Professional Documents

Culture Documents

CH 4 Solman 2012

Uploaded by

Ms. FitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 4 Solman 2012

Uploaded by

Ms. FitCopyright:

Available Formats

CHAPTER 4

THE STATEMENT OF COMPREHENSIVE INCOME

AND THE STATEMENT OF CHANGES IN EQUITY

PROBLEMS

4-1. (LAS VEGAS COMPANY)

Capital, December 31, 2012

Total assets

Less total liabilities

Capital, December 31, 2011

Total assets

Less total liabilities

Increase in capital

Withdrawals by the owner

Additional investments by the owner

Profit

P1,218,000

276,000

P 970,000

202,000

4-2. (BELLAGIO TRADING COMPANY)

Debit changes

Increase in assets

Decrease in liabilities

Credit changes

Increase in share capital

Increase in share premium

Increase (decrease) in retained earnings

Dividends

Profit for the year

P600,000

250,000

P400,000

125,000

4-3. (VENETIAN COMPANY)

Raw material purchases

Increase in raw materials inventory

Raw materials used

Direct labor

Factory overhead

Total manufacturing costs

Increase in work in process inventory

Cost of goods manufactured

Decrease in finished goods

Cost of goods sold for 2008

4-4.

P942,000

768,000

P174,000

250,000

(100,000)

P324,000

P850,000

525,000

P325,000

120,000

P445,000

P430,000

(15,000)

P415,000

200,000

300,000

P915,000

(20,000)

P895,000

35,000

P930,000

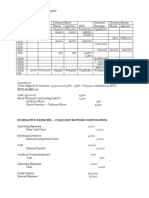

(MGM COMPANY)

Cost of goods manufactured

Finished goods, beginning

Finished goods, end

Cost of goods sold

Gross profit

Sales

P2,720,000

380,000

(418,000)

P2,682,000

962,000

P3,644,000

18

Chapter 4 The Statement of Comprehensive Income

and the Statement of Changes in Equity

4-5.

(MANDALAY COMPANY)

Let x = cost of sales

.30x = .18 sales

x = .18/.30 sales

x = .60 sales

Therefore, 100% - 60% - 18% - 12% = 10%

Sales = 280,000/10%; Sales = 2,800,000

Cost of sales = 60% x 2,800,000 = 1,680,000

Income tax is ignored.

4-6.

(EXCALIBUR PRODUCTS)

Excalibur Products

Income Statement

For the Year Ended December 31, 2012

Sales

Cost of sales

Beginning inventory

Purchases

Ending inventory

Gross profit

Selling expenses

General and administrative expenses

Profit before income tax

Income tax

Profit

P895,000

P126,000

466,250

(189,500)

(402,750)

P492,250

(161,100)

(128,880)

P202,270

(60,681)

P141,589

4-7. (LUXOR COMPANY)

Requirement a (nature of expense method)

Luxor Company

Statement of Comprehensive Income

For Year Ended December 31, 2012

Note

PROFIT OR LOSS

Net sales revenue

Rent revenue

Total revenues

Operating Expenses

Net purchases

Increase in inventory

Delivery expense

Advertising expense

Salaries and commissions

Depreciation expense

Supplies expense

Bad debts expense

Insurance and taxes

Other operating expenses

Total Operating Expenses

(11)

P3,359,000

105,000

P3.464.000

(12)

(13)

1,762,000

(105,000)

77,000

170,000

502,000

241,000

75,000

27,000

85,000

170,000

3,004,000

(14)

(15)

(16)

(17)

19

Total

Chapter 4 The Statement of Comprehensive Income

and the Statement of Changes in Equity

Profit from Operations

Interest expense

Profit before income tax from continuing operations

Income tax expense

Profit from continuing operations

Discontinued operations, net of tax

(18)

Profit

OTHER COMPREHENSIVE INCOME

Unrealized Gains on Investments at fair value through other

comprehensive income, net of P24,000 income tax

Actuarial Gains Taken to Equity, net of P12,000 income

tax

Total Other Comprehensive Income

TOTAL COMPREHENSIVE INCOME

P460,000

( 37,000)

P423,000

126,900

P296,100

(245,000)

P 51,100

P 56,000

28,000

P 84,000

P135,100

Notes to Financial Statements (after presenting notes for basis of presentation and

summary of significant accounting policies)

