% F = 27.65 with p = .000

se = 3.43

Quadratic Model: y = 47.68663 + 1.853339 x 0.052834 x2

R2 = 76.6% F = 34.37 with p = .000

se = 2.55

In the quadratic regression model, both the linear and squared terms have

significant t statistics at alpha .001 indicating that both are contributing. In

addition, the R2 for the quadratic model is considerably higher than the R2 for the

linear model. Also, se is smaller for the quadratic model. All of these indicate

that the quadratic model is a stronger model.

Students Solutions Manual and Study Guide: Chapter 15

Page 33

15.43 The regression equation is:

Equity Funds = -359.1 + 2.0898 Money Market Funds

R2 = 88.2%

se = 582.685

D = 0.84

For n = 26 and = .01, dL = 1.07 and dU = 1.22.

Since D = 0.84 < dL = 1.07, the null hypothesis is rejected. There is significant

autocorrelation in this model.

Students Solutions Manual and Study Guide: Chapter 15

Page 34

Bankruptcies = 75,532.436 0.016 Year

15.45 The model is:

Since R2 = .28 and the adjusted R2 = .23, this is a weak model.

et

- 1,338.58

- 8,588.28

- 7,050.61

1,115.01

12,772.28

14,712.75

- 3,029.45

- 2,599.05

622.39

9,747.30

9,288.84

- 434.76

-10,875.36

- 9,808.01

- 4,277.69

- 256.80

et et-1

(et et-1)2

- 7,249.7

1,537.7

8,165.6

11,657.3

1,940.5

-17,742.2

430.4

3,221.4

9,124.9

- 458.5

- 9,723.6

-10,440.6

1,067.4

5,530.3

4,020.9

52,558,150

2,364,521

66,677,023

135,892,643

3,765,540

314,785,661

185,244

10,377,418

83,263,800

210,222

94,548,397

109,006,128

1,139,343

30,584,218

16,167,637

(e e

t

D =

(e e

e

t 1

2

)2

t 1

)2 =921,525,945

et2

1,791,796

73,758,553

49,711,101

1,243,247

163,131,136

216,465,013

9,177,567

6,755,061

387,369

95,009,857

86,282,549

189,016

118,273,455

96,197.060

18,298,632

65,946

=936,737,358

921,525,945

= 0.98

936,737,358

For n = 16, = .05, dL = 1.10 and dU = 1.37

Since D = 0.98 < dL = 1.10, the decision is to reject the null hypothesis and

conclude that there is significant autocorrelation.

You might also like

- Machine-Learning Models For Sales Time Series Forecasting: Bohdan M. PavlyshenkoDocument11 pagesMachine-Learning Models For Sales Time Series Forecasting: Bohdan M. PavlyshenkoognjanovicNo ratings yet

- Machine-Learning Models For Sales Time Series Forecasting: Bohdan M. PavlyshenkoDocument11 pagesMachine-Learning Models For Sales Time Series Forecasting: Bohdan M. PavlyshenkoognjanovicNo ratings yet

- Machine-Learning Models For Sales Time Series Forecasting: Bohdan M. PavlyshenkoDocument11 pagesMachine-Learning Models For Sales Time Series Forecasting: Bohdan M. PavlyshenkoJohnson BezawadaNo ratings yet

- COMP1801 - Copy 1Document18 pagesCOMP1801 - Copy 1SujiKrishnanNo ratings yet

- Single Exponential Smoothing PDFDocument14 pagesSingle Exponential Smoothing PDFSachen KulandaivelNo ratings yet

- ORM-2 Assignment 1Document2 pagesORM-2 Assignment 1Komal ModiNo ratings yet

- EViews 7 Users Guide II PDFDocument822 pagesEViews 7 Users Guide II PDFismamnNo ratings yet

- TSF Shoe Sales & Softdrink by Shubradip Ghosh Pgpdsba 2022 MarDocument61 pagesTSF Shoe Sales & Softdrink by Shubradip Ghosh Pgpdsba 2022 MarShubradip GhoshNo ratings yet

- Introduction To Data Cleaning and Bias in AnalysisDocument35 pagesIntroduction To Data Cleaning and Bias in AnalysisJunjie GohNo ratings yet

- Eviews User Guide 2Document822 pagesEviews User Guide 2Rana Muhammad Arif KhanNo ratings yet

- Project Data Mining Tanaya LokhandeDocument58 pagesProject Data Mining Tanaya Lokhandetanaya lokhandeNo ratings yet

