Professional Documents

Culture Documents

Avighna Permit SQ 02-11-15

Uploaded by

Pragathees WaranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Avighna Permit SQ 02-11-15

Uploaded by

Pragathees WaranCopyright:

Available Formats

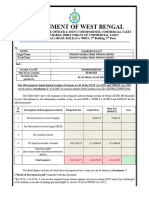

PERMIT NO : IG5K213742H

CARGO CLEARANCE PERMIT

MESSAGE TYPE

DECLARATION TYPE

:

:

PG : 1 OF 3

IN-PAYMENT PERMIT

GST (INCLUDING DUTY EXEMPTION)

IMPORTER:

AVIGHNA TRADING SERVICES PTE. LTD

VALIDITY PERIOD

201105974M

EXPORTER:

TOTAL GROSS WT/UNIT :

TOTAL OUTER PACK/UNIT:

TOT EXCISE DUT PAYABLE :

TOT CUSTOMS DUT PAYABLE:

TOT OTHER TAX PAYABLE :

TOTAL GST AMT

:

TOTAL AMOUNT PAYABLE

:

CARGO PACKING TYPE: OTHER

IN TRANSPORT IDENTIFIER:

HANDLING AGENT:

PORT OF LOADING/NEXT PORT OF CALL:

COIMBATORE

PORT OF DISCHARGE/FINAL PORT OF CALL:

02/11/2015 16/11/2015

570.000 /KGM

51 /CTN

S$

0.00

S$

0.00

S$

0.00

S$

70.70

S$

70.70

NON-CONTAINERIZED

COUNTRY OF FINAL DESTINATION:

CONVEYANCE REFERENCE NO: SQ

OBL/MAWB NO:

618 9440 4855

ARRIVAL DATE

: 02/11/2015

OU TRANSPORT IDENTIFIER:

INWARD CARRIER AGENT:

SINGAPORE AIRPORT TERMINAL SERVICES

CONVEYANCE REFERENCE NO:

OBL/MAWB/UCR NO:

DEPARTURE DATE

OUTWARD CARRIER AGENT:

CERTIFICATE NO:

PLACE OF RELEASE:

CHANGI FTZ

CZ

LICENCE NO:

IP11G1091

PLACE OF RECEIPT:

AVIGHNA TRADING SERVICES PTE. LTD

O

CUSTOMS PROCEDURE CODE (CPC):

-----------------------------------------------------------------------------------UNIQUE REF : 200403041D 20151102 1003

PERMIT NO : IG5K213742H

CARGO CLEARANCE PERMIT

======================

(CONTINUATION PAGE)

PG : 2 OF 3

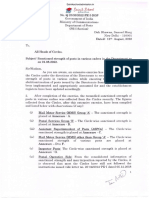

CONSIGNMENT DETAILS

-----------------------------------------------------------------------------------S/NO

HS CODE

CURRENT LOT NO

PREVIOUS LOT NO

MARKING

CTY OF ORIGIN

BRAND NAME

PACKING/GOODS DESCRIPTION

HS QUANTITY & UNIT

CIF/FOB VALUE (S$)

GST AMOUNT (S$)

MANUFACTURER'S NAME

-----------------------------------------------------------------------------------01

04061010

UNBRANDED

IN

51 CTN

51.0000 CTN

FRESH UNRIPENED OR UNCURED CHEESE INCL WHEY CHEESE

1010.00

(KGM)

70.70

NIHAS VALES STREAM EXPORTS

-----------------------------------------------------------------------------------S/NO

CA/SC PRODUCT CODE

CA/SC PRODUCT QTY & UNIT

01

DCP0AA00000

500.0000 KGM

------------------------------------------------------------------------------------

-----------------------------------------------------------------------------------CONTAINER IDENTIFIERS

01)

-----------------------------------------------------------------------------------NO UNAUTHORISED ADDITION/AMENDMENT TO THIS PERMIT MAY BE MADE AFTER APPROVAL

-----------------------------------------------------------------------------------NAME OF COMPANY:

