Professional Documents

Culture Documents

AP Problems 2015

Uploaded by

Rodette Adajar PajanonotCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AP Problems 2015

Uploaded by

Rodette Adajar PajanonotCopyright:

Available Formats

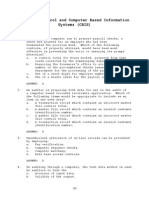

AUDITING PROBLEMS

PROBLEM NO. 1 STATEMENT OF CASH FLOWS

(Intermediate Accounting 16th Edition Stice)

The schedule below shows the account balances of BENEFICIO CORPORATION at the

beginning and end of the year ended December 31, 2015:

DEBITS

Cash and cash equivalents

Investment in trading securities

Accounts receivable

Inventories

Prepaid insurance

Land and building

Equipment

Discount on bonds payable

Treasury shares (at cost)

Cost of goods sold

Selling and general expenses

Income taxes

Unrealized loss on trading securities

Loss on sale of equipment

Total debits

CREDITS

Allowance for bad debts

Accumulated depreciation Building

Accumulated depreciation Equipment

Accounts payable

Notes payable current

Miscellaneous expenses payable

Taxes payable

Unearned revenue

Notes payable long-term

Bonds payable long-term

Deferred income tax liability

Ordinary shares, P2 par

Retained earnings appropriated for

treasury shares

Retained earnings appropriated for

possible building expansion

Unappropriated retained earnings

Share premium

Sales

Gain on sale of investment securities

Total credits

Dec. 31, 2015

P222,000

10,000

148,000

291,000

2,500

195,000

305,000

8,500

5,000

539,000

287,000

35,000

4,000

1,000

P2,053,000

8,000

26,250

39,750

55,000

70,000

18,000

35,000

1,000

40,000

250,000

47,000

359,400

Dec. 31, 2014

P 50,000

40,000

100,000

300,000

2,000

195,000

170,000

9,000

10,000

P 876,000

5,000

22,500

27,500

60,000

20,000

8,700

10,000

9,000

60,000

250,000

53,300

200,000

5,000

10,000

38,000

34,600

116,000

898,000

12,000

P2,053,000

23,000

112,000

5,000

P 876,000

Additional information:

a) All purchases and sales were on account.

b) Equipment with an original cost of P15,000 was sold for P7,000.

c) Selling and general expenses include the following:

Building depreciation

P 3,750

Equipment depreciation 25,250

Bad debt expense

4,000

Interest expense

18,000

d) A six-month note payable for P50,000 was issued toward the purchase of new

equipment.

Page

e) The long-term note payable requires the payment of P20,000 per year plus

interest until paid.

f) Treasury shares were sold for P1,000 more than their cost.

g) During the year, a 30% stock dividend was declared and issued. At that time,

there were 100,000 shares of P2 par ordinary shares outstanding. However,

1,000 of these shares were held as treasury shares at the time and were

prohibited from participating in the stock dividend. Market price was P10 per

share when the stock dividend was declared.

h) Equipment was overhauled, extending its useful life, at a cost of P6,000. The

cost was debited to Accumulated DepreciationEquipment.

i) Beneficio has determined that its purchases and sales of trading securities are

operating activities.

Based on the given data, calculate the following:

1. Net income for 2015

A. P45,000

B. P50,300

C. P43,500

D. P44,000

2. Cash dividends declared and paid during 2015

A. P8,000

B. P52,000

C. P7,400

D. P 0

3. Proceeds from issuance of ordinary shares in 2015

A. P100,000

B. P110,000

C. P210,000

D. P269,400

4. Proceeds from sale of trading securities

A. P26,000

B. P38,000

D. P14,000

C. P42,000

5. Accumulated depreciation of equipment sold

A. P7,000

B. P15,000

C. P8,000

D. P9,000

6. Cash paid for purchase of equipment

A. P50,000

B. P106,000

C. P150,000

D. P100,000

7. Proceeds from sale of treasury shares

A. P6,000

B. P5,000

C. P4,000

D. P10,000

8. Net cash provided by operating activities

A. P45,000

B. P87,000

C. P83,000

D. P89,300

9. Net cash used in investing activities

A. P106,000

B. P99,000

D. P93,000

C. P61,000

10. Net cash provided by financing activities

A. P188,000

B. P187,000

C. P182,000

PROBLEM NO. 2 CORRECTION OF ERRORS

(Test Bank Intermediate Accounting 14th Edition - Kieso)

D. P106,000

Page

The following list of accounts and their balances represents the unadjusted trial

balance of ALTERADO COMPANY at December 31, 2015:

Cash

P290,900

Equity investments (trading)

600,000

Accounts receivable

690,000

Allowance for doubtful accounts

Inventory

547,200

Prepaid rent

360,000

Plant and equipment

1,600,000

Accumulated depreciation Plant and equipment

Accounts payable

Bonds payable

Ordinary share capital

Retained earnings

Sales

Cost of goods sold

1,544,000

Freight-out

110,000

Salaries and wages expense

320,000

Interest expense

20,400

Rental income

Miscellaneous expense

8,900

Insurance expense

110,500

P6,201,900

P 5,000

147,400

113,700

900,000

1,700,000

971,800

2,148,000

216,000

P6,201,900

Additional data:

1. The balance in the Insurance expense account contains the premium costs of

three policies:

Policy 1, remaining cost of P25,500, 1-year term, taken out on May 1, 2014;

Policy 2, original cost of P72,000, 3-year term, taken out on October 1,

2015;

Policy 3, original cost of P13,000, 1-year term, taken out on January 1, 2015.

2. On September 30, 2015, Alterado received P216,000 rent from its lessee for

eighteen-month lease beginning on that date.

3. The regular rate of depreciation is 10% per year. Acquisitions and retirements

during a year are depreciated at half this rate. There were no purchases during

the year. On December 31, 2014, the balance of the Plant and equipment

account was P2,400,000.

4. On December 28, 2015, the bookkeeper incorrectly credited Sales for a receipt

on account in the amount of P100,000.

5. At December 31, 2015, salaries and wages accrued but unpaid were

P4,200,000.

6. Alterado estimates that 1% of sales will become uncollectible.

7. On August 1, 2015, Alterado purchased, as a short-term investment, 600

P1,000, 7% bonds of Alendog Corp. at par. The bonds mature on August 1,

2016. Interest payment dates are July 31 and January 31.

8. On April 30, 2015, Alterado rented a warehouse for P30,000 per month, paying

P360,000 in advance.

