Professional Documents

Culture Documents

SGV Cup Accounting

Uploaded by

MCDABCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SGV Cup Accounting

Uploaded by

MCDABCCopyright:

Available Formats

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

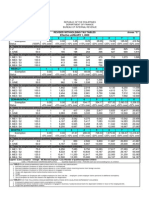

SGV CUP 1

TOPICS: THEORY OF ACCOUNTS & PRACTICAL ACCOUNTING 1

EASY

1. Any gain on a subsequent increase in the fair value less cost to sell of a noncurrent asset classified as

held for sale should be treated as follows:

A. The gain should be recognized in full.

B. The gain should not be recognized.

C. The gain should be recognized but not in excess of the cumulative impairment loss.

D. The gain should be recognized but only in retained earnings.

Answer: C

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations paragraph 21 states that

An entity shall recognize a gain for any subsequent increase in fair value less costs to sell of an

asset, but not in excess of the cumulative impairment loss that has been recognised either in

accordance with this IFRS or previously in accordance with IAS 36 Impairment of Assets.

2. The following are included in inventories, except

A. Assets held for sale in the ordinary course of business

B. Assets in the process of production for such sale

C. Assets in the form of materials or supplies to be consumed in the production process or in the

rendering of services

D. Assets in the form of office store supplies

Answer: D

IAS 2 Inventories paragraph 6 explicitly defines inventories as assets:

a) held for sale in the ordinary course of business;

b) in the process of production for such sale; or

c) in the form of materials or supplies to be consumed in the production process or in the

rendering of services.

Assets in the form of office store supplies are not included.

3. In 2011, Brighton Co. changed from the individual item approach to the aggregate approach in

applying the lower of FIFO cost or market to inventories. The change should be reported in

Brightons financial statements as a

A.

B.

C.

D.

Change in estimate on a prospective basis.

Cumulative effect of change in accounting principle on the current year income statement.

Retrospective application to the earliest period presented if practicable.

Prior period adjustment with a separate disclosure.

Answer: C

A change in inventory method no longer receives cumulative effect treatment on the income

statement. The accounting change is given retrospective application to the earliest period

presented, if practicable.

4. Upon first-time adoption of IFRS, an entity may elect to use fair value as deemed cost for

A. Biological assets related to agricultural activity for which there is no active market.

B. Intangible assets for which there is no active market.

C. Any individual item of property, plant, and equipment.

D. Financial liabilities that are not held for trading.

Answer: C

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

The requirement is to identify the assets for which the entity may use fair value as deemed cost

upon adoption of IFRS. Answer C is correct because the entity may use fair value as deemed cost

for any individual item of property plant and equipment.

5. Under IFRS 8 Operating Segments, entity-wide disclosures include the following except:

A. Information about intersegment sales or transfer

B. Information about major customers

C. Information about geographical areas

D. Information about products and services

Answer: A

IFRS 8 Operating Segments paragraphs 32 34, entity-wide disclosures do not include

information about intersegment sales or transfer.

6. During 2015, Loki Company decided to change from FIFO method of inventory valuation to the

weighted-average method. Inventory balances under each method were as follows:

January 1

December 31

FIFO

1,420,000

1,580,000

Weighted Average

1,540,000

1,660,000

Assuming a tax rate of 35%, what amount should Loki report as the effect of this accounting change?

a. -0b. P78,000

c. P80,000

d. P120,000

ANSWER: B

A change from the FIFO to average method of inventory costing requires a retroactive adjustment

since this is a change in accounting policy. The amount to be adjusted to the accumulated profits is

the difference between the beginning balances of inventory under FIFO and weighted average method

as follows:

Weighted Average, January 1

P1,540,000

FIFO, January

1,420,000

Effect of change in policy before tax 120,000

Tax effect (120,000 x 35%)

(42,000)

Effect of change in policy after tax

P78,000

7. On July 31, 2015, Gossip Girl Company discounted at the bank, a customers P1,200,000,

6-month, 10% notes receivable dated May 31, 2015. The bank discounted the note at 12%. How

much is the net proceeds of Gossip Girl Company from the discounted note?

a. P1,128,000

b. P1,152,000

c. P1,209,600

d. P1,234,800

ANSWER: C

Maturity Value of the Note:

[1,200,000 + (1,200,000 x 10% x 6/12)]

Less Discount

[1,260,000*(12% x 4/12)]

Net Proceeds

P1,260,000

50,400

P1,209,600

8. On July 1, 2015, one of LLOYD INC.s delivery trucks was destroyed in an accident. On that date,

the trucks book value was P900,000. On July 15, 2007, LLOYD INC. received and recorded a

P42,000 invoice for a new engine that was installed in the truck in May 2007 and another P6,000

invoice for various repairs.

What amount should LLOYD INC. use to determine the gain or loss on disposal of the truck?

a. P900,000

b. P942,000

2

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

c. P948,000

d. P936,000

ANSWER: B

The amount used to determine the gain or loss would include the book value and the invoice for the

new engine. The invoice for repairs are recorded as an expense and not capitalized as part of the

trucks cost.

9. On January 2, 2011, Brandon Company received a grant of P60,000 to compensate it for costs it

incurred in planting trees over a period of five years. Brandon Company will incur such cost in this

manner:

Years

Costs

2011

P2,000,000

2012

P4,000,000

2013

P6,000,000

2014

P8,000,000

2015

P10,000,000

What amount of income should Brandon Company recognize at the end of the year 2015?

a. P8,000,000

b. P12,000,000

c. P16,000,000

d. P20,000,000

ANSWER: D

PAS 20 Accounting for Government Grants and Disclosure of Government Assistance provides that

grants shall be recognized in profit or loss on a systematic basis over the periods in which the entity

recognizes as expenses the related costs for which grants are intended to compensate.

