Professional Documents

Culture Documents

Journal Entries and Posting To T-Accounts

Uploaded by

Mary100%(6)100% found this document useful (6 votes)

6K views15 pagesDemstration of Journal Entries and Posting to T-Accounts.

Original Title

Journal Entries and Posting to T-Accounts

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDemstration of Journal Entries and Posting to T-Accounts.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(6)100% found this document useful (6 votes)

6K views15 pagesJournal Entries and Posting To T-Accounts

Uploaded by

MaryDemstration of Journal Entries and Posting to T-Accounts.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 15

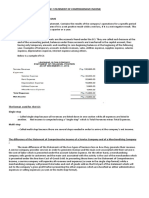

Journal Entries

Basics examples of how to do

general journal entries

List of Transactions for the month of January 2006

• Marie Collins invested $100,000 of her own money into her new pet shop

on January 1, 2006. The store will be named “Love thy Pet.”

• For January 1, 2006, Marie paid $1,350 rent on the pet shop.

• For January 2, 2006, Marie borrowed $50,000 by signing a 4-month, 10%

note payable.

• For January 5, 2006, Marie purchased pet store equipment for $7,500 in

cash.

• For January 6, 2006, Marie hired two salespeople to begin work on the 9th

of January in the store for a bi-weekly wage of $800 each.

• For January 8, 2006, Marie receives a cash advance of $1,200 from a

customer for an Irish sheep dog that will not arrive from the breeder until

March 7, 2006.

• For January 10, 2006, Marie received $5,500 in cash for two bulldogs

sold to a customer.

• For January 14, 2006, Marie purchased 2-months of pet supplies on

account at a cost of $500 from Morrison pet supply store.

• For January 15, 2006, Marie declared and paid a dividend to stockholders

of $400.

• For January 31, 2006 Marie purchased a 2-year insurance policy costing

$2,400 that will expire on January 31 of 2008.

• For January 31, 2006, Marie paid the salespersons bi-weekly wages.

Marie Collins invested $100,000 of her own money

into her new pet shop on January 1, 2006. The

store will be named “Love thy Pet.”

For January 1, 2006, Marie paid $1,350 rent on the

pet shop.

For January 2, 2006, Marie borrowed $50,000 by

signing a 4-month, 10% note payable.

For January 5, 2006, Marie purchased pet store

equipment for $7,500 in cash.

For January 6, 2006, Marie hired two salespeople to begin

work on the 9th of January in the shop for a bi-weekly wage

of $800 each.

This transaction requires no journal entries because

assets were not exchanged at the time of this event.

For January 8, 2006, Marie receives a cash advance of

$1,200 from a customer for an Irish sheep dog that will not

arrive from the breeder until March 7, 2006.

For January 10, 2006, Marie received $5,500 in cash for

two bulldogs sold to a customer.

For January 14, 2006, Marie purchased 2-months of pet

supplies on account for a cost of $500 from Morrison pet

supply store.

For January 15,2006, Marie declared and paid a

dividend to stockholders of $400.

For January 31, 2006 Marie purchased a 2-year insurance

policy costing $2,400 that will expire on January 31 of

2008.

For January 31, 2006, Marie paid the salespeople

their bi-weekly wages.

You might also like

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Transaction AnalysisDocument14 pagesTransaction AnalysisMaryNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Purchase Journal and Accounts Payable Subsidiary LedgerDocument4 pagesPurchase Journal and Accounts Payable Subsidiary LedgerMary100% (6)

- Accounting Journal Entries With Business Transactions PDFDocument7 pagesAccounting Journal Entries With Business Transactions PDFBackchodi OverLoadedNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- Assignment Qs 1 - Journalization and PostingDocument2 pagesAssignment Qs 1 - Journalization and PostingShehzad Qureshi100% (1)

- Accounting: Accounting made easy, including basic accounting principles, and how to do your own bookkeeping!From EverandAccounting: Accounting made easy, including basic accounting principles, and how to do your own bookkeeping!No ratings yet

- Accounting CycleDocument13 pagesAccounting CycleMylene SalvadorNo ratings yet

- Accounting: Adjusting EntriesDocument11 pagesAccounting: Adjusting EntriesCamellia100% (2)

- Comprehensive Accounting Cycle Review Problem Copy 2Document12 pagesComprehensive Accounting Cycle Review Problem Copy 2api-252183085No ratings yet

- Comprehensive ProblemDocument11 pagesComprehensive Problemapi-295660192No ratings yet

- Problems Journal EntryDocument5 pagesProblems Journal EntryColleen GuimbalNo ratings yet

- Simple Interest and Maturity ValueDocument2 pagesSimple Interest and Maturity ValueMary100% (6)

- Branches of AccountingDocument14 pagesBranches of AccountingSharif ShaikNo ratings yet

