Professional Documents

Culture Documents

Pag-IBIG MULTI-PURPOSE LOAN APPLICATION FORM

Uploaded by

alexcastilloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pag-IBIG MULTI-PURPOSE LOAN APPLICATION FORM

Uploaded by

alexcastilloCopyright:

Available Formats

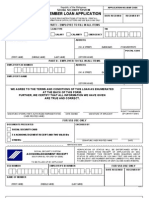

FLS010

APPLICATION No.

Pag-IBIG MULTI-PURPOSE

LOAN APPLICATION FORM (MPLAF)

(TO BE FILLED OUT BY APPLICANT)

Type or print entries

LAST NAME FIRST NAME MIDDLE NAME MAIDEN NAME (For married women) DESIRED LOAN AMOUNT

MAX OF 60% (24-59 MOS.)

MAX OF 80% (AT LEAST 120 MOS.)

MAX OF 70% (60-119 MOS.)

OTHER AMOUNT, PLS. SPECIFY _______________

HOME ADDRESS (Pls. indicate complete address) GENDER CIVIL STATUS EMPLOYEE No.

MALE

SINGLE

WIDOW/ER

ANNULLED

FEMALE

MARRIED

LEGALLY SEPARATED

MOTHER'S MAIDEN NAME MOBILE PHONE No. HOME TEL. No. TIN

BIRTHDATE BIRTHPLACE Pag-IBIG ID No. SSS/GSIS ID No.

mm dd yyyy

COMPANY/EMPLOYER NAME FOR AFP EMP-SERIAL/ACCOUNT No.

FOR DECS EMP - DIV. CODE/STATION CODE/

EMPLOYEE No.

COMPANY/EMPLOYER ADDRESS (Pls. indicate complete address) OFFICE TEL. NO. TYPE OF LOAN LOAN PURPOSE

NEW PAYMENT OF OTHER NON-

HOUSING LOAN HOUSING- HOUSING

RENEWAL ARREARAGES RELATED RELATED

(Mo.Yr.)

EMPLOYMENT HISTORY FROM DATE OF Pag-IBIG MEMBERSHIP (Use another sheet if necessary) DATE OF Pag-IBIG MEMBERSHIP

NAME OF EMPLOYER ADDRESS FROM(Mo./Yr.) TO (Mo./Yr.)

SIGNATURE OF APPLICANT MEMBER'S PAYROLL BANK ACCOUNT NO.

IN THE EVENT OF THE APPROVAL OF MY APPLICATION FOR MULTI-PURPOSE

LOAN, I HEREBY AUTHORIZE Pag-IBIG FUND TO CREDIT MY LOAN PROCEEDS NAME OF BANK/BRANCH (Where member maintains payroll account)

THROUGH MY PAYROLL BANK ACCOUNT THAT I HAVE INDICATED ON THE

RIGHT PORTION. BANK ADDRESS

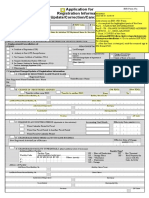

APPLICATION AGREEMENT

In consideration of the loan that may be granted by virtue of this application subject to the pertinent provisions of the Implementing Rules This office agrees to collect the corresponding monthly

and Regulations of the Pag-IBIG Fund, I hereby waive my rights under R.A. No. 1405 and authorize Pag-IBIG Fund to verify/validate amortizations on this loan and the monthly Pag-IBIG

my payroll account number. Furthermore, I hereby authorize my present employer contributions of herein applicant through payroll deduction,

______________________________________________________________________________ or any employer with whom I may get together with the Pag-IBIG employer counterpart

employed in the future, to deduct the monthly Pag-IBIG contribution and amortization due from my salary and remit the same to Pag-IBIG contributions, and remit said amounts to Pag-IBIG Fund on

Fund. If the resulting monthly net take home pay after deducting the computed monthly amortization on MPL falls below the monthly net take or before the scheduled day of every month, for the

home pay as required under the GAA/company policy, I authorize Pag-IBIG Fund to compute for a lower loanable amount. duration that the loan remains outstanding. However,

Should I be classified as having an outstanding housing loan account in arrears for more than 9 months upon loan application but said should we deduct the monthly amortization due from the

account is not yet cancelled or foreclosed, I hereby assign the proceeds of the loan to Pag-IBIG Fund and authorize the latter to apply the applicant's salary but failed to remit it on due date, this

said proceeds to the payment of my housing loan arrearages. office agrees to pay the corresponding penalties

I understand that should I fail to pay the monthly amortization due, I shall be charged a penalty of 1/2% of any unpaid amount for every equivalent to 1/2% of any unpaid amount for every month

month of delay. of delay.

