Professional Documents

Culture Documents

Spiceland SM 7ech09 PDF

Uploaded by

mas azizOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Spiceland SM 7ech09 PDF

Uploaded by

mas azizCopyright:

Available Formats

Find more slides, ebooks, solution manual and testbank on www.downloadslide.

com

Chapter 9

Inventories: Additional Issues

QUESTIONS FOR REVIEW OF KEY TOPICS

Question 9-1

GAAP generally require the use of historical cost to value assets, but a departure from cost is

necessary when the utility of an asset is no longer as great as its cost. The utility or benefits from

inventory result from the ultimate sale of the goods. This utility could be reduced below cost due to

deterioration, obsolescence, or changes in price levels. To avoid reporting inventory at an amount

greater than the benefits it can provide, the lower-of-cost-or-market approach to valuing inventory

was developed. This approach results in the recognition of losses when the value of inventory

declines below its cost, rather than in the period in which the goods are ultimately sold.

Question 9-2

The designated market value in the LCM rule is the middle number of replacement cost (RC),

net realizable value (NRV) and net realizable value less a normal profit margin (NRV-NP). This is

the amount compared with cost to determine LCM.

Question 9-3

The LCM determination can be made based on individual inventory items, on logical

categories of inventory, or on the entire inventory.

Question 9-4

The preferred method is to record the loss from the write-down of inventory as a separate item

in the income statement rather than including the write-down in cost of goods sold. A less desirable

alternative is to include the loss in cost of goods sold.

Question 9-5

The gross profit method estimates cost of goods sold, which is then subtracted from cost of

goods available for sale to obtain an estimate of ending inventory. The estimate of cost of goods

sold is found by multiplying sales by the historical ratio of cost to selling prices. The cost

percentage is the reciprocal of the gross profit ratio.

Question 9-6

The key to obtaining accurate estimates when using the gross profit method is the reliability of

the cost percentage. If the cost percentage is too low, cost of goods sold will be understated and

ending inventory overstated. Cost percentages usually are based on relationships of past years,

which arent necessarily representative of the current relationship. Failure to consider theft or

spoilage also could cause an overstatement of ending inventory.

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-1

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Answers to Questions (continued)

Question 9-7

The retail inventory method first determines the amount of ending inventory at retail by

subtracting sales for the period from goods available for sale at retail. Ending inventory at retail is

then converted to cost by multiplying it by the cost-to-retail percentage.

Question 9-8

The main difference between the gross profit method and the retail inventory method is in the

determination of the cost percentage used to convert sales at selling prices to sales at cost. The retail

inventory method uses a cost percentage, called the cost-to-retail percentage, which is based on a

current relationship between cost and selling price. The gross profit method relies on past data to

reflect the current cost percentage.

Question 9-9

Initial markup Original amount of markup from cost to selling price.

Additional markup Increase in selling price subsequent to initial markup.

Markup cancellation Elimination of an additional markup.

Markdown Reduction in selling price below the original selling price.

Markdown cancellation Elimination of a markdown.

Question 9-10

When using the retail method to estimate average cost, the cost-to-retail percentage is

determined by dividing total cost of goods available for sale by total goods available for sale at

retail. By including beginning inventory in the calculation of the cost-to-retail percentage, the

percentage reflects the average cost/retail relationship for all inventory, not just the portion acquired

in the current period.

Question 9-11

The lower-of-cost-or-market (LCM) retail variation combined with the average cost method is

called the conventional retail method. The LCM rule is incorporated into the retail inventory

estimation procedure by excluding markdowns from the calculation of the cost-to-retail percentage.

Question 9-12

When applying LIFO, if inventory increases during the year, none of the beginning inventory

is assumed sold. Ending inventory includes the beginning inventory plus the current years layer.

To determine layers, we compare ending inventory at retail to beginning inventory at retail and

assume that no more than one inventory layer is added if inventory increases. Each layer carries its

own cost-to-retail percentage that is used to convert each layer from retail to cost.

Question 9-13

Freight-in is added to purchases in the cost column. Net markups are added in the retail

column before the calculation of the cost-to-retail percentage. Normal spoilage is deducted in the

retail column after the calculation of the cost-to-retail percentage. If sales are recorded net of

employee discounts, the discounts are added to net sales before sales are deducted in the retail

column.

The McGraw-Hill Companies, Inc., 2007

9-2

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Answers to Questions (continued)

Question 9-14

The dollar-value LIFO retail method eliminates the stable price assumption of regular retail

LIFO. In effect, it combines dollar-value LIFO (Chapter 8) with LIFO retail. Before comparing

beginning and ending inventory at retail prices, ending inventory is deflated to base year retail using

the current years retail price index. After identifying the layers in ending inventory with the years

they were created, in addition to converting retail prices to cost using the cost-to-retail percentage,

the dollar-value LIFO method requires that each layer first be converted from base year retail to

layer year retail using the years retail price index.

Question 9-15

Changes in inventory methods, other a change to the LIFO method, are reported

retrospectively. This means reporting all previous periods financial statements as if the new

inventory method had been used in all prior periods.

Question 9-16

When a company changes to the LIFO inventory method from any other method, it usually is

impossible to calculate the income effect on prior years. To do so would require assumptions as to

when specific LIFO inventory layers were created in years prior to the change. As a result, a

company changing to LIFO usually does not report the change retrospectively. Instead, the LIFO

method simply is used from that point on. The base year inventory for all future LIFO

determinations is the beginning inventory in the year the LIFO method is adopted.

Question 9-17

If a material inventory error is discovered in an accounting period subsequent to the period in

which the error is made, any previous years financial statements that were incorrect as a result of

the error are retrospectively restated to reflect the correction. And, of course, any account balances

that are incorrect as a result of the error are corrected by journal entry. If retained earnings is one of

the incorrect accounts, the correction is reported as a prior period adjustment to the beginning

balance in the statement of shareholders equity. In addition, a disclosure note is needed to describe

the nature of the error and the impact of its correction on net income, income before extraordinary

item, and earnings per share.

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-3

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Answers to Questions (concluded)

Question 9-18

2004:

2005:

Cost of goods sold

Net income

Ending retained earnings

Net purchases

Cost of goods sold

Net income

Ending retained earnings

overstated

understated

understated

no effect

understated

overstated

correct

Question 9-19

Purchase commitments are contracts that obligate the company to purchase a specified amount

of merchandise or raw materials at specified prices on or before specified dates. These agreements

are entered into primarily to secure the acquisition of needed inventory and to protect against

increases in purchase price.

Question 9-20

Purchases made pursuant to a purchase commitment are recorded at the lower of contract price

or market price on the date the contract is executed. A loss is recognized if the market price is less

than the contract price. For purchase commitments outstanding at year-end, a loss is recognized if

the market price at year-end is less than the contract price.