Year

Grant

Ratio

Income Recognized

2011

P60,000,000

X 2/30

=

P4,000,000

2012

P60,000,000

X 4/30

=

P8,000,000

2013

P60,000,000

X 6/30

=

P12,000,000

2014

P60,000,000

X 8/30

=

P16,000,000

2015

P60,000,000

X 10/30 =

P20,000,000

10. Orange Companys P190,000 net income for the quarter ended September 30, 2015 included the

following after tax items:

a. A P120,000 gain on the disposal of equipment, realized on April 30, 2015 was allocated equally

to the 2nd, 3rd and 4th quarters.

b. A P32,000 cumulative effect loss resulting from a change in inventory valuation method was

recognized on August 4, 2015.

In addition, Orange Company paid P96,000 on February 1, 2015, for 2015 calendar year property

taxes, of this amount, P24,000 was allocated to the 3 rd quarter of 2015. For the quarter ended

September 30, 2015, how much should Oranges report as net income?

a. 182,000

b. 206,000

c. 222,000

d. 230,000

ANSWER: A

Net income reported

Gain on disposal (P120,000/3)

Cumulative effect-loss

Net Income

P190,000

(40,000)

32,000

P182,000

The gain on disposal is not allocated among the interim periods; the full amount is recognized on a

particular interim period, that is, the period when the transaction actually occurred. The cumulative

effect-gain or loss is not reported in the income statement.

AVERAGE

3

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

1. When an owner-occupied property becomes an investment property to be carried at fair value, the

resulting increase in carrying amount is:

A. treated to the extent that the increase reverses a previous impairment loss, the increase is

recognized in other comprehensive income.

B. treated as part of other comprehensive income or revaluation surplus within equity, if no

previous impairment has been recorded.

C. recognized directly to profit or loss.

D. None of the above.

Answer: B

Paragraph 62 of PAS 40 Investment Property

TRANSFERS

Up to the date when an owner-occupied property becomes an investment property carried at fair

value, an entity depreciates the property and recognizes any impairment losses that have

occurred. The entity treats any difference at that date between the carrying amount of the property

in accordance with IAS 16 and its fair value in the same way as a revaluation in accordance with

IAS 16. In other words:

(a) any resulting decrease in the carrying amount of the property is recognized in profit or loss.

However, to the extent that an amount is included in revaluation surplus for that property, the

decrease is recognized in other comprehensive income and reduces the revaluation surplus

within equity.

(b) any resulting increase in the carrying amount is treated as follows:

(i) to the extent that the increase reverses a previous impairment loss for that property,

the increase is recognized in profit or loss. The amount recognized in profit or loss does not

exceed the amount needed to restore the carrying amount to the carrying amount that would

have been determined (net of depreciation) had no impairment loss been recognized.

(ii) any remaining part of the increase is recognized in other comprehensive income and

increases the revaluation surplus within equity. On subsequent disposal of the investment

property, the revaluation surplus included in equity may be transferred to retained earnings.

The transfer from revaluation surplus to retained earnings is not made through profit or loss.

2. Under PAS 11, Contract costs comprise of costs that relate directly to the specific contract. This

includes:

I.

site labor costs, including site supervision

II.

costs of moving plant, equipment and materials to and from the contract site

III.

claims from third parties

IV.

costs of hiring plant and equipment

A. I

B. II and III

C. I, II and IV

D. I, II, III and IV

Answer: D

Paragraph 16 and 17 of PAS 11 Construction Contracts

16 Contract costs shall comprise:

a) costs that relate directly to the specific contract;

b) costs that are attributable to contract activity in general and can be allocated to the

contract; and

c) such other costs as are specifically chargeable to the customer under the terms of the

contract.

17 Costs that relate directly to a specific contract include:

a) site labour costs, including site supervision;

b) costs of materials used in construction;

c) depreciation of plant and equipment used on the contract;

d) costs of moving plant, equipment and materials to and from the contract site;

e) costs of hiring plant and equipment;

f) costs of design and technical assistance that is directly related to the contract;

4

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

g) the estimated costs of rectification and guarantee work, including expected warranty

costs; and

h) claims from third parties.

3. Which of the following statements regarding interest methods of allocations is not true?

A. The term interest methods of allocation refers both to the convention for periodic reporting

and to the several approaches to dealing with changes in estimated future cash flows.

B. Interest methods of allocation are reporting conventions that use present value techniques in

the absence of a fresh-start measurement to compute changes in the carrying amount of an

asset or liability from one period to the next.

C. Interest methods of allocation are grounded in the notion of current cost.

D. Holding gains and losses are generally excluded from allocation systems.

Answer: C

Like depreciation and amortization conventions, interest methods are grounded in notions of

historical cost, not current cost.

4. Deferred tax assets are the amount of income taxes recoverable in future periods in respect of:

A. Permanent differences

B. Carryforward of unused tax losses only

C. Taxable temporary differences and carryforward of unused tax losses

D. Deductible temporary differences and carryforward of unused tax credits.

Answer: D

Paragraph 5 of PAS 12 Income taxes:

Deferred tax assets are the amounts of income taxes recoverable in future periods in respect of:

(a) deductible temporary differences;

(b) the carryforward of unused tax losses; and

(c) the carryforward of unused tax credits.

5. Hedging relationships are of three types. Which of the following is not included as set forth by

IAS 39?

A. Fair Value Hedge

B. Cash Flow Hedge

C. Hedge of a Net Investment in a Foreign Operation

D. Hedge of Foreign Currency Risk of a Firm Commitment

Answer: D

Based on IAS 39 Financial Instruments: Recognition and Measurement, paragraph 86, hedging

relationships are of three types:

a) fair value hedge: a hedge of the exposure to changes in fair value of a recognised asset or

liability or an unrecognised firm commitment, or an identified portion of such an asset,

liability or firm commitment, that is attributable to a particular risk and could affect profit or

loss.

b) cash flow hedge: a hedge of the exposure to variability in cash flows that (i) is attributable to

a particular risk associated with a recognised asset or liability (such as all or some future

interest payments on variable rate debt) or a highly probable forecast transaction and (ii)

could affect profit or loss.

c) hedge of a net investment in a foreign operation as defined in IAS 21.