FLORA MART PTE LTD

DECLARANT NAME :

THAZHAKUDY KUNASEELAN SHUNMUGAM KALAISELVAN

DECLARANT CODE : XXXX1129B

TEL NO

: 66569514

-----------------------------------------------------------------------------------CONTROLLING AGENCY/CUSTOMS CONDITIONS

A20 - APPROVED BY AVA (PROCESSED FOOD) SUBJECT TO COMPLIANCE WITH THE SALE OF

FOOD ACT AND THE FOOD REGULATIONS. THIS CCP ALSO SERVES AS AN AVA PERMIT,

---- - FOR ALL ITEMS.

---- - THESE ITEMS ARE UNDER AVA CONTROL AND SUBJECT TO COMPLIANCE WITH THE

FOOD LAWS. PLEASE NOTE THAT MEAT AND SEAFOOD PRODUCTS ARE NOT ALLOWED TO

DECLARE UNDER THIS PERMIT. FAILURE TO COMPLY MAY BE SUBJECTED TO A FINE NOT

EXCEEDING $10,000 AND/OR IMPRISONMENT NOT EXCEEDING 3 MONTHS.

Z10 - APPROVED BY SINGAPORE CUSTOMS SUBJECT TO THE CONDITION THAT YOU COMPLY

WITH THE REQUIREMENTS OF THE COMPETENT AUTHORITY.

Y95 - PLS CHECK AGAIN THE DECLARED 1) HS CODES/DESCRIPTION, 2) ITEM QUANTITY

OR VALUE, OR 3) ITEM VALUE WHICH EXCEEDED $1 MILLION. IF WRONG, PLEASE AMEND OR

CANCEL THIS UNUSED PERMIT WITHIN 48 HOURS. IN PARTICULAR, FOR UNUSED GST

PAYMENT PERMITS, CANCELLATION OF PERMITS OR AMENDMENTS TO FIELDS AFFECTING GST

SHOULD BE SUBMITTED WITHIN 23:59:59 HOURS OF THE DATE OF PERMIT APPROVAL.

GA

- APPROVED BY CUSTOMS SUBJECT TO THE IMPORTER, EXPORTER, DECLARING AGENT

OR/AND THE DECLARANT COMPLYING WITH THE FOLLOWING CONDITION(S) FOR THE PERMIT

TO BE VALID. FAILURE TO COMPLY WITH CONDITION(S) IS AN OFFENCE.

GQ

- IF THE DUTY/GST IS NOT PAID WITHIN THE VALIDITY PERIOD OF THE PERMIT,

THIS PERMIT MUST BE CANCELLED BEFORE ITS EXPIRY DATE IF IT IS NOT USED FOR CARGO

CLEARANCE.

MA

- THE GOODS AND THIS PERMIT WITH INVOICES, BL/AWB, ETC MUST BE PRODUCED

FOR CUSTOMS CLEARANCE AT A FREE TRADE ZONE 'OUT' GATE, WOODLANDS

TRAIN/WOODLANDS/TUAS CHECKPOINT UNLESS IT IS DIRECTED TO THE 'GREEN LANE' AT

THE TIME OF CLEARANCE, OR A DESIGNATED CUSTOMS OFFICE OR STATION AS INSTRUCTED.

G7

- SUCCESSFUL GIRO DEDUCTION OF THE AMOUNT TO BE PAID FROM THE DECLARING

AGENT'S ACCOUNT. YOU MUST HAVE ENOUGH FUNDS IN YOUR BANK ACCOUNT TO MEET PAYMENT

BEFORE MAKING THE DECLARATION.

-----------------------------------------------------------------------------------UNIQUE REF : 200403041D 20151102 1003

PERMIT NO : IG5K213742H

CARGO CLEARANCE PERMIT

======================

(CONTINUATION PAGE)

PG : 3 OF 3

CONSIGNMENT DETAILS (Cont'd)

-----------------------------------------------------------------------------------GX

- THE DUTY/GST MUST BE PAID SHOULD THE GIRO DEDUCTION FAIL. CUSTOMS MAY

INVOKE THE IMPORTER/DECLARANT'S BG FOR RECOVERY OF THE DUTY/GST. A PENALTY

CHARGE MAY BE IMPOSED BY CUSTOMS FOR AN UNSUCCESSFUL GIRO DEDUCTION.