Note11 Net sales revenue

Sales

Less sales discounts

Sales returns and allowances

Net sales revenue

P3,529,000

P 49,000

121,000

Note 12 Net purchases

Purchases

Add freight-in

Total

Less purchase discounts

Purchase returns and allowances

Net purchases

170,000

P3,359,000

P1,730,000

135,000

P1,865,000

P41,000

62,000

103,000

P1,762,000

Note 13 Increase in inventory

Inventory, December 31

Inventory, January 1

Increase in inventory

P446,000

341,000

P105,000

Note 14 Salaries and commissions

Sales commissions and salaries

Office salaries

Total salaries and commissions

P182,000

320,000

P502,000

Note 15 Depreciation expense

Depreciation Buildings and office equipment

Depreciation Store equipment

Total depreciation expense

P145,000

96,000

P241,000

Note 16 Supplies expense

Store supplies expense

Office supplies expense

Total supplies expense

P56,000

19,000

P75,000

20

Chapter 4 The Statement of Comprehensive Income

and the Statement of Changes in Equity

Note 17 Other operating expenses

Loss on sale of equipment

Loss from typhoon

Total other operating expenses

P 50,000

120,000

P170,000

Note 18 Discontinued Operations

Revenues

Expenses

Profit (loss) before income tax

Income tax benefit

Profit (loss) from operations of discontinued operations

Loss on sale of assets, net of tax benefit of P60,000

Discontinued Operations

P 900,000

(1,050,000)

P (150,000)

45,000

P (105,000)

(140,000)

P (245,000)

(function of expense method)

Luxor Company

Statement of Comprehensive Income

For Year Ended December 31, 2012

Net sales revenue

Cost of goods sold

Gross profit

Other Operating Income

Rent Revenue

Total Income

Operating Expenses

Selling Expenses

General and Administrative Expenses

Other Operating Expenses

Total Operating Expenses

Profit from Operations

Interest expense

Profit before income tax from continuing operations

Income tax expense

Profit from continuing operations

Discontinued operations, net of tax

Profit

OTHER COMPREHENSIVE INCOME

Unrealized Gains on Investments at fair value through

other comprehensive income, net of P24,000 income

tax

Actuarial Gains Taken to Equity, net of P12,000 income

tax

Total Other Comprehensive Income

TOTAL COMPREHENSIVE INCOME

Note

(11)

(12)

Total

P3,359,000

1,657,000

P1,702,000

105,000

P 1,807,000

(12)

(13)

(14)

(18)

P581,000

596,000

170,000

P1,347,000

P460,000

( 37,000)

P423,000

126,900

P296,100

(245,000)

P 51,100

P 56,000

28,000

P 84,000

P135,100

Notes to Financial Statements (after presenting notes for basis of presentation and summary

of significant accounting policies)

21

Chapter 4 The Statement of Comprehensive Income

and the Statement of Changes in Equity

Note 11 Net sales revenue

Sales

Less sales discounts

Sales returns and allowances

Net sales revenue

P3,529,000

P 49,000

121,000

Note 12 Cost of goods sold

Inventory, January 1

Purchases

Add freight-in

Total

Less purchase discounts

Purchase returns and allowances

Cost of goods available for sale

Less Inventory, December 31

Cost of goods sold

170,000

P3,359,000

P341,000

P1,730,000

135,000

P1,865,000

(41,000)

(62,000)

1,762,000

P2,103,000

446,000

P1,657,000

Note 13 Selling expenses

Sales commissions and salaries

Store supplies expense

Delivery expense

Advertising expense

Depreciation expense store equipment

Total selling expenses

P182,000

135,000

77,000

170,000

96,000

P581,000

Note 14 General and Administrative expenses

Bad debts expense

Office supplies expense

Insurance and taxes

Office salaries

Depreciation buildings and office equipment

Total administrative expenses

P27,000

19,000

85,000

320,000

145,000

P596,000

Note 15 Other operating expenses (continuing operations)

Loss on sale of equipment

Loss from typhoon

Total other operating expenses

P 50,000

120,000

P170,000

Note 16 Discontinued Operations

Revenues

Expenses

Profit (loss) before income tax

Income tax benefit

Profit (loss) from operations of discontinued operations

Loss on sale of assets, net of tax benefit of P60,000

Discontinued Operations

22

P 900,000

(1,050,000)