1. What are the adjusted balances of the following accounts on December 31,

2015?

Page

A.

B.

C.

D.

Prepaid insurance

P 6,000

0

54,000

66,000

Insurance expense

P104,500

110,500

56,500

44,500

2. What is the total depreciation expense for the year ended December 31, 2015?

A. P120,000

B. P240,000

C. P200,000

D. P160,000

3. What is the bad debt expense for the year ended December 31, 2015?

A. P15,480

B. P25,480

C. P21,480

D. P20,480

4. What amount of interest and rent income should be reported in the income

statement for the year ended December 31, 2015?

Interest income

Rental income

A.

P24,500

P 36,000

B.

17,500

180,000

C.

24,500

180,000

D.

17,500

36,000

5. What adjusting entry is necessary on December 31, 2015 for the Prepaid rent

account?

A. Rent expense

270,000

Prepaid rent

270,000

B. Prepaid rent

270,000

Prepaid rent

270,000

C. Prepaid rent

240,000

Rent expense

240,000

D. Rent expense

240,000

Prepaid rent

240,000

PROBLEM NO. 3 PROPERTY, PLANT, AND EQUIPMENT (PPE)

(Intermediate Accounting 14th Edition - Kieso)

Page

A depreciation schedule for semi-trucks of ISIDRO MANUFACTURING COMPANY was

requested by your auditor soon after December 31, 2015, showing the additions,

retirements, depreciation, and other data affecting the income of the company in

the 4-year period 2012 to 2015, inclusive.

The following data were ascertained.

Balance of Trucks account, Jan. 1, 2012

Truck No. 1 purchased Jan. 1, 2009, cost

Truck No. 2 purchased July 1, 2009, cost

Truck No. 3 purchased Jan. 1, 2011, cost

Truck No. 4 purchased July 1, 2011, cost

Balance, Jan. 1, 2012

P180,000

220,000

300,000

240,000

P940,000

The Accumulated DepreciationTrucks account previously adjusted to January 1,

2012, and entered in the ledger, had a balance on that date of P302,000

(depreciation on the four trucks from the respective dates of purchase, based on a

5-year life, no salvage value). No charges had been made against the account

before January 1, 2012.

Transactions between January 1, 2012, and December 31, 2015, which were

recorded in the ledger, areas follows.

July 1, 2012 Truck No. 3 was traded for a larger one (No. 5), the agreed purchase

price of which was P400,000. Isidro Mfg. Co. paid the automobile

dealer P220,000 cash on the transaction. The entry was a debit to

Trucks and a credit to Cash, P220,000. The transaction has commercial

substance.

Jan. 1, 2013 Truck No. 1 was sold for P35,000 cash; entry debited Cash and credited

Trucks, P35,000.

July 1, 2014 A new truck (No. 6) was acquired for P420,000 cash and was charged

at that amount to the Trucks account. (Assume truck No. 2 was not

retired.)

July 1, 2014 Truck No. 4 was damaged in a wreck to such an extent that it was sold

as junk for P7,000 cash. Isidro Mfg. Co. received P25,000 from the

insurance company. The entry made by the bookkeeper was a debit to

Cash, P32,000, and credits to Miscellaneous Income, P7,000, and

Trucks, P25,000.

Entries for depreciation had been made at the close of each year as follows: 2012,

P210,000; 2013, P225,000; 2014, P250,500; 2015, P304,000.

1. What is the total depreciation expense for the year ended December 31, 2012?

A. P180,000

B. P198,000

C. P172,000

D. P228,000

2. What is the gain (loss) on trade in of Truck #3 on July 1, 2012?

A. (P30,000)

B. P10,000

C. (P60,000)

D. P190,000

3. What is the net book value of the Trucks on December 31, 2015?

A. P414,000

B. P348,000

C. P228,500

D. P894,000

Page

4. The total depreciation expense recorded for the 4-year period (2012-2015) is

overstated by

A. P185,500

B. P265,500

C. P287,500

D. P275,500

5. Assuming that the books have not been closed for 2015, what is the compound

journal entry on December 31, 2015 to correct the companys errors for the 4year period (2012-2015)?

A. Accumulated depreciation

629,500

Trucks

480,000

Retained earnings

9,500

Depreciation expense

140,000

B. Accumulated depreciation

665,500

Trucks

480,000

Retained earnings

45,500

Depreciation expense

140,000

C. Accumulated depreciation

665,500

Trucks

480,000

Retained earnings

185,500

D. Accumulated depreciation

665,500

Trucks

665,500

PROBLEM NO. 4 PPE AND INTANGIBLES

(Intermediate Accounting 17th Edition Stice)

Page

The TOY COMPANY completed the following transactions during 2015:

Mar.

1 Purchased real property for P8,297,000, including a charge for P297,000

representing property tax for March 1 June 30 which was prepaid by the

vendor. Of the purchase price, 25% is deemed applicable to land and the

remaining 75% to buildings. The Toy Company assumed a mortgage of

P4,600,000 on the purchase and paid cash for the balance.

30 The building acquired necessitates current reconditioning at a cost of

P342,000 because previous owners had failed to take care of normal

maintenance and repair requirements on it.

May 15 Garages in the rear of the building were demolished. The Toy Company

recovered P66,000 on the lumber salvage. It then proceeded to construct

a warehouse at P1,013,000, which was almost exactly the same as bids

made by construction companies. Upon completion of construction, city

inspectors ordered extensive modifications to the warehouse as a result of

failure on the part of the company to comply with building safety code.

Such modifications, which could have been avoided, cost P124,000.

June

1 The company exchanged its own ordinary share capital with a market

value of P640,000 (par, P40,000) for a patent and new toy-making

machine. The machine has a market value of P310,000.

July

1 The new machinery for the new building arrived. In addition to the

machinery, a new franchise was acquired from the manufacturer of the

machinery to produce toy robots. Payment was made by issuing the

companys own ordinary shares (par, P1,000,000). The value of the

franchise is set at P500,000, while the machines fair value is P610,000.

Nov. 20 The company contracted for parking lots and landscaping at a cost of

P420,000 and P89,000, respectively. The work was completed and paid

for on November 20.

Dec. 31

The business was closed to permit taking the year-end inventory. During

this time, required redecorating and repairs were completed at a cost of

P64,000.