- Journal Entries TradingDocument79 pagesJournal Entries TradingAvox EverdeenNo ratings yet

- Week11-Completing The Accounting CycleDocument44 pagesWeek11-Completing The Accounting CycleAmir Indrabudiman100% (2)

- Journal Entry ExampleDocument52 pagesJournal Entry Examplesriram998983% (6)

- One Full Accounting Cycle Process ExplainedDocument11 pagesOne Full Accounting Cycle Process ExplainedRiaz Ahmed100% (1)

- Manual Accounting Practice SetDocument13 pagesManual Accounting Practice SetNguyen Thien Anh Tran100% (2)

- Journal Entries GuideDocument5 pagesJournal Entries GuideRaez Rodillado100% (1)

- Accounting Practice ExercisesDocument2 pagesAccounting Practice ExercisesRussell FernandezNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesJon PangilinanNo ratings yet

- Journalizing, Posting and BalancingDocument21 pagesJournalizing, Posting and Balancinganuradha100% (1)

- Normal Balances of AccountsDocument16 pagesNormal Balances of AccountsKeith Elisa OlivaNo ratings yet

- Journal Entries ExamplesDocument9 pagesJournal Entries Examplesmoon_mohi50% (2)

- Test Question For Exam Chapter 1 To 6Document4 pagesTest Question For Exam Chapter 1 To 6Cherryl ValmoresNo ratings yet

- Module 1 - Business Transaction and Their Analysis Part 1Document12 pagesModule 1 - Business Transaction and Their Analysis Part 11BSA5-ABM Espiritu, CharlesNo ratings yet

- Adjusting Entries Service BusinessDocument18 pagesAdjusting Entries Service BusinessrichelleNo ratings yet

- Perpetual Inventory System Journal EntriesDocument1 pagePerpetual Inventory System Journal EntriesMary86% (7)

- Perpetual Inventory SystemDocument5 pagesPerpetual Inventory SystemRey ArudNo ratings yet

- Accounting-Adjusting Journal EntriesDocument27 pagesAccounting-Adjusting Journal EntriesMary92% (24)

- Adjusting Entries For StudentsDocument57 pagesAdjusting Entries For Studentsselvia egayNo ratings yet

- Voucher System, Special Journals, and Subsidiary LedgersDocument9 pagesVoucher System, Special Journals, and Subsidiary LedgersCatherine Calero50% (2)

- Fundamentals of Accounting by Prof. Neha PatelDocument29 pagesFundamentals of Accounting by Prof. Neha Patelnayan bhowmick100% (1)

- Adjusting Journal EntriesDocument11 pagesAdjusting Journal EntriesKatrina RomasantaNo ratings yet

- 22 How To Solve Difficult Adjustments and Journal Entries in Financial AccountsDocument43 pages22 How To Solve Difficult Adjustments and Journal Entries in Financial AccountsKushal D Kale79% (33)

- CashflowDocument6 pagesCashflowAizia Sarceda Guzman71% (7)

- Chapter 7 The Accounting EquationDocument57 pagesChapter 7 The Accounting EquationCarmelaNo ratings yet

- Accounting CycleDocument7 pagesAccounting CycleJenny BernardinoNo ratings yet

- ACCOUNTING FOR VARIOUS BUSINESS TRANSACTIONSDocument31 pagesACCOUNTING FOR VARIOUS BUSINESS TRANSACTIONSAlbert Moreno100% (4)

- How To Create A WorksheetDocument3 pagesHow To Create A WorksheetMary100% (2)

- Analyzing Business TransactionsDocument13 pagesAnalyzing Business TransactionsEricJohnRoxasNo ratings yet

- 1 How To Prepare An Income StatementDocument4 pages1 How To Prepare An Income Statementapi-299265916No ratings yet

- FABM 1 Lesson 7 The Accounting EquationDocument19 pagesFABM 1 Lesson 7 The Accounting EquationTiffany Ceniza100% (1)

- Basic Acctg 4th SatDocument11 pagesBasic Acctg 4th SatJerome Eziekel Posada PanaliganNo ratings yet

- Journal EntryDocument30 pagesJournal EntrySanjay MehrotraNo ratings yet

- Fundamentals of AccountingDocument50 pagesFundamentals of AccountingCarmina Dongcayan100% (2)

- Accounting ProblemsDocument7 pagesAccounting Problemspammy313100% (1)

- CFS ComponentsDocument11 pagesCFS ComponentsAlyssa Nikki VersozaNo ratings yet

- Accounting Adjusting EntryDocument20 pagesAccounting Adjusting EntryClemencia Masiba100% (1)

- Accounting cycle stepsDocument36 pagesAccounting cycle stepsRodolfo CorpuzNo ratings yet