- Project TSDocument6 pagesProject TSVIGNESHANo ratings yet

- Walmart Sales Prediction Using Support Vector Regression and Multivariate RegressionDocument5 pagesWalmart Sales Prediction Using Support Vector Regression and Multivariate RegressionDeblin BagchiNo ratings yet

- The Combination Forecasting Model of Auto Sales Based On Seasonal Index and RBF Neural NetworkDocument10 pagesThe Combination Forecasting Model of Auto Sales Based On Seasonal Index and RBF Neural NetworkAnonymous iuYx49KcsNo ratings yet

- Final Report On AerosolDocument23 pagesFinal Report On AerosoltanvirNo ratings yet

- EViews 6 Users Guide IIDocument688 pagesEViews 6 Users Guide IIsandraexplicaNo ratings yet

- EViews 6 Users Guide IIDocument688 pagesEViews 6 Users Guide IItianhvtNo ratings yet

- Timeseries AnalysisDocument5 pagesTimeseries AnalysisFuad Hasan GaziNo ratings yet

- Forecasting: IE 503: Operations Analysis Jayendran VenkateswaranDocument29 pagesForecasting: IE 503: Operations Analysis Jayendran VenkateswaranjayNo ratings yet

- Quantitative Business Analysis Practice Exercises - SolutionsDocument17 pagesQuantitative Business Analysis Practice Exercises - Solutionsdalia alhazaziNo ratings yet

- Forecasting TechniquesDocument18 pagesForecasting TechniquesEphreen Grace MartyNo ratings yet

- Moving Average PDFDocument15 pagesMoving Average PDFSachen KulandaivelNo ratings yet

- Case Study of Sales ForecastingDocument22 pagesCase Study of Sales ForecastingChauhan ChetanNo ratings yet

- Trend Analysis OverviewDocument15 pagesTrend Analysis OverviewSachen KulandaivelNo ratings yet

- Chapter 10 Regression SlidesDocument46 pagesChapter 10 Regression SlidesAbhishek KumarNo ratings yet

- Predict employment for the next 12 months using trend analysis and decompositionDocument4 pagesPredict employment for the next 12 months using trend analysis and decompositionRGH_11No ratings yet

- Sberbank Project ReportDocument19 pagesSberbank Project ReportSamar Taj ShaikhNo ratings yet

- Assignment 3Document3 pagesAssignment 3Sidharth Ranjan PalaiNo ratings yet

- Updated DEA Models and LimitationsDocument6 pagesUpdated DEA Models and LimitationsZohaib OmerNo ratings yet

- QMB FL. Chap 02Document63 pagesQMB FL. Chap 02Manula JayawardhanaNo ratings yet

- Quantitative Techniques at a GlanceDocument20 pagesQuantitative Techniques at a GlanceDivyangi WaliaNo ratings yet

- BRM Multi VarDocument38 pagesBRM Multi VarUdit SinghNo ratings yet

- Ken Black QA 5th Chapter17 SolutionDocument44 pagesKen Black QA 5th Chapter17 SolutionRushabh VoraNo ratings yet

- Assignment IIDocument5 pagesAssignment IIsarah josephNo ratings yet

- Data Mining Business Report Hansraj YadavDocument34 pagesData Mining Business Report Hansraj YadavP Venkata Krishna Rao83% (12)

- MS-08 2015 SolvedDocument18 pagesMS-08 2015 SolvedLalit ThakurNo ratings yet

- Data Mining Project ReportDocument29 pagesData Mining Project Reporthema aarthiNo ratings yet

- Market Response Models and Techniques for Objective Decision MakingDocument2 pagesMarket Response Models and Techniques for Objective Decision MakingGopi ChandNo ratings yet

- 10 Missing Values OptionDocument49 pages10 Missing Values OptionJonathan RuizNo ratings yet

- Demand Estimation and ForecastingDocument4 pagesDemand Estimation and Forecasting'mYk FavilaNo ratings yet

- Asgkit Prog4Document22 pagesAsgkit Prog4Obed DiazNo ratings yet

- Question 2Document6 pagesQuestion 2SounakNo ratings yet

- 2 Forecasting Techniques Time Series Regression AnalysisDocument47 pages2 Forecasting Techniques Time Series Regression Analysissandaru malindaNo ratings yet

- Machine Learning: Key Differences Between Supervised vs Unsupervised LearningDocument11 pagesMachine Learning: Key Differences Between Supervised vs Unsupervised LearningDurgesh PatilNo ratings yet

- 2 Forecasting TechniquesDocument47 pages2 Forecasting Techniquessandaru malindaNo ratings yet