I further authorize my employer to deduct the outstanding balance of my MPL from my retirement and/or separation pay and remit the

same to Pag-IBIG Fund. This authorization is irrevocable until such time that the said loan is fully paid.

In the event my retirement and/or separation pay is not sufficient to settle the outstanding balance of my MPL or my employer fails, for _________________________________________

whatever reason, to deduct the same from said retirement and/or separation pay in settlement of the outstanding balance of my MPL, I HEAD OF OFFICE OR AUTHORIZED REPRESENTATIVE

hereby authorize Pag-IBIG Fund to apply whatever benefits are due me from the Fund to settle the said obligation. (Signature over printed name)

I certify that the information given and any or all statements made herein are true and correct to the best of my knowledge and belief. I

hereby certify under pain of perjury that my signature and thumbmarks appearing herein are genuine and authentic.

________________________________________________

__________________________________ DESIGNATION

Signature of Applicant over Printed Name

______________ _______________ ______________

COM. TAX CERT. NO. _______________________

EMPLOYER AGENCY CODE BRANCH CODE

ISSUED ON _____________ AT _______________ LEFT THUMBMARK OF RIGHT THUMBMARK OF SSS/ GSIS NO.

APPLICANT APPLICANT

PROMISSORY NOTE

For value received, I promise to pay on due date without need of demand to the order of 5. The borrower shall be considered in default in any of the following cases:

Pag-IBIG Fund with principal office at the Atrium of Makati, Makati Ave., City of Makati the sum a. Any willful misrepresentation made by the borrower in any of the documents executed in

of Pesos: relation hereto.

b. Failure on the part of the borrower to pay any 3 consecutive monthly amortizations.

(P_______________) Philippine Currency, with the interest rate of 10.75% p. a. for the c. Failure of the borrower to pay any 3 consecutive monthly membership contributions.

duration of the loan. d. Any violation made by the borrower on existing policies, rules, regulations and guidelines of

the Pag-IBIG Fund.

I hereby waive notice of demand for payment and agree that any legal action, which 6. In the event of default, the outstanding loan balance, all accumulated interests and penalties

may arise in relation to this note, may be instituted in the proper court of Makati City. shall become due and demandable. The outstanding obligation shall be deducted from the

Total Accumulated Value (TAV) credited to the borrower at the end of the term of the loan.

Finally, this note shall likewise be subject to the following terms and conditions: However, immediate offsetting of the borrower’s outstanding loan obligation may be

1. The borrower shall pay the amount of Pesos: _______________________________ effected upon occurrence of any of the following justifiable reasons and upon validation

(P_______________) through payroll deduction over a period of 24 months. In case of by the Fund: Unemployment; total or partial disability, as certified by a duly licensed

resignation/separation from the employer, suspension from work, leave of absence physician; illness of the member-borrower or any of his immediate family member; or

without pay, or insufficient monthly net take home pay prior to full payment of this death of any of his immediate family members. Under the foregoing instances, the

loan, monthly/full payments should be made directly to the Pag-IBIG Fund office where borrower hereby authorizes the Pag-IBIG Fund to offset the outstanding obligation

the loan was released. against his TAV.

2. Payments are due on or before the ___________________ of the month starting on 7. In case of membership termination prior to full payment of the loan, no claim for provident

_________________________ and 23 succeeding months thereafter. benefit shall be paid to the borrower or his beneficiaries until after the full satisfaction of any

3. Payments made by the borrower after due date shall be applied in the following order of amount arising from this note which remains unpaid as of the date of such termination.

priorities: Penalties, interest, and principal. 8. In case of falsification, misrepresentation or any similar acts committed by the borrower, Pag-

4. A penalty of 1/2% of any unpaid amount shall be collected from the borrower for every IBIG Fund shall automatically suspend his loan privileges indefinitely. The borrower shall abide

month of delay. with all the applicable rules and regulations governing this lending program that Pag-IBIG Fund

Signed in the presence of: may promulgate from time to time.