After considering the preceding transactions, compute the year-end balances of the

following:

1. Buildings

A. P7,289,000

B. P7,511,750

C. P7,413,000

D. P7,635,750

2. Land

A. P2,074,250

B. P2,000,000

C. P2,583,250

D. P2,509,000

3. Machinery

A. P1,070,000

B. P920,000

C. P770,000

D. P931,000

4. Share premium

A. P10,000

B. P500,000

C. P710,000

D. P600,000

5. Intangibles

A. P830,000

B. P500,000

C. P330,000

D. P840,000

PROBLEM NO. 5 PROVISION FOR WARRANTY

Page

(Intermediate Accounting 17th Edition Stice)

LAFAYETTE CORPORATION, a client, requests that you compute the appropriate

balance of its estimated liability for product warranty account for a statement as of

June 30, 2015.

Lafayette Corporation manufactures television components and sells them with a 6month warranty under which defective components will be replaced without charge.

On December 31, 2014, Estimated Liability for Product warranty had a balance of

P620,000. By June 30, 2015, this balance had been reduced to P120,400 by debits

for estimated net cost of components returned that had been sold in 2014.

The corporation started out in 2015 expecting 7% of the peso volume of sales to be

returned. However, due to the introduction of new models during the year, this

estimated percentage of returns was increased to 10% on May 1. It is assumed that

no components sold during a given month are returned in that month. Each

component is stamped with a date at time of sale so that the warranty may be

properly administered. The following table of percentages indicates the likely

pattern of sales returns during the 6-month period of the warranty, starting with the

month following the sale of components.

Percentage of Total

Returns Expected

30%

20

20

30

100%

Month Following Sale

First

Second

Third

Fourth through sixth10% each month

Gross sales of components were as follows for the first six months of 2015:

Month

January

February

March

Amount

P4,200,000

4,700,000

3,900,000

Month

April

May

June

Amount

P3,250,000

2,400,000

1,900,000

The corporations warranty also covers the payment of freight cost on defective

components returned and on the new components sent out as replacements. This

freight cost runs approximately 5% of the sales price of the components returned.

The manufacturing cost of the components is roughly 70% of the sales price, and

the salvage value of returned components averages 10% of their sales price.

Returned components on hand at December 31, 2013, were thus valued in

inventory at 10% of their original sales price.

Based on the given information, determine the following:

1. Total estimated returns from the sales made during the first 6 months of 2015

A. P1,481,500

B. P1,651,000

C. P1,424,500

D. P1,553,500

2. Total estimated returns subsequent to June 30, 2015

A. P678,250

B. P648,850

C. P591,850

D. P615,950

3. Estimated loss on component replacement (in percentage of sales price)

A. 65%

B. 75%

C. 70%

D. 80%

4. Required Estimated Liability for Product Warranty balance at June 30, 2015

A. P301,353

B. P421,753

C. P120,400

D. P77,847

5. Required adjustment to liability account

A. P301,353 debit

C. P421,753 debit

B. P301,353 credit

D. P421,753 credit

PROBLEM NO. 6 - INVENTORIES

Page

(Intermediate Accounting 13TH ED - KIESO)

MALOX Specialty Company manufactures three models of gear shift components for

bicycles that are sold to bicycle manufacturers, retailers, and catalog outlets. Since

beginning operations in 2012, Malox has used normal absorption costing and has

assumed a first-in, first-out cost flow in its perpetual inventory system. The

balances of the inventory accounts at the end of Maloxs fiscal year, November 30,

2015, are shown below. The inventories are stated at cost before any year-end

adjustments.

Finished goods

Work in process

Raw materials

Factory supplies

P647,000

112,500

264,000

69,000

The following information relates to Maloxs inventory and operations.

1. The finished goods inventory consists of the items analyzed below.

Cost

NRV

Down tube shifter

Standard model

Click adjustment model

Deluxe model

Total down tube shifters

P 67,500

94,500

108,000

270,000

P 67,000

89,000

110,000

266,000

Bar end shifter

Standard model

Click adjustment model

Total bar end shifters

83,000

99,000

182,000

90,050

97,550

187,600

78,000

117,000

195,000

P647,000

77,650

119,300

196,950

P650,550

Head tube shifter

Standard model

Click adjustment model

Total head tube shifters

Total finished goods

2. One-half of the head tube shifter finished goods inventory is held by catalog

outlets on consignment.

3. Three-quarters of the bar end shifter finished goods inventory had been

pledged as collateral for a bank loan.

4. One-half of the raw materials balance represents derailleurs acquired at a

contracted price 20 percent above the net realizable value.

The net

realizable value of the rest of the raw materials is P127,400.

5. The total net realizable value of the work in process inventory is P108,700.

6. Included in the cost of factory supplies are obsolete items with historical cost

of P4,200. The net realizable value of the remaining factory supplies is

P65,900.

7. Malox applies the lower of cost or net realizable value method to each of the

three types of shifters in finished goods inventory. For each of the other three

inventory accounts, Malox applies the lower of cost or net realizable value

method to the total of each inventory account.

8. Consider all amounts presented above to be material in relation to Maloxs

financial statements taken as a whole.

Based on the preceding information, determine the proper values of the following

on November 30, 2015.

Page

1. Finished goods inventory

A. P647,000

B. P643,000

C. P650,550

D. P654,550

2. Work in process inventory

A. P108,300

B. P112,500

C. P108,700

D. P104,500

3. Raw materials inventory

A. P264,000

B. P227,400

C. P242,000

D. P237,400

4. Factory supplies

A. P64,800

C. P61,700

D. P69,000

B. P65,900

5. Which of the following best describes the PAS 2 requirement for applying the

same cost formula to all inventories?

A. When they are purchased from different suppliers.

B. When they are purchased from the same geographic region.

C. When they are similar in nature or use.

D. When they sell for the same price.

PROBLEM NO. 7 BIOLOGICAL ASSETS

(IFRS Practical Implementation Guide and Workbook 2nd edition)

10

Page

11

GATAS, INC. produces milk on its farms. It produces 30% of the countrys milk that

is consumed. Gatas owns 450 farms and has a stock of 21,000 cows and 10,500

heifers. The farms produce 8 million kilograms of milk a year, and the average

inventory held is 150,000 kilograms of milk. However, the company is currently

holding stocks of 500,000 kilograms of milk in powder form.