P (150,000)

45,000

P (105,000)

(140,000)

P (245,000)

Chapter 4 The Statement of Comprehensive Income

and the Statement of Changes in Equity

Requirement b

Luxor Company

Statement of Changes in Equity

For the Year Ended December 31, 2012

Ordinary

Share

Reserves

Balances, January 1

P700,000 P660,000

Correction of prior years income due to

understated depreciation, net of

P54,000 income tax

Restated balances, January

P700,000 P660,000

Issuance of ordinary shares

100,000

40,000

Comprehensive Income

84,000

Dividends declared

Balances, December 31

P800,000 P784,000

Retained

Earnings

P1,785,000

(126,000)

P1,659,000

51,100

(60,000)

P1,650,100

Total

P3,145,000

(126,000)

P3,019,000

140,000

135,100

(60,000)

P3,234,100

Reserves at January 1 included the share premium (P610,000) and unrealized gain on investments

carried at fair value through OCI (P50,000). The amounts may be reported in separate columns.

4-8.

(TRUMP COMPANY)

a.

Revenues

Selling and Administrative Expenses

Disposal costs

Operating Profit (Loss) before income tax

Income tax benefit

Operating Profit (loss)

P5,000,000

5,080,000

(75,000)

P(155,000)

46,500

P(108,500)

Fair value less cost to sell is P830,000 (980,000 150,000) which is greater than the

carrying amount of P800,000.

b.

Revenues

Selling and Administrative Expenses

Disposal costs

Operating Profit (Loss) before income tax

Income tax benefit

Operating Profit (loss)

Loss from measurement to NRV, net of income tax

benefit of P54,000

Discontinued Operations

P5,000,000

5,080,000

(75,000)

P(155,000)

46,500

P(108,500)

(126,000)

P(234,500)

Fair value less cost to sell is P620,000 which is P180,000 lower than the carrying amount

of P800,000, which is reported as loss from measurement to NRV.

23

Chapter 4 The Statement of Comprehensive Income

and the Statement of Changes in Equity

4-9. (CAESARS PALACE COMPANY)

Caesars Palace Company

Statement of Changes in Equity

For the Years Ended December 31, 2012 and 2011

January 1, 2011, balances as previously reported

Prior period adjustment

2010 expense charged erroneously to Equipment,

net of income tax of P24,000

January 1, 2011 balances, as restated

2011 Changes

Profit

Dividends

Balances, December 31, 2011

2012 Changes

Profit

Dividends

Balances, December 31, 2012

Share

Capital

P2,000,000

Retained

Earnings

P1,500,000

Total

P3,500,000

P2,000,000

(56,000)

P1,444,000

(56,000)

P3,444,000

P2,000,000

514,000*

(200,000)

P1,758,000

514,000

(200,000)

P3,758,000

P2,000,000

750,000

(500,000)

P2,008,000

750,000

(500,000)

P4,008,000

Note: The solution above disregards the effect of income tax.

2011 Restated profit = P500,000 + depreciation erroneously recognized (20,000 x 70%).

4-10.

(TUSCANY COMPANY)

Tuscany Company

Comparative Income Statements

For the Years Ended December 31, 2012 and 2011

2012

P3,000,000

(1,420,000)

1,580,000

(350,000)

(260,000)

P970,000

(291,000)

P 679,000

Sales

Cost of goods sold

Gross profit

Selling expenses

General and administrative expenses

Profit before income tax

Income tax

Profit

Ending inventory, 2011, as reported

Cost of goods sold, as reported in 2011

Goods available for sale

Beginning inventory, as reported in 2011

Purchases in 2011

P 355,000

1,140,000

P1,495,000

250,000

P1,245,000

Purchases

P1,245,000

Inventory, beg (weighted average)

210,000

Inventory, end (weighted average)

(312,000)

Restated Cost of sales in 2011, weighted average P1,143,000

24

2011

P2,540,000

(1,143,000)

1,397,000

(210,000)

(220,000)

P967,000

(290,100)

