Professional Documents

Culture Documents

Understanding RESPA Reform

Uploaded by

Federal Title & Escrow CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Understanding RESPA Reform

Uploaded by

Federal Title & Escrow CompanyCopyright:

Available Formats

Understanding

RESPA Reform

It’s your business

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Sponsored by Federal Title

• Independence

• Value

• Technology

• Leading the pack since 1996

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

New RESPA Rule

• Transparency

• Accountability

• Reliability

• Federal Title’s role

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Transparency

• Consumer protection

• Up-front disclosure

• Eliminate surprises, “hidden fees”

• Federal Title’s approach all along:

• Guaranteed quote

• REAL Credit™ Program

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Accountability

• For lenders, precision is more vital than ever.

• Penalties

• Closing delays

• For title companies, accuracy is key.

• Tolerance violations

• Federal Title welcomes new RESPA rule

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Reliability

• Title service providers MUST deliver quotes:

• Instantly

• Accurately

• Efficiently

• Federal Title takes it a step further, introducing:

• ‘Zero Tolerance’ Guarantee – NEW!

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

‘Zero Tolerance’ Guarantee

• Online settlement orders comply with Good

Faith Estimate tolerance requirements.

• If the Order and final HUD-1 differ, Federal Title

will indemnify the lender for tolerance violations.¹

• Online orders only

• Up to 30 days after closing

¹ Full details coming in December.

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Now Playing:

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

RESPA Background

• RESPA reform going on since 1992

• Never without controversy, as proposed

changes typically pit settlement service

providers against each other

• 2002: when HUD introduced a proposed rule

calling for a guaranteed mortgage package

• 2004: Settlement service industry led

movement to have the rule withdrawn

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

RESPA Background (cont.)

• 2005: HUD conducted a series of roundtable

discussions with industry representatives, trade

associations and consumer groups

• March 14, 2008: HUD published its proposed

RESPA rule and received around 12,000 public

comments in response to the proposed rule

• Nov. 17, 2008: HUD published its final rule

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Main Components

• 3-page Good Faith Estimate

• Controversial YSP disclosure

• Tolerance limitations on settlement charges

• 3-page HUD-1 settlement statement

• Average charges

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate

• Centerpiece of RESPA reform

• Goal was greater clarity and transparency

• Only HUD could simplify the process by taking

a 1-page GFE and turning it into 3 pages

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate

• Provide a GFE within 3 days of receiving an

“application”

• Settlement charges must remain open for 10

business days

• Initial interest rate is available until specified

date

• Limits GFE fees to the cost of a credit report

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 1

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 1

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 1

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Disclosure of Yield Spread Premiums

• A YSP is disclosed as a “credit” to the lender

or broker’s origination charge

• Discount points are disclosed as a “charge,”

which is added to the lender or broker’s

“origination charge”

• HUD includes comparison chart on Page 3 of

final GFE

• Lender’s completion of chart is optional

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Hypotheticals

Par interest rate = 6%

Total origination fee = $1,500

3 Possibilities

i. Loan closes at par rate

$1,500 origination fee

ii. Loan closes at 6.5% interest rate

$1,500 origination fee to lender

$2,000 YSP to mortgage broker

iii. Loan closes below par at 5.5% rate

Borrower charged $2,000 in discount points

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 2

1,500

X 6 0

1,500

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 2

3,500

X 2,000 6.5 -2,000

1,500

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 2

1,500

X 2,000 5.5 2,000

3,500

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

GFE – Yield Spread Premium Litigation

• Dec. 19, 2008: NAMB sues HUD

• Sought permanent injunction

• Claim rule is

• Arbitrary and capricious

• Violates APA

• Unlevel playing field = lower fees

• July 2009: Court denies NAMB request

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 2

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 2

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate - Tolerances

• 3 buckets of settlement charges

• Fixed fees

• 10% tolerance

• No restrictions

• Absent “changed circumstances,” cannot

provide new GFE

• HUD gives lenders 30-day cure period

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 3

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 3

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Good Faith Estimate – Page 3

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

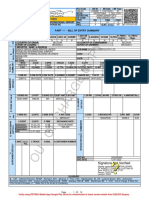

HUD-1 Settlement Statement

• Modifies Page 2 of HUD-1 to compare final

settlement charges with the GFE

• Includes “(from GFE #_)” next to itemized

charges

• Uses language consistent with GFE

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

HUD-1 (cont.)