- Lecture 11 Forecasting Methods QMDocument7 pagesLecture 11 Forecasting Methods QMNella KingNo ratings yet

- Standard Deviation VariationstudentDocument2 pagesStandard Deviation VariationstudentMinh ĐăngNo ratings yet

- A Quantitative Approach to Commercial Damages: Applying Statistics to the Measurement of Lost ProfitsFrom EverandA Quantitative Approach to Commercial Damages: Applying Statistics to the Measurement of Lost ProfitsNo ratings yet

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Marketing Analytics: Data-Driven Techniques with Microsoft ExcelFrom EverandMarketing Analytics: Data-Driven Techniques with Microsoft ExcelRating: 4.5 out of 5 stars4.5/5 (2)

- Introduction to Dynamic Macroeconomic General Equilibrium ModelsFrom EverandIntroduction to Dynamic Macroeconomic General Equilibrium ModelsNo ratings yet

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesFrom EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNo ratings yet

- Handbook of Statistical Analysis and Data Mining ApplicationsFrom EverandHandbook of Statistical Analysis and Data Mining ApplicationsRating: 3.5 out of 5 stars3.5/5 (2)

- DATA MINING AND MACHINE LEARNING. PREDICTIVE TECHNIQUES: REGRESSION, GENERALIZED LINEAR MODELS, SUPPORT VECTOR MACHINE AND NEURAL NETWORKSFrom EverandDATA MINING AND MACHINE LEARNING. PREDICTIVE TECHNIQUES: REGRESSION, GENERALIZED LINEAR MODELS, SUPPORT VECTOR MACHINE AND NEURAL NETWORKSNo ratings yet

- Methods for Applied Macroeconomic ResearchFrom EverandMethods for Applied Macroeconomic ResearchRating: 3.5 out of 5 stars3.5/5 (3)

- Assessing The Domestic and Foreign Islamic Banks Ef Ficiency: Insights From Selected Southeast Asian CountriesDocument14 pagesAssessing The Domestic and Foreign Islamic Banks Ef Ficiency: Insights From Selected Southeast Asian CountriesFayz Al FarisiNo ratings yet

- Uud 1945Document6 pagesUud 1945Fayz Al FarisiNo ratings yet

- Mankiw Chapter 18 InvestmentDocument43 pagesMankiw Chapter 18 InvestmentFayz Al FarisiNo ratings yet

- Presentation 1Document1 pagePresentation 1Fayz Al FarisiNo ratings yet

- P 150226Document8 pagesP 150226Fayz Al FarisiNo ratings yet

- ZakatDocument23 pagesZakatFayz Al FarisiNo ratings yet

- 111 - Natural Sciences PDFDocument13 pages111 - Natural Sciences PDFFayz Al FarisiNo ratings yet

- Accounting treatment for corporate zakat: a critical reviewDocument14 pagesAccounting treatment for corporate zakat: a critical reviewCheng CheongNo ratings yet

- Stock Prices and Bank Loan Dynamics in A Developing Country: The Case of MalaysiaDocument19 pagesStock Prices and Bank Loan Dynamics in A Developing Country: The Case of MalaysiaFayz Al FarisiNo ratings yet

- Ijns 2015 v17 n1 p49 56Document8 pagesIjns 2015 v17 n1 p49 56Fayz Al FarisiNo ratings yet

- Bond Value FinanceDocument23 pagesBond Value FinancemirkazimNo ratings yet

- The Relationship Between Economic Growth and Capital Structure of Listed Companies: Evidence of Japan, Malaysia, and PakistanDocument22 pagesThe Relationship Between Economic Growth and Capital Structure of Listed Companies: Evidence of Japan, Malaysia, and PakistanFayz Al FarisiNo ratings yet

- 2506 Hooi GrangerDocument23 pages2506 Hooi GrangerFayz Al FarisiNo ratings yet

- 09E01263Document126 pages09E01263Fayz Al FarisiNo ratings yet

- The Relationship Between Economic Growth and Capital Structure of Listed Companies: Evidence of Japan, Malaysia, and PakistanDocument22 pagesThe Relationship Between Economic Growth and Capital Structure of Listed Companies: Evidence of Japan, Malaysia, and PakistanFayz Al FarisiNo ratings yet

- 2001 JME Inflation Fin SectorDocument33 pages2001 JME Inflation Fin SectorFayz Al FarisiNo ratings yet

- 173 578 1 PBDocument19 pages173 578 1 PBFayz Al FarisiNo ratings yet