Professional Documents

Culture Documents

Adjusting Journal Entries

Uploaded by

MaryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Journal Entries

Uploaded by

MaryCopyright:

Available Formats

Adjusting Journal Entries

Prepaid Expenses:

Transaction Description Journal Entry Account Title Debit Credit

Supplies: Beginning supplies plus any purchases minus supplies on hand Insurance: Original cost divided by number of months paid for

Supplies Expense Supplies Insurance Expense Prepaid Insurance

XXX XXX XXX XXX

Depreciation Expense XXX Depreciation: Based on type of depreciation method used Accumulated Depreciation-Asset title XXX You pay for in advance of usage these assets. Each is divided by the period in which the asset will be used up.

Unearned Revenues:

Transaction Description Journal Entry Account Title Debit Credit

XXX Advance payments: Accounting for any Unearned Service Revenue amount earned during the fiscal period Service Revenue XXX Other types of revenue accounts could be titled: Unearned Sales Revenue, Unearned Subscription Revenue, and Unearned Ticket Revenues. The number of products or services sold only limits the possibilities for account titles.

Accrued Revenues:

Transaction Description Journal Entry Account Title Debit Credit

Revenues earned but not yet billed at the Accounts Receivable end of the fiscal period Service Revenue

XXX XXX

Accrued Expenses:

Transaction Description Accrued Interest: Expense incurred but not yet due to be paid Accrued Salaries: Salaries earned but not due to be paid until next payday occurs Journal Entry Account Title Interest Expense Interest Payable Salaries Expense Salaries Payable Debit XXX Credit XXX XXX XXX

MJC Revised 10-2011

Page 1

You might also like

- Classification of AccountsDocument3 pagesClassification of AccountsSaurav Aradhana100% (1)

- Ratios Used in Analysis of Financial StatementsDocument2 pagesRatios Used in Analysis of Financial StatementsMary100% (4)

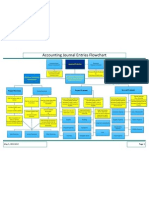

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Instructions For A Classified Balance SheetDocument5 pagesInstructions For A Classified Balance SheetMary91% (11)

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- Account ClassificationDocument2 pagesAccount ClassificationMary96% (23)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Rose Flower Business TransactionsDocument7 pagesRose Flower Business TransactionsMhel DemabogteNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Asset Accounts With Normal BalancesDocument2 pagesAsset Accounts With Normal BalancesMary100% (2)

- Cash Flows Statement Indirect MethodDocument2 pagesCash Flows Statement Indirect MethodMary100% (1)

- ACC1002X Cheat Sheet 2Document1 pageACC1002X Cheat Sheet 2jieboNo ratings yet

- Analysis of Financial Statements RatiosDocument2 pagesAnalysis of Financial Statements RatiosMaryNo ratings yet

- Accounting Cycle Review - Qualifying Exams 2011Document18 pagesAccounting Cycle Review - Qualifying Exams 2011Leslie Sparks100% (6)

- Stockholders' Equity Accounts With Normal BalancesDocument3 pagesStockholders' Equity Accounts With Normal BalancesMary67% (3)

- Instructions For A Cash Flows Statement Direct MethodDocument5 pagesInstructions For A Cash Flows Statement Direct MethodMary100% (8)

- Basic Everyday Journal EntriesDocument2 pagesBasic Everyday Journal EntriesMary73% (15)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting: Adjusting EntriesDocument11 pagesAccounting: Adjusting EntriesCamellia100% (2)

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Basic Instructions For A Bank Reconciliation StatementDocument4 pagesBasic Instructions For A Bank Reconciliation StatementMary100% (14)

- Activate Your BPI Credit CardDocument3 pagesActivate Your BPI Credit CardAl Patrick Dela CalzadaNo ratings yet

- Emperor BTC-Volume Profile Seasson VolumeDocument10 pagesEmperor BTC-Volume Profile Seasson VolumeJasiresya GroupNo ratings yet

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsMary100% (4)

- Journal Entries For ReceivablesDocument2 pagesJournal Entries For ReceivablesMary80% (10)

- Indirect Method of Cash Flows Statement DirectionsDocument5 pagesIndirect Method of Cash Flows Statement DirectionsMary94% (18)

- Basic Everyday Journal Entries For A Sole Propietorship-Colored BackgroundDocument2 pagesBasic Everyday Journal Entries For A Sole Propietorship-Colored BackgroundMary100% (4)

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Perpetual Inventory System Journal EntriesDocument1 pagePerpetual Inventory System Journal EntriesMary86% (7)

- Journal Entries For Stockholders' EquityDocument2 pagesJournal Entries For Stockholders' EquityMary100% (11)

- Basic Instructions For A Simple Income StatementDocument1 pageBasic Instructions For A Simple Income StatementMary100% (4)

- Adjusting Entries For Bank ReconciliationDocument1 pageAdjusting Entries For Bank ReconciliationMaryNo ratings yet