At October 31, 2015, the herds are:

21,000 cows (3 years old), all purchased on or before November 1, 2014

7,500 heifers, average age 1.5 years, purchased on April 1, 2015

3,000 heifers, average age 2 years, purchased on November 1, 2014

No animals were born or sold in the year.

The unit fair values less estimated point-of-sale costs were:

1-year-old animal at October 31, 2015

P3,200

2-year-old animal at October 31, 2015

4,500

1.5-year-old animal at October 31, 2015

3,600

3-year-old animal at October 31, 2015

5,000

1-year-old animal at November 1, 2014 and

April 1, 2015

3,000

2-year-old animal at November 1, 2014

4,000

The company has had problems during the year: Contaminated milk was sold to

customers. As a result, milk consumption has gone down. The government has

decided to compensate farmers for potential loss in revenue from the sale of milk.

This fact was published in the national press on September 1, 2015. Gatas received

an official letter on October 10, 2015, stating that P5 million would be paid to it on

January 2, 2016.

The companys business is spread over different parts of the country. The only

region affected by the contamination was Central Visayas, where the government

curtailed milk production in the region.

The cattle were unaffected by the

contamination and were healthy.

The company estimates that the future

discounted cash flow income from the cattle in the Central Visayas region amounted

to P4 million, after taking into account the government restriction order. The

company feels that it cannot measure the fair value of the cows in the region

because of the problems created by the contamination. There are 6,000 cows and

2,000 heifers in the region. All these animals had been purchased on November 1,

2014. A rival company had offered Gatas P3 million for these animals after point-ofsale costs and further offered P6 million for the farms themselves in that region.

Gatas has no intention of selling the farms at present. The company has been

applying PAS 41 since November 1, 2014.

1. What is the fair value of the cattle (excluding Central Visayas region) at

November 1, 2014?

A. P93 million

B. P64 million

C. P63 million

D. P48 million

2. What is the fair value of the cattle (excluding Central Visayas region) at

October 31, 2015?

A. P106.5 million

B. P113.25 million C. P105.6 million D. P105.75

million

3. What is the increase in fair value of the cattle (excluding Central Visayas

region) due to price change?

A. P10.7 million

B. P12.8 million

C. P9.2 million

D. P16.7 million

4. What is the increase in fair value of the cattle (excluding Central Visayas

region) due to physical change?

A. P9.2 million

B. P11.8 million

C. P18.55 million D. P9.4 million

5. On October 31, 2015, the cattle in the Central Visayas region would be valued

at

A. P39 million

B. P3 million

C. P4 million

D. P5 million

Page

12

PROBLEM NO. 8 - DEPLETION

(INTERMEDIATE ACCOUNTING-IFRS - KIESO)

MINA MINING CO. has acquired a track of mineral land for P27,000,000. Mina Mining

estimates that the acquired property will yield 120,000 tons of ore with sufficient

mineral content to make mining and processing profitable. It further estimates that

6,000 tons of ore will be mined the first and last year and 12,000 tons every year in

between. (Assume 11 years of mining operations.) The land will have a residual

value of P900,000.

Mina Mining builds necessary structures and sheds on the site at a total cost of

P1,080,000. The company estimates that these structures can be used for 15 years

but, because they must be dismantled if they are to be moved, they have no

residual value. Mina Mining does not intend to use the buildings elsewhere.

Mining machinery installed at the mine was purchased secondhand at a total cost of

P1,800,000. The machinery cost the former owner P4,500,000 and was 50%

depreciated when purchased. Mina Mining estimates that about half of this

machinery will still be useful when the present mineral resources have been

exhausted but that dismantling and removal costs will just about offset its value at

that time. The company does not intend to use the machinery elsewhere. The

remaining machinery will last until about one-half the present estimated mineral ore

has been removed and will then be worthless. Cost is to be allocated equally

between these two classes of machinery.

1. What are the estimated depletion and depreciation charges for the first year?

Depletion

Depreciation

A.

P2,610,000

P189,000

B.

P1,305,000

P378,000

C.

P2,610,000

P234,000

D.

P1,305,000

P189,000

2. What are the estimated depletion and depreciation charges for the 5 th year?

Depletion

Depreciation

A.

P1,305,000

P378,000

B.

P2,610,000

P234,000

C.

P2,610,000

P378,000

D.

P1,305,000

P234,000

3. What are the estimated depletion and depreciation charges for the 6 th year?

Depletion

Depreciation

A.

P2,610,000

P378,000

B.

P1,305,000

P288,000

C.

P1,305,000

P189,000

D.

P2,610,000

P288,000

4. What are the estimated depletion and depreciation charges for the 11 th year?

Depletion

Depreciation

A.

P1,305,000

P99,000

B.

P1,305,000

P189,000

C.

P2,610,000

P99,000

D.

P2,610,000

P234,000

5. What are the depletion and depreciation charges for the first year assuming

actual production of 5,000 tons of mineral ore? (Nothing occurred during the

year to cause the company engineers to change their estimates of either the

mineral resources or the life of the structures and equipment.)

Depletion

Depreciation

A.

P1,087,500

P157,500

B.

P1,305,000

P99,000

C.

P1,305,000

P189,000

D.

P1,087,500

P82,500

Page

13

PROBLEM NO. 9PPE/DEPRECIATION

(INTERMEDIATE ACCOUNTING-IFRS - KIESO)

DEBBY CORP., a manufacturer of computer parts, has been experiencing growth in

the demand for its products over the last several years. This prompted the

company to obtain additional manufacturing facility. A real estate firm located an

available factory near Debbys production facility, and Debby agreed to purchase

the factory and used machinery from Que Company on October 1, 2014.

Renovations were necessary to convert the factory for Debbys manufacturing use.

The terms of the agreement required Debby to pay Que P1,500,000 when

renovations started on January 1, 2015, with the balance to be paid as renovations

were completed. The overall purchase price for the factory and machinery was

P12,000,000. The building renovations were contracted to Malibay Construction

Company at P3,000,000. The payments made, as renovations progressed during

2015, are shown below. The factory was placed in service on January 1, 2016.

Que

January 1

April 1

October 1

December 31

Malibay

P 1,500,000

2,700,000

3,300,000

4,500,000

P12,000,000

P 900,000

900,000

1,200,000

P3,000,000

On January 1, 2015, Debby obtained a 2-year, P3 million loan with a 12% interest

rate to finance the renovation of the acquired factory. This is Debbys only

outstanding loan during 2015.