• Groups previously itemized lender, title

insurance charges into single fees

• Breaks out settlement fee from bundled

title services fee

• Itemizes title agent’s and title underwriter’s

portions of premium

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

HUD-1 Settlement Statement – Page 1

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

HUD-1 Settlement Statement – Page 2

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

HUD-1 Settlement Statement – Page 2

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

HUD-1 Settlement Statement – Page 3

• Adds Page 3 to the HUD-1

• Requires comparison chart between GFE

and final settlement charges on HUD-1

• Includes a summary of loan terms

• Replaces the proposed closing script

• Obligates lender to supply settlement agent

with sufficient information to complete Page 3

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

HUD-1 Settlement Statement – Page 2

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

HUD-1 Settlement Statement – Page 2

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Average Charges

• Final rule permits any settlement service

provider to use average charges for settlement

services obtained from third parties

• Average charge not allowed for services

that are priced based on loan amount or

price of home, or for a provider’s own

internal charges

• This is optional – rule doesn’t require use of

average charges

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Average Charges (cont.)

• No specific method prescribed to determine

average charges

• Must be calculated every 6 months

• Average charge must be used for every

transaction within a specific class of

transactions

• If average charge used, must retain

documentation of calculation for 3 years

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Effective Dates

• New GFE and HUD-1 forms go into effect

January 1, 2010

• Average charges went into effect

January 16, 2009

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Questions?

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Thanks for your attention!

Amy and Matt Bales

Federal Title & Escrow Company

4000 Ponce de Leon Blvd.

Suite 470

Coral Gables, FL, 33146

QUESTIONS@FEDERALTITLE.COM

305-777-0211 (Phone)

305-375-3577 (Fax)

www.miami.federaltitle.com

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

Please keep in touch …

Amy and Matt Bales

Federal Title & Escrow Company

4000 Ponce de Leon Blvd.

Suite 470

Coral Gables, FL, 33146

QUESTIONS@FEDERALTITLE.COM

305-777-0211 (Phone)

305-375-3577 (Fax)

www.miami.federaltitle.com

Federal Title &

Escrow Company www.miami.federaltitle.com RESPA Reform | 04 Nov 2009

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- GCAAR Regional Sales ContractDocument10 pagesGCAAR Regional Sales ContractFederal Title & Escrow CompanyNo ratings yet

- Maryland Transfer and Recordation Tax Table (2020)Document2 pagesMaryland Transfer and Recordation Tax Table (2020)Federal Title & Escrow CompanyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MAIN PPT Business Ethics, Corporate Governance & CSRDocument24 pagesMAIN PPT Business Ethics, Corporate Governance & CSRrajithaNo ratings yet

- GCAAR Form 1316Document2 pagesGCAAR Form 1316Federal Title & Escrow CompanyNo ratings yet

- DC Homestead Deduction Application 2020Document2 pagesDC Homestead Deduction Application 2020Federal Title & Escrow CompanyNo ratings yet

- ASSIGNMENT 3 - Evaluating A Single ProjectDocument9 pagesASSIGNMENT 3 - Evaluating A Single ProjectKhánh Đoan Lê ĐìnhNo ratings yet

- DC MD Agents Cheats SheetDocument2 pagesDC MD Agents Cheats SheetFederal Title & Escrow CompanyNo ratings yet

- DC Tax Abatement ApplicationDocument9 pagesDC Tax Abatement ApplicationFederal Title & Escrow CompanyNo ratings yet