- Adjusting journal entries optimize financial reportsDocument11 pagesAdjusting journal entries optimize financial reportsBenjaminJrMoronia100% (1)

- Fabm2: Pres. Sergio Osmena High School Senior High School ABM 12 Prepared By: Mrs. Eleonor E. MujalDocument20 pagesFabm2: Pres. Sergio Osmena High School Senior High School ABM 12 Prepared By: Mrs. Eleonor E. MujalKenneth C. BulanNo ratings yet

- Tesda Perpetual and Periodic Inventory SystemsDocument6 pagesTesda Perpetual and Periodic Inventory Systemsnelia d. onteNo ratings yet

- Completing The Accounting Cycle For A Merchandising BusinessDocument11 pagesCompleting The Accounting Cycle For A Merchandising BusinessRhea BernabeNo ratings yet

- Assignment November11 KylaAccountingDocument2 pagesAssignment November11 KylaAccountingADRIANO, Glecy C.No ratings yet

- Basic Everyday Journal Entries For A Sole Propietorship-Colored BackgroundDocument2 pagesBasic Everyday Journal Entries For A Sole Propietorship-Colored BackgroundMary100% (4)

- Posting To T-AccountsDocument19 pagesPosting To T-AccountsMary100% (9)

- Diagram of Accounting EquationDocument1 pageDiagram of Accounting EquationMary100% (3)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Analysis of Financial Statements RatiosDocument2 pagesAnalysis of Financial Statements RatiosMaryNo ratings yet

- Make or Buy AnalysisDocument4 pagesMake or Buy AnalysisMaryNo ratings yet

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Special Order AnalysisDocument2 pagesSpecial Order AnalysisMaryNo ratings yet

- Cash Flows Statement Indirect MethodDocument2 pagesCash Flows Statement Indirect MethodMary100% (1)

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Adjusting Entries For Bank ReconciliationDocument1 pageAdjusting Entries For Bank ReconciliationMaryNo ratings yet

- Kirkpatrick + ModelDocument1 pageKirkpatrick + ModelMaryNo ratings yet

- Product Cost AnalysisDocument10 pagesProduct Cost AnalysisMaryNo ratings yet

- Horizontal Analysis of A Balance SheetDocument3 pagesHorizontal Analysis of A Balance SheetMary100% (6)

- Scaffolding MethodDocument1 pageScaffolding MethodMaryNo ratings yet

- Continue or Eliminate AnalysisDocument3 pagesContinue or Eliminate AnalysisMaryNo ratings yet

- Chunking Method DiagramDocument1 pageChunking Method DiagramMaryNo ratings yet

- ARCS Method of MotivationDocument1 pageARCS Method of MotivationMaryNo ratings yet

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDocument1 pageCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryNo ratings yet

- Circle of LifeDocument1 pageCircle of LifeMaryNo ratings yet

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Table Factors For Present and Future Value of One DollarDocument6 pagesTable Factors For Present and Future Value of One DollarMaryNo ratings yet

- Partial Income Statement For Manufacturing CompanyDocument1 pagePartial Income Statement For Manufacturing CompanyMary50% (2)

- Simplified Charts - Percentage Method Income Tax Withholding 2012Document4 pagesSimplified Charts - Percentage Method Income Tax Withholding 2012MaryNo ratings yet

- Labor Variance FormulasDocument2 pagesLabor Variance FormulasMaryNo ratings yet

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsMary100% (4)

- Materials Variance FormulasDocument2 pagesMaterials Variance FormulasMary100% (1)

- Transaction Analyzes For A CorporationDocument2 pagesTransaction Analyzes For A CorporationMaryNo ratings yet

- Simplified Charts-Percentage Method Income Tax Withholding 2008Document4 pagesSimplified Charts-Percentage Method Income Tax Withholding 2008MaryNo ratings yet

- Gross Profit Section of Income Statement-Periodic SystemDocument3 pagesGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- Affordable Care Act Tax - Fact CheckDocument26 pagesAffordable Care Act Tax - Fact CheckNag HammadiNo ratings yet

- Tambunting Pawnshop Vs CIR Re VATDocument7 pagesTambunting Pawnshop Vs CIR Re VATMark Lester Lee AureNo ratings yet

- Oscar Ortega Lopez - 1.2.3.a BinaryNumbersConversionDocument6 pagesOscar Ortega Lopez - 1.2.3.a BinaryNumbersConversionOscar Ortega LopezNo ratings yet

- CVP Solution (Quiz)Document9 pagesCVP Solution (Quiz)Angela Miles DizonNo ratings yet

- Product Catalog: Ductless Mini-Splits, Light Commercial and Multi-Zone SystemsDocument72 pagesProduct Catalog: Ductless Mini-Splits, Light Commercial and Multi-Zone SystemsFernando ChaddadNo ratings yet