EEE - END OF CARGO CLEARANCE PERMIT.

-----------------------------------------------------------------------------------UNIQUE REF : 200403041D 20151102 1003

You might also like

- He LeDocument2 pagesHe LeDwayne GanNo ratings yet

- Permit - Alpine MiaDocument2 pagesPermit - Alpine MiakatemesiasNo ratings yet

- Icpo For Ago TFD Cif GhanaDocument4 pagesIcpo For Ago TFD Cif Ghanajessica OdiliNo ratings yet

- Blue StarDocument13 pagesBlue StarWell WisherNo ratings yet

- Sales Contract for 100,000MT of White Refined SugarDocument4 pagesSales Contract for 100,000MT of White Refined SugarAnonymous 9q5GEfm8INo ratings yet

- proforma pivot 30H VALLEY_2Document5 pagesproforma pivot 30H VALLEY_2Amdjed HydrauNo ratings yet

- Port of Discharge/Final Port of Call: ShanghaiDocument2 pagesPort of Discharge/Final Port of Call: ShanghaiAudi GohNo ratings yet

- 101019050065Document3 pages101019050065alaminNo ratings yet

- 1274 PDFDocument1 page1274 PDFAbhilashKrishnanNo ratings yet

- 1274 PDFDocument1 page1274 PDFAbhilashKrishnanNo ratings yet

- Epson Advance Rc#2Document18 pagesEpson Advance Rc#2Shanthi GowthamNo ratings yet

- Vat Refunds (Compilation)Document42 pagesVat Refunds (Compilation)Jesús LapuzNo ratings yet

- 1000&1250 11 Oltc R1Document3 pages1000&1250 11 Oltc R1Rohan KallaNo ratings yet

- Saroj Eng WorksDocument1 pageSaroj Eng WorksVidya SinghNo ratings yet

- Cargo clearance permit for ethylene butene copolymer exportDocument2 pagesCargo clearance permit for ethylene butene copolymer exportLucretia FabianNo ratings yet

- Icpo Atyrau Refinery LLP VineetDocument5 pagesIcpo Atyrau Refinery LLP VineetJawhar MagidNo ratings yet

- Tax Invoice for Vehicle ServiceDocument3 pagesTax Invoice for Vehicle ServiceSanjay PatelNo ratings yet

- Monthly CcaDocument61 pagesMonthly Ccaroshan sahNo ratings yet

- Full Corporate Offer: PrincipalDocument3 pagesFull Corporate Offer: PrincipalGrigory Vladimirovich TishkinNo ratings yet

- Eg2f0a UDocument12 pagesEg2f0a UAnonymous SIotTdNo ratings yet

- Government crackdown on tax evasion by real estate firmDocument6 pagesGovernment crackdown on tax evasion by real estate firmSeemaNaikNo ratings yet

- Documentary Credit DetailsDocument3 pagesDocumentary Credit DetailsHasibul Ehsan KhanNo ratings yet

- Croma Juicer WarrantyDocument2 pagesCroma Juicer WarrantyHimanshu YadavNo ratings yet

- Import Forklift LC IssuedDocument3 pagesImport Forklift LC IssuedMirza AsadNo ratings yet

- MFCWL-EDIIG Sale Facilitation and Vehicle ListDocument7 pagesMFCWL-EDIIG Sale Facilitation and Vehicle ListSourabh TiwariNo ratings yet

- Deposit Products: & Other Services@CBSDocument26 pagesDeposit Products: & Other Services@CBSRitika AroraNo ratings yet

- R2112O0253-IDM 70 SprocketDocument9 pagesR2112O0253-IDM 70 SprocketMilan KothariNo ratings yet