The McGraw-Hill Companies, Inc., 2007

9-4

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

BRIEF EXERCISES

Brief Exercise 9-1

NRV = $30 - 4 = $26

NRV NP = $26 (30% x $30) = $17

RC = $18

The designated market is the middle value of NRV, NRV-NP, and RC, which is

$18. Since this is lower than the cost of $20, the unit value is $18.

Brief Exercise 9-2

(1)

(2)

Ceiling

NRV (*)

(3)

Floor

NRV-NP

(**)

Product

RC

$48

$64

$54

26

32

24

(4)

(5)

Cost

Per Unit

Inventory

Value

[Lower of (4)

and (5)]

$54

$50

$50

26

30

26

Designated

Market Value

[Middle value

of (1), (2) & (3)]

* Selling price less disposal costs.

** NRV less normal profit margin

Product 1 (1,000 units)

Product 2 (1,000 units)

Cost

LCM value

Cost

$50,000

30,000

$80,000

LCM

$50,000

26,000

$76,000

Before-tax income will be lower by $4,000, the amount of the required inventory

write-down.

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-5

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-3

Beginning inventory (from records)

Plus: Net purchases (from records)

Cost of goods available for sale

Less: Cost of goods sold:

Net sales

Less: Estimated gross profit of 30%

Estimated cost of goods sold

Estimated cost of inventory destroyed

$220,000

400,000

620,000

$600,000

(180,000)

(420,000)

$200,000

Brief Exercise 9-4

Beginning inventory (from records)

Plus: Net purchases (from records)

Cost of goods available for sale

Less: Cost of goods sold:

Net sales

Less: Estimated gross profit

Estimated cost of goods sold

Estimated cost of inventory lost

$150,000

450,000

600,000

$700,000

( ? )

( ? )

$ 75,000

Estimated cost of goods sold = $600,000 75,000 = $525,000*

Estimated gross profit = $700,000 525,000* = $175,000

$175,000 $700,000 = 25% gross profit ratio

The McGraw-Hill Companies, Inc., 2007

9-6

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-5

Cost

$300,000

861,000

22,000

Beginning inventory

Plus: Net purchases

Freight-in

Net markups

Less: Net markdowns

Goods available for sale

______

1,183,000

Retail

$ 450,000

1,210,000

48,000

(18,000)

1,690,000

$1,183,000

Cost-to-retail percentage:

= 70%

$1,690,000

Less: Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost (70% x $490,000)

Estimated cost of goods sold

Solutions Manual, Vol.1, Chapter 9

(1,200,000)

$ 490,000

(343,000)

$ 840,000

The McGraw-Hill Companies, Inc., 2007

9-7

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-6

Beginning inventory

Plus: Net purchases

Freight-in

Net markups

Less: Net markdowns

Goods available for sale (excluding beg. Inventory)

Goods available for sale (including beg. Inventory)

Cost

$300,000

861,000

22,000

_______

883,000

1,183,000

Retail

$450,000

1,210,000

48,000

(18,000)

1,240,000

1,690,000

$883,000

Cost-to-retail percentage:

= 71.21%

$1,240,000

Less: Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost:

Retail

Cost

Beginning inventory $ 450,000

$ 300,000

Current periods layer

40,000 x 71.21 % = 28,484

Total

$ 490,000

$328,484 (328,484)

Estimated cost of goods sold

$854,516

The McGraw-Hill Companies, Inc., 2007

9-8

(1,200,000)

$ 490,000

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-7

Cost

$300,000

861,000

22,000

Beginning inventory

Plus: Net purchases

Freight-in

Net markups

Goods available for sale

Retail

$ 450,000

1,210,000

48,000

1,708,000

$1,183,000

Cost-to-retail percentage:

= 69.26%

$1,708,000

Less: Net markdowns

______

Goods available for sale

1,183,000

Less: Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost (69.26% x $490,000) (339,374)

Estimated cost of goods sold

$ 843,626

Solutions Manual, Vol.1, Chapter 9

(18,000)

1,690,000

(1,200,000)

$ 490,000

The McGraw-Hill Companies, Inc., 2007

9-9

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-8

Cost

$220,000

640,000

17,800

Beginning inventory

Plus: Purchases

Freight-in

Plus: Net markups

Retail

$ 400,000

1,180,000

16,000

1,596,000

$877,800

Cost-to-retail percentage:

= 55%

$1,596,000

Less: Net markdowns

Goods available for sale

Less:

Normal spoilage

Net sales*

_______

877,800

Estimated ending inventory at retail

Estimated ending inventory at cost (55% x $272,000) (149,600)

Estimated cost of goods sold

$728,200

(6,000)

1,590,000

(3,000)

(1,315,000)

$272,000

*$1,300,000 + 15,000 (employee discounts) = $1,315,000

The McGraw-Hill Companies, Inc., 2007

9-10

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-9

Cost

$ 40,800

155,440

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

_______

155,440

196,240

Retail

$ 68,000

270,000

6,000

(8,000)

268,000

336,000

$40,800

Base layer cost-to-retail percentage:

= 60%

$68,000

$155,440

2006 layer cost-to-retail percentage:

= 58%

$268,000

Less: Net sales

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost (calculated below)

Estimated cost of goods sold

(250,000)

$ 86,000

(50,451)

$145,789

___________________________________________________________________________

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$86,000

$86,000

(above)

= $84,314

1.02

$68,000 (base)

16,314 (2006)

x 1.00 x 60% =

x 1.02 x 58% =

Total ending inventory at dollar-value LIFO retail cost ......................

Solutions Manual, Vol.1, Chapter 9

$40,800

9,651

$50,451

The McGraw-Hill Companies, Inc., 2007

9-11

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-10

Cost

$ 50,451

168,000

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

_______

168,000

218,451

Retail

$ 86,000

301,000

3,000

(4,000)

300,000

386,000

$155,440

2006 layer cost-to-retail percentage:

= 58%

$268,000

$168,000

2007 layer cost-to-retail percentage:

= 56%

$300,000

Less: Net sales

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost (calculated below)

Estimated cost of goods sold

(280,000)

$106,000

(59,762)

$158,689

___________________________________________________________________________

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$106,000

$106,000

(above)

= $100,000

1.06

$68,000 (base)

16,314 (2006)

15,686 (2007)

x 1.00 x 60%* =

x 1.02 x 58% =

x 1.06 x 56% =

Total ending inventory at dollar-value LIFO retail cost ......................

The McGraw-Hill Companies, Inc., 2007

9-12

$40,800

9,651

9,311

$59,762

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

*$40,800 $68,000 = 60%

Brief Exercise 9-11

Hopyard applies the FIFO cost method retrospectively; that is, to all prior periods

as if it always had used that method. In other words, all financial statement amounts

for individual periods that are included for comparison with the current financial

statements are revised for period-specific effects of the change.