6. Service Company markets products to real estate agents and to new homeowners, purchased a

customer list for P600,000 on January 2, 2014. Because turnover among real-estate agents and new

homeowners gradually become established homeowners, the list is expected to have economic value

for only four years. The Company uses the straight-line method of depreciation. In January 2015, the

customer list was tested for impairment as a result of substantial turndown in the real estate market in

the area. It is estimated that the customer list will generate future cash flows of P100,000 per year for

the next three years and that the fair value (less costs to sell) of the customer list is P240,000. The

market rate of interest on this date is 8%. What amount of impairment loss on customer lists should

Service Company recognize?

5

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

a.

b.

c.

d.

P-0P192,300

P210,000

P450,000

ANSWER:B

Recoverable amount (Note A)

Carrying value (600,000 x )

Impairment Loss

P257,700

(450,000)

P192,300

Note A - Recoverable amount is higher between:

Fair value less cost to sell

Value in use (P100,000 x 2.577)

P240,000

P257,700

7. Rowena Company grants 150 share options to each of its 500 employees on January 2, 2013, and

exercisable starting December 31, 2015 for a 2-year period. Each grant is conditional upon the employee

working for the entity over the next three years. Rowena estimates the fair value of each option is P40. On

the basis of weighted average probability, the entity estimates that 20% of the employees will leave

during the three-year period and forfeit their rights to share options. During the year 2013, 20 employees

leave and during the three-year period and believes that 20% is a fair estimate of employee departures.

During 2014, a further 22 employee leave. Due to low turnover as of December 31, 2014, Rowena revises

its estimate of employee departures over the three-year period from 20% to 15%. During 2015, a further

18 employees leave. What is the compensation expense to be recognized by Antonia Company for the

share options in 2015?

a. P800,000

b. P900,000

c. P940,000

d. P1,700,000

ANSWER: C

Cumulative compensation expense 2015:

150 x 40 x (500-60) persons

P2,640,000

Cumulative compensation expense 2014:

150 x 40 x (500 x 85%) persons x 2/3

1,700,000

Compensation expense 2015

940,000

8. On December 31, 2015, Ronnin Company has 200,000 ordinary shares outstanding with a par value of

P100 per share. Information revealed that Ronnin had a 9% convertible debenture, P1,000,000 face value

bonds. The bond has a carrying value of P1,067,830 as of January 2, 2015 based on a prevailing rate of

7%. Each 1,000 bond is convertible into 20 ordinary shares. The bonds were dated January 1, 2015. Net

income after tax of 32% for 2015 was P418,000.

How much should Ronnin Company report as diluted earnings per share in its financial statements?

a. P1.90

b. P2.09

c. P2.13

d. P2.89

ANSWER: B

Basic earnings per share (P418,000/200,000)

Diluted earnings per share:

Net income after tax

Interest after tax of convertible debt

P1,067,380 x 7% x (1-32%)

Total

Outstanding shares if bond was converted from the beginning

[200,000 + (1,000,000/1,000 x 20)]

Earnings per share

6

P2.09

418,000

50,807

468,807

220,000

2.13

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

Diluted earnings per share

P2.09

Because diluted earnings per share is increased when taking into account the convertible bond, the

convertible bond is antidilutive and is ignored in the calculation of diluted earnings per share.

Therefore, diluted earnings per share is equal to the basic earnings per share of P2.09.

9. An entity is planning to dispose of a collection of assets. The entity designates these assets as a disposal

group, and the carrying amount of these assets immediately before classification as held for sale was

P20,000,000. Upon being classified as held for sale, the assets were revalued to P18,000,000. The entity

feels that fair value less cost to sell would be P17,000,000. How would the reduction in the value of the

assets on classification as held for sale be treated in the financial statements?

a. The entity recognizes a loss of P2,000,000 immediately before classification as held for sale and

then recognizes an impairment loss of P1,000,000

b. The entity recognizes an impairment loss of P3,000,000

c. The entity recognizes an impairment loss of P2,000,000

d. The entity recognizes a loss of P3,000,000 immediately before classifying the disposal group as

held for sale.

ANSWER: A

PFRS 5 Non-current Assets Held for Sale and Discontinued Operations states that immediately

before the initial classification of the asset (or disposal group) as held for sale, the carrying amounts

of the asset shall be measured in accordance with applicable PFRSs. Prior to classification, the assets

are covered in PAS 16 Property, Plant, and Equipment and revaluation is appropriate per standard.

Thus a revaluation loss of P2,000,000 should be recognized first and a subsequent impairment loss of

P1,000,000 at year-end.

10. On June 30, 2015, Kimmy Company sold equipment with an estimated useful life of 10 years and

immediately leased it back for 5 years. The equipments carrying amount was P820,000. The sales price

was P750,000. The fair value of the equipment was P790,000. The lease agreement is an operating lease.

What amount of deferred loss should the Company recognize on June 30, 2015 assuming future rental

is equal to market rate rent?

a. P-0b. P30,000

c. P40,000

d. P70,000

ANSWER: A

PAS 17 Leases provides that for operating leases, if the sales price is below fair value, any profit or

loss shall be recognized immediately, except that if the loss is compensated by future lease payments

at below market price, it shall be deferred and amortized in proportion to the lease payments over the

period for which the asset is expected to be used. Since the loss is not compensated by lower future

rentals, the loss is not deferred and expensed immediately.

Fair Value

Selling Price

Loss recognized outright

Deferred loss

P790,000

(750,000)

40,000

P-0-

DIFFICULT

1. When deciding on the discount rate that should be used, which factors should not be taken into

account?

A. The time value of money

B. Risk that relate to the asset for which the future cash flows estimates have not been adjusted

C. Risks specific to the asset for which future cash flows estimates have been adjusted

D. Pretax rates

Answer: C

7

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

According to paragraph 55 of IAS 36 Impairment of Assets, The discount rate (rates) shall be a

pre-tax rate (rates) that reflect(s) current market assessments of:

a) the time value of money; and

b) the risks specific to the asset for which the future cash flow estimates have not been

adjusted.