- GST & RCM Accounting TreatmentDocument2 pagesGST & RCM Accounting TreatmentGoel Singhal & AssociatesNo ratings yet

- RS - Q13838 CALIBRATOR 4-20maDocument1 pageRS - Q13838 CALIBRATOR 4-20maCharlo GordoNo ratings yet

- InvoiceDocument2 pagesInvoiceKaushal Ramesh giriNo ratings yet

- Issued Date - OfferDocument5 pagesIssued Date - Offerkong yun100% (3)

- Maynilad Water Bill DetailsDocument1 pageMaynilad Water Bill DetailsJenelyn DomalaonNo ratings yet

- Ago Sonara IMEX2022Document5 pagesAgo Sonara IMEX2022ivana LahameuNo ratings yet

- Question As Emailed To Us On 24 Oct 2020 by Safique SardarDocument4 pagesQuestion As Emailed To Us On 24 Oct 2020 by Safique SardarSk Asif AliNo ratings yet

- Et Delmas GabonDocument57 pagesEt Delmas GabonalainestorNo ratings yet

- SCO TURKMENISTANDocument3 pagesSCO TURKMENISTANAdnan IsmailNo ratings yet

- Split AC On RCDocument11 pagesSplit AC On RCSubir Kumar BiswasNo ratings yet

- Two (2) Usa Sellers Oil & Gas - Updated May 2022Document4 pagesTwo (2) Usa Sellers Oil & Gas - Updated May 2022AlanNo ratings yet

- Government Rate Contract for Online UPSDocument13 pagesGovernment Rate Contract for Online UPSwasim ahmad0% (1)

- 0605Document6 pages0605Ivy TampusNo ratings yet

- Orders ReportDocument6 pagesOrders ReportMudassar76No ratings yet

- 066012509512512252345000Document3 pages066012509512512252345000InderpalMankuNo ratings yet

- Page 1/3Document3 pagesPage 1/3pankaj kumarNo ratings yet

- Zamboanga City Zonal ValuesDocument168 pagesZamboanga City Zonal ValuesArnold Cavalida BucoyNo ratings yet

- BriDocument3 pagesBriJody Subiyantoro100% (1)

- 3876 FDocument3 pages3876 FSushanta DasNo ratings yet

- Revised Spa - Crude Rapeseed Oil Non-Gmo-125k UcraineDocument9 pagesRevised Spa - Crude Rapeseed Oil Non-Gmo-125k UcraineAlexandraNo ratings yet

- Cmo 1-2013 SGLDocument4 pagesCmo 1-2013 SGLErico Jan AstrologoNo ratings yet

- $520000 CSL UcblDocument3 pages$520000 CSL Ucblgohoji4169No ratings yet

- CA Final IDT Amendments For May 2016Document11 pagesCA Final IDT Amendments For May 2016Venugopal RNo ratings yet

- Form Sr. Instruction Instructions For Filling in Return Form & Wealth StatementDocument8 pagesForm Sr. Instruction Instructions For Filling in Return Form & Wealth StatementajgondalNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Booking ConfirmationDocument4 pagesBooking ConfirmationCAROLINA CORTESNo ratings yet

- Commercial Invoive & Ppop UptimeDocument9 pagesCommercial Invoive & Ppop Uptimeyjmfvffqx9No ratings yet

- SDD Solution Design DocumentDocument5 pagesSDD Solution Design DocumentSandeep ReddyNo ratings yet

- Fco Sonar A 150922Document5 pagesFco Sonar A 150922ivana LahameuNo ratings yet

- Jet Fuel Jpa1 Aviation Kerosene Colonial Grade A1 - Russian Virgin Fuel Oil D6 20180113063743Document2 pagesJet Fuel Jpa1 Aviation Kerosene Colonial Grade A1 - Russian Virgin Fuel Oil D6 20180113063743Jose CastroNo ratings yet

- TAX INVOICE FOR TRANSPORT COMPANYDocument3 pagesTAX INVOICE FOR TRANSPORT COMPANYSanjay PatelNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNo ratings yet