- Adjusting Entries For Bank ReconciliationDocument1 pageAdjusting Entries For Bank ReconciliationMaryNo ratings yet

- Closing Journal EntriesDocument1 pageClosing Journal EntriesMary91% (11)

- Purchase Journal and Accounts Payable Subsidiary LedgerDocument4 pagesPurchase Journal and Accounts Payable Subsidiary LedgerMary100% (6)

- Journal Entries For Long Lived AssetsDocument2 pagesJournal Entries For Long Lived AssetsMary100% (20)

- Petty Cash FundDocument1 pagePetty Cash FundMary100% (2)

- Topic 8 - Accounting For Manufacturing OperationsDocument41 pagesTopic 8 - Accounting For Manufacturing Operationsdenixng100% (8)

- Food Safety Audit: Confidential Information - Proprietary To Yum! Brands, IncDocument31 pagesFood Safety Audit: Confidential Information - Proprietary To Yum! Brands, IncObaid Bilgarami50% (2)

- Sales Journal and Accounts Receivable Subsidiary LedgerDocument4 pagesSales Journal and Accounts Receivable Subsidiary LedgerMary100% (5)

- Journal Entries For Bank ReconciliationDocument1 pageJournal Entries For Bank ReconciliationMary90% (10)

- Week11-Completing The Accounting CycleDocument44 pagesWeek11-Completing The Accounting CycleAmir Indrabudiman100% (2)

- General Journal EntriesDocument10 pagesGeneral Journal EntriesLeonilaEnriquezNo ratings yet

- Accounting CycleDocument1 pageAccounting CycleMary100% (3)

- Solution Manual For Auditing and Assurance Services 17th Edition Alvin A Arens Randal J Elder Mark S Beasley Chris e HoganDocument31 pagesSolution Manual For Auditing and Assurance Services 17th Edition Alvin A Arens Randal J Elder Mark S Beasley Chris e HoganMeredithFleminggztay100% (78)

- Chapter 12 - Bank ReconciliationDocument29 pagesChapter 12 - Bank Reconciliationshemida100% (7)

- Adjusting EntriesDocument7 pagesAdjusting EntriesJon PangilinanNo ratings yet

- Bank ReconciliationDocument19 pagesBank ReconciliationSheenaGaliciaNew100% (4)

- Comprehensive Problem Accounting 101Document2 pagesComprehensive Problem Accounting 101Heidi Norris Dawson25% (4)

- BRB23 TaxDocument203 pagesBRB23 TaxIsabella Siggaoat100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Accounting For Merchandising OperationsDocument58 pagesAccounting For Merchandising OperationsHEM CHEA100% (11)

- Periodic Inventory System Journal EntriesDocument1 pagePeriodic Inventory System Journal EntriesMary100% (3)

- Accounting-Adjusting Journal EntriesDocument27 pagesAccounting-Adjusting Journal EntriesMary92% (24)

- Article 1771Document1 pageArticle 1771karl doceoNo ratings yet

- One Full Accounting Cycle Process ExplainedDocument11 pagesOne Full Accounting Cycle Process ExplainedRiaz Ahmed100% (1)

- Horizontal Analysis of A Balance SheetDocument3 pagesHorizontal Analysis of A Balance SheetMary100% (6)

- Gross Pay CalculationsDocument2 pagesGross Pay CalculationsMary100% (3)

- Basic Instructions For Retained Earnings StatementDocument1 pageBasic Instructions For Retained Earnings StatementMary100% (5)

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Gross Profit Section of Income Statement-Periodic SystemDocument3 pagesGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Closing Journal Entries-Sole ProprietorshipDocument1 pageClosing Journal Entries-Sole ProprietorshipMary100% (3)

- Owners Equity Statement Form InstructionsDocument2 pagesOwners Equity Statement Form InstructionsMary100% (4)

- How To Create A WorksheetDocument3 pagesHow To Create A WorksheetMary100% (2)

- Comprehensive Accounting Cycle Review Problem 1Document13 pagesComprehensive Accounting Cycle Review Problem 1api-270882496No ratings yet

- Adjusting Journal EntriesDocument11 pagesAdjusting Journal EntriesKatrina RomasantaNo ratings yet

- Simple Discount NoteDocument1 pageSimple Discount NoteMary100% (2)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Diagram of Accounting EquationDocument1 pageDiagram of Accounting EquationMary100% (3)

- Make or Buy AnalysisDocument4 pagesMake or Buy AnalysisMaryNo ratings yet

- Kirkpatrick + ModelDocument1 pageKirkpatrick + ModelMaryNo ratings yet

- Continue or Eliminate AnalysisDocument3 pagesContinue or Eliminate AnalysisMaryNo ratings yet

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Product Cost AnalysisDocument10 pagesProduct Cost AnalysisMaryNo ratings yet