_________________________ _________________________

___________________________________

Witness Witness

Signature of Applicant over Printed Name

(Signature over Printed Name) (Signature over Printed Name)

THIS PORTION IS FOR Pag-IBIG FUND USE ONLY

CLAIM/HOUSING LOAN/STL VERIFICATION

PARTICULARS NONE WITH DV/CHECK NO. / APPLICATION NO. DATE FILED / DV NO. VERIFIED DATE

CLAIMS

HOUSING LOAN

MPL

LOAN APPROVAL

LOAN AMOUNT GRANTED INTEREST PREVIOUS LOAN BALANCE LOAN PROCEEDS MONTHLY AMORT

REVIEWED BY DATE APPROVED BY DATE DISAPPROVED BY DATE

THIS FORM CAN BE REPRODUCED. NOT FOR SALE (Revised 07/2006)

GUIDELINES AND INSTRUCTIONS

A. Who May File

Any Pag-IBIG member who satisfies the following requirements may apply for a multi-

purpose loan (MPL):

CERTIFICATE OF NET PAY 1. The member has made at least 24 monthly contributions.

2. The monthly net take home pay requirement of government employees shall be subject to

the rules and regulations as provided for in the General Appropriations Act (GAA). On the

other hand, the monthly net take home pay of employees working with the private sector

shall be based on their respective company policies, if there is any.

3. Members with active Fund membership at the time of application with commitment from

both the employee and employer to continuously remit contributions at least for the term

of the loan.

4. For members who have withdrawn their membership contributions due to membership

NAME OF BORROWER maturity, the reckoning date of the updated 24 monthly contributions shall be the first

monthly contribution following the month the member qualified to withdraw his Pag-IBIG

contributions.

For the month of: __________________ 5. For members who have active contributions under both the Pag-IBIG I and Pag-IBIG II,

the membership contributions under Pag-IBIG II shall be considered to meet the required

24 monthly contributions.

6. A member with an outstanding Pag-IBIG housing loan that is not more than

Add: Allowances 9 months in arrears and is not yet cancelled or foreclosed.

7. A member with an outstanding Pag-IBIG housing loan that is more than 9 months

in arrears but is not yet cancelled or foreclosed may be allowed to avail of an MPL,

________________________ ___________ provided that the purpose of the MPL is to update his/her housing loan arrearages.

The MPL proceeds to be applied to the housing loan arrearages shall be subject to

the applicant’s loan entitlement.

________________________ ___________

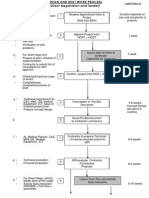

B. How to File

The applicant shall:

________________________ ___________ 1. Secure the Pag-IBIG Multi-Purpose Loan Application Form (MPLAF) from any Pag-IBIG

Fund NCR/Provincial branch.

2. Accomplish 1 copy of the application form.

3. Under PACSVAL/PDDTS releasing, attach photocopy of passbook or Automated

Teller Machine (ATM) card reflecting the account name and bank account number.

________________________ ___________ 4. Submit complete application, together with the required documents to any Pag-IBIG Fund

NCR/Provincial Branch. Processing of loans shall commence only upon submission of

complete documents.

________________________ ___________

C. Loan Features

1. Loan Amount

________________________ ___________ The loanable amount shall depend on the number of contributions made, based on the

following schedule:

Number of Contributions Loan Amount

24 to 59 months Up to 60% of the TAV

60 to 119 months Up to 70% of the TAV

Gross Monthly Income ___________ At least 120 months Up to 80% of the TAV

2. Interest

The loan shall bear an interest rate of 10.75% p. a. for the duration of the loan.

3. Manner of Release of Loan

The loan proceeds shall be released through a check payable to the borrower or shall be

Less: Deductions

credited to the borrower’s bank account through the LANDBANK’s Payroll Credit Systems

Validation (PACSVAL) and Philippine Domestic Dollar Transfer System (PDDTS)

facilities, and other similar modes of payment.

________________________ ___________ However, for MPL used as payment of housing loan arrearages, the check shall be

made payable to Pag-IBIG Fund for the account of the member-borrower.