2. Which of the following statements is not correct?

A. Periodic allocations of acquisition cost, made on a systematic and rational basis, are

recognized as current expense in conformity with the matching principle

B. Depreciation accounting is a process of valuation, not of allocation

C. At acquisition cost, operational assets are recorded at cost on the basis of the cost principle

D. Subsequent to acquisition, tangible assets that have a limited life are reported at the cost

recognized at acquisition less accumulated allocations of such cost

Answer: B

It is explicitly indicated in IAS 16 Property, Plant and Equipment, paragraph 6 that Depreciation

is the systematic allocation of the depreciable amount of an asset over its useful life.

3. An entity shall disclose a single amount on the face of the income statement comprising the total of

A. The post-tax profit or loss of discontinued operations and the pre-tax gain or loss recognized

on the measurement to fair value less costs to sell or on the disposal of the assets or disposal

group(s) constituting the discontinued operations.

B. The post-tax profit or loss of discontinued operations and the post tax gain or loss recognized

on the measurement to fair value less costs to sell or on the disposal of the assets or disposal

group(s) constituting the discontinued operations.

C. The pre-tax profit or loss of discontinued operations and the post tax gain or loss recognized

on the measurement to fair value less costs to sell or on the disposal of the assets or disposal

group(s) constituting the discontinued operations.

D. The pre-tax profit or loss of discontinued operations and the pre-tax gain or loss recognized

on the measurement to fair value less costs to sell or on the disposal of the assets or disposal

group(s) constituting the discontinued operations.

Answer: B

As stated in paragraph 33 of IFRS 5 Non-current Assets Held for Sale and Discontinued

Operations, an entity shall disclose:

a) a single amount in the statement of comprehensive income comprising the total of:

i.

the post-tax profit or loss of discontinued operations and

ii.

the post-tax gain or loss recognised on the measurement to fair value less costs to

sell or on the disposal of the assets or disposal group(s) constituting the

discontinued operation.

4. Which of the following statements are true?

I.

An intangible asset should be measured initially at cost

II.

If payment for an intangible asset is deferred beyond normal credit terms, its cost is the

equivalent cash price

III.

If an intangible asset is acquired in exchange for equity instruments of the reporting

enterprise, the cost of the asset is the fair value of the equity instruments issued, which is

equal to the fair value of the asset.

IV.

The acquirer may recognise a group of complementary intangible assets as a single asset

provided the individual assets have similar useful lives.

A.

B.

C.

D.

I and II

I, II and III

II, III and IV

I, II, III and IV

Answer: D

I IAS 38 Intangible Assets paragraph 24 states that An intangible asset shall be measured

initially at cost.

8

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

II IAS 38 paragraph 32 says that If payment for an intangible asset is deferred beyond normal

credit terms, its cost is the cash price equivalent. The difference between this amount and the total

payments is recognised as interest expense over the period of credit unless it is capitalised in

accordance with IAS 23 Borrowing Costs.

III IAS 38 paragraph 8 states that Cost is the amount of cash or cash equivalents paid or the

fair value of other consideration given to acquire an asset at the time of its acquisition or

construction.

IV - IAS 38 paragraph 37 states that The acquirer may recognise a group of complementary

intangible assets as a single asset provided the individual assets have similar useful lives. For

example, the terms 'brand' and 'brand name' are often used as synonyms for trademarks and other

marks. However, the former are general marketing terms that are typically used to refer to a group

of complementary assets such as a trademark (or service mark) and its related trade name,

formulas, recipes and technological expertise.

5. A subsidiarys fiscal year-end is June 30 and the parents fiscal year-end is December 31. The effect

of this difference is significant to the consolidated financial statements. In preparing consolidated

financial statements

A. The subsidiary should be consolidated using more recent interim financial statements.

B. The subsidiary should not be consolidated but its financial results are disclosed in the notes to

the consolidated financial statements.

C. The subsidiary should be consolidated using its June 30 annual financial statements

D. The subsidiary should not be consolidated but accounted for by the equity method in the

consolidated financial statements.

Answer: A

Appendix B of PFRS 10, paragraph B92-93 states that:

B92 The financial statements of the parent and its subsidiaries used in the preparation of the

consolidated financial statements shall have the same reporting date. When the end of the

reporting period of the parent is different from that of a subsidiary, the subsidiary prepares, for

consolidation purposes, additional financial information as of the same date as the financial

statements of the parent to enable the parent to consolidate the financial information of the

subsidiary, unless it is impracticable to do so.

B93 If it is impracticable to do so, the parent shall consolidate the financial information of the

subsidiary using the most recent financial statements of the subsidiary adjusted for the effects

of significant transactions or events that occur between the date of those financial statements and

the date of the consolidated financial statements. In any case, the difference between the date of

the subsidiary's financial statements and that of the consolidated financial statements shall be no

more than three months, and the length of the reporting periods and any difference between the

dates of the financial statements shall be the same from period to period.

Accordingly, the financial statements of the subsidiary should be adjusted at least as of September

30.

6. Jackson Company is engaged in a small export business. The Company maintains limited records.

Most of the Companys transactions are summarized in a cash journal while; non-cash transactions

are recorded by making memo entries. The following are abstracted from the Companys records.

Accounts receivable

370,000

Increase

Notes receivable

200,000

Decrease

Accounts payable

150,000

Decrease

Notes payable-trade

200,000

Increase

Notes payable-bank

300,000

Increase

Sales returns

30,000

Sales discounts

20,000

Purchase returns

80,000

Purchase discounts

35,000

Accounts written off

60,000

Recovery of accounts written off

18,000

Cash sales

300,000

Cash purchases

250,000

Cash received from account customers

1,500,000

9

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

Cash payment to trade creditors

What is the amount of gross sales?

a. P1,780,000

b. P2,062,000

c. P2,080,000

d. P2,130,000

1,200,000

ANSWER: B

Increase in accounts receivable

Sales returns

Accounts written off

Collection

Sales Discount

Total

Less: Decrease in notes receivable

Recovery of write-off

Sales on account

Cash Sales

Gross sales

P 370,000

30,000

60,000

1,500,000

20,000

P1,980,000

P200,000

18,000

218,000

P1,762,000

300,000

P2,062,000

7. MEGATRON Inc. reported inventory of P360,000 on December 31, 2015. The following data were

gathered to confirm the reported inventory figure.