- Company's Profile Presentation (Mauritius Commercial Bank)Document23 pagesCompany's Profile Presentation (Mauritius Commercial Bank)ashairways100% (2)

- Capran+980 CM en PDFDocument1 pageCapran+980 CM en PDFtino taufiqul hafizhNo ratings yet

- ADC Driver Reference Design Optimizing THD, Noise, and SNR For High Dynamic Range InstrumentationDocument22 pagesADC Driver Reference Design Optimizing THD, Noise, and SNR For High Dynamic Range InstrumentationAdrian SuNo ratings yet

- Tita-111 2Document1 pageTita-111 2Gheorghita DuracNo ratings yet

- Parasim CADENCEDocument166 pagesParasim CADENCEvpsampathNo ratings yet

- FC Bayern Munich Marketing PlanDocument12 pagesFC Bayern Munich Marketing PlanMateo Herrera VanegasNo ratings yet

- Borneo United Sawmills SDN BHD V Mui Continental Insurance Berhad (2006) 1 LNS 372Document6 pagesBorneo United Sawmills SDN BHD V Mui Continental Insurance Berhad (2006) 1 LNS 372Cheng LeongNo ratings yet

- Marketing Management NotesDocument115 pagesMarketing Management NotesKajwangs DanNo ratings yet

- Building A Computer AssignmentDocument3 pagesBuilding A Computer AssignmentRajaughn GunterNo ratings yet

- Ridge Regression: A Concise GuideDocument132 pagesRidge Regression: A Concise GuideprinceNo ratings yet

- Exp19 Excel Ch08 HOEAssessment Robert's Flooring InstructionsDocument1 pageExp19 Excel Ch08 HOEAssessment Robert's Flooring InstructionsMuhammad ArslanNo ratings yet

- Sap Fi/Co: Transaction CodesDocument51 pagesSap Fi/Co: Transaction CodesReddaveni NagarajuNo ratings yet

- Draft of The English Literature ProjectDocument9 pagesDraft of The English Literature ProjectHarshika Verma100% (1)

- Uniform Bonding Code (Part 2)Document18 pagesUniform Bonding Code (Part 2)Paschal James BloiseNo ratings yet

- Vallance - Sistema Do VolvoDocument15 pagesVallance - Sistema Do VolvoNuno PachecoNo ratings yet

- Entrepreneurship and EconomicDocument2 pagesEntrepreneurship and EconomicSukruti BajajNo ratings yet

- 10 Consulting Frameworks To Learn For Case Interview - MConsultingPrepDocument25 pages10 Consulting Frameworks To Learn For Case Interview - MConsultingPrepTushar KumarNo ratings yet

- Rejoinder To Adom Ochere's Misrepresentation - FinalDocument3 pagesRejoinder To Adom Ochere's Misrepresentation - FinalFuaad DodooNo ratings yet

- 16 BPI V FernandezDocument1 page16 BPI V FernandezAngelica Joyce BelenNo ratings yet

- Upgrade DB 10.2.0.4 12.1.0Document15 pagesUpgrade DB 10.2.0.4 12.1.0abhishekNo ratings yet

- Air Cycle Refrigeration:-Bell - Coleman CycleDocument21 pagesAir Cycle Refrigeration:-Bell - Coleman CycleSuraj Kumar100% (1)

- JRC Wind Energy Status Report 2016 EditionDocument62 pagesJRC Wind Energy Status Report 2016 EditionByambaa BattulgaNo ratings yet

- Dewatering Construction Sites Below Water TableDocument6 pagesDewatering Construction Sites Below Water TableSOMSUBHRA SINGHANo ratings yet

- MSDS Metafuron 20 WPDocument10 pagesMSDS Metafuron 20 WPAndi DarmawanNo ratings yet

- Optimize Coverage and Performance with 12dB MTMA AmplifierDocument3 pagesOptimize Coverage and Performance with 12dB MTMA AmplifierpecqueurNo ratings yet

- Naples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoFrom EverandNaples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoRating: 5 out of 5 stars5/5 (1)

- Arizona, Utah & New Mexico: A Guide to the State & National ParksFrom EverandArizona, Utah & New Mexico: A Guide to the State & National ParksRating: 4 out of 5 stars4/5 (1)

- The Bahamas a Taste of the Islands ExcerptFrom EverandThe Bahamas a Taste of the Islands ExcerptRating: 4 out of 5 stars4/5 (1)

- Japanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensFrom EverandJapanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensNo ratings yet

- New York & New Jersey: A Guide to the State & National ParksFrom EverandNew York & New Jersey: A Guide to the State & National ParksNo ratings yet

- South Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptFrom EverandSouth Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptRating: 5 out of 5 stars5/5 (1)