Unclaimed checks shall be mailed to the member-borrower after 3 days from the

DV/check date

________________________ ___________ 4. Loan Term

The loan shall be paid over a maximum period of 24 months, plus the applicable grace

period of 2 months for local accounts and 5 months for centralized accounts. Centralized

________________________ ___________ accounts shall refer to employers that prepare the payroll in advance, usually at

the head/central office. All other accounts not falling under the category of

centralized accounts shall be classified as local accounts.

________________________ ___________ 5. Loan Payments

The loan shall be paid in equal monthly amortizations in such amounts as may fully cover

________________________ ___________ the loan obligation. For Employed Members, payments shall be made thru salary

deduction. For Voluntary Members/Individual Payors, payments shall be made through

any of the following modes: a. Over-the-counter; b. Auto-debit arrangement with banks;

Total Deductions ___________ c. Other mode of payment that Pag-IBIG Fund may adopt in the future.

Remittance of MPL amortizations by government and private employers shall

commence on the 3rd month following the date on the DV/Check for local accounts

and on the 6th month for centralized accounts. It shall be in accordance with the

following schedule:

First Character of Employer’s Name Due Date

A to D 10th to 14th day of the month

Net Monthly Income ___________ E to L 15th to 19th day of the month

M to Q 20th to 24th day of the month

R to Z, and Numeral 25th to end of the month

For Voluntary Members/Individual Payors, payments shall be remitted to the Fund

on or before the 15th day of each month, beginning on the 3rd month following the

date on the DV/Check.

Issued this _______ day of ____________, 20__. A penalty of 1/2% of any unpaid amount shall be charged to the borrower for every month

I certify under pain of perjury that the above- of delay. However, for borrowers paying their loans through automatic salary

deduction, penalties shall be cancelled/reversed only upon presentation of proof

mentioned information is true and correct. that non-payment was due to the fault of the employer. The said penalties shall

then be charged against the employer.

The member may fully pay the outstanding balance of the loan prior to loan maturity.

Should any of the following instances arise, the borrower shall pay directly to any

______________________________________________ Pag-IBIG Fund office:

HEAD OF OFFICE/AUTHORIZED REPRESENTATIVE a. Separation from employer;

b. Suspension from work;

(Signature over printed name) c. Leave of Absence without pay;

d. Insufficiency of take home pay

In case of separation from employer, the borrower may opt to pay thru his new employer,

after notifying the Fund of his change of employer.

6. Application of Payment

Payments made after the due date shall be applied according to the following order of

priorities:

a. Penalties

b. Interest

c. Principal

D. Loan Renewal

A borrower may renew his MPL upon payment of at least 6 amortizations. The outstanding

balance together with any accumulated interests, penalties and charges shall be deducted

from the proceeds of the new loan. In case of full payment prior to loan maturity, a

borrower shall be allowed to apply for a new loan any time.

You might also like

- Pag-Ibig Salary Loan Form PDFDocument3 pagesPag-Ibig Salary Loan Form PDFtandangmark75% (52)

- Forms Pension ResumptionDocument2 pagesForms Pension ResumptionMei Mei100% (1)

- FPF060 Membership Contributions Remittance Form (MCRF)Document2 pagesFPF060 Membership Contributions Remittance Form (MCRF)Mathenie David56% (9)

- Authorize ATM Debit Card ClaimDocument2 pagesAuthorize ATM Debit Card ClaimFrances Mae Vera CruzNo ratings yet

- Transaction SlipDocument2 pagesTransaction SlipSIMPLEJG88% (8)

- Certification of EmploymentDocument1 pageCertification of EmploymentNaire JayNo ratings yet

- Pag-IBIG MPL Application FormDocument2 pagesPag-IBIG MPL Application Formhailglee192580% (5)

- SSS Member Loan Application FormDocument2 pagesSSS Member Loan Application FormJr Sam90% (49)

- SSS Change RequestDocument3 pagesSSS Change RequestAngelica SarzonaNo ratings yet

- RSBSA Enrollment Form SummaryDocument2 pagesRSBSA Enrollment Form Summaryanon_28428654175% (133)

- PFF002 - Employer's Data Form - V04 - PDF PDFDocument2 pagesPFF002 - Employer's Data Form - V04 - PDF PDFarlyn100% (1)

- Letter Request For Dr. DuhaylungsodDocument1 pageLetter Request For Dr. DuhaylungsodYong Rosabal100% (1)

- Bir Form 1902Document4 pagesBir Form 1902fatmaaleah100% (1)