Inventory, December 31, 2014

Purchases during 2015

Cash sales during 2015

Shipment received on December 26, 2015 included in

physical inventory but not recorded as purchases

Deposit made with suppliers, entered as purchased;

goods were not received during 2015

Collections on accounts receivable during 2015

Accounts receivable, December 31, 2014

Accounts receivable, December 31, 2015

Gross profit percentage on sales

P320,000

1,410,000

350,000

10,000

20,000

1,800,000

250,000

300,000

40%

What is the estimated inventory shortage on December 31, 2015?

a. P60,000

b. P50,000

c. P40,000

d. P5,000

ANSWER: C

Collections on accounts receivable during 2015

Accounts receivable, December 31, 2014

Accounts receivable, December 31, 2015

Cash Sales during 2015

Total Sales

Purchases (1,410,000+10,000-20,000)

Inventory, December 31, 2014

Cost of Goods Available for Sale

Cost of Goods Sold (2,200,000 x 60%)

Ending Inventory, per records

Ending Inventory, per physical count

Estimated inventory shortage

10

1,800,000

(250,000)

300,000

350,000

2,200,000

1,400,000

320,000

1,720,000

1,320,000

400,000

(360,000)

P40,000

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

8. Angel has an associate, Buttle, and owns 40% of the share capital. The fair value of Buttles net assets at

acquisition was P6,000,000 and the initial carrying amount including goodwill in Angels books was

P2,200,000. The carrying amount of the investment at December 31, 2015 is P2,800,000 and Buttles net

assets are fair valued at P9,000,000. Buttle issues new shares so that Angels holding is reduced to 20% as

Angel did not subscribe for the new shares which raised P8,000,000. The accounting for Buttle on the

issue of the new shares will be:

a. The carrying value of the associate decreases by P200,000 and the loss on dilution is P200,000

b. The carrying value of the associate increases by P2,200,000 and the gain on dilution is

P2,200,000

c. The carrying value of the associate increases by P200,000 and the gain on dilution is P200,000

d. The carrying value of the associate decreases by P2,200,000 and the gain on dilution is

P2,200,000

ANSWER: C

Angels share in the issue of new shares

(P8,000,000 x 20%)

Carrying value of disposed interest

(P2,800,000 x 20%/40%)

Gain on dilution/ increase in carrying value

P1,600,000

(1,400,000)

P200,000

9. The following are the details abstracted from the records of CINDY Corp.

i.

The President is to receive a bonus consisting of a basic amount equivalent to 5% of the

Companys net income before deduction of bonus but after deduction of corporate income tax.

ii.

In addition, the basic bonus will be increased by the Companys tax savings because the total

amount of bonus is deductible in computing the Companys taxable income. The tax savings is

the difference between the income tax the Company would have paid if there were no bonus and

the taxes the Company must pay after deducting the bonus.

iii.

CINDY Corp. reported a net income of P280,000 in 2015 before deduction of the Presidents

bonus and the corporate income tax.

iv.

The Company is subject to a corporate income tax of 35% of its net income after deducting the

Presidents bonus.

Compute for the total amount of bonus the President should receive in 2015.

a. P9,100

b. P9,352

c. P14,387

d. P14,136

ANSWER:C

B=5% x (280,000 T) + (280,000 x 35% - T)

T=35% x (280,000 B)

T=98,000 0.35B

B=5% x (280,000 98,000+ 0.35B) + (98,000 98,000 +0.35B)

B=5% x (182,000 + 0.35B) +0.35B

B=9,100 + 0.0175B + 0.35B

0.6325B=9,100

B=14,387

10. CO Company provides the following information for the year ended December 31, 2015:

Net monetary assets, January 1

P1,320,000

Sales

4,500,000

Purchases

1,800,000

Expenses

1,350,000

Income tax

900,000

Cash dividend paid on December 31

300,000

The sales, purchases, expenses and income tax were accrued evenly during the year. Selected price

index numbers are: January 1 110; Average for the year 125; December 31 140.

How much is the gain or loss on purchasing power?

11

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

a.

b.

c.

d.

P204,000

P414,000

P504,000

P1,884,000

ANSWER: B

Net monetary assets, January 1 restated

(1,320,000 x140/110)

Net Change in net monetary assets:

Profit

(4,500,000 1,800,000 1,350,000 900,000) x

140/125

Cash dividend paid on December 31

Net monetary assets, December 31 restated

Actual monetary assets, December 31

(1,320,000 +4,500,000 1,800,000 1,350,000

900,000 - 300,000)

Loss on purchasing power (1,884,000 1,470,000)

P1,680,000

504,000

(300,000)

1,884,000

1,470,000

P414,000

CLINCHER

1. A companys wages payable increased from the beginning to the end of the year. In the companys

statement of cash flows in which the operating activities section is prepared under the direct method,

the cash paid for wages would be

A. Salary expense plus wages payable at the beginning of the year.

B. Salary expense plus the increase in wages payable from the beginning to the end of the year.

C. Salary expense less the increase in wages payable from the beginning to the end of the year.

D. The same as salary expense.

Answer: C

In a statement of cash flows in which the operating activities section is prepared using the direct

method, the cash paid for wages would be equal to the accrual-basis salary expense, plus/minus any

decrease/increase in the wages payable account. (The logic is essentially the same as an accrual-basis

to cash-basis adjustment.)

2. The excess of the fair value of leased property at the inception of the lease over its cost or carrying

amount should be classified by the lessor as

A. Unearned income from a sales-type lease.

B. Unearned income from a direct-financing lease.

C. Manufacturers or dealers profit from a sales-type lease.

D. Manufacturers or dealers profit from a direct financing lease.

Answer: C

The excess of the fair value of leased property at the inception of the lease over the lessors cost is

defined as the manufacturers or dealers profit. Answer A is incorrect because the unearned income

from a sales-type lease is defined as the difference between the gross investment in the lease and the

sum of the present values of the components of the gross investment. Answer B is incorrect because

the unearned income from a direct-financing lease is defined as the excess of the gross investment

over the cost (also the PV of lease payments) of the leased property. Answer D is incorrect because a

sales-type lease involves a manufacturers or dealers profit while a direct financing lease does not.