P 676,900

Chapter 4 The Statement of Comprehensive Income

and the Statement of Changes in Equity

Tuscany Company

Statement of Changes in Equity

For the Years Ended December 31, 2012 and 2011

Share

Capital

P1,000,000

Retained

Earnings

P 600,000

Total

January 1, 2011, balances as previously reported

P1,600,000

Cumulative effect of changing from FIFO to weighted

average method of inventory costing, net of income

tax of P12,000*

(28,000)

(28,000)

January 1, 2011 balances, as restated

P1,000,000

P572,000

P1,572,000

2011 Changes

Profit

676,900

676,900

Dividends

(400,000)

(400,000)

December 31, 2011 balances

P1,000,000

P848,900

P1,848,900

2012 Transactions

Profit

679,000

679,000

Balances, December 31, 2012

P1,000,000

P1,527,900

P2,527,900

* based on 30% income tax rate

Cumulative effect shown on the statement of changes in equity

Difference in beginning inventory of 2011 (250,000-210,000)

P40,000

Applicable tax (30% x 40,000)

12,000

Net adjustment (deduction) from retained earnings, January 1, 2011

P28,000

The cumulative effect, however, is taken up in the books during 2012, when the change was

decided upon by the management. The following 2012 entry: is made:

Retained earnings

30,100

Income tax payable

12,900

Inventory, beginning (or cost of sales)

43,000

Thus, the retained earnings at December 31, 2012 is P879,000 - 30,100 + 679,000 = P1,527,900.

4-11. (RIVIERA COMPANY)

Riviera Company

Comparative Statement of Comprehensive Income

For Year Ended December 31, 2012 and 2011

(In million pesos)

Revenue

Raw materials and consumables used

Employee benefit expense

Depreciation and amortization

Other expenses

Income from operations

Finance costs

Profit before income tax

Income tax expense

Profit for the year

Other comprehensive income

Unrealized gains (losses) on investments measured at fair

value through other comprehensive income, net of

applicable tax

Total comprehensive income

25

2012

P2,000

(850)

(100)

(40)

(2)

P1,008

(4)

P1,004

(301.2)

P702.8

2011

P1,800

(745)

(95)

(40)

(3)

P917

(5)

P912

(273.6)

P638.4

.56

P703.36

(.84)

P637.56

Chapter 4 The Statement of Comprehensive Income

and the Statement of Changes in Equity

MULTIPLE CHOICE

Theory

MC1

MC2

MC3

MC4

MC5

MC6

D

C

D

A

A

B

Problems

MC25 D

MC26

MC27

MC28

MC29

MC30

MC31

MC32

A

A

D

B

B

MC33

MC34

MC35

MC36

MC37

MC38

MC39

MC40

MC41

C

C

B

C

C

B

D

B

D

MC42

MC43

MC44

MC45

D

C

B

MC46

MC47

MC48

MC49

MC50

MC51

D

D

C

B

A

B

MC52

MC7

MC8

MC9

MC10

MC11

MC12

A

A

A

D

D

B

MC13

MC14

MC15

MC16

MC17

MC18

B

B

A

D

B

D

MC19

MC20

MC21

MC22

MC23

MC24

B

B

B

D

C

C

210,000 50,000 = 160,000; 260,000 60,000 = 200,000

200,000 160,000 = 40,000 + 12,000 50,000 = 78,000 LOSS

225,000 + 100,000 + 10,000 + 15,000 = 350,000;

150,000 + 50,000 + 20,000 + 100,000 + 15,000 = 335,000

350,000 335,000 = 15,000 + 25,000 125,000 = 85,000 LOSS

21,000+25,00010,000+70,000+5,000(5,000 x 8)+15,00050,0001,000

20,000=15,000

150,000 + 80,000 + (220,000 x ) + 140,000 = 480,000

170,000 + (240,000 x ) = 290,000

150,000 x 8 = 1,200,000 + 80,000 = 1,280,000

272,000 + 36,000 41,600 = 266,400 + 76,800 = 343,200

.125/.25 = .50; 100% - 50% - 12.5% - 17.5% - 5% = 15%

750,000/15% = 5,000,000 x 50% = 2,500,000

5,800,000(4,800,000+650,000550,000)=900,000(7.5%,x900,000)=532,500

.15/.25=60%; 100%-60%-10% - 15% - 3% = 12%; 480,000/12% = 4.0M

1,080000/80% = 1,350,000/90% = 1,500,000 x 30% = 450,000

3,500,000/70% = 5,000,000

5M-3.5M=1.5M (60% x 1.5M) = 600,000

3,500,000 500,000 = 3,000,000

600,000+900,000 1,000,000 = 500,000

P1,550,000 P1,100,000 = 450,000

450,000 + 600,000 250,000 = 800,000;