- Member'S Contribution Remittance Form (MCRF) : Employer/Business Name Employer/Business AddressDocument4 pagesMember'S Contribution Remittance Form (MCRF) : Employer/Business Name Employer/Business AddressBinoe ManalonNo ratings yet

- Annual Pensioners Information Revalidation (Apir) Form: Pension TypeDocument1 pageAnnual Pensioners Information Revalidation (Apir) Form: Pension TypeJefferson Ballad67% (3)

- Deped School Form 137-ADocument4 pagesDeped School Form 137-APrince Yahwe Rodriguez100% (1)

- Appendix 29 - CASH RECEIPTS RECORDDocument1 pageAppendix 29 - CASH RECEIPTS RECORDPau PerezNo ratings yet

- BIR 1905 Form (Update or Transfer of RDO)Document4 pagesBIR 1905 Form (Update or Transfer of RDO)lily mayersNo ratings yet

- Basic Education Enrollment FormDocument4 pagesBasic Education Enrollment FormDwight Kayce VizcarraNo ratings yet

- MSRF (Hqp-pff-053)Document8 pagesMSRF (Hqp-pff-053)Angel PunzalanNo ratings yet

- Pag-IBIG Employer Remittance FormDocument4 pagesPag-IBIG Employer Remittance FormMatthew Niño0% (1)

- Downloadable Application Form For Pasig City ScholarsDocument1 pageDownloadable Application Form For Pasig City ScholarsReggie Joshua AlisNo ratings yet

- Member'S Data Form (MDF) : InstructionsDocument2 pagesMember'S Data Form (MDF) : InstructionsEloisa CornelNo ratings yet

- Resignation ChelDocument1 pageResignation ChelKezia Merilainen Fabriga100% (1)

- Pass Slip Pass Slip: Schools District of Calinog Ii Schools District of Calinog IiDocument1 pagePass Slip Pass Slip: Schools District of Calinog Ii Schools District of Calinog IiQueennie Mae Legada100% (1)

- FM GSIS OPS CPR 01 - Pensioners Request Form FillableDocument1 pageFM GSIS OPS CPR 01 - Pensioners Request Form FillableAttorney Rhy Jay100% (2)

- Sworn Declaration for JCYE Express Payment CenterDocument1 pageSworn Declaration for JCYE Express Payment CenterAidalyn Mendoza100% (1)

- HDMF Loan FormDocument2 pagesHDMF Loan FormDivina Gammoot100% (3)

- Union Bank Payroll Epaycard FormDocument2 pagesUnion Bank Payroll Epaycard FormFranzesca Vinoya33% (21)

- Official Business Form for Region VII Department of EducationDocument1 pageOfficial Business Form for Region VII Department of EducationFirst Name100% (2)

- Authorization Letter PhilHealth DavaoDocument1 pageAuthorization Letter PhilHealth DavaoIrvin CastilloNo ratings yet

- Sample Check Deposit Slip Withdrawal SlipDocument1 pageSample Check Deposit Slip Withdrawal SlipVevianJavierCervantes100% (1)

- Appendix 32 Disbursement VoucherDocument1 pageAppendix 32 Disbursement VoucherVerena Raga50% (2)

- Sykes Enrollment in Gcash AccountDocument1 pageSykes Enrollment in Gcash AccountJohn Mari Lloyd DaosNo ratings yet

- Form For Legal BeneficiaryDocument1 pageForm For Legal BeneficiaryErlinda Porcadilla100% (2)

- Reimbursement Expense ReceiptDocument1 pageReimbursement Expense ReceiptAlexie CarvajalNo ratings yet

- Membership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Document2 pagesMembership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Sevy D PoloyapoyNo ratings yet

- SLF002 Calamity Loan Application FormDocument2 pagesSLF002 Calamity Loan Application FormRoy NarapNo ratings yet

- PFF053 Member'SContributionRemittanceForm V03.1Document2 pagesPFF053 Member'SContributionRemittanceForm V03.1FA Marquez64% (11)

- Pag-Ibig LoanDocument2 pagesPag-Ibig LoanNicasio AlonzoNo ratings yet

- FLS020 HDMF Calamity Loan Application Form Aug 09 - 092809Document2 pagesFLS020 HDMF Calamity Loan Application Form Aug 09 - 092809appantaleon_gcdriveNo ratings yet

