Professional Documents

Culture Documents

ACC 305 Week 2 Ex. E4 19 Wainwright Corporation

Uploaded by

Aarti JOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 305 Week 2 Ex. E4 19 Wainwright Corporation

Uploaded by

Aarti JCopyright:

Available Formats

E4-19 - Wainwright Corporation - ACC305 Intermediate Accounting I Ashford

University

Required:

1.Analyze each transaction and classify each as a financing, investing and/or

operating activity (a transaction can represent more than one type of activity). In

doing so, also indicate the cash effect of each, if any. If there is no cash effect,

simply place a check mark () in the appropriate column(s).

2.Prepare a statement of cash flows, using the direct method to present cash flows

from operating activities. Assume the cash balance at the beginning of the month

was $40,000.

Exercise 4-19

Requirement 1

1.

2.

3.

4.

5.

6.

7.

8.

9.

Financing

$300,000

Investing

Operating

$(10,000)

$ (5,000)

(6,000)

(70,000)

55,000

__________

__________

__________

$300,000

$(10,000)

$(26,000)

$264,000

Requirement 2

Wainwright Corporation

Statement of Cash Flows

For the Month Ended March 31, 2011

Cash flows from operating activities:

Collections from customers

$ 55,000

Payment of rent

(5,000)

Payment of one-year insurance premium

(6,000)

Payment to suppliers of merchandise for sale (70,000)

Net cash flows from operating activities

$ (26,000)

Cash flows from investing activities:

Purchase of equipment

(10,000)

Net cash flows from investing activities

(10,000)

Cash flows from financing activities:

Issuance of common stock

Net cash flows from financing activities

Net increase in cash

Cash and cash equivalents, March 1

Cash and cash equivalents, March 31

300,000

300,000

264,000

40,000

$ 304,000

Noncash investing and financing activities:

Acquired $40,000 of equipment by paying cash and issuing a note as follows:

Cost of equipment

$40,000

Cash paid

Note issued

10,000

$30,000

You might also like

- American Finance Association, Wiley The Journal of FinanceDocument8 pagesAmerican Finance Association, Wiley The Journal of FinanceAarti JNo ratings yet

- Accounting Homework Help IliskimeDocument1 pageAccounting Homework Help IliskimeAarti JNo ratings yet

- Hi5019 Individual Assignment t1 2019 Qyuykqw5Document5 pagesHi5019 Individual Assignment t1 2019 Qyuykqw5Aarti J50% (2)

- Saudi Vision2030Document85 pagesSaudi Vision2030ryx11No ratings yet

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Document32 pagesChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNo ratings yet

- CR 1845Document90 pagesCR 1845Aarti JNo ratings yet

- Mgt201 Solved Subjective Questions Vuzs TeamDocument12 pagesMgt201 Solved Subjective Questions Vuzs TeamAarti JNo ratings yet

- CostingDocument3 pagesCostingAarti JNo ratings yet

- NCK - Annual Report 2017 PDFDocument56 pagesNCK - Annual Report 2017 PDFAarti JNo ratings yet

- 1 - Sis40215 CPT Case Studies 3Document61 pages1 - Sis40215 CPT Case Studies 3Aarti J0% (2)

- 6 Capital Market Intermediaries and Their RegulationDocument8 pages6 Capital Market Intermediaries and Their RegulationTushar PatilNo ratings yet

- TFTH C 636639530213947535 31700 2Document55 pagesTFTH C 636639530213947535 31700 2Aarti JNo ratings yet

- Caltex Australia CTX 2017 Annual ReportDocument127 pagesCaltex Australia CTX 2017 Annual ReportAarti JNo ratings yet

- CH 07 SMDocument11 pagesCH 07 SMAarti JNo ratings yet

- Deegan Chapter 10Document18 pagesDeegan Chapter 10Aarti JNo ratings yet

- 2 Case - 2Document10 pages2 Case - 2Aarti JNo ratings yet

- Investment Decision MethodDocument44 pagesInvestment Decision MethodashwathNo ratings yet

- Ch03 Prob3-6ADocument9 pagesCh03 Prob3-6AAarti J100% (1)

- Mergers Don't Always Lead To Culture Clashes.Document3 pagesMergers Don't Always Lead To Culture Clashes.Lahiyru100% (3)

- Accounting Changes and Errors: HapterDocument46 pagesAccounting Changes and Errors: HapterAarti JNo ratings yet

- Philanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Document2 pagesPhilanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Aarti JNo ratings yet

- Organizational CultureDocument21 pagesOrganizational CultureAarti JNo ratings yet

- Coles Year in Review 2017Document28 pagesColes Year in Review 2017Aarti JNo ratings yet

- Case Study Ch03Document3 pagesCase Study Ch03Munya Chawana0% (1)

- 2010 06 13 - 091545 - Case13 30Document6 pages2010 06 13 - 091545 - Case13 30Sheila Mae Llamada Saycon IINo ratings yet

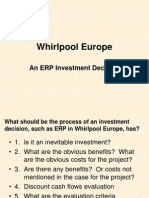

- Whirlpool EuropeDocument19 pagesWhirlpool Europejoelgzm0% (1)

- Relevant Cost Examples EMBA-garrison Ch.13Document13 pagesRelevant Cost Examples EMBA-garrison Ch.13Aarti JNo ratings yet

- The Whirlpool Europe Case: Investment On ERPDocument8 pagesThe Whirlpool Europe Case: Investment On ERPAarti JNo ratings yet

- MCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Document139 pagesMCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Aarti J100% (1)

- ACCG315Document4 pagesACCG315Joannah Blue0% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)