Debbys policy regarding purchases of this nature is to use the appraisal value of

the land for book purposes and prorate the balance of the purchase price over the

remaining items. The building had originally cost Que P9,000,000 and had a net

book value of P1,500,000, while the machinery originally cost P3,750,000 and had a

net book value of P1,200,000 on the date of sale. The land was recorded on Ques

books at P1,200,000.

The following values were determined based

independent appraisers at the time of acquisition.

Land

Building

Machinery

on

appraisal

conducted

by

P8,700,000

3,150,000

1,350,000

Gin G. Neer, Debbys chief engineer estimated that the renovated plant would be

used for 15 years, with an estimated residual value of P900,000. Neer estimated

that the productive machinery would have a remaining useful life of 5 years and

residual value of P90,000. Debbys depreciation policy is to apply the 200%

declining balance method for machinery and the 150% declining balance method

for the plant. One-half years depreciation is taken in the year the plant is placed in

service and one-half year is allowed when the property is disposed of or retired.

Determine the amounts to be recorded on the books of Debby Corp. as of December

31, 2015, for each of the following properties.

Page

14

1. Land

A. P7,909,000

B. P8,700,000

C. P9,060,000

D. P10,909,000

2. Building

A. P5,670,000

B. P6,223,600

C. P3,223,600

D. P5,310,000

3. Machinery

A. P1,227,300

B. P1,098,000

C. P1,335,300

D. P990,000

Calculate the 2016 depreciation expense for each of the following properties.

4. Building

A. P238,500

B. P311,180

C. P283,500

D. P265,500

5. Machinery

A. P180,000

B. P198,000

C. P219,600

D. P227,460

PROBLEM NO. 10 INVENTORIES/BIOLOGICAL ASSETS

(INTERMEDIATE ACCOUNTING-IFRS - KIESO)

Page

15

Presented below are two independent situations. Answer the questions at the end

of each situation.

GARLA HOME IMPROVEMENTS installs replacement siding, windows, and louvered

glass doors for single family homes and condominium complexes in Quezon City.

The company is in the process of preparing its annual financial statements for the

fiscal year ended May 31, 2015, and Jimmy Lansang, controller for GARLA, has

gathered the following data concerning inventory.

At May 31, 2015, the balance in GARLAs Raw Materials Inventory account was

P1,224,000, and the Allowance to Reduce Inventory to NRV had a credit balance of

P82,500. Lansang summarized the relevant inventory cost and market data at May

31, 2015, in the schedule below.

Aluminum siding

Cedar shake siding

Louvered glass doors

Thermal windows

Cost

P 210,000

258,000

336,000

420,000

P1,224,000

Sales Price

P 192,000

282,000

559,200

464,400

P1,497,600

Net Realizable Value

P 168,000

254,400

504,900

420,000

P1,347,300

1. What amount should be reported as Allowance to Reduce Inventory to Net

Realizable Value at May 31, 2015?

A. P168,900

B. P45,600

C. P273,600

D. P123,300

2. What amount of gain or loss should be recorded for the year ended May 31,

2015, due to the change in the Allowance to Reduce Inventory to Net

Realizable Value?

A. P36,900 gain

B. P86,400 loss

C. P40,800 loss

D. P82,500

gain

MANGO BANGGO purchased a mango farm in August 2015 for P2,250,000. The

purchase was risky because the growing season was coming to an end, the

mangoes must be harvested in the next few weeks, and Mango has limited

experience in carrying off a mango harvest.

At the end of the first quarter of operations, Mango is feeling pretty good about his

early results. The first harvest was a success; 30,000 kilos of mangoes were

harvested with a value of P90,000 (based on current local commodity prices at the

time of harvest). The fair value of Mangos mango farm has increased by P45,000

at the end of the quarter. After storing the mangoes for a short period of time,

Mango was able to sell the entire harvest for P105,000.

3. What amount of gain should be recognized on the change in fair value of

Mangos mango farm?

A. P150,000

B. P45,000

C. P90,000

D. P135,000

4. At what amount should the mangoes harvested be initially recorded on

Mangos books?

A. P90,000

B. P105,000

C. P60,000

D. P150,000

5. What is the total effect on income for the quarter related to Mangos biological

asset and agricultural produce?

A. P150,000

B. P45,000

C. P15,000

D. P60,000

Page

16

PROBLEM NO. 11 - SMEs

(IFRS for SMEs Training Modules Modules 14, 18 and 21)

The following independent cases relate to different SMALL AND MEDIUM-SIZED

ENTITIES (SMEs):

Case 1

On January 1, 20X4, SME A acquired a trademark for a line of products in a separate

acquisition from a competitor for P300,000. SME A expected to continue marketing

the line of products using the trademark indefinitely. An analysis of (i) product life

cycle studies, (ii) market, competitive and environmental trends, and (iii) brand

extension opportunities provides evidence that the line of trademarked products

may generate net cash inflows for the acquiring entity for an indefinite period.

Because management is unable to estimate the useful life of the trademark, SME A

amortizes the cost of the trademark over 10 years (i.e., its presumed useful life)

using the straight-line method.

In 20X7, a competitor unexpectedly revealed a technological breakthrough that is

expected to result in a product, that when launched by the competitor, will

extinguish for SME As patented product-line. Demand for SME As patented

product-line is expected to remain strong until December 20X9, when the

competitor is expected to launch its new product.

On December 31, 20X7, SME A assessed the recoverable amount of the trademark

at P50,000. SME A intends to continue manufacturing the patented products until

December 31, 20X9. SME A has a December 31 financial year-end.

Case 2

SME B gives warranties at the time of sale to purchasers of its product. Under the

terms of the contract of sale, SME B undertakes to make good, by repair or

replacement, manufacturing defects that become apparent within one year from the

date of sale. On the basis of experience, it is probable (i.e., more likely than not)

that there will be some claims under the warranties.

At December 31, 20X1, SME B appropriately recognized P50,000 warranty provision.

SME B incurred and charged P140,000 against the warranty provision in 20X2.

P80,000 of this related to warranties for sales made in 20X2. The increase during

20X2 in the discounted amount recognized as a provision at December 31, 20X2

arising from the passage of time is P2,000.

At December 31, 20X2, SME B estimated that it would incur expenditures in 20X3 to

meet its warranty obligations at December 31, 20X2, as follows:

5 percent probability of P400,000

20 percent probability of P200,000

50 percent probability of P80,000

25 percent probability of P20,000

Assume for simplicity that the 20X3 cash flows for warranty repairs and

replacements take place, on average, on June 30, 20X3.