3. Bannon Corp. transferred financial assets to Chapman, Inc. The transfer meets the conditions to be

accounted for as a sale. As the transferor, Bannon should do each of the following, except

A. Remove all assets sold from the balance sheet.

B. Record all assets received and liabilities incurred as proceeds from the sale.

C. Measure the assets received and liabilities incurred at cost.

D. Recognize any gain or loss on the sale.

12

National Federation of Junior Philippine Institute of Accountants

Western Mindanao Council

18th Regional Mid-Year Convention

Answer: C

The transferor, Bannon, should measure the assets received and liabilities incurred at fair value, not at

cost. The transferee, Chapman, should record any assets obtained and liabilities incurred at fair value.

4. Paris Corporation incurred P198,900 of research and development costs to develop a product for

which a patent was granted on January 2, 2012. Legal fees and other costs associated with registration

of the patent totaled P44,200. On January 2, 2015, Paris paid P62,400 for legal fees in a successful

defense of the patent. The patent has a useful economic life of 20 years. What amount should Paris

record as amortization expense for 2015?

a. P2,210

b. P5,200

c. P7,800

d. P19,500

ANSWER: A

Legal fees and other costs for registration of the

patent

Legal life

Annual amortization

P44,200

20 years

P2,210

IAS 38 Intangible Assets states that an intangible asset shall be recognized if and only if: (a) it is

probable that the expected future economic benefits that are attributable to the asset will flow to the

entity, and (b) the cost can be measured reliably. Based on the given facts, only legal fees and other

costs for registration can be capitalized as cost of the patent.

Legal fees for the successful defense cannot be capitalized as it is incurred only to maintain the asset

and will not enhance and contribute to the expected future benefits from the patent.

Research and development costs as a rule are not capitalized except for development costs under

strict conditions in PAS 38 of which the problem is silent.

5. On January 2, 2015, Silence Corporation has an investment property that was carried at fair value

with a carrying amount of P2,400,000 (historical cost, P2,500,000). As of December 31, 2015, the

carrying amount of the property is P2,300,000. On December 31, 2015, the fair market value of the

property was P2,800,000. On this date, Silent Corporation decided to reclassify/transfer the property

to inventory. On the date of transfer, what amount should the inventory be valued?

a. P2,300,000

b. P2,400,000

c. P2,500,000

d. P2,800,000

ANSWER: D

Per PAS 40 Investment Property, a transfer from investment property carried at fair value to owneroccupied property or inventories shall be in accordance with PAS 16 or PAS 2 for which the

propertys deemed cost for subsequent accounting shall be its fair value at the date of change in use.

Thus, the inventory should be valued at P2,800,000.

13

You might also like

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- Mock Examination QuestionnaireDocument9 pagesMock Examination QuestionnaireRenabelle CagaNo ratings yet

- 7th Pylon Cup Final Round SGVDocument11 pages7th Pylon Cup Final Round SGVrcaa04No ratings yet

- Rmyc SGV Cup Final Round QM Copy v1Document15 pagesRmyc SGV Cup Final Round QM Copy v1Darelle Hannah MarquezNo ratings yet

- Module 3 Cost Volume Profit Analysis NA PDFDocument4 pagesModule 3 Cost Volume Profit Analysis NA PDFMadielyn Santarin Miranda50% (2)

- Toa - Preboard - May 2016Document11 pagesToa - Preboard - May 2016Kenneth Bryan Tegerero Tegio100% (1)

- Accounting - Answer Key Quiz - Investments in Associates and Additional ConceptsDocument2 pagesAccounting - Answer Key Quiz - Investments in Associates and Additional ConceptsNavsNo ratings yet

- 1.3 Responsibility Accounting Problems AnswersDocument5 pages1.3 Responsibility Accounting Problems AnswersAsnarizah PakinsonNo ratings yet

- Correction of ErrorsDocument6 pagesCorrection of ErrorsJanjielyn MoralesNo ratings yet

- Naqdown Final Round 2013Document8 pagesNaqdown Final Round 2013MJ YaconNo ratings yet

- Mockboard (Mas)Document3 pagesMockboard (Mas)Nezhreen MaruhomNo ratings yet

- AfardocDocument14 pagesAfardocJhedz CartasNo ratings yet

- Regulatory Framework For Business TransactionsDocument13 pagesRegulatory Framework For Business TransactionsNash VelisanoNo ratings yet

- Financial Reporting I: Key Accounting ConceptsDocument5 pagesFinancial Reporting I: Key Accounting ConceptsKim Cristian Maaño50% (2)

- AFAR ProblemDocument14 pagesAFAR ProblemGil Enriquez100% (1)

- Insurance Accounting ReviewDocument2 pagesInsurance Accounting ReviewRafael BarbinNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- Updates to IFRS 3 Definition of a Business and IAS 1 and IAS 8 Definition of Material (39 charactersDocument9 pagesUpdates to IFRS 3 Definition of a Business and IAS 1 and IAS 8 Definition of Material (39 charactersShane CabinganNo ratings yet

- National Federation of Junior Philippine Institute of Accountants Financial AccountingDocument8 pagesNational Federation of Junior Philippine Institute of Accountants Financial AccountingWeaFernandezNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- Discontinued Operations ProblemsDocument4 pagesDiscontinued Operations ProblemsJeane Mae BooNo ratings yet

- Chapter 35 001Document8 pagesChapter 35 001Grace Ann Aceveda QuinioNo ratings yet

- Differences Between PFRS Reporting FrameworksDocument2 pagesDifferences Between PFRS Reporting FrameworksRisalyn BiongNo ratings yet

- Chapter 12 - Answer PDFDocument13 pagesChapter 12 - Answer PDFHarlenNo ratings yet