- Hysys User GuideDocument168 pagesHysys User GuideAmine NitroNo ratings yet

- Cyclone Separator deDocument26 pagesCyclone Separator dePragathees WaranNo ratings yet

- Amine Sweetening Unit Simplified Design EquationsDocument20 pagesAmine Sweetening Unit Simplified Design EquationsPragathees Waran100% (1)

- Digester Design2Document16 pagesDigester Design2Pragathees WaranNo ratings yet

- TipsDocument1 pageTipsArchi MakakalikasanNo ratings yet

- Avighna Permit SQ 02-11-15Document3 pagesAvighna Permit SQ 02-11-15Pragathees WaranNo ratings yet

- 14.03.15 PermitDocument3 pages14.03.15 PermitPragathees WaranNo ratings yet

- Textile WasteDocument56 pagesTextile WastePragathees WaranNo ratings yet

- M13L17 Digester DesignDocument12 pagesM13L17 Digester DesignPragathees WaranNo ratings yet

- Module 21 Anaerobic Wastewater TreatmentDocument13 pagesModule 21 Anaerobic Wastewater TreatmentPragathees WaranNo ratings yet

- Design Glycol Units For Maximum EfficiencyDocument12 pagesDesign Glycol Units For Maximum EfficiencyHassan BadriNo ratings yet

- M23L38Document17 pagesM23L38Pragathees WaranNo ratings yet

- PGFP CH 4 Three-Phase Separation (Enginnering)Document18 pagesPGFP CH 4 Three-Phase Separation (Enginnering)GiftObionochieNo ratings yet

- Three Phase Separators - Times DefinitionDocument5 pagesThree Phase Separators - Times DefinitionPragathees Waran100% (1)

- WastwaterTreatment 2011 Ch1-7Document28 pagesWastwaterTreatment 2011 Ch1-7Pragathees Waran100% (1)

- HydrocycloneDocument8 pagesHydrocycloneTracyNo ratings yet

- Datasheet of Pipe Flocculator: Design SpecificationDocument1 pageDatasheet of Pipe Flocculator: Design SpecificationPragathees WaranNo ratings yet

- Java ProgramDocument59 pagesJava ProgramPragathees WaranNo ratings yet

- Textile Effluent Treatment Options in BangladeshDocument36 pagesTextile Effluent Treatment Options in BangladeshPragathees WaranNo ratings yet

- Clarifier DrawingsDocument3 pagesClarifier DrawingsPragathees WaranNo ratings yet

- A MySQL Tutorial For BeginnersDocument58 pagesA MySQL Tutorial For BeginnersIpung NurdiantoNo ratings yet

- Technical Summary of Oil & Gas Produced Water Treatment TechnologiesDocument53 pagesTechnical Summary of Oil & Gas Produced Water Treatment TechnologiesPrie TeaNo ratings yet

- Office ReadmeDocument1 pageOffice Readmesagar323No ratings yet

- GA For 6.5 m3hrDocument3 pagesGA For 6.5 m3hrPragathees WaranNo ratings yet

- 0 DD7 Z 8 S J2 DC 6 o 41 CN 93 SX TMVDocument8 pages0 DD7 Z 8 S J2 DC 6 o 41 CN 93 SX TMVAlina RădulescuNo ratings yet

- Datasheet of Pipe Flocculator: Design SpecificationDocument1 pageDatasheet of Pipe Flocculator: Design SpecificationPragathees WaranNo ratings yet

- Java ProgramDocument59 pagesJava ProgramPragathees WaranNo ratings yet

- Java QuestionsDocument118 pagesJava QuestionsPragathees WaranNo ratings yet

- Jay & B Cust Price ListDocument2 pagesJay & B Cust Price ListPragathees WaranNo ratings yet

- Disequilibrium in The Balance of PaymentsDocument20 pagesDisequilibrium in The Balance of PaymentsAditya KumarNo ratings yet