An appropriate discount rate is 10 percent per year. An appropriate risk adjustment

factor to reflect the uncertainties in the cash flow estimates is an increment of 6

percent to the probability-weighted expected cash flows.

Page

17

SME B is also the defendant in a breach of patent lawsuit. Its lawyers believe there

is a 70 percent chance that SME B will successfully defend the case. However, if the

court rules in favor of the claimant, the lawyers believe that there is a 60 percent

chance that the entity will be required to pay damages of P2 million (the amount

sought by the claimant) and a 40 percent chance that the entity will be required to

pay damages of P1 million (the amount that was recently awarded by the same

judge in a similar case). Other amounts of damages are unlikely.

The court is expected to rule in late December 20X3. There is no indication that the

claimant will settle out of court.

A 7 percent risk adjustment factor to the cash flows is considered appropriate to

reflect the uncertainties in the cash flow estimates. An appropriate discount rate is

10 percent per year.

Case 3

On January 1, 20X1, SME AA acquired 25 percent of the equity of each of entities

BB, CC and DD for P10,000, P15,000 and P28,000, respectively. SME AA has

significant influence over entities BB, CC and DD. Transaction costs of 1 percent of

the purchase price of the shares were incurred by SME AA.

On January 2, 20X1, entity BB declared and paid dividends of P1,000 for the year

ended 20X0. On December 31, 20X1, entity CC declared a dividend of P8,000 for

the year ended 20X1. The dividend declared by entity CC was paid in 20X2.

For the year ended December 31, 20X1, entities BB and CC recognized profit of

respectively P5,000 and P18,000. However, entity DD recognized a loss of P20,000

for that year.

Published price quotations do not exist for the shares of entities BB, CC and DD.

Using appropriate valuation techniques, SME AA determined the fair value of its

investment in entities BB, CC and DD at December 31, 20X1 as P13,000, P29,000

and P15,000, respectively. Costs to sell are estimated at 5 percent of the fair value

of the investments.

Based on the above information, calculate the following:

1. Trademark amortization for the year ended December 31, 20X7

A. P90,000

B. P70,000

C. P30,000

D. P 0

2. Impairment loss to be recognized for the trademark at December 31, 20X7

A. P90,000

B. P50,000

C. P130,000

D. P60,000

3. The carrying amount of the warranties provision at December 31, 20X2

A. P88,000

B. P50,000

C. P52,000

D. P106,000

4. The amount of loss on litigation that should be reported by SME B at December

31, 20X2

A. P1,000,000

B. P1,070,000

C. P1,019,050

D. P 0

Page

18

Assume SME AA measures all its investments in associates using the

cost model.

5. The amount of impairment loss that SME AA should recognize at December 31,

20X1

A. P13,750

B. P14,030

C. P9,030

D. P 0

6. The net amount to be recognized by SME AA in profit or loss for the year ended

December 31, 20X1

A. P11,780

B. P14,030

C. P2,000

D. P2,250

Assume SME AA measures all its investments in associates using the

equity method. Assume that there is neither implicit goodwill nor fair

value adjustments.

7. The amount of impairment loss that SME AA should recognize at December 31,

20X1

A. P13,750

B. P14,030

C. P9,030

D. P 0

8. The net amount to be recognized by SME AA in profit or loss for the year ended

December 31, 20X1

A. P8,280

B. P6,030

C. P6,780

D. P2,250

Assume SME AA measures all its investments in associates after initial

recognition using the fair value model.

9. The increase in fair value that SME AA should recognize in profit or loss for the

year ended December 31, 20X1

A. P4,000

B. P3,470

C. P1,150

D. P620

10. The carrying amount of the investment in associates under each of the

following assumptions

Cost

Equity

Fair Value

Model

Method

Model

A.

P38,970

P43,000

P57,000

B.

38,970

52,030

54,150

C.

39,500

43,000

57,000

D.

39,500

52,030

54,150

Page

19

PROBLEM NO. 12 CORRECTION OF ERRORS

(Intermediate Accounting 17Th Edition Stice)

HIATT TEXTILE CORPORATION is in the process of obtaining a loan at City Bank. The

bank has requested audited financial statements. Hiatts financial statements have

never been audited before. It has prepared the following comparative financial

statements for the years ended December 31, 2015 and 2014.

HIATT TEXTILE CORPORATION

COMPARATIVE STATEMENTS OF FINANCIAL POSITION

December 31, 2015 and 2014

2015

2014

Assets

Current assets:

Cash and cash equivalents

P1,205,000

P 800,000

Accounts receivable

1,960,000

1,480,000

Allowance for bad debts

(185,000)

(90,000)

Inventory

1,035,000

1,010,000

Total current assets

4,015,000

3,200,000

Noncurrent assets:

Property, plant, and equipment

Accumulated depreciation

Total noncurrent assets

Total assets

Liabilities and Shareholders Equity

Liabilities:

Accounts payable

Shareholders equity:

Ordinary shares, P20 par value;

150,000 shares authorized;

65,000 shares issued and outstanding

Retained earnings

Total shareholders equity

Total liabilities and shareholders equity

835,000

(608,000)

227,000

P4,242,000

847,500

(532,000)

315,500

P3,515,500

P 607,000

P 980,500

1,300,000

2,335,000

3,635,000

P4,242,000

1,300,000

1,235,000

2,535,000

P3,515,500

HIATT TEXTILE CORPORATION

COMPARATIVE INCOME STATEMENTS

For the Years Ended December 31, 2015 and 2014

2015

Sales

Cost of goods sold

Gross income

Operating expenses:

Selling expenses

Administrative expenses

Total operating expenses

Net income

The 2015 audit revealed the following facts:

2014

P5,000,000

2,150,000

2,850,000

P4,500,000

1,975,000

2,525,000

1,150,000

600,000

1,750,000

P1,100,000

1,025,000

525,000

1,550,000

P 975,000

Page

20

a. On January 5, 2014, Hiatt Textile Corporation had charged a 5-year insurance

premium to expense. The premium totaled P31,000.

b. The amount of loss due to bad debts has steadily decreased over the last 2

years. Hiatt Textile Corporation has decided to reduce the amount of bad debt

expense from 2% to 1 % of sales, beginning with 2015. (A charge of 2% has

already been made for 2014.)

c. Hiatt Textile Corporation uses the periodic inventory system. The following are

the inventory errors for the last 2 years.