- Special Order AnalysisDocument2 pagesSpecial Order AnalysisMaryNo ratings yet

- Chunking Method DiagramDocument1 pageChunking Method DiagramMaryNo ratings yet

- Circle of LifeDocument1 pageCircle of LifeMaryNo ratings yet

- ARCS Method of MotivationDocument1 pageARCS Method of MotivationMaryNo ratings yet

- Transaction Analyzes For A CorporationDocument2 pagesTransaction Analyzes For A CorporationMaryNo ratings yet

- Scaffolding MethodDocument1 pageScaffolding MethodMaryNo ratings yet

- Partial Income Statement For Manufacturing CompanyDocument1 pagePartial Income Statement For Manufacturing CompanyMary50% (2)

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDocument1 pageCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryNo ratings yet

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- Simplified Charts - Percentage Method Income Tax Withholding 2012Document4 pagesSimplified Charts - Percentage Method Income Tax Withholding 2012MaryNo ratings yet

- Labor Variance FormulasDocument2 pagesLabor Variance FormulasMaryNo ratings yet

- Table Factors For Present and Future Value of One DollarDocument6 pagesTable Factors For Present and Future Value of One DollarMaryNo ratings yet

- Materials Variance FormulasDocument2 pagesMaterials Variance FormulasMary100% (1)

- Simplified Charts-Percentage Method Income Tax Withholding 2008Document4 pagesSimplified Charts-Percentage Method Income Tax Withholding 2008MaryNo ratings yet

- Gross Profit Section of Income Statement-Periodic SystemDocument3 pagesGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- Savings Interest CalculatorDocument7 pagesSavings Interest Calculatorعمر El KheberyNo ratings yet

- Ch 1: Info Systems Overview MCQDocument2 pagesCh 1: Info Systems Overview MCQruvenNo ratings yet

- 3901 LN1Document3 pages3901 LN1Ayushmaan BhattacharjiNo ratings yet

- FlangeDocument1 pageFlangeTejasNo ratings yet

- Custom Writing Service - Special PricesDocument4 pagesCustom Writing Service - Special PricesGORGO NewsNo ratings yet

- PDF New Oil Gas Power Coal Diesel Water Infra DLDocument13 pagesPDF New Oil Gas Power Coal Diesel Water Infra DLShubham TyagiNo ratings yet

- Terminologies in Petroleum IndustryDocument7 pagesTerminologies in Petroleum Industryarvind_dwivedi100% (1)

- Working Capital Management in Textile IndustryDocument7 pagesWorking Capital Management in Textile IndustryAmaan KhanNo ratings yet

- Bankruptcy in KenyaDocument12 pagesBankruptcy in Kenyany17No ratings yet

- Experienced Healthcare Business AnalystDocument5 pagesExperienced Healthcare Business AnalystH JKNo ratings yet

- The New York Times - Sunday, November 11th 2012Document166 pagesThe New York Times - Sunday, November 11th 2012Míni (Anca)100% (1)

- Wellesley CollegeDocument11 pagesWellesley CollegeAyam KontloNo ratings yet

- CEAT Limited Integrated Annual Report FY23 PG 85 85Document177 pagesCEAT Limited Integrated Annual Report FY23 PG 85 85sumitminocha00No ratings yet

- MMC at 1PbDocument4 pagesMMC at 1PbRandy PaderesNo ratings yet

- Types of Investors and Investment AlternativesDocument13 pagesTypes of Investors and Investment AlternativesAnjali ShuklaNo ratings yet

- Critical Analysis of BASEL III & Deutsche Bank and The Road To Basel III by Group-1Document14 pagesCritical Analysis of BASEL III & Deutsche Bank and The Road To Basel III by Group-1Kathiravan RajendranNo ratings yet

- Evaluation and Comparison of Construction Safety Regulations in Kuwait Government SectorsDocument5 pagesEvaluation and Comparison of Construction Safety Regulations in Kuwait Government SectorsUntungSubarkahNo ratings yet

- ZATCA Electronic Invoice XML Implementation Standard VTrackDocument75 pagesZATCA Electronic Invoice XML Implementation Standard VTrackmfarzadk123No ratings yet

- Projects Payment Procedures Manual Rev 9.0Document140 pagesProjects Payment Procedures Manual Rev 9.0danudmwNo ratings yet

- Org Chart Updated 2021Document1 pageOrg Chart Updated 2021Shan Dela VegaNo ratings yet

- MSc Thesis Topics in Sustainable Development, Tourism Management and TechnologyDocument13 pagesMSc Thesis Topics in Sustainable Development, Tourism Management and TechnologyAllan AlbanoNo ratings yet

- Development Economics-Module 2iiDocument16 pagesDevelopment Economics-Module 2iimaleeha shahzadNo ratings yet

- Perez, Et Al. vs. Philippine National Bank, Et AlDocument5 pagesPerez, Et Al. vs. Philippine National Bank, Et AlDorky DorkyNo ratings yet

- Economic Syllzclass 12 E-WPS OfficeDocument11 pagesEconomic Syllzclass 12 E-WPS OfficeSrjNo ratings yet