- Interest Rates SummaryDocument28 pagesInterest Rates SummaryMichael ArevaloNo ratings yet

- Unit 2 GLOBALIZATION OF WORLD ECONOMICSDocument2 pagesUnit 2 GLOBALIZATION OF WORLD ECONOMICSCarl Jeffner EspinaNo ratings yet

- Business Studies Chapter 15 NotesDocument3 pagesBusiness Studies Chapter 15 NotesMuhammad Faizan RazaNo ratings yet

- Global Debt and Equity MarketDocument37 pagesGlobal Debt and Equity MarketKim Andrey JimenaNo ratings yet

- Post Office Notification PDFDocument17 pagesPost Office Notification PDFNilanjan RoyNo ratings yet

- NAVA DC Application FormDocument4 pagesNAVA DC Application FormrolfNo ratings yet

- Cha 4 ProDocument90 pagesCha 4 Proyonas bezaNo ratings yet

- TVM Concepts ExplainedDocument15 pagesTVM Concepts ExplainedIstiaque AhmedNo ratings yet

- Chapter 13 Statement of Cash Flows: Answer KeyDocument104 pagesChapter 13 Statement of Cash Flows: Answer KeyOjv FgjNo ratings yet

- Report On The Appellate Body of The WtoDocument174 pagesReport On The Appellate Body of The Wtobobjones3296No ratings yet

- CIF CombinedDocument621 pagesCIF CombinedDivyansh SehgalNo ratings yet

- Chapter 16Document27 pagesChapter 16tranm21410caNo ratings yet

- Power of Compounding - Vaishnavi SomaniDocument1 pagePower of Compounding - Vaishnavi SomaniVaishnavi SomaniNo ratings yet

- 2019 - Resources and Energy Quarterly June 2019Document143 pages2019 - Resources and Energy Quarterly June 2019Izzul AzmiNo ratings yet

- Icc IncotermDocument113 pagesIcc Incotermermiastes6600No ratings yet

- Percentage Tax vs. Value-Added Tax (VAT) : What Are The Reasons To Levy Excise Taxes?Document1 pagePercentage Tax vs. Value-Added Tax (VAT) : What Are The Reasons To Levy Excise Taxes?Brithney ButalidNo ratings yet

- History of Tourism and Hospitality IndustryDocument20 pagesHistory of Tourism and Hospitality IndustryJJ LongnoNo ratings yet

- Index Masterclass Webinar Slides Upload Black FridayDocument192 pagesIndex Masterclass Webinar Slides Upload Black FridayBananaboi gamingNo ratings yet

- Worksheet Money and Banking 2023Document6 pagesWorksheet Money and Banking 2023Reyaz KhanNo ratings yet

- General Journal Date Account Title and Explanation PR Debit CreditDocument8 pagesGeneral Journal Date Account Title and Explanation PR Debit CrediteljaneNo ratings yet

- DMARTDocument33 pagesDMARTJaspal Singh Fande100% (2)

- Invoice 2Document1 pageInvoice 2Dd GargNo ratings yet

- Hanjin LocalchagreDocument5 pagesHanjin LocalchagreTrần Minh CườngNo ratings yet

- Market Turning Points Step Candle Pattern Buy & Hold Price Trends Interview Review, Quick-ScanDocument68 pagesMarket Turning Points Step Candle Pattern Buy & Hold Price Trends Interview Review, Quick-ScanJohn Green100% (1)

- Government Bond: Financial MarketsDocument7 pagesGovernment Bond: Financial MarketsJonahNo ratings yet

- Money Answer All ThingsDocument76 pagesMoney Answer All ThingsJose Artur PaixaoNo ratings yet

- Facts On RBIDocument3 pagesFacts On RBIchiku singNo ratings yet

- 1 Tariff and Statiscal Nomenclature PDFDocument3 pages1 Tariff and Statiscal Nomenclature PDFjeoNo ratings yet

- A Refresher On Net Present ValueDocument6 pagesA Refresher On Net Present ValueFrancis BellidoNo ratings yet