ending inventory before write off is P100,000 + 150,000 = 250,000

5,000,000 + 28,000 + 520,000 280,000 500,000 720,000 110,000 + 16,000

+ 100,000400,000+55,00070,00050,00080,000 120,000 450,000 = 419,000

500,000 + (400,000 X 60%) + 70,000 + 120,000 = 930,000

450,000 + 2,800,000 + 80,000 520,000 = 2,810,000

Cost of sales = 20/50 = 40%

100%-40% = 60% - 20%-5% = 35% Profit before tax

2,450,000/70% = 3.5M; 3.5M/35% = 10M;10M x 40% = 4M CGS x 130%=5.2M

2,000,000 + 100,000 2,100,000 = 0

0 + gain of P1,000,000 on disposal income tax of P300,000 = 700,000

(3,500,000 500,000) x 70% = 2,100,000

(360,000 320,000) x 70% = P28,000

400,000 84,000 + 40,000 4,000 280,000 = 72,000; 72,000 x 70% = 50,400

Total profit = P50,400 + (40,000 x 70%) =78,400

1,600,000 + (16,000 x 70%) (24,000 x 70% )+ 78,400 ) 12,000 = P1,660,800

400,000 84,000 + 40,000 4,000 280,000 + 40,000 = 112,000

112,000 x 70% = 78,400

26

You might also like

- Basic Accounting and Financial Management GuideDocument163 pagesBasic Accounting and Financial Management GuideBernard Owusu100% (1)

- Financial Accounting Workbook Version 2Document90 pagesFinancial Accounting Workbook Version 2Honey Crisostomo EborlasNo ratings yet

- Attempt History: Due Mar 16 at 19:45 Available Mar 16 at 17:45 - Mar 16 at 19:45 1 / 1 PtsDocument5 pagesAttempt History: Due Mar 16 at 19:45 Available Mar 16 at 17:45 - Mar 16 at 19:45 1 / 1 PtsmlaNo ratings yet

- Fabm2-3 Statement of Changes in EquityDocument24 pagesFabm2-3 Statement of Changes in EquityJacel GadonNo ratings yet

- Statement of Changes in Equity MCQDocument4 pagesStatement of Changes in Equity MCQMia CatanNo ratings yet

- Chapter 9 - Shareholders' Equity AnalysisDocument4 pagesChapter 9 - Shareholders' Equity AnalysisJudy Ann Acruz100% (1)

- 9706 International Accounting Standards (For Examination From 2023)Document58 pages9706 International Accounting Standards (For Examination From 2023)waheeda17No ratings yet

- Final Departmental Exam - Acco 20173 - Business Tax - 1St Semester AY 2020-2021Document30 pagesFinal Departmental Exam - Acco 20173 - Business Tax - 1St Semester AY 2020-2021Josephine CastilloNo ratings yet

- Problem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Document6 pagesProblem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Actg SolmanNo ratings yet

- Financial Statement Analysis and InterpretationDocument69 pagesFinancial Statement Analysis and InterpretationCharisa ProvidoNo ratings yet

- AE4 - Activity 5ADocument2 pagesAE4 - Activity 5AMaricar PinedaNo ratings yet

- ch3 PDFDocument49 pagesch3 PDFMekanchha Dhakal100% (2)

- Answers 2014 Vol 3 CH 4 PDFDocument8 pagesAnswers 2014 Vol 3 CH 4 PDFLian Blakely CousinNo ratings yet

- Chapter 7 - Calculating Earnings Per Share and Diluted EPSDocument5 pagesChapter 7 - Calculating Earnings Per Share and Diluted EPSthenikkitr0% (1)

- This Study Resource Was: Mr. X Has The Following Data On His Passive Income Earned During 2019Document1 pageThis Study Resource Was: Mr. X Has The Following Data On His Passive Income Earned During 2019Anne Marieline BuenaventuraNo ratings yet

