Professional Documents

Culture Documents

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

"

NIKKI GLOBAL FINANCE LTD.

Registered Office: 1-9, LGF, Lajpat Nagar -1 New Delhi- 110024

Telefax: +91-11-64000323

Web: www.nikkiglobal.com

CIN: L65999DLl986PLC024493

I E-mail:

info@nikkiglobal.com

Date: - 30.01.2016

Ref. No.:- NIKKII2015-16/

To,

The Deputy General Manager,

Department of Corporate Services,

Bombay Stock Exchange, Mumbai

Phiroze Jeejeephoy Towers,

Dalal Street,

Mumbai - 400001

Dear Sir/Madam,

Sub.:- Un-audited Financial Results for the quarter ended on 31-12-2015

Ref.:- Scrip Code - 531272

Pursuant to Regulation 33 of SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015, we are enclosing herewith Un-audited Financial Results of the company for

the quarter ended on 31-12-2015, duly approved by the Board of Directors of the company at

their meeting held today on 30-01-2016. A copy of Limited Review Report issued by the Auditor

of the company for quarter ended on 31-12-2015 is also enclosed. The meeting of the Board of

Directors commenced at 11:00 a.m. and concluded at 2:00 p.m.

Kindly take the same in your records and acknowledge the receipt.

Thanking you,

Yours Faithfully,

For Nikki Global Finance Limited

(Gunjita Kalani)

Company Secretary

Encl.:- ala

NIKKI GLOBAL FINANCE LTD.

Registered Office: 1-9, LGF, Lajpat Nagar -1 New Delhi- 110024

Telefax: +91-11-64000323

CIN: L65999DLl986PLC024493

I E-mail:

Web: www.nikkiglobal.com

info@nikkiglobal.com

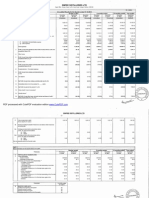

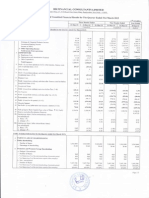

UN-AUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 31ST DECEMBER. 2015

(Rs. in Lakhs except earning per share)

Statement of Standalone Unaudited results for the Quarter Ended 3111212015

3 months

Preceding

Corresponding 3

Year to date

Year to date

Previous

3 months

months ended in

figuers for

figuers for

accounting

ended

ended

the previous

current period

previous year

year ended

ended

ended

year

(30/09/2015)

(31/12/2014)

(31/03/2015)

(31/12/2015)

(31/12/2014)

(31/12/2015)

PART I

S.

No.

Particulars

(Unaudited)

(Refer Notes Below)

1

Income from ODerations

al Net Salesllncome from operations (Net of excise duty)

b) Other Operatmq Income

Total Income from ooerations net

Exoenses

a. Cost of materials consumed

b. Purchases of stock-in-trade

84.59

0.60

85.19

4

5

(Unaudited)

(Unaudited)

62.06

0.33

62.39

80.44

0.15

80.59

242.96

8.39

251.35

(Audited)

159.15

22.91

136.24

234.89

22.19

212.70

NIL

NIL

63.29

NIL

68.74

249.42

163.02

NIL

241.93

(8.75)

(1.83)

14.11

(16.27)

(7.79)

(7.98)

1.08

0.015

1.3

0.015

3.53

0.045

7.72

0.06

3.64

0.09

f. Other expenses(Any item exceeding 10% of the total

expenses relating to continuing operations to be shown

seperately)

0.99

1.14

0.91

0.015

2.42

5.07

4.93

6.35

Total expenses

Profit 1 (Loss) from operations before other income,

finance costs and exceptional Items (1-2)

Other income

Profit 1(Loss) from ordinary activities before finance

costs and exceptional Items (3+4)

79.65

5.55

63.92

(1.53)

86.20

(5.60)

241.80

9.56

167.94

(31.70)

244.03

(31.33)

NIL

5.55

NIL

(1.53)

NIL

(5.60)

NIL

9.56

NIL

(31.70)

NIL

(31.33)

NIL

5.55

NIL

(1.53)

NIL

(5.60)

NIL

9.56

NIL

(31.70) .