- SLF065 - Multi-Purpose Loan Application Form (Applicable To Imus Branch Members Only) PDFDocument2 pagesSLF065 - Multi-Purpose Loan Application Form (Applicable To Imus Branch Members Only) PDFlokuloku100% (2)

- HDMF Calamity Loan Application Form (Claf)Document2 pagesHDMF Calamity Loan Application Form (Claf)ema sofioNo ratings yet

- Pag Ibig01Document2 pagesPag Ibig01Jm LobigasNo ratings yet

- (For IISP Branch Only) : Application AgreementDocument2 pages(For IISP Branch Only) : Application AgreementRachel CabanlitNo ratings yet

- Calamity Loan Application Form (CLAF)Document2 pagesCalamity Loan Application Form (CLAF)Ayan VicoNo ratings yet

- CALAMITY LOAN Pag-IBIG Calamity Loan Application FormDocument2 pagesCALAMITY LOAN Pag-IBIG Calamity Loan Application FormAyan VicoNo ratings yet

- SLF066 CalamityLoanApplicationForm V03 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V03 PDFKram Tende AwanucavNo ratings yet

- SLF066 CalamityLoanApplicationForm V04Document2 pagesSLF066 CalamityLoanApplicationForm V04marta100% (4)

- SLF066 CalamityLoanApplicationForm V04 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V04 PDFLevyCastillo100% (3)

- Calamity Loan Application SummaryDocument2 pagesCalamity Loan Application SummaryReddy RentarNo ratings yet

- PAGIBIG CalamityLoanApplicationForm - V06Document3 pagesPAGIBIG CalamityLoanApplicationForm - V06michelleqborbeNo ratings yet

- EPaycard - Customer Account Opening Form - 2015Document1 pageEPaycard - Customer Account Opening Form - 2015Drw ArcyNo ratings yet

- Loan Application FormDocument2 pagesLoan Application FormAgape LabuntogNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V03Document2 pagesSLF065 MultiPurposeLoanApplicationForm V03Belle Adante100% (1)

- SLF065 MultiPurposeLoanApplicationForm V03Document2 pagesSLF065 MultiPurposeLoanApplicationForm V03Cheery Fernandez SumargoNo ratings yet

- Auto Loan Application Form For Individual and Sole PropietorshipsDocument1 pageAuto Loan Application Form For Individual and Sole PropietorshipsChristianNo ratings yet

- SLF066 CalamityLoanApplicationForm V05 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V05 PDFHakdog Longgadog100% (1)

- Https2Fwww Pagibigfund Gov Ph2Fdocument2Fpdf2Fdlforms2Fprovidentrelated2FDocument4 pagesHttps2Fwww Pagibigfund Gov Ph2Fdocument2Fpdf2Fdlforms2Fprovidentrelated2FKingNo ratings yet

- Calamity Loan Application FormDocument2 pagesCalamity Loan Application FormMervin BauyaNo ratings yet

- Nationalities TestDocument6 pagesNationalities TestalexcastilloNo ratings yet

- NameDocument1 pageNamealexcastilloNo ratings yet

- Bonifacio Residences Sample Computation: Option 1 Option 2 Option 1 Option 2Document1 pageBonifacio Residences Sample Computation: Option 1 Option 2 Option 1 Option 2alexcastilloNo ratings yet

- Globe Broadband ManualDocument49 pagesGlobe Broadband Manualalexcastillo83% (6)

- Korean NameDocument2 pagesKorean Namealexcastillo100% (1)

- Dir 300Document2 pagesDir 300alexcastillo100% (5)

- Device ControlDocument42 pagesDevice ControlalexcastilloNo ratings yet

- Event Control SystemDocument13 pagesEvent Control SystemalexcastilloNo ratings yet

- Canon Power Shot G9Document16 pagesCanon Power Shot G9alexcastillo100% (1)

- BenQ JoyBook R23Document50 pagesBenQ JoyBook R23alexcastillo100% (2)

- CHAPTER3 Foundations of Individual BehaviorDocument32 pagesCHAPTER3 Foundations of Individual BehaviorLynoj AbangNo ratings yet

- Disinfecting Water Wells Shock ChlorinationDocument3 pagesDisinfecting Water Wells Shock ChlorinationmayaNo ratings yet