Then, the cumulative effects of the new method on periods prior to those

presented are reflected in the reported balances of the assets and liabilities affected as

of the beginning of the first period reported and a corresponding adjustment is made

to the opening balance of retained earnings for that period.

The effect of the change on each line item affected should be disclosed for each

period reported as well as any adjustment for periods prior to those reported. Also, the

nature of and justification for the change should be described in the disclosure notes.

2006 cost of goods sold is $7,000 higher than it would have been if Hopyard had

not switched to FIFO. This is because beginning inventory is $18,000 higher

($145,000 127,000) and ending inventory is $11,000 higher ($162,000 151,000).

An increase in beginning inventory causes an increase in cost of goods sold, but an

increase in ending inventory causes a decrease in cost of goods sold. Purchases for

2006 are the same regardless of the inventory valuation method used.

Brief Exercise 9-12

When a company changes to the LIFO inventory method from any other method,

it usually is impossible to calculate the income effect on prior years. To do so would

require assumptions as to when specific LIFO inventory layers were created in years

prior to the change. As a result, a company changing to LIFO usually does not report

the change retrospectively. Instead, the LIFO method simply is used from that point

on. The base year inventory for all future LIFO determinations is the beginning

inventory in the year the LIFO method is adopted, $150,000 in this case.

A disclosure note is needed to explain (a) the nature of and justification for the

change, (b) the effect of the change on current year's income and earnings per share,

and (c) why retrospective application was impracticable.

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-13

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-13

The 2004 error caused 2004 net income to be overstated, but since 2004 ending

inventory is 2005 beginning inventory, 2005 net income was understated the same

amount. So, the income statement was misstated for 2004 and 2005, but the balance

sheet (retained earnings) was incorrect only for 2004. After that, no account balances

are incorrect due to the 2004 error.

Analysis:

2004

Beginning inventory

Plus: net purchases

Less: ending inventory

Cost of goods sold

Revenues

Less: cost of goods sold

Less: other expenses

Net income

Retained earnings

The McGraw-Hill Companies, Inc., 2007

9-14

U = Understated

O = Overstated

O

U

U

O

O

2005

Beginning inventory

Plus: net purchases

Less: ending inventory

Cost of goods sold

O

O

Revenues

Less: cost of goods sold

Less: other expenses

Net income

Retained earnings

O

U

corrected

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Brief Exercise 9-13 (concluded)

However, the 2005 error has not yet self-corrected. Both retained earnings and

inventory still are overstated as a result of the second error.

Analysis:

2005

Beginning inventory

Plus: net purchases

Less: ending inventory

Cost of goods sold

Revenues

Less: cost of goods sold

Less: other expenses

Net income

Retained earnings

U = Understated

O = Overstated

O

U

U

O

O

Retained earnings on January 1, 2006, in this case, would be overstated by

$500,000 (ignoring income taxes).

Brief Exercise 9-14

The financial statements that were incorrect as a result of both errors (effect of

one error in 2004 and effect of two errors in 2005) would be retrospectively restated

to report the correct inventory amounts, cost of goods sold, income, and retained

earnings when those statements are reported again for comparative purposes in the

current annual report. A prior period adjustment to retained earnings would be

reported, and a disclosure note should describe the nature of the error and the impact

of its correction on each years net income, income before extraordinary items, and

earnings per share.

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-15

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

EXERCISES

Exercise 9-1

(1)

(2)

Ceiling

(3)

Floor

(4)

(5)

Cost

Per Unit

Inventory

Value

[Lower of (4)

and (5)]

$29

$20

$20

50

80

90

80

48

48

50

48

NRV-NP

(**)

Product

RC

NRV (*)

$18

$ 34

$29

85

80

40

60

Designated

Market Value

[Middle value

of (1), (2) & (3)]

* Selling price less disposal costs.

** NRV less normal profit margin

The McGraw-Hill Companies, Inc., 2007

9-16

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-2

Requirement 1

(1)

(2)

Ceiling

(3)

Floor

(4)

(5)

NRV-NP

Designated

(NP=

Market Value

25%

[Middle value

of cost) of (1), (2) & (3)]

Cost

Inventory

Value

[Lower of

(4) and (5)]

$100,000

$120,000

$100,000

87,500

87,500

90,000

87,500

50,000

35,000

40,000

60,000

40,000

50,000

42,500

42,500

Totals

30,000

$300,000

30,000

$257,500

Product

RC

NRV

101

$110,000

$100,000

$70,000

102

85,000

110,000

103

40,000

104

28,000

The inventory value is $257,500.

Requirement 2

Loss from write-down of inventory: $300,000 - 257,500 = $42,500

Exercise 9-3

Beginning inventory (from records)

Plus: Net purchases (from records)

Cost of goods available for sale

Less: Cost of goods sold:

Net sales

Less: Estimated gross profit of 25%

Estimated cost of goods sold

Estimated cost of inventory destroyed

Solutions Manual, Vol.1, Chapter 9

$140,000

370,000

510,000

$550,000

(137,500)

(412,500)

$ 97,500

The McGraw-Hill Companies, Inc., 2007

9-17

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-4

Beginning inventory (from records)

Plus: Net purchases (from records)

Cost of goods available for sale

Less: Cost of goods sold:

Net sales

Less: Estimated gross profit of 35%

Estimated cost of goods sold

Estimated ending inventory

Less: Value of usable damaged goods

Estimated loss from fire

$100,000

140,000

240,000

$220,000

(77,000)

(143,000)

97,000

(12,000)

$ 85,000

Exercise 9-5

Merchandise inventory, January 1, 2006

Purchases

Freight-in

Cost of goods available for sale

Less: Cost of goods sold:

Sales

Less: Estimated gross profit of 20%

Estimated loss from fire

The McGraw-Hill Companies, Inc., 2007

9-18

$1,900,000

5,800,000

400,000

8,100,000

$8,200,000

(1,640,000)

(6,560,000)

$1,540,000

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-6

Beginning inventory + Net purchases - Ending inventory = Cost of goods sold

$27,000 + 31,000 - 28,000 = $30,000 = Cost of goods sold

Cost of goods sold

Cost percentage =

Net sales

$30,000

Cost percentage =

= 60%

$50,000

Exercise 9-7

Cost

$35,000

19,120

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale

______

54,120

Retail

$50,000

31,600

1,200

(800)

82,000

$54,120

Cost-to-retail percentage:

= 66%

$82,000

Less: Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost (66% x $50,000)

Estimated cost of goods sold

Solutions Manual, Vol.1, Chapter 9

(32,000)

$50,000

(33,000)