NIL

(31.33)

NIL

5.55

1.71

NIL

(1.53)

NIL

(5.60)

NIL

9.56

NIL

(31.70)

NIL

(31.33)

0

5.60

NIL

2.95

6.61

NIL

0

(31.70)

NIL

0

(31.33)

NIL

6.61

(31.70)

(31.33)

8

9

Finance costs

Profit 1 (Loss) from ordinary activities

but before exceptional items (5-6)

Exceotional items

Profit 1 (Loss) from ordinary activities

10

11

12

Tax exoense

Net Profit 1 (Lossl from ordinary activities after tax (9-10)

Extraordinary items (net of tax expense Rs. ___

Lakhs)

3.84

NIL

0

(1.53)

NIL

13

Net Profit! (Loss) for the period (11-12)

3.84

(1.53)

14

15

Share of Profit 1 loss of accociates"

Minority Interest'

16

Net profit I(Loss)after taxes, minority interest and share

of profit/loss of associates (13+14+15)'

6

7

(Unaudited)

86.31

c. Changes in inventories of finished goods. work-in-progress

and stock-in-trade

d. Employees benefits expense

e. DepreCiation and amortisation expense

(Unaudited)

after Finance costs

before tax (7-8)

Paid -up equity share capital (face value of the Shares shall

be indicatedl

18 Reserve excluding Revaluation Reserves as per balance

sheet of pervious accountinq year

19.1 Earnings per share (before extraordinary items) (of RS.l01

each) (not annualised):

17

a Basic

b) Diluted

19.ii Earnings per share (after extraordinary

eachllnot annualisedl:

a) Basic

b Diluted

(5.60)

NIL

NIL

0

NIL

0

NIL

0

NIL

0

NIL

0

NIL

0

NIL

341.97

341.97

341.97

341.97

341.97

341.97

(131.62)

0.11

0.11

{0.04

0.04

{0.16

0.16

0.19

0.19

(0.93

(0.93)

0.916

{0.916

0.11

0.11

(0.04

0.04)

10.16

(0.16)

0.19

0.19

0.93

(0.93)

0.916

(0.916

items) (of Rs.l0/I

NIKKI GLOBAL FINANCE LTD.

Registered Office: 1-9, LOF, Lajpat Nagar -1 New Delhi- 110024

Telefax: +91-11-64000323

Web: www.nikkiglobal.com

CIN: L65999DLl986PLC024493

I E-mail:

info@nikkiglobal.com

PART 11

Particulars

.

A

1

PARTICULARS OF SHAREHOLDING

ublic shareholding

- rsumoer or ,snares

t-'ercemage 01 snarenololng

3 months

ended

Preceding

3 months

ended

Corresponding 3

months ended in

the previous

year

Year to date

figuers for

current period

ended

Year to date

figuers for

previous year

ended

Previous

accounting

year ended

(31/12/2015)

(30/09/2015)

(3111212014)

(31112/2015)

(31/12/2014)

(31/03/2015)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Audited)

3152776

92.19

3152776

92.19

3152776

92.19

3152776

92.19

3152776

92.19

3152776

92.19

Promoters and Promoter Group Shareholding

a) Pledged 1 Encumbered

Number of shares

Percentage of shares (as a % of the total shareholding of

promoter and promoter group)

Percentage of shares (as a % of the total share capital of the

company)

NIL

NIL

NtL

NIL

NIL

NIL

NIL

NIL

NtL

NIL

NIL

NtL

NIL

NIL

NtL

NIL

NIL

NIL

Number of shares

266924

266924

266924

266924

266924

266924

- Percentage of shares (as a % of the total shareholding of the

promoter and Promoter group)

- Percentage of shares (as a % of the total share capital of the

company)

100.00

100.00

100.00

100.00

100,00

100.00

7.81

7.81

7.81

7.81

7.81

7.81

b) Non-encumbered

Partlcu ars

INVESTOR COMPLAINTS

Pending at the beginning of the quarter

3 months ended (31/1212015)

Received during the quarter

0

0

Disposed of during the quarter

Remaining unresolved at the end of the quarter

IApplicable

in case of Consolidated

Results

Notes:

1

The above results have been reviewed by the Audit

and the Statutory Auditor have issued their Limited

2

Figures have been regroupedlrearranged

whenever

3

Statement of Investor's Complaint has alredy been

Committee and taken on record by the Board of Directors at their meeting held on 30.01.2016

Review Report on the same.

necessary,

submitted to BSE under Regulation 13(3).

;r;J.:r:- -f

By Order of the Board of Directors

mD

PLACE: NEW DELHI

DATE: 30.01.2016

DIN: 023

l~6\JJ

AGARWAL & ASSOCIATES

CHARTERED ACCOUNTANTS

124, Z-l, HEMANT VIHAR, BARRA -2, KANPUR - 208027

Tel: (0) +919235444005 (M) 09415044443

E-mail:-julujagarwal@gmail.com.julujagarwal@rediffmail.com

Review Report

(Annexure V)

To,

Nikki Global Finance Limited,

1-9, LGF, Lajpat Nagar-l,

New Delhi - 110024

CIN: L65999DL1986PLC024493

Dear Sir,

We have reviewed the accompanying statement of Un-audited financial results ofNikki Global Finance Limited

for the quarter ended on 31st December, 2015. This statement is the responsibility or the company's

management and has been approved by the Board of Directors. Our responsibility is to issue a report on these

financial statements based on our review.