2014 - Ending inventory overstated by P75,500

2015 - Ending inventory overstated by P99,000

d. An equipment costing P150,000 was acquired on January 3, 2014. The purchase

was recorded by a charge to operating expense. The equipment has a useful life

of 10 years and a residual value of P25,000. Hiatt Textile Corporation uses the

straight-line method in depreciating its assets.

e. Assume that the books for 2015 have not yet been closed.

implications.

Ignore tax

Based on the above information, answer the following:

1. The December 31, 2015 adjusting entry to correct the expensing of insurance

premium paid is

A. Prepaid insurance

18,600

Insurance expense

6,200

Retained earnings

24,800

B. Prepaid insurance

18,600

Retained earnings

18,600

C. Insurance expense

18,600

Retained earnings

18,600

D. Insurance expense

6,200

Retained earnings

6,200

2. The December 31, 2015 adjusting entry to correct the expensing of the

equipment purchased on January 3, 2014 should include a credit to

A. Accumulated depreciationP12,500.

B. Retained earningsP137,500.

C. EquipmentP12,500.

D. Depreciation expenseP12,500.

3. The December 31, 2015 adjusting entry to correct the inventory errors should

include a debit to

A. Cost of goods soldP99,000.

B. InventoryP23,500.

C. Retained earningsP75,500.

D. Cost of goods soldP75,500.

4. What is Hiatts corrected net income for the year ended December 31, 2014?

A. P1,012,200

B. P1,212,800

C. P786,800

D. P1,061,800

5. What is Hiatts corrected net income for the year ended December 31, 2015?

A. P1,095,200

B. P1,129,800

C. P1,082,800

D. P1,107,800

--- END ---

You might also like

- (Problems) - Audit of Prepayments and Intangible AssetsDocument13 pages(Problems) - Audit of Prepayments and Intangible Assetsapatos0% (1)

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDocument13 pagesAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoNo ratings yet

- Seatwork - Advacc1Document2 pagesSeatwork - Advacc1David DavidNo ratings yet

- Seatwork in Audit 2-3Document8 pagesSeatwork in Audit 2-3Shr BnNo ratings yet

- Acctg630 - ICMA 1st Sem SY2013-14 - With AnswerDocument35 pagesAcctg630 - ICMA 1st Sem SY2013-14 - With AnswerJasper Andrew AdjaraniNo ratings yet

- Homework on investment property analysisDocument2 pagesHomework on investment property analysisCharles TuazonNo ratings yet

- Audit of EquityDocument5 pagesAudit of EquityKarlo Jude Acidera0% (1)

- Ap 59 PW - 5 06 PDFDocument18 pagesAp 59 PW - 5 06 PDFJasmin NgNo ratings yet

- AUDDocument20 pagesAUDJay GamboaNo ratings yet

- (Odd) Acc 101 LT#2B PDFDocument5 pages(Odd) Acc 101 LT#2B PDF有福No ratings yet

- Accounting for Liquidation and Foreign ExchangeDocument8 pagesAccounting for Liquidation and Foreign Exchangeprecious mlb100% (1)

- Auditing Problems AP 007 to 010 SolutionsDocument6 pagesAuditing Problems AP 007 to 010 SolutionsSerena Van der WoodsenNo ratings yet

- CH 08Document22 pagesCH 08xxxxxxxxxNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- Cpar - Ap 09.15.13Document18 pagesCpar - Ap 09.15.13KamilleNo ratings yet

- Quiz Recl FinancingDocument1 pageQuiz Recl FinancingLou Brad IgnacioNo ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- Audit of PpeDocument5 pagesAudit of PpeCathleen VillalvitoNo ratings yet

- Activity Audit in InventoryDocument4 pagesActivity Audit in InventoryKizzea Bianca GadotNo ratings yet

- FinAcc 1 Quiz 6Document10 pagesFinAcc 1 Quiz 6Kimbol Calingayan100% (1)

- Audit of Intangible Assets TitleDocument2 pagesAudit of Intangible Assets TitleJaycee FabriagNo ratings yet

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Dr. Lee's patient service revenue calculation under accrual basisDocument6 pagesDr. Lee's patient service revenue calculation under accrual basisAndrea Lyn Salonga CacayNo ratings yet

- AP - TestbankDocument22 pagesAP - TestbankRamon Jonathan SapalaranNo ratings yet

- Quiz-3 Cost2 BSA4Document6 pagesQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Q - Process Further Scarce ResourceDocument2 pagesQ - Process Further Scarce ResourceIrahq Yarte TorrejosNo ratings yet

- October 2010 Business Law & Taxation Final Pre-BoardDocument11 pagesOctober 2010 Business Law & Taxation Final Pre-BoardPatrick ArazoNo ratings yet

- Advanced Accounting Baker Test Bank - Chap004Document56 pagesAdvanced Accounting Baker Test Bank - Chap004donkazotey90% (10)

- Cup 3 Questions Answer KeyDocument34 pagesCup 3 Questions Answer KeyDenmarc John AragosNo ratings yet

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjNo ratings yet

- Audit of Inventories - STDocument7 pagesAudit of Inventories - STFrancine Holler0% (2)

- PAS 11: Long-term construction contractsDocument5 pagesPAS 11: Long-term construction contractsLester John Mendi0% (1)

- Ad2 1Document13 pagesAd2 1MarjorieNo ratings yet

- Auditing Problems Intangibles Impairment and Revaluation PDFDocument44 pagesAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaNo ratings yet

- Chapter 03Document30 pagesChapter 03ajbalcitaNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Calculating Investment Income from AssociatesDocument2 pagesCalculating Investment Income from Associatesmiss independent100% (1)

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Set DDocument6 pagesSet DJeremiah Navarro PilotonNo ratings yet

- Handout Audit of InventoriesDocument4 pagesHandout Audit of InventoriesJAY AUBREY PINEDA0% (2)

- Auditing Problem ReviewerDocument10 pagesAuditing Problem ReviewerTina Llorca83% (6)

- Ppe ApDocument5 pagesPpe ApGrace A. Manalo0% (1)

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With Answersaerwinde79% (34)

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- Cash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Document3 pagesCash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Christine BNo ratings yet

- Audit of Financial StatementsDocument5 pagesAudit of Financial StatementsMoises A. AlmendaresNo ratings yet