- Chapter 12-14Document18 pagesChapter 12-14Serena Van Der WoodsenNo ratings yet

- Answer - ELEC 001Document2 pagesAnswer - ELEC 001Kris Van HalenNo ratings yet

- Buang Ang TaxDocument17 pagesBuang Ang TaxEdeksupligNo ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Activity 2Document5 pagesActivity 2Lala FordNo ratings yet

- Module 4 - Going Concern Asset Based Valuation - Comparable Company AnalysisDocument3 pagesModule 4 - Going Concern Asset Based Valuation - Comparable Company AnalysisLiaNo ratings yet

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- San Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimDocument5 pagesSan Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimAllyssa Kassandra LucesNo ratings yet

- Accounting Errors CorrectionDocument5 pagesAccounting Errors CorrectionandreaNo ratings yet

- TAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsDocument1 pageTAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsGie MaeNo ratings yet

- MasDocument20 pagesMasMarie AranasNo ratings yet

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- Abc Stock AcquisitionDocument13 pagesAbc Stock AcquisitionMary Joy AlbandiaNo ratings yet

- Maximizing shareholder value vs satisfying customersDocument4 pagesMaximizing shareholder value vs satisfying customersIsha LarionNo ratings yet

- Vdocuments - MX - Answers Chapter 3 Vol 2 RvsedDocument13 pagesVdocuments - MX - Answers Chapter 3 Vol 2 RvsedmirayNo ratings yet

- ACC104: Debt Restructuring Problems (IFRS vs US GAAPDocument1 pageACC104: Debt Restructuring Problems (IFRS vs US GAAPMiles SantosNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Advanced Accounting PDocument4 pagesAdvanced Accounting PMaurice Agbayani100% (1)

- Business Combinations ExplainedDocument8 pagesBusiness Combinations ExplainedLabLab ChattoNo ratings yet

- Partnership FormationDocument13 pagesPartnership FormationGround ZeroNo ratings yet

- Defined Benefit Plan-Midnight CompanyDocument2 pagesDefined Benefit Plan-Midnight CompanyDyenNo ratings yet

- Solution Chapter 10Document9 pagesSolution Chapter 10KarjonNo ratings yet

- After Securing Lease Commitments From Several Major Stores LoboDocument1 pageAfter Securing Lease Commitments From Several Major Stores LoboM Bilal Saleem0% (1)

- Chapter 19 - AnswerDocument31 pagesChapter 19 - AnswerAgentSkySkyNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- AccountingDocument3 pagesAccountingrenoNo ratings yet

- Feu Mas Midterm Summer 2019Document27 pagesFeu Mas Midterm Summer 2019louise carinoNo ratings yet

- Since Accountancy Is A Quota CourseDocument1 pageSince Accountancy Is A Quota Courselindsay boncodinNo ratings yet

- FC Trans Rem - NotesDocument3 pagesFC Trans Rem - NotesVenz LacreNo ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Cordillera Career Development College problems and solutionsDocument10 pagesCordillera Career Development College problems and solutionsapatosNo ratings yet

- Case Analysis: A. Relevant FactsDocument4 pagesCase Analysis: A. Relevant FactsVahia Ralliza DotarotNo ratings yet

- Business Combination.: Pfrs 3Document33 pagesBusiness Combination.: Pfrs 3Reginald Valencia100% (1)

- Kaladkaren Corporation Bankruptcy Liquidation StatementsDocument51 pagesKaladkaren Corporation Bankruptcy Liquidation StatementsrenoNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Compre ExamDocument11 pagesCompre Examena20_paderangaNo ratings yet

- CONSOLIDATED FINANCIAL STATEMENTS & INTERCOMPANY TRANSACTIONSDocument4 pagesCONSOLIDATED FINANCIAL STATEMENTS & INTERCOMPANY TRANSACTIONSJanella CastroNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Essay on Activity-Based Costing for Ingersol DraperiesDocument13 pagesEssay on Activity-Based Costing for Ingersol DraperiesLhorene Hope DueñasNo ratings yet

- Chapter Exercises DeductionsDocument11 pagesChapter Exercises DeductionsShaine KeefeNo ratings yet