We conducted our review in accordance with Standard on Review Engagement (SRE) 2400, engagements to

Review Financial Statements issued by the Institute of Chartered Accountants of India. This standard requires

that we plan and perform the review to obtain moderate assurance as to whether the financial statements are free

of material misstatement. A review is limited primarily to inquiries of company personnel and analytical

procedures applied to financial data and thus provides less assurance than an audit. We have not performed an

audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to believe that the

accompanying statement of unaudited financial results prepared in accordance with applicable accounting

standards and other recognized accounting practices and policies has not disclosed the information required to

be disclosed in terms of Regulation 33 ofSEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015 including the manner in which it is to be disclosed, or that it contains any material misstatement.

~O~~\t,\\6

CA Jalaj Agarwa\

Partner

M.No. 071738

Place: - Kanpur

0.-\' ,1;

Date: - 30-01-2016/ ~ TO'

You might also like

- NON Negotiable Unlimited Private BondDocument2 pagesNON Negotiable Unlimited Private Bonddbush277886% (14)

- Options strategies and spreads guideDocument9 pagesOptions strategies and spreads guideSatya Kumar100% (1)

- Faysal Bank Car Leasing ReportDocument21 pagesFaysal Bank Car Leasing ReportShehrozAyazNo ratings yet

- Financial PlanningDocument119 pagesFinancial PlanningUmang Jain100% (1)

- Chapter 14Document43 pagesChapter 14Dominic RomeroNo ratings yet

- 7.-ICED OJK Risk - Management.due .DiligenceDocument59 pages7.-ICED OJK Risk - Management.due .DiligenceAryoAdiatmo100% (1)

- Project Report On Analysis of Indian BankDocument74 pagesProject Report On Analysis of Indian Banksanthoshni81% (27)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document4 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document6 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results & Limited Review Report For December 31, 2015 (Result)Document3 pagesStandalone Financial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- UG BCom Pages DeletedDocument22 pagesUG BCom Pages DeletedVijeta SinghNo ratings yet

- Offset Agreement - Wikipedia, The Free EncyclopediaDocument20 pagesOffset Agreement - Wikipedia, The Free EncyclopedianeerajscribdNo ratings yet

- Currency Wars: Impact On IndiaDocument7 pagesCurrency Wars: Impact On IndiaAbhishek TalujaNo ratings yet

- Quantitative Techniques For Decision Making - CasesDocument6 pagesQuantitative Techniques For Decision Making - CasesPragya SinghNo ratings yet

- Working Capital Management AbstractDocument14 pagesWorking Capital Management AbstractPriyanka GuptaNo ratings yet

- Guidelines For Withdrawal PDFDocument3 pagesGuidelines For Withdrawal PDFMary LeandaNo ratings yet

- Eros Sampoornam New Phase PL W.E.F 16.06.2020Document1 pageEros Sampoornam New Phase PL W.E.F 16.06.2020Gaurav SinghNo ratings yet

- Understanding Financial Leverage RatiosDocument17 pagesUnderstanding Financial Leverage RatiosChristian Jasper M. LigsonNo ratings yet

- Aeropostale Checkout ConfirmationDocument3 pagesAeropostale Checkout ConfirmationBladimilPujOlsChalasNo ratings yet

- Full FM Module Final Draft 222Document157 pagesFull FM Module Final Draft 222bikilahussenNo ratings yet

- Elliott WaveDocument7 pagesElliott WavePetchiramNo ratings yet

- Joinpdf PDFDocument1,043 pagesJoinpdf PDFOwen Bawlor ManozNo ratings yet

- Credit Rating AgenciesDocument20 pagesCredit Rating AgenciesKrishna Chandran PallippuramNo ratings yet

- Management Accounting: 2 Year ExaminationDocument24 pagesManagement Accounting: 2 Year ExaminationChansa KapambweNo ratings yet

- IB Chapter08Document52 pagesIB Chapter08ismat arteeNo ratings yet

- DEPOSITSLIP#192792#1Document1 pageDEPOSITSLIP#192792#1AsadNo ratings yet

- Lesson 1.6 Compound InterestDocument103 pagesLesson 1.6 Compound Interestglenn cardonaNo ratings yet

- Regular ManualDocument164 pagesRegular ManualManikdnathNo ratings yet

- Salary, Wage, Income: Business MathematicsDocument20 pagesSalary, Wage, Income: Business MathematicsNatasha Dela PeñaNo ratings yet

- Indonesia Coal Firm Bukit Asam Earnings Beat EstimatesDocument7 pagesIndonesia Coal Firm Bukit Asam Earnings Beat EstimatesDarren WijayaNo ratings yet

- General Power of AttorneyDocument1 pageGeneral Power of AttorneyAriel Hartung100% (1)

- Final Order - Case No 38 of 2014Document148 pagesFinal Order - Case No 38 of 2014sachinoilNo ratings yet

- OP 4.09 Pest ManagementDocument2 pagesOP 4.09 Pest ManagementRina YulianiNo ratings yet