- Closing Disclosure Form (Sample)Document5 pagesClosing Disclosure Form (Sample)Federal Title & Escrow Company100% (1)

- DC Tax Abatement Form Oct 2020Document9 pagesDC Tax Abatement Form Oct 2020Federal Title & Escrow CompanyNo ratings yet

- DC First Time Home Buyer Program (HPAP) TableDocument1 pageDC First Time Home Buyer Program (HPAP) TableFederal Title & Escrow CompanyNo ratings yet

- MD Homestead Deadline Is Dec. 31Document3 pagesMD Homestead Deadline Is Dec. 31Federal Title & Escrow CompanyNo ratings yet

- ClosingDocument3 pagesClosingFederal Title & Escrow CompanyNo ratings yet

- TOPA Affidavit IndividualDocument1 pageTOPA Affidavit IndividualFederal Title & Escrow CompanyNo ratings yet

- Property Tax Escrow ReservesDocument3 pagesProperty Tax Escrow ReservesFederal Title & Escrow CompanyNo ratings yet

- $5,000 DC Homebuyer Tax Credit Off The Table For NowDocument2 pages$5,000 DC Homebuyer Tax Credit Off The Table For NowFederal Title & Escrow CompanyNo ratings yet

- Standard V Enhanced: Title Policy ComparisonDocument5 pagesStandard V Enhanced: Title Policy ComparisonFederal Title & Escrow CompanyNo ratings yet

- Respro 1 10 11Document6 pagesRespro 1 10 11Federal Title & Escrow CompanyNo ratings yet

- Chart - Compare Title Insurance PoliciesDocument3 pagesChart - Compare Title Insurance PoliciesFederal Title & Escrow CompanyNo ratings yet

- Ironwood - Settlement Disclosure Form (Draft)Document6 pagesIronwood - Settlement Disclosure Form (Draft)Federal Title & Escrow CompanyNo ratings yet

- D.C. Homestead Deduction Form (Rev. 3/11)Document2 pagesD.C. Homestead Deduction Form (Rev. 3/11)Federal Title & Escrow CompanyNo ratings yet

- Hornbeam - Settlement Disclosure Form (Draft)Document5 pagesHornbeam - Settlement Disclosure Form (Draft)Federal Title & Escrow CompanyNo ratings yet

- Breakdown of DC, MD and VA Property, Transfer TaxesDocument2 pagesBreakdown of DC, MD and VA Property, Transfer TaxesFederal Title & Escrow CompanyNo ratings yet

- Respro 1 10 11Document6 pagesRespro 1 10 11Federal Title & Escrow CompanyNo ratings yet

- Respro 1 10 11Document6 pagesRespro 1 10 11Federal Title & Escrow CompanyNo ratings yet

- D.C. $5000 First-Time Homebuyer Tax Credit (Form 8859)Document2 pagesD.C. $5000 First-Time Homebuyer Tax Credit (Form 8859)Federal Title & Escrow CompanyNo ratings yet

- DC Tax Abatement SummaryDocument2 pagesDC Tax Abatement SummaryFederal Title & Escrow CompanyNo ratings yet

- Federal Title's New Business Card DesignDocument2 pagesFederal Title's New Business Card DesignFederal Title & Escrow CompanyNo ratings yet

- Federal Title Closing Costs Below National/state AvgDocument1 pageFederal Title Closing Costs Below National/state AvgFederal Title & Escrow CompanyNo ratings yet

- Real Estate, Property Taxes in MoCo County, MarylandDocument17 pagesReal Estate, Property Taxes in MoCo County, MarylandFederal Title & Escrow CompanyNo ratings yet

- DC Tax Abatement SummaryDocument2 pagesDC Tax Abatement SummaryFederal Title & Escrow CompanyNo ratings yet

- Understanding DC Tax AbatementDocument2 pagesUnderstanding DC Tax AbatementFederal Title & Escrow CompanyNo ratings yet

- Prepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADDocument29 pagesPrepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADBino JosephNo ratings yet