- NFJPIA Region XII 8th Annual Regional Convention Mock Board ExaminationDocument49 pagesNFJPIA Region XII 8th Annual Regional Convention Mock Board ExaminationRonnel Tagalogon100% (1)

- p1 ADocument8 pagesp1 Aincubus_yeahNo ratings yet

- AP AnswerKeyDocument6 pagesAP AnswerKeyRosalie E. Balhag100% (2)

- BSA4A-Midterm Exam - Questions PDFDocument6 pagesBSA4A-Midterm Exam - Questions PDFRochelleDianRaymundoNo ratings yet

- Non Current Assets 2019ADocument4 pagesNon Current Assets 2019AKezy Mae GabatNo ratings yet

- Advance AccountingDocument5 pagesAdvance AccountingChristopher PriceNo ratings yet

- Financial Statement Analysis of PRTC CorporationDocument10 pagesFinancial Statement Analysis of PRTC CorporationRaymond PacaldoNo ratings yet

- Eos CupFinal RoundDocument7 pagesEos CupFinal RoundMJ YaconNo ratings yet

- Act 20-Ap 04 PpeDocument7 pagesAct 20-Ap 04 PpeJomar VillenaNo ratings yet

- Accrual Basis, Cash Basis, Single Entry & Error CorrectionDocument3 pagesAccrual Basis, Cash Basis, Single Entry & Error CorrectionYour MaterialsNo ratings yet

- Bfjpia Cup 2 - Practical Accounting 1 Easy: Page 1 of 10Document10 pagesBfjpia Cup 2 - Practical Accounting 1 Easy: Page 1 of 10kristelle0marisseNo ratings yet

- Removal JulyDocument8 pagesRemoval JulyRosanna RomancaNo ratings yet

- Business Law and TaxationDocument22 pagesBusiness Law and TaxationRodette Adajar Pajanonot100% (1)

- AP Solutions 2015Document12 pagesAP Solutions 2015Rodette Adajar PajanonotNo ratings yet

- Advacc Differences PDFDocument6 pagesAdvacc Differences PDFRodette Adajar PajanonotNo ratings yet

- Bataan Peninsula State University: Reaction Paper in Advanced Accounting IiiDocument1 pageBataan Peninsula State University: Reaction Paper in Advanced Accounting IiiRodette Adajar PajanonotNo ratings yet

- Kunci Ukk 2022 P2-ModifikasiDocument86 pagesKunci Ukk 2022 P2-ModifikasiAlfata RFNo ratings yet

- HR Business Partner - CourseDocument55 pagesHR Business Partner - Coursesaptaksamadder4No ratings yet

- Myanmar Cost Sheet for Island Tours and AccommodationsDocument16 pagesMyanmar Cost Sheet for Island Tours and AccommodationsHein Thu AyeNo ratings yet

- Market MicrostructureDocument15 pagesMarket MicrostructureBen Gdna100% (2)

- Marginal Costing Tutorial: Learn Key Concepts With ExamplesDocument5 pagesMarginal Costing Tutorial: Learn Key Concepts With ExamplesRajyaLakshmiNo ratings yet

- Financial Accounting: Accounting For Merchandise OperationsDocument84 pagesFinancial Accounting: Accounting For Merchandise OperationsAnnie DuolingoNo ratings yet

- CORE Analysis of Puma SEDocument8 pagesCORE Analysis of Puma SEPiyushNo ratings yet

- Customer Behavior Regarding Mutual Fund at Axis BankDocument63 pagesCustomer Behavior Regarding Mutual Fund at Axis BankHardikNo ratings yet

- Chapter 6 Perfect CompetitionDocument17 pagesChapter 6 Perfect CompetitionCollege Sophomore 2301No ratings yet

- 5161 - Session 3 Master Production SchedulingDocument39 pages5161 - Session 3 Master Production SchedulingLuv.Ids FckNo ratings yet

- Cash FlowsDocument26 pagesCash Flowsvickyprimus100% (1)

- Upgrade & Increase Credit Limit FormDocument3 pagesUpgrade & Increase Credit Limit FormTan Kae JiunnNo ratings yet

- Customer Based Brand EquityDocument36 pagesCustomer Based Brand EquityGanesh MNo ratings yet

- Marketing Management: Chapter QuestionsDocument10 pagesMarketing Management: Chapter Questionsfernandes yosepNo ratings yet

- Private Credit in Asia PacificDocument22 pagesPrivate Credit in Asia PacifictamlqNo ratings yet

- 2013 LalPir Power LTD ProspectusDocument84 pages2013 LalPir Power LTD ProspectusMuhammad Usman Saeed0% (1)

- Project On Personal Care ProductDocument7 pagesProject On Personal Care Productrishabh guptaNo ratings yet

- Proposal To Tata Indicom From RashtradootDocument24 pagesProposal To Tata Indicom From Rashtradootkhekra sonuNo ratings yet

- Lecture Note 3Document14 pagesLecture Note 3Rahil VermaNo ratings yet

- Standard Costing and Variance Analysis: This Accounting Materials Are Brought To You byDocument16 pagesStandard Costing and Variance Analysis: This Accounting Materials Are Brought To You byChristian Bartolome LagmayNo ratings yet

- Financial Accounting Formulas and NotesDocument10 pagesFinancial Accounting Formulas and NotesAntonio LinNo ratings yet

- Ambit PDFDocument70 pagesAmbit PDFshahavNo ratings yet

- CAT T1 Recording Financial Transactions Course SlidesDocument162 pagesCAT T1 Recording Financial Transactions Course Slideshazril46100% (5)

- Analyzing Financial Statement of Vinamilk Group 2Document24 pagesAnalyzing Financial Statement of Vinamilk Group 2Phan Thị Hương TrâmNo ratings yet

- Understanding Financial DerivativesDocument15 pagesUnderstanding Financial DerivativesBetaa TaabeNo ratings yet

- Portfolio Management - Chapter 7Document85 pagesPortfolio Management - Chapter 7Dr Rushen SinghNo ratings yet

- KC Corporation Manufactures An AirDocument2 pagesKC Corporation Manufactures An AirElliot RichardNo ratings yet

- Accounting Concepts and ConventionsDocument40 pagesAccounting Concepts and ConventionsAmrita TatiaNo ratings yet

- Research ReportDocument34 pagesResearch ReportSalman QasimNo ratings yet

- Cbse Accountancy Class XIi Sample Paper PDFDocument27 pagesCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNo ratings yet

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungFrom EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)