- Leonila Rivera MGT9Document1 pageLeonila Rivera MGT9Asvag OndaNo ratings yet

- 4 5 AnswersDocument4 pages4 5 AnswersKesselNo ratings yet

- This Study Resource Was: Solutions To Assigned Problems & ExercisesDocument3 pagesThis Study Resource Was: Solutions To Assigned Problems & ExercisesMikaela Amigan EvangelistaNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- UNDERSTANDING INTERCOMPANY TRANSACTIONSDocument2 pagesUNDERSTANDING INTERCOMPANY TRANSACTIONSMark Lyndon YmataNo ratings yet

- Chapter 09 - InventoryDocument29 pagesChapter 09 - InventoryMkhonto XuluNo ratings yet

- Income Statement and OCI - Exercises - AnswerDocument3 pagesIncome Statement and OCI - Exercises - AnswerYstefani ValderamaNo ratings yet

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Notes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1Document2 pagesNotes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1JonellNo ratings yet

- Korbel Foundation College Inc.: (Messenger)Document2 pagesKorbel Foundation College Inc.: (Messenger)Jeanmay CalseñaNo ratings yet

- Financial Statement 2014Document9 pagesFinancial Statement 2014shahid2opuNo ratings yet

- ACTG240 - Ch01Document44 pagesACTG240 - Ch01xxmbetaNo ratings yet

- Statement of Changes in EquityDocument2 pagesStatement of Changes in EquityEllaine LariritNo ratings yet

- Megaworld 2nd Quarter 2019 Financial ReportDocument31 pagesMegaworld 2nd Quarter 2019 Financial ReportRyan CervasNo ratings yet

- Seminar 2-3Document8 pagesSeminar 2-3Nguyen Hien0% (1)

- 页面提取自-IMW 9781292086262 v2 PDFDocument8 pages页面提取自-IMW 9781292086262 v2 PDFKatherine HuNo ratings yet

- Chapter 5 Statement of Changes in EquityDocument4 pagesChapter 5 Statement of Changes in Equityellyzamae quiraoNo ratings yet

- Example of The Statement of EquityDocument2 pagesExample of The Statement of EquityLaston MilanziNo ratings yet

- A Level Accounting (9706) IAS Booklet v1 0Document58 pagesA Level Accounting (9706) IAS Booklet v1 0Mei Yi YeoNo ratings yet

- Lesson 3A Investments: ContentsDocument19 pagesLesson 3A Investments: ContentsSimon PeterNo ratings yet

- HW On Statement of Changes in EquityDocument2 pagesHW On Statement of Changes in EquityCharles TuazonNo ratings yet

- Laporan Keuangan BOLT 31-12-2020Document137 pagesLaporan Keuangan BOLT 31-12-2020Chelsea SofiaNo ratings yet

- Vertical CFS Tutorial Q1-3Document10 pagesVertical CFS Tutorial Q1-3Aen DayahNo ratings yet

- FinAcc3 Chap4Document9 pagesFinAcc3 Chap4Iyah AmranNo ratings yet

- Maynard Solutions Ch15Document27 pagesMaynard Solutions Ch15Anton VitaliNo ratings yet

- Consolidated Accounts QuestionsDocument10 pagesConsolidated Accounts QuestionsGiedrius SatkauskasNo ratings yet

- Financial Statement (Types)Document23 pagesFinancial Statement (Types)Prabir Kumer RoyNo ratings yet

- Statement of Changes in EquityDocument8 pagesStatement of Changes in EquityGonzalo Jr. RualesNo ratings yet

- Lkas1 Presentation of Financial StatementsDocument21 pagesLkas1 Presentation of Financial StatementssamaanNo ratings yet

- Lesson 3 - The Statement of Changes in Equity - ActivityDocument2 pagesLesson 3 - The Statement of Changes in Equity - ActivityEmeldinand Padilla MotasNo ratings yet

- WatatapsDocument29 pagesWatatapsjessa mae zerdaNo ratings yet

- Annual Report 2018Document467 pagesAnnual Report 2018Tasneef ChowdhuryNo ratings yet

- Complete Worksheet of Mod 1-Final Accounts of CompaniesDocument10 pagesComplete Worksheet of Mod 1-Final Accounts of CompaniesNaomi SaldanhaNo ratings yet