- PRMB PDFDocument13 pagesPRMB PDFkshitijsaxenaNo ratings yet

- Aviation Investment Economic Appraisal For Airports - Air Traffic Management - Airlines and AeronauticsDocument259 pagesAviation Investment Economic Appraisal For Airports - Air Traffic Management - Airlines and AeronauticsDipendra ShresthaNo ratings yet

- Invoice - INNOPARKDocument1 pageInvoice - INNOPARKAnkit SinghNo ratings yet

- Key Employee DefinitionDocument1 pageKey Employee DefinitionDanielle MartinNo ratings yet

- MKC006910 PDFDocument1 pageMKC006910 PDFShylesh RaveendranNo ratings yet

- Assignment Account Res458 (Set E) - Ap225Document18 pagesAssignment Account Res458 (Set E) - Ap225nurulamalia asriNo ratings yet

- Apparel Roi CalculatorDocument3 pagesApparel Roi CalculatorRezza AdityaNo ratings yet

- Discussion Exercises Accounts ReceivableDocument2 pagesDiscussion Exercises Accounts ReceivableFrancine Thea M. LantayaNo ratings yet

- Dell Working Capital Solution ExplainedDocument15 pagesDell Working Capital Solution ExplainedFarabi AhmedNo ratings yet

- FUNDLOANS Pre-QualificationDocument1 pageFUNDLOANS Pre-QualificationChristopher LeoneNo ratings yet

- Abm 3 Exam ReviewerDocument7 pagesAbm 3 Exam Reviewerjoshua korylle mahinayNo ratings yet

- GIA Application Form.2018Document9 pagesGIA Application Form.2018Charles Lim100% (1)

- Solaria Cuentas enDocument71 pagesSolaria Cuentas enElizabeth Sánchez LeónNo ratings yet

- Final Answer KeyDocument13 pagesFinal Answer Keysiva prasadNo ratings yet

- Accounts Imp Qns ListDocument192 pagesAccounts Imp Qns ListRamiz SiddiquiNo ratings yet

- Master Thesis 2021: Aakash Mishra URN 2021-M-10081997Document48 pagesMaster Thesis 2021: Aakash Mishra URN 2021-M-10081997Akash MishraNo ratings yet

- Glaski - Appellant's Reply Brief-1Document22 pagesGlaski - Appellant's Reply Brief-183jjmackNo ratings yet

- 679089110072023INBLR4BE1120720231426Document12 pages679089110072023INBLR4BE1120720231426Abishek AbiNo ratings yet

- Risk ManagementDocument3 pagesRisk ManagementMITHUN MOHANNo ratings yet

- Abm Business Mathematics Reading Materials 2019Document16 pagesAbm Business Mathematics Reading Materials 2019Nardsdel Rivera100% (1)

- Law of Diminishing Returns: App & TPPDocument25 pagesLaw of Diminishing Returns: App & TPPAnandKuttiyanNo ratings yet

- Corporate Finance and Investment AnalysisDocument80 pagesCorporate Finance and Investment AnalysisCristina PopNo ratings yet

- The Risk Based AuditDocument6 pagesThe Risk Based AuditHana AlmiraNo ratings yet

- 17 Big Advantages and Disadvantages of Foreign Direct InvestmentDocument5 pages17 Big Advantages and Disadvantages of Foreign Direct Investmentpatil mamataNo ratings yet

- 1 200604 Vietnam Consumer Finance Report 2020 Standard 5 Tran My Nhu 20200610151736Document88 pages1 200604 Vietnam Consumer Finance Report 2020 Standard 5 Tran My Nhu 20200610151736Tuấn Tú VõNo ratings yet

- International Financial Management 9Document38 pagesInternational Financial Management 9胡依然100% (3)

- Certificate of Registration of A Russian Organization With A Tax Authority at Its LocationDocument2 pagesCertificate of Registration of A Russian Organization With A Tax Authority at Its Locationdaniel100% (1)