- Design and Built-A4Document2 pagesDesign and Built-A4farahazuraNo ratings yet

- WSO 2022 IB Working Conditions SurveyDocument42 pagesWSO 2022 IB Working Conditions SurveyPhạm Hồng HuếNo ratings yet

- Indonesia Organic Farming 2011 - IndonesiaDOCDocument18 pagesIndonesia Organic Farming 2011 - IndonesiaDOCJamal BakarNo ratings yet

- ME JBP 70A Pen Dissolved Oxygen Meter PDFDocument1 pageME JBP 70A Pen Dissolved Oxygen Meter PDFpiknikmonsterNo ratings yet

- BIRADS Lexicon and Its Histopathological Corroboration in The Diagnosis of Breast LesionsDocument7 pagesBIRADS Lexicon and Its Histopathological Corroboration in The Diagnosis of Breast LesionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- M-LVDT: Microminiature Displacement SensorDocument2 pagesM-LVDT: Microminiature Displacement Sensormahdi mohammadiNo ratings yet

- PHAR342 Answer Key 5Document4 pagesPHAR342 Answer Key 5hanif pangestuNo ratings yet

- Lesson 1 CA 3Document13 pagesLesson 1 CA 3myndleNo ratings yet

- Acc101Q7CE 5 3pp187 188 1Document3 pagesAcc101Q7CE 5 3pp187 188 1Haries Vi Traboc MicolobNo ratings yet

- Cellular Basis of HeredityDocument12 pagesCellular Basis of HeredityLadyvirdi CarbonellNo ratings yet

- Calm Your Aggressive DogDocument58 pagesCalm Your Aggressive DogASd33475% (4)

- Proper Operating Room Decorum: Lee, Sullie Marix P. Maderal, Ma. Hannah Isabelle JDocument15 pagesProper Operating Room Decorum: Lee, Sullie Marix P. Maderal, Ma. Hannah Isabelle Jjoannamhay ceraldeNo ratings yet

- Aphasia PDFDocument4 pagesAphasia PDFRehab Wahsh100% (1)

- 2016.05.16 - Org ChartDocument2 pages2016.05.16 - Org ChartMelissaNo ratings yet

- Benefits and Limitations of Vojta ApproachDocument50 pagesBenefits and Limitations of Vojta ApproachAlice Teodorescu100% (3)

- 3 Types of Chemical BondsDocument12 pages3 Types of Chemical BondsSaediRisquéBriskeyNo ratings yet

- 3-Step Mindset Reset: Overcome Self-Doubt with Mel Robbins' TrainingDocument11 pages3-Step Mindset Reset: Overcome Self-Doubt with Mel Robbins' TrainingBožana RadošNo ratings yet

- Insects, Stings and BitesDocument5 pagesInsects, Stings and BitesHans Alfonso ThioritzNo ratings yet

- Intake Sheet SampleDocument1 pageIntake Sheet SampleRochelleNo ratings yet

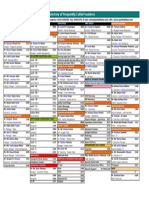

- Directory of Frequently Called Numbers: Maj. Sheikh RahmanDocument1 pageDirectory of Frequently Called Numbers: Maj. Sheikh RahmanEdward Ebb BonnoNo ratings yet

- EcoLettsandSOM, Dulvy Et Al 2004Document25 pagesEcoLettsandSOM, Dulvy Et Al 2004Nestor TorresNo ratings yet

- December - Cost of Goods Sold (Journal)Document14 pagesDecember - Cost of Goods Sold (Journal)kuro hanabusaNo ratings yet

- EEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanDocument3 pagesEEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanBELJUNE MARK GALANANNo ratings yet

- Practical Examination Marking Guideline Grade 12 Physical Science 2019 PDFDocument5 pagesPractical Examination Marking Guideline Grade 12 Physical Science 2019 PDFWonder Bee Nzama100% (1)

- Chapter 3 - CT&VT - Part 1Document63 pagesChapter 3 - CT&VT - Part 1zhafran100% (1)

- To The OneDocument8 pagesTo The OnePizzaCowNo ratings yet

- Tugas B InggrisDocument9 pagesTugas B InggrisDellyna AlmaNo ratings yet

- Gate Installation ReportDocument3 pagesGate Installation ReportKumar AbhishekNo ratings yet