- Ap 06 REO Receivables - PDF 074431Document19 pagesAp 06 REO Receivables - PDF 074431ChristianNo ratings yet

- 01 x01 Basic ConceptsDocument10 pages01 x01 Basic ConceptsAzureBlazeNo ratings yet

- 4083 EvalDocument11 pages4083 EvalPatrick ArazoNo ratings yet

- Quiz Bee Final 2Document101 pagesQuiz Bee Final 2joshNo ratings yet

- Ia3 IsDocument3 pagesIa3 IsMary Joy CabilNo ratings yet

- Construction Contracts GuideDocument3 pagesConstruction Contracts GuideJamie RamosNo ratings yet

- Afar 09Document14 pagesAfar 09RENZEL MAGBITANGNo ratings yet

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- Quiz 2 Ncahs/ Discontinued Operation: FeedbackDocument67 pagesQuiz 2 Ncahs/ Discontinued Operation: FeedbackAngela Miles DizonNo ratings yet

- CORDILLERA CAREER DEVELOPMENT COLLEGE INCOME TAXATION FINAL EXAMDocument7 pagesCORDILLERA CAREER DEVELOPMENT COLLEGE INCOME TAXATION FINAL EXAMRoldan Hiano Manganip0% (1)

- Name: - Date: - Year &sec. - ScoreDocument10 pagesName: - Date: - Year &sec. - ScorePigging Etchuzera0% (1)

- Summary Accounting For InvestmentsDocument2 pagesSummary Accounting For InvestmentsJohn Rashid HebainaNo ratings yet

- Periodic inventory system purchase and sale of merchandiseDocument4 pagesPeriodic inventory system purchase and sale of merchandiseDerick FloresNo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneyLj SzeNo ratings yet

- DocxDocument13 pagesDocxMingNo ratings yet

- 13th NCR Cup Series 7 SGVDocument9 pages13th NCR Cup Series 7 SGVrcaa04No ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- This Study Resource Was: Profit Loss Profit LossDocument9 pagesThis Study Resource Was: Profit Loss Profit LossrogealynNo ratings yet

- Summary of Ifrs 5Document4 pagesSummary of Ifrs 5Divine Epie Ngol'esuehNo ratings yet

- Course Syllabus-Strategic Cost MGTDocument7 pagesCourse Syllabus-Strategic Cost MGTJesel CatchoniteNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- Clip 12Document2 pagesClip 12ATLASNo ratings yet

- 2013 SGV Cup Level Up FinalDocument17 pages2013 SGV Cup Level Up FinalAndrei GoNo ratings yet

- Quiz BeeDocument15 pagesQuiz Beejoshua100% (1)

- Audit of Companies Under Specialized IndustriesDocument19 pagesAudit of Companies Under Specialized IndustriesMarj ManlagnitNo ratings yet

- CUP VI - Financial Accounting and ReportingDocument17 pagesCUP VI - Financial Accounting and ReportingRonieOlarte0% (1)

- Error DiscussionDocument2 pagesError DiscussionGloria Beltran100% (1)

- Installment Liquidation ExplainedDocument28 pagesInstallment Liquidation Explainedcynthia reyesNo ratings yet

- Intermediate Accounting 1amp2 PDF FreeDocument20 pagesIntermediate Accounting 1amp2 PDF FreeShao LiNo ratings yet

- Quiz BeeDocument15 pagesQuiz BeeRudolf Christian Oliveras UgmaNo ratings yet

- CMA Exam Review - Part 2 AssessmentDocument66 pagesCMA Exam Review - Part 2 AssessmentAlyssa PilapilNo ratings yet

- Pas 32 Pfrs 9 Part 2Document8 pagesPas 32 Pfrs 9 Part 2Carmel Therese100% (1)

- FAR2Document27 pagesFAR2Sheena CalderonNo ratings yet

- AcccountantDocument13 pagesAcccountantBerthil ValezaNo ratings yet

- Torrent Downloaded From Bt-Scene - CCDocument1 pageTorrent Downloaded From Bt-Scene - CCMCDABCNo ratings yet

- (TGX) Downloaded FromDocument1 page(TGX) Downloaded FromdaniNo ratings yet

- Andres Bonifacio College College of Arts and Sciences TEST I: MCQ-Encircle The Best AnswerDocument7 pagesAndres Bonifacio College College of Arts and Sciences TEST I: MCQ-Encircle The Best AnswerMCDABCNo ratings yet

- Torrent Downloaded From Demonoid - WWW - Demonoid.pwDocument1 pageTorrent Downloaded From Demonoid - WWW - Demonoid.pwMCDABCNo ratings yet

- XVII. Gloria ArroyoDocument7 pagesXVII. Gloria ArroyoMCDABC100% (1)

- XII. Diosdado MacapagalDocument3 pagesXII. Diosdado MacapagalMCDABCNo ratings yet

- PNoy Aquino 15th President of the PhilippinesDocument7 pagesPNoy Aquino 15th President of the PhilippinesMCDABCNo ratings yet

- Joseph Estrada Joseph "Erap" Ejercito Estrada (Born Jose Marcelo Ejercito April 19, 1937) Is A Filipino Politician Who WasDocument7 pagesJoseph Estrada Joseph "Erap" Ejercito Estrada (Born Jose Marcelo Ejercito April 19, 1937) Is A Filipino Politician Who WasMCDABCNo ratings yet

- Audited FreskosDocument8 pagesAudited FreskosMCDABCNo ratings yet

- Report Iconic IndeedDocument23 pagesReport Iconic IndeedMCDABCNo ratings yet

- President Ferdinand E. Marcos of the Philippines (1965-1986Document15 pagesPresident Ferdinand E. Marcos of the Philippines (1965-1986MCDABCNo ratings yet

- XV. Fidel RamosDocument2 pagesXV. Fidel RamosMCDABCNo ratings yet

- PERFAST Corporation 2016 Financial StatementsDocument9 pagesPERFAST Corporation 2016 Financial StatementsMCDABCNo ratings yet

- Working Capital Management TechniquesDocument41 pagesWorking Capital Management TechniquesMCDABCNo ratings yet