$21,120

The McGraw-Hill Companies, Inc., 2007

9-19

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-8

Cost

$190,000

600,000

8,000

Beginning inventory

Plus: Purchases

Freight-in

Net markups

Retail

$ 280,000

840,000

20,000

1,140,000

$798,000

Cost-to-retail percentage:

= 70%

$1,140,000

Less: Net markdowns

Goods available for sale

Less: Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost (70% x $336,000)

The McGraw-Hill Companies, Inc., 2007

9-20

_______

798,000

(4,000)

1,136,000

(800,000)

$ 336,000

$235,200

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-9

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale (excluding beg. Inventory)

Goods available for sale (including beg. Inventory)

Cost

$160,000

607,760

_______

607,760

767,760

Retail

$ 280,000

840,000

20,000

(4,000)

856,000

1,136,000

$607,760

Cost-to-retail percentage:

= 71%

$856,000

Less: Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost:

Retail

Cost

Beginning inventory

$280,000

$160,000

Current periods layer

56,000 x 71% = 39,760

Total

$336,000

$199,760

Estimated cost of goods sold

Solutions Manual, Vol.1, Chapter 9

(800,000)

$ 336,000

(199,760)

$568,000

The McGraw-Hill Companies, Inc., 2007

9-21

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-10

Cost

$ 12,000

102,600

3,480

(4,000)

Beginning inventory

Plus: Purchases

Freight-in

Less: Purchase returns

Plus: Net markups

Retail

$ 20,000

165,000

(7,000)

6,000

184,000

$114,080

Cost-to-retail percentage:

= 62%

$184,000

Less: Net markdowns

Goods available for sale

Less:

Normal spoilage

Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost (62% x $24,800)

Estimated cost of goods sold

The McGraw-Hill Companies, Inc., 2007

9-22

_______

114,080

(3,000)

181,000

(4,200)

(152,000)

$ 24,800

(15,376)

$ 98,704

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-11

Requirement 1

Cost

$ 40,000

207,000

14,488

(4,000)

Beginning inventory

Plus: Purchases

Freight-in

Less: Purchase returns

Plus: Net markups

Retail

$ 60,000

400,000

(6,000)

5,800

459,800

$257,488

Cost-to-retail percentage:

= 56%

$459,800

Less: Net markdowns

_______

Goods available for sale

257,488

Less:

Normal breakage

Sales:

Net sales

$280,000

Add back employee discounts

1,800

Estimated ending inventory at retail

Estimated ending inventory at cost (56% x $168,500)

(94,360)

Estimated cost of goods sold

$163,128

(3,500)

456,300

(6,000)

(281,800)

$168,500

Requirement 2

Net markdowns are included in the cost-to-retail percentage:

$257,488

Cost-to-retail percentage:

= 56.43%

$456,300

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-23

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-12

Net purchases:

Using LIFO, the beginning inventory is excluded from the calculation of the cost-toretail percentage:

Cost of goods available (excluding beg. inventory)

Cost-to-retail percentage =

Goods available at retail (excluding beg. inventory)

$10,500

50% =

, and x = $21,000.

x

Net purchases at retail equals $21,000 less markups plus markdowns.

Net purchases = $21,000 - 4,000 + 1,000 = $18,000

Net sales:

The cost-to-retail percentage can be calculated as follows:

Cost

Retail

$21,000.00 $ 35,000

10,500.00 18,000

4,000

_________

(1,000)

31,500.00 56,000

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale

$31,500

Cost-to-retail percentage:

= 56.25%

$56,000

Less: Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost (56.25% x ?) =

?

?

$17,437.50

Estimated ending inventory at retail is:

$17,437.50

= $31,000

.5625

The McGraw-Hill Companies, Inc., 2007

9-24

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Net sales = $56,000 - 31,000 = $25,000

Exercise 9-13

1.

2.

3.

4.

b

c

d

c

Exercise 9-14

Cost

$ 71,280

112,500

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

_______

112,500

183,780

Retail

$132,000

255,000

6,000

(11,000)

250,000

382,000

$71,280

Base year cost-to-retail percentage:

= 54%

$132,000

$112,500

2006 cost-to-retail percentage:

= 45%

$250,000

Less: Net sales

Estimated ending inventory at current year retail prices

(232,000)

$150,000

Estimated ending inventory at cost (below)

(77,004)

Estimated cost of goods sold

$106,776

___________________________________________________________________________

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$150,000

$150,000

(above)

= $144,231

1.04

$132,000 (base)

12,231 (2006)

x 1.00 x 54% =

x 1.04 x 45% =

Total ending inventory at dollar-value LIFO retail cost ......................

Solutions Manual, Vol.1, Chapter 9

$71,280

5,724

$77,004

The McGraw-Hill Companies, Inc., 2007

9-25

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-15

Requirement 1

$15,000

Cost-to-retail percentage =

= 80%

$18,750

Requirement 2

2006

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$25,000

$25,000

(given)

= $20,000

1.25

$18,750 (base) x 1.00 x 80% =

1,250 (2006) x 1.25 x 82% =

Total ending inventory at dollar-value LIFO retail cost .............

$15,000

1,281

$16,281

2007

$28,600

$28,600

(given)

= $22,000

1.30

$18,750 (base) x 1.00 x 80% =

1,250 (2006) x 1.25 x 82% =

2,000 (2007) x 1.30 x 85% =

Total ending inventory at dollar-value LIFO retail cost .............

The McGraw-Hill Companies, Inc., 2007

9-26

$15,000

1,281

2,210

$18,491

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-16

Cost

$160,000

350,200

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

_______

350,200

510,200

Retail

$250,000

510,000

7,000

(2,000)

515,000

765,000

$160,000

Base layer cost-to-retail percentage:

= 64%

$250,000

$350,200

2006 layer cost-to-retail percentage:

= 68%

$515,000

Less: Net sales

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost (calculated below)

Estimated cost of goods sold

(380,000)

$385,000

(234,800)

$275,400

___________________________________________________________________________

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$385,000

$385,000

(above)

= $350,000

1.10

$250,000 (base)

100,000 (2006)

x 1.00 x 64% =

x 1.10 x 68% =

Total ending inventory at dollar-value LIFO retail cost ......................

Solutions Manual, Vol.1, Chapter 9

$160,000

74,800

$234,800

The McGraw-Hill Companies, Inc., 2007

9-27

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-17

Cost-to-retail percentage, 1/1/06:

$21,000

= 75%

$28,000

Cost-to-retail percentage, 12/31/06:

$33,600

= $30,000 = Ending inventory at base year retail

1.12

$30,000 - 28,000 = $2,000 = LIFO layer added during 2006 at base year retail

$2,000 x 1.12 = $2,240 = LIFO layer added at current year retail

$22,792 - 21,000 = $1,792 = LIFO layer added at current year cost

$1,792

= 80% = Cost-to-retail percentage for the year 2006 layer

$2,240

The McGraw-Hill Companies, Inc., 2007

9-28

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-17 (concluded)

2007 ending inventory:

Cost

$22,792

60,000

$82,792

Beginning inventory

Plus: Net purchases

Goods available for sale (including beginning inventory)

Retail

$ 33,600

88,400

122,000

$60,000

Cost-to-retail percentage:

= 67.87%

$88,400

Less: Net sales

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost (below)

(80,000)

$ 42,000

$26,864

___________________________________________________________________________

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$42,000

$42,000

(above)

= $35,000

1.20

$28,000 (base)

2,000 (2006)

5,000 (2007)

x 1.00 x 75.00% =

x 1.12 x 80.00% =

x 1.20 x 67.87% =

Total ending inventory at dollar-value LIFO retail cost ..................

Solutions Manual, Vol.1, Chapter 9

$21,000

1,792

4,072

$26,864

The McGraw-Hill Companies, Inc., 2007

9-29

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-18

Requirement 1

To record the change:

Retained earnings ..........................................................

Inventory ($32 million - 23.8 million) .............................

($ in millions)

8.2

8.2

Requirement 2

CPS applies the average cost method retrospectively; that is, to all prior periods

as if it always had used that method. In other words, all financial statement amounts

for individual periods that are included for comparison with the current financial

statements are revised for period-specific effects of the change.

Then, the cumulative effects of the new method on periods prior to those

presented are reflected in the reported balances of the assets and liabilities affected as

of the beginning of the first period reported and a corresponding adjustment is made

to the opening balance of retained earnings for that period. Lets say CPS reports

2006-2004 comparative statements of shareholders equity. The $8.2 million

adjustment above is due to differences prior to the 2006 change. The portion of that

amount due to differences prior to 2004 is subtracted from the opening balance of

retained earnings for 2004.

The effect of the change on each line item affected should be disclosed for each

period reported as well as any adjustment for periods prior to those reported. Also, the

nature of and justification for the change should be described in the disclosure notes.

The McGraw-Hill Companies, Inc., 2007

9-30

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-19

Requirement 1

Retained earnings ................................................................

Inventory ($83,000 78,000) ...........................................

5,000

5,000

Requirement 2

Effect on cost of goods sold:

Decrease in beginning inventory ($78,000 - 71,000)

- $7,000

Decrease in ending inventory ($83,000 - 78,000)

Decrease in cost of goods sold

+ 5,000

$2,000

Cost of goods sold for 2005 would be $2,000 lower in the revised income

statement.

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-31

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-20

Requirement 1

The 2004 error caused 2004 net income to be understated, but since 2004 ending

inventory is 2005 beginning inventory, 2005 net income was overstated the same

amount. So, the income statement was misstated for 2004 and 2005, but the balance

sheet (retained earnings) was incorrect only for 2004. After that, no account balances

are incorrect due to the 2004 error.

Analysis:

2004

Beginning inventory

Plus: net purchases

Less: ending inventory

Cost of goods sold

Revenues

Less: cost of goods sold

Less: other expenses

Net income

U = Understated

O = Overstated

U

O

O

U

Retained earnings

The McGraw-Hill Companies, Inc., 2007

9-32

2005

Beginning inventory

Plus: net purchases

Less: ending inventory

Cost of goods sold

U

U

Revenues

Less: cost of goods sold

Less: other expenses

Net income

U

O

Retained earnings

corrected

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-20 (concluded)

However, the 2005 error has not yet self-corrected. Both retained earnings and

inventory still are overstated as a result of the second error.

Analysis:

2005

Beginning inventory

Plus: net purchases

Less: ending inventory

Cost of goods sold

Revenues

Less: cost of goods sold

Less: other expenses

Net income

Retained earnings

U = Understated

O = Overstated

O

U

U

O

O

Requirement 2

Retained earnings (overstatement of 2005 income) ............. 150,000

Inventory (overstatement of 2006 beginning inventory) ...

150,000

Requirement 3

The financial statements that were incorrect as a result of both errors (effect of

one error in 2004 and effect of two errors in 2005) would be retrospectively restated

to report the correct inventory amounts, cost of goods sold, income, and retained

earnings when those statements are reported again for comparative purposes in the

current annual report. A prior period adjustment to retained earnings would be

reported, and a disclosure note should describe the nature of the error and the impact

of its correction on each years net income, income before extraordinary items, and

earnings per share.

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-33

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-21

U = understated

O = overstated

NE = no effect

1. Overstatement of ending inventory

2. Overstatement of purchases

3. Understatement of beginning inventory

4. Freight-in charges are understated

5. Understatement of ending inventory

6. Understatement of purchases

7. Overstatement of beginning inventory

8. Understatement of purchases +

understatement of ending inventory by

the same amount

The McGraw-Hill Companies, Inc., 2007

9-34

Cost of

Goods Sold

U

O

U

U

O

U

O

NE

Net

Income

O

U

O

O

U

O

U

NE

Retained

Earnings

O

U

O

O

U

O

U

NE

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-22

1.

To include the $4 million in year 2006 purchases and increase retained earnings

to what it would have been if 2005 cost of goods sold had not included the $4

million purchases.

Analysis:

2005

Beginning inventory

Purchases

Less: Ending inventory

Cost of goods sold

Revenues

Less: Cost of goods sold

Less: Other expenses

Net income

Retained earnings

2006

Beginning inventory

Purchases

O

O

U = Understated

O = Overstated

U

U

($ in millions)

Purchases ........................................................

Retained earnings ........................................

4

4

2.

The 2005 financial statements that were incorrect as a result of the errors would

be retrospectively restated to reflect the correct cost of goods sold, (income tax

expense if taxes are considered), net income, and retained earnings when those

statements are reported again for comparative purposes in the 2006 annual report.

3.

A prior period adjustment to retained earnings would be reported, and a

disclosure note should describe the nature of the error and the impact of its

correction on each years net income, income before extraordinary items, and

earnings per share.

Exercise 9-23

1.

2.

a

c

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-35

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-24

List A

e

1. Gross profit ratio

2.

3.

4.

k

b

5.

6.

7.

8.

9.

c 10.

f 11.

g 12.

h 13.

m 14.

List B

a. Reduction in selling price below the original selling

price.

Cost-to-retail percentage

b. Beginning inventory is not included in the calculation

of the cost-to-retail percentage.

Additional markup

c. Deducted in the retail column after the calculation of

the cost-to-retail percentage.

Markdown

d. Requires base year retail to be converted to layer year

retail and then to cost.

Net markup

e. Gross profit divided by net sales.

Retail method, FIFO & LIFO f. Material inventory error discovered in a subsequent

year.

Conventional retail method g. Must be added to sales if sales are recorded net of

discounts.

Change from LIFO

h. Deducted in the retail column to arrive at goods

available for sale at retail.

Dollar-value LIFO retail

i. Divide cost of goods available for sale by goods

available at retail.

Normal spoilage

j. Average cost, LCM.

Requires retrospective

k. Added to the retail column to arrive at goods

restatement

available for sale.

Employee discounts

l. Increase in selling price subsequent to initial markup.

Net markdowns

m. Ceiling in the determination of market.

Net realizable value

n. Accounting change requiring retrospective treatment.

The McGraw-Hill Companies, Inc., 2007

9-36

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-25

1. d. The failure to record a sale means that both accounts receivable and sales will

be understated. However, inventory was correctly counted, so that account and

cost of goods sold were unaffected.

2. d. The overstatement (double counting) of inventory at the end of year 1 caused

year 1 cost of goods sold (BI + Purchases EI) to be understated and both

inventory and income to be overstated. The year 1 ending inventory equals

year 2 beginning inventory. Thus, the same overstatement caused year 2

beginning inventory and cost of goods sold to be overstated and income to be

understated. This is an example of a self-correcting error. By the end of year 2,

the balance sheet is correct.

3. b. The conventional retail inventory method adds beginning inventory, net

purchases, and markups (but not markdowns) to calculate a cost percentage.

The purpose of excluding markdowns is to approximate a lower-of-averagecost-or-market valuation. The cost percentage is then used to reduce the retail

value of the ending inventory to cost. FCLs cost-retail ratio is 40% ($90,000 /

$225,000), and ending inventory at cost is therefore $20,000 (40% x $50,000

ending inventory at retail).

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-37

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-26

Requirement 1

If market price at year-end is less than contract price for outstanding purchase

commitments, a loss is recorded for the difference.

December 31, 2006

Estimated loss on purchase commitment ($60,000 - 56,000) ....

Estimated liability on purchase commitment ..................

4,000

4,000

Requirement 2

If market price on purchase date declines from year-end price, the purchase is

recorded at market price.

March 21, 2007

Inventory............................................................................

Loss on purchase commitment ($56,000 - 54,000) .................

Estimated liability on purchase commitment ......................

Cash ..............................................................................

The McGraw-Hill Companies, Inc., 2007

9-38

54,000

2,000

4,000

60,000

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Exercise 9-27

If market price is less than the contract price, the purchase is recorded at the

market price.

June 15, 2006

Purchases (market price) .......................................................

Loss on purchase commitment (difference) ...........................

Cash ...............................................................................

85,000

15,000

100,000

If market price at year-end is less than contract price for outstanding purchase

commitments, a loss is recorded for the difference.

June 30, 2006

Estimated loss on purchase commitment ($150,000 - 140,000) .

Estimated liability on purchase commitment ..................

10,000

10,000

If market price on purchase date declines from year-end price, the purchase is

recorded at market price.

August 20, 2006

Purchases (market price)........................................................ 120,000

Loss on purchase commitment ($140,000 - 120,000) .............. 20,000

Estimated liability on purchase commitment ...................... 10,000

Cash ..............................................................................

150,000

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-39

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

PROBLEMS

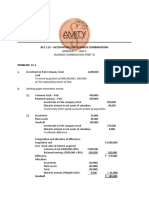

Problem 9-1

Requirement 1

Product

A

B

C

D

E

NRV per unit

$16 - (15% x $16) = $13.60

$18 - (15% x $18) = $15.30

$ 8 - (15% x $8) = $ 6.80

$ 6 - (15% x $6) = $ 5.10

$13 - (15% x $13) = $11.05

(1)

(2)

(3)

Ceiling

Floor

NRV-NP per unit

$13.60 - (40% x $16) = $7.20

$15.30 - (40% x $18) = $8.10

$ 6.80 - (40% x $ 8) = $3.60

$ 5.10 - (40% x $ 6) = $2.70

$11.05 - (40% x $13) = $5.85

(4)

Designated

Market Value

[Middle value

NRV-NP of (1), (2) & (3)]

(5)

Cost

Inventory

Value

[Lower of

(4) and (5)]

$12,000

$10,000

$10,000

6,480

8,800

12,000

8,800

4,080

2,160

2,160

1,800

1,800

800

1,020

540

800

1,400

800

7,200

6,630

3,510

6,630

8,400

6,630

$30,390

$33,600

$28,030

Product

(units)

RC

NRV

A (1,000)

$12,000

$13,600

$7,200

B (800)

8,800

12,240

C (600)

1,200

D (200)

E (600)

Totals

Inventory carrying value would be $28,030.

Requirement 2

Inventory carrying value would be $30,390, the lower of aggregate inventory cost

($33,600) and aggregate inventory market ($30,390). The amount of the loss from

inventory write-down is $3,210 ($33,600 - 30,390).

The McGraw-Hill Companies, Inc., 2007

9-40

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-2

Requirement 1

Product

Tools:

Hammers

Saws

Screwdrivers

Total tools

Paint products:

1-gallon cans

Paint brushes

Total paint

Total

Cost

$

Designated

Market

Value

Lower-of-cost-or-market

(a)

(b)

(c)

By

By

Individual

Product

By Total

Products

Type

Inventory

500

$ 550

500

2,000

1,800

1,800

600

$3,100

780

$3,130

600

$3,000

$2,500

2,500

400

$3,400

450

$2,950

400

$6,500

$6,080

$5,800

$3,100

2,950

$6,050

$6,080

Requirement 2

(a) Individual products

$6,500 - 5,800 = $700

(b) Product type

$6,500 - 6,050 = $450

(c) Total inventory

$6,500 - 6,080 = $420

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-41

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-3

Requirement 1

Fruit

Toppings

Estimate of cost of goods sold:

Cost percentage

x Net sales

Marshmallow

Toppings

Chocolate

Topping

80%

$200,000

$160,000

70%

$55,000

$38,500

65%

$20,000

$13,000

$ 20,000

150,000

170,000

$ 7,000

36,000

43,000

$ 3,000

12,000

15,000

Less: Estimate of cost of goods sold

160,000

38,500

13,000

Estimate of cost of inventory lost

$ 10,000

$ 4,500

$ 2,000

Beginning inventory

Plus: Net purchases

Cost of goods available for sale

Requirement 2

The two main factors that could cause the estimates of the inventory lost to be

over or understated are:

1. The historical cost percentages used may not be representative of the current

relationship between cost and selling price.

2. Theft or spoilage losses may not be appropriately considered in the cost

percentage.

The McGraw-Hill Companies, Inc., 2007

9-42

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-4

1. Average cost

Cost

$ 90,000

355,000

9,000

(7,000)

Beginning inventory

Plus: Purchases

Freight-in

Less: Purchase returns

Plus: Net markups

Less: Net markdowns

Abnormal spoilage

Goods available for sale

(4,800)

442,200

Retail

$180,000

580,000

(11,000)

16,000

(12,000)

(8,000)

745,000

$442,200

Cost-to-retail percentage:

= 59.36%

$745,000

Less:

Normal spoilage

Sales:

Net sales ($540,000 - 10,000)

$530,000

Add back employee discounts

4,000

Estimated ending inventory at retail

Estimated ending inventory at cost (59.36% x $208,000)

Estimated cost of goods sold

Solutions Manual, Vol.1, Chapter 9

(3,000)

(534,000)

$208,000

(123,469)

$318,731

The McGraw-Hill Companies, Inc., 2007

9-43

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-4 (concluded)

2. Conventional (average, LCM)

Cost

$ 90,000

355,000

9,000

(7,000)

Beginning inventory

Plus: Purchases

Freight-in

Less: Purchase returns

Plus: Net markups

Less: Abnormal spoilage

(4,800)

Retail

$180,000

580,000

(11,000)

16,000

(8,000)

757,000

$442,200

Cost-to-retail percentage:

= 58.41%

$757,000

Less: Net markdowns

Goods available for sale

Less:

Normal spoilage

Sales:

Net sales ($540,000 - 10,000)

$530,000

Add back employee discounts

4,000

Estimated ending inventory at retail

Estimated ending inventory at cost (58.41% x $208,000)

Estimated cost of goods sold

The McGraw-Hill Companies, Inc., 2007

9-44

_______

442,200

(12,000)

745,000

(3,000)

(534,000)

$208,000

(121,493)

$320,707

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-5

Requirement 1

Sales to employees must be deducted in the retail column at their gross amount:

$250,000

= $312,500*

.80

Cost

$ 100,000

1,387,500

10,000

Beginning inventory

Plus: Purchases

Freight-in

Plus: Net markups

Retail

$ 150,000

2,000,000

300,000

2,450,000

$1,497,500

Cost-to-retail percentage:

= 61.12%

$2,450,000

Less: Net markdowns

Goods available for sale

Less:

Normal shrinkage

Sales:

Sales to customers

Sales to employees

Estimated ending inventory at retail

Estimated ending inventory at cost

(61.12% x $222,500)

Estimated cost of goods sold

Solutions Manual, Vol.1, Chapter 9

________

1,497,500

(150,000)

2,300,000

(15,000)

$1,750,000

312,500*

(2,062,500)

$ 222,500

(135,992)

$1,361,508

The McGraw-Hill Companies, Inc., 2007

9-45

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-5 (concluded)

Requirement 2

Beginning inventory

Plus: Purchases

Freight-in

Plus: Net markups

Less: Net markdowns

Goods available for sale (excluding beginning

Cost

$ 100,000

1,387,500

10,000

Retail

$ 150,000

2,000,000

________

1,397,500

300,000

(150,000)

2,150,000

1,497,500

2,300,000

inventory)

Goods available for sale (including beginning inventory)

$1,397,500

Cost-to-retail percentage:

= 65%

$2,150,000

Less:

Normal shrinkage

Sales:

Sales to customers

$1,750,000

Sales to employees

312,500

Estimated ending inventory at retail

Estimated ending inventory at cost:

Retail

Cost

Beginning inventory

$150,000

$100,000

Current periods layer

72,500 x 65% = 47,125

Total

$222,500

$147,125

Estimated cost of goods sold

The McGraw-Hill Companies, Inc., 2007

9-46

(15,000)

(2,062,500)

$ 222,500

(147,125)

$1,350,375

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-6

Requirement 1

Cost

$ 20,000

100,151

5,100

(2,100)

Beginning inventory

Plus: Purchases

Freight-in

Less: Purchase returns

Plus: Net markups ($2,500 - 265)

Retail

$ 30,000

146,495

(2,800)

2,235

175,930

$123,151

Cost-to-retail percentage:

= 70%

$175,930

Less: Net markdowns

Goods available for sale

Less:

Normal spoilage

Net sales

Estimated ending inventory at retail

Estimated ending inventory at cost (70% x $34,900)

_______

$123,151

(800)

175,130

(4,500)

(135,730)

$ 34,900

$24,430

Requirement 2

The difference between the inventory estimate per retail method and the amount

per physical count may be due to:

1. Theft losses.

2. Spoilage or breakage above normal.

3. Differences in cost-to-retail percentage for purchases during the month, beginning

inventory, and ending inventory.

4. Markups on goods available for sale inconsistent between cost of goods sold and

ending inventory.

5. A wide variety of merchandise with varying cost-to-retail percentages.

6. Incorrect reporting of markdowns, additional markups or cancellations.

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-47

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-7

Cost

$ 80

671

30

(1)

($ in 000s)

Beginning inventory

Purchases

Freight-in on purchases

Purchase returns

Net markups

Net markdowns

Goods available for sale

___

$780

Cost-to-retail percentages:

Average cost ratio:

$780 $1,125 =

Average (LCM) cost ratio: $780 ($1,125 + $8) =

Deduct: Net sales

Ending inventory:

At retail (sales price)

At Average cost

At Average (LCM)

Retail

$ 125

1,006

(2)

4

(8)

1,125

.6933

.6884

(916)

$ 209

($209 x .6933)

($209 x .6884)

$144.90

$143.88

Note that lower of cost or market is approximated by excluding net markdowns.

The McGraw-Hill Companies, Inc., 2007

9-48

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-8

($ in 000s)

Cost

$80

671

30

Beginning inventory

Plus: Net purchases

Freight-in

Net markups

Less: Purchase returns

Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

(1)

___

700

780

Retail

$125

1,006

4

(2)

(8)

1,000

1,125

$80

Base layer cost-to-retail percentage:

= 64%

$125

$700

2006 layer cost-to-retail percentage:

= 70%

$1,000

Less: Net sales

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost (calculated below)

Estimated cost of goods sold

(916)

$209

(130)

$650

___________________________________________________________________________

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$209

$209

(above)

= $190

1.10

$125 (base)

65 (2006)

x 1.00 x 64% =

x 1.10 x 70% =

Total ending inventory at dollar-value LIFO retail cost ......................

Solutions Manual, Vol.1, Chapter 9

$ 80

50

$130

The McGraw-Hill Companies, Inc., 2007

9-49

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

The McGraw-Hill Companies, Inc., 2007

9-50

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-9

Sales to employees must be deducted in the retail column at their gross amount.

2006:

$2,400

= $3,000 = Gross sales to employees

.80

Beginning inventory

Plus: Net purchases

Freight-in

Net markups

Less: Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

Cost

$28,000

85,000

2,000

______

87,000

115,000

Retail

$ 40,000

108,000

10,000

(2,000)

116,000

156,000

$ 87,000

Cost-to-retail percentage:

= 75%

$116,000

Less: Net sales ($100,000 + 3,000)

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost (below)

Estimated cost of goods sold

(103,000)

$ 53,000

(35,950)

$79,050

___________________________________________________________________________

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$53,000

$53,000

(above)

= $50,000

1.06

$40,000 (base)

10,000 (2006)

x 1.00 x 70%

x 1.06 x 75%

Total ending inventory at dollar-value LIFO retail cost ............

Solutions Manual, Vol.1, Chapter 9

=

=

$28,000

7,950

$35,950

The McGraw-Hill Companies, Inc., 2007

9-51

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-9 (concluded)

2007:

$4,000

= $5,000 = Gross sales to employees

.80

Beginning inventory

Plus: Net purchases

Freight-in

Net markups

Less: Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

Cost

$35,950

90,000

2,500

______

92,500

128,450

Retail

$ 53,000

114,000

8,000

(2,200)

119,800

172,800

$ 92,500

Cost-to-retail percentage:

= 77.21%

$119,800

Less: Net sales ($104,000 + 5,000)

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost (below)

Estimated cost of goods sold

(109,000)

$ 63,800

(42,744)

$85,706

___________________________________________________________________________

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$63,800

$63,800

(above)

= $58,000

1.10

$40,000 (base)

10,000 (2006)

8,000 (2007)

x 1.00 x 70%

=

x 1.06 x 75%

=

x 1.10 x 77.21% =

Total ending inventory at dollar-value LIFO retail cost ............

The McGraw-Hill Companies, Inc., 2007

9-52

$28,000

7,950

6,794

$42,744

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-10

Requirement 1

Cost

$ 27,500

282,000

26,500

(6,500)

(5,000)

Beginning inventory

Plus: Purchases

Freight-in

Less: Purchase returns

Purchase discounts

Plus: Net markups

Retail

$ 45,000

490,000

(10,000)

25,000

550,000

$324,500

Cost-to-retail percentage:

= 59%

$550,000

Less: Net markdowns

Goods available for sale

Less:

Gross sales

$492,000

Less: Returns

(5,000)

Plus: Employee discounts

3,000

Estimated ending inventory at retail

Estimated ending inventory at cost (59% x $50,000)

Solutions Manual, Vol.1, Chapter 9

_______

$324,500

(10,000)

540,000

(490,000)

$ 50,000

$ 29,500

The McGraw-Hill Companies, Inc., 2007

9-53

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-10 (continued)

Requirement 2

Beginning inventory

Plus: Purchases

Freight-in

Less: Purchase returns

Purchase discounts

Plus: Net markups

Less: Net markdowns

Goods available for sale (excluding beg. inventory)

Goods available for sale (including beg. inventory)

Cost

$ 27,500

282,000

26,500

(6,500)

(5,000)

_______

297,000

$324,500

Retail

$ 45,000

490,000

(10,000)

25,000

(10,000)

495,000

540,000

$297,000

Cost-to-retail percentage:

= 60%

$495,000

Less:

Gross sales

$492,000

Less: Returns

(5,000)

Plus: Employee discounts

3,000

Estimated ending inventory at retail

Estimated ending inventory at cost:

Retail

Cost

Beginning inventory

$45,000

$27,500

Current periods layer

5,000 x 60% = 3,000

Total

$50,000

$30,500

The McGraw-Hill Companies, Inc., 2007

9-54

(490,000)

$ 50,000

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-10 (concluded)

Requirement 3

2005

Ending

Inventory

at Year-end

Retail Prices

Step 1

Ending

Inventory

at Base Year

Retail Prices

Step 2

Inventory

Layers

at Base Year

Retail Prices

Step 3

Inventory

Layers

Converted to

Cost

$56,100

$56,100

= $55,000

1.02

$50,000 (base)

5,000 (2005)

x 1.00 x 61%* = $30,500

x 1.02 x 62% = 3,162

Total ending inventory at dollar-value LIFO retail cost ..............

$33,662

* $30,500

= 61%

$50,000

2006

$48,300

$48,300

= $46,000

$46,000 (base)

x 1.00 x 61% = $28,060

1.05

Total ending inventory at dollar-value LIFO retail cost ............... $28,060

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-55

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-11

Requirement 1

Retained earnings ................................................................

Inventory ($150,000 130,000) .......................................

20,000

20,000

Requirement 2

FIFO method cost of goods sold:

Cost of goods available for sale

Less ending inventory:

5,000 units @ $40

2,000 units @ $36

$530,000

$200,000

72,000

Cost of goods sold

(272,000)

$258,000

Average cost method cost of goods sold:

Beginning inventory (5,000 units)

Purchases:

5,000 units @ $36

5,000 units @ $40

$130,000

$180,000

200,000

Cost of goods available for sale (15,000 units)

Less ending inventory (below)

Cost of goods sold

380,000

510,000

(238,000)

$272,000

Cost of ending inventory:

$510,000

Weighted average unit cost =

= $34

15,000 units

7,000 units x $34 = $238,000

The effect of the change for the year 2006 is a $14,000 increase in cost of goods

sold ($272,000 - 258,000) resulting in a $14,000 decrease in income before tax and a

$8,400 decrease in income after tax [$14,000 x (1 - .40)].

The McGraw-Hill Companies, Inc., 2007

9-56

Intermediate Accounting,4/e

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Solutions Manual, Vol.1, Chapter 9

The McGraw-Hill Companies, Inc., 2007

9-57

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Problem 9-12

Requirement 1

Analysis:

2004

Beginning inventory

Plus: Net purchases

Less: Ending inventory

Cost of goods sold

Revenues

Less: Cost of goods sold

Less: Other expenses

Net income

U-6,000

O-6,000

U-6,000

U-3,000

O-9,000

U-18,000

U-6,000

Revenues

Less: Cost of goods sold U-18,000

Less: Other expenses

Net income

O-18,000

U-6,000

Retained earnings

O-6,000

Retained earnings

U = Understated

O = Overstated

2005

Beginning inventory

Plus: Net purchases

Less: Ending inventory

Cost of goods sold

O-12,000

Requirement 2

Retained earnings ..........................................................

Inventory ...................................................................

Purchases ..................................................................

12,000

9,000

3,000

Requirement 3

The financial statements that were incorrect as a result of both errors (effect of

one error in 2004 and effect of three errors in 2005) would be retrospectively restated

to report the correct inventory amounts, cost of goods sold, income, and retained

earnings when those statements are reported again for comparative purposes in the

2006 annual report. A prior period adjustment to retained earnings would be

reported, and a disclosure note should describe the nature of the error and the impact

of its correction on each years net income, income before extraordinary items, and

earnings per share.

The McGraw-Hill Companies, Inc., 2007

9-58

Intermediate Accounting,4/e