- Feasibility Study (MATS CNG Filling Station) : Students of MBA 3 SemesterDocument61 pagesFeasibility Study (MATS CNG Filling Station) : Students of MBA 3 SemesterMCDABC0% (1)

- Money Creation: - Key Concepts - Summary - Practice Quiz - Internet ExercisesDocument73 pagesMoney Creation: - Key Concepts - Summary - Practice Quiz - Internet ExercisesMCDABCNo ratings yet

- Make or BuyDocument4 pagesMake or BuyMCDABCNo ratings yet

- Philippines Tax Guide 2016-17Document15 pagesPhilippines Tax Guide 2016-17MCDABCNo ratings yet

- MCMCMCDocument4 pagesMCMCMCMCDABCNo ratings yet

- LP Mathematics Q2 Week 3Document8 pagesLP Mathematics Q2 Week 3MCDABCNo ratings yet

- LP English Q2 Week 3Document11 pagesLP English Q2 Week 3MCDABCNo ratings yet

- Sample NotesDocument175 pagesSample NotesMCDABCNo ratings yet

- Undiscussed ValuesDocument9 pagesUndiscussed ValuesMCDABCNo ratings yet

- Lesson Plan in Science V DATEDocument5 pagesLesson Plan in Science V DATEMCDABC100% (2)

- Sample NotesDocument175 pagesSample NotesMCDABCNo ratings yet

- Working Capital Management TechniquesDocument41 pagesWorking Capital Management TechniquesMCDABCNo ratings yet

- Macro EconDocument94 pagesMacro EconMCDABCNo ratings yet

- Liabilities: The ofDocument13 pagesLiabilities: The ofMCDABCNo ratings yet

- Lesson 1 Overview of IT AuditDocument42 pagesLesson 1 Overview of IT AuditMCDABCNo ratings yet

- Revised Withholding Tax TablesDocument1 pageRevised Withholding Tax TablesJonasAblangNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document5 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- Cortazar Schwartz Naranjo 2007Document17 pagesCortazar Schwartz Naranjo 2007carreragerardoNo ratings yet

- 6-Ratios Prop Indices LogsDocument4 pages6-Ratios Prop Indices LogsPushkar0% (1)

- Bosch Performance by Ratio AnalysisDocument34 pagesBosch Performance by Ratio AnalysisSantosh KumarNo ratings yet

- SGC Composition and FunctionsDocument2 pagesSGC Composition and FunctionsDecember Cool100% (5)

- The CQF Careers Guide 2023Document45 pagesThe CQF Careers Guide 2023ashaik1No ratings yet

- SARELSON LAW FIRM, P.A., 1200 Brickell Avenue, Suite 1440, Miami, Florida 33131, 305-379-0305, 800-421-9954 (Fax) 1Document73 pagesSARELSON LAW FIRM, P.A., 1200 Brickell Avenue, Suite 1440, Miami, Florida 33131, 305-379-0305, 800-421-9954 (Fax) 1Matthew Seth SarelsonNo ratings yet

- Role of PAODocument29 pagesRole of PAOAjay DhokeNo ratings yet

- Lincoln Heights Presentation: 2021-GE AviationDocument18 pagesLincoln Heights Presentation: 2021-GE AviationWVXU NewsNo ratings yet

- Rosillo:61-64: 61) Pratts v. CADocument2 pagesRosillo:61-64: 61) Pratts v. CADiosa Mae SarillosaNo ratings yet

- Project IdentificationDocument89 pagesProject Identificationtadgash4920100% (3)

- Section 2. Original Certificates of Title Shall Be Reconstituted From Such of TheDocument2 pagesSection 2. Original Certificates of Title Shall Be Reconstituted From Such of TheAlexylle ConcepcionNo ratings yet

- Chapter-7 Investment ManagementDocument7 pagesChapter-7 Investment Managementhasan alNo ratings yet

- Executive Order 1035 Streamlines Gov't Land AcquisitionDocument5 pagesExecutive Order 1035 Streamlines Gov't Land Acquisitionahsiri22No ratings yet

- CXC 20180206 PDFDocument16 pagesCXC 20180206 PDFJoshua BlackNo ratings yet

- Key Technical Questions For Finance InterviewsDocument27 pagesKey Technical Questions For Finance InterviewsSeb SNo ratings yet

- Walmart's $16 Billion Acquisition of FlipkartDocument2 pagesWalmart's $16 Billion Acquisition of FlipkartAmit Dharak100% (1)

- SEC Vs BalwaniDocument23 pagesSEC Vs BalwaniCNBC.comNo ratings yet

- Written Math Solutions and Word ProblemsDocument1 pageWritten Math Solutions and Word ProblemsShakir AhmadNo ratings yet

- Bohol Diocese Co-op Membership FormDocument2 pagesBohol Diocese Co-op Membership FormIBP Bohol Chapter100% (1)

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21MaheshNo ratings yet

- Laws Governing Insurance AcceptanceDocument1 pageLaws Governing Insurance AcceptanceCamille BugtasNo ratings yet

- Contoh Soal TOEIC Grammar Dan JawabanDocument4 pagesContoh Soal TOEIC Grammar Dan Jawabanqiya mamaNo ratings yet

- Accounting P2 May-June 2022 Answer Book EngDocument10 pagesAccounting P2 May-June 2022 Answer Book Engbonks depoiNo ratings yet

- CH 7 Stocks Book QuestionsDocument9 pagesCH 7 Stocks Book QuestionsSavy DhillonNo ratings yet

- Adidas Anual Report 2011Document242 pagesAdidas Anual Report 2011EricNyoniNo ratings yet

- Ifrs Framework PDFDocument23 pagesIfrs Framework PDFMohammad Delowar HossainNo ratings yet

- Entre November 16Document42 pagesEntre November 16Charlon GargantaNo ratings yet

- Chapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoDocument101 pagesChapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoJay senthilNo ratings yet

- Calculating future, present values of cash flows at different interest ratesDocument6 pagesCalculating future, present values of cash flows at different interest ratesSouvik